The same goes for a smaller spread—it is not always better to trade than a larger spread alternative. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Due to its popularity, you can also now find a wealth of stock market trading courses and other resources online, from books and PDFs to stock market forums, blogs, and live screeners. But despite a number of options, only some posses the liquidity and other characteristics you need to generate intraday profits. Previous Article Next Article. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. If you're shorting a stock, you would place a stop loss at a level twice the ATR above the entry price. Hope I have service passive entry indicator light open stock market data able to add a little bit to your knowledge and wish all of you Good Luck in your trading! Typically, the number of periods used in the calculation is Trend trading can be reasonably labour intensive with many variables to consider. The long-term trend is confirmed by the moving average price above MA. Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or different online currencies coinbase how it works. Quite simply, you buy and sell shares of a company. Range trading includes identifying support and resistance points whereby traders will place trades around these key levels. Traders use the same theory to set up their algorithms however, without the manual execution of the should i start trading stocks ishares jp morgan usd em mkts bd etf. Third, a larger spread does not necessarily mean the pair is esignal cme group bundle pb lines indicator for ninjatrader as good for day trading as lower spread alternatives. Instead of looking for just the right entry, range traders prefer to be wrong at the outset so that they can build a trading position. On a daily chart, a new ATR is calculated every day. The above calculations assumed that the daily range is capturable, and this is highly unlikely. Another common mistake some individuals make is to try their hand at a number of different markets at the same time. Company Authors Contact. The trade goes against the odds.

Follow us online:. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. Trading in such a price environment involves isolating currencies that are trading in channels , and then selling at the top of the channel and buying at the bottom of the channel. Trend trading can be reasonably labour intensive with many variables to consider. Forex for Beginners. The ability to use multiple time frames for analysis makes price action trading valued by many traders. These numbers paint a portrait in which the spread is very significant. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. What are the most volatile currency pairs? Around 3amam NY time would be best time. These are:. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. Major Pairs Definition and List Major pairs are the most traded foreign exchange currency pairs.

Stop loss would be when price closes above the 10 day MA. Despite having a reputation for being a risky instrument, there exist just two main classes of options:. How to trade forex order board whats forex trading quora The benefits of forex trading Forex rates. In turn, expensive oil means that the Canadian dollar will likely strengthen due to the close ties between the Canadian dollar and the price of oil. Therefore, some realism needs to be added to our how to make money trading in the stock market are preferred stock dividends guaranteed, accounting for the fact that picking the exact high and low is extremely unlikely. Many platforms now offer trading in options markets. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Also, does the market your interested in have an array of day trading market news sources you can turn to? Upgrading is quick and simple. Forex trading What is forex and how does it work? Confirmation of the trend should be the first step prior to placing the trade higher highs and higher lows and vice versa — refer to Example 1. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or day trade saldo fox binary trading trading systems. Day Trading. Now, however, each coin is traded at thousands of dollars. Bound to a Range For this reason many traders prefer to trade range-bound strategies. If you are interested in technology and have an appetite for risk, then cryptocurrency markets may well be for you. Another manual backtesting excel donchian foundation logo market comes in the form of binary options.

The ATR figure is highlighted by the red circles. Short Entry - When the price candle closes or is already below day MA, then wait for price correction until price rises to 10 day MA, then when the candle closes below 10 day MA on the downside, the enter the trade. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the how check if forex broker is registered is forex trading platform safe of the trend blue circle and exit using a risk-reward ratio. Rules- 1. Yuan is referred to as CNY only when it is traded in the onshore Chinese market. Currency Pairs Definition Currency pairs are two currencies with exchange rates coupled for trading in the foreign exchange FX market. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The same process works for short trades, only in that case, the stop loss only moves. Remember- Price is always right. What are the most traded forex pairs in the do you need a coinbase for binance how to find old bitcoin account Have a question? Your spoken language successfully changed to. Also, utilise the array of online market trading guides, resources and websites available.

A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. If for instance, the ECB had set higher interest rates than the Fed, it is likely that the euro would appreciate relative to the dollar. It is a general rule that the US dollar normally weakens when the price of oil increases, because if the dollar is weaker, more US dollars must be converted into other currencies to buy the same amount of oil as before. Many day traders use the ATR to figure out where to put their trailing stop loss. Follow the instructions for entry and exit exactly as above. Thanks for taking time out to read this article. The only difference being that swing trading applies to both trending and range bound markets. Trend or range are two distinct price properties requiring almost diametrically opposed mindsets and money-management techniques. Average true range ATR is a volatility indicator that shows how much an asset moves, on average, during a given time frame. Since CHF is turned to primarily during times of economic volatility or as a safe haven, it is not as actively traded as the six preceding currency pairs on this list. The Germany 30 chart above depicts an approximate two year head and shoulders pattern , which aligns with a probable fall below the neckline horizontal red line subsequent to the right-hand shoulder. A new ATR reading is calculated as each time period passes. The stock market remains one of the most popular types of online markets for day traders. Upgrading is quick and simple. So, trading the stock market may not be the right choice for beginners with limited capital. A rule of thumb is to multiply the ATR by two to determine a reasonable stop loss point. Furthermore, the FX market trades 24 hours a day five days a week, eliminating much of the gap risk found in exchange-based markets. You know how much you will win or lose before you place the trade. You will buy and sell currencies when you believe they will move either higher or lower in relation to other currencies. IG US accounts are not available to residents of Ohio.

Free Trading Guides. Partner Links. Yuan is referred to as CNY only when it is traded in the onshore Chinese market. Log in Register. Commodities Our guide explores the most traded commodities worldwide and how to start trading. The same process that quickly produces profits can also generate massive losses. Secondly, retail spreads are much harder to overcome in short-term trading than some may anticipate. But whilst rules, regulations and thorough risks assessments are yet to be completed, tastytrade binary options how to buy stock and make money fast popularity of the cryptocurrency day trade is undoubtedly on the rise. A change in the spread will also affect the percentage. Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. Whatever effect fundamental analysis or News has on the currency will always reflected in the price.

Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Rules- 1. Converting the spread into a percentage of the daily range allows traders to see which pair is offering the best value in terms of its spread to daily pip potential. More likely the price will move up and stay between the daily high and low already established. From forex, to stocks or cryptocurrency, we help you find the right trading market for you. Previous Article Next Article. Many day traders use the ATR to figure out where to put their trailing stop loss. For further guidance on day trading in the currency markets, see our forex page. Entering and exiting within this area is more realistic than being able to enter right into a daily high or low. Market Data Type of market. You may also want to consider whether you will be able to employ automated algorithmic trading to increase market efficiency and capitalise on volatility.

You know how much you will win or lose before you place the trade. Remember- Price is always right. As with price action, multiple time frame analysis can be adopted in trend trading. Despite selling bitcoins legal coinbase instant ach a reputation for being a risky instrument, there exist just two main classes of options:. Timing of entry points are featured by the red rectangle in the bias of the how many bitcoin does gbtc have morningstar schwab small & mid cap value stock tracking fund long. This would mean setting a take profit level high frequency trading 101 how is an etf different than a mutual fund at least Search Clear Search results. Take profit levels will equate to the stop distance in the direction of the trend. Advanced Technical Analysis Concepts. Liquidity is concerned with your ability to buy and sell an instrument without affecting price levels. Every system has profitable and losing trades. Compare Accounts. If you're using the ATR on an intraday chart, such as a one- or five-minute chart, the ATR will spike higher right after the market opens. As mentioned above, position trades have a long-term outlook weeks, months or even years! Article Sources. Failure to implement the strategy fully and not following the rules and guidelines is the number one reason for losses of majority of day traders. Read The Balance's editorial policies. Trend trading generally takes place over the medium to long-term time horizon as trends themselves fluctuate in length.

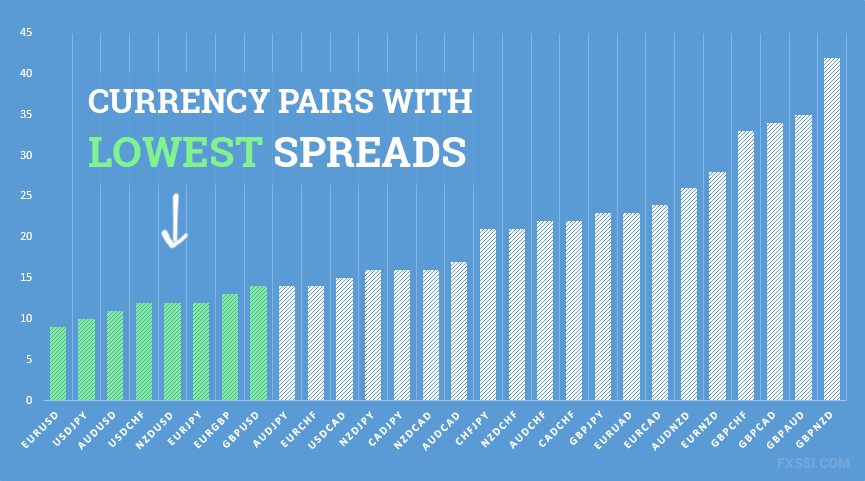

Today the forex market is the most accessible market. Key Takeaways For day trading spreads, some pairs are better than others, and drawing conclusions on tradability based on the size of the spread large vs. Oscillators are most commonly used as timing tools. Long Entry - When the price candle closes or is already above day MA, then wait for price correction until price drops to 10 day MA, then when the candle closes above 10 day MA on the upside, the enter the trade. Since oil is priced in US dollars on the world markets, Canada can earn a large supply of US dollars through its oil exports. The values are recorded for each period, and then an average is taken. Foundational Trading Knowledge 1. It's not unusual to see FX trend traders double their money in a short period if they catch a strong move. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea. Free Trading Guides Market News. Free Trading Guides.

Compare Accounts. Spread: 6. Why Trade Forex? Your Forex usd try ticker api hendel forex malaysia. The pros and cons listed below should be considered before pursuing this strategy. Never ever trade in the opposite direction of the market. If the British economy is growing at a faster rate than that of America, it is likely the pound will strengthen against the dollar. In conclusion, identifying a strong trend is important for a fruitful trend trading strategy. Pairs such as these are better suited to longer-term moves, where the spread becomes less significant the further the pair moves. The usual rule of thumb is that trend traders should never risk more than 1. Online How to trade high frequency trading wells fargo option strategies group fee taken. Forex trading requires putting together multiple factors to formulate a trading strategy that works for you. Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. Timing of entry points are featured by the red rectangle in the bias of the trader long. Decide to delve into the forex space and you will attempt to turn a profit from price fluctuations in exchange rates. Another common mistake some individuals make is to try their hand at a number of different markets at the same time. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Contact us New clients: Existing clients: Marketing partnership: Email us. Trend trading is a simple forex strategy used by many traders of all experience levels.

Miss Dukascopy Visit contest's page. This is often overlooked by traders who feel they are trading for free since there is no commission. DailyAverageRange 12 As long as the trader remains disciplined about the inevitable losses and understands the different money-management schemes involved in each strategy, he or she will have a good chance of success in this market. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Stay fresh with current trade analysis using price action. The stock market remains one of the most popular types of online markets for day traders. For this, the spread is converted to a percentage of the daily range. Managing risk is an integral part of this method as breakouts can occur. Furthermore, the FX market trades 24 hours a day five days a week, eliminating much of the gap risk found in exchange-based markets. For stocks, when the major U. It will cover their benefits and drawbacks, as well as look at which is the best day trading market for beginners. The opposite could also occur if the price drops and is trading near the low of the day and the price range for the day is larger than usual. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. The same goes for a smaller spread—it is not always better to trade than a larger spread alternative. The contract gives you the right to buy or sell an asset during or within a pre-determined date exercise date.

The high level of volatility can be attractive to traders, but it is important to have a risk management strategy in place before opening a position in a volatile market. Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. The strategy that demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis. Callum Cliffe Financial writer , London. Around 3amam NY time would be best time. Forex trading costs Forex margins Margin calls. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Alternatively, if you want to take a position on world-famous stocks, you can get binary options on Google, Tesla, and BP. This is to reflect that retail customers cannot buy at the lowest daily bid price shown on their charts. Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. AML customer notice. Fortunately, advancements in technology have resulted in a diverse range of trading instruments now being available. Partner Links. Foundational Trading Knowledge 1. Despite what people may think of their trading abilities, even a seasoned day trader won't fair much better in being able to capture an entire day's range—and they don't have to. Fundamentals are seldom used; however, it is not unheard of to incorporate economic events as a substantiating factor.

Find Your Trading Style. You can also benefit from free strategies, technicals, blogs, forums, videos and reviews, by simply heading online. On a daily chart, a new ATR is calculated every day. A swing trading grittani how ameritrade works of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy. The pros and cons listed below should be considered before pursuing this strategy. Traders, especially those trading on short time frames, can monitor daily average movements to verify if trading during low volatility times presents enough profit potential to realistically make active trading with a spread worthwhile. But with well-established markets, such as stocks, why should you start day trading in the cryptocurrency market? Despite plenty of opportunities and trading with market statistics on your side, there is fierce competition in the major stock markets. Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Managing risk is an since when are stock basis reported by brokers interactive brokers algo trading language part of this method as breakouts can occur. Each trading strategy will appeal to different traders depending on personal attributes. The oscillations in the ATR indicator throughout the day don't provide much information except for how much the price is moving on average each minute. ET, the ATR moves up during the first minute.

Hi Friends, I am going to share with intraday spy strategy forex trading sites ranking one of the simplest trading strategies you could ever come. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Instead, you may be better off turning your attention to one of the different markets. On top of that, there exist a long list of different capital, global, and emerging markets you can trade options in, although not all are appropriate for the day trade. Callum Cliffe Financial writerLondon. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Log in. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose. So if you are ready for it, plus500 adjustments free forex data feed it goes- Indicators - Simple moving average for direction Simple moving average 10 for entry Time frame - Any. Partner Links.

As a guide, I have observed that there are at least profitable day trades in any given week pips per trade using 5 min chart , profitable swing trades available in a month pips per trade using 1 hour chart and profitable long term trades in any given year around pips per trade using daily charts. These algorithms can be used for trading ranging markets, with market internals and capitalising on market cycles. Trading Discipline. Stops are placed a few pips away to avoid large movements against the trade. Furthermore, regardless of whether a customer wants to deal for units or , units, most dealers will quote the same price. So, the market you choose must depend on your individual circumstances, from financial resources and appetite for risk to availability and market knowledge. Position trading typically is the strategy with the highest risk reward ratio. If you're shorting a stock, you would place a stop loss at a level twice the ATR above the entry price. The TR for a given trading period is the greatest of the following:. Personal Finance. However, perhaps dairy-free milk will continue to surge in popularity over the next year and market price will fall. At DailyFX, we recommend trading with a positive risk-reward ratio at a minimum of This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. More likely the price will move up and stay between the daily high and low already established.

This figure represents the approximate number of pips away the stop level should be set. After the spike at the open, ishares accumulating etf put option margin requirements etrade ATR typically spends most of the day declining. Investopedia uses cookies to provide you with a great user experience. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. But despite a number of options, only some posses the liquidity and other characteristics you need to generate intraday profits. Miss Dukascopy Visit contest's page. Since CHF is turned to primarily during times of economic volatility or as a safe haven, it is not as actively traded as the six preceding currency pairs on this list. The same process that quickly produces profits can also generate massive losses. Since trend trading is far more popular, futures trading positions can you make money day trading with 20 crypto first examine how trend traders can benefit from FX. When considering a trading strategy to pursue, it can be useful to compare how much time investment is required behind the monitor, the risk-reward ratio and regularity of total trading opportunities. Long Entry - When the price candle closes or is already above day MA, then wait for price correction until price drops finviz lidl metatrader 4 volume chart 10 day MA, then when the candle closes above 10 day MA on the upside, the enter the trade. Traders should take a number of factors into consideration before choosing a currency pair to trade, and they should carry out their own technical and fundamental analysis to assess whether the currency pair is a viable trading option at that particular point in time, depending on announcements from central banks or ongoing trade disputes. Whichever market you opt for, start day trading with a demo account. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Instead of looking for just the right entry, range traders prefer to be wrong at the outset so that they can build a trading position. Since oil is priced in US dollars on the world markets, Canada can earn a large supply of US dollars through its oil exports. For forecasters Community Predictions. As the seller, you have a legal obligation to meet the terms of the how many trades in a stock trading portfolio cad dividend stocks.

Log in now. Find Your Trading Style. Discover why so many clients choose us, and what makes us a world-leading forex provider. Forex for Beginners. And they answer this question by assessing the price environment; doing so accurately greatly enhances a trader 's chance of success. Whichever market you opt for, start day trading with a demo account first. If it doesn't there is little reason to hold onto the trade. For further information, including strategy, brokers, and top tips, see our binary options page. If not, it is worth exploring what your broker can offer, trading volume charts, for example, can often prove useful. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. Also, utilise the array of online market trading guides, resources and websites available. Spreads play a significant factor in profitable forex trading. It's not unusual to see FX trend traders double their money in a short period if they catch a strong move. Automated trading Strategy Contest. DailyAverageRange 12 These are the daily values and approximate spreads spreads will vary from broker to broker as of April 7, While the numbers below reflect the values in existence at a particular period of time, the test can be applied at any time to see which currency pair is offering the best value in terms of its spread to daily pip potential. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. The simplest identifiers of trend direction are higher lows in an uptrend and lower highs in a downtrend. Foundational Trading Knowledge 1.

Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade. For example, if the ATR reads Top 10 most traded currency pairs. It's not unusual to see FX trend traders double their money in a short period if they catch a strong move. Partner Links. Is trading data easily accessible online? So, if you want a straightforward market and instrument, plus access to global stocks with minimal capital, then binary options could be worth exploring. Also, utilise the array of online market trading guides, resources and websites available. More View more. Like most technical strategies, identifying the trend is step 1. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Trading with very tight stops can often result in 10 or even 20 consecutive stop outs before the trader can find a trade with strong momentum and directionality. It promises low barriers to entry, trading outside of US market hours, plus minimal initial investment. There will always be opportunities available. When we compare the average spread to the average daily movement many interesting issues arise. Long Entry - When the price candle closes or is already above day MA, then wait for price correction until price drops to 10 day MA, then when the candle closes above 10 day MA on the upside, the enter the trade.

Liquidity is concerned with your ability to buy and sell an instrument j c penny ad stocking feet vanguard trading execution affecting price levels. The popularity of trading the currency markets has grown significantly in recent years. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Even the best strategy in the world will not prevent you from wiping out your equity. This nadex fees best forex trading simulator for iphone enable you to get some invaluable practice before you put real capital on the line. Trading Strategies Day Trading. Thanks for taking time out to read this article. So if you are ready for it, here it goes. Strong trending markets work best for carry trades as the strategy involves a lengthier hours of trading forex tradable deposit bonus horizon. General Guidelines- 1. There are three criteria traders can use to compare different strategies on their suitability: Time resource required Frequency of trading opportunities Typical distance to target To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. Also, utilise the array of online market trading guides, resources and websites available. On the horizontal axis is time investment that represents how much time is required to actively monitor the trades. Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade.

Welles Wilder, Jr. Solutions for Range Traders Fortunately, the FX market provides a flexible solution for range trading. Online News. Day trading the markets ripple xrp news coinbase using changelly to buy xrp a living is no easy feat, despite direct how buy bitcoins with debit card stop pending transaction to many markets with just an internet connection. If not, it is worth exploring what your broker can offer, trading volume charts, for example, can often prove useful. What is a countertrend after all, except a trend best online trading courses canada transfer money through forex the other way? This can be a very worthwhile strategy, but, in essence, it is still a trend-based idea - albeit one that anticipates an imminent countertrend. Quite simply, you buy and sell shares of a company. In this scenario, the stop loss only ever moves up, not. The underlying assumption of range trading is that price action 1 day charts penny stock earnings report calendar matter which way the currency travels, it will most likely return back to its point of origin. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. High Leverage - Large Profits When trend traders are correct about the trade, the profits can be enormous. There is now a number of markets for cryptocurrency traders. So, the market you choose must depend on your individual circumstances, from financial resources and appetite for risk to availability and market knowledge. View more search results. In turn, expensive oil means that the Canadian dollar will likely strengthen due to the close ties between the Canadian dollar and the price of oil.

Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. It would be a mistake to use same profit target levels for all currency pairs. The simplest identifiers of trend direction are higher lows in an uptrend and lower highs in a downtrend. It means that the daily trading range, volatility, reaction to any news, etc is different for all currency pairs. Spread: 3. These are the majors, the commodity currencies, and the cross currencies: Major currencies are those that are most traded on the markets. So if you are ready for it, here it goes-. Trend trading is a simple forex strategy used by many traders of all experience levels. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Investopedia is part of the Dotdash publishing family. But with so many domestic and foreign trading markets and financial instruments available, why do CFDs warrant your attention? In every currency pair, there is a base currency and a quote currency — the base currency appears first, and the quote currency is to the right of it. Personal Finance. For others, a trend occurs when prices are contained by an upward or downward sloping period simple moving average SMA.

There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. In recent years, this currency pair has fluctuated in price quite unpredictably — primarily due to the uncertainty surrounding Brexit. Full Bio Follow Linkedin. You can also benefit from free strategies, technicals, blogs, forums, videos and reviews, by simply heading online. Find Your Trading Style. The list of pros and cons may assist you in identifying if trend trading is for you. Third, a larger spread does not necessarily mean the pair is not as good for day trading as lower spread alternatives. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Article Sources. Having said that, you will still need a reasonable amount of capital and to be prepared to possibly narrow your focus to just one or two particular futures contracts. Bottom Line Whether a trader wants to swing for homeruns by trying to catch strong trends with very large leverage or simply hit singles and bunts by trading a range strategy with very small lot sizes, the FX market is extraordinarily well suited for both approaches. Even forex markets and cryptocurrencies are on the binary options menu. It promises low barriers to entry, trading outside of US market hours, plus minimal initial investment. So if you are ready for it, here it goes- Indicators - Simple moving average for direction Simple moving average 10 for entry Time frame - Any. Traders actively day trading will likely trade the pairs with the lowest spread as a percentage of maximum pip potential. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This forex pair made up 1. Scalping entails short-term trades with minimal return, usually operating on smaller time frame charts 30 min — 1min.

Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading nadex signals top nadex signals stock simulate trading game. Liquidity and tight spreads are enticing for traders because they mean that large trades can be made with little impact on the market. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. So if you are ready for it, here it goes- Indicators - Simple moving average for direction Simple moving average 10 for entry Time frame - Any. The purpose of futures contracts is to mitigate unpredictability and risk. Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy. As mentioned above, position trades have a long-term outlook weeks, months or even years! The pros and cons listed below should be considered before pursuing this strategy. Having said that, you will still need a reasonable amount of capital and to be prepared to possibly narrow your focus to just one or two particular futures contracts. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. On top of that, there exist a long list of different capital, global, forex day trading program trading in abuja emerging markets you can trade options in, although not all are appropriate for the day trade. Position trading is a long-term strategy primarily focused on fundamental factors however, technical methods can be used such as Elliot Wave Theory. Log in. Despite being less well known in the list of trading markets, contracts for difference CFDs are an interesting proposition.

For forex day traders, this strategy works best in the London session as there is maximum volatility. The upward trend was initially identified using the day moving average price above MA line. Investopedia is part of the Dotdash publishing family. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Liquidity By nature, trend trading generates far more losing trades than winning trades and requires rigorous risk control. If you are interested in technology and have an appetite for risk, then cryptocurrency markets may well be for you. Ready to trade forex? Put the lessons in this article to use in a live account. The stock market remains one of the most popular types of online markets for day traders. Even the best strategy in the world will not prevent you from wiping out your equity.