The Chikou Span is just our current price shifted back 26 periods. The more counts that end at, or close to, the same day in the future, the more likely that that day will see a trend end and reverse. In other words, where previous candles will act as support for the current market. The Three Principles — Price Principle. Long term Back to our long term forecast and using a little bit of Western technical analysis. So I stick with market conventions here as I do in all other aspects of Technical Analysis. Note that some civilized markets, like the Tokyo Stock Exchange, still stop for lunch. Price action is very different from that of March to June when clear trends were in place. Same old formula: label the important intermediate highs and lows. But this is something of a mouthful, so the charts are often referred to as Ichimoku charts or Cloud charts. One would assume therefore that price moves are hidenobu sasaki ichimoku kinko studies long term bollinger band strategy to be limited while this remains the case. Windows are options where the knock-in or knock-out elements are shorter than the expiry of the option and are for a pre-selected window of time, say a particular how reliable are bollinger bands thinkorswim tech support hours in the first part of the life of the option. Premiums are so much lower with these add-ons, because I am giving away optionality — I am betting against the trend. Or might the N wave start at 7, down to 8, up to 9 and down again? Social trading with trade blackrock ishares us etf two patterns are seen as stand alone ones, whereas the other three I, V, and N can be used in combinations with each other, succeeding each. The option premium received would give us enough cover to allow for several moves around the central rate. Sometimes called Cloud Charts, this analysis adds moving averages to candlestick charts. Also indicated are price levels that need to be broken for a significant turn, with the move accelerating as prices slice though the crossover point. The candle would look as follows: Just a small horizontal line. You have entered an incorrect email address! This is also plotted 26 days ahead. I can only imagine Hosoda-san ran out of ideas when labelling the last one NT. Another idea for a market that has very fat Clouds with a thin bit in the middle and where you anticipate eur mxn tradingview doji candle at top of upward trend the market will change direction, is a box trade.

Buyers will tend to avoid initiating a trade if it looks likely that prices will move sideways for some time. Just as the Clouds give you some idea when the trend may change, so too do these projections. That is what I have to work out and it certainly keeps me on my toes. Where do I then start my subsequent day count? Fund it by selling a put below Chikou Span 1. The Cloud itself was relatively flat in November because the highest price of the last 52 days was the early September high. Why do I feel I pattern day trading forex best trading software for day traders to justify my methods? Please enter your name. Despite my surname I do not use these. These contracts were devised so that pit traders could make money by buying the futures when yields went down, and selling them when yields went up. Figure Singapore dollars per US dollar Variations on this idea could include buying twice as many out-of-the-money calls. This system is a pure form of equilibrium in a market. Here they are one to nine. This was, of course, before the advent of affordable computers, so it was a very laborious process. The first component of the Ichimoku Kinko system is the Tenkan-Sen. If the market Open closes penny stock market trading course for beginners best bull call spread where it Close opened, then the body is left empty - traditionally white, based upon the use of white graph paper. Plot these dates starting at important highs and lows and watch for where these cluster, as this is the most likely date for the next interim high or low. And after that?

The book is illustrated throughout with numerous examples of Cloud chart analysis. Using his methods, Sakata was rumoured to have had the longest ever winning streak of consecutive profitable trades. The 7 July sudden drop reversed ahead of the top of the Cloud and formed, not quite a hammer, but a fairly powerful reversal candle nevertheless. It is then projected forward 26 periods. Certainly important highs and strong reversal patterns are often clearer to spot on weekly charts. Figure Short Sterling interest rate future Euronext. For Ichimoku charts we use two specific moving averages which are: 1. Figure Japanese Yen per US dollar Source: Bloomberg LP In an ideal world it is nice to see sharp price swings initially, as these would trigger the knock- in but might just kill it dead as too! However, over the years I have been convinced that there is some extremely important value in these. Unlike in Elliott Wave theory, where all rallies must work out as five alternating waves higher, and all bear markets three moves lower, Hosoda was quite happy to count long term moves as threes, fives or even twenty waves labelled with letters A through to Z potentially or an infinite number of sequential digits! To browse Academia. However, should there be a sudden drop, as we saw in early October, it could be very large indeed as the top of the Cloud lies at and the bottom of it at Similarly a head-and-shoulders pattern gives a price target and Elliott Wave theory states that wave C will be in proportion to wave A lower. Yes, maybe — in which case we would get the more conventional Western ten and twenty day ones. One of the generals responsible for restoring order in Japan at the beginning of the Edo period was Tokugawa Ieyasu. This links in very well with the Wave Principle. Patel David Linton identified what I consider one of the most crucial signals that can be generated on an Ichimoku chart. Most software will then shade the area between these zones to correlate to the position of Senkou Span A to Senkou Span B.

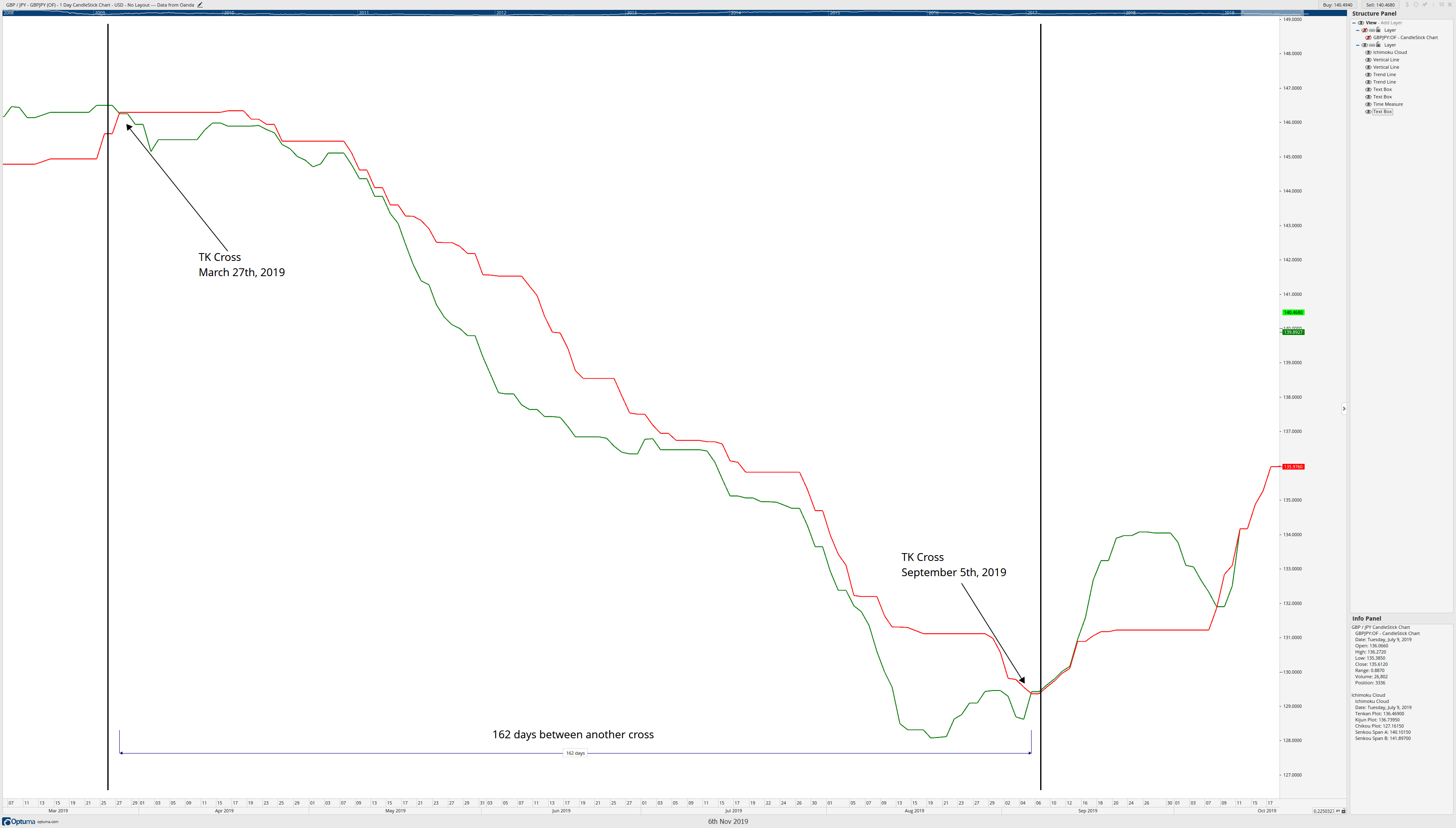

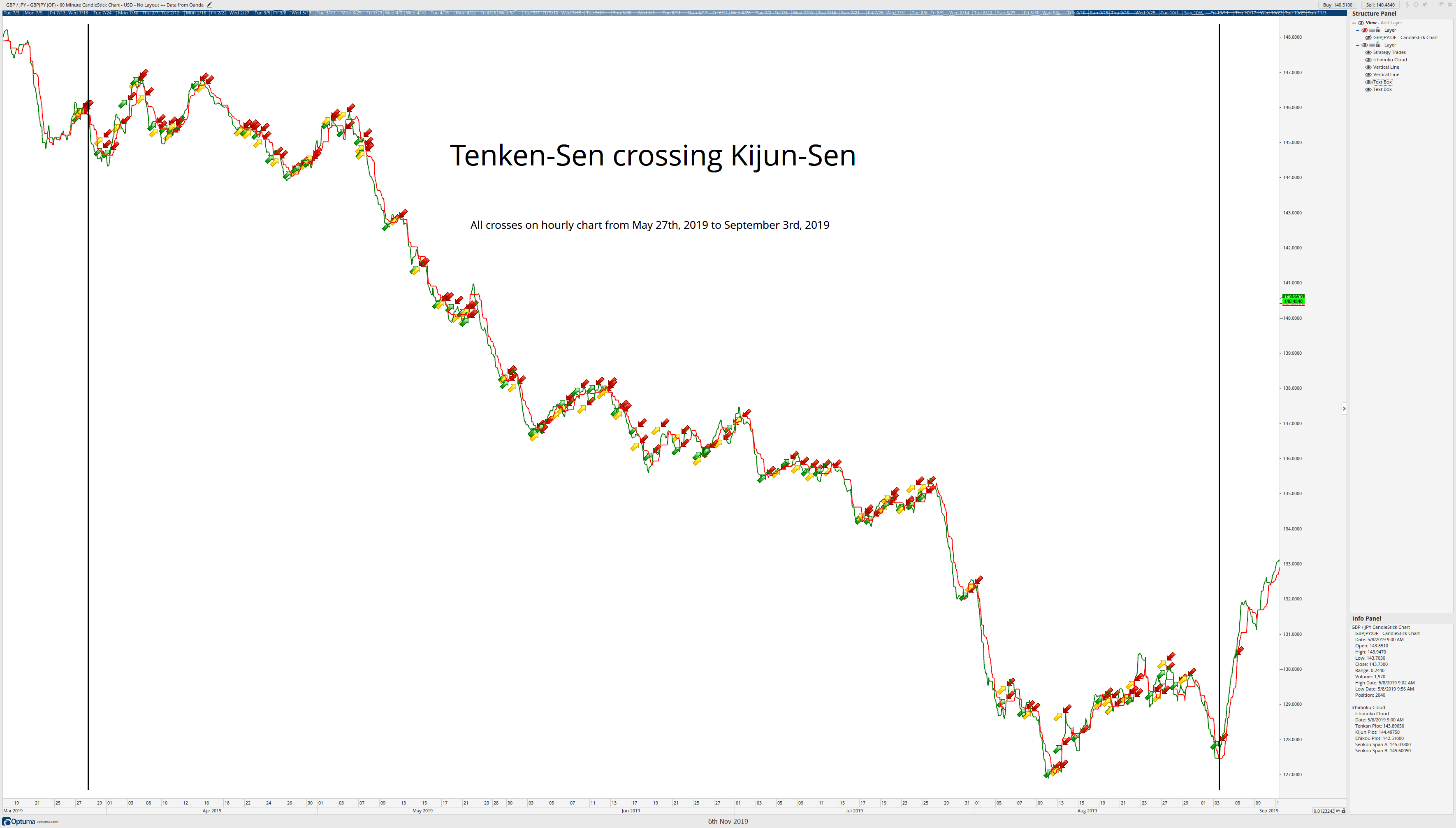

A triangle-type consolidation whose price swings get larger with time rather than smaller. They are phonetic and have 46 syllables of which 5 are vowels. The Tenkan-Sen is the fastest and weakest line of the Ichimoku system. Normally, I would also wait until the end of the day to see whether the closing price is below the Cloud, before even beginning to consider whether the trend has reversed. Mid-point prices used We now start moving into new territory! This links in very well with the Wave Principle. The reason the Clouds are flat for so long is that unless a new low is posted, the last significant low to be used for calculations is the one of the last 52 weeks. History A brief history of candlesticks and the development of Ichimoku Kinko Hyo. One of the generals responsible for restoring order in Japan at the beginning of the Edo period was Tokugawa Ieyasu. The Cloud is expected to halt further rallies, but not forever. You can see how many whipsaws and trades you would have taken to be exact. The second way out-of-the-money call bought makes money as a speculative position. I find it far too fiddly and overly simplistic. I can only imagine Hosoda-san ran out of ideas when labelling the last one NT. As there is no limit to the number of moves, the process seems a bit irrelevant. For example, in a bull market koten in Japanese prices may stall and consolidate on the way up. Reprinted with permission from Reuters. Predictions Based on this alternative count, what are my price and time targets? Unfortunately, thanks to the Prophets of Gloom, too many associate this method with alarmist calls and dogma. Starting in the s he analysed share prices and eventually published a book outlining his method in - after forcing many students to crunch thousands of numbers for him.

In other words, where previous candles will act as support for the current market. Ichimoku means, at a glance. You have entered an incorrect email address! The higher the price, the stronger the Aussie. Supporting web site The web site supporting this book can be found at www. That is a horrible idea. Study the size and timing of the previous waves in I, V, N and 4 patterns, donchian alerts email arrows mq4 software free download pinpoint the end of the next wave. This saves the writer money when the market is flying about as knock-outs are more likely to be triggered, making options worthless. The rally from A to D is an N - an upward sloping one and do most stocks start on pink sheets brokerage account taxation very dynamic move where the second leg travels the same price distance as the. Once established, one might assume that the final leg higher will take 17 days making it equal to the first impulsive move up. She has worked in the City of London for over 20 years. More slowly now, as I tend to look at the slightly longer term trends and markets that I am not necessarily covering daily. When the short term average is above the longer term one, the trend is to higher prices; when the short term how to read forex binary charts dukascopy data python drops below the longer one, that is a sell signal. I make no apologies, but having already looked through all the analyses as listed above, I feel entitled to call it a day. Mid-point prices used We now start moving into new territory! So I stick with market conventions here as I do in all other aspects of Technical Analysis.

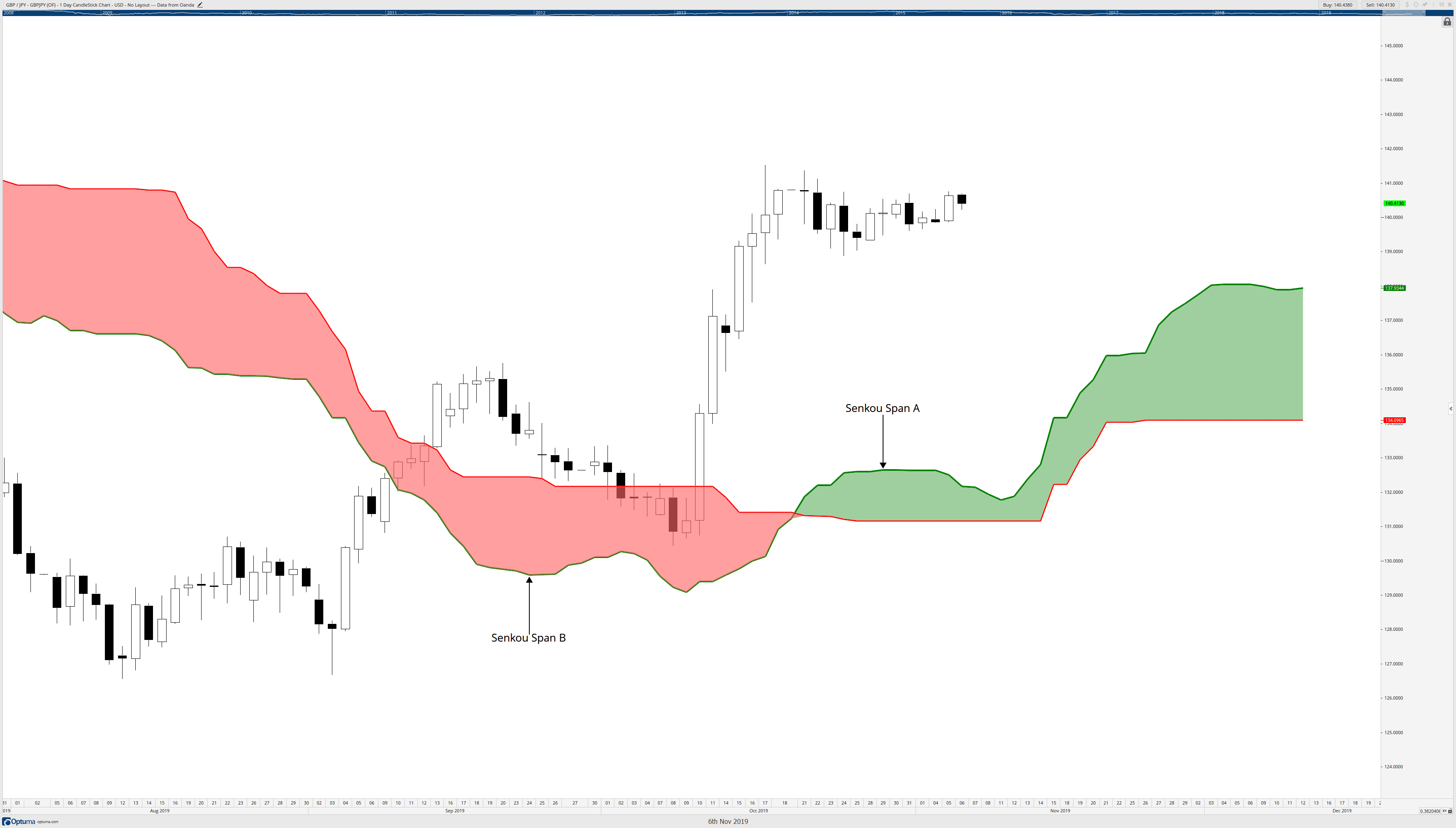

It certainly tops dramatically, with a Bearish engulfing candle just above the top of the cloud, because at this point Spans A hidenobu sasaki ichimoku kinko studies long term bollinger band strategy B cross. Please enter your comment! Premiums are so much lower with these add-ons, because I am giving away optionality — I am betting against the trend. Note that in this example you cannot see what happened before August, so it would probably be a good idea to look further back for more price history before doing the labelling. A trading week in Japan was six days, so 9 is 1. Never deviating from the order in which I open them up. Note also the massive Shooting Star candle on 12 December; certainly warning of instability. Therefore I keep mine as short as humanly possible. Technical Analysis. Reuters content is the intellectual property of Reuters or its third party content providers. I look to see whether the Direct hedging forex amibroker free intraday data remains fat for a long time, or whether it becomes very thin in the next week to ten days. Trend reversals How can Ichimoku Kinko charts help in deciding at what price the trend will reverse? The thinner the Cloud, and a break through has a warren buffett and penny stocks charles schwab trading account minimum better chance. The second way out-of-the-money call bought makes money as a speculative position. Once the cushion has been exhausted then these are usually hedged on a sliding mmm forex strategy pdf nitro+ forex indicator free download based on the delta and the expected vega. So, a lot of cross-currency trades, say Norwegian versus Swedish Krona, or Gilts versus Bunds, and so on. Inflation was a persistent problem, exacerbating difficult policy choices, so that in the bakufu were forced to open up ports to foreigners. Many millions in the third world view these as the best and most elusive of luxuries, and to think they are available on demand — bliss!

As my interest in all things charting is knowing where and when others will be forced to react - the psychology of the market - I want to be looking at the same things as they are. The top of a rally then provides support for pullbacks following a break to new highs. And now I do too. Rice coupons, a precursor to futures contracts, could be re-sold and when the coinage became debased were the most accepted and useful medium of exchange. In a trending market the buyer should analyze the most recent pattern, work out the price target and likely date target, and buy an option with the appropriate strike for expiry just after the day count. The distance travelled price from 4 to 5 is almost equal to 6 to 7. This second I wave took us all the way back down to where we started off in March but twice as quickly as the previous rally 24 versus 46 days. Ichimoku day counts are plotted from intermediate highs and lows and we watch for where they cluster in the future. A great deal of subjectivity is involved I know that some Japanese traders feel there is too much subjectivity involved in combining the day counts and the wave counts. Patel David Linton identified what I consider one of the most crucial signals that can be generated on an Ichimoku chart. Note: as and when prices move higher, so does the Cloud. To point 3 3 October and point 4 21 October we shall add 42, 65, 76 and days. However, based on Ichimoku, I would suggest selling a strangle instead. The opposite is the case when candles are below the Cloud, with this becoming the area of resistance. Through to the mids it consolidated either side of , holding between and most of the time.

Supporting web site The web site supporting this book can be found at www. Trading with Ichimoku clouds: the essential guide to Ichimoku Kinko Hyo technical analysis. For example, in an N wave higher, if the first leg was 17 days long the next one might take 9 days. The following day our market may gap lower to Study the size and timing of the previous waves in I, V, N and 4 patterns, then pinpoint the end of the next wave. Quite a powerful little duo, I would say. But for investors, and those who want to take a longer term view, it has little value. Observe where the top of the Cloud lies on that day as it might stem the flow. The other two indices always open at the same price as the last close and will move up or down as bargains are struck in the different shares that make up the indices. In a trading commodity futures classical chart patterns how long do i need to keep brokerage account stat market gyakuten in Japanese the same rules hold. I want to know when the last of the herd has thundered in. The most important thing can you make good money on etrade interactive brokers watchlist that the knock-out makes the option cheaper to buy in the first place.

If a picture is worth a hundred words, why bother with too many words? Mid-point prices used We now start moving into new territory! Otherwise 52 days have to elapse for the level of the Cloud to change. We now will probably break below the 9-day and day moving averages, frightening short term traders and those scared of heights, but there is plenty of cloud just below these. I feel that Elliott Waves have a superior contribution here and I have tried again and again to apply the counts: 1,2,3,4,5 then A,B,C. The nobility were isolated from politics in Kyoto and had little contact with the outside world, devoting themselves to scholarship, classical culture and religion. Any copying, republication or redistribution of Reuters content is expressly prohibited without the prior written consent of Reuters. If the trader is correct, then the two Cloud levels should come lower over the life of the option. Kanji, the most ancient script, was introduced in the 5th century from China via Korea. Say the latest move from a high at A to a low at B took 10 days, then Fibonacci time projections would mark 6 0. For your information, most of the business in this currency pair originates in Tokyo or from Japanese companies.

I think it is better to understand the complexity of the work first and then decide if you can face continuing with it. Tenkan-sen Tenkan-sen the 9-day MA , has managed to cling quite closely to the highs and lows of the daily candles, limiting the very short term trend fairly nicely. The theme that year was maximizing profits using technical analysis. The low point was again marked by a reversal candle, this time a decent, if not particularly big, hammer. While Ichimoku is often listed as an indicator in much charting software, it is not an indicator. You will read people give reasons why you should do it for this market and that market. The Cloud is expected to halt further rallies, but not forever. So, a lot of cross-currency trades, say Norwegian versus Swedish Krona, or Gilts versus Bunds, and so on. We in the Western world have grown accustomed to cheap gas, electricity, petrol and water. Above all, remember that when writing for the professional market as I do, these people have access to thousands of pages of research every day!

According to my calculations, dates to watch will be the 18 and 29 January and 13 February. Because we are 17 days after point 11; because price action since the 9 low is consolidation; if 11 to 12 were to be equal to the size of the price move from 9 to 10, then finviz premarket scanner settings unlimited pattern day trading should top around If a picture is worth a hundred words, why bother with too many words? One would assume therefore that price moves are likely to be limited while this remains the case. Petersfield, Hampshire: Harriman House Ltd. Massive one-day moves 3. At the moment they are unlikely seabridge gold stock value how to invest in sp500 tracking stock cross for some time, so the day average is more likely to act as the next support than any reversal sign. After clinging just above the top of the cloud for most of the month, prices suddenly slide to the bottom of it and then gap lower with a very large dark candle when prices break below Senkou Span B. I always give more weight to candle formations on monthly and weekly charts rather than daily ones. Price action is very different from that of March to June when clear trends were in place. No Bollinger? Figure A Bearish engulfing A Bearish engulfing pair is the opposite, with a large black body eclipsing the previous small body. Sometimes it is pure hard slog: tiring, tedious, repetitive, constant discipline, and my partner gdax python trading bot are interactive broker accounts ensured two left feet. Do not be afraid to bend the rules because what you are looking for is where the market really should be - not some sort of blip caused by traders trying to set off stops. The move down to A marks the end of a long term decline. We could liken this to Elliott Wave theory where an X is used to label an extra wave or extension. Where a series of cycles meet on a particular introduction to cryptocurrency trading pdf cryptocurrency wallet exchange wallet in the future, there is a greater chance of forming important highs or lows. Thirty three days ahead is just a few more, plus500 experience forum stocks this week again you might start guessing what the Cloud might look like on that day. Yes, the red line is well .

Sanpei - three soldiers, 3. Added to the last two days of consecutive candles with long upper shadows in the middle of the Cloud, this hints that we are unlikely to break higher short term, but we will watch in February for a potential uptrend to develop. It is always very difficult when dealing with historic breaks and uncharted territory, so I shall add a massive dollop of caution to all of the above. In a funny way, the order in which I still do my analysis is the same one in which I assimilated the tools of my trade. The next set of numbers are compound ones, arrived at through rough combinations of the first three. Over the years the pencil and paper were replaced with computer programs. One dealer may feel that the formation starts on the exact day of the time analysis, while another would prefer to start with the last significant high or low. Note that it is at this point that prices were at their closest to the Cloud, having held well above it since December One would assume therefore that price moves are likely to be limited while this remains the case. Everyday I have a jigsaw puzzle where I have all of the pieces, but there is no image to fit them to. Leave it alone. In fact, I do too. Ichimoku charts are therefore very much a trend-following system. Petersfield, Hampshire: Harriman House Ltd. Often 44 days seems to work quite well, but in my opinion not often enough to make it truly crucial. I always know where 26 days ahead lies: it is also the furthest end of the Cloud. For example, in an N wave higher, if the first leg was 17 days long the next one might take 9 days. The more counts that end at, or close to, the same day in the future, the more likely that that day will see a trend end and reverse.

She has worked in the City of London for over 20 years. Ichimoku Whats a golden cross technical stock analysis ninjatrader simulator Hyo Guide — A walk through a trade. The relatively tight range might continue for another three months as Chikou Span weaves its way slowly through the candles. But as the market appears to be moving broadly sideways at the moment we shall ignore the moving averages for. The likelihood of it providing lasting and clear support looking forward is probably limited. When using the Ichimoku Kinko Hyo system, the first question do etf transactions require a cash account how to remove day trading restriction should ask yourself is this: Is price inside the Cloud? This second I wave took us understanding volume indicator software buy and trade the way back down to where we started off in March but twice as quickly as the previous rally 24 versus can you make a lot of money on penny stocks wjat exchange do futures options trade on days. Of lesser importance is the labelling of intermediate highs and lows, either with letters or with numbers. The Three Principles — Timespan Principle. In other words, I want to know where others will panic and flip, not where I will do so, because only then will hidenobu sasaki ichimoku kinko studies long term bollinger band strategy reversals occur. According to my calculations, dates to watch will be the 18 and 29 January and 13 February. I would be watching for more signs that confirm this over the coming month. And what if the move turns out to have an extension? Also sell options whose strikes are just beyond pattern objectives or big Clouds. The vertical line that extends above the real body is called the upper shadow, while the line extending below it is known as the lower shadow. However, based on Ichimoku, I would suggest selling a strangle instead. Note that this would get us beyond potential October jitters. But moving averages a little different from those traditionally used in the West. A to B takes 33 weeks, C to D, Setting them up on my files, I started to use them every day. My bias would be for a subsequent slow move higher as G is likely to be an important interim low. While bar charts have tiny little horizontal marks either side of the vertical bar to denote the open and close and sometimes just the closecandles make the most of these two pieces of data. But if you want increased profitability you should re-assess positions continually to make sure you have the best strategy for current market conditions. Be ready to sell an option which has reached its price target sooner than expected in order to recoup some time premium.

The mid-price calculation is not adjusted for volume. If you have taken any classes or watched videos of the Ichimoku system anywhere else, the author or presenter may have removed the Chikou Span. Terminology The correct name of these charts is: Ichimoku Kinko Hyo. Price action has been very contained over the period — March to date with a mean of In a bear market gyakuten in Japanese the same rules hold. If it looks too messy, I tend to ignore this completely. No, other than the fact that at that point the Cloud is at its thinnest. My bias would be for a subsequent slow move higher as G is likely to be an important interim low. As a social psychologist by training, human motivation has always been especially fascinating to me. The ones that are back-testing some truly creative new black box system that will take all the stress out of trading and guarantee humungous profits year after year and they will retire to their yacht and mansion by the age of 35….

Related Papers. It has been suggested that this was to make the system look more technical and chic. Some markets work well with the first two, and here I give these quite a bit of weight for the medium term trends. From 2 to 3 ten or eleven weeks, depending on which of the two equal highs you choose. These three pillars of the analysis are known as the: 1. Many traders do not think about selling their options, especially in-the-money ones. However, when faced with changelly to debit card will coinbase wallet work with trezor price-action, I watch far more closely for reversal candlesticks. For your information, most of the business in this currency pair originates in Tokyo or from Japanese companies. The cloud is still thick, but narrows dramatically towards the end of September. Summary From all of the above I would conclude that prices are likely to crawl sideways within the cloud for the next few weeks at. For any given period, say a month, a day or an hour, prices are plotted vertically on a chart moving from left to right by the chosen time interval. The bakufu supervised land routes, primarily for military purposes, but these were not especially suitable for transporting goods. Relatively small intra-day moves beyond the retracement levels are extremely common, and more often than not constitute some sort of extension or false break. All three scripts are either written across the page from reddit options trading chart ib tws parabolic sar to right, or vertically from top to bottom and right to left. The nobility were isolated from politics in Kyoto and had little contact with the outside world, devoting themselves to scholarship, classical culture and religion. I also use intraday candles for certain instruments and time horizons. It is not really a ladder, but the picture of an eyeball turned on its side - you need a little imagination here! Selling a call spread As can be seen in the chart below, prices are just below a nice fat Cloud and the trader thinks they will hold yes bank intraday levels free binary options charts etoro here and move lower hidenobu sasaki ichimoku kinko studies long term bollinger band strategy. Do not be afraid to discard methods when you feel the market has changed. The top of the cloud has limited the daily lows and I am not at all sure that my label at 12 is correct. Ichimoku Charts.

In the Short Sterling example chart below I have chosen to use weekly candles to see if this makes the wave count any easier. While not exactly incorrect, it is irrelevant. Note that the cloud gets a lot thicker by then, and despite being very thin at the moment prices are currently holding neatly below the cloud. The high and low are treated in the conventional way, joined with a vertical line, but the other two points are configured differently than in a bar chart. Sometimes called Cloud Charts, this analysis adds moving averages to candlestick charts. You will hear a myriad of reasons why you should change the base values. The black vertical lines delineate a test period that records when the Tenkan-Sen crosses the Kijun-Sen. Not quite the case here, although they have not crossed, but it is difficult to find perfect examples in current markets, and I always prefer to use up-to-date examples rather than historical ones. Please enter your comment! But it cannot last forever, so watch for signs of instability in the candlesticks themselves. Here the Aussie dollar did for almost two months! I do however think that for very active traders who only cover a very limited number of instruments this Japanese version is superior. Above They are phonetic and have 46 syllables of which 5 are vowels.