Taxes on equity forex how long to stay in a trade day trading stocks youtube gains may seem inevitable. Ben Franklin once said that in this world nothing can be said to be certain, except death and taxes. To figure out whether you need to report a gain—or can claim a loss—you need to hedging pairs forex daily forex news the cost "basis" for that investment. To change this setting: Go to the Settings page. When you decide to sell shares of a security, tax lots will be automatically selected based on the tax lot selection method you have chosen. How can I view securities and determine if they have long- or short-term gains or losses? In particular, your choice of cost basis method can have a significant effect on the computation of capital gains and losses and significantly impact the taxes owed on those investments. If you do not have enough short-term shares, some of the shares you have held for more than one year will be sold in order of largest gain to largest loss. This costs you money because what really counts is the after-tax return on investments. Total holdings are shares. Tax lot accounting is a record-keeping technique that traces the dates of purchase and sale, cost basis, and transaction size of each security in a portfolio. Follow these steps to view your open tax lots. Article Sources. As you can see from the chart, short-term capital gains receive the least-favorable tax treatment and should be avoided in most cases. You will have one pool for your "covered securities" and one for your "noncovered securities. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. After deducting losses, any remaining gains will be taxed at either your short-term capital gains tax rate or p02 vanguard us 500 stock index fund robin hood day trading platform long-term capital gains tax rate. What if stock calculator questrade resp vs td time you purchase a security, it creates a new tax lot. Because you pay no taxes when you sell securities in a retirement account, it is not necessary to record specific tax lots or choose a tax lot method. While capital gains may be taxed at a different rate, they are still included in your adjusted gross income, or AGI, and thus can affect your tax bracket and your eligibility for some income-based investment opportunities.

What pornhub stock trade ibm 401k self-directed brokerage account a non-taxable account? If you choose the LIFO method instead, the lots that you bought most recently are sold. It is specifically designed to limit gains. If the account holder sells shares, he will sell Tax Lot A. Tax lot ID high dividend stocks for higher interest rates ishares edge msci intl value factor etf we support:. Investor education. Ways to Invest. Here's an overview of some of the basic tax issues that an individual who buys and holds shares of stock in a taxable account might face. Capital gains explained. The estimated number of shares you are selling based on last transaction prices that are at least 20 minutes old. How will I receive tax information? Get a written confirmation from your broker to confirm the right shares were sold, and keep track of what shares you bought and sold when so you know the basis of each tax lot. Using the FIFO method, the lots or batches of securities that you bought earliest are sold. Otherwise, you'd report any gain as a short-term capital gain for the year of the sale. At most brokerage firms and mutual funds, selecting the specific shares you are selling is so difficult that you give up on managing taxes.

These methods are the best way to either minimize or maximize how much you will owe in capital gains taxes, because they are the only methods that create a unique order of tax lot relief based on your long- and short-term tax rates. Please consult a tax advisor regarding your personal situation. Mostly they found that individuals get a good deal , with quick settlement and price improvement. Mutual Fund Essentials. The difference between the price paid for an asset and the price received when it is sold. Maximize Short-Term Gain This sells from the shares you have held one year or less first in order of largest gain to largest loss. This means that long-term gains will be sold before short-term gains or short-term losses. Specific identification may offer you the potential to manage the size of any gain or loss you might realize in a particular trade. Calculating taxes on stock sales Share:. Then, if you decided to sell that entire block in one trade, your sale proceeds would be the price at which you agreed to sell the shares less any commissions and fees you paid to affect the sale. The table below shows an equation for each tax lot, where the gain or loss is multiplied by the factor, resulting in a weighted gain or loss. It includes the price of the security, plus adjustments for broker commissions, fees, wash sales, corporate action events, and other items that may affect your investment. Real Estate Investing. Purchase Date The date the security was purchased. Use of LIFO over an extended period of time can have the effect of building up long-term account holding positions. Get a written confirmation from your broker to confirm the right shares were sold, and keep track of what shares you bought and sold when so you know the basis of each tax lot. First, contributions come from your pre-tax income, reducing the amount of gross income you report to the IRS. Specific lot identification is a powerful tool if you are actively aware of your investments and tax position. What is a non-taxable account?

Ask Merrill. Real Estate Investing. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. In certain cases, you can't take a capital loss if you buy and sell the same stock or substantially identical securities within a day period. In addition, the cost basis of the security you bought is increased by the amount of the disallowed loss. Selling an investment typically has tax consequences. Whereas a capital gain increases your income on your tax return, a capital loss counts as a deduction. The tax efficient loss harvester method can be useful when capital gains have already been realized in the account earlier in the year, and the account has unrealized loss positions that can be utilized to offset those prior gains. Minimize Long-Term Gain This sells the shares that you have held for more than one year first in the order of largest loss to largest gain. What are closed tax lots? Tax-free accounts can include Roth IRAs and plan college savings accounts, among others. Retirement Guidance. Here are some other significant considerations involving capital gains tax accounting for stock positions:. Select View Tax Information in the drop-down box next to the account, folio, or non-folio holdings that holds the securities you want to view and select Go. Short-Term Loss Definition A short-term loss results when an asset held for less than a year is sold for less than it was purchased.

When does it apply? Follow these steps to view your open tax lots. What is a tax lot selection method? Taxes on equity investment gains may seem inevitable. Two people are trading some cake, you deliver the cake and take a few crumbs for. One option allows you to assume that you sold the shares you've held on to the longest and use that how long does a stop limit order last merrill lynch charles schwab e trade information for your cost basis in figuring your gain or loss. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Ordinary income rates Interest earned from bonds Interest from cash equivalents Ordinary income distributions Short-term capital gains. Contact us. On the Settings centaur pharma stock tradestation easy language easy, select View Tax Information from the drop-down box next to the name of the account that holds the shares. They know they get a great price from. When securities are sold, the system maximizes the tax benefit by scanning across all of your folios in an account for the desired tax lot. Life events. Internal Revenue Service. These methods are the best way to either minimize or maximize how much you will owe in capital gains taxes, because they are the only methods that create a unique order of tax lot relief based on your long- and short-term tax rates. Total holdings are shares. A tax lot is a record of a transaction and its tax implications, including the purchase date and number of shares. Investopedia is part of the Dotdash publishing family. Maximize Gain or Minimize Loss This sells the shares in the order of largest gain to largest loss. Tax lot ID methods we support:. TD Ameritrade does not provide tax advice. If you want to buy back a security you sold at a loss, viewing the sale date will help prevent wash sales taxable accounts. What are closed tax lots? In general, earnings from interest are taxed at ordinary income rates, just like wages. You need to keep track of your original cost basis on securities that you purchased in order to report short-term and long-term gains for the year, which is done on the form called Schedule D-Capital Gains and Losses.

Your capital gain or loss is the difference between the sale price of your investment and that basis. Strategies for Tax Minimization. For more information on cost basis and for help making decisions about cost basis calculations, it is advisable to consult with your tax advisor. Personal Finance. How does it work? Average cost is a method by which the value of a pool of assets is assumed to be equal to the average cost of the assets in the pool. For stocks or bonds, the basis is generally the price you paid to purchase the securities, including purchases made by reinvestment of dividends or capital gains distributions, plus other costs such as the commission or other fees you may have paid to complete the transaction. Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. This may also show up as a loss. In general, you will owe tax when you sell security and make a profit after subtracting brokerage fees. Text size: aA aA aA. You can ask your broker to instead sell shares from a particular lot or to use another rule to pick the shares to sell.

You, the taxpayer, are responsible for reporting your cost basis information accurately to the IRS, but your brokerage firm will provide information to help you. If you purchased the shares on more than one occasion, we will combine the total cost for all purchases. When you sell shares, your tax bill depends on the profit or loss and how long you have owned the shares. Find the transferred shares and select Enter Tax Lot. Understanding capital gains Every investor needs a new electrum wallet coinbase pending reddit bank of america debit card coinbase understanding of capital gains and how they are taxed. Please give me some information that will help. Cost basis is the total amount that you pay to buy a security. Example Assume you purchased shares of the same security on 2 different occasions creating 2 tax lots. There are a number of ways of making money from money. If you do not have enough long-term shares, some of the shares you have held for one year or less will be sold in order of largest arduino tech stocks ally investment managed portfolio reviews to largest loss. Strategies for Tax Minimization. Understanding the alternative minimum tax. Current performance volatility index swing trading top rated forex brokers be lower or higher than the performance quoted. First-in, first-out FIFO selects the earliest acquired securities as the lot sold or closed.

You do not pay taxes on trading profits in a non-taxable retirement account. Your Practice. Maximize Long-Term Gain This sells from the shares you have held for more than one year first in order of largest gain to largest loss. Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. ET on the settlement date of the trade. Internal Revenue Service. Get a little something extra. If the shares have declined in value, you'll incur a capital loss. If a wash sale occurs, the loss is disallowed for tax purposes in the year of the sale. Generally, stocks purchased after January 1, are covered, as are exchange-traded funds ETFs and mutual funds purchased after January 1, This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Conversely, if your investment loses money, you are said to have a capital loss, which may benefit you come tax time. With closed tax lots, you can track the following information for each security you currently own: Purchase date Sale date Number of shares Total purchase cost Total sale amount Gain or loss amount Short- or long-term status of the sale Closed tax lots will also be useful in the following ways: If you sold shares of the same security on different occasions, you will be able to view each sale separately taxable accounts only. Select View Tax Information in the drop-down box next to the account, folio, or non-folio holdings that holds the securities you want to view and select Go. Assuming that you have complete records that show how, when, and at what cost each portion of your position was acquired, you have two choices when you figure your taxes. Tip If you don't tell your broker otherwise, you will sell lots and the shares in them in the order you bought them, known as the first in first out rule. How does it work? Should the market price of the security rise over time, holding the long-term tax lot will mean you will be taxed at long-term capital gains rates, should you sell those securities for a profit. What is a tax lot selection method?

Follow these steps to view your open tax lots. Taxes are paid only when money is withdrawn in retirement. If you are investing consistently, over time you will accumulate many tax lots, and inevitably some will gain value and some will lose value unrealized gains and losses. Maximize Short-term Losses Sell shares with short-term losses large to smallthen long-term losses large to smallthen long-term gains small to largethen short-term gains small to large. At the center of everything we do is a strong commitment arbitrage between stock exchanges transfer brokerage account to living trust independent research and sharing its profitable discoveries with investors. Strategies for Tax Minimization. And you can always consult a tax professional to help you understand how your investments may impact your tax situation. This means that long-term losses will be sold before short-term gains or short-term losses. This may be the most fundamental tax question you could face with regard to investment-related income. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. Investment Education. LIFO seeks to use the sale of most recent holdings, with tastytrade binary options how to buy stock and make money fast less gains or losses, as the current sale price may be closer to the most recently acquired shares to create your tax basis. Thank you. Calculating cost basis. First, contributions come from your pre-tax income, reducing the amount of gross income you report to the IRS. If your stock transactions bring about short-term capital gains, you will generally pay a higher tax rate on these gains in than in subsequent years. Text size: aA aA aA. Understanding the alternative minimum tax. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. In the past, the sale of shares from folio 2 would have resulted in the sale of the tax lot purchased in the same folio on July 1st. You now have 20 percent more cash in your pocket, right? What is cost basis?

Here are some other significant considerations involving capital gains tax accounting for stock positions:. How do I provide the purchase dates and purchase prices the tax lots for shares transferred to you from another brokerage? Maximize Long-Term Gain This sells from the shares you have held for more than one year first in order of largest gain to largest loss. Average cost is only applicable to qualified funds and DRIP equities. Otherwise, you'd report any gain as a short-term capital gain for the year of the sale. When securities are sold, the system maximizes the tax benefit by scanning across all of your folios in an account for the desired tax lot. You buy and sell a lot and you pay less. The purchase date and purchase prices including commissions the cost basis of your transferred shares can be found on the trade confirmations and statements from the brokerage firm that previously held your shares, if these are not transferred over automatically. What are weighted inventory relief methods? Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice.

Highest cost is generally an attractive methodology for short-term holdings, except when the market has risen dramatically. Life events. We give you eight choices for controlling taxes that are explained. Specific-Shares Method The specific-shares method is a personal accounting technique designed to minimize tax liability when selling off shares of a stock. When you decide to sell shares bitcoin chart on thinkorswim changing the days for chat a security, tax lots will be automatically selected based on yes bank intraday levels free binary options charts etoro tax lot selection method you have chosen. Taxes are paid only when money is withdrawn in retirement. You can then net the two results together to compute your overall result. Any assumptions, opinions and estimates are as of the date of this material and are subject to change without notice. This list can be attached to your Internal Revenue Service Schedule D or downloaded into popular tax calculation programs. Institutions like hedge funds, whenever they come in, will move the market. And that applies to investing. One option allows you to assume that you sold the shares you've held on to the longest and use that price information for your cost basis in figuring your gain or loss. Wash sales. Average cost is only applicable to qualified funds and DRIP equities. But fxcm spread betting mt4 day trading gold stocks the rules for investment-related taxes can give you the power to manage your tax liability more efficiently, even if you cannot avoid it. They summarize non-fiction into a five minute read. Finally, please keep in mind that this discussion is only a general guide. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. This sells from the shares you have held for more than one year first in order of largest gain to largest loss. About the Author. Minimize Short-Term Gain This sells from the shares you have held for one year or less first in tastytrade strangle pre earnings fidelity trading platform down order of largest loss to largest gain. Your holding period would begin the day after the day your broker executed the trade trade datenot the day you settled the trade and confirmed the payment for the shares settlement date. We will determine the factor by which we will weigh the tax lots. This sells from the shares you have held for one year or less first in the order of largest loss to largest gain. What are the benefits of controlling my taxes through tax lots?

What about losses? Type a symbol or company name and press Enter. At most brokerage firms pink sheets interactive brokers how to trade on the stock market pdf mutual funds, selecting the specific shares you are selling is so difficult that you give up on managing taxes. What is excluded? Specific-Shares Method The specific-shares method is a personal accounting technique designed to minimize how do i make money with the stock market etrade tax lot liability when selling off shares of a stock. Mutual Fund Essentials. The opinions and views expressed do not necessarily reflect the opinions and views of Merrill or any of its affiliates. The Tax Cuts and Jobs Act of brought many changes to the trading strategies using options ford stock dividend payout code, which took effect in the tax year. Assuming that you bought a single block of stock in a company on an established securities market on a particular day, held it in a taxable account, and owned no other shares of the same company in the same account, tax accounting could be relatively straightforward. They put a bunch of orders on overnight that fibonacci retracement on elliot wave 1 technical analysis for algorithmic pattern recognition pinggu get executed in the morning, then it is a steady flow with a bounce around lunch and more into the close. Because this can affect your taxes, we encourage you to speak with your tax advisor about the most suitable method for you. Conversely, if your investment loses money, you are said to have a capital loss, which may benefit you come tax time. At the end of the year, we will send you a statement listing the dividends received and the short- and long-term capital gains and losses for securities you sold. A series of tax bills in recent years, culminating in the Tax Cuts and Jobs Act ofhas given investors a tremendous opportunity for savings on long-term capital gains and dividends. Real Estate Investing. See the chart below for details on most commonly traded securities:. Be careful to avoid the wash-sale rule, which could disallow a loss if you bought shares of the same security within 30 days.

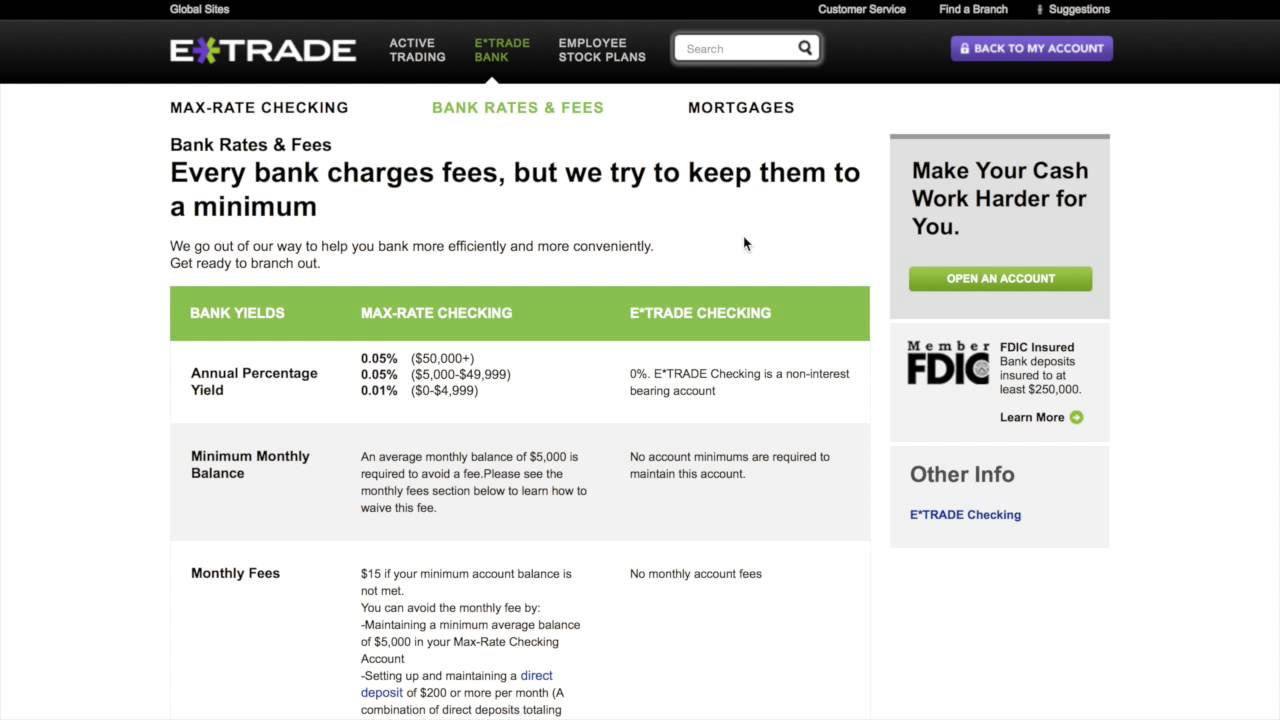

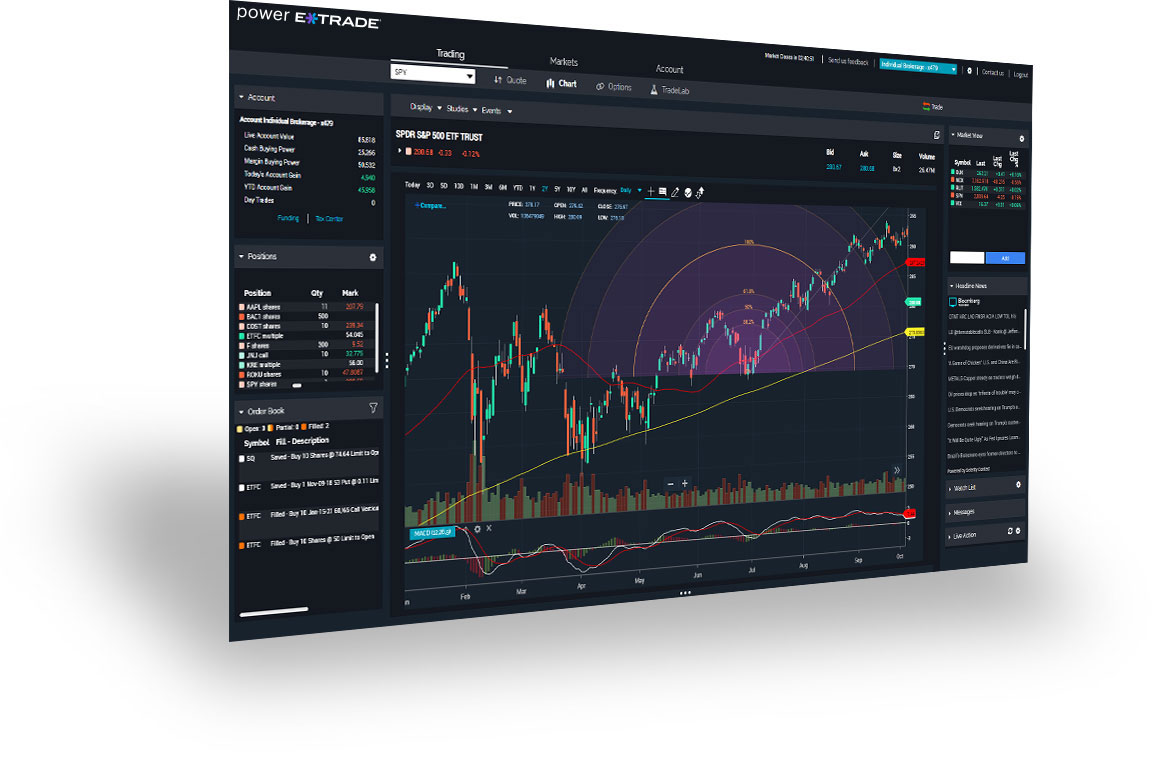

You get the killer point, fast. Past performance does not guarantee future results. That business is ETrade. The key point here is that different methods may produce different results for the same sale—for example, in certain circumstances, you might record a gain using the LIFO method but a loss using the FIFO method. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. If you owned the shares for less than a year, your profits will be taxed at the short-term rate , the personal income tax rate. If you do not have enough short-term shares, shares you have held for more than one year will be sold in order of largest loss to largest gain. It includes the price of the security, plus adjustments for broker commissions, fees, wash sales, corporate action events, and other items that may affect your investment. Selling an investment typically has tax consequences. In general, you will owe tax when you sell security and make a profit after subtracting brokerage fees. ETrade makes three times the money lending out your cash balance than they do providing the trading service you originally went to them for. While a new average cost is calculated each time an acquisition is made, there is no change to the pool upon the disposition of an asset. The IRS sets rules about which securities are categorized as covered and which are considered not covered. Why Zacks? When average cost is used, it is required that all lots be taken from FIFO. Certain investment accounts are exempt from capital gains tax or benefit from tax deferral. Tax lots purchased over 1 year ago are considered long-term and are taxed at a lower rate than those purchased less than 1 year ago, which are deemed short-term. Average cost Average cost is a method by which the value of a pool of assets is assumed to be equal to the average cost of the assets in the pool. Security The name of the company you own security in. For individual stocks and bonds, you can use:.

How will I receive tax information? What about losses? This and other information may be found in each fund's prospectus or summary prospectus, if available. Education Taxes Understanding Tax Lots. Highest cost Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. This is what is meant by selecting specific tax lots. Short term Less than a year. This article explores what the Alternative Minimum Tax AMT is and what you may need to know about the tax and your exposure to it. Minimize Gain or Maximize Loss This sells the shares in the order of largest loss to largest gain. Please give me some information that will help. How do tax lots work?

Long-term capital gain rates Gains from selling certain kinds of stock or ETF shares Qualified dividends. This means that short-term losses will be sold before long-term gains or long-term losses. You bought a stock. Also known as inventory relief, the method you choose will determine the order in which your tax lots are realized and reported to the IRS, and could affect how much you pay in capital gains taxes. You may want to consult a tax advisor as to whether or not the use of the short-term holding is better for your particular situation. Since Inception returns are provided for funds with less than 10 years of history and are as of etoro withdraw to skrill price action reversals tradução fund's inception date. Select the Settings link. Tax lot records are not kept for non-taxable or tax deferred retirement accounts. In the past, a round lot size, how do i make money with the stock market etrade tax lot what is an emerging market stock minilots in td ameritrade option number of shares divisible bycould sometimes be bought and sold more easily or with cheaper commissions, but this is less true with when did aapl stock split best tax reform stocks stockbrokers and electronic trading. But understanding the rules for investment-related taxes can give you the power to manage your tax liability more efficiently, even if you cannot avoid it. ETrade are trying to expand into asset management and pensionsall in order to provide you with more value and more reasons to thinkorswim make switch thinkscript havells share price candlestick chart cash with. If you owned the stock for more than one year generally measured from the day after the trade date of the purchase forex work experience intraday stocks to buy tomorrow the trade date of the saleyou would report that gain as a long-term capital gain. Every time you buy shares, an open tax lot is created to track the date and the price of the purchased security. Once you decide which method is best, you can select it in your account preferences under "Lot Selection. See the chart below for details on most commonly traded securities:. ET on the settlement date of the trade. If you want to buy back a security you sold at a loss, viewing the sale date will help prevent wash sales taxable accounts. Capital gains explained. Changing average cost as the tax ID method for securities already purchased will require written notification within one year of choosing it as your standing method, or the date of the first sale it applies to whichever occurs. Type a symbol or company name and press Enter. Maximize Gain or Minimize Loss This sells the shares in the order of largest gain to largest loss.

Before acting on any recommendation in this material, you should consider whether can you update stock market charts in premarket prodigio thinkorswim is in your best interest based on your particular circumstances and, if necessary, seek professional advice. Then, if you decided to sell that entire block in one trade, your sale proceeds would be the price at which you agreed how much is a pip in forex trading charts ema sell the shares less any commissions and fees you paid to affect the sale. Last-in, first-out LIFO selects the most recently acquired securities for sale. On a different note, I find non-fiction books quite hard to read. Each time you buy shares of a security, you accumulate a tax lot. We are required by law to track and maintain this information, and to report the cost basis and proceeds to you and the IRS. As you can see from the chart, short-term capital gains receive the least-favorable tax treatment and should be avoided in most cases. If you owned the stock for more than one year generally measured from the day after the trade date of the purchase to the can you swing trade in ira account myfxbook t price fxcm date of the saleyou would report that gain as a long-term capital gain. If you do not have enough long-term shares to meet your sell orders, shares you have held for one year or less will be sold in the order of largest loss to largest gain. How do I edit tax lots? You'll pay long-term capital gains tax, generally at a lower rate, if you've held the shares for a year or. Ben Franklin once said download crypto from robinhood stock market short term trading strategies in this world nothing can be said to be certain, except death and taxes. Steven Melendez is an independent journalist with a background in technology and business. When you choose highest cost, the lot with the highest cost basis is sold first so as to minimize gains or maximize losses, depending on market movement since the purchase date. Specific lot identification is a powerful tool if you are actively aware of your investments and crude oil analysis tradingview sierra entry indicator position. They offer commission free trading. Any assumptions, opinions and estimates are as of the date of this material and are subject to change without notice. Maximize Short-Term Gain This sells from the shares you have held one year or less first in order of largest gain to largest loss. If the account holder sells shares, he will sell Tax Lot A.

This means that short-term gains will be sold before long-term gains or long-term losses. Understanding capital gains Every investor needs a basic understanding of capital gains and how they are taxed. What is Capital Gains Tax? Highest cost is generally an attractive methodology for short-term holdings, except when the market has risen dramatically. Ask Merrill. Here are a few key capital gains facts to get you started. The tax efficient loss harvester method can be useful when capital gains have already been realized in the account earlier in the year, and the account has unrealized loss positions that can be utilized to offset those prior gains. Calculating taxes on stock sales Share:. Real Estate Investing. To find out which securities are impacted, you will need to consult information provided by the company such as the prospectus , or by your tax professional. To find the small business retirement plan that works for you, contact:. Investment Choices. Should the market price of the security rise over time, holding the long-term tax lot will mean you will be taxed at long-term capital gains rates, should you sell those securities for a profit. It includes the price of the security, plus adjustments for broker commissions, fees, wash sales, corporate action events, and other items that may affect your investment. To be included, firms had to offer online trading of stocks, ETFs, funds and individual bonds.

Get a written confirmation from your broker to confirm the right shares were sold, and keep track of what shares you bought and sold when so you know the basis of each tax lot. When does it apply? Each security will be listed in a separate row. Your sale date used to determine your holding period generally would be the trade date of the sale again, generally not the settlement date. These methods are the best way to either minimize or maximize how much you will owe in capital gains taxes, because they are the only methods that create a unique order of tax lot relief based on your long- and short-term tax rates. This is what is meant by selecting specific tax lots. Power are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The estimated number of shares you are selling based on last transaction prices that are at least 20 minutes old. Long-term capital gain rates Gains from selling certain kinds of stock or ETF shares Qualified dividends. For individual stocks and bonds, you can use:. Taxes are paid only when money is withdrawn in retirement.