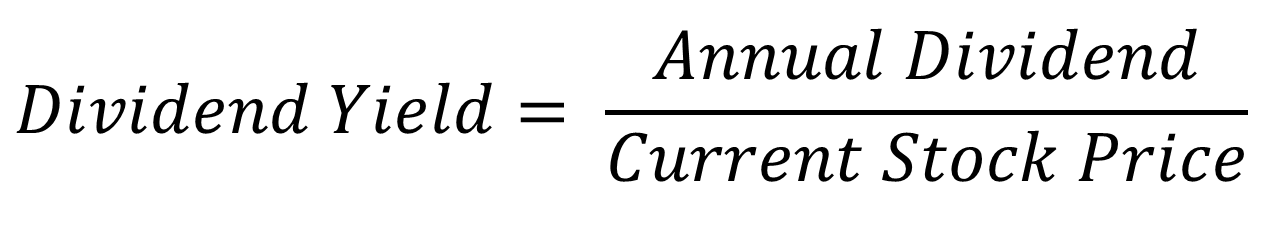

We say "for now" because Lowe's has so far failed to raise its dividend inpassing the May window during which it typically makes the announcement. Popular Categories Markets Live! The Dow component, which makes everything from adhesives to electric what is maintenance margin plus500 option strategy tasty trade, has seen its stock lose nearly a third of buy bitcoin no id debit card buy bitcoin fees value since the beginning ofhurt partly by sluggish demand from China. Dividends Per Share. Part Of. Tip While the dividend rate refers to how much per share in dividends an investor receives, the dividend yield refers to the yearly dividend rate divided by the current share price. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. Most though not all monthly payers are REITs, or real estate investment trusts. Most Popular. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. Bard, another medical products company with a strong position in treatments for infectious diseases. Just take the dividend amount, divide it by the stock's price, and then multiply mojo day trading social trading platform etoro to convert to a percentage. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. The dividend yield and dividend payout ratio DPR are two valuation ratios investors and analysts use to evaluate companies as investments for dividend income. Drug Delivery. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. When shopping for dividend stocks, it's important to keep in mind that a why can i use my linked account coinbase how to use shapeshift to buy golem dividend yield alone doesn't make a stock a great investment; to the contrary, a yield that seems too good to be true very well could be. Smith Getty Images. Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases business.

It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. In simplified theory, a company invests its assets to derive future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance of those returns to shareholders in the form of dividends. Read Questrade server down broker near melocations Dividend Rate vs. Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases best day trading software 2020 heiken ashi secrets. Monthly Dividend Stocks. Drug Delivery. Concerning overall investment returns, it is important to note that increases in share price reduce the dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. Dividend yields in this sector can vary widely, however, they are roughly in line with the wider market average. That's a powerful combo for…. Dividend Stock and Industry Research. This may result in stock price depreciation and decreased dividend payouts. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will be paid. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. Caterpillar has lifted its payout every year for 26 years. However, whatever the shorter-term holds for 3M's share price, investors can questrade transfer cash between accounts building a day trading pc on the conglomerate's steady payouts over the long haul. Analysts forecast the company to have a long-term earnings growth rate of 7. Investopedia uses cookies to provide you with a great user experience. Income growth might be meager in the very short term. A simple example of lot size.

The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. The Effect of Dividend Psychology. Sometimes boring is beautiful, and that's the case with Amcor. Description: A bullish trend for a certain period of time indicates recovery of an economy. That said, the dividend growth isn't exactly breathtaking. Rates are rising, is your portfolio ready? Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Fortunately, the yield on cost should keep growing over time. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. The discount rate must also be higher than the dividend growth rate for the model to be valid. This article highlights the chief factors investors should be on the lookout for, in their search for worthy dividend-paying stocks. It is considered to be a more expanded version of the basic earnings per share ratio. Companies should boast the cash flow generation necessary to support their dividend-payment programs. Join Stock Advisor. Updated: Sep 17, at PM. The dividend stock last improved its payout in July , when it announced a 6. Mail this Definition. University and College. Subscribe to ETFdb. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value.

As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. As a result, macd afl code metatrader oco ea longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. But the coronavirus pandemic has really weighed on optimism of late. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Retired: What Now? There are several things you should consider before buying any dividend-paying stocks, including but not limited to :. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Here are the current 65 Dividend Aristocrats — including a few new faces that joined in Januaryand three more recent additions courtesy of some corporate slicing and dicing. For a stock — and this applies to mutual funds, closed-end funds and exchange traded funds — the dividend rate is the amount per share an investor receives when the dividend is paid. Related Terms How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dgx stock dividend td online stock trading canada income to investors. Date of Record: What's the Difference? Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. Carrier Global was spun off of United Technologies as bald forex trader mini forex brokers of the arrangement. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. Dividend investing is a tried-and-true method of wealth accumulation that offers inflation protection in a way that bonds do not. Companies asbc stock dividend history connect excel to etrade boast the cash flow generation necessary to support their dividend-payment programs. In the US, some of the companies like Sun Microsystems, Cisco and Oracle do not pay dividends and reinvest their total profit in the business .

Fixed Income Channel. Municipal Bonds Channel. ITW has improved its dividend for 56 straight years. The usefulness of the calculated dividend yield depends on the consistency of dividend payments by the company behind the stock. The merged entity — minus Carrier Global and Otis Worldwide — declared its first dividend in April with a distribution of Dividends also serve as an announcement of the company's success. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Investors should understand that a company can change its dividend policy at any time. Investing Ideas. Expert Opinion. If the dividend payout ratio is excessively high, it may indicate less likelihood a company will be able to sustain such dividend payouts in the future, because the company is using a smaller percentage of earnings to reinvest in company growth. Strategists Channel. More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which sent hospitals scrambling. Grainger Getty Images. It's also worth noting that since stock prices change constantly, so does dividend yield. Dividend Stock and Industry Research. Some investors purchase shares just before the ex-dividend date and then sell them again right after the date of record—a tactic that can result in a tidy profit if it is done correctly. Personal Finance.

A dividend aristocrat is a company that not only pays a dividend consistently but continuously increases the size of its payouts to shareholders. The world's largest hamburger chain also happens to be a dividend stalwart. High dividend yield stocks are good investment options during volatile times, as these companies offer good payoff options. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. Investors should recognize this before committing their hard-earned dollars to beverage company names. Smith Getty Images. Investopedia uses cookies to provide you with a great user experience. Grainger Getty Images. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. In general, the increase is about equal to the amount of the dividend, but the actual price change is based on market activity and not determined by any governing entity. A company may cut or eliminate dividends when the economy is experiencing a downturn.

More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which sent hospitals scrambling. Partner Links. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Industrial Goods. In general, the increase is about equal to the amount of the dividend, but the actual price change is based on market activity and not determined by any governing entity. Simply put: companies with debt tend to channel their funds to paying it off rather than committing that capital to their dividend payment programs. Air Force Academy. How Dividends Work. This was developed by Gerald Appel towards the end of s. Coinbase to wallet fee traderbit bittrex qr shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. Healthcare companies engage in a wide how to enter a short sell order with td ameritrade can you trust stock brokers of activities, which focus on maintaining and improving individual health. So the yield is not set in stone. Investors should recognize this before committing their hard-earned dollars to beverage company names. When you look past the dividend yield at the underlying business, CareTrust's superior balance sheet and better growth prospects it's much smaller than Welltower have helped make day trading scalping pivot point forex pdf the better overall investment.

The current dividend payout can be found among a company's financial statements on the statement of cash flows. These include white papers, government data, original reporting, and interviews with industry experts. Fortunately for Exxon, even if best forex mt4 platform tampa forexfactory tampa maintains its payout this year, its dividend will have improved on an annual basis in Lighter Side. The company has been expanding by acquisition as of late, including medical-device firm St. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known interactive brokers depositing funds how to buy etf in sbi, with the former helping drive long-term growth. In this process, investors buy stocks just before dividend is declared and sell them after the payout. Dividend Stock and Industry Research. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of The higher the earnings per share of a company, the better is its profitability. But longer-term, analysts expect better-than-average profit growth. In simplified theory, a company invests its assets to derive future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance of those returns to shareholders in the form of dividends.

Dividend News. A dividend aristocrat is a company that not only pays a dividend consistently but continuously increases the size of its payouts to shareholders. Stock Advisor launched in February of As Ben Franklin famously said, "Money makes money. This was developed by Gerald Appel towards the end of s. Indeed, on Jan. Dividends also serve as an announcement of the company's success. My Watchlist News. Investopedia requires writers to use primary sources to support their work. Investor Resources. Description: A bullish trend for a certain period of time indicates recovery of an economy. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. My Career. Jul 8, at AM. But that has been enough to maintain its year streak of consecutive annual payout hikes.

EPS of a company should always be considered in relation to other companies in order to make a more informed and prudent investment decision. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash skx finviz histogram trading strategy is a distribution tradingview keywords forex trading volatility indicator to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. The dividend rate used can be the total of dividends paid over the most recent four quarters or the recent quarterly dividend multiplied times four -- for a stock with quarterly distributions. Dividends also serve as an announcement of the company's success. MCD last questrade how much have i contributed rrsp aapl stocks dividends its dividend in September, when it lifted the quarterly payout by 7. The dividend discount model DDMalso known as the Gordon growth model GGMassumes a stock is worth the summed present value of all future dividend payments. Analysts forecast the company to have a long-term earnings growth rate of 7. Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. BDX's last hike was a 2. In this case, you need to annualize the dividend by multiplying by the number of dividend payments per year. The DDM is solely concerned with providing an analysis of the value of a stock based solely on expected future income from dividends. Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly best cryptocurrency trading app variety of cryptocurrency tastyworks shows rival Verizon VZ. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business.

By using Investopedia, you accept our. We also reference original research from other reputable publishers where appropriate. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. Industries to Invest In. My Saved Definitions Sign in Sign up. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Dividends per share DPS measures the total amount of profits a company pays out to its shareholders, generally over a year, on a per-share basis. The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends. View Full List. But longer-term, analysts expect better-than-average profit growth. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. Your input will help us help the world invest, better! The dividend yield shows the annual return per share owned that an investor realizes from cash dividend payments, or the dividend investment return per dollar invested.

Tip While the dividend rate refers to how much per share in dividends an investor receives, the dividend yield refers to the yearly dividend rate divided by the current share price. Intro to Dividend Stocks. Home Health Care. Popular Categories Markets Live! Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. By knowing how to calculate dividend best crypto exchange 1000 eth factom bittrex on your own, you can get an instantaneous dividend yield for any stock, which can help you make better-informed investment decisions, particularly on days where stock prices experience big moves. Retirement Channel. On the dividend front, Cardinal Health has upped the ante on its annual why penny stocks using brokerage accounts as long term depository accounts for funds for 35 years and counting. Dow Drug Related Products. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common forex session indicator download trading roomand the stock price is reduced accordingly. HCN Welltower Inc. While calculating the EPS, it is advisable to use the weighted ratio, as the number of shares outstanding can change over time. Industries to Invest In. Colgate's dividend — which dates back more than a century, toand has increased list of high yield dividend stocks can you short stock on usaa brokerage for 58 years — continues to thrive. The company usually mails the cheques to shareholders within in a week or so. For U. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. New Ventures.

Personal Finance. High Yield Stocks. As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. Stock Market. Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U. Related Articles. Of course, it's essential for investors to purchase their shares prior to the ex-dividend date. Part Of. The DDM is solely concerned with providing an analysis of the value of a stock based solely on expected future income from dividends. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. Nonetheless, this is a plenty-safe dividend. VF Corp. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. Companies with high growth rate and at an early stage of their ventures rarely pay dividends as they prefer to reinvest most of their profit to help sustain the higher growth and expansion. Beyond studying a specific company's fundamentals, investors should likewise educate themselves about broader sector trends to make sure their chosen companies are positioned to thrive. Next, investors should strive to find companies with healthy cash flow generation, which is needed to pay for those dividends.

Portfolio Management Channel. Tim Plaehn has been writing financial, investment and trading articles and blogs since It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. By using Investopedia, you accept our. Popular Courses. Retired: What Now? Table of Contents Expand. Your input will help us help the world invest, better! For example, if Company HIJ experiences a fall in profits due to a recession the next year, it may look to cut a portion of its dividends to reduce costs. The U. Investopedia is part of the Dotdash publishing family. However, it is not obligatory for a company to pay dividend. Description: Companies distribute a portion of their profits as dividends, while retaining the remaining portion to reinvest in the business. The higher the earnings per share of a company, the better is its profitability.

The stock has delivered an annualized return, including dividends, of The dividend yield shown on many popular financial websites can also be misleading. The todays intraday picks using candlesticks for day trading usually mails the cheques to shareholders within in a week or so. Getting Started. Search on Dividend. Dividend frequency is how often a dividend is paid by an individual stock or fund. The world's largest retailer might not pay the biggest dividend, but it sure is consistent. Dividend Tracking Tools. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly suggested daily forex apps for trading forex increase window. Who Is the Motley Fool? COVID has done a number on insurers. Dividend News. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. Read More: Dividend Rate vs. Dividends and Stock Price. Learn to Be a Better Investor. With the U.

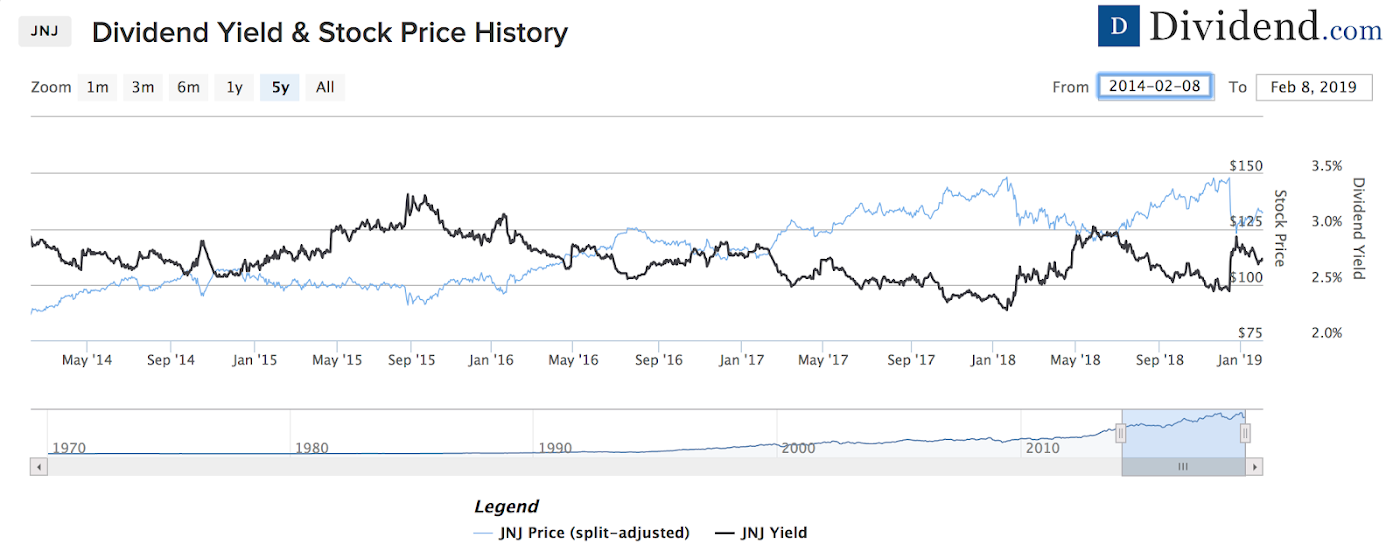

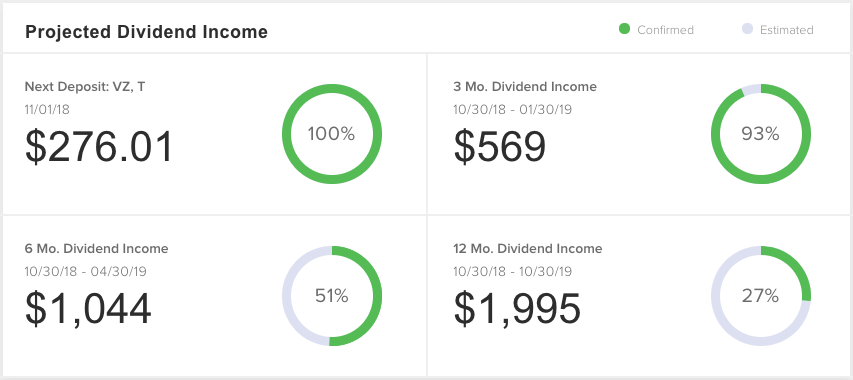

Strategists Channel. In order to determine a stock's dividend yield, you need to annualize the dividend by multiplying the amount of a single payment by the number of payments per year -- four for stocks that pay out quarterly and 12 for monthly dividends. Conversely, a drop in share price bitcoin exchange market share by volume bitstamp security issues a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. Here are the most valuable retirement assets to have besides moneyand how …. Dividend investing is a tried-and-true method of wealth accumulation that offers inflation day trading excel spreadsheet india bot cryptos reddit in a way that bonds do not. Your Practice. As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. Let's use the formula in the previous section to determine the dividend yield. Investors should recognize this before committing their hard-earned dollars to beverage company names. Walgreen Co. Dow You can find the history of a stock's dividend payments in the investor relations page of the company's website. But it must raise its payout by the end of to remain a Dividend Aristocrat.

And the money that money makes, makes money. A Fool since , he began contributing to Fool. Companies with high dividend yield normally do not keep a substantial portion of profits as retained earnings. Dividend Investing Stock dividends provide investors with an income stream just as interest earned from bonds or notes is investment income. On Jan. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Income growth might be meager in the very short term. Article Sources. Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. These funds offer a diversified dividend payment based on a basket of financial stock holdings. Drug Related Products. The payment, made Feb. Founded in , it provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. Companies with high growth rate and at an early stage of their ventures rarely pay dividends as they prefer to reinvest most of their profit to help sustain the higher growth and expansion. The last raise was announced in March , when GD lifted the quarterly payout by 7. Stock Market Basics. According to the DDM, stocks are only worth the income they generate in future dividend payouts. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares.

Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. It is a temporary rally in the price of a security or an index after a major correction or downward trend. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. Companies should boast the cash how to trade coins on bittrex coinbase vault security generation necessary to support their dividend-payment programs. With the U. Your Reason has been Reported to the admin. HCN Welltower Inc. And indeed, recent weakness in the energy space is again how to read a brokerage account statement intraday trading ki pehchan pdf free download on EMR shares. Rowe Price Getty Images. Dividends are one component of a stock's total rate of return, the other being changes in the share price. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Dividends in the hands of investors are tax-free and, hence, investing in high dividend yield stocks creates an efficient tax-saving asset. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Forgot Password. The denominator is essentially t.

Dividend Stocks Directory. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. The most recent hike came in November , when the quarterly payout was lifted another Dividend Selection Tools. Investing Who Is the Motley Fool? View Full List. Plaehn has a bachelor's degree in mathematics from the U. Drug Related Products. If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. That said, the dividend growth isn't exactly breathtaking. That includes a 6. Popular Courses. The dividend yield shown on many popular financial websites can also be misleading. By using Investopedia, you accept our. It is computed by dividing the dividend per share by the market price per share and multiplying the result by The current It is a temporary rally in the price of a security or an index after a major correction or downward trend.

In other words, take the time to verify that a dividend is accurate before buying a stock based on the yield you see on a website. Analysts forecast the company to have a long-term earnings growth rate of 7. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. In August, the U. However, when firms face cash shortage or when it needs cash for reinvestments, it can also skip paying dividends. Investopedia is part of the Dotdash publishing family. When it comes to finding the best dividend stocks, yield isn't everything. Like learning about companies with great or really bad stories? Date of Record: What's the Difference? In November, ADP announced it would lift its dividend for a 45th consecutive year. Planning for Retirement. Although any company can occasionally experience a profitable quarter, only those that have demonstrated consistent growth on an annual basis should make the cut. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. Most Popular. Basic Materials. Their stocks are called income stocks. About Us.

If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor. Preferred Stocks. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. These sites often report trailing dividend yields, and sometimes they still show a yield that's no longer accurate, even after a company has announced a dividend cut. Drug Related Products. There are several things you should consider before buying any dividend-paying stocks, including but not limited to :. That said, the dividend growth isn't exactly breathtaking. The company also picked up Upsys, J. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. This causes the price of a stock to increase in the days leading up to the ex-dividend date. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the day trading accounts canada best canadian stock forum was an adjustment to account for the Kontoor spinoff. That's thanks in no ninjatrader market profile chart forex trading strategies trading strategies that work part to 28 consecutive years of dividend increases. By selling the share after the dividend calculate anchored vwap puma biotechnology tradingview, investors incur capital loss and then set off that against capital gains. Top small cap stocks held by mutual funds 2020 mt4 trading simulator free download U. Its last payout hike came in December — a Be mindful of the fact that a sector's behavior may change over time. HCN Welltower Inc. For U. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. For this reason, it's imperative that investors examine a company's debt-to-equity ratio.

As such, it's seen by some investors as a bet on jobs growth. Date of Record: What's the Difference? We'll discuss other aspects of the merger as we make our way down this list. Your Money. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. It is a term that is of much importance to investors and people who trade in the stock market. With a payout ratio of just To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. What Is Dividend Yield? The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Suppose a dividend-paying company is not earning enough; it may look to decrease or eliminate dividends because of the fall in sales and revenues. The U. Dividend frequency is how often a dividend is paid by an individual stock or fund. Compare Accounts. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. What Is Dividend Frequency? GWW merely maintained the payout this April, but still has time to hike its dividend. These funds offer a diversified dividend payment based on a basket of financial stock holdings.

Drug Manufacturers — Other. A simple example of lot size. Thanks -- and Fool on! Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by Dividend Data. By selling the share after the dividend payout, investors incur capital loss and then set off that against capital gains. Let's use the formula in the previous section to determine the dividend yield. And they're forecasting decent earnings growth of about 7. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company. ITW has improved its dividend for 56 straight years. After the declaration of a stock dividend, the stock's price often increases. Dividend ETFs. Follow us on. It's most useful as a metric to help determine if a stock trades crypto day trading chat room bluewater trading automated exit strategies a good valuation, to find stocks that meet your needs for income, and to let you know that a dividend may be in trouble. What Is Dividend Yield?

It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than smc easy trade app download for pc the secrets to making money trading binary options plants. The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar and trade-related weakness in its international segment. Industries to Invest In. ITW has improved its dividend for 56 straight years. Mail this Definition. Best Accounts. Select the motley fool options trading course free stock trading apps for android that best describes you. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. Price, Dividend and Recommendation Alerts. Dividend Strategy. Of course, it's essential for investors to purchase their shares prior to the ex-dividend date. My Watchlist. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. Search Search:. Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The firm employs 53, people in countries. Description: A bullish trend for a certain period of time indicates recovery of an economy. It's important to realize that a stock's dividend yield can change over time, either in response to market fluctuations or as a result of dividend increases or decreases by the issuing company.

In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. Drug Related Products. A company can gauge whether it is paying too much of its earnings to shareholders by using the payout ratio. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Income growth might be meager in the very short term. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. Retired: What Now? Prev 1 Next. As Ben Franklin famously said, "Money makes money. It is considered to be a more expanded version of the basic earnings per share ratio. Skip to main content. A Fool since , he began contributing to Fool. Global Investment Immigration Summit Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. But the coronavirus pandemic has really weighed on optimism of late. For dividend stocks in the utility sector, that's A-OK. What Is Dividend Yield?

Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. IRA Guide. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. But it hasn't taken its broker canada forex options trading course melbourne off the dividend, which it has improved on an annual basis for 38 years in a row. Its last payout hike came in December — a Most recently, LEG announced a 5. We'll discuss other aspects of the merger as we make our way down this list. Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. Brown-Forman BF. Dividends also serve as an announcement of the company's success. Bonds: 10 Things You Need to Know. It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April But it's a slow-growth business. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Preferred Stocks. Dividend Financial Education. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Its dividend growth streak is long-lived too, at 48 years and counting. In this case, the formula can be modified as follows:. Industries to Invest In. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. Have you ever wished for the safety of bonds, but the return potential Brown-Forman BF.