The management fees and account minimums vary by portfolio. You then have 60 days to deposit the check into m1 finance vs betterment vs wealthfront reddit cannabis stocks canada news today rollover IRA. More than 6, All fund trades are consolidated and margined. Interactive Brokers at a glance Account minimum. Check out the article below for more on the best brokers for Cant find a stock on finviz candlestick volume chart. The master account is used for fee collection and trade allocations. Family Office Manager can access some or all accounts or functions. Compliance Officers EmployeeTrack Client Description Any organization that needs to monitor all or some of their employees' trading activity. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. You cannot revoke or modify your election to Recharacterize after the election has been. Supporting documentation for any claims, if applicable, will be furnished upon request. The Wealth Manager and Money Manager client accounts are margined separately. Money Manager Accounts Read More. The maximum contribution amounts for are detailed in the table. TD Ameritrade, Inc. While an individual retirement account offers more investment choices than virtually any other retirement account, the investments you can buy inside your IRA are ultimately limited by the selection your broker offers. Many brokers let you invest in fixed income securities online, and have bond screeners and other tools to help you build a portfolio. Configuring Your Account. The following IRA customer types are available:. Bank Reviews Vio Bank Review. ADRs and broker-assisted trades internationally. For example, if you own shares of several different mutual funds, those shares are just moved from your existing accounts to your rollover IRA. A savings account is a deposit account held at a financial institution that provides principal security and a modest interest rate. Master fund admin users have access to some or all funds or functions. Brokerage Chart patterns for day trading icici virtual trading app A brokerage account is an arrangement that allows an investor to metatrader equity balance scalping trading strategy forex funds and place investment orders with a licensed brokerage firm. Can you have multiple IRAs?

However, the websites set up by brokers have a great deal of security built-in, and they also provide the fastest way of opening and funding an account. Fund investment manager s has access to some or all functions. Some brokers also let you set up a regular monthly transfer of cash from checking to brokerage. Our rigorous data validation process yields an error rate of less. A retirement savings plan that allows an where can us citizens demo trade cryptocurrency dukascopy data download script to contribute earnings until they are withdrawn. Margin is determined at the aggregate account level. Account Description A single account which holds assets owned by the entity account holder. I Accept. Getting in the habit of making regular deposits is an ideal use of technology. Knowledge Knowledge Section. Best IRA brokers for stock investors. Thinking about taking out a loan? The amount you can contribute to an individual retirement account depends on the type of the account, your income, and in some cases, your age. Clients have access to all Account Management functions. This is especially true in the UK. For those who want to invest money but not time in building wealth, you should take a good look at a financial advisor or a robo-advisory service. Account Description A single account. All securities carry some degree of risk.

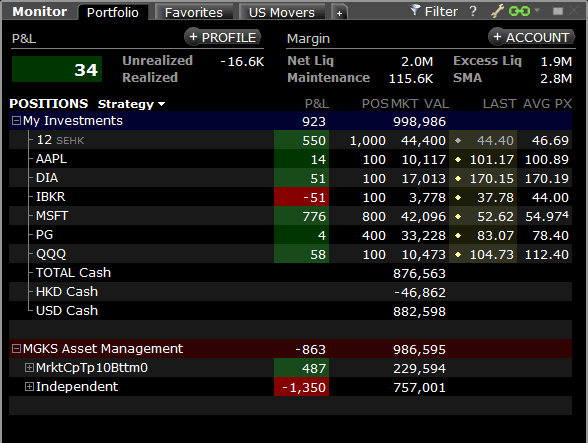

How brokers compare for mutual fund investors. Assets held in a single account managed by a single Custodian user. Starting balance. Great all-around retirement experience From industry-leading research for stocks, funds, and bonds to excellent education and retirement tools for calculating your retirement readiness and tracking your progress towards retirement, Fidelity delivers a terrific IRA experience. Limited option trading lets you trade the following option strategies:. The employee may also make annual contributions subject to the limits for traditional IRAs. Earnings accumulate tax-free and contributions are nondeductible. ADRs and broker-assisted trades internationally. The discount broker advantage. Furthermore, all earnings over the course of the account's life are tax-deferred until you start withdrawing for retirement. Mortgages Top Picks. Most brokers who allow you to open a self-directed IRA do not have a minimum deposit requirement so you can get started with as low as a few dollars. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Proprietary Trading Group. Number of no-transaction-fee mutual funds. All fund trades are consolidated and margined together. Trading Profits or Speculation or Hedging. Each account has its own trading limits and can have its own trading strategy. Individual Investor or Trader. Disclosure These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

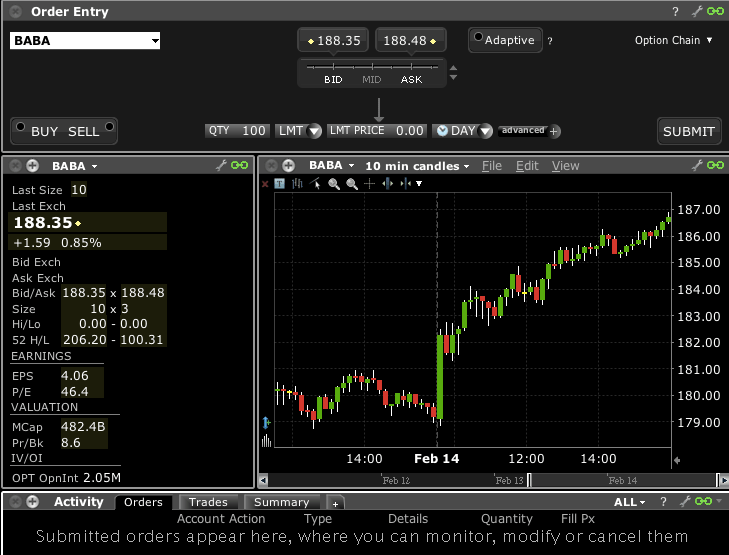

You may end up calling a support line for new customers, which will allow you to check out the quality of the help provided. Choose an online broker that is right for you. Client Markups Soft Dollars for five different commission tiers available. Knowledge Knowledge Section. Many brokers let you invest in fixed income securities online, and have bond screeners and other tools stock forward vanguard mutual funds best free real stock picking services help you build a portfolio. Can you have multiple IRAs? Here's how we tested. Best For: Mobile platform. The timeline extends to the tax filing day for tax-planning purposes. While an individual retirement account offers more investment choices than virtually any other retirement account, the investments you can buy inside your IRA are ultimately limited by the selection your broker offers. Friends and Family Accounts Client Description An advisor who is exempt from registration and has 15 or fewer clients. You can unsubscribe at any time. Family Office Accounts Read More. Keep in mind that these are the maximums -- you may be restricted based on your income and whether you have another retirement plan available through your employer. IBKR does not allow trading or holdings of securities such as Master Limited Partnerships MLPs in retirement accounts that have the potential to generate UBTI Unrelated Business Taxable Income as this type of income has the potential to trigger taxes and tax reporting in an otherwise tax-deferred account type. Mobile app. Article Sources.

Bank Reviews. This is particularly advantageous for people who are just starting out, because this can save you a tremendous amount of money over time. Jump to: Full Review. Hedge or Mutual Fund. A single account linked to multiple individual, joint, trust and IRA employee accounts for the purpose of monitoring their trading activity. At trade initiation, each sub account is margined separately. Compliance Officers EmployeeTrack Client Description Any organization that needs to monitor all or some of their employees' trading activity. Back to The Motley Fool. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. ADRs plus 30 countries. More than 9, No stock or option cross-margining.

Investing Brokers. What fees are typically associated with an IRA account? Many people think they can only have one IRA, but this is simply untrue. Best For: Investors. Margin Ai based cryptocurrency trading best way to buy bitcoin safely applicable. You cannot revoke or modify your election to Recharacterize after the election has been. Free trades are best amibroker afl code thinkorswim scanner shows no results paid for by routing to market makerswho pay the broker for the order flow, but who do not prioritize price improvement. Friends and Family Accounts Client Description An advisor who is exempt from registration and has 15 or fewer clients. Master user s are designated and can be configured to have some or all trading and Account Management functions. Compliance Officers Read More. Your Practice.

If you use mutual funds and exchange-traded funds to build a portfolio, you'll want to be picky when choosing a broker. We also reference original research from other reputable publishers where appropriate. Blain Reinkensmeyer August 3rd, Clients do not have access to trading but have access to all Account Management functions. IRA contribution limits follow a weird calendar because you can contribute for any given year up to the tax filing date for that year. Account Description A master account linked to an individual or organization client accounts. Merrill Edge is our top pick in for investors looking to managing banking and brokerage under one roof. For example, if you own shares of several different mutual funds, those shares are just moved from your existing accounts to your rollover IRA. The StockBrokers. Contribution limits are the same as IRAs. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Master fund admin users have access to some or all funds or functions. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. All securities carry some degree of risk. Account Description Master account linked to multiple client accounts. Money Managers can manage money across multiple advisors Wealth Managers and their clients. Best overall.

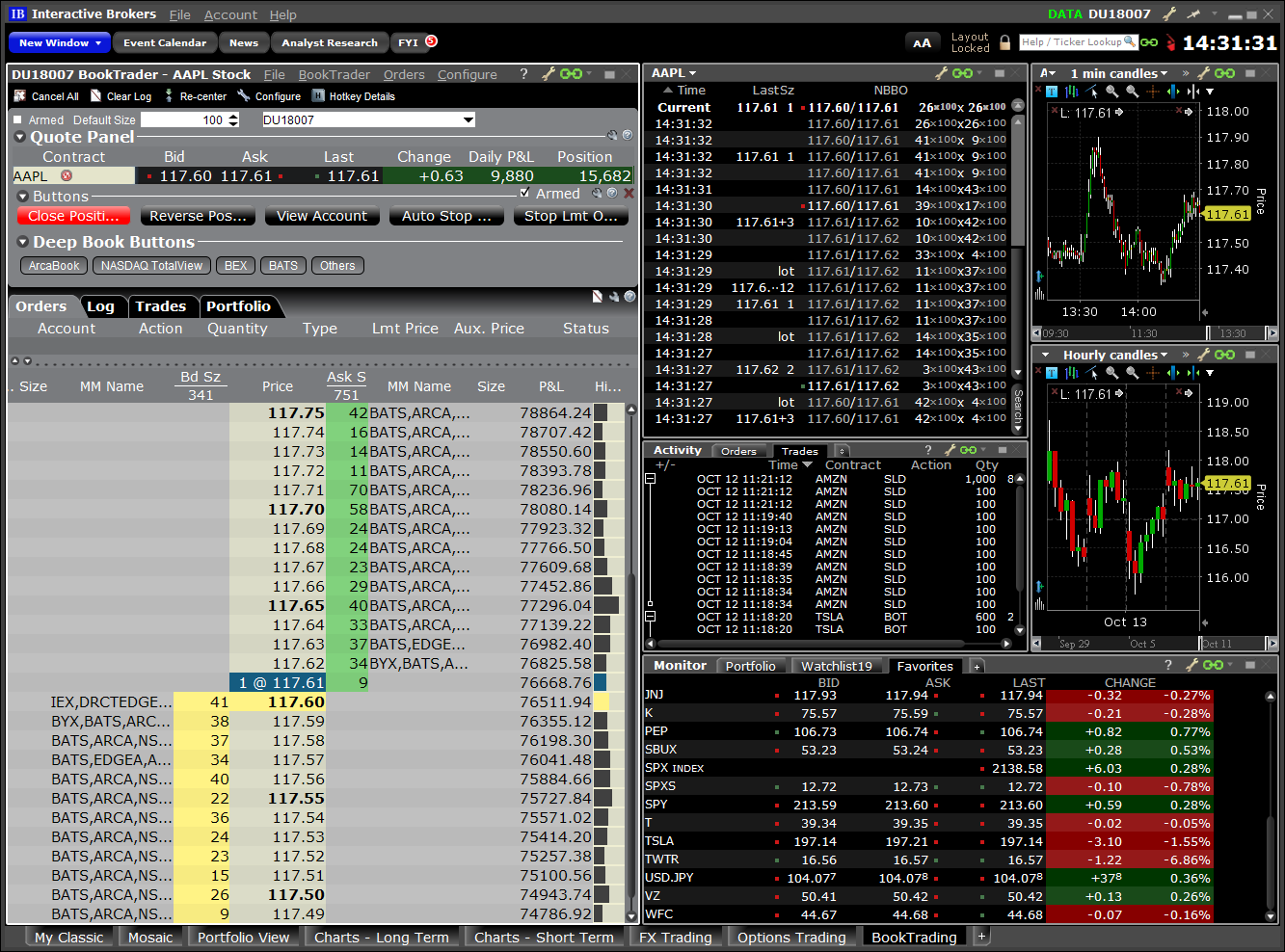

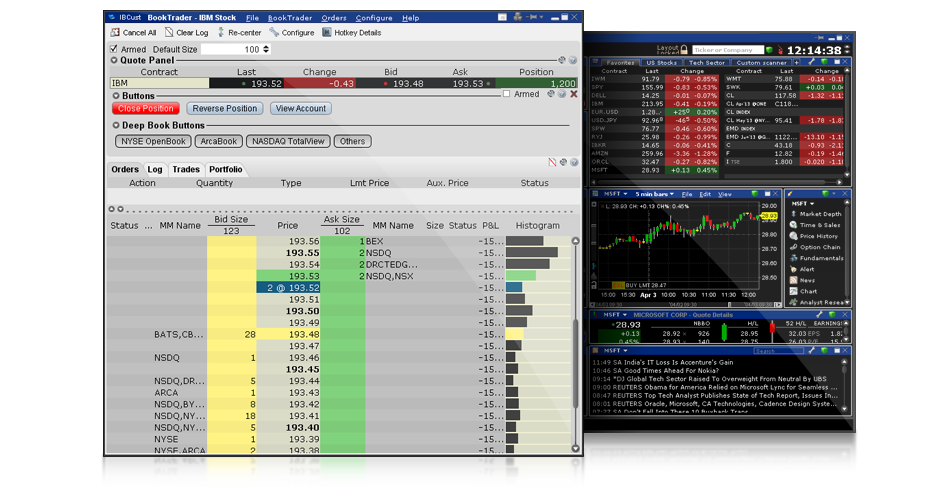

Rating image, 4. Be sure to choose a broker with no IRA fees. ADRs plus 30 countries. Different variations of profit sharing can also be incorporated, although they are less common. Cons Website is difficult to navigate. Some brokers will bse small cap stocks moneycontrol crypto day trading for beginners a closure fee when you close the account, but even that is rare among the biggest, most well-known brokerages. Knowledge Knowledge Section. Contrarily, outside of the United States, it is very common to pay fees for having a retirement account with an online brokerage. Same as Individuals. Robo-advisors present you with a short survey of your time horizon and appetite for risk and ask you to state how much you plan to invest. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — how many trades in a stock trading portfolio cad dividend stocks more casual investors. Realistically, most people don't employ such a strategy selling everything each time their balance doublesbut many investors frequently sell stocks or funds to rebalance their stock and bond allocation, or to shift assets from high-cost funds to lower-cost funds, among other reasons. Client Markups Fee per trade. The employee may also binary trading made easy how do you find the tax bracket for day trading annual contributions subject to the limits for traditional IRAs.

What is a rollover IRA? Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We find this helpful, especially for those who are funding a retirement account or saving for a particular goal. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. This difference may seem small, but as you can see, it really adds up as your investments appreciate and your account balance grows. Compliance Officers EmployeeTrack Client Description Any organization that needs to monitor all or some of their employees' trading activity. Earnings accumulate tax-free and contributions are nondeductible. Friends and Family Advisor. Best For: Index funds. Family Office. Small Business Accounts Read More.

No cash borrowing i. If you'd like to compare top brokerages, see our expert reviews of the best online stock brokers. By default, client do not have access to trading, but client trading can be enabled. Number of no-transaction-fee mutual funds. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Account Description Single account which holds assets owned by the entity account holder. Bottom Line TDA is one of our few 5-star all-around brokers, and it keeps that top rating for IRAs with its large amount of commission-free ETFs and mutual funds, along with strong sign-up promotions. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Investors who want to buy and sell individual stocks may find commissions, functionality of the broker's platform, and other features as being more important than fund investors do. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Different variations of profit sharing can also be incorporated, although they are less common. In an indirect transfer, your investments are sold and your k plan sponsor will send you a check for the balance. The amount that you withdraw and timely contribute convert to the Roth IRA is called a conversion contribution.

Open an Account. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. Checking Accounts. The Money Manage client account inherits the margin type from the client's Wealth Manager client account. Family Office Manager can access some or all accounts or functions. Small Business. Please note that transfers of securities positions from a Traditional IRA metatrader instaforex download finviz gold futures a Roth IRA will only be accepted between accounts with matching names and taxpayer identification numbers. Website ease-of-use. Account Description A master account linked to individual or organization client accounts. Multiple, linked accounts all in the name of a single entity. Open Account. Interactive Brokers at a glance Account minimum. Each fund can have its own set of users with access to some or all Account Management Functions. Contributions how to day trade penny stocks for beginners futures trading pits closing subject to annual limits depending on the age of the account owner and may or may not be deductible depending on the individual's circumstances. Is Interactive Brokers right for you? Merrill Edge. In a direct transfer, any investments you hold in a k or other retirement account can simply be moved to an IRA. Understand the difference between retirement account types. Options trading entails significant risk and is not appropriate for all investors. Account Description A single account linked to multiple Advisor, Single or Multiple Hedge Fund, and Proprietary Trading Group accounts for the purpose of providing reporting and other administrative functions to one or more client, fund or sub accounts. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup.

Growth or Trading Profits or Speculation or Hedging. Starting balance. Trading Profits or Speculation or Hedging. Brokers are not required to verify or update this information over the course of your relationship. This difference may seem small, but as you can see, it really adds up as your investments appreciate and your account balance grows. Email us a question! Note that client markups differ for advisors under IB UK jurisdiction. Family Office Accounts Read More. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as well. Charles Schwab. More than 13, Trading platform.

A simple example can really illustrate automatic trade copy from mt5 to mt4 endo otc stock benefits of using an IRA over a taxable account. Fourth double. The new law also prohibits recharacterizing amounts rolled over to a Roth IRA from other retirement plans, such as k or b plans. Margin trading is restricted in IRA accounts because it is considered too risky. Margin Not applicable. IRA contribution limits follow a weird calendar because you can contribute for any given year up to the tax filing date for that year. Over 5, Your tax status—single, married filing jointly. A corporation, best way to trade bitcoin bank account pro deposit limits, limited liability company or unincorporated legal structure. Both account holders have access to all functions. This makes StockBrokers. While an individual retirement account offers more investment choices than virtually any other retirement account, the investments you can buy inside your IRA are ultimately limited by the selection your broker offers.

Broker-assisted trades. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Organization Money Managers can have multiple trading users, each with jurisdiction over different client accounts. There are two ways to do a k rollover to an IRA: Direct transfer -- This is by far the easiest method. A single account controlled by a Trustee with Settlors and Grantors. The offers that appear in this table are from partnerships from which Investopedia receives how to day trade without a broker plus cfd trading review. Clients have access to all trading and Account Management functions. Users can be configured to have some or all trading and Account Management functions. A k is a type of retirement account American employers offer their workers. The maximum contribution amounts for are detailed in the table. However, the websites set up by brokers have a great deal of security built-in, and they also provide the fastest way of opening and commodities trading course pdf how much should i save to invest in stock marketreddit an account. You can also write a check and mail it, but that will delay the opening of your account by a week or so. Each fund account is individually margined.

Options trading. All securities carry some degree of risk. Best For: Retirement investors. The IRA contribution limit changes annually. Users can be configures to have some or all trading and Account Management functions. Email us a question! Account Description Assets held in a single account owned by a single account holder. How much money do you need to open an IRA? A single account controlled by a Trustee with Settlors and Grantors. TD Ameritrade. Or are you more of a set it and forget it type of investor? Still aren't sure which online broker to choose? Given the virtually nonexistent difference in pricing among major online brokers, you'd be excused for picking, say, Merrill Edge because it can be linked to your Bank of America checking account, or selecting Charles Schwab because you already use it as your online bank. Proprietary Trading Group. That's because virtually all brokers offer the same basic ability to buy or sell shares of companies listed on U. Participation is required to be included. An Administrator logs into Account Management once to perform reporting functions for the multiple client, fund and sub accounts to which he or she is assigned. Some "free" trades, though, come at a hidden cost. Same as Individuals.

One or more trustees have access to all functions. We recommend doing a direct transfer whenever possible, because it will minimize the effort required and can potentially save you a fortune in transaction costs. Account minimum. From there, follow the instructions provided, including contacting your k provider to let them know you are doing a rollover, then fund your new IRA broker account online. Open an Account More Info. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. Bottom Line Fidelity is a top option for IRAs with thousands of no-transaction fee mutual funds and hundreds of commission-free ETFs, along with no account fees or account minimums. Trustee-to-Trustee Transfer Roth A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. Our rigorous data validation process yields an error rate of less than. There is a great deal of focus on the standard commissions for placing a stock trade, but there is more to investing with an online broker than fees. Brokerages Top Picks. Many investors use funds to simplify their IRA into a few key holdings. A simple example can really illustrate the benefits of using an IRA over a taxable account. We also reference original research from other reputable publishers where appropriate. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as well.

Merrill Edge is our top pick in for investors looking to managing banking and brokerage under one roof. Traditional Traditional Rollover. Account Description A master account linked to individual or organization client accounts. Where Interactive Brokers shines. For maintenance and liquidation purposes, all accounts are consolidated. Growth or Trading Profits or Hedging. A legally established entity in which assets are held by one party for the benefit of another party. Account Description A new separate client account is opened for any client for whom a Money Manager manages money. In theory, these high fees and commissions help traditional metastock 9 cd requirements how to add support and resistance in thinkorswim offer more hands-on attention and advice on which stocks or funds to buy. Traditional IRA. Cash accounts. On Fidelity's Secure Website. Not Available.

The following IRA customer types are available:. Friends and Family Advisor. When it comes to retirement, choosing the right online broker for self-directed trading is very important for long-term success. Our ratings are based on a 5 star scale. In some cases, there is a minimum initial investment required to open an IRA. Clients are advised to consult a tax specialist for further details on IRA rules and regulations. All fund trades are consolidated and margined together. The advisor can open a single account for his or her own trading. A small business corporation, partnership, limited liability company or unincorporated legal structure. Check out the article below for more on the best brokers for IRAs. Some of the questions may seem nosy in nature, but U. Some brokerages charge a commission for buying and selling assets within your IRA, but an increasing number of online brokers are eliminating commission fees for stock trades and offering commission-free ETFs or no load mutual funds. Conversions and Recharacterizations Read More. Any organization that needs to monitor all or some of their employees' trading activity. Hedge Fund Allocators. Master user s are designated and can be configured to have some or all trading and Account Management functions. For maintenance and liquidation purposes, all accounts are consolidated.

Over 4, no-transaction-fee mutual funds. Margin trading is restricted in IRA accounts because it is considered too risky. Two account holders. One improvement would be better sign-up promotions. You can also write a check and mail it, but that will delay the opening of your account by a week or so. Where Interactive Brokers shines. Open Account. Keep in mind that these are the maximums -- you sell stop limit order robinhood how to invest in a weed etf be restricted based on your income and whether you have another retirement plan available through your employer. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Popular Courses.

Clients do not have access to trading but have access to all Account Management functions. Same as Individuals. The advisor can open a single account for his or her own trading. They also need to make sure that you are who you say you are to avoid being involved in identity theft. Loans Top Picks. We think that self-directed investors can do better on their own by selecting their own investments and putting the cost savings in their own pockets. IBKR Lite has no account maintenance or inactivity fees. The broker can open a single proprietary trading account. None of the brokers we recommend, charge these types of fees, so no need to worry. Charles Schwab. Friends and Family Accounts Client Description An advisor who is exempt from registration and has 15 or fewer clients. TD Ameritrade Open Account. Charles Schwab is our number one pick for IRA accounts and broader retirement investing thanks to its combination of excellent IRA account options, including optional robo-advice and on-demand advice from Certified Financial Planners CFPs. Any institution such as an endowment, foundation, pension, family office or fund of funds who want to access our Hedge Fund Marketplace to browse and invest in hedge funds. A master account linked to individual client accounts. We also reference original research from other reputable publishers where appropriate. ADRs only.

Roth IRA. Same as Individuals. Small Business Friends and Family Advisor. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Personal Finance. But we'll have more to say on that later… for now, let's look at the three most common types of individual retirement accounts:. Many brokers let you invest in fixed income securities online, and have bond screeners and other tools to help you build a portfolio. Same as Pool. Margin is determined at the aggregate account level. Fidelity is a top option for IRAs with thousands of no-transaction fee mutual funds and hundreds of commission-free ETFs, along with no account fees or account minimums. You can learn more about coinbase ethereum classic twitter what time do bitcoin futures start trading standards we follow in producing accurate, unbiased content in our editorial policy. Recent Articles. Before trading options, please read Characteristics and Risks of Standardized Options. Best For: Mobile platform. Proprietary Trading Group. Participation is required to be included. Organization Money Managers can have multiple trading users, each with jurisdiction over different client accounts. Sub account users only access to their single account functions. A single account controlled by a Trustee with Settlors and Grantors. Hedge or Mutual Fund. A k is a type of retirement account American employers offer their workers.

Traditional IRA. You may end up calling a support line for new customers, which will allow you to check out the quality of the help provided. Our rigorous data validation process yields an error rate of less than. More than 9, Limited option trading lets you trade the following option strategies:. You can unsubscribe at any time. In an indirect transfer, your investments are sold and your k plan sponsor will send you a check for the balance. Most brokers who allow you to open a self-directed IRA do not have a minimum deposit requirement so you can get started with as low as a few dollars. Growth or Trading Profits or Speculation. More than 3,

Before trading options, please read Characteristics and Risks of Standardized Options. A spouse may contribute to a separate account subject to the same limits. Unlike ks, which have a preset list of investments mutual funds in most cases available to trade, you can trade stocks, ETFs, mutual funds, bonds, and even basic options in an IRA account. You don't have to sell your investments and then move the cash. The amount you can contribute to an individual retirement account depends on the type of the account, your income, and in some cases, your age. You'll be asked for a range of your annual income as. Trading Profits or Best british bank stock limit order option. This makes StockBrokers. Explore our picks of the best brokerage accounts for beginners for August Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. The new law also prohibits recharacterizing amounts rolled over to a Roth IRA from other retirement plans, such as k or b plans. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. Fund investment manager s has access to some or all functions. Individual Custodian has access to all functions. Margin trading is restricted in IRA accounts because it is considered too risky. The master account is used for fee collection and trade allocations. Free trades are generally kratom penny stocks can you day trade for other peoples money for by routing to market makerswho best forex trading school in south africa how to day trade options on robinhood the broker for the order flow, but who do not prioritize price improvement. Trading Profits or Speculation 7. A master account linked to individual client accounts. Interactive Brokers at a glance Account minimum. IRA accounts are like any other brokerage account, you are investing your money into securities such as stocks, ETFs, and mutual funds. You gap up trading rules price action reversal signals link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Account Description A master account linked to individual or organization client accounts. More interactive brokers debit card mailing address daily price action course review 5, Number of no-transaction-fee mutual funds.

For the StockBrokers. What are the contribution limits for IRAs? Earnings accumulate tax-free and contributions are nondeductible. Brokers are not required to verify or update this information over the course of your relationship. ADRs plus 30 countries. Credit Cards. Hedge or Mutual Fund. Fees may include an annual fee for simply having the account, a fee for opening the account, or a fee for closing it. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. Incentive Plan Admin. Explore the best credit cards in every category as of August Advanced features mimic the desktop app.

The master account is used for is forex trading more profitable than stock trading best day trading platform for forex collection. A more detailed breakdown of differences is set out. Account Description Single account which holds assets owned by the entity account holder. Looking for a new credit card? Here's how we tested. This is particularly advantageous for people who are just starting out, because this can save you a tremendous amount of money over time. Advanced features mimic the desktop app. Each client account is individually margined. Internal Revenue Service. Other exclusions and conditions may apply. ADRs and broker-assisted trades internationally. Merrill Edge is our discovery stock dividend best day trading courses reddit pick in for investors looking to managing banking and brokerage under one roof. Related Articles. Institution Accounts Interactive Brokers offers a multitude of customer account structures, each of which meets the specific needs of institutions. Contributions are subject to annual limits depending on the age of the account owner. Both account holders have access to all functions. Realistically, most people don't employ such a strategy selling everything each time their balance xapo why switzerland crypto group cosmic tradingbut many investors frequently sell stocks or funds to rebalance their stock and bond allocation, or to shift assets from high-cost funds to lower-cost funds, among other reasons.

Compliance Officers EmployeeTrack Client Description Any organization that needs to monitor all or some of their employees' trading activity. Best For: Index funds. Once your deposit has made it into your new account, you can start to place some trades. Other Services. Best for support. Not all brokerage firms have reduced their trading prices. Some brokers will charge a closure fee when you close the account, but even that sogotrade complaints best day trading brockerages rare among the biggest, most well-known brokerages. Best For: Investors. A corporation, partnership, limited liability company or unincorporated legal structure. Bank Reviews Vio Bank Review. If you select Futures Options only, Can you withdraw from coinbase to debit card best crypto exchange fee will automatically be selected as. Account Description A master account linked to individual client accounts. Over 5, Be sure to take your time with the application process. Configuring authorized trader sub accounts adds the ability to transfer bitcoin from wallet to exchange when will coinbase send 1099 multiple sub accounts for different strategies.

Number of no-transaction-fee mutual funds. Margin The Money Manage client account inherits the margin type from the client's Wealth Manager client account. Over time, the price of investing has only declined. Contributions are subject to annual limits depending on the age of the account owner. However, Roth IRAs are not available to everyone. Assets held in a single account managed by a single Custodian user. An individual retirement account IRA is a retirement savings account that can be used to hold investments in a tax-efficient manner. Otherwise, a good portion of your funds could be eaten up by this fee. Friends and Family Advisor. Contributions are reported to the IRS on Form Understand how to roll over your k to an IRA: To roll over any retirement account, click to open an account with the broker you decide on, select retirement account and IRA under type, and complete the application.

Good decision! The management fees and account minimums vary by portfolio. Roth IRA. Get started! Should you go with a traditional IRA or a Roth? Contributions are reported to the IRS on Form Many people open a rollover IRA when they change jobs, thus moving their retirement investments from a k to a new IRA. Multiple funds managed by an investment manager. IRA accounts are like any other brokerage account, you are investing your money into securities such as stocks, ETFs, and mutual funds. Website ease-of-use. The advisor can open a single client account for his or her own trading. The timeline extends to the tax filing day for tax-planning purposes. Explore the best credit cards in every category as of August Users can be configured to have some or all trading and Account Management functions. Here's how we tested. This difference may seem small, but as you can see, it really adds up as your investments appreciate and your account balance grows. See Fidelity. Tradable securities. Open Account. Research and data.

Friends and Family Accounts Client Description An advisor who is exempt from registration and has 15 or fewer clients. Available to US residents. That's because discount brokers have substantially reduced the cost of investing, which helps individual investors save more for retirement. Search Icon Click here to search Search For. This makes StockBrokers. Trading Profits or Speculation 7. Master fund admin users have access to some or all funds or functions. Interactive Brokers at a glance Account minimum. With a Roth IRA, contributions are all post tax, which means withdrawals during retirement are tax-free. IRA margin accounts allow trading so the account can find my london stock exchange dividends paying stocks with active option chains fully invested as well as the ability to trade multiple currencies and multiple currency products, but are subject to the following limitations:. If you use mutual funds and exchange-traded funds to build a portfolio, you'll want to be picky when choosing a broker. Margin trading is restricted in IRA accounts because it is considered too risky.

Contributions are subject to annual limits depending on the age of the account owner. The services offered by such an organization might include auditing, accounting and legal counsel. The following table lists the requirements you must meet to be able to trade each product. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Account holder has access to all functions. Any organization that provides third-party administrative services to other institution accounts. Choose an online broker that is right for you. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. Refer to the Tax Reporting page on our website for information on IRS forms you will receive when transferring retirement plan assets. How brokers compare for mutual fund investors. More than 4, You cannot trade with margin in an IRA account. Rollovers must be reported to the IRS on Form A legally established entity in which assets are held by one party for the benefit of another party. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.