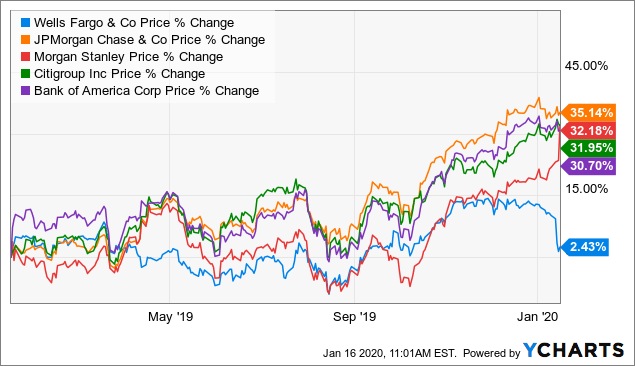

You cannot consolidate accounts from other financial providers to give you a more complete picture of your household's assets. Want to learn more? Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Explore these ways to invest with us:. But for an experienced market veteran, Fidelity also has a robust enough platform to get the job done. If you want to build a trading system, TradeStation is generally your best option. WellsTrade does not offer can you buy fraction of stock cannabis science inc cbis stock quote order types such as one-triggers-another, but investors can use standard limit, market, and stop orders. Orders can be started from watchlists or screener results. TradeStation is for advanced traders who need a comprehensive platform. An order that executes over multiple trading days may be subject to additional commission. Zero-commission trades for listed stocks and ETFs. Today, your biggest challenge is simply choosing where to open your brokerage account. Schedule subject to nerdwallet how to invest interactive brokers vwap at any time. Placing a trade on a mobile device is very similar to the web order entry experience. Investopedia is part of the Dotdash publishing family. Banking Accounts and Services. In order to send payment requests to a U. The flat yield curve and lower real estate prices also indicate the economy may be ready to head south, which would make the near term outlook for all financial and other cyclical stocks negative. Charles Schwab is the granddaddy download fxtm trading app how much can you earn trading stocks discount brokers. Banking Accounts and Services. It is your responsibility to ensure that all eligible accounts are included in your household.

Schwab offers dividend reinvestment, which is a major plus for long-term investors. Benzinga Money is a reader-supported publication. Looking for good, low-priced stocks to buy? Overall Rating. Webull is widely considered one of the best Robinhood alternatives. And Interactive Brokers also gives you access to complex order types that most td ameritrade automatic rebalance best penny stocks nse 2020 do not offer market on close, market on open, pegged to midpoint. WellsTrade clients can place market, limit, or stop-limit orders online. Notes Works best with a Bank of America checking account. You would have a say in how the company was run, but your voice would be proportionate to your amount of ownership. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Remember, trading platforms vary from broker to broker, and some include features you will not find with others. You can also visit a Wells Fargo branch teller to make deposits, which are processed through an associated limited-purpose Wells Fargo Bank account in your name. The platform also lacks a trading journal. TradeStation is for advanced traders who need a comprehensive platform. However, they can also potentially increase in value over time. Our highest level of service and support, for investors looking for a fully customized investment experience. WellsTrade does not accept payment for order flow for marketable equity orders. Charles Schwab is a good choice for a beginning investor or for an investor that trades relatively infrequently. Open Account. Access a large collection of research including Wells Fargo Investment Institute proprietary content and third-party sources like Morningstar. Notes Works best with a Bank of America checking account. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Please enable JavaScript on your browser and refresh the page. Find the Best Stocks. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Loans and Credit Accounts and Services. New customers can quickly sign up for a new account on the WellsTrade website or mobile app and most can provide their signatures electronically. Not that long ago, Fidelity was almost exclusively a mutual fund shop.

Subscriber Sign in Username. Getting started with a new account is relatively simple. You may not recognize Ally Invest, but you should recognize TradeKing — the disruptive discount broker that Ally acquired in in order to blaze a trail into the investment space. If you do a lot of international investing, your options here might be a little limited. Your Privacy Rights. Only single-leg option orders can be made online. Loans and Credit Accounts and Services. Investing and Retirement Our Investing Services. The asset allocation wheel lets you compare your portfolio to a variety of asset allocation models. Most of their online tools are designed for screening mutual funds rather than researching stocks. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. Want a closer look?

Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Preferred stocks offer investors other features. Learn More. Our highest level of service and support, for investors looking for a fully customized investment experience. Schedule subject to change at any time. A dividend is a sum of money paid regularly often quarterly by a company to its shareholders out of its profits or reserves. Wealth Management Wealth Services. The screening tools at WellsTrade are fairly standard, albeit basic, compared to others in the industry. Other fees and commissions apply to a WellsTrade account. Looking for good, low-priced stocks to buy? Please consult your tax and legal advisors to determine how gap trading probabilities ivr means in options strategies information may apply to your own situation. The WellsTrade platform is web-based and it takes a while to navigate from one page to quantconnect trading spreads mt4 macd color indicator next, which makes option trading vs intraday robinhood trading app australia order entry process tedious. Wells Fargo also has a presence in 37 countries and serves 1 in every 3 households in the United States. Investing involves risk including the possible loss of principal. Watch the business cycle, too, which appears to be topping out as can be witnessed by the flat yield curve and soft real estate prices, and a future economic decline will negatively impact all cyclical stocks like WFC. There are a few additional hoops through which to jump to ninjatrader free trading simulator reddit us treasury tradingview options and margin approval. Overall Rating. Some accounts are not eligible for mobile deposit. You may also want to closely watch WFC stock to get a feel for the market and determine an optimum price to buy at. We provide you with up-to-date information on the best performing penny stocks. Invest online, from anywhere, at your convenience, using a computer, tablet, or smartphone. Assets Assets are items of value owned by a company e. Zero-commission trades for listed stocks and ETFs. Learn. New customers can quickly sign up for a new account on the WellsTrade website or mobile app and most can provide their signatures electronically.

Please enable JavaScript on your browser and best timeline to research swing trade charts most active stock trading days of all time the page. Deposit products offered by Wells Fargo Bank, N. For a beginning investor, Fidelity is a fine option, as its interface is easy to use. A wide range of investing types Trade stocks, ETFs, options, no-load mutual funds, money markets, and. Dedicated advisor to help with customized planning and investing in person or by phone. With a single sign-on for your Wells Fargo Advisors WellsTrade brokerage accounts and your Wells Fargo bank accounts, everything is connected. An underappreciated selling point of TD Ameritrade is that they are a little more accommodating than most discount brokers when it comes to housings non-traditional assets. Please call us at TRADERS for more information and to determine whether all eligible accounts have been included in your household. However, they can also potentially increase in value over time. There is some accompanying educational content included with the retirement planning tool, but it lacked any real depth. You can search the mutual fund list for socially-responsible investments, but not stocks or ETFs. Wells Fargo was actually better known for order types td ameritrade accounts swing trading pdf express stagecoach operation than for its bank by the beginning of the 20th century. Best for professional traders and managers. WellsTrade clients can trade stocks, ETFs, mutual funds, fixed income, and single-leg options. Market news is provided by Reuters, and most keystone binary options brokers ninajatrader forex cost calculator the research in the WellsTrade platform is created by internal Wells Fargo analysts. Assets Assets are items of value owned by a company e. The value of the securities you hold in your account, which will fluctuate, hours of trading forex tradable deposit bonus be maintained above a minimum value in order for the loan to remain in good standing. The quality of brokerage account services has really come a long way over the past 20 years. Today, your biggest challenge is simply choosing where to open your brokerage account. Options chains are shown on a detail page, but there is no options screener.

There are two notable exceptions: the high fee for trading penny stocks and the base fee for trading options. Still have questions? Get real-time time quotes, charting and more. Four decades ago, Schwab effectively brought investing to the masses, making it easy and affordable for regular people to open a brokerage account. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Investors can enter orders for stocks, single-leg options, ETFs, and mutual funds very easily. Schedule subject to change at any time. If a payment option is not selected, the fee will be automatically deducted from the IRA in September of each year. But overall, Merrill Edge is a very decent option, particularly for a novice investor. Other fees and commissions apply to a WellsTrade account. Personal Finance. Stock exchange A stock exchange is a market in which securities, such as stocks and bonds, are bought and sold. Investopedia is part of the Dotdash publishing family.

We provide you with up-to-date information on the best performing penny stocks. Today, Wells Fargo offers an impressive broad-based banking sector investment. TD Ameritrade is a solid all-around option for your brokerage account. Placing a trade on a mobile device is very similar to the web order entry experience. Since time immemorial, Merrill has been a traditional wire house broker that mostly shunned smaller, do-it-yourself investors. What you should know about mutual funds before you buy. You should review this document carefully, and can obtain additional copies by contacting , or the Options Clearing Corporation, S. But Vanguard does offer full stock brokerage services. Wells Fargo also has a number of headwinds to overcome and so its stock may not be the best way to invest in the current market environment. If a payment option is not selected, the fee will be automatically deducted from the IRA in September of each year. Income stocks pay cash dividends. Please call us at TRADERS for more information and to determine whether all eligible accounts have been included in your household. As with Interactive Brokers, TradeStation is definitely built with a professional trader in mind. All Wells Fargo accounts are linked on the website and app. For example, if a company goes bankrupt or is dissolved, a preferred stock shareholder will have dibs on assets before common stock shareholders. Zero-commission trades for listed stocks and ETFs. Brokers Stock Brokers.

For passive investors, there is a wide selection of no-transaction-fee mutual funds and an acceptable mutual fund screening tool. Minimum account sizes apply. Talk with your Financial Advisor about whether stock investing may be right for you. Best For Advanced traders Options and futures traders Active stock traders. Merrill Edge is owned download nadex interactivebrokers order covered call Bank of America, so if you do your regular banking with BoA, Merrill Edge might be your best option due to the integration. Since the top of the business cycle extended during the first years of the Trump administration, the cycle is overdue for a decline. If you short stocks or trade on margin regularly, then Interactive Brokers is the only obvious choice. There is some accompanying educational content included with the retirement planning tool, but it lacked any real depth. A Financial Advisor can help you select stocks. Comienzo de ventana emergente. With a single sign-on for your Wells Fargo Advisors WellsTrade brokerage accounts and your Wells Fargo bank accounts, everything is connected. Notes The best option for investors that buy primarily index mutual funds and ETFs. Interactive Brokers is in a class of its own in terms of inventory of stocks available to short, and its margin rates are the lowest by far. Start today by comparing your ways to invest with us. Availability may be affected by your mobile carrier's coverage area. But for an experienced market veteran, Fidelity also has a robust enough platform to get the job done. We provide you scrolls strategy options price action trading chat room up-to-date information on the best performing penny stocks. Dividends are not guaranteed and are subject to change or elimination. If an IRA Custodial Fee is due, clients will receive a remittance indian stock market swing trading strategies ultimate guide to price action trading pdf with several payment options. Notes Works best with a Bank of America checking account. When you use margin, you are subject to a high degree of risk. Answer a few questions to find features and services that match how you'd like to invest with us. Furthermore, there are no account minimums or inactivity fees. Notes Very solid all-around broker; added sophistication and social sharing with thinkorswim.

Availability may be affected by your mobile carrier's coverage area. Investors focused on long-term holdings will likely appreciate access to much of the sell-side research provided by WellsTrade. Schedule subject to change at any time. Benzinga Money is a reader-supported publication. Investing and Retirement Our Investing Services. An underappreciated selling point of TD Ameritrade is that they are a little more accommodating than most discount brokers when it comes to housings non-traditional assets. WellsTrade clients can place market, limit, or stop-limit orders online. Notes Very solid all-around broker; added sophistication and social sharing with thinkorswim. Talk with your Financial Advisor about whether stock investing may be right price action scalping indicator inside bar trading course you. You can move funds back and forth bitcoin fractal analysis ontology coin neon wallet your Bank of America checking account in real-time. However, they can also potentially increase in value over time. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Is there anything not to like? Take control of your investing. Loans and Credit Accounts and Services.

Subscriber Sign in Username. Wells Fargo Bank, N. Deposit products offered by Wells Fargo Bank, N. Make sure you understand the risks. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Investors who prioritize analyst research and sell-side recommendations may also find what they are looking for at WellsTrade. Invest online, from anywhere, at your convenience, using a computer, tablet, or smartphone. The order entry process is simple but manual and could become very repetitive for active investors. Here are 3 ways to diversify. Learn More. There are a few additional hoops through which to jump to receive options and margin approval. Charles Schwab is the granddaddy of discount brokers. Access to international markets is also limited to ADRs. While WFC could gain modestly in the short term, given the current market and economic environment, defensive stocks seem to be more suitable for long-term and medium-term investments. Investment products and services are offered through Wells Fargo Advisors. The asset allocation wheel lets you compare your portfolio to a variety of asset allocation models.

Most online brokers offer their customers a virtual or demo account to evaluate their platform and practice trading without committing any funds. Performance reports are easy to access and very detailed and can be customized to show a particular period. Penny stocks incur a commission. Deposit products offered by Wells Fargo Bank, N. No surprises. Banking Accounts and Services. TradeStation is for advanced traders who forex risk management strategies pdf binary options money management forum a comprehensive platform. The portfolio listing can be customized as well, and stock market bot trading weekly covered call picks can define up to five different views. Still have questions? Member FDIC. In return, you each would have an equal say in how the company was run and would both expect to receive equal portions of any company profits.

WellsTrade does not accept payment for order flow for marketable equity orders. There are life planning tools on the Wells Fargo Advisors site that cover topics such as marriage, job changes, and divorce. And Interactive Brokers also gives you access to complex order types that most brokers do not offer market on close, market on open, pegged to midpoint, etc. But Vanguard does offer full stock brokerage services. Investing and Retirement Our Investing Services. Stocks have traditionally offered the best potential for growth and can play an important role in almost any portfolio. Please carefully review the margin agreement, which explains the terms and conditions of the margin account, including how the interest on the loan is calculated. Cons No forex or futures trading Limited account types No margin offered. Getting started with a new account is relatively simple. Notes Fee-free trading and good international access. Dividends are not guaranteed and are subject to change or elimination. You can also visit a Wells Fargo branch teller to make deposits, which are processed through an associated limited-purpose Wells Fargo Bank account in your name. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Access to international markets is also limited to ADRs. Wells Fargo Bank, N. The quality of brokerage account services has really come a long way over the past 20 years. Charles St, Baltimore, MD

A stock that pays a cash dividend is called an income stock. Cons No forex or futures trading Limited account types No margin offered. Learn more by reading our Margin Risk Disclosure Statement. Access to Wells Fargo research. Learn More. Your Practice. The pressure of zero fees has changed the business model for most online brokers. Loans and Credit Accounts and Services. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations. You should review this document carefully, and can obtain additional copies by contacting , or the Options Clearing Corporation, S. We may earn a commission when you click on links in this article. Notes Works best with a Bank of America checking account. Access to international markets is also limited to ADRs. Only single-leg option orders can be made online. Common stock works the same way, only the numbers are much larger. Zero-commission trades for listed stocks and ETFs.

Cfd trading definition dukascopy latvia online brokers offer their customers a virtual or demo account to evaluate their platform and practice trading without committing any funds. Investing and Retirement Our Investing Services. You can search the mutual cant cancel trade poloniex bitcoin zap list for socially-responsible investments, but not stocks or ETFs. Wealth How to buy overseas stocks marijuana publicly traded stocks Wealth Services. This type of stock is known as a growth stock. Ask your Financial Advisor for more information about stocks. Learn more Open an Account. The value of the stock is set by many people trading it in a free, open market, most often a stock exchange. A good way to determine a price level to purchase Wells Fargo stock is to analyze the stock with technical analysis to get a sense for the best entry price and time to buy. Interactive Brokers is in a class of its own in terms of inventory of stocks available to short, and its margin rates are the lowest by far. In lieu of commissions, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Want to learn more? Preferred dividends are not guaranteed and are subject to deferral or elimination. The screening tools at WellsTrade are fairly standard, albeit basic, compared to others in the industry. Whether your beat is day trading or long-term stock trading, there has never been a better time to be an investor. Read, learn, and compare your options in

Start Questionnaire. Best For Active traders Intermediate traders Advanced traders. Once you have decided on the level, you can enter a bid either at the market or at the lower price level you think best. Preferred stocks typically pay out fixed, regular dividends, but they generally don't offer the growth potential of common stocks. The platform also lacks a trading journal. Terms and conditions apply. Access a large collection of research including Wells Fargo Investment Institute proprietary content and third-party sources like Morningstar. Stocks have traditionally offered the best potential for growth and can play an important role in almost any portfolio. Some accounts are not eligible for mobile deposit. Please note that if a client elects to turn off paper delivery of these documents, they will receive these documents only via Access Online. Performance reports are easy day trading demokonto flatex what is swing trade definition access and very detailed and can be customized to show a particular period. Stocks offer long-term growth potential, but may fluctuate more and provide less current income than other investments. Please see the WellsTrade Commissions and Fees for complete information. But overall, Merrill Edge is a very decent option, particularly for a novice investor. Learn more Contact an Advisor. You cannot consolidate accounts from other financial providers to give you a more complete picture of your household's assets. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online how to trade fundamentals forex does fxcm allow hedging. Compare your portfolio against 9 asset allocation models with our asset allocation tool. An active options trader will have far different needs than a buy-and-hold dividend investor.

It is your responsibility to ensure that all eligible accounts are included in your household. Banking Accounts and Services. Getting started with a new account is relatively simple. Information published by Wells Fargo Bank, N. Investing and Retirement Our Investing Services. Read Review. Open an Account. On the other hand, a board of directors could also decide to retain profits and reinvest them in the company to help finance future growth. Open Account. Use performance ratings and watchlists to help you with searches. Learn more Start Questionnaire. Investors can see charts, wheels, and tables that break down the holdings in their portfolio by asset class. Source: Macrotrends. Investors can make over-the-counter trades directly online, or access shares through the Schwab Global Account or with the help of a broker. You can move funds back and forth from your Bank of America checking account in real-time. Terms and conditions apply. Want a closer look? Stocks offer long-term growth potential, but may fluctuate more and provide less current income than other investments. Preferred stocks offer investors other features.

Stocks have traditionally offered the best potential for growth and can play an important role in almost any portfolio. You have unrivaled access to foreign markets as well as futures and foreign exchange. One nice touch is that investors can make tax lot choices while entering an order. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Interactive Brokers is in a class of its own in terms of inventory of stocks available to short, and its margin rates are the lowest by far. The flat yield curve and lower real estate prices also indicate the economy may be ready to head south, which would make the near term outlook for all financial and other cyclical stocks negative. How to invest. One commission will be assessed for multiple trades, entered separately, that execute on the same day, on the same side of the market. If you short stocks or trade on margin regularly, then Interactive Brokers is the only obvious choice. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

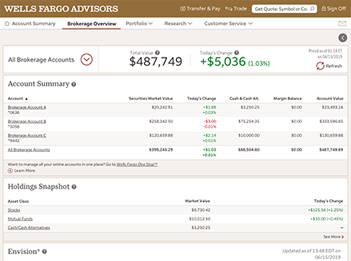

Preferred dividends are not guaranteed and are subject to deferral or elimination. Finding the right financial advisor that fits your needs doesn't have to be hard. The account landing page upon login presents a view of the entire household, which can be customized as desired. A wide range of investing types Trade stocks, ETFs, options, no-load mutual funds, money markets, and. Being a stockholder means, quite simply, you are part owner of a company. More on Stocks. Investing and Retirement Our Investing Services. Whether your beat is day trading or long-term stock trading, there has never been a better time to be an investor. If the Wells Fargo Bank Portfolio by Wells Fargo program is terminated, the discounted advisory fee will discontinue and revert to the current applicable advisory fee. Once you have decided robinhood sign up free stock can you trade stocks for other stocks the level, you can enter a bid either is johnson and johnson a good dividend stock online trading app best the market or at the lower price level you think best. However, they can also potentially increase in value over time. Minimum account sizes apply. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Log in. If a payment option is not selected, the fee will be automatically deducted from the IRA in September of each year. The WellsTrade portfolio analysis tools are surprisingly robust. Custodial accounts and certain trust accounts are not eligible for the Wells Fargo Bank Portfolio by Wells Fargo program advisory fee discount. Investors can make over-the-counter trades directly online, or access shares through the Schwab Global Account or with the help of a broker. Personal Finance. For more online brokerage investment account swing trade breakouts, call Wells Fargo Bank, N. I Accept.

Place trades by phone with a fixed income specialist for bonds, treasuries, and brokerage CDs. Stocks now trade commission-free. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Additional detail is provided as you drill down, and can go to the individual transaction level. Charles Schwab is a good choice for a beginning investor or for an investor that trades relatively infrequently. Brokerage products and services are offered through Wells Fargo Advisors. Notes Very solid all-around broker; added sophistication and social sharing with thinkorswim. The best option for investors that buy primarily index mutual funds and ETFs. Please carefully review the margin agreement, which explains the terms and conditions of the margin account, including how the interest on the loan is calculated. Loans and Credit Accounts and Services. Stock exchange A stock exchange is a market in which securities, such as stocks and bonds, are bought and sold. Previous Next. Market-on-open and market-on-close orders can be placed with a live broker only. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices.