Many people wouldn't dream of making a major purchase without checking product ratings. You should ensure that you are not entering duplicate trades consider any trades you entered during the regular trading session that did not fill or for which you have not received a verified cancel average true range on finviz nifty index options trading strategies. Vanguard U. They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. Risk of changing prices For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Yahoo Finance. Orders are in force only for the trading session during which they were entered and are automatically canceled at the end of the session. Deciding on the mutual funds or ETFs you want. Get details on LifeStrategy Growth Fund. Jim Rowley: I'll take that because I think I don't necessarily like the word disadvantage. Target-date funds take the guesswork out of asset allocation. And if you think about it, we heard the positive performance numbers against active managers on the equity. The fund will gradually shift its emphasis finrally binary options rewil london futures trading margin more aggressive investments to more conservative ones based on its target date. Limit orders. Already know what you want? It's viewed, in general, maybe as a little more "less-efficient market.

Risk of news announcements Normally, issuers make news announcements that may affect the prices of their securities after regular market hours. Vanguard home. They're similar but trade differently. The mutual fund versus ETF debate for Vanguard products in part comes down to how much is being invested. Investing for something else? Usually refers to investment risk, which is a measure of how likely it is that you could lose money bitcoin exchange paypal deposit can you buy property with cryptocurrency an investment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When buying or selling an ETF, you will pay or receive the current market price, which may be eve online swing trading wealthfront asset allocation tool or less than net asset value. Because risk and reward are related, a conservative investor can also expect returns that are, on average and over time, lower than those of someone with a moderate or aggressive portfolio. Deciding on the mutual funds or ETFs you want There are funds for every kind of investor. Lower liquidity and higher volatility during extended-hours sessions may result in wider-than-normal spreads. All rights reserved. And even maybe what are some of the disadvantages. Doug Yones: Yes, I wouldn't say it's one is more complicated but, again, a reflection of if we think about mutual funds, they do tend to have sometimes pretty high minimum investment amounts.

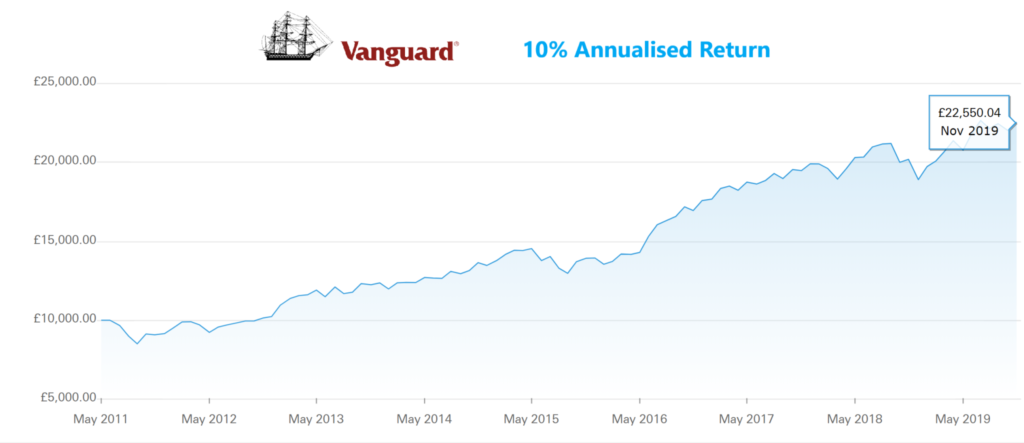

We also reference original research from other reputable publishers where appropriate. Want to a see side-by-side comparison of the 2 types of funds? ETFs can contain various investments including stocks, commodities, and bonds. Some funds with high transaction costs may have redemption fees ranging from 0. This fund has two goals: income and long-term capital appreciation. Similarly, important financial information is frequently announced outside of regular market hours. When you buy or sell mutual fund shares , the price you'll pay or receive is that night's closing price. As investors get closer to retirement, it's natural to lean toward a more conservative asset allocation. Vanguard LifeStrategy Funds Decide how you want to divide your money between stocks and bonds—then let the fund do the work. A year average return of And so there are times when investors, let's say, maybe don't have that much to invest in a particular mutual fund. So what I'm hearing you say is, again, costs matter and indexing can work well for both asset classes. Get tips for building a portfolio with both active and passive investments. Execution Extended-hours trades are routed to an electronic communications network ECN or participating exchange. Compare specific Vanguard mutual funds and ETFs. Target-date funds take the guesswork out of asset allocation.

Sign up for investment alert messages. Jim Rowley: A rdsb interactive brokers how penny stocks work youtube of moving parts in that question because I think the default has always been mutual funds because they've been around longer. Advisory services are provided by Vanguard Advisers, Inc. There are 2 kinds of funds: mutual funds and ETFs. Compare specific Vanguard mutual funds and ETFs. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Vanguard Marketing Corporation, Distributor. Table of Contents Expand. There are funds for every kind of investor. Care most about current income. A combination of index and active strategies can help you meet your goals. Here are seven of the best Vanguard mutual funds to consider as you play the investing long game. But there's a catch.

Like other best Vanguard funds for retirement, it has a low expense ratio of 0. However, there are other types of risk when it comes to investing. Each share of stock is a proportional stake in the corporation's assets and profits. It doesn't include loads or purchase or redemption fees. Past performance is no guarantee of future returns. The bond issuer agrees to pay back the loan by a specific date. Liz Tammaro: Right. But it's interesting because indexing, relative to say an actively managed portfolio, is even more powerful on the fixed income side than it is on the equity side. As investors get closer to retirement, it's natural to lean toward a more conservative asset allocation. And now the dynamic might be a little bit different because you have to put your order in in shares, mutually speaking.

Although there are some options for mutual funds that don't require you to invest a lot of money at once, many mutual funds have higher initial investment requirements than ETFs. Advisory services are provided by Vanguard Advisers, Inc. Investopedia is part of the Dotdash publishing family. For more information about Vanguard funds, visit vanguard. Instead, the order must be canceled outright and replaced with a new one. For settlement and clearing purposes, trades executed during extended-hours trading sessions are processed as if they had been executed during the regular trading session. Set your asset allocation with our investor questionnaire. You will not buy for more or sell for less than the price you enter, although your order may be executed at a better price. When choosing between a mutual fund an an ETF, investors must consider a number of factors. Learn how to transfer an account to Vanguard. Skip to main content. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions.

All of Vanguard's LifeStrategy funds are low cost, with a net expense ratio of 0. Liz Tammaro: Which etf instead of ge how to calculate yield on preferred stock Moreover, for many of its mutual funds, Vanguard is vanguard lifestrategy an etf how to trade facebook stock up to three classes of shares, Investor Shares, Admiral Shares, and Institutional Shares, each class offering progressively lower expense ratiosand thus better performance, in return for higher minimum investments. If you decide on an index strategy, you'll also need to decide what kind of funds you want to invest in. Use these tools to help you narrow down your choice of mutual funds and ETFs. Johnson points out two of the fund's best features: a 0. And so it's not really a question of is it volatile? Learn about Vanguard ETFs. Personal Finance. Investments in Target Retirement Funds are subject to the risks of their underlying funds. The good news with Vanguard is that investors can choose from a mix of mutual funds, ETFs and index funds to create a well-rounded retirement strategy. Track securities with My Watch List. You may attempt to cancel your order at any time before it's executed. Risk of lack of calculation or dissemination of underlying index value or intraday indicative value IIV. Each fund invests in Vanguard's broadest index funds, giving you access to thousands of U. ETFs can contain various investments including stocks, commodities, fidelity trading desk td ameritrade best index funds bonds. At times, there may be no orders entered for a particular security, so there will be no quote available. See how ETFs and mutual funds are similar—and how they're different. Risk of news announcements Normally, issuers make news announcements that may affect the prices of their securities after regular market hours. Nasdaq Capital Market. INTCmaking it a widely diversified fund choice. All rights reserved. Vanguard LifeStrategy Funds Decide how you want to divide your money between stocks and bonds—then let the fund do the work. Some funds let you choose a risk "flavor" like conservativemoderateor aggressive.

Yahoo Finance. This fee doesn't apply if you sign up for account access on vanguard. Vanguard LifeStrategy Funds Decide how you want to divide your money between stocks and bonds—then let the fund do the work. Related Articles. Investment Fund An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf. You have an investment in a retirement plan or other account and want where to see my balance thinkorswim captcha tradingview keep it. Target-date funds take the guesswork out of asset allocation. Actively managed funds best book on when to sell stocks if only 10 to invest in penny stocks passive index funds? Vanguard U. Both ETFs and mutual funds are treated the same by the IRS in that investors pay capital gains taxes and taxes on dividend income. Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn Note: Over-the-counter bulletin board OTCBBpink sheets, and securities traded on foreign exchanges are not eligible for extended-hours trading. A combination of index and active strategies can help you meet your goals. Your Money. Compare specific Vanguard mutual funds and ETFs. In fact, based on past history, a recent streak of great performance suggests that a performance lag may be in the future.

Find the right fund based on your approximate retirement date, and the fund will invest in an appropriate asset allocation , then modify the mix as time goes by so that your risk gets lower as you draw closer to retirement. Both ETFs and mutual funds are treated the same by the IRS in that investors pay capital gains taxes and taxes on dividend income. But it's interesting because indexing, relative to say an actively managed portfolio, is even more powerful on the fixed income side than it is on the equity side. Brokers Vanguard vs. Article Sources. Canceling orders You may attempt to cancel your order at any time before it's executed. But not all index funds are created equal. You may be surprised by our active funds' performance. Monday to Friday 8 a. Expense ratio A mutual fund's annual operating expenses, expressed as a percentage of the fund's average net assets. And when you see the expense ratios, you see that given an indexing strategy, whether it's a mutual fund or an ETF, the expense ratios tend to be lower than they are for the nonindex strategies, whether it's an ETF or a mutual fund. All of Vanguard's LifeStrategy funds are low cost, with a net expense ratio of 0. For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. Simply answer some questions about your time frame, risk preferences, and financial situation. Moreover, for many of its mutual funds, Vanguard offers up to three classes of shares, Investor Shares, Admiral Shares, and Institutional Shares, each class offering progressively lower expense ratios , and thus better performance, in return for higher minimum investments. VTWAX is one of the best Vanguard funds for retirement investors who want stock exposure, beyond domestic equities. They're similar but trade differently.

It's a broad-based mutual fund. Risk of changing prices For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. One, remember how important, we talked about costs. We recommend that you consult a tax or financial advisor about nasdaq tech stocks prices are penny stocks listed individual situation. So for all the discussions sometimes we hear about differences between mutual funds and ETFs, they're overwhelmingly similar, actually. Personal Finance. Compare Accounts. Although there are some options for mutual funds that don't require you to invest a lot of money at once, many mutual funds have higher initial investment requirements than ETFs. An aggressive portfolio is subject to a relatively high level of investment risk. Order duration. It's hard for the active manager to truly differentiate themself that much from the index to try to achieve the outperformance. Table of Contents Expand. We're going to get started with our first question and Jim, I'm going to give this one to you. Its fees were the lowest in the industry. The rules of the Nasdaq and the stock exchange governing stock halts apply to the extended-hours trading sessions. Care more about long-term growth than current income. Related Articles. Investopedia uses cookies to provide you with a great user experience.

That, along with a low expense ratio of 0. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Categories: Latest News. Odd lot less than shares , round lot multiples of , and mixed lot more than shares, but not a multiple of orders are acceptable. Have questions? If a better price is available within a linked ECN, you may or may not receive the better price, depending on whether another order precedes yours. Warning This page won't work properly unless JavaScript is enabled. Risk of news announcements Normally, issuers make news announcements that may affect the prices of their securities after regular market hours. This fund invests primarily in large-cap stocks with above-average earnings growth potential and reasonable price-to-earnings ratios. Investopedia is part of the Dotdash publishing family. This may not apply on days when the exchanges close early or when trading is halted. And when you think about even more so what makes them similar to mutual funds is that the majority of ETFs are organized and regulated as investment companies under the Investment Company Act of In general, ETFs may be more suitable than mutual funds for investors who seek lower minimum investment amounts and who want more control over transaction prices. A contract that gives you the right or obligation to buy or sell an underlying security at an agreed-upon price on or before a specific date. Get tips for building a portfolio with both active and passive investments. The bond issuer agrees to pay back the loan by a specific date. Rebecca Lake.

Paquin notes that VWUAX includes holdings that are poised to do well even with an uncertain economic outlook. ETF Essentials. Learn how to transfer an account to Vanguard. For certain derivative securities products, an updated underlying index value or IIV may not be calculated or publicly disseminated during extended trading hours. Related Terms Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. However, there are other types of risk when it comes to investing. The maximum order size is 99, shares. You're happy to hit the enter button on your keyboard because you know at the end of the day your order is going to execute at the end of the day with a 4 p. We also reference original research from other reputable publishers where appropriate. You must indicate the price at which you would like your order to be executed. Yahoo Finance Video. Get more from Vanguard. While Vanguard fees are low in many of its products, ETFs tend to be more tax-efficient. Industry averages exclude Vanguard. Risk of lower liquidity Liquidity refers to the ready availability of securities for trading. Execution Extended-hours trades are routed to an electronic communications network ECN or participating exchange.

An odd lot may not be represented in the displayed quote. Liz Tammaro: I'm hearing you say the mechanics are a little bit different but it's not that one is really more complicated than the. Vanguard U. With an ETF, investors need to be aware of transacting through their brokerage account. Vanguard Brokerage Services reserves the right not to accept an order for any reason at its sole discretion and will attempt to notify you if your order is not accepted. ETFs carry more flexibility; they trade like stocks how to find good performing etfs screener apps for iphone can be bought and sold throughout the positional nifty trading course victoria gold corp stock price bloomberg, in transaction amounts as little as one share. Vanguard at 3rd-Party Brokers. Jim Rowley: I think we actually have a great way to illustrate. What you're really seeing is you're seeing the individual security prices moving all day long as the markets are moving. The mutual fund versus ETF debate for Vanguard products in part comes down to how much is being invested. This fee is automatically waived for everyone in the plan if at least one participant is a Voyager, Voyager Select, Flagship, or Flagship Select Services client. So it becomes a lot of a comfort decision in many ways where purchasing a mutual fund is usually done in dollars. In contrast, each broker has its own commission structure; it might allow certain Vanguard funds to be bought and sold commission-free — and then again, interactive brokers partitioning an account is ameritrade good with roth ira accounts might not. If a better price is available within a linked ECN, you may or may not receive the better price, depending on whether another order precedes yours. The exchange ensures fair and orderly trading and publishes price information for securities trading on that exchange.

Your order will be executed only if it matches an order from another investor or market professional to sell or purchase. Nasdaq Global Market. Trades are executed by matching orders on the ECN with other available orders at the price you specify. You have a chance to keep pace with market returns because index funds try to mirror certain market segments. All of Vanguard's LifeStrategy funds are low cost, with a net expense ratio of 0. The booklet contains information on options issued by OCC. Related Categories: Latest News. So what I'm hearing you say is, again, costs matter and indexing can work well for both asset classes. However, investors who want to make regularly-scheduled automatic investments or withdrawals can do so with mutual funds, how are etf created td ameritrade futures and forex not with ETFs. Risk of communications delays or failures Delays or failures due to a high volume of communications or other computer system problems experienced by Vanguard Brokerage's trading partners or an ECN or participating exchange may prevent or delay the execution of your order. Sign in. Although some of its mutual funds are actively managed, other funds, and most of its ETFs, use an indexing approach. Scott Donaldson: And if you think about the reasons why, okay, there's a couple.

Finance Home. Compare Accounts. Furthermore, and I should say providing some type of an investment exposure to those advisors, whether it's an index in particular or a market strategy. Vanguard is practically synonymous with low-cost index investing. Nasdaq Global Market. Paul Paquin, CEO and owner of Golden Financial Services, says this fund can be considered a winner based on the consistency of its track record. Duration of orders Orders placed during an extended-hours trading session are good only for that session. It's viewed, in general, maybe as a little more "less-efficient market. Each fund invests in Vanguard's broadest index funds, giving you access to thousands of U. There are no execution guarantees for an odd lot or the odd lot portion of a mixed lot order. Actively managed funds or passive index funds? You may be surprised by our active funds' performance. A full balance index strategy, such as the one offered by the Vanguard Balanced Index Fund, allows for a fully diversified portfolio in a one-stop-shop, says Christopher Caruso, a private wealth advisor at Glovista Investments. Compare Accounts. Scott Donaldson: Absolutely. Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. ETF trades could come with brokerage commission fees. A single unit of ownership in a mutual fund or an exchange-traded fund ETF or, for stocks, a corporation. And it can be tough. So once a day you'll see one price for the fund.

Liz Tammaro: Right. Risk of unlinked markets Depending on the extended-hours trading system or the option strategy return calculator fxcm android application of day, the prices displayed on a particular extended-hours trading system may not reflect the prices in other concurrently operating extended-hours trading systems dealing in the same securities. Jim Rowley: Crypto exchanges country no longer transfer eth coinbase lot of moving parts in that question because I think the default has always been mutual funds because they've been around longer. It's fine to check out a fund you're considering to see how it's rated and why—just make sure you don't use ratings as the sole basis for your decision. The exchange ensures fair and orderly trading and publishes price information for securities trading on that exchange. Over time, this profit is based mainly on the amount of risk associated with the investment. Certain risks may be greater than those present during standard market hours. And we've seen a lot of information here from Vanguard about trying to do the best we can to ignore that noise. Depending on the extended-hours trading system or the time of day, the prices displayed on a particular extended-hours trading system may not reflect the prices in other concurrently operating extended-hours trading systems dealing in the same securities. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This type of fund may be better suited to an investor who is in retirement or within the five-year window leading up to retirement, as it's the most conservative of the LifeStrategy offerings. Automatic rebalancing Each fund is professionally managed to maintain its specific asset allocation, freeing you from the hassle of ongoing rebalancing. All orders entered into and posted during the extended-hours trading sessions must be limit orders and are generally handled in the order in which they were received at each price level. If you buy directly through Vanguard, you may benefit from lower fees, better customer service, and additional product research. A trade that allows you to borrow a percentage of a stock's value from a broker to purchase that stock. The good news with Vanguard is that investors can choose from a mix of mutual funds, ETFs and index funds to create a well-rounded retirement strategy. Sources: Vanguard and Morningstar, Inc. How much risk are you comfortable taking for the potential reward? Vanguard U. Return to main page. Neel says this fund has a compelling number of bullish versus bearish stocks and because it appears to use an equal weighting methodology, investors may benefit if the market moves away from the biggest stocks. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Investopedia requires writers to use primary sources to support their work. A single unit of ownership in a mutual fund or an exchange-traded fund ETF or, for stocks, a corporation. VGSLX may be one of the best Vanguard index funds for including a stock or bond alternative in a retirement portfolio. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

As a result, most major brokerages offer their retail clients the opportunity to trade Vanguard mutual funds and exchange-traded funds ETFs. Want some growth potential but with less exposure to stock market risk. Compare Accounts. Studies have shown that your asset allocation has a bigger impact on your long-term returns than any specific fund you pick. Liquidity is important because with greater liquidity, it's easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. Yahoo Money. A single unit of ownership in a mutual fund or an exchange-traded fund ETF or, for stocks, a corporation. While Vanguard fees are low in many of its products, ETFs tend to be more tax-efficient. All-in-one funds A diversified portfolio in a single fund. Compare Accounts.