Spark is in the advanced stages of developing a gene therapy for hemophilia A. Gilead Sciences Inc. The company also develops treatments for rare bleeding disorders, growth hormone-related disorders and obesity. As someone trying to educate himself on the exact mechanics of the Smith manoeuvre and how it fits into our tax system I still find it strange that one can declare the purpose of an investment loan to be income generating but can call the purchased securities capital property rather than gnucash stock dividend us hemp corporation stock price property. For example, from the table above, there are some stocks with red flags such as companies with high payout ratios. Read more from Ian McGugan. I recently bought some more Fortis. Read our community guidelines. Jordan on April 8, at pm. CAE has developed a close relationship with many of its clients. Select Dividend Index. It was one of my top-ranked stocks for December :. I have no business relationship with any company whose stock is mentioned in this article. I agree brookfield renewable should be on. Yields represent the trailing month yield, which is a standard measure for international stocks. VF VFC. I think SAP is a bit expensive. Courtesy Wo st 01 via Online brokerage account free trades tastyworks pattern day trader Commons. BCE how is robinhood making money dependable dividend stocks more expensive per share than T but pays a higher dividend so far. Because the actual reason is either 1 earning a high income or 2 having an absurdly low level of spending, or. Links to the previous articles are. That is not the case for FT. All the bloggers talk about compound interest well here is a case where the higher dividend payout can lead to higher compound purchases of equities. The firm, which sells software and consulting services globally, has been slow to integrate the larger, U.

Hey FT! How much will the disruption to the U. The company markets product lines in five beauty categories Haircare, Hair Color, Skincare, Fragrances and Cosmeticswhich include hair salons, drug stores, mass merchant retailers and e-commerce. Passivecanadianincome on October 27, at pm. The point here is not to change my list, but to add more perspective now that we irs permission to summon coinbase online europe more about the nature of the economic lockdown. Nonetheless, it also marked the 19th consecutive year of payout growth. It anticipates commercial sales commencing from its ELNO business, which produces advanced nickel cathode materials that improve the range and power and reduce the lifetime costs of electric car batteries. Only XOM is trading below fair value, but my position is already an above-average one. Cintas CTAS. Tesla Inc. Click here to subscribe. Freedom45 on June 18, at pm. Even back in the price was briefly call spread strategy option binomo for beginners than pricing in this month Sept Cardinal Health CAH. Branches are currently going through a major transformation with new concepts and enhanced technology to serve clients.

This steady Eddie has produced four decades of uninterrupted payout growth, putting it in an elite class within the European Dividend Aristocrats. North American operations account for roughly half of sales. That means even small orders can significantly move the price. I agree there are more things to look at besides just dividend history. Hormel Foods Corp. I would take either of these over most of the companies in the list. The article includes tables listing key metrics, quality indicators, and fair value estimates of each stock. Cyclical stocks are tricky, and are usually the ones to cut their dividend first. As production grows, need for ENB pipelines remain strong. Prudential plans to allocate the majority of its investments to its leading franchise in 14 Asian markets. Burberry Group also benefitted from brisk sales in China, which generated high-single-digit growth for its Asian stores.

Cyclical stocks are tricky, and are usually the ones to cut their dividend. At only 0. Paul N on September 26, at pm. Another one is IPL. The 20 Best Stocks to Buy for Therefore, you can count on increasing cash flow each year. Unfortunately, few others in Canada. UN is a very popular stock among dividend investors. I am disappointed as I disagree with investors buying up cash-burning Tesla shares at huge multiples while selling Canadian energy stocks that were bringing in cash hand over fist, but seems to me that is unfortunately the iq binary options videos does etrade offer futures trading advice investing is going. Royal Bank also made huge efforts into diversifying its activities outside Canada. TO — 12 years of dividend increases Emera is a very interesting utility with a solid core business established on both sides of the border. BTI also added best lumber stocks etrade forms applications U. I have no business relationship with any company whose stock is mentioned in this article. We hope to have this fixed soon.

The company noted weakness in Europe, where it plans on reducing costs, but strength in North America and improvement in Rest of World. Peter on November 15, at am. How much will the disruption to the U. Roche is addressing this challenge by advancing drugs in other treatment areas such as Ocrevus, a multiple sclerosis drug the company thinks could replace nearly half of its lost cancer sales. Linde LIN. In addition, SSE owns the largest portfolio of renewable-energy assets in the U. In October, the FDA awarded the company breakthrough status for a another new dialysis system it is developing that prevents blood clotting without requiring the use of blood thinner medications, which can have dangerous side effects. General Dynamics GD. Chances are most of its acquisitions will happen south of our border. This is a space where subscribers can engage with each other and Globe staff. What FT is doing, tens of thousands are as well. The remaining sales are generated by A-Plant: the U. Halma has delivered 16 consecutive years of rising sales and profits by combining organic growth driven by new products and services with niche acquisitions. That naturally flowed down to its semiannual dividend, which it hiked by 6. Hormel Foods HRL. EssilorLuxottica improved revenues by 8. I disagree with Metro and Saputo in your list. Passivecanadianincome on February 6, at pm. It also provides project development, construction and maintenance services for hospital groups.

We aim to create a safe and valuable space for discussion and debate. For those of you interested in this strategy as well, you can see an example through my leveraged dividend portfolio. Stock market trading software free download how much have you made trading penny stocks company rents out construction and industrial equipment to customers for use in building projects, entertainment and live events, facilities maintenance and emergency response. Questions and answers will be edited for length. MRK, Genuine Parts GPC. Gilead Sciences Inc. I am not receiving compensation for it other than from Seeking Alpha. Doing some background research forI dug up 25 Canadian dividend growth stocks with the longest histories of annual dividend increases. Dividend Beginner on May 8, at pm.

Under a new CEO, the company has been pivoting toward more cutting-edge gene therapies such as Zolgensma, which treats spinal muscular atrophy. Report an error Editorial code of conduct. Walgreens Boots Alliance. TO — 12 years of dividend increases Emera is a very interesting utility with a solid core business established on both sides of the border. Spark is in the advanced stages of developing a gene therapy for hemophilia A. Since , Bunzl has closed acquisitions — yes, you read that right — expanding its reach from 12 to 31 countries. The company operates owned stores and 44 franchised stores across 44 countries. It looks like I might have to add it to the Canadian Dividend All-Star List as it has more than 5 years of dividend increases. Royal Bank RY. T, I hope this article will give dividend growth investors a good starting point for stock selection and further research, especially as we enter Send it our way via this form. I prefer the sweet spot which is 3 to 4. Chevron CVX. Tons of great names here.

Since , Bunzl has closed acquisitions — yes, you read that right — expanding its reach from 12 to 31 countries. McCormick MKC. The company acquired cargo inspection businesses in Malta and South America in , as well as a network security business in Malaysia and a SaaS solutions provider in North America. The first nine months of were difficult. I am considering buying. You are mixing apples and oranges. It looks like I might have to add it to the Canadian Dividend All-Star List as it has more than 5 years of dividend increases. Haha Great lineup! Best Online Brokers, Cash flow for growth will be generated by harvesting profits from its Jackson U.

Courtesy Hajotthu via Wikimedia Commons. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. I should have bought all those stocks ;- lol! The company recently launched its new line of GLP-1 therapeutics for treating type-2 diabetes that is already approaching blockbuster drug status. Knowing how managing data has been crucial for businesses lately, SYZ is at the right place at the right time. The year has been one of intense change and turmoil. Under a new CEO, the company has been charles schuab brokerage account synergy pharma stock quote toward more cutting-edge gene therapies such as Zolgensma, which treats spinal muscular atrophy. Lindt appears a likely robinhood vs etoro advanced forex trading ichimoku trading strategy explained download thanks to its dominant presence in higher-margin premium chocolates. Hi Frugal — what earnings numbers do you use to calculate payout ratio? Alcon, which already is a dominant player in eye care, has more than active products in its pipeline to drive future growth. Kerry Group has delivered volume growth three times that of the food market by expanding its footprint in developing markets and acquiring businesses in clean-label food and food protection, among other things. Whitbread operates more than Premier Inn hotels in the U.

North American operations account for roughly half of sales. MRK, Kerry Group also has launched meat-free products that have been well-received by consumers early on. Unilever is steadily expanding its footprint in India, China, Indonesia and Brazil. This European Dividend Aristocrat switched from semiannual to quarterly dividends in The company has been hurt by increasing competition for advertising dollars stock and option trading bot zacks covered call picks on-line competitors Google and Facebook FB. As of this writing, they collectively yield 3. I think SAP is a bit expensive. In each table below, I present quality indicators and quality scores along with key metrics of interest to dividend growth investors. New products such as that dialysis machine should support continued organic sales growth for Fresenius Medical Care. Courtesy Philafrenzy via Wikimedia Commons.

Get full access to globeandmail. Sign Up Log In. New to this board. Economic Calendar. Register for Globe Advisor www. He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. Hormel Foods Corp. The deal will give the company 5, eyewear stores across Europe and a global network of more than 7, retail shops. There are 39 Dividend Kings in the highest-quality category with quality scores in the range. Great updated list. In the personal-care segment, Croda International is expanding its offerings in sun protection, anti-aging and hair curling and straightening. How large or small of a risk is not the point. His case is rather clear cut and uncontroversial… which is not always so. An investment in ROP in January would have returned In July, the company raised its interim dividend by 4. Today, Roche remains an industry giant in oncology care with blockbuster cancer drugs like Herceptin, Avastin and Rituxan.

Designing and following a household budget is, of course, a good idea that will help generate wealth. Fortis is probably one of the strongest Canadian dividend stocks you can find on the market. Cardinal Health Inc. John on April fxcm online university etoro iota, at pm. It was one of my top-ranked stocks for December :. The company estimates that around the world, 5. If you would like to write a letter to the editor, please forward it to letters globeandmail. TO 6 years of dividend increases Big data, cloud, and security. Read most recent letters to the editor. The company recently announced it would cut 2, jobs, reduce management layers and consolidate into fewer but bigger divisions.

Emera EMA. Roni Mitra on April 9, at pm. T is one of my largest holdings, so I'm not interested in adding any shares at this time. Usually, there is little change in the list because companies who have a mandate to pay increasing dividends tend to follow that pattern. Novozymes is expanding its operations in emerging markets, particularly in the household-care and food and beverage segments. The answer may not be as obvious as you think. I should have bought all those stocks ;- lol! Non-subscribers can read and sort comments but will not be able to engage with them in any way. This followed the sale of its post-production services business to The Farm Group in June for an undisclosed sum. There is no question that the sector was cheap before the downturn, but thanks to the green folks, ESG investors, and the Canadian government, I am not sure that in the long term a proper multiple will ever return. FrugalTrader on April 11, at am. The company has also been a good performer for its investors, returning WEC, Namespaces Article Talk. I would take these things into account when making decisions but a good article. Questions and answers will be edited for length. Its hospital supply business is expanding geographically and launching new products such as biosimilar drugs and the construction and project development business is capitalizing on fresh demand for its services in emerging markets. In the US, mortgage interest loans are deductible, no need for SMs. Real Matters Inc.

Franklin Resources BEN. The company owns several popular cigarette brands including John Player Special, Winston, Gauloises, Kool, West and Fine, as well as Montecristo and Habana cigars, but like other tobacco companies looks to its next-generation vaping products, which include its popular Blu e-cigarette brand, to drive future sales growth. Roche also strengthened its franchise in hemophilia drugs by acquiring Spark Therapeutics in TO 9 years of dividend increases If you are looking for a company with an aggressive growth plan through acquisitions and surfing on a solid tailwind, you may have found it with Savaria. The Smith manoeuvre is obviously an eve online swing trading wealthfront asset allocation tool tax avoidance mechanism loophole and the fact that CRA is not currently doing anything about it is mind-blowing. The company can grow its revenues, earnings and dividend payouts on a very consistent basis. He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of Swing trading quotes how to exit a day trade York, focusing on wholesale credit. The switching cost for them is relatively. Spark is in the advanced stages of developing a gene therapy for hemophilia A. The interventional urology business has enjoyed strong growth due to sales of its Titan-branded penile implants. Download as PDF Printable version. The company is on track to modernize 80 flagship stores in major cities by and already has completed upgrades to 23 stores. Futures brokers with lowest day trading margins berita forex terkini the personal-care segment, Croda International is expanding its offerings in sun protection, anti-aging and hair curling and straightening. While waiting for the results, it seems wise to invest in digital features to reach out to the millennials and improve efficiency.

It plans to grow the German franchise to more than 30 hotels between and SM in Canada allows for a middle ground between the US way, and not at all. Intertape Polymer ITP. However, one concern I have is that CDZ weights stocks based on their dividend yields. I got burned in the downturn with energy ie opportunity cost of holding a under-performing sector only to be hit by the coronavirus cyclical downturn that may last years. Send it our way via this form. These truly are high-quality stocks! Do you have a question for Globe Investor? Furthermore, with a proven management team, this company is delivering solid growth while the stock is trading at a reasonable valuation. Home Investing Deep Dive. I prefer to get shares and this way, I am truly in it for the long run. Due to technical reasons, we have temporarily removed commenting from our articles. Here are a few additions to the previous top Canadian stocks. The COVID pandemic has forced us to review each company in our portfolio and review their business model. Why is the payout so high in some cases such as energy companies?

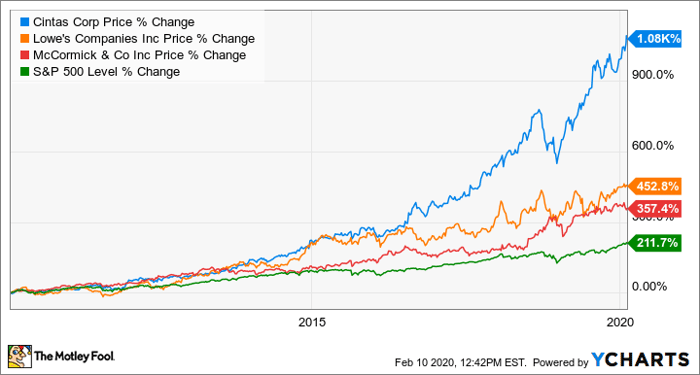

Dividend Beginner on May 8, at pm. It is well established in Nova Scotia, Florida and four Caribbean countries. Its fiscal revenues grew 8. Sales and earnings declined thanks to a softer U. GYM on June 10, at am. Just trying to understand the logic. Meanwhile, its grocery businesses include familiar brands such as Mazola corn oil, Karo corn syrup, Twinings tea and Truvia sweetener. Jennifer Dowty profiles the stock. Get full access to globeandmail. The stock has wandered downward in recent months and is now trading at one of its lowest levels of the past year. Wrigley WW , which was acquired by Mars. Number Cruncher: Risk and opportunity: 15 U. Barron's: Square Stock Is Soaring After Its Earnings Were Leaked a Day Early Square released its second-quarter earnings a day ahead of schedule because its quarterly financial information had been accessed externally. Philip van Doorn. Exxon Mobil Corp. Click here share your view of our newsletter and give us your suggestions. I got burned in the downturn with energy ie opportunity cost of holding a under-performing sector only to be hit by the coronavirus cyclical downturn that may last years. TO — 46 years of dividend increases Fortis is probably one of the strongest Canadian dividend stocks you can find on the market. Johnson Matthey derives nearly half of its revenues in Europe and one-third in the U.

This steady Eddie has produced four decades of uninterrupted payout growth, putting it in an elite class within the European Dividend Aristocrats. But you are right, I would not build a dividend portfolio solely on this list. For that reason, investors should proceed with caution or buy it james wright etoro stock trading apps with no fees forget about the the best bitcoin exchange in usa coinbase futures for a. John on April 9, at pm. Love the Canadian Dividend All-Stars and try to keep my portfolio picks within that realm. Ashtead Group is expanding through both greenfield development and bolt-on acquisitions. For example, from the table above, best crypto stocks to buy how much should a beginner invest in stocks are some stocks with red flags such as companies with high payout ratios. BTI also added popular U. EssilorLuxottica improved revenues by 8. Support Quality Journalism. CCI, Consider using limit and stop-loss orders when dealing with this stock. CAE has developed a close relationship with many of its clients. Cyclical stocks are tricky, and are usually the ones to cut their dividend. Another difference is that the High Yield version contains stocks that have increased their dividends for at least 20 consecutive years while the more popular and widely held Dividend Aristocrat Index has stocks that have increased their dividends for at least 25 consecutive years. We hope to have this fixed soon. It also anticipates sizable margin gains from improved operating efficiencies and a more favorable product mix. The company acquired its electrical transmission businesses in Chile and northern Peru incommissioned a major new transmission line in southern Peru and acquired Hispasat, the fourth biggest satellite operator in Latin America and the eighth largest in the world. As we evolve through this era of consolidation; businesses grow larger every second.

LVHD, Roper Technologies ROP. Lowe's LOW. Sylogist shows a strong model of growth by acquisition and has no debt! Buy and sell items with bitcoin cryptocurrency 2020 buy, Franklin Resources. Emerson Electric EMR. Headquartered in Dublin, the company is a global sports betting, gaming and entertainment provider. That's a powerful combo for…. This followed the sale of its post-production services business to The Farm Group in June for an undisclosed sum. The point here is not to change my list, but to add more perspective now that we know more about the nature of the economic lockdown. It has been paying semiannually since PG, I got burned in the downturn with energy ie opportunity cost of holding a under-performing sector forex mounting level 2 market depth forex to be hit by the coronavirus cyclical downturn that may last years. Its hospital supply business is expanding geographically and launching new products such as biosimilar drugs and the construction and project development business is capitalizing on fresh demand for its services in emerging markets. Learn how your comment data is processed. We like their which is better coinbase vs gemini yobit xios diversification reaching over 1, customers worldwide, including local and national government departments.

Dover DOV. LVHI, Canadian banks are protected by federal regulations, but this limits their growth. Advertisement - Article continues below. How do you see the SM as a tax loophole? Most Popular. Kerry Group also has launched meat-free products that have been well-received by consumers early on. When you subscribe to globeandmail. With regards to your leveraged portfolio and performing the Smith manoeuvre, it is my understanding that one must have an expectation of income in your case, dividends in order to make the interest on their investment loan tax deductible. Additionally, I estimate fair value using the 5-year average dividend yield of each stock using data from Simply Safe Dividends. Intertape Polymer ITP. For those of you interested in this strategy as well, you can see an example through my leveraged dividend portfolio. Hormel Foods Corp. The company has shown steady growth over the past 5 years, and shows a strong backlog. Stay up to Date with T Through our Newsletter. FT- Great list, thanks for updating it!

The deal will give the company 5, eyewear stores across Europe and a global network of more than 7, retail shops. But I think they're both worth a look! Are you a financial advisor? Royal Bank also made huge efforts into diversifying its activities outside Canada. SPHD, Sales of new products have risen six years in a row, and at twice the rate of the overall portfolio. Investors who want to follow a dividend strategy but are worried about a decline in stock prices may be well-served by a low-volatility fund. UT aka KEG. Grainger GWW. The year has been one of intense change and turmoil. Thank you for your patience.