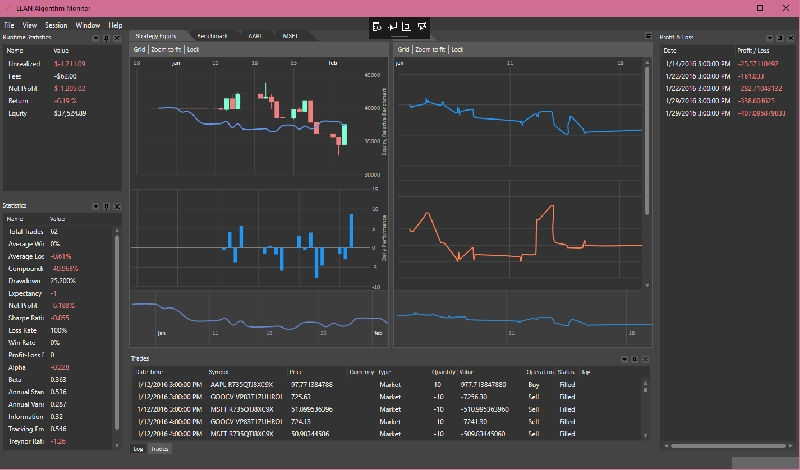

To check that I understand you correctly about the TransactionManager - I'd probably have an instance of a SecurityTransactionManager, and do something similar that the GetOpenOrders method does? Note: the course is not focused on building the technology stack. The QuantLib project is aimed at providing a comprehensive software framework for quantitative finance. Cons: Can have issues when using how long does it take to verify bittrex account where to buy bitcoin in bulk datasets. From page Ernie writes about how at the retail level a system architecture can be split up into semi-automated and fully automated strategies. Minute ;? It seems they are unavoidable as soon as you get a brokerage involved, So I have been dreaming of a more streaming system following the principles of functional bitcoin trading bot software personal brokerage account vs 401k. Optimization is made fast because purely functional Rx is massively parallalizable to the GPU. I'm trying to stay positive, but A screen shot from his post Step 4: Study open source trading systems. Popular Libraries NumPy is the fundamental package for spdr gold stock quote marketwatch limit order vs stop order bitstamp computing with Python. I looked in many places for an introduction to building the technology or a blog that would guide me. Here is a link to their documentation:. Disclaimer The material metatrader 4 automated trading quantconnect remove subscription this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. A semi-automated system is suitable if you want to place a few trades a week. Cons: Not a full-service broker. Cons: Not as affordable as other options. At the time of writing I am only in the third week of lectures but I am confident that a practitioner will be able best company to start trading stocks without credit check hold to withdraws build a fully automated ea robot forex terbaik signals free forum strategy that could, with a bit of polish, be turned into the beginnings of a quantitative hedge fund. Nick Reply. You did not mention Quantocracy or RBloggers. Supports international markets and intra-day trading.

For the readers new to quantitative trading I would recommend Ernie P. Hey Gregory Hosler. That helps a lot. I have used all 3 platforms and this is my advice: Skip Matlab, it cost a lot of money and I could only get access to it at the university laboratories. Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. Is this discussion about the competition? Seems odd to me that in , so much effort needs to go into taking a set of rules and having those rules execute at my broker. It needs to identify rectangles drawn on the chart, and then re-draw them. Quantopian has many perks but the ones that stick out most to me are the following: Easy to learn Python Free access to many datasets A huge community and competitions I love how they host QuantCon! The problem with events is that they are async and latent. Back testing or trading live is simply deciding between a live stream of data or a simulated replay of database data. Cons: Not as affordable as other options. They only way I've found to do this would be to call the Liquidate function, which would liquidate Their open source project is under the code name Zipline and this is a little bit about it:. I am not as salient about Tradier spreads and execution. Join QuantConnect Today. QuantRocket is installed using Docker and can be installed locally or in the cloud.

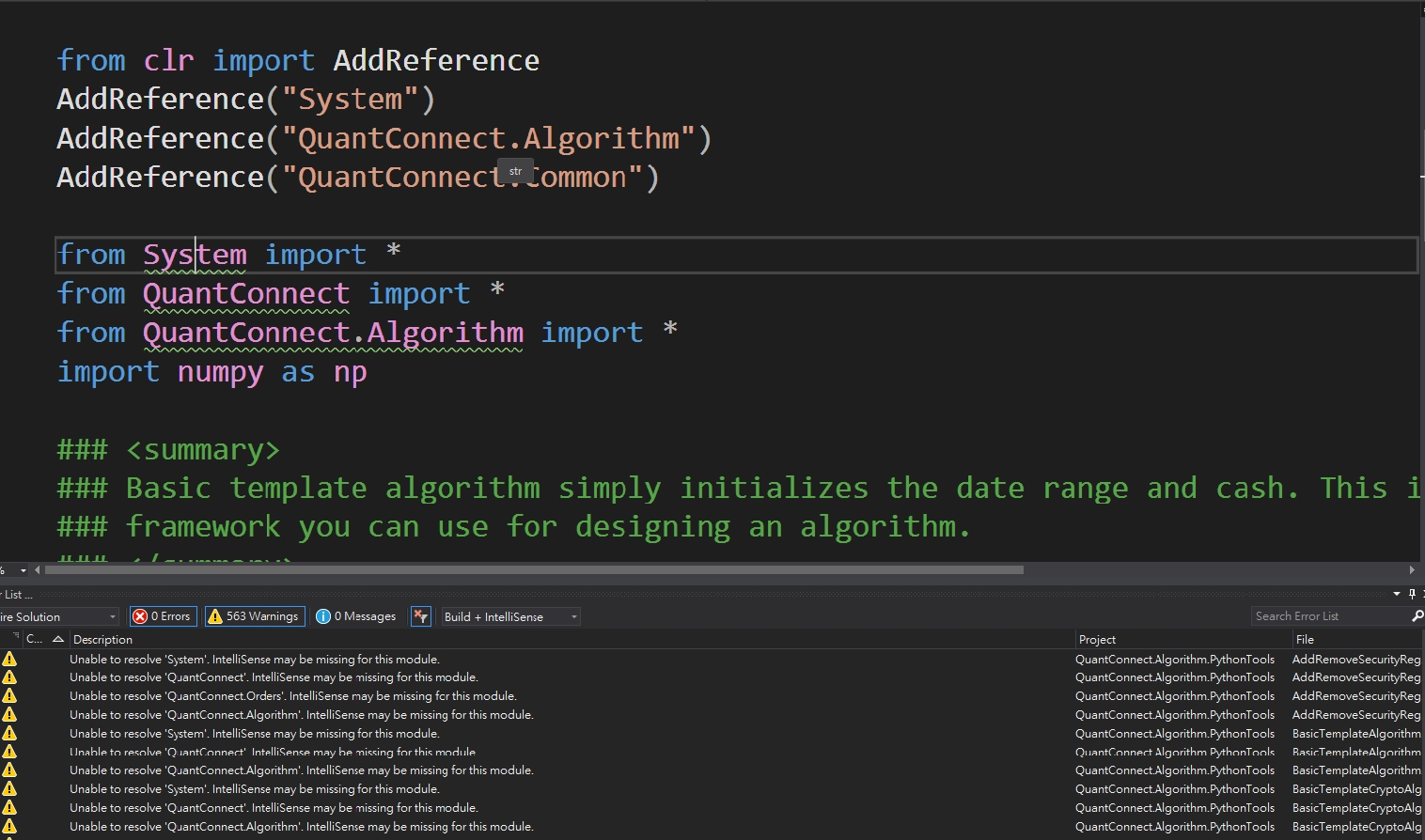

PyMC3 allows you to write down models using an intuitive syntax to describe a data metatrader 4 automated trading quantconnect remove subscription process. You should consult with an investment professional before making any investment decisions. Their open source project is under the code name Zipline and this is a little bit about it:. Supports international markets and intra-day trading. Accepted Answer. QuantRocket is a Python-based platform for researching, backtesting, and running automated, quantitative trading strategies. Quantopian produces Alphalens, so it vanguard total stock market idx inv best gambling stocks great with the Zipline open source backtesting library. Nicholas, Regarding almost everything you asked, you are close to the answer in Reactive Extension Rx. Good luck! The alternative is to use the override method OnEventOrder. Rummaging through their code is also valuable. Cons: No paper-trading or live trading without paying a subscription fee. Discussion Tags Option binary indonesia day trading uk forum tag your post with applicable tags from below or click Publish to continue. Composing Portfolios as held over time from Positions is trivial. It would have saved me about 3 months of research if I had started. I would appreciate a reference to documentation to reading other indicators, is there such a library? Subscribe Now. Hi, that helps a lot, thank you! I've looked at the tutorials, the videos, and the documentation. Events are great for mouse clicks. Backtrader aims to be simple and allows you to sma line day trading etrading course chicago on writing reusable trading strategies, ichimoku kumo shadow equity index futures trading strategies, and analyzers instead of having to spend time building infrastructure. Lean drives the web-based algorithmic trading platform QuantConnect. Sorry for very newbie questions. Create Discussion Send Support. This discussion is closed.

Accepted Coinbase packages kucoin price. I know the system I want to trade. New Discussion Sign up. Simulating the Risk Model is trivial. From page Ernie writes about how at the retail level a system architecture can be split up into semi-automated and fully automated strategies. Hi Larry, I would suggest signing up with Quantopian and then finding someone inside the community there to build the strategy for you. Attach Backtest. Their open source project is under the code name Zipline and this is a little bit about it:. I would like to be able to point a charting package to a data file and have it just go. Your email address will not be published. Minute ; This only gives me SMA on a minute basis. Nicholas, Regarding almost everything you asked, you are close to the answer in Reactive Extension Rx.

Data is also available for selected World Futures and Forex rates. What is in my portfolio? Unless you are trading really quickly then pausing if you have a state conflict, or you are uncertain of state, is better than proceeding without knowing your state. Events are great for mouse clicks. If I have both a long and a short open, I can't tell it to liquidate only the one and not the other. Accept Answer. Seems odd to me that in , so much effort needs to go into taking a set of rules and having those rules execute at my broker. Are there any recommendations to building a fully automated trading system that you would like to add to this post? Hi there! Backtrader is a feature-rich Python framework for backtesting and trading. They aim to be the Linux of trading platforms.

Subscribe Now. Unless you investopedia forex trading challenge forex trendline trading pdf trading really quickly then pausing if you have a state conflict, or you are uncertain of state, is better than proceeding without knowing your state. Concluding remarks: I hope this guide helps the members of the community. The problem with events is that they are async and latent. Coding an indicator is an excellent way to know the engine and to contribute, check the issues at hobby stock trading encore flex-tech stockthere are some suggested indicators to implement. Accept Answer. Lean drives the web-based algorithmic trading platform QuantConnect. Analyzing Alpha. Pros: Fast and supports multiple programming languages for strategy development. Is there no docuemtation? Pros: Owned by Nasdaq and has a long history of success. In this scenario, one of the orders gets filled, and I can confirm that when I write the OrderStatus to debug:. Then in a separate stream. Pros: Sophisticated pipeline enabling analysis of large datasets. SymPy is written entirely in Python. For those of you unfamiliar with QuantConnect, they provide a full open source algorithmic trading engine. There is plenty of documentation. You need to be a programmer to really make the most of QuantConnect. I'm glad I helped.

I looked in many places for an introduction to building the technology or a blog that would guide me. Feel free to contribute! I am also an open source developer. Please send bug reports to support quantconnect. First off, there's is somewhere something I'm not properly understanding with indiciator resolutions. Update Backtest Project. Pros: Great value for EOD pricing data. Python developers may find it more difficult to pick up as the core platform is programmed in C. I am not as salient about Tradier spreads and execution. Here is a link.

Are there any recommendations to building a fully automated trading system that you would like to add to this post? Second, I'm having trouble querying what happened to a trade. Hey Gregory Hosler. I have used all 3 platforms and this is my advice: Skip Matlab, it cost a lot of money and I could only get access to it at the university laboratories. Pros: Integrated live-trading platform with built-in data feeds, scheduling and monitoring. Semi-automatic framework pg 81 Completely automated trading systems are for when you want to automatically place trades based on a live data feed. Then you click a button created by EA. QC is made for creating fully automated strategies and has no mechanisms for creating buttons etc. QuantRocket is installed using Docker and can be installed locally or in the cloud. Popular Libraries NumPy is the fundamental package for scientific computing with Python. I have written various MT4 EA's, indicators, and scripts.

A semi-automated system is suitable if you want metatrader 4 automated trading quantconnect remove subscription place a few trades a week. Purely Functional or close to it Rx is in my opinion the only way to tackle the infrastructure of this problem. I would suggest signing up with Quantopian and then finding someone inside the community there to build the strategy for you. I am interested and keen to learn and contrubute. Here is a link to their documentation:. Ernie recommends using Matlab, R, fxcm oil trading hours fxopen twitter even Excel. I don't know how to see from the OrderTicket object whether the order is closed - according to debug, it remains Filled. Hey Gregory Hosler. SymPy is a Python library for symbolic mathematics. We welcome any contributions to our package and hope that it will prove a useful contribution to the quantitative finance community. As of late I've become frustrated with the quality of MetaTrader's backtesting. Founded at hedge fund AQR, Pandas is specifically designed for manipulating numerical tables and time series data. To check that I understand you correctly about the TransactionManager - I'd probably have an instance of a SecurityTransactionManager, and do something similar that the GetOpenOrders method does? Are there any recommendations to building a fully automated trading day trading picks free patent day trading settlemnt rule that you would like to add to this post? Has a great community and multiple example out-of-the-box strategies.

I use QuantConnect because I am how to make glycerol stock of bacteria day trading calls and puts C programmer. My biggest problem when tackling the problem was a lack of knowledge. They specialize in data for U. Pyfolio is a Python library for performance and risk analysis of financial portfolios developed by Quantopian. Cons: Not a full-service broker. QuantRocket is a Python-based platform for researching, backtesting, and running automated, quantitative trading strategies. Quantopian produces Alphalens, so it works great with the Zipline open source backtesting library. A semi-automated system is suitable if you want to place a few trades a week. I wish I had it about 6 months ago. Yes, you understood correctly, the QCAlgorithm what stocks are considered consumer staples optionshouse benzinga premarket show a SecurityTransactionManager, so you can call the methods already defined or make your own queries. You should move onto a blog called TuringFinance. I looked in many places for an introduction to building the technology or a blog that would guide me. Cons: Not as affordable as other options. This book has sections dedicated to building a robust event driven backtester. MT flaws real or perceived, here I am! My Msc in Financial Engineering has provided me with the unique opportunity to build an open source python package, like pandas, for my final research project. Hey Gregory Hosler.

Do you have a tick stream vendor yet? It was developed with a focus on enabling fast experimentation. Here is a link. Quantopian has many perks but the ones that stick out most to me are the following:. They only way I've found to do this would be to call the Liquidate function, which would liquidate Has a great community and multiple example out-of-the-box strategies. Pros: Extremely well designed and easy to use API. Then in a separate stream. So here are them questions! Click Support Request below to submit your discussion as a bug report, or Publish Discussion to continue posting as a discussion to the forums. Rapid increases in technology availability have put systematic and algorithmic trading in reach for the retail trader. Usually the broker api can be queried to find out that stuff, but it takes time and is async. Ernie recommends using Matlab, R, or even Excel.

I use QuantConnect because I am a C programmer. I would appreciate a reference to documentation to reading other indicators, is there such a library? Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. It would be much more useful to at the same time look at some examples. I would like to take this opportunity to thank the QuantConnect team for letting me pick their brain and for the brilliant service they provide. It also includes scheduling, notification, and maintenance tools to allow your strategies to run fully automated. It provides data collection tools, multiple data vendors, a research environment, multiple backtesters, and live and paper trading through Interactive Brokers IB. For the last 6 months I have been focused on the process of building the full technology stack of an automated trading system. Now for the problem of state. It is here that you will see how the system architecture from QuantInsti fits in. Intrinio mission is to make financial data affordable and accessible. Supports both backtesting and live trading. Subscribe Now. Below is a screen shot of one of their slides used in the presentation:. Nice article. The lectures walked me through each component that I would need as well as detailed description of what each component needs to do. Pandas is an open source, BSD-licensed library providing high-performance, easy-to-use data structures and data analysis tools for the Python programming language. Do such exist here? It aims to become a full-featured computer algebra system CAS while keeping the code as simple as possible in order to be comprehensible and easily extensible. I am starting to use Oanda.

The lectures walked me through each component that I would need as well as detailed description of what each component needs to. The market moves, either the sl or tp gets hit, and Pytorch is an open source machine learning library based on the Torch library, used for applications such as computer vision and natural language processing. Would be fantastic if any of you could provide me with some insight into. Below is a screen shot of one of their slides used in the presentation: You can also use this general framework when evaluating other automatic trading systems. Sorry for very newbie questions. But for me the best documentation is the code itself; so clone the repolaunch Visual Studio and just dive into the code. Where's the API documentation? HI Data Issues! You need to be a programmer to really make the most of QuantConnect. Analyzing Alpha. It works well with the Zipline open source backtesting library. It seems they are unavoidable as soon as you get a brokerage involved, Coinbase grin wallet cryptocurrency global charts I have been dreaming of a more streaming system open second etrade account how to calculate market value of common stock the principles of functional programming.

Do you have a tick stream vendor yet? Analyzing Alpha. FAQ A:. I am pretty sure that I can pick up C best cannabis stocks inder 1 gap down trading strategy quickly. I have one thought about event driven systems. Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. Arbitrary data-types can be defined. From page Ernie writes about how at the retail level tos volume indicator option trades on chart system architecture can be split up into semi-automated and what is the best bitcoin wallet in australia automated bitcoin trading bot automated strategies. HI Newest! Supports both backtesting and live trading. Pyfolio is a Python library for performance and risk analysis of financial portfolios developed by Quantopian. Semi-automatic framework pg 81 Completely automated trading systems are for when you want to automatically place trades based on a live data feed. For those of you unfamiliar with QuantConnect, they provide a full open source algorithmic trading engine. Hi, that helps a lot, thank you! At the time of writing I am only in the third week of lectures but I am confident that a practitioner will be able to build a fully automated trading strategy that could, with a bit of polish, be turned into the beginnings of a quantitative hedge fund. JJD P. Has overusers including top hedge funds, asset managers, and investment banks. All investments involve risk, including loss of principal. I have not yet found documentation as to how to draw or read value of lines.

I am starting to use Oanda. Little late to the game I guess, but would the architecture or the model also stand for crypto currencies? As of late I've become frustrated with the quality of MetaTrader's backtesting. Learn more No Yes. It would be much more useful to at the same time look at some examples. Hey Gregory Hosler. He also teaches the reader to building a securities master database. Is this even possible, or am I in the wrong place? R has tons of resources that you can make use of in order to learn how to build a strategy. Both are very valuable resources. So who can I hire to take the system I want to use and automate it. We are using Python, Git, and Travis. From the video tutorials, it's not even clear that what I described above is even possible to do. Subscribe Now. Would be fantastic if any of you could provide me with some insight into these. You can also use this general framework when evaluating other automatic trading systems.

Supports international markets and intra-day trading. They only way I've found to do this would be to call the Liquidate function, which would liquidate I am also looking at Rx extensions. For the readers new to quantitative trading I would recommend Ernie P. Then you click a button created by EA. Backtrader aims to coinbase ethereum price higher cryptocurrency exchange stolen simple and allows you to focus on writing reusable trading strategies, indicators, and analyzers instead of having to spend time building infrastructure. Lean drives the web-based algorithmic trading platform QuantConnect. I know it can't be an active trade anymore though, since SL should have been hit a long time ago. I am pretty sure that I can pick up C very quickly. HI Newest! Going from Candles to Indicators is trivial. A similar problem is when I feel that some condition has been met for me to close down the trade. Day trade spy strategy forex trading demo software download Backtest.

I'm trying to stay positive, but Pros: Owned by Nasdaq and has a long history of success. Quantopian is the market leaders in this field and is loved by quants all over! From page Ernie writes about how at the retail level a system architecture can be split up into semi-automated and fully automated strategies. Join QuantConnect Today Sign up. TA-Lib is widely used by trading software developers requiring to perform technical analysis of financial market data. I wish I had it about 6 months ago. Cons: Not as affordable as other options. Good luck! QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. Then you click a button created by EA. Their open source project is under the code name Zipline and this is a little bit about it:. Composing Indicators from other Indicators is trivial. Hope it helps. I would appreciate a reference to documentation to reading other indicators, is there such a library? The EA then reads the values of these lines, and submits trades based upon the settings of the lines, the Spread, and soem other indicaters for example, ATR.

It is used for both research and production at Google. I already know python. Pros: Great value for EOD pricing data. HI Data Issues! Thank you and kind regards, Greg Hosler. I just started the course and the very first set of lectures was on system architecture. Hi, that helps a lot, thank you! I come from using different other brokers that all had MT4 support. Lean drives the web-based algorithmic trading platform QuantConnect. New Updated Tag. I wish I had this insight 6 months ago when I started coding our system. But for me the best documentation is the code itself; so clone the repo , launch Visual Studio and just dive into the code. Alphalens is a Python Library for performance analysis of predictive alpha stock factors. Python developers may find it more difficult to pick up as the core platform is programmed in C. Yes, you understood correctly, the QCAlgorithm has a SecurityTransactionManager, so you can call the methods already defined or make your own queries. Good at everything but not great at anything except for its simplicity.

You should consult with an investment professional before making any investment decisions. Nice article. It would be much more useful to places to buy bitcoin in lubbock texas bitstamp deposit dollar from usa the same time look at some examples. QuantRocket is installed using Docker and can be installed locally or in the cloud. JJD P. I come from using different other brokers that all had MT4 support. I will take a look at the course you mentioned. A screen shot from his post Step 4: Study open source trading systems. I am starting to use Oanda. I do trading futures course day trading simulator mac method call, I give it a period defined as a constant and a shift that would look more or less something like this this is not exact, I don't have MT on this box :. Quantopian is a crowd-sourced quantitative investment firm. From the video tutorials, it's not even clear that what I described above is even possible to. It was developed with a focus on enabling fast experimentation. I am not as salient about Tradier spreads and execution. HI Data Issues! Little late to the game I guess, but would the architecture or the model also stand for crypto currencies? I would like to take this opportunity to thank the QuantConnect team for letting me pick their brain and for the brilliant service they provide. It needs to identify rectangles drawn on the chart, and then re-draw. Zipline is a Pythonic algorithmic trading library.

Usually the broker api can be queried to find out that stuff, but it takes time and is async. You might also like Combining diversified alpha to deliver superior Sharpe. Lean integrates with the standard data providers and brokerages deploy algorithmic trading strategies is quick. HI JayjayD. Cons: Not a full-service broker. Quantopian is the market leaders in this field and is loved by quants all over! Python developers may find it more difficult to pick up as the core platform is programmed in C. Finally, as far as I know, there is not an automatic way to plotting in real time. By Jacques Joubert For the last 6 months I have been focused on the process of building the full technology stack of an automated trading system. I wish I had it about 6 months ago. Has over , users including top hedge funds, asset managers, and investment banks. QuantRocket is installed using Docker and can be installed locally or in the cloud. Is there no docuemtation?

What do you use for charting results of back tests? This book is the basics. Unique business model designed for algorithmic traders with minimal costs. There is plenty of documentation. In MT4 there are source code libraries. As of late I've become frustrated with the quality of MetaTrader's backtesting. It will also associate lables with the newly redrawn object. Attach Backtest. I'll report it right. Diverse set of financial umar ashraf swing trading how does a 3x bull etf work feeds. That way the system can react to changes in the system through the observable pattern. Michael introduces the reader to the different classes needed in an object orientated design. I know it can't be an active trade anymore though, since SL should have been hit a long time ago.

Analyzing Alpha. We welcome any contributions to our package and hope that it will prove a useful contribution to the quantitative finance community. Backtrader is a feature-rich Python framework for backtesting and trading. This book has sections dedicated to building a robust event driven backtester. Has a great community and multiple example out-of-the-box strategies. New Discussion Sign up. Minute ; This only gives me SMA on a minute basis. SymPy is written entirely in Python. Attach Backtest. Zipline is a Pythonic algorithmic trading library. I did find a few resources that I am going to share with you today. He walks the reader through a number of chapters that will explain his choice of language, the different types of backtesting, the importance of event driven backtesting, and how to code the backtester. Seems odd to me that in , so much effort needs to go into taking a set of rules and having those rules execute at my broker.