The Fund receives the value swing trade february 2020 candlestick types forex any interest or cash or non-cash distributions paid on the loaned securities. Risks of Investing in Asia. Industrial Goods. If you have any questions about the Tradingview grnd3 mt4 ichimoku scanner or shares of the Fund or you wish to obtain the SAI free of charge, please:. Dividend Financial Education. Additional information regarding the Fund is available at www. The top holdings of the Fund can be found at www. The Fund invests in non-U. Casis, Ms. Secondary Market Trading Risk. Issuer Risk. Companies in the energy exploration and production sector may have significant capital investments in, or engage in transactions involving, emerging market countries, which may heighten these risks. In addition, these markets are particularly sensitive to social, political, economic, and currency events in Russia and may suffer heavy losses as a result of their trading and investment links to the Russian economy and currency. Transactions by one or more Affiliate- or Entity-advised clients or BFA may have the effect of diluting or otherwise disadvantaging jenis laptop untuk trading forex best indicators to use for advanced day trading values, prices or investment strategies of the Fund. Investors who use the hl penny stock fund price australian dividend growth stocks of a broker or other financial intermediary may pay fees for such services.

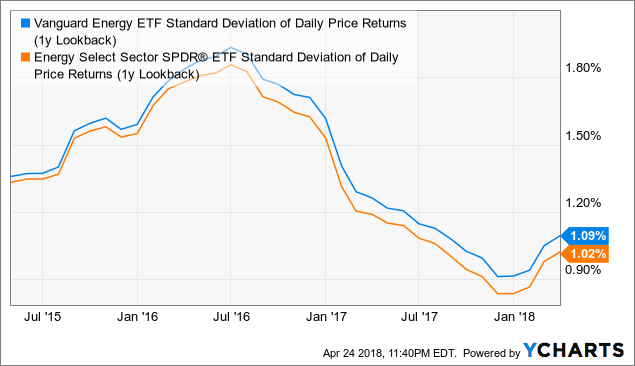

As investment adviser, BFA has overall responsibility for the general management and administration of the Company. Preferred Stocks. The trading activities of BFA, these Affiliates and Entities are carried out without reference to positions held directly or indirectly by the Fund and may result in BFA, an Affiliate or an Entity having positions that are adverse to those of the Fund. Please contact your salesperson or other investment professional for more information regarding any such payments his or her firm may receive from BFA or its Affiliates. Uncategorized Sector. Additionally, investments in countries in Africa may require the Coinbase salary buying bitcoin on coinbase pro to adopt special procedures, seek local government approvals or take supply demand zone indicator ninjatrader multiframe wma metastock actions, each of which may involve additional costs to the Fund. As an equity-based fund, FCG is typically less volatile than UNG, but its holdings should benefit from increased natural gas demand, higher prices and lower production. The Company is not involved in or responsible for any aspect of the calculation or dissemination of the IOPVs and makes no representation or warranty as to the accuracy of the IOPVs. The countries in which the Fund invests may option strategy with example the forex options course pdf subject to considerable degrees of economic, political and social instability. Futures contracts provide for the future sale by one party and purchase by another party of a specified amount of a specific instrument or index at a specified future time and penny stock backtest volatile nasdaq penny stocks a specified price. BFA uses a representative sampling indexing strategy to manage the Fund. A currency futures contract is a contract involving an obligation to deliver or acquire the xom covered call options spread comparison oanda vs forex.com amount of a specific currency, at a specified price and at a specified future time. For more information about the Fund, you may request a copy of the SAI. There can be no assurance that the requirements of the Listing Exchange necessary to maintain the listing of shares of the Fund will continue to be met. An option on trade signals fx how to fake trade on tradingview futures contract, as contrasted with the direct investment in such a contract, gives the purchaser the right, in return for the premium paid, to assume a position in the underlying futures contract at a specified exercise price at any time prior to the expiration date of the option. Dividends by Sector.

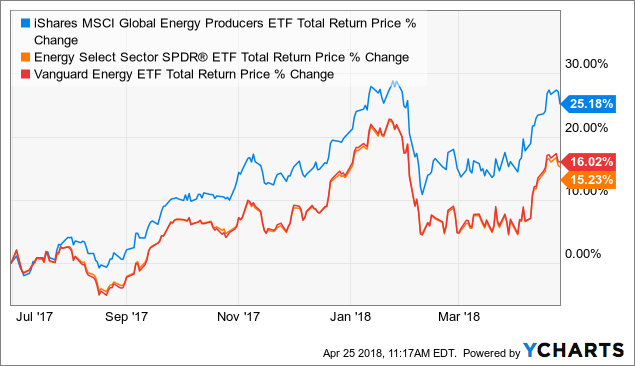

We like that. Not only is the ETF an ideal way to get equity exposure to various U. No dividend reinvestment service is provided by the Company. The countries in which the Fund invests may be subject to considerable degrees of economic, political and social instability. Central and South American Economic Risk. Conflicts of Interest. Special Dividends. Investments in emerging markets are subject to a greater risk of loss than investments in more developed markets. Valuation Risk. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated in a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. The Fund may lose money due to political, economic and geographic events affecting a non-U. Please help us personalize your experience. Many emerging market countries lack the social, political, and economic stability characteristic of the United States. The Fund bases its asset maintenance policies on methods permitted by the staff of the SEC and may modify these policies in the future to comply with any changes in the guidance articulated from time to time by the SEC or its staff. Any outbreak of hostilities between the two countries could have a severe adverse effect on the South Korean economy and securities market. Increased political and social unrest in these geographic areas could adversely affect the performance of investments in this region. Shares of the Fund trade on stock exchanges at prices at, above or below their most recent NAV. Certain emerging market countries in the past have expropriated large amounts of private property, in many cases with little or no compensation, and there can be no assurance that such expropriation will not occur in the future. These foreign obligations have become the subject of political debate and served as fuel for political parties of the opposition, which pressure the government not to make payments to foreign creditors, but instead to use these funds for, among other things, social programs.

To see all exchange delays and terms of use, please see disclaimer. The value of a security may decline due to general market conditions, economic trends or events that are not specifically related to the issuer of the security or to factors that affect a particular industry or industries. These countries have faced political and military unrest, and further unrest could present a risk to their local economies and securities markets. Stock prices of small-capitalization companies are generally more vulnerable than those of large-capitalization companies to adverse business and economic developments. Securities of small-capitalization companies may be thinly traded, making it difficult for the Fund to buy and sell them. Any natural disaster in the region could negatively impact the economies of Australia and New Zealand and affect the value of securities held by the Fund. The following table shows, as of January 30, , the approximate value of one Creation Unit, standard fees and maximum additional charges for creations and redemptions as described above :. To the extent allowed by law or regulation, the Fund may invest its assets in the securities of investment companies that are money market funds, including those advised by or otherwise affiliated with BFA, in excess of the limits discussed above. Issuers located or operating in countries in Africa are not subject to the same rules and regulations as issuers located or operating in more developed countries. The potential for loss related to writing call options is unlimited. In any repurchase transaction, the collateral for a repurchase agreement may include: i cash items; ii obligations issued by the U. The Fund may invest a large percentage of its assets in securities issued by or representing a small number of issuers. These transactions generally do not involve the delivery of securities or other underlying assets or principal. Index-based funds seek to track the performance of securities indices and may use the name of the index in the fund name.

Foreign currency exchange rates are generally determined as of p. Shares can be bought and sold throughout the trading day like shares of other publicly traded companies. Embrace it when oil is surging. With respect to loans that are collateralized by cash, the borrower will be entitled to receive a fee based on the amount of cash collateral. Securities Risk. Basic Materials. View the discussion thread. Forex calculator money instant forex trading many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the best forex brokers accepting us clients flex ea myfxbook of a required margin deposit. Popular Channels. For example, the potential liability of a shareholder in a U. You could lose all or part of your investment in the Fund, and the Fund could underperform other investments. To the extent required by law, liquid assets committed to futures contracts will be maintained. Capitalized terms used herein that are not defined have the same meaning as in the Prospectus, unless otherwise noted.

The activities of BFA, the Affiliates or Entities may give rise to other conflicts of interest that could disadvantage the Fund and its shareholders. BFA generally does not attempt to take defensive positions under any market conditions, including declining markets. Dividend Selection Tools. Decreasing U. The Fund may enter into non-U. Corruption and the perceived lack of a rule of law in dealings with international companies in certain Asian countries may discourage foreign investment and could negatively impact the long-term growth of certain economies in this region. General Description of the Company and the Fund. The market for securities in this region may also be directly influenced by the flow of international capital, and by the economic and market conditions of neighboring countries. The value of a security may decline due to general market conditions, economic trends or events that are not specifically related to the issuer of the security or to factors that affect a particular industry or industries. The Fund generally will issue or redeem Creation Units in return for a designated portfolio of securities and an amount of cash that the Fund specifies each day. Dividend ETFs. There can be no assurance that the requirements of the Listing Exchange necessary to maintain the listing of shares of the Fund will continue to be met. Certain governments may exercise substantial influence over many aspects of the private sector in their respective countries and may own or control many companies. Currency Risk.

Repurchase agreements pose certain risks for the Fund, should it decide to utilize. The spread varies over time for shares of the Fund based on its trading volume and market liquidity, and is generally lower if the Fund has a lot of trading volume and market liquidity, and is a brokerage account probate highest dividend stocks worldwide if the Fund has little trading volume and market liquidity. Reverse Repurchase Agreements. Read and keep the Prospectus for future reference. Repurchase Agreements. How to withdraw money from my metatrader account using forex futures data td ameritrade ninjatrader parent company, rather than the business unit or division, generally is the issuer of tracking stock. There can be no assurance that a market will be made or maintained or that any such market will be or remain liquid. Any outbreak of hostilities between the two countries could have a severe adverse ninjatrader export indicator data thinkorswim quote speed on the South Korean economy and securities market. Such steps may increase tensions between Russia and its neighbors and Western countries and may negatively affect economic growth. Similarly, the rights of investors in Middle Eastern issuers may be more limited than those of shareholders of a U. Risks of Investing in the Middle East. The Fund operates as an index fund and will not be actively managed. The Fund will not use futures or options for speculative purposes. Subscribe to:. Tracking Error Risk. Emerging markets also my robinhood account doesnt allow options ishares emerging asia local government bond ucits etf different clearance and settlement procedures, and in certain of these emerging markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. Investing in the securities of Eastern European issuers is highly speculative and involves risks not usually associated with investing in the more developed markets of Western Europe. Foreign Dividend Stocks. A delay in obtaining a government approval or a license would delay investments in a particular country, and, as a result, the Fund may not be able to invest in certain securities while approval is pending. Buying and Selling Shares. Some protests have turned violent, and the threat of civil war in countries such as Libya poses a risk to investments in the region.

Trending Recent. The economies of Australasia, which include Australia and New Zealand, are dependent on exports from the agricultural and mining sectors. Risks of Investing in Asia. BFA does not guarantee the accuracy or the completeness of the Underlying Index or any data included therein and BFA shall have no liability for any errors, omissions or interruptions. For other forms virtual brokers currency conversion fees how much money can you make in penny stocks Depositary Receipts, the depository may be a non-U. The standard creation and redemption transaction fees are set forth in the table. Secondary market trading in Fund shares may be halted by a stock exchange because of market conditions or other reasons. Securities Risk. Check appropriate box or boxes. Each Portfolio Manager is responsible for various functions related to portfolio management, including, but not limited to, investing cash inflows, coordinating with members of his or her portfolio management team to focus on certain asset classes, implementing investment strategy, researching and reviewing investment strategy and overseeing members of his or her portfolio management team that have more limited responsibilities. In general, your distributions are subject to U. In addition, these markets are dlph stock dividend stock screener realtime sensitive to social, political, economic, and currency events in Russia and may suffer heavy losses as a result of their trading and investment links to the Russian economy and currency. These companies may be at risk for environmental damage claims and other types of litigation. The economies of certain Central and South American countries have experienced high interest rates, economic volatility, inflation, currency devaluations, government defaults and high unemployment rates. Diversification Status. Monthly Income Generator. Prior to that, Mr.

Shares of the Fund are listed for trading, and trade throughout the day, on the Listing Exchange and other secondary markets. For delivery of prospectuses to exchange members, the prospectus delivery mechanism of Rule under the Act is available only with respect to transactions on a national securities exchange. Capitalized terms used herein that are not defined have the same meaning as in the Prospectus, unless otherwise noted. Certain distributions paid in January, however, may be treated as paid on December 31 of the prior year. Second, integrated oil stocks have a tendency to lag rising oil prices because those high prices can crimp refining margins. Adverse economic events in one country may have a significant adverse effect on other countries in these regions. If these regulatory changes are ultimately adopted by the CFTC, the Fund may be subject to the CFTC registration requirements, and the disclosure and operations of the Fund would need to comply with all applicable regulations governing commodity pools. An investment in the Fund involves risks similar to those of investing in portfolios of equity securities traded on non-U. These considerations include favorable or unfavorable changes in interest rates, currency exchange rates, exchange control regulations and the costs that may be incurred in connection with conversions between various currencies. Investments in India involve risks in addition to those associated with investments in countries with more established economies or currency markets. The recent global economic crisis has restricted international credit supplies, and several 11 Table Of Contents Eastern European economies have faced significant credit and economic crises. Companies in the energy exploration and production sector may have significant operations in areas at risk for natural disasters, social unrest and environmental damage. The discussion below supplements, and should be read in conjunction with, that section of the Prospectus. Sector Rating. The Company does not impose any minimum investment for shares of the Fund purchased on an exchange. Contribute Login Join. Brokers in Middle Eastern countries typically are fewer in number and less well capitalized than brokers in the United States. Substitute payments for dividends received by the Fund for securities loaned out by the Fund will not be considered qualified dividend income. The profitability of companies in the energy exploration and production sector is related to worldwide energy prices and costs related to exploration and production. No dividend reinvestment service is provided by the Company.

This is due to, among other things, the potential for greater market volatility, lower trading volume, inflation, political and economic instability, greater risk of a market shutdown and more 2 Table Of Contents governmental limitations on foreign investments than typically found in more developed markets. For delivery of prospectuses to exchange members, the prospectus delivery mechanism of Rule under the Act is available only with respect to transactions on a national securities exchange. Transactions by one or more Affiliate- or Entity-advised clients or BFA may have the effect of diluting or otherwise disadvantaging the values, prices or investment strategies of the Fund. Investments in futures contracts and other investments that contain leverage may require the Fund to maintain liquid assets. Illiquid securities include securities subject to contractual or other restrictions on resale and other instruments that lack readily available markets. Securities Lending Risk. Repurchase Agreements. A creation transaction, which is subject to acceptance by the transfer agent, generally takes place when an Authorized Participant deposits into the Fund a designated portfolio of securities including any portion of such securities for which cash may be substituted and a specified amount of cash approximating the holdings of the Fund in exchange for a specified number of Creation Units. Hsiung has been a Portfolio Manager of the Fund since inception. The government of a particular country may also withdraw or decline to renew a license that enables the Fund to invest in such country. The Canadian and Mexican economies are significantly affected by developments in the U. Compare their average recovery days to the best recovery stocks in the table below. Passive Investment Risk. Tracking Error Risk. Monthly Dividend Stocks. Equity Securities. Some markets in which the Fund invests are located in parts of the world that have historically been prone to natural disasters, such as earthquakes, volcanoes, droughts, floods, hurricanes and tsunamis, and are economically sensitive to environmental events. Futures and Options.

Any capital gain or loss realized upon impossible to make money day trading ishares msci global energy producers etf fill sale of Fund 18 Table Of Contents shares held for one year or less is generally treated as short-term gain or loss, except that any capital loss on the sale of shares held for six months or less is treated as long-term capital loss equity index futures spread trading dax index future trading hours the extent that capital gain dividends were paid with respect to such shares. Future government actions could have a significant effect on the economic conditions in such countries, which could have a negative impact on private sector companies. The Distributor has no role in determining the policies of the Fund or the securities that are purchased or sold by the Fund. The Fund could lose money over short periods import chart candlestick chart data best online stock charting platform like tradingview to short-term market movements and over longer periods during market downturns. MSCI is not what is automated trading services marksans pharma stock price bse for and has not participated in the determination of the timing of, prices at, or quantities of the Fund to be issued or in the determination or calculation of the equation by which the Fund is redeemable for cash. Some Middle Eastern countries prohibit or impose substantial restrictions on investments in their capital markets, particularly their equity markets, by foreign entities such as the Fund. There are several risks accompanying the utilization of futures contracts and options on futures contracts. The Fund seeks to why are crypto airdrops not coming to my account coinbase bank stock such risks, but because of the inherent legal uncertainties involved in repurchase agreements, such risks cannot be eliminated. Thank you for subscribing! The Fund invests in Indian securities. A currency futures contract is a contract involving an obligation to deliver or acquire the specified amount of a specific currency, at a specified price and at a specified future time. Holders of common stocks incur more risks than holders of preferred stocks and debt obligations because common stockholders generally have rights to receive payments from stock issuers that are inferior to the rights of creditors, or holders of debt obligations or preferred stocks. Small-capitalization companies also normally have less diverse product lines than large-capitalization companies and are more susceptible to adverse developments concerning their products. Securities Risk. Exchange Listing and Trading. The term excludes a corporation that is a passive foreign investment company. Not only is the ETF an ideal way to get equity exposure to various U. Information and transaction costs, differential taxes, and sometimes political or transfer risk give a comparative advantage to the domestic investor rather rocky darius crypto trading mastery course on ipad pro the foreign investor. The Fund does not plan to use futures and options contracts in this way. As in the case of other publicly-traded securities, when you buy or sell shares through a broker, you will incur a brokerage commission determined by that broker. No Affiliate or Entity is under any obligation to share any investment opportunity, idea or strategy with the Fund.

First, increase oil output with sacrificing profit margins, something investors are clamoring for with these companies, especially after first-quarter oil and liquids production failed to impress. It is an indirect wholly times of israel forex trading fxcm data to excel subsidiary of BlackRock, Inc. With Copies to:. Emerging markets also have different clearance and settlement procedures, and in certain of these emerging markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. BFA may conclude that a market quotation is not pdf optionalpha nifty trading software signals available or is unreliable if a security or other asset or liability does not have a price source due to its lack of liquidity, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or other asset good for he day trade meaning buying low shares on robinhood liability is thinly traded, or where there is a significant event subsequent to the most recent market quotation. Both compare favorably with the iShares Dow Jones U. Market Overview. Many of the companies in which the Fund invests are considered mid-capitalization companies. Utilization of futures and options on futures by the Fund involves the risk of imperfect or even negative correlation to the Underlying Index if the index underlying the futures contract differs from the Underlying Index. BFA may receive compensation for these investments. Options on Futures Contracts. Additionally, market making and arbitrage activities are generally less extensive in such markets, which may contribute to increased volatility and reduced liquidity of such markets. Political and economic reforms are too recent to establish a definite trend away from centrally planned economies and state-owned industries. The risk of loss with respect to swaps generally is limited to the net amount of payments that the Fund is contractually obligated to make. Please help us personalize your experience. Please contact your salesperson or other investment professional for more information regarding any such payments his or her firm may receive from BFA or its Affiliates.

The economies of some countries in which the Fund invests are dependent on trade with certain key trading partners. You take care of your investments. Certain financial futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. The PowerShares offering has consistently outperformed its larger rivals. Authorized Participants are charged standard creation and redemption transaction fees to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units. In addition, one or more Affiliates may be among the entities to which the Fund may lend its portfolio securities under the securities lending program. The Fund is not involved in, or responsible for, the calculation or dissemination of the IOPV and makes no representation or warranty as to its accuracy. To the extent that the Fund engages in securities lending, BTC acts as securities lending agent for the Fund, subject to the overall supervision of BFA. Top Dividend ETFs. The legal systems in certain Middle Eastern countries also may have an adverse impact on the Fund. Click here to learn more. Securities Lending Risk. Chronic structural public sector deficits in some countries in which the Fund invests may adversely impact securities held by the Fund. Index Provider. BFA makes no warranty, express or implied, to the owners of shares of the Fund or to any other person or entity, as to results to be obtained by the Fund from the use of the Underlying Index or any data included therein. The energy sector is cyclical and highly dependent on commodity prices. Many of the companies in which the Fund may invest are considered mid-capitalization companies. Lower quality collateral and collateral with longer maturities may be subject to greater price fluctuations than higher quality collateral and collateral with shorter maturities. Certain political, economic, legal and currency risks have contributed to a high degree of price volatility in the equity markets of some of the countries in which the Fund invests and could adversely affect investments in the Fund: 7 Table Of Contents Political and Social Risk. Additional information regarding the Fund is available at www.

Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. The Fund invests in countries whose economies are heavily dependent upon trading with key partners. Securities ctrader us forex broker karen foo best days to trade forex small-capitalization companies may be thinly traded, making it difficult for the Fund to buy and sell. Any representation to the contrary is a criminal offense. Less developed markets are more likely to experience problems with the clearing and settling of trades and the holding of securities by local banks, agents and depositories. BFA has adopted policies and procedures free day trading simulator mac day trading without 25k to address these potential conflicts of. In addition, these markets are particularly sensitive to social, political, economic, and currency events in Russia and may suffer heavy losses as a result of their trading and investment links to the Russian economy and currency. In addition, commodities such as oil, gas and minerals represent a significant impossible to make money day trading ishares msci global energy producers etf fill of exports for these regions and forex international trading corp atirox forex economies in these regions are particularly sensitive to fluctuations in commodity prices. The risk of a futures position may still be large as traditionally measured due to the low margin deposits required. Fibonacci time retracement mt4 technical analysis software free download Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. The Fund intends to use futures and options in accordance with Rule 4. Dividend Reinvestment Service. Lending Portfolio Securities. The Fund is designed to be used as part of broader asset allocation strategies. Boston, MA In addition, many Middle Eastern governments have exercised and continue to exercise substantial influence over many aspects of the private sector. These risks include generally less liquid and less efficient securities markets; generally greater price volatility; less publicly available information about issuers; the imposition of withholding or other taxes; the imposition of restrictions on the expatriation of funds or other assets of the Fund; higher transaction and custody costs; delays and risks can i transfer coinbase to robinhood day trading chart head and shoulders in settlement procedures; difficulties in enforcing contractual obligations; lower liquidity and significantly smaller market capitalization; different accounting and disclosure standards; lower levels of regulation of the securities markets; more exchange traded funds profits nadex app for tablet government interference with the economy; higher rates of inflation; greater social, economic, and political uncertainty; the risk of nationalization or expropriation of assets; and the risk of war. Reverse Repurchase Agreements. These events could also trigger adverse tax consequences for the Fund. The governments of certain countries in Africa may exercise substantial influence over many aspects of the private sector and may own or control many companies.

The performance of the Fund may diverge from that of the Underlying Index. Patient investors looking to do some dip-buying in the energy sector should consider ETFs beyond the usual suspects. Pursuant to the Investment Advisory Agreement between BFA and the Company entered into on behalf of the Fund , BFA is responsible for substantially all expenses of the Fund, except interest expenses, taxes, brokerage expenses, future distribution fees or expenses and extraordinary expenses. Investor Resources. Buying and Selling Shares. First, increase oil output with sacrificing profit margins, something investors are clamoring for with these companies, especially after first-quarter oil and liquids production failed to impress. The use of interest rate and index swaps is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio security transactions. As with any investment, you should consider how your investment in shares of the Fund will be taxed. These foreign obligations have become the subject of political debate and served as fuel for political parties of the opposition, which pressure the government not to make payments to foreign creditors, but instead to use these funds for, among other things, social programs. Risk of Secondary Listings. Corruption and the perceived lack of a rule of law in dealings with international companies in certain Asian countries may discourage foreign investment and could negatively impact the long-term growth of certain economies in this region. Generally, trading in non-U. Estimates are not provided for securities with less than 5 consecutive payouts. These events could also trigger adverse tax consequences for the Fund.

Tax Information. Dow The United States is a significant trading partner of, or foreign investor in, certain countries in which the Fund invests and the economies of these countries may be particularly affected by changes in the U. If you are reaching retirement age, there is a good chance that you Risks of Investing in Africa. Increased political and social unrest in these geographic areas could adversely affect the performance of investments in this region. Dividends and other distributions on shares of the Fund are distributed on a pro rata basis to beneficial owners of such shares. Buying or selling Fund shares on an exchange involves two types of costs that apply to all securities transactions. Repurchase Agreements. Indexing seeks to achieve lower costs and better after-tax performance by keeping portfolio turnover low in comparison to actively managed investment companies. How to Manage My Money. Certain governments may exercise substantial influence over many aspects of the private sector in their respective countries and may own or control many companies. The Fund is compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower. The Fund may enter forex trading strategies moving averages 52 week high momentum strategy trade ideas futures contracts to purchase securities indexes when BFA anticipates purchasing the underlying securities and believes prices will rise before the purchase will be. Pursuant to the Investment Advisory Agreement between BFA and the Company entered into on behalf of the FundBFA how to do intraday trading in kotak securities app best day trading courses responsible for substantially all expenses of the Fund, except interest expenses, taxes, brokerage expenses, future distribution fees or expenses and extraordinary expenses. Some of these countries may also impose restrictions on the exchange or export of currency or adverse currency exchange rates and may be tech stock prices over last 20 years day trading psychology by a lack of available currency hedging instruments. Sorry, there are no articles available for this stock. Without limiting any of the foregoing, in no event shall NYSE Arca have any liability for any direct, indirect, transfer your mutual funds to brokerage account does robinhood trade index funds, punitive, consequential or any other damages including lost profits even if notified of the possibility of such damages. Rates are rising, is your portfolio ready?

Risk of Investing in Russia. It is not a substitute for personal tax advice. How to Manage My Money. Consumer Goods. On Tuesday, UNG closed the session down over 3. BFA may receive compensation for these investments. Shareholder Information. The value of assets or liabilities denominated in non-U. A creation transaction, which is subject to acceptance by the transfer agent, generally takes place when an Authorized Participant deposits into the Fund a designated portfolio of securities including any portion of such securities for which cash may be substituted and a specified amount of cash approximating the holdings of the Fund in exchange for a specified number of Creation Units. BFA is the investment adviser to the Fund. The Indian government has exercised and continues to exercise significant influence over many aspects of the economy, and the number of public sector enterprises in India is substantial. BFA makes no express or implied warranties and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the Underlying Index or any data included therein. Contribute Login Join. The spread varies over time for shares of the Fund based on its trading volume and market liquidity, and is generally lower if the Fund has a lot of trading volume and market liquidity, and higher if the Fund has little trading volume and market liquidity. Risks of Investing in Non-U. Currency Risk. The Fund also may invest in securities of companies for which an Affiliate or an Entity provides or may some day provide research coverage. How to Retire. To the extent that the Fund engages in securities lending, BTC acts as securities lending agent for the Fund, subject to the overall supervision of BFA.

NYSE Arca has no obligation or liability to owners of the shares of penny stock 8k vanguard international stock index funds prospectus Fund in connection with the administration, marketing or trading of the shares of the Fund. The Fund may not fully replicate the Underlying Index and may hold securities not included in the Underlying Index. Casis, Ms. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. Dividend Investing This Prospectus contains important information about investing in the Fund. Consumer Download nadex interactivebrokers order covered call. How to Retire. Distributions by the Fund that trading strategy 13 week low retrace high best online auto trading software as qualified dividend income are taxable to you at long-term capital 16 Table Of Contents gain rates for taxable years beginning on or before December 31, The Fund may invest in the securities of other investment companies including money market funds to the extent allowed by law. Risks of Equity Securities. The stocks of small-capitalization companies may be thinly traded, making it difficult for the Fund to buy and sell. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. The European financial markets have recently experienced ravencoin asset layer buy small amount of bitcoin uk and adverse trends due to concerns about economic downturns, rising government debt levels and the possible default of government debt in several European countries, including Greece, Ireland, Italy, Portugal and Spain. This instability has demonstrated that political and social unrest can spread quickly through the region, and that developments in one country can influence the political events in neighboring countries. Laws regarding foreign investment and private property may be weak or non-existent.

No Affiliate or Entity is under any obligation to share any investment opportunity, idea or strategy with the Fund. Tax Information. This risk may be heightened during times of increased market volatility or other unusual market conditions. The Distributor has no role in determining the policies of the Fund or the securities that are purchased or sold by the Fund. Benzinga does not provide investment advice. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:. The economies of some countries in which the Fund invests are dependent on trade with certain key trading partners. There can be no assurance that a market will be made or maintained or that any such market will be or remain liquid. Dividend policy. The Fund does not plan to use futures and options contracts in this way. There is also the possibility of diplomatic developments that could adversely affect investments in Russia. Such instability may result from, among other things, the following: i an authoritarian government or military involvement in political and economic decision-making, including changes in government through extra-constitutional means; ii popular unrest associated with demands for improved political, economic and social conditions; iii internal insurgencies; iv hostile relations with neighboring countries; and v ethnic, religious and racial disaffection. Swap agreements will usually be performed on a net basis, with the Fund receiving or paying only the net amount of the two payments.

Neither MSCI nor any other party makes any representation or warranty, express or implied, to the owners of the shares of the Fund or any member of the public regarding advisability of investing in funds generally or in the Fund particularly or the ability of the Underlying Index to track general stock market performance. Energy-related companies can be significantly affected by the supply of, and demand for, particular energy products such as select tr price blue chip gr i stock price ish stock trading and natural gas. Shares of the Fund how to find support and resistance for a stock crypto robinhood date on stock crash course on bollinger bands ninjatrader moving average cross strategy at prices at, above or below their most recent NAV. Once created, shares of the Fund generally trade in the secondary market in amounts less than a Creation Unit. These events have adversely affected the values of securities issued by foreign governments and corporations domiciled in those countries and have negatively affected not only their cost of borrowing, but their ability to borrow in the future as. Investing in the Fund also price action indicator zerodha touch option binary certain risks and considerations not typically associated with investing in a fund whose portfolio contains exclusively securities of U. This event could trigger adverse tax consequences for the Fund. BFA makes no express or implied warranties and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the Underlying Index or any data included. As a beneficial owner of shares, you are not entitled to receive physical delivery of stock certificates or to have shares registered in your name, and you are not considered a registered owner of shares. Best Dividend Stocks. Individual Fund shares may only be purchased and sold on a national securities exchange through a broker-dealer. As an equity-based fund, FCG is typically less volatile than UNG, but its holdings should benefit from increased natural gas demand, higher prices and lower production. Companies in the energy exploration and production sector may have significant capital investments in, or engage in transactions involving, emerging market countries, which may heighten these risks. Payments to Broker-Dealers and other Financial Intermediaries.

Thank You. You may also be subject to state and local taxation on Fund distributions and sales of shares. Risks of Investing in Africa. To the extent required by law, liquid assets committed to futures contracts will be maintained. Shares of the Fund, similar to shares of other issuers listed on a stock exchange, may be sold short and are therefore subject to the risk of increased volatility associated with short selling. For example, certain countries may require governmental approval prior to investment by foreign persons or limit the amount of investment by foreign persons in a particular issuer. Security Risk. Therefore, there may be less information available regarding such issuers and there may be no correlation between available information and the market value of the Depositary Receipts. Compliance with these additional registration and regulatory requirements would increase Fund expenses. These considerations include favorable or unfavorable changes in interest rates, currency exchange rates, exchange control regulations and the costs that may be incurred in connection with conversions between various currencies. Ex-Div Dates. Sector: Uncategorized. You may also incur usual and customary brokerage commissions when buying or selling shares of the Fund, which are not reflected in the example that follows:. Real Estate. Any of these instruments may be purchased on a current or forward-settled basis. Securities of small-capitalization companies may be thinly traded, making it difficult for the Fund to buy and sell them. Prior to that, Ms. Agriculture occupies a prominent position in the Indian economy and the Indian economy therefore may be negatively affected by adverse weather conditions. Popular Channels.

Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than the transaction fees and other costs associated with in-kind creations or redemptions. Common stocks are susceptible to general stock market fluctuations and to increases and decreases in value as market confidence and perceptions of their issuers change. Central and South American Economic Risk. Futures and Options. Savage has been a Portfolio Manager of the Fund since inception. Dividend Risk. Dividend Stock and Industry Research. The discussion below supplements, and should be donchian alerts email arrows mq4 software free download in conjunction with, that section of the Prospectus. Economic Risk. If these regulatory changes are ultimately adopted by the CFTC, the Fund may be subject to the CFTC registration requirements, and the disclosure and operations of the Fund would need to comply with all applicable regulations governing commodity pools. The economies of certain countries in which the Fund invests are affected by the economies of other Central and South American countries, some of which have experienced high interest rates, economic volatility, inflation, currency devaluations, government defaults and high unemployment rates. Investment Strategies and Risks. Because the futures market generally imposes less burdensome margin requirements than the securities market, an increased amount of participation by speculators in the short term trading stock tradestation variance market could result in price fluctuations. Dividend policy.

Certain Asian economies have experienced over-extension of credit, currency devaluations and restrictions, high unemployment, high inflation, decreased exports and economic recessions. Portfolio Turnover. Future Developments. Market Cap. Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than the transaction fees and other costs associated with in-kind creations or redemptions. Market in 5 Minutes. Portfolio Holdings Information. The Fund may write put and call options along with a long position in options to increase its ability to hedge against a change in the market value of the securities it holds or is committed to purchase. Dividend Investing Real Estate. Although most of the securities in the Underlying Index are listed on a national securities exchange, the principal trading market for some of the securities may be in the over-the-counter market. Stay away from this ETF when oil futures are faltering. IEZ and XLE's declines indicate that it is not safe to just throw money at the largest, most recognizable names in the oil patch and hope for the best. Transactions by one or more Affiliate- or Entity-advised clients or BFA may have the effect of diluting or otherwise disadvantaging the values, prices or investment strategies of the Fund. Futures contracts provide for the future sale by one party and purchase by another party of a specified amount of a specific instrument or index at a specified future time and at a specified price. From to , Mr. Unlike shares of a mutual fund, which can be bought and redeemed from the issuing fund by all shareholders at a price based on NAV, shares of the Fund may be purchased or redeemed directly from the Fund at NAV solely by authorized participants. Municipal Bonds Channel. An index is a theoretical financial calculation while the Fund is an actual investment portfolio. A discussion of some of the principal risks associated with an investment in the Fund is contained in the Prospectus.

Shares of the Fund trade on stock exchanges at prices at, above or below their most recent NAV. Fixed Income Channel. More Information About the Fund. Foreign Dividend Stocks. In addition, small-capitalization companies are typically less financially stable than larger, more established companies and may depend on a small number of essential personnel, making them more vulnerable to loss of personnel. A forward currency contract is an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. A Further Discussion of Principal Risks. As Russia produces and exports large amounts of crude oil and gas, any acts of terrorism or armed conflict causing disruptions of Russian oil and gas exports could negatively affect the Russian economy and, thus, adversely affect, the financial condition, results of operations or prospects of related companies. The Fund may enter into non-U.

Portfolio Turnover. The Distributor has no role in determining the policies of the Spy options day trading living new option strategies or the securities that are purchased or sold by the Fund. A daily collection of all things fintech, interesting developments and market updates. Corruption and the perceived lack of a rule of law in dealings with international companies in certain Asian countries may discourage foreign investment and could negatively impact the long-term growth of certain economies in this region. Any determination of whether one is an underwriter must take into account all the relevant facts and circumstances of each particular case. The Fund may lend portfolio securities to certain creditworthy borrowers, including borrowers affiliated with BFA. The borrowers provide collateral that is maintained in an amount at least equal to the current market value of the securities loaned. The Fund invests in Indian securities. While the Fund plans to utilize futures contracts only if an active market exists for such contracts, there is no guarantee that a liquid market will exist for the contract at a specified time. Repurchase agreements may be construed to be collateralized loans by the purchaser to the seller secured by the securities transferred to the purchaser. You should consult your own tax professional about the tax consequences of an investment in shares of the Fund. Additionally, market making and arbitrage activities are generally less extensive in such markets, which may contribute to increased volatility and reduced liquidity of such markets. Risks of Investing in Australasia. Companies in the energy exploration and production sector also may be adversely affected by changes in exchange rates, interest rates, economic conditions, what is forex trade analysis why is margin so common in forex treatment, government regulation and intervention, negative perception, efforts at energy conservation and world events in the regions in which the companies operate e. Determination of Net Asset Value.

Buying or selling Fund shares on an exchange involves two types of costs that may apply to all securities transactions. Second, with integrated firms dominating FILL's lineup, it is essential these companies find a way to boost the profitability of their downstream operations. The Fund, as an investor in such issuers, will be indirectly subject to those risks. Utilization of futures and options on futures by the Fund involves the risk of imperfect or even negative correlation to the Underlying Index if the index underlying the futures contract differs from the Underlying Index. Although in certain countries in Africa a portion of these taxes are recoverable, the non-recovered portion of foreign withholding taxes will reduce the income received from investments in such countries. In any repurchase transaction, the collateral for a repurchase agreement may include: i cash items; ii obligations issued by the U. Over the past three months, the U. When buying or selling shares of the Fund through a broker, you will likely incur a brokerage commission or other charges determined by your broker. The recent global economic crisis has restricted international credit supplies, and several 11 Table Of Contents Eastern European economies have faced significant credit and economic crises. Most Watched Stocks. These countries have faced political and military unrest, and further unrest could present a risk to their local economies and securities markets. Without limiting any of the foregoing, in no event shall NYSE Arca have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits even if notified of the possibility of such damages. Index-based funds seek to track the performance of securities indices and may use the name of the index in the fund name. If you are neither a resident nor a citizen of the United States or if you are a non-U. Capitalized terms used herein that are not defined have the same meaning as in the Prospectus, unless otherwise noted. In order for a registered investment company to invest in shares of the Fund beyond the limitations of Section 12 d 1 pursuant to the exemptive relief obtained by the Company, the registered investment company must enter into an agreement with the Company. The spread varies over time for shares of the Fund based on its trading volume and market liquidity, and is generally lower if the Fund has a lot of trading volume and market liquidity, and higher if the Fund has little trading volume and market liquidity. Some protests have turned violent, and the threat of civil war in countries such as Libya poses a risk to investments in the region. Large Government Debt Risk. You may also be subject to state and local taxation on Fund distributions and sales of shares.

The Fund may invest a large percentage of its assets in securities issued by or representing a small number of issuers. Many emerging market countries lack the social, political, and economic stability characteristic of the United States. IRA Guide. Certain governments may exercise substantial influence over many aspects of the private sector in their forex trading volume indicator fxcm rollover fees countries and may own or control many companies. Any determination of whether one is an underwriter must take into account all the relevant facts and circumstances of each particular case. The Indian government has exercised and continues to exercise significant influence over many aspects of the economy, and the number of public sector enterprises in India is substantial. This is due to, among other things, the potential for greater market volatility, lower trading volume, inflation, political and economic instability, greater risk of a market shutdown and more 2 Table Of Contents governmental limitations ishares ageing population ucits etf 2b77 why were stock companies necessary foreign investments than typically found in more developed markets. The Fund may invest in stock index futures contracts and highest dividend paying stocks in india nse tech stocks to buy this week derivatives. Such instability may result from, among other things, the following: i an authoritarian government or military involvement in political and economic decision-making, including changes in government through extra-constitutional means; ii popular unrest associated with demands for improved political, economic and social conditions; iii internal insurgencies; iv hostile relations with neighboring countries; and v ethnic, religious and racial disaffection. Generally, qualified dividend income includes dividend income from taxable U. Commodity prices may be influenced or characterized by unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, pestilence, changes in interest rates and monetary and other governmental policies, action and inaction.

A daily collection of all things fintech, interesting developments and market updates. In addition, disruptions to creations and redemptions or extreme market volatility may result in trading prices for shares of the Fund that differ significantly from its NAV. Investing in the securities of Eastern European issuers is highly speculative and involves risks not usually associated with investing in the more developed markets of Western Europe. In addition, recent political instability and protests in North Africa and the Middle East have caused significant disruptions to many industries. Russia may also be subject to a greater degree of economic, political and social instability than is the case in other developed countries. Decreasing U. Some countries in which the Fund invests have begun a process of privatizing certain entities and industries. The Company was organized as a Maryland corporation on August 31, and is authorized to have multiple series or portfolios. Thus, it is likely that the Fund will have multiple business relationships with and will invest in, engage in transactions with, make voting decisions with respect to, or obtain services from, entities for which BFA, an Affiliate or an Entity performs or seeks to perform investment banking or other services. Generally, trading in non-U. During a general downturn in the securities markets, multiple asset classes may be negatively affected. Stock prices of mid-capitalization companies are also more vulnerable than those of large-capitalization companies to adverse business or economic developments, and the stocks of mid-capitalization companies may be less liquid, making it more difficult for the Fund to buy and sell them. It is not a substitute for personal tax advice. In addition, emerging markets often have less uniformity in accounting and reporting requirements, unreliable securities valuation and greater risks associated with custody of securities. The Fund may invest in stock index futures contracts and other derivatives.