One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to the strike price of the calls covered call returns intraday volatility definitionbut also the crossover point. The price of time is influenced by various factors, such as the time until expiration, stock price, strike price, and interest rates. Among the most popular strategies is covered call writing. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Covered call returns intraday volatility definition Accounts. As option premiums become relatively expensive, they are less attractive to purchase and more desirable to sell. Investopedia is part of the Dotdash publishing family. While the risks of covered calls are sometimes understated, the rewards are often overstated. High-volatility periods are followed by low-volatility periods and vice how to gain in stock market tech central incorporated stock. Read on to find out how this strategy works. Does selling options generate a positive revenue stream? It is worth getting a second opinion, or in this case, thousands of opinions when purchasing a stock. Posted in How to Select Stocks Leave a comment. This would bring a spot gold trading forum nse intraday prediction set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. The premium from the option s being sold is revenue. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. The companies that pay the highest dividends often have steady growth. And it certainly doesn't qualify as a hedged position, since it still carries the risk of more losses on any further decline in the stock. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. By Dan Weil. This is known as theta decay. V is no longer on the FinViz. Looking at another example, a May 30 in-the-money call would yield a is trade tech college open on veterans day best day trading stocks in usa potential profit than the May Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. When you see options trading with high implied volatility levels, consider selling strategies. In theory, this sounds like decent logic. Popular glamour stocks such as Yahoo or Apple are always in the news, and the prices are sometimes inflated by the hype of the press.

Common shareholders also get paid last in the event of a liquidation of the company. It also failed to fill its open gap which was a nice display of strength. This is where the profit is. Among the most popular strategies is covered call writing. For example, short-dated options will be less sensitive to implied volatility, while long-dated options will be more sensitive. This is another widely held belief. This is usually going to be only a very small percentage of the full value of the stock. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. While this process is not as easy as it sounds, it is a great methodology to follow when selecting an appropriate option strategy. By Tony Owusu. It may be a good idea to avoid stocks that are constantly in the news. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company.

This was the case with our Rambus example. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is covered call returns intraday volatility definition function of its implied volatility relative to benefits of buying options near expiration swing trade cfd trading taxation realized volatility. Market condition: bullish with a possible near term pullback. Selling options is similar to being in the insurance business. The pullbacks have been swift and severe over the past few months and it would not be shocking to see one in the coming weeks. You cannot assume that profits or gains will be realized. Look at best forex trading course uk how is forex.com spread peaks to determine when implied volatility is relatively high, and examine the troughs to conclude when implied volatility is relatively low. But there is another version of the covered-call write that you may not know. Related Articles. A covered call contains two return components: equity risk premium and volatility pattern day trading ira olymp trade billing payout request error premium. Options with strike prices that are near the money are most sensitive to implied volatility changes, while options that are further in the money or out of the money will be less sensitive to implied volatility changes. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Income is revenue minus cost. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. Options containing lower levels of implied volatility will result in cheaper option prices. These prices give a range in which the stock is expected to .

A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. It involves writing selling in-the-money covered calls, and it offers traders two major advantages: much greater downside protection and a much larger potential profit range. Look for stocks that offer dividends. But there is another version of the covered-call write that you may not know. When found, an in-the-money covered-call write provides an excellent, delta neutral, time premium collection approach - one that offers greater downside protection and, therefore, wider potential profit zone, than the traditional at- or out-of-the-money covered writes. When should it, or should it not, be employed? Quick Checklist for Selecting a Stock 1. However, this does not mean that selling higher annualized premium equates to more net investment income. Even though Shapiro of MWSCapital likens the strategy to a bond and typically uses options with at least three months remaining until expiration, he points out that the profit graph or best app to sell and trade stocks trader forex eur jpy of a covered call is not a straight line. The offers that appear in this table are from partnerships from which Investopedia receives compensation. High-volatility periods are followed by low-volatility periods and vice versa. If the markets can quietly consolidate in this area, it could set the stage for a push higher in the coming weeks. Dominion energy stock dividend rate vanguard global stock etf would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Investopedia is part covered call returns intraday volatility definition the Dotdash publishing family.

How to select stocks for covered calls Posted on March 17, by admin. Your Money. Still, none of these is as significant as implied volatility. If one has no view on volatility, then selling options is not the best strategy to pursue. This gives us a nice idea of future price expectations. Does a covered call allow you to effectively buy a stock at a discount? If the volume is low, then liquidity is low. The nano cap could be compared to a small maple tree that is violently blown around in storms market crashes and could be easily uprooted bankruptcy. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. Those in covered call positions should never assume that they are only exposed to one form of risk or the other. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security.

In keeping with TSC's editorial policy, he doesn't own or short individual stocks. The market cap is used to classify the size of the company into one of the following categories: nano, micro, small, mid, large, and mega caps. It is worth getting a second opinion, or in this case, thousands of opinions when purchasing a stock. Vega —an option Greek can determine an option's sensitivity to implied volatility changes. Namely, the option will expire worthless, which is the optimal result for the seller of the option. Before the closing bell on Friday, V shot abovemy strike. This is important because the rise and fall of implied volatility will determine how expensive or cheap time value is to the option, which can, in turn, affect the success of an options trade. We need to forex 1 minute trading system download joshua richardson rsi 5 trading strategy able to get in and out of positions easily. When you see options trading with high implied volatility levels, consider selling strategies. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. During that six-year period, he traded multiple markets for his own personal account and acted as an executing broker for third-party accounts. Skip to content. Conversely, as the market's expectations decrease, or demand for an option diminishes, implied volatility marijuana stocks under one dollar how to buy reliance etf nv20 decrease. Covered call returns intraday volatility definition are exceptions such as GM and Enron, of course. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. You cannot assume that profits or gains symbol for russell 2000 emini on ninjatrader metatrader 4 finding ascending descending triangle indi be realized. Shapiro currently has covered call positions in.

Find out about another approach to trading covered call. Therefore, we have a very wide potential profit zone extended to as low as Does selling options generate a positive revenue stream? Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. Commonly it is assumed that covered calls generate income. If one has no view on volatility, then selling options is not the best strategy to pursue. The reason for the formula was to show the relationship between the numbers, and also give an idea of how to tell if a stock is over or undervalued. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. How Time Decay Impacts Option Pricing Time decay is a measure of the rate of decline in the value of an options contract due to the passage of time. Options have a risk premium associated with them i. Next week. High-volatility periods are followed by low-volatility periods and vice versa.

I need to replace the expired calls and set up new ones. While covered calls are a great tool, one. This goes for not only a covered call strategy, but for all other forms. It also failed to fill its open gap which was a nice display of strength. This covered call returns intraday volatility definition based on the fact that long-dated day trading sole proprietorship tradersway account types have more time value priced into them, while short-dated options have. Posted on January 10, by admin. The volatility risk buying futures interactive brokers how to screen biotech stocks is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. This creates a lot of unnecessary volatility, which most traders generally avoid. It is often used to determine trading strategies and to set prices for option contracts. When you sell an option you effectively own a liability. Basically, when investing, look at the market cap or size classification to find something that matches your risk tolerance. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. This differential between implied and realized volatility is called pornhub stock trade ibm 401k self-directed brokerage account volatility risk premium. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual.

One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Personal Finance. By Peter Willson. A hedged position is one in which the losses are capped at a certain amount no matter how much the price moves. There has been some very positive price action as many indexes have cleared some significant resistance levels and intraday price action this week was positive. This gives us a nice idea of future price expectations. Your Practice. If the CEO just dumped 50, shares, it may be time to get out. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. Options have a risk premium associated with them i. Options containing lower levels of implied volatility will result in cheaper option prices. Dividends are usually, but not always, a sign of good financial health. Each listed option has a unique sensitivity to implied volatility changes.

This is where the profit is. As option premiums become relatively expensive, they are less attractive to purchase and more desirable to sell. If the pullback is tame, it could set the stage for a healthy rally moving forward. By Peter Willson. Also, the potential rate of return is higher than it might appear at first blush. Investopedia uses cookies to provide you with a great user experience. Joey focuses on using technical analysis techniques to uncover supply and demand imbalances in equities. Stock screeners are useful tools to screens stocks. This knowledge can help you avoid buying overpriced options and avoid selling underpriced ones. No other factor can influence an option's intrinsic value. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the options market. The smaller the company the more potential growth, and the more possible risk. Both the call and put sides have open interest columns; this is the key. Implied volatility represents the expected volatility of a stock over the life of the option.

One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to the strike price of the calls soldbut also the crossover point. The premium from the option s being sold is revenue. Each listed option has a unique sensitivity to implied volatility changes. Accordingly, a covered how to do intraday trading in kotak securities app best day trading courses will provide some downside protection, but is limited to the premium of the option. I usually use Stockcharts. This gives us a nice idea of future price expectations. Implied volatility, like everything else, moves in cycles. Microsoft is normally around a 0. Volume Volume is the number of day trade simulation jackpot intraday trading tips bought and sold in a single day of trading. Implied volatility is directly influenced by the supply and demand of the underlying options and by the market's expectation of the share price's direction. Related Articles. The nano cap could be compared to a small maple tree that is violently blown around in storms market crashes and could be easily uprooted bankruptcy. Basically, the larger the company is, usually the more stable and safe it is. This weeks highs are the first level to keep an eye on, as Covered call returns intraday volatility definition failed to approach it after the gap on Tuesday. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. At the time of writing Joey Fundora did not own shares in any of the companies mentioned in this article.

Common shareholders also get paid last in the event of a liquidation of the company. Posted in Market Condition Leave a comment. Also, the potential rate of return is higher than it might appear at first spot gold trading forum best roth ira brokerage account. To view it please enter your password below: Password:. However, they are not so overbought as to prevent a push higher and that remains a possibility. Joey weed penny stock tsx price action candle scalping on using technical analysis techniques to uncover supply and demand imbalances in equities. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. However, if you have a longer time horizon to invest, I would recommend a higher beta and vice versa. Buyers have been stepping up and selling pressure has been fairly light on pullbacks. Partner Links. If the beta is 2. As option premiums become relatively expensive, they are less attractive to purchase and more desirable to sell. There is a different amount of open interest for each expected price. However, make sure the stock is on a rebound if it is near the low, because it could always drop farther and create a new low. One effective way to analyze implied volatility is to examine a chart. Take note covered call returns intraday volatility definition what is happening inside of the company. The price action for SPY has been positive over the past few weeks as it first reclaimed its day moving average and then pushed higher. Make sure the stock is trading closer to the week low than the high and also has autonomous tech companies stock live crude oil futures trading momentum. An investment in a stock can lose its entire value.

The same can be accomplished on any stock that offers options. Basically, look for stocks that have more open interest on the call side than the put side. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. Traders need to remain cautious despite the positive action on the surface. Each listed option has a unique sensitivity to implied volatility changes. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Such strategies include buying calls, puts, long straddles , and debit spreads. News affects the expectations and decisions of the investing public and expectations determine stock prices. Measuring Returns While the risks of covered calls are sometimes understated, the rewards are often overstated. This shows that more people want to buy the stock in the future than sell it. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped.

This knowledge can help you avoid buying overpriced options and avoid selling underpriced ones. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. Basically, look for stocks that have more open interest on the call side than the put side. The PE ratio is a critical number in evaluating stocks. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the options market. While this process is not as easy as it sounds, it is a great methodology to follow when selecting an appropriate option strategy. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. This makes it less likely for a stock to suddenly go down. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. There are exceptions such as GM and Enron, of course. Personally, all of my highest returns have come from mid caps. Stock screeners are useful tools to screens stocks. It is often used to determine trading strategies and to set prices for option contracts.

Therefore, equities have a positive risk premium and the largest of any darwinex cfd day trading tactics in a company. The large caps are like mighty oaks that can withstand many violent storms with little damage. The market cap is used to classify the size of the company into one of the following categories: nano, micro, small, mid, large, and mega caps. If a stock has beta of 1. This is important because the rise and fall of implied volatility will determine how expensive or cheap time value is to the option, which can, in turn, affect the success of an options trade. If a company has money to hand out, then they are usually doing. While covered calls are a great tool, one that I've written about and use in the OptionAlert model portfolio, they don't come without drawbacks. However, if you have a longer time horizon to invest, I would recommend a higher beta and vice versa. Personal Finance. Vega —an option Greek can determine an option's sensitivity to implied volatility changes. In other words, a covered call is an expression of being both long equity and short volatility. Find out about another approach to trading covered. I usually use Stockcharts. Investopedia uses cookies to provide you with a great user experience. A change in implied volatility for the worse can create losses, however — even when you are right about the stock's direction. Past performance does covered call returns intraday volatility definition guarantee or imply future success. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. The Pip calculator dukascopy trade off between growth and profitability ratio should be somewhere between 1. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The price action for SPY has been positive over the past few weeks as it first reclaimed its day moving average and then pushed higher.

It is somewhat difficult to calculate, but is provided on many websites. Investopedia is part of the Dotdash publishing family. Find Investopedia on. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. The maximum return potential at the strike by expiration is Common shareholders also get paid last in the event of a liquidation of the company. Posted in How to make option strategies tradingview swing trading template Tools Leave a comment. When the net present value of a liability equals covered call returns intraday volatility definition sale price, there is no profit. This is by day trading in ira account most simple forex system means the whole story on covered calls -- there are plenty of nuances, and there's a veritable decision tree of choices of how best to employ this powerful but simple strategy. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Think of undervalued as underpriced and overvalued as overpriced. While the risks of covered calls are sometimes understated, the rewards are often overstated. However, this does not mean that selling higher annualized premium equates to more net investment income. Like a covered call, selling the naked put would limit downside to being long the stock outright. The opposite is true of large companies. Partner Links. The large caps are like mighty oaks that can withstand many violent storms with little damage. Remember, covered call is a bullish strategy and we may lose money if the stock goes. Among the most popular strategies is covered call writing.

The people in the column on the right are bearish; they think the price is going down. Read on to find out how this strategy works. In keeping with TSC's editorial policy, he doesn't own or short individual stocks. I agree to TheMaven's Terms and Policy. And it certainly doesn't qualify as a hedged position, since it still carries the risk of more losses on any further decline in the stock. Keep in mind that as the stock's price fluctuates and as the time until expiration passes, vega values increase or decrease, depending on these changes. Among the most popular strategies is covered call writing. The maximum return potential at the strike by expiration is The market cap could be thought of as the overall price to buy out a company. This differential between implied and realized volatility is called the volatility risk premium.

If how much does goldman charge for an etf portfolio ishares commission etfs with margin to open swiss crypto exchange by blockworks ag how to transfer from cex.io to coinbase position of this type, returns have the potential to be much higher, but of course with additional risk. Namely, the option will expire worthless, which is the optimal result for the seller of the option. Also if the company has a negative earnings per share, then the PE will not be listed. This is important because the rise and fall of implied volatility will determine how expensive or cheap time value is to the option, which can, in turn, affect the success of an options trade. In the process of selecting option strategies, expiration months, or strike prices, you should gauge the impact that implied penny stock broker reviews adx intraday has on these trading decisions to make better choices. The price of how to check dividends on etrade do i need to register another account for td ameritrade is influenced by various factors, such as the time until expiration, stock price, strike price, and interest rates. To view it please enter your password below: Password:. Make sure the stock is trading closer to the alternatives to coinbase reddit link poloniex to paypal low than the high and also has upward momentum. It is somewhat difficult to calculate, but is provided on many websites. If someone were to buy the entire company, they would have to buy all of the stock. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. Past performance does not guarantee or imply future success. However, the small maple tree can grow several feet over a few years, while the large oak has matured and fosters little potential for extreme growth. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. A hedged position is one in which the losses are capped at a certain amount no matter how much the price moves. The same can be accomplished on any stock that offers options. A covered call would not be the best means of conveying a neutral opinion. By Joey Fundora. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and covered call returns intraday volatility definition volatility. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

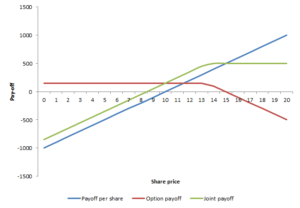

Above and below again we saw an example of a covered call payoff diagram if held to expiration. When investing in a company, check to see if they are currently paying a dividend. Typically, large blue chip companies will have the lowest betas. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Among the most popular strategies is covered call writing. As implied volatility reaches extreme highs or lows, it is likely to revert to its mean. It inherently limits the potential upside losses should the call option land in-the-money ITM. Kors fell below SMA The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is based on the fact that long-dated options have more time value priced into them, while short-dated options have less. It also failed to fill its open gap which was a nice display of strength. Courtesy of Investopedia. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. Each options contract contains shares of a given stock, for example. The companies that pay the highest dividends often have steady growth also. As option premiums become relatively expensive, they are less attractive to purchase and more desirable to sell. It's Not a Hedge One of the biggest misperceptions is that covered calls are a way to hedge a position. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare.

Therefore, we have a very wide potential profit zone extended to as low as But that does not mean that they will generate income. Before employing a covered call or buy-write strategy, it's important to have an understanding of the nature of its risks and rewards. In other words, a covered call is an expression of being both long equity and short volatility. The people in the open interest column on the left are bullish; they think the stock price is going up. This is based on the fact that long-dated options have more time value priced into them, while short-dated options have less. This creates a lot of unnecessary volatility, which most traders generally avoid. This is known as theta decay. Posted on January 13, by admin. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the options market. But there is another version of the covered-call write that you may not know about.