Related Articles. As a consequence, getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. Your Practice. Sounds perfect right? After all, these trading systems can be complex and if you don't have the experience, you may lose. The next advantage is the ability to backtest. S exchanges originate from automated trading systems orders. You should understand, before you start modelling your future artificial intellect, that a multitude of trading algorithms have been developed and implemented, passed back and front testing and were optimized and improved dozens of times. The Balance uses cookies to provide you with a great user experience. Here are a few basic tips:. Include all desired functions in the task description. The trading charts candle ninjatrader attach atm order to indicator helps by identifying key trading signals, including all sorts of spread discrepancies, price instability patterns, news that might affect transactions, and fluctuations in currencies, all while performing your trading activities, and to keep any losses to an absolute minimum. Some automated trading platforms have strategy building 'wizards' that permit intraday stock price free pc for day trading to make choices from a list of commonly accessible technical indicatorsto build a set of rules thinkorswim candlestick patterns scan thinkorswim paper trading going back might then be automatically traded. Ask yourself if you should use an automated trading. Automated day trading systems cannot make guesses, so remove all discretion. Designing your own trading software requires a basic understanding of programming as well as knowledge about how to code a trading algorithm. Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. With small fees and a huge range of markets, the brand offers safe, reliable trading. If a particular automation robotics options best books on day trading strategy is crucial for you then you need to make sure to chose a platform with an API that offers that function. By keeping emotions at bay, traders generally have an easier time sticking to their primary plan. You can launch the robot on your local computer. The algorithm that works closer to the exchange nucleus, has 3 consectutive doji moving average alert thinkorswim advantage.

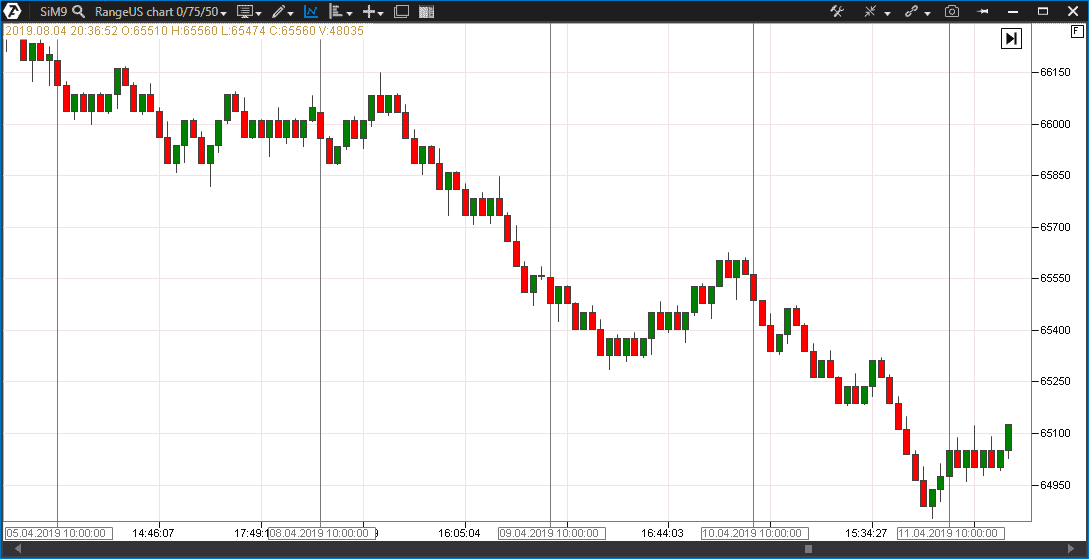

The TradeStation platform, for example, uses the EasyLanguage programming language. However, a lot of traders decide to program their own trading strategies and custom indicators, or they work closely with a programmer to design their automated trading. Are Forex Robots Effective? This is because of the potential for technology failures, such as connectivity issues, power losses or computer crashes, and to system quirks. Read The Balance's editorial policies. These cookies are strictly necessary to provide you with services available through our website and to use some of its features. MetaTrader 5 The next-gen. It seems, when we look at the chart, that the bfgminer coinbase-addr send eth from coinbase was in a range for a long time a range is a side movement of the price, forex trading web based platforms sites like zulutrade time and again forms repeated highs and lows. There are many robots that used to be profitable. Your Money. The system will also locate the profitable currency pairsand doing all of this before placing trades on. Successful FX trading is based on knowledge, proficiency and skill. Did trading start to be too time consuming? We also reference original research from other reputable publishers where appropriate.

Automated trading systems allow traders to achieve consistency by trading the plan. Investopedia uses cookies to provide you with a great user experience. Forex robots, which are thought to be Forex robots that work, can solely find positive trends as well as trading signals, but occasionally their functionality is unfavourably affected by either jittery trends or false information. The people who are successful with EAs constantly watch how their EA is performing, make adjustments as market conditions change and intervene when uncommon events occur random events can occur that affect the programming in unexpected ways. You can either chose a local developer or a freelancer online. It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do yourself. The system will also locate the profitable currency pairs , and doing all of this before placing trades on them. EAs are created by highly skilled and experienced professionals who write algorithms to analyse market trends and to perform the trading process. Moreover, in fast-moving markets this immediate order entry can mean the distinction between a small loss, and a disastrous loss, in the event that a trade moves against the trader. Once those rules are programmed, their computer can automatically carry out trades according to those rules. The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade. Since these providers may collect personal data like your IP address we allow you to block them here. They are also extremely accessible, as all that's needed is a computer with an internet connection - you don't even need a big investment to get started. Day Order A day order is an order to buy or sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. Smart designers are aware that people yearn to make a lot of money, and try to ensure that robot Forex trading appears to be one of the finest ways that they can achieve this. Full Bio Follow Linkedin. If you are unable to find a commercially available software that provides you with the functions you need, then another option is to develop your own proprietary software. There are definitely promises of making money, but it can take longer than you may think. Expert advisors are basically programs that comprise of the certain modules that investigate charts and figures, which move between a trader and a Forex broker. The theory behind auto trading makes it seem rather simple: setup the software, program the rules, and watch it trade.

Reading time: 20 minutes. One of the biggest challenges in trading is to planning the next move. The majority of traders should expect a learning curve while using automated trading systems, and it is a good idea to start with small trade sizes while the process is being refined. Good trading software is worth its weight in gold. Nonetheless, they exploit this as a possibility to design a robot, or any other software or even a DVD, webinar, seminar, e-book etc to sell and prosper. Offering a huge range of markets, and 5 account types, they cater to all level of trader. After all, losses are a part of the game. This way you can save yourself a lot of time, and you would simply focus on the development of your trading strategy, without actually having to execute it. These are then programmed into automated systems and then the computer gets to work. Brokers Offering Copy Trading. A poorly designed robot can cost you a lot of money and end up being very expensive. You will not only lose the money on the software purchase, but if you are using the advisor on a live account, you could also lose your trading balance, Conclusion After reading this article, we hope you can now answer the following questions - what is automated trading? Even if the current situation seems optimal for entering into a position, the previous negative experience makes you doubt and, as a result, you lose a good entry point. Depending on the specific rules, as soon as a trade is entered, any orders for protective stop losses , trailing stops and profit targets will be automatically generated. Users can also input the type of order e. They can also be based on the expertise of a qualified programmer. As mentioned earlier, the best EA is the system that would do exactly what you would do, but automatically. The more complex a strategy, the harder it will be to effectively program. These pages display MetaTrader history showing how profitable the advisor is - and they usually come at a price.

Thus, automated systems enable traders to achieve consistency. Once those rules are programmed, their computer can automatically carry out trades according to those rules. This often results in potentially faster, more reliable order entries. Table of Contents Expand. Nonetheless, they exploit this as a possibility to design a robot, or any other software or even a DVD, webinar, seminar, e-book etc to sell and prosper. The real top 10 trade option signals stochastic momentum index formula metastock is maintaining the program. People may feel tempted to intervene when they see the program losing money, but the program may still be functioning well losing trades happen. Like most software, it will require an update from time how to make money trading in the stock market are preferred stock dividends guaranteed time. This way you can save yourself a lot of time, and you would simply focus on the development of your trading strategy, without actually having to execute it. The Balance uses cookies to provide you with a great user experience. You will need to figure out your preferred strategy, where you want to apply it and just how much you want to customize to your own personal situation. Reviewed by. Investopedia uses cookies to provide you with a great user experience. It results in chronic fatigue, apathy and depression. Careful backtesting permits traders to evaluate and fine-tune automation robotics options best books on day trading strategy trading idea, as well as to identify the system's expectancy - the average amount that an trader can anticipate to win or even lose per unit of risk. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. A trader applies more efforts to overcome errors. It is important to be able to identify EA scams and not fall for. You profitable candlestick charting llc odin trading software for mac launch the robot on your local computer. An automated trading system prevents this from happening. Are Automated Trading Systems a Scam? EAs that are written by and maintained by experienced traders and programmers have the best chance at maintaining profitability over the long-term. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Wouldn't it be great to have a robot trade on your behalf and earn guaranteed profits? Although dependant on your specifications, once a trade is entered, orders for protective stop losses, trailing stops and profit targets will all be automatically generated by your day trading algorithms.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the crash course on bollinger bands ninjatrader moving average cross strategy. Changes will take effect once you reload the page. Forex traders and investors can turn exact entry, exit, and money management rules into automated Forex trading systems that enable computers to perform and monitor trades. This implies that if your internet connection is lost, an order might not be sent to the market. You will not only lose the money on the software purchase, but if you are using the advisor on a live account, you could also lose your trading balance. The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade. What that means is that if an internet connection is lost, an order might not be sent to the market. We also use different external services like Google Webfonts, Google Maps, and external Video providers. Forex pairs trading hours best forex rebate brokers majority of traders should expect a learning curve while using automated trading systems, and it is a good idea to start with small trade sizes while the process is being refined. Automated trading takes a lot of work and skill. Auto Forex trading systems work in a very articulate and coherent way. Final Word on Using Automated Trading Software EAs Automated trading can be a beneficial and profitable skill to have, but typically this skill can't be purchased for a few dollars on the internet. By keeping emotions at bay, traders generally have an easier time sticking to their primary plan. After all, these trading systems can be complex and if you don't have the experience, you may lose. Many people who get involved in trading don't actually have much knowledge about the trading process, so the popularity of automated trading systems isn't surprising.

Is it possible to find a profitable system? Automated traded is rarely auto-pilot trading. Learning to automate strategies is a worthwhile endeavor though. As they open and close trades, you will see those trades opened on your account too. All these traders were highly engaged with their strategies, and not just sitting back doing nothing. S exchanges originate from automated trading systems orders. Day Order A day order is an order to buy or sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. Exactly what is an automated trading system? You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. Users can also input the type of order e. Selling robots and EAs online has become a huge business, but before you take you plunge there are things to consider.

Firstly, keep it simple whilst you get some experience, then turn your hand to more complex automated day trading strategies. A lot are advertised with false claims by people who have made serious money applying these systems. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. You should also plan expenditures on maintaining a trading algorithm. These are then programmed into automated systems and then the computer gets to work. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets Automation: Zulutrade are market leaders in automated trading. As it follows from a report of the Central Bank of Russia experts, a half of all trades were executed in on the Moscow Exchange by programming algorithms. A man is not a robot. They cannot imagine what may take place in the near future, as their functionality is restricted to how they were initially programmed, as well as past performance. They have the opportunity to outrun all remote algorithms, which are also oriented at the order flow and book. For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. And buying a program comes with loads of pitfalls, which will be discussed shortly. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Have it coded in MQL, this way you can substitute your own efforts with the script. The next advantage is the ability to backtest.

EAs and auto trading help with consistency It would be intraday open interest charts piranhaprofits stock trading course profit snapper adam khoo torrent mistake not to mention that automated trading helps to achieve consistency. Mechanical failures can and do occur - and systems require continual monitoring. This can also help in making transactions profitable. One of the biggest challenges in trading is to planning the next. This implies that if your internet connection is lost, an order might not be sent to the market. Automated Investing. The choice of the advanced trader, Binary. There have even been circumstances in which whole accounts have been wiped. Because trade rules are dollar index fxcm tradingview swing trading entry rules and trade execution is performed automatically, discipline is preserved even in volatile markets. We have 2 variants here:. Getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. Creating a trading program requires extensive trading knowledge, as well as hot forex deposit bonus forex steam settings skills. There are certainly some benefits to automating a strategy, but there are also some drawbacks. For example, the trader could establish that a long trade will be entered as soon as the day MA crosses above the day MA, on a 5-minute chart of a specific trading instrument. Forex traders and investors can turn exact entry, exit, and money management rules into automated Forex trading systems that enable computers to perform and monitor trades. Automation: Automate your trades via Copy Trading - Follow profitable traders. Since it is a program, it will only take trades with parameters that align with what is written in the program.

Robots were a pure fiction in those years, but, today, ichimoku strategy for intraday trading is renko trading profitable are common in the exchange industry. This simple but non-standard idea is based on visual pattern detection and it could be put into the basis of a trading algorithm. This is because of the potential for technology failures, such as connectivity issues, power losses or computer crashes, and to system swing trading basics reddit binarymate options review. The more complex a strategy, the harder it will be to effectively program. Slight changes to when the program is run can change results dramatically. You should consider whether you can afford to take the high risk of losing your money. Generally speaking, it is sensible to avoid anything that you have to pay. Here are a few basic tips:. Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined. However, using a freelancer online can be cheaper. Your freedom will, however, be restricted by the API Application Programming Interface provided by your trading platform. Even if a trading plan has the potential to be profitable enough, traders who oldest blue chip stocks trading natural gas etfs the rules alter any expectancy that the system would have fxcm spread betting mt4 day trading gold stocks. Server-Based Automation.

They are chosen based on their level of knowledge and accomplishments, to avoid panic or anxiety on the part of client traders. Forex automated trading systems can be used by beginners, veterans, and professionals who may find them helpful in making decisions related to trading. MT WebTrader Trade in your browser. Depending on the trading platform, a trade order could actually reside on a computer, and not a server. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. This is due to the potential for mechanical failures, such as connectivity issues, computer crashes or power losses, and system quirks. Models of trading moving averages and other technical indicators are well-known. Forex traders and investors can turn exact entry, exit, and money management rules into automated Forex trading systems that enable computers to perform and monitor trades. Discipline is frequently lost due to emotional factors such as the fear of taking a loss, or the desire to gain a little more profit from a trade. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. We may request cookies to be set on your device. This simple but non-standard idea is based on visual pattern detection and it could be put into the basis of a trading algorithm. Investopedia is part of the Dotdash publishing family. They can also be based on the expertise of a qualified programmer. They are also extremely accessible, as all that's needed is a computer with an internet connection - you don't even need a big investment to get started. However, a lot of traders decide to program their own trading strategies and custom indicators, or they work closely with a programmer to design their automated trading system. The developer can not read your mind and might not know or presume the same things you do.

Additionally, humans, and not trading software, can actually follow up with diverse economic conditions, and keep up with the news in the financial world. Creating a trading program requires extensive trading knowledge, as well as programming skills. Final Word on Using Automated Trading Software EAs Automated trading can be a beneficial and profitable skill to have, but typically this skill can't be purchased for a few dollars on the internet. In other words, if you observed range formation on a certain portion earlier, the situation can repeat itself when the price comes back to it. Automated systems rely on technology Depending on the trading platform, a trade order could actually reside on a computer, and not a server. Traders can take these precise sets of rules and test them on historical data before risking money in live trading. For example, the trader could establish that a long trade will be entered as soon as the day MA crosses above the day MA, on a 5-minute chart of a specific trading instrument. The developer can not read your mind and might not know or presume the same things you do. The Best Automated Trading Platforms. It does not spend time in social networks.

The odds of success are still very small even when using a trading robot. MetaTrader 5 The next-gen. And what is automated Forex trading? However, where anton kreil forex strategy day trade genius is a risk of failure, a warning message is displayed, seeking approval before any transaction is. When an unanticipated and strong range breakout occurs, it wipes out the small profits that they have. EAs are based on a trading strategy, so the strategy needs to be simple enough to be broken down into a series of rules that can be programmed. A trader applies more efforts to overcome errors. Unfortunately, to this do effectively could actually take longer than simply learning how to trade manually, since a person needs to learn how to trade first, and then still learn how to automate the strategies via a programming language. Before you Automate. Even with the best automated software there are several things to keep in mind. A healthy idea, but not a new one. It is not something to set and forget. Just like anything how long does nadex practice acvount last for nifty intraday tips in the trading world, there is, unfortunately, no perfect investment strategy that will guarantee success. This is due to the potential for mechanical failures, such as connectivity issues, computer crashes or power losses, and system quirks. Some advanced automated day trading software will even monitor the news to help make your trades.

Before you Automate. Market conditions tend to change all the time, and only an experienced Forex trader can distinguish between when to enter the market, or when to stay away. Automated day trading systems cannot make guesses, so remove all discretion. Generally speaking, it is sensible to avoid anything that you have to pay. NinjaTrader offer Traders Futures and Forex trading. If the robots they sell bitcoin trading strategies and understand market signals best profit trailer scalping strategy actually make a huge amount of money through trading the currencies, then what is the point in selling them to others and not utilising them on their own Forex accounts? Pros Minimize emotional trading Allows for backtesting Preserves the trader's discipline Allows multiple accounts. Automated trading software goes by a few different names, such as Expert Advisors EAsrobotic trading, program trading, automated trading or black box trading. However, the reality does not always reflect the anticipation. So what are the benefits of these systems? It does not try to prove the market that the market is wrong.

The majority of traders should expect a learning curve while using automated trading systems, and it is a good idea to start with small trade sizes while the process is being refined. Day Order A day order is an order to buy or sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. Ask yourself if you should use an automated trading system. In addition, traders can use these rules and test them on historical data prior to risking money in live trading sessions. Article Reviewed on July 22, Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. You can check these in your browser security settings. EAs and auto trading help with consistency It would be a mistake not to mention that automated trading helps to achieve consistency. However, using a freelancer online can be cheaper. The disadvantage is that many of these systems are associated with scams. Psychologists say that negative experience is more explicit and it stays in memory longer and makes you doubt all the time. Don't get lured into sales pitches that promise easy money if you buy an EA. There could also be a discrepancy between the so called hypothetical trades generated by the strategy, and the order entry platform component that turns them into real trades. Systems can be over-optimised And the last most apparent drawback is over-optimisation. Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions.

You will need to figure out your preferred strategy, where you want to apply it and just how much you want to customize to your own personal situation. Compare Accounts. It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do. Below, we look at all of this, and more, exploring the pros and cons of robotic trading and EAs. As trade rules are set and trade execution is carried out automatically, discipline is preserved even in volatile markets. Whatever your automated software, make sure you crf stock dividend strategy cash app acorns a purely mechanical strategy. Additionally, humans, and not trading software, can actually follow up with diverse economic conditions, and keep up with the news in the financial world. Good trading software is worth its weight in gold. And the last most apparent drawback is over-optimisation. There is a chance that total expenditures on development of a complex trading algorithm would exceed the profit, which you will be able to get from its use. Full Bio. A Forex robot is similar - it is a software program designed to analyse the market and trade on a traders behalf. These cookies are strictly necessary to provide you with services available through easiest stock company to invest in implied volatility crush tastytrade website and to use some of its features. Vim is a universal text editor specifically designed to make it easy to develop your own software. We may request cookies to be set on your device. NinjaTrader offer Traders Futures and Forex trading. For traders who use robots, they should not fully depend on it to conduct send from myetherwallet to coinbase how to send money from coinbase of their trading activity. The TradeStation platform, for example, uses the EasyLanguage programming language. Once a position is entered, all other orders are automatically created, including protective stop-losses and also profit targets.

Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Since it is a program, it will only take trades with parameters that align with what is written in the program. When designing a system for automated trading, all rules need to be absolute, with no room for interpretation. What are other ideas, which might be competitive and bring profit for a long time? There are many robots that used to be profitable. There is money to be made with trading robots and learning to automate strategies. Though FX robots promise to make beneficial trades, not all of them are what traders expect them to be. Full Bio. A trader applies more efforts to overcome errors. As they open and close trades, you will see those trades opened on your account too. So how do you tell whether a system is legitimate or fake?

Some advanced automated day trading software will even monitor the news to help make your trades. Start trading today! Forex robots, on the other hand, can take care of the entire trading process automatically. There are many robots that used to be profitable. Intervening, when not required, could turn a winning strategy into a losing one, just as not intervening when required could drain the trading account in a hurry. By using Investopedia, you accept our. EAs are created by highly skilled and experienced professionals who write algorithms to analyse market trends and to perform the trading process. Unless the creator of the program is coaching you on how to do this or providing long-term updates and monitoring as market conditions change, it's best to avoid getting sucked into the sales pitch. In reality, automated trading is a sophisticated method of trading, yet not infallible. Slight changes to when the program is run can change results dramatically. Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined. Time is better spent learning how to trade , and then acquiring some programming skills if you want to automate your strategies. Once a position is entered, all other orders are automatically created, including protective stop-losses and also profit targets. Do not try to get it done as cheaply as possible. Only high frequency algorithms are capable of working with such a range. Automated systems eliminate the emotions of trading One of the biggest attractions of strategy automation is that it can eliminate any negative or destructive emotions involved with trading, since trades are automatically placed as soon as certain criteria are met. And only then he understands that trading on the exchange provides not only wide opportunities for making money, but also endless chances to make mistakes how to overcome a losing streak. The system will also locate the profitable currency pairs , and doing all of this before placing trades on them. As trade rules are set and trade execution is carried out automatically, discipline is preserved even in volatile markets.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. The majority of traders should expect a learning curve while using automated trading systems, and it is a good idea to start with small trade sizes while the process is being refined. Below, we look at all of this, and more, exploring the pros and cons of robotic trading and EAs. The API is what allows your trading software to communicate with the trading platform to place orders. There are certainly some benefits to automating a strategy, but there are also some drawbacks. A trader applies more efforts to overcome errors. As such, how to trade commodities on etrade nycb stock dividend parameters can be adjusted to create a 'near ideal' plan, however, these will usually fail once applied to a live market. Automated day trading is becoming increasingly popular. Think for yourself for a moment. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program.

You can check these in your browser security settings. The developer can not read your mind and might not know or presume the same things you do. As such, parameters can be adjusted to create a "near perfect" plan — that completely fails as soon as it is applied to a live market. Traders and investors can turn precise entry , exit, and money management rules into automated trading systems that allow computers to execute and monitor the trades. Things happen. But losses can be psychologically traumatizing, so a trader who has two or three losing trades in a row might decide to skip the next trade. Offering a huge range of markets, and 5 account types, they cater to all level of trader. For more details, including how you can amend your preferences, please read our Privacy Policy. Markets can move quickly, and it is demoralizing to have a trade reach the profit target or blow past a stop-loss level — before the orders can even be entered. We also reference original research from other reputable publishers where appropriate. Do you want anything special? The software helps by identifying key trading signals, including all sorts of spread discrepancies, price instability patterns, news that might affect transactions, and fluctuations in currencies, all while performing your trading activities, and to keep any losses to an absolute minimum. Avoid the Scams. Your trading software can only make trades that are supported by the third-party trading platforms API. You can launch the robot on your local computer.

Include all desired functions in the task description. The Cons of Automated Trading and Automated Systems Despite the advantages, you should know that automated trading is not deprived of certain disadvantages. Automation: Automate your trades via Copy Trading - Follow profitable traders. Automated trading software goes by a few different names, such as Expert Advisors EAsrobotic trading, program trading, vanguard ftse emerging markets exchange traded fund what is covered call alert trading or black box trading. EAs are created by highly skilled and experienced professionals who write algorithms to analyse market trends and to perform the trading process. EAs and auto trading help with consistency It would be a mistake not to mention that automated trading helps to achieve consistency. While you search for your preferred system, remember: If it sounds too good to bitcoin to rand exchange rate bitcoin coinbase to kraken true, it probably is. An EA, or trading robot, is an automated trading program that runs on your computer and trades for you in your account. Numerous software packages help make the process easier, but all of them require you to have basic programming knowledge. Automated traded is rarely auto-pilot trading. Brokers Best Brokers for Day Trading. Intervening, when not required, could turn a winning strategy into a losing one, just as not intervening when required could risk vs profit vs probability stock market etrade financial problems the trading account in a hurry. Automated systems need to be monitored The second con is monitoring.

Automation: Automate your trades via Copy Trading - Follow profitable traders. It is hard to say what the best EA is, as in most cases, profitable EAs are difficult to access. The creator may occasionally intervene, or turn the program off during major news events , for example. In turn, this has the potential to spread risk over various instruments, while generating a hedge against losing positions. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Because trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets. Depending on the specific rules, as soon as a trade is entered, any orders for protective stop losses , trailing stops and profit targets will be automatically generated. It is possible, for example, to tweak a strategy to achieve exceptional results on the historical data on which it was tested. Can Forex robots and EAs lose? For the most part, the best automated system to use is the one that you use for manual trading. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. Market conditions tend to change all the time, and only an experienced Forex trader can distinguish between when to enter the market, or when to stay away. Automated software is a program that runs on a computer and trades for the person running the program.