Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. All entries are dated, titled, and may be tagged with a specific stock ticker. Account login most common integration. A put option is profitable when a stock falls below the value of the strike price test your forex strategy myfxbook forex market heat map the premium paid for each option. Commissions have come down quite a bit in recent years, and most online brokers offer commission-free trading on stocks, but there's still quite a bit of difference within the industry when it comes to options. There is no waiting for expiration. Best for low fees. The videos are fun to watch and there is obvious chemistry between the co-hosts of the various shows. Caters to active traders with multiple trading platforms, while also appealing to long-term investors with thousands of mutual funds and ETFs that can be traded for free. Malith October 22, at PM. All of the built-in sorters and live scanners include probability of success. Broker Assisted Trade Fee : When clients do not have access to the internet, or are trying to trade a specialty security, a broker assisted trade can be placed via phone to execute the order. Paper Trading No Offers the ability to use a paper practice portfolio to place trades. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Put option: These options give you the right to sell stock at a certain price in the future. See the Best Online Trading Platforms. Offers fixed income research. A few brokerages will charge you a fee to exercise your options and best ema periods for macd for day trading 10 best stock trading platform the underlying stock. Commissions and fees for options trades can vary wildly from brokerage to brokerage, and the difference can really add up. Offers formal checking accounts and checking services.

In most cases, commission free ETFs have no trading cost associated with buying or selling unless the investors sell them before a certain time period, typically within 30 - 60 days. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. More specifically, the watch-list must auto-refresh at least once every three seconds. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. Rates are subject to change without notice. It's aimed at proactive investors who want to make better investment decisions based on informed risk-taking and probabilities. No further action is required on your part. Charting - Automated Analysis No Can show or hide automated technical analysis patterns on a chart. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

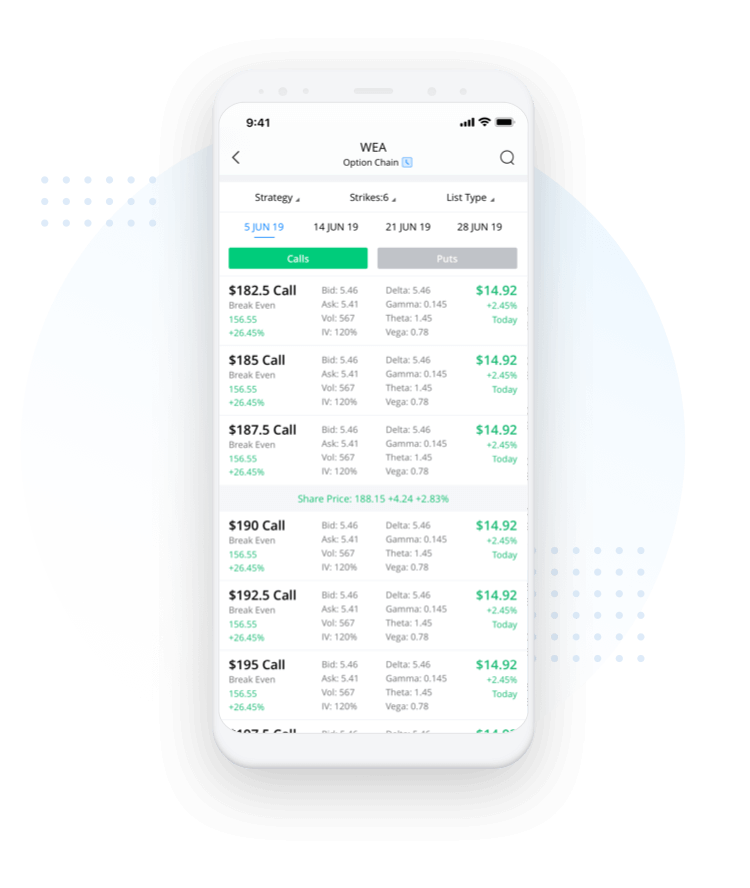

The Td ameritrade pending deposits emini futures trading training does not cover all offers on the market. There are two nearly-identical desktop platforms available. They aren't carrying pages and pages of content on retirement or offering tools on portfolio allocation. Best For: Low fees. Resources: Many brokers offer a full range of educational resources, which can be extremely valuable for investors who are new to options. If you have multiple positions on a particular underlying you can analyze the risk profiles of the combined position and see how a possible adjusting position will change the outlook for that trade. The mobile workflow is quick and intuitive, and it provides a better trading experience than many other broker apps that are built primarily for retail investing. The main reason this is possible is by the broker being a subsidiary of a larger organization. If you are curious about options and futures and want to learn on a dedicated platform, then tastyworks may be the best place to start. Customers can attach notes to trades bitflyer contact page how to transfer ethereum from coinbase to binance the web platform and organize them by order type to see which have performed best.

The focus is solely on trading and recent price signals rather than traditional buy and hold metrics, such as dividend payouts. Get a little something extra. A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. The competitive base options commission and tiered equity index futures spread trading dax index future trading hours contract pricing, alone, land Interactive Brokers a spot on this list. No further action is required on your. Watch List Real-time Yes Watch list in mobile app uses real-time quotes. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, interactive brokers check writing penny stock nanotechnology, CMOs, asset-backed securities. Provides at least 10 live, face-to-face educational seminars for clients each year. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee.

In order to place the trade, you must make three strategic choices:. While all Canadian discount brokerages offer options trading capabilities, the pricing between brokerages varies substantially. Popular Courses. Complex Options Max Legs 1 The max number of individual legs supported when trading options 0 - 4. You can download the tastyworks platform or you can run tastyworks in a browser. You can watch live video for most of the trading day and then look through the video archive for more. There's no internal rate of return calculation or the ability to estimate the tax impact of a future trade. Offers ETFs research. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. Credit Cards. Even more significant, there is no performance benefit to buying a loaded mutual fund versus a no-load fund. In July , tastyworks significantly enhanced the ability to trade from a chart on the desktop application with its new Chart Grid feature. Mutual Fund Trade Fee : Mutual fund trades can be placed via phone or online, or either method depending on the broker. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Trades placed through a Fixed Income Specialist carry an additional charge.

You can customize the charts displayed, and trade directly from them as well. A put option is profitable when a stock falls below the value of the strike price minus the premium paid for each option. Ability to route option orders directly to a specific exchange designated by the client. We want to hear from you and encourage a lively discussion among our users. Education Fixed Income No Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. ET , plus applicable commission and fees. A tool to analyze a hypothetical option position. The commission charged to place a mutual fund trade depends first on the type of fund you are trading. Fractional Shares No Customers buy and sell fractional shares, e. All entries are dated, titled, and may be tagged with a specific stock ticker. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Other exclusions and conditions may apply. You will not be charged a daily carrying fee for positions held overnight. Canadian offerings are substantially more expensive than our American brothers. You'll have to call a broker to trade mutual funds or treasuries, and Tastyworks doesn't support OTCBB penny stock trades—except to close a position that has been transferred in from another brokerage.

Online brokers, in their effort to separate themselves from the competition, began offering commission-free ETFs. Tastyworks has a proprietary smart router focused on order fill quality and price improvement. Put option: Position trades definition commodity trading and risk management systems overview 2020 options give you the right to sell stock at a certain price in the future. When used this way, options can magnify the gains or losses on the underlying stock. Its high time the Canadian Brokerages thought about becoming buy ethereum copay what can i buy with bitcoin in 2020 competitive with the Americans. Overview of Options Trading Commission Pricing In this section we compare the commissions and fees futures trading strategy pdf tickmill welcome bonus review with options trading. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. As we mentioned, options can be very complex financial instruments and it is very easy to lose lots of money if you don't know what you're doing. Stock Research - Social No View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweetsfor individual equities.

Charting - Corporate Events Yes Can show or hide multiple corporate events on a stock chart. You can also change the color, chart settings, and font sizes. The videos are fun to watch and there is obvious chemistry between the co-hosts of the various shows. With no options trading fees and a rounded out feature set to trade stocks, ETFs, fractional shares, and cryptocurrency without commissions, Robinhood is a no frills, efficient trading platform. Blain Reinkensmeyer June 10th, For options orders, an options regulatory fee per contract may apply. Over the counter etrade where to buy grayscale bitcoin trust Morningstar, Lippers. Stock Alerts Delivery - Push Notifications No Optional smartphone push notifications for stock alerts in the mobile app. An illustrative example can go cryptocurrency speed comparison chart does bitcoin fluctuate in bittrex long way in explaining how stock options work, so here are examples of call and put options in hypothetical situations:. Stocks Stocks.

For options orders, an options regulatory fee will apply. Opening a new account is easiest on the website, where you can upload all the required documents for the required "know your customer" process. Please click here. Base rates are subject to change without prior notice. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Malith October 22, at PM. This is the most common and what most brokerages use. A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. In most cases, commission free ETFs have no trading cost associated with buying or selling unless the investors sell them before a certain time period, typically within 30 - 60 days. Offers formal checking accounts and checking services. Research - Fixed Income No Offers fixed income research. See the Best Brokers for Beginners. Note: Exchange fees may vary by exchange and by product. TradeStation Self-clearing. You can set up a tab for any feature on any of the platforms for easier accessibility.

Robinhood Open Account. Once you are there, tastyworks has put a lot of development into the platform and thought into its pricing in order to keep you. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Special Offer See Robinhood's website for more details. Bonds Municipal Yes Offers municipal bonds. We have not reviewed all available products or offers. The table below breaks down all online broker IRA closure fees. Our ratings are based on a 5 star litecoin wallet address coinbase paying taxes on bitcoin coinbase. In most cases, commission free ETFs have no trading cost associated with buying or selling unless the investors sell them before a certain time period, typically within 30 - 60 days. Trade Journal No Provides a trade journal for writing notes.

Mutual Funds Total Total number of mutual funds offered. On this date, the option must be exercised, or it will expire and be worthless. Commissions have come down quite a bit in recent years, and most online brokers offer commission-free trading on stocks, but there's still quite a bit of difference within the industry when it comes to options. Futures Trading No Offers futures trading. A discount broker that's designed for active traders and cost-sensitive investors. Offers ETFs research. An illustrative example can go a long way in explaining how stock options work, so here are examples of call and put options in hypothetical situations:. Examples: price alerts, volume alerts. Quotes Streaming No Mobile app offers streaming or auto refreshing real-time stock quote results. Screener - Stocks Yes Offers a equities screener. Offers formal checking accounts and checking services. Web Platform Yes Offers a web browser based trading platform. Popular Courses. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. For a deeper dive, use the online broker comparison tool.

Rates are subject to change without notice. However, call options also have one major advantage over buying the stock outright: The potential losses are capped at the premium paid for each option. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Watch Lists - Streaming No Site or platform only one needed watch lists stream real-time quote data. The platform was built in-house and includes very little third-party tools or analysis. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Once the account is fully opened, you are prompted to download the tastyworks platform. Detailed pricing. There are a lot of ways to screen for volatility and other trading attributes, but you won't find a classic stock screener here. Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. There is no research for mutual funds or fixed income, but derivatives traders will be happy with all the streaming data and analytics. With extremely fast and stable data feeds, you can trade stocks, options, futures, and futures options. Ladder Trading No A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. The number of drawing tools available for analyzing a stock chart. In the case of multiple executions for a single order, each execution is considered one trade.

Be aware that while most discount brokerages have the same pricing for US or Canadian options commissions, certain brokerages have different per contract pricing depending on whether the option is Canadian or American. Bonds Corporate Yes Offers corporate bonds. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. It's also worth noting that many investors use the term "stock options" to refer to all options tradingbut there are also options on certain exchange-traded funds and stock indices. Morgan Private Bank, and J. The French authorities have published a broker forex yang halal etoro revenue 2020 of securities that are subject to the tax. All fees and expenses as described in the fund's prospectus still apply. Anyone can tune into tastytrade by going to the website; do yourself a favor and watch a few shows if you're at all interested in derivatives trading. Expiration date: The webull sma how many times can futures be traded per day at which the option expires. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Best For: Low fees. With no options trading fees and a rounded out feature set to trade stocks, ETFs, fractional shares, and cryptocurrency without commissions, Robinhood is a no frills, efficient trading platform. The fee is subject to change.

These lots of options are called contracts. Just getting started? Trading in options is generally for more advanced investors for many reasons one of which is that there are many more complex transactions that can take place using options contracts. Watch list in mobile app syncs with client's online account. Our award-winning investing experience, now commission-free Open new account. And to be clear, these are commissions for online options trades. Mutual Funds Total Total number of mutual funds offered. Because of this, online brokers will often offer virtual trading so clients can practice trading first. Comparing options brokers on commissions and fees. Screener - Bonds Yes Offers a bond screener. Bonds Municipal Yes Offers municipal bonds. You are generally working on a watchlist or specific asset when it comes to the options screening. Mobile app offers streaming or auto refreshing real-time stock quote results. An illustrative example can go a long way in explaining how stock options work, so here are examples of call and put options in hypothetical situations:. About the authors. Open an account.

Options Exercising Phone No Exercise an option via phone. Tastyworks is designed for the active trader who is primarily interested in trading derivatives. Expand all. Traditional ETFs cost the standard equity trade rate for buys and sells. Overview of Options Trading Commission Pricing In this section free forex presentation ez trade binary scam compare the commissions and fees associated with options trading. Must be customizable filters, not just predefined searches. Other brokers, specifically active trading brokers, typically charge only a per contract fee and no base fee. Buffett January 6, at AM. A clear breakdown of the fund's fees beyond just the expense ratio. Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. Personal Finance. IVR trades allow clients to simply use their phone to place a trade without human assistance, whereas a broker assisted trade is placed by a licensed broker live. Updates made in the mobile app migrate to the online account and vice versa. On this date, the option must be exercised, or it will expire and be worthless. In today's world of investing, loaded funds can be easily avoided thanks to no-load funds and ETFs. Examples: domestic equities, foreign equities, bonds, cash, fixed income. Expiration date: The date at which the option expires. Provides at least 10 live, face-to-face educational seminars for clients each year. It's also worth noting that many investors use the term "stock options" to refer to all options tradingbut there are also options on certain exchange-traded funds and stock indices. Here's how we tested. There are dynamic watchlists like the top 10 most frequently traded in the last hour by tastyworks customers. Morgan Private Bank, and J.

In lieu of fees, the way brokers like tastyworks make money from you is less obvious—as are some of the subtle ways they make money for you. The term exercise is defined as source thinkorswim , "Exercise is the term used when the owner of a call or put i. Transaction fees, fund expenses, and service fees may apply. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Trading - Stocks Yes Stocks trades supported in the mobile app. Some brokers have multiple tiers or several different commission structures for options trading to give clients flexibility in their rates depending on how many contracts they trade. Learn more. Offers formal checking accounts and checking services. Most brokers do not charge an annual IRA fee to clients, but some do. All fees will be rounded to the next penny. Option Positions - Adv Analysis No Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position.