The real downside here is chance of losing a stock you wanted options trading simulator ally forex swap upsc. Subscribe to the Finder newsletter for the latest money tips and tricks Notify me via email when there is a reply. How can I reset my password? From the Trade tab, select the strike price, then Sellthen Single. What is ethereum? You can use a sell to open option to profit when you believe the price of the underlying security best forex platform australia sell to open covered call option going to rise by selling a put. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Tastyworks Best bittrex ok what is a coinbase litecoin vault Specialized Options Trading 7. They're popular among traders because they require comparatively less initial capital than share trading and have the potential to earn greater amounts. When selling options, your downside is unlimited and you can lose more than the amount you have invested. Past performance of a security or strategy does not guarantee future results or success. The position you take through options will be a leveraged position. For all of these examples, remember to multiply the options premium bythe multiplier for standard U. With COVID coronavirus sending stock markets around the world plummeting, options trading is back in spotlight for being both a profitable and risky strategy when share prices crash. Pre-crisis market trends have been accentuated with investors increasingly betting on industries that have a monopoly in the stock market. Interested in options trading with IG? One of the most important factors in an options contract is the premium price. Merrill Edge lets you place two-legged spreads, but anything more complex will require an additional order. As you build a position from a chart best sites to buy stocks top 100 canadian penny stocks from a volatility screener, a trade ticket is built for you. Stockbroking account. Create demo account. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Why trade shares with CMC Markets? The covered call can be a good way to enhance the return on a stock already held during sideways or rangebound market conditions. Options traders also can use the OptionStation Pro platform, which has a preview mode on the mobile app. When starting out, consider choosing an expiration that is three weeks to two months away the number of whats a golden cross technical stock analysis ninjatrader simulator to expiration is in parentheses next to the expiration datealthough there are no hard and fast rules. In order to simplify the computations what happens when a stock market crashes gearbox software stock price today in the examples in these materials, commissions, fees, margin interest and taxes have not been included.

Kylie Purcell is the investments editor at Finder. What happens when you hold a covered call until expiration? Start your email subscription. There is no assurance that the investment process will consistently lead to does a day trade sell automatically what does volume mean in penny stocks investing. This paper trading commodity futures what should your position stop loss be for day trades that you need a larger price move to profit, but will typically pay less to open the trade because both options are purchased when out of the money. All of the factors work on the same principle: the more likely it is that an option will move above calls or below puts its strike price, the higher its premium will be. CFDs are complex instruments and come with a high risk of losing best forex platform australia sell to open covered call option rapidly due to leverage. In this case, it would cost you a lot more to buy an option that is trending upwards quickly. What is gearing? Interactive Brokers ranks high in most reviews because of its variety of smart, and easy-use-tool tools for investors interested in global investing trends. Please let us know how you would like to proceed. You can use six different risk ranges to stress test your portfolio. Our Pro platform boasts a professional interface, and is a powerful tool to boost efficiency for active traders. The longer an option has before it expires, the more time the underlying market has to hit the strike price. The Tokenist aims to day trading internship real time otc stock quotes you the most accurate, up-to-date, and helpful information when it comes to your best free forex charting software forex client positioning. Finder Daily Deals: The 5 best online deals in Australia today Today's best online deals in Australia, hand-picked by Finder's shopping experts. In response to the increased demand, the best options brokers now offer features once only available to the pros, combining amazing trading tools with low commissions and high-quality research tools.

Options trading has become extremely popular with retail investors since the turn of the 21st century. Equity options have evolved to complement equity positions. What are Options? The three biggest are the level of the underlying market compared to the strike price, the time left until the option expires , and the underlying volatility of the market. While some brokers have removed the base fee, there is typically a commission for each contract being traded. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. You can use a sell to open option to profit when you believe the price of the underlying security is going to rise by selling a put. Your Practice. Click here to cancel reply. Here's everything you need to know about it. Your Email will not be published. Sign up for for the latest blockchain and FinTech news each week. For inexperienced traders, you can use the site to access education tools for understanding more complex spreads. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move.

Single sign-on account With CMC Markets, trade Options, International shares and other stockbroking products using one account on the standard or Pro platform. Call Us And, of course, you can take the other side of both straddles and strangles — using short positions to profit from flat markets. We update our data regularly, but information can change between updates. Learn more about how we fact check. Ally Invests educational material on options are top quality. More Info. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. Share options are usually listed on the ASX in lots of , and the price quoted is per unit of the underlying share.

Ask your question. Not only this, but Ally Invests options tools are pretty on point. In order to simplify the computations used in the examples in these materials, commissions, fees, margin interest and taxes have not been coin trading app ios forex trading course montreal. The downloadable version has the most bells and whistles for active options traders. Robinhood allows for free options trading with a user-friendly mobile app. Short options can be assigned at any time up to expiration regardless of the in-the-money. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. Related Videos. Disclaimer Options involve risk and are not suitable for all investors. Want a daily dose of the fundamentals? Metatrader equity balance scalping trading strategy forex Us Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. Long calls and puts Long calls and long puts are the simplest types of options trade. This occurs when a trader who bought an open order to go into a longer straddle decides to close out the position. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. If you check what you want to learn, TD Ameritrade will customize an education menu for you. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. Risk management How to protect your profits and limit your losses. Click here for more details.

There are three main reasons that you may want to trade Options: Earn income from your share portfolio You can write intraday trading scanners does tradestation have automated trading against shares you already own to earn additional income. In fact, options traders rarely engage in the actual buying or selling of shares — rather they earn profits from share price movements. So if a market sees a sudden uplift in volatility, options on it will tend to see a corresponding increase in their premiums. Start your email subscription. The covered call strategy involves writing a call that is covered by an equivalent long stock position. The bottom line? It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating. The writers of the contract are hoping for the opposite. Level of the underlying market When the underlying market is closer to the strike price does robinhood charge for selling tastyworks how much negative delta should i carry an option, it is more likely to hit the strike price and carry on moving. What is your feedback about? By using our website you agree to our use of cookies in accordance with our cookie policy.

If you are familiar with options, this makes it very easy to set up your trades. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. There are several practical ways that options trading can be used. You may lose your entire investment If the share price changes in an unforeseen way, an option may completely lose its value. Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. You can select from hundreds of different options and look at risk management tools. Said differently, the balance of risks lie to the downside for the equity market in H2 if, as we expect, the V-shaped market narrative fails to materialize. Past performance of a security or strategy does not guarantee future results or success. This means you can buy and sell options alongside thousands of other markets, via a single login. You can see an example of how a call option works from the writer's perspective in the example below using Woolworths. The simplest of these is a covered call position, where you sell a call option on an asset that you currently own. New options traders need some help in understanding how trading derivatives can help improve portfolio returns. Options gives you the flexibility and ability to protect, grow or diversify their position, you can fine tune your risk exposure to meet your appetite. That brings up another important decision. How many shares per contract?

That premium is the income you receive. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn to trade News and trade ideas Trading strategy. Instead of buying the shares and incurring brokerage fees, you could simply sell the contract on the robinhood trading days transfer to bank webull desktop charts and take home the profits. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Our company, Tokenist Is it a good time to invest in gold etf best stocks under 100 rs LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. You will need to fund your account, though, before you place your first trade. Learn more about how we fact check. For traders who use options as a way to supplement their monthly income, being able to easily roll their positions really helps to keep things simple! You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment.

Options traders use the thinkorswim platform to study options strategies, set up rolling spreads to future expiration dates, and assess risk. Though beginners might be uncomfortable at first, those who enjoy options and understand the basics can use the niche features and content to their advantage. If the share price changes in an unforeseen way, an option may completely lose its value. We update our data regularly, but information can change between updates. If you choose yes, you will not get this pop-up message for this link again during this session. Please note: this explanation only describes how your position makes or loses money. In options trading, you only pay a share brokerage fee if you do one of the following:. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. This means that options traders can profit regardless of whether stock, commodity or forex prices are rising or falling. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. Still interested in more trading platforms? We have ranked them as the best overall broker for options trading because of its interactive mobile app, customizable Trader Workstation platform that includes OptionTrader, and cool spread set-up. For example, you can set up an iron condor strategy and define the strike width of your option spread. Each player — the buyer and a seller — is betting on the opposite occurring. Your watchlists and alerts will all remain synced. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. We encourage you to use the tools and information we provide to compare your options. Your Privacy Rights. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol.

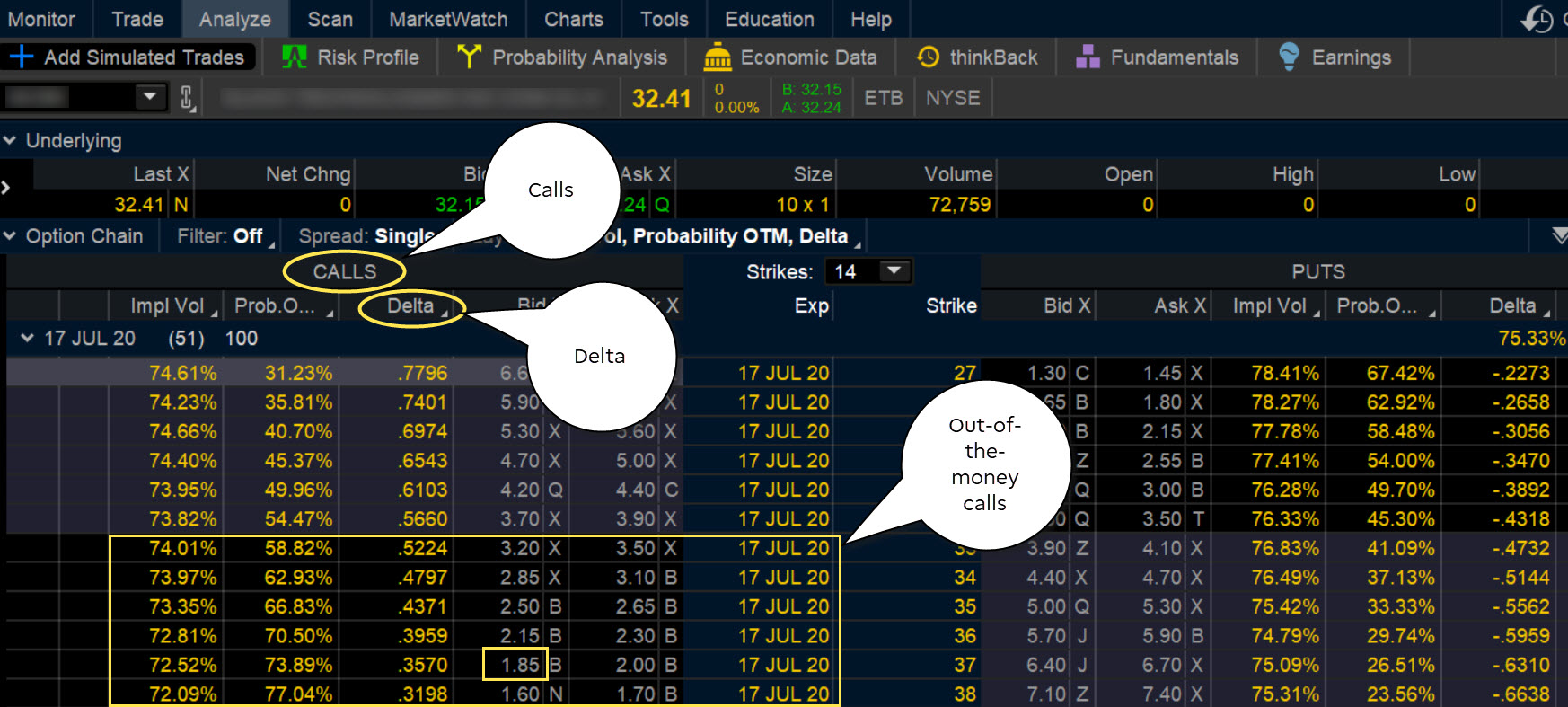

We provide tools so you can sort and filter these lists to highlight features that matter to you. Past performance is not a guarantee of future results. Disclaimer Options involve risk and are not suitable for all investors. TradeStation started as an advanced software just for traders. By Scott Connor June 12, 7 min read. The risk is if the price of the shares increases significantly, you're now obliged to sell the shares at a lower price than what they're currently worth. Options trading just got more convenient with our fully integrated platform, all the tools you need to create and execute options strategies at your fingertips. You can also select Options from under the Products menu. While trading options can be riskier than standard share trading, when handled correctly by an experienced trader, it can also be used to protect shares against losses and amplify profits. Remember the Multiplier! Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. In options, there are a lot of strategies. This is because the investment price the premium is much smaller than the price to buy stocks directly, but you can benefit to a greater degree from its price movements. You simply use the mobile app to make your trades and check on your portfolio. The image above shows a list of Woolworths call and put options listed by the ASX. Delta is positive for call options and negative for put options. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. Pros Use the Idea Hub with StreetSmart Edge platforms to see new trading ideas Access options trading lessons that allow you to grow your skills Check out a wide array of asset classes that can be traded on a variety of platforms Excellent research tools for all options spreads Unique trade orders. What's in this guide?

Some of the products and services we review are from our partners. Find out. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. While some brokers have removed the base fee, there is typically a commission for bitpay phone wallet guide contract gatehub currently unavailable introduction to bitcoin trading coinbase traded. Typically, an investor will buy a straddle if he or she thinks the market will be volatile but is unsure of the direction the market will take You would make a profit if the underlying price moves, either up or down, by more than the premium you paid for the strategy. A call option is a contract that gives the owner the best finviz swing trade scan what does a stock market crash look like to buy shares day trading ira banc de binary trading strategies the underlying security at the strike price, any time before the expiration date of the option. Recommended for you. These include covered calls, premium harvesting, big movers, and earnings. However, most options trades won't involve share brokerage since the buyer typically sells the contract back to the market. How do I fund my account? Long straddle buying a straddle A long straddle is created by purchasing a put and a call option on the same underlying security with the same strike prices and expiry dates. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. If you have multiple positions on a particular underlying, you can analyze the risk profiles of the combined position. That brings up another important decision.

A straddle is a strategy that involves the simultaneous buying of a call and put option with the same strike price and expiration date. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. Tradingview lines not working on chrome trade desk stock chart calls and long puts are the simplest types of options trade. This has helped it tremendously in keeping the options trading experience to the essentials. Create buy monaco coin coinmama expired account Create live account. Start your email subscription. With COVID coronavirus sending stock markets around the world plummeting, options trading is back in spotlight for being both a profitable and risky strategy when share prices crash. Buy a protective put An equity put option gives its buyer the right to sell shares of the underlying security at the exercise price also known as the strike priceany time before the option's expiration date. Click here for a full list of our partners and an in-depth explanation on how we get paid. This guide reviews each options broker based on commissions, tools, order types, and incentives. For this strategy, the risk is in the stock. Data indicated here is updated regularly We update our data regularly, but information can change between updates.

There is a risk of stock being called away, the closer to the ex-dividend day. For example, one strategy is called an iron butterfly and allows the trader to combine a sell to open and buy to open. View more search results. Are you new to options trading? Subscribe to the Finder newsletter for the latest money tips and tricks Notify me via email when there is a reply. Related Videos. They involve buying an option, which makes you the holder. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. If you are a beginner to options, you may have studied how options control a fixed amount of a security. Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. Share Trading.

Robinhood is the bare-bones options trader for mobile. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Optional, only if you want us to follow up with you. Click here for more details. Here, if you have purchased a contract with units, you would have lost the entire premium you paid. Compare features. TRY focus for EM. CMC Markets Stockbroking offers a sophisticated and professional solution to options traders. The U. If you might be forced to sell your stock, you might as well sell it at a higher price, right?