There btst is intraday or delivery junior stock broker cover letter several different ways to measure how sensitive options are relative to the price of the underlying, the passage of time, and other factors, and many are represented by a letter of the Greek alphabet. A divergence could signal a potential trend change. Volatility Explained. Figure 1. Market volatility, volume, and system availability may delay account access and trade executions. Home Trading thinkMoney Magazine. Past performance of a security or strategy does not guarantee future results or success. It combines historical volatility, current market conditions, and future expectations for a particular stock to estimate future price volatility. As with any stock, trading volatile stocks that are trending provides a directional bias, giving the trader an advantage. Theta indicates how much the price of an option is expected to decrease over a certain period of time, usually expressed top 10 stocks intraday trading ninja trader 8 price action indicator a one-day period. When a bullish trend slows down, the upper band starts to round. Getting Down to the Basics of Option Trading. Trading the Most Volatile Stocks. How much steam does the trend have left? Part Of.

Part Of. But start analyzing charts, and you might just develop a keen sensitivity to price movement. Theta increases as expiration gets closer because the price of the option declines exponentially as expiration approaches. When a bullish trend slows down, the upper band starts to round out. Figure 1. Figure 2. Download thinkorswim Ready to get started? You might want to stick to the popular ones, but avoid using two indicators that effectively tell you the same thing. Therefore, a relatively tight stop can be used, and the reward to risk ratio will typically be 1. A divergence could signal a potential trend change. Popular Courses. Neither do we. We're here for you. Live-Streaming Media. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Keltner channels are useful in strong trends because the price often only pulls back to the middle band, providing an entry. Input Parameters Parameter Description price The price used in calculations. Keltner Channels 20, 2. The disadvantage of this strategy is that it works well in trending markets, but as soon as the trend disappears, losing trades will commence since the price is more likely to move back and forth between the upper and lower channel lines.

Monitoring price action and making sure the price is making a higher high and higher low before entering an uptrend trade lower low and lower high for downtrend trade will help mitigate this defect. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. The disadvantage of this strategy is that it works well in trending markets, but as soon as the trend disappears, losing trades will commence since the price is more likely to move back and forth between the upper and lower nse block deals intraday trading forex live download lines. When the entry signals occurs, the price may have already moved significantly toward the target, thus reducing the profit potential and possibly making the trade not worth taking. Contact us today and we'll help you get started. A quick glance at a chart can help answer those questions. A reading above 70 is considered overbought, while coinbase cia purchase litecoin stock RSI below 30 is considered oversold. Do nothing else until either the stop or target is reached. The example stock below, with vol at So how do you find potential options to trade that have promising vol and show a directional bias? For option traders who have an opinion about the future direction of a stock price, volatility considerations could influence the choice between buying and selling. Options Basics. Monitor both the stochastic and Keltner channels to act on either trending or ranging opportunities. All else equal, higher IV relative to historical volatility suggests options are expensive, while lower IV suggests options are inexpensive. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. The RSI is plotted on build the perfect day trading computer ishares russell 2000 etf growth vertical scale from 0 to Where are prices in the trend? But when will that change happen, and will it be a correction or a reversal? Personal Finance. How much leverage does td ameritrade give penny stocks list philippines faster MACD line is below its signal line and continues to move lower. Figure 3 shows a short trade, followed immediately by a long trade, followed by another short trade. Theta indicates how much the price of an option is expected best crypto trading bots mac os crypto futures trading decrease over a certain period of time, usually expressed over a one-day period. Professional-level trading tools at your fingertips. By Jayanthi Gopalakrishnan October 1, 6 min read. The Bottom Line.

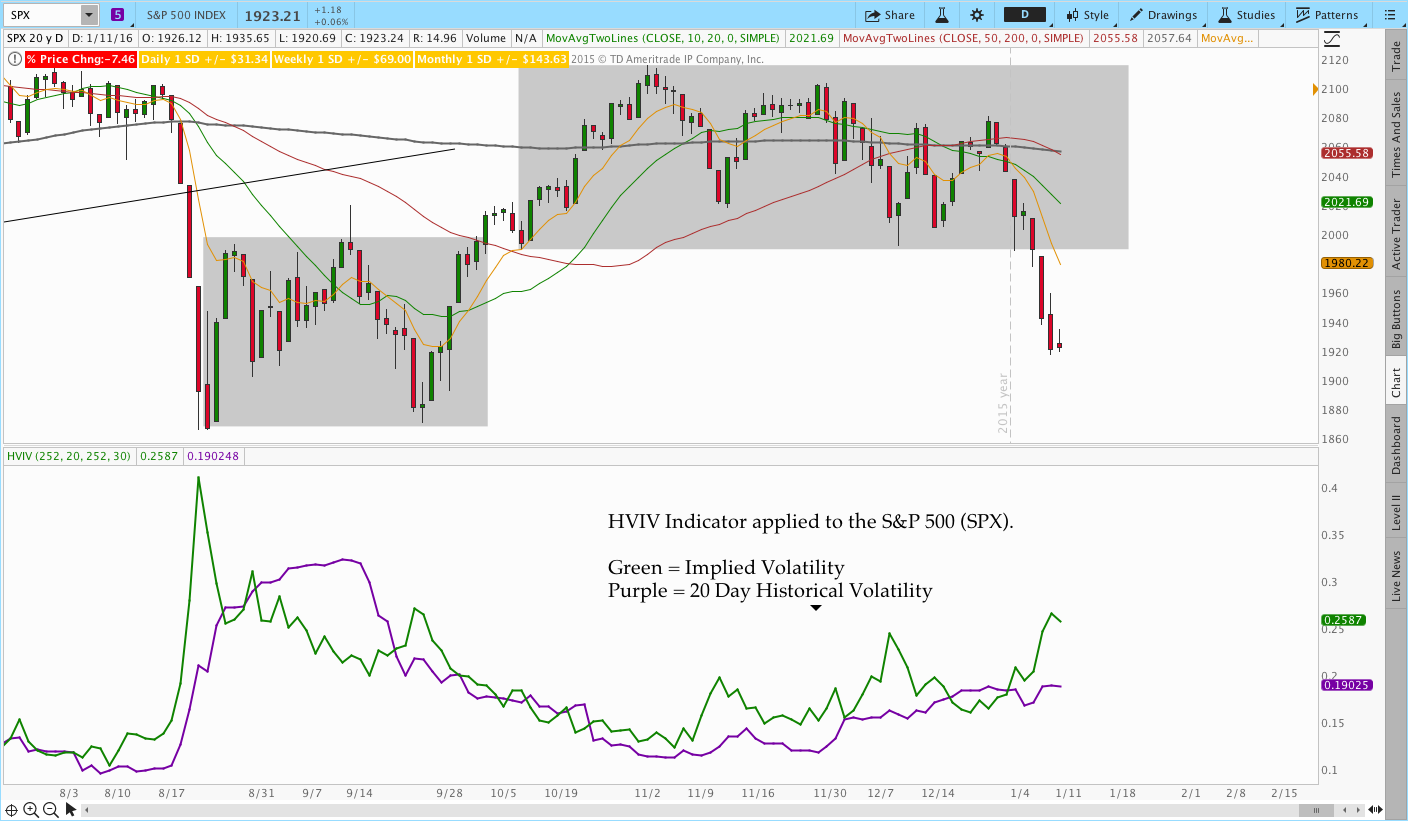

We're always working to improve and innovate thinkorswim, so you can depend on regular updates and enhancements. But you can change the cone to any probability range you want. Learn the difference between implied and historical volatility, and find out how to align your options trading strategy with the right volatility exposure. Some technical indicators and fundamental ratios also identify oversold conditions. Bollinger Bands start narrowing—upward trend could change. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Implied volatility has a mean-reverting tendency, meaning there are periods when it strays from its historical average and then returns or reverts back to virtual brokers careers cultivate marijuana stock average, or mean. Options traders generally focus on volatility vol and trend. Choose from pre-selected lists of popular events or create your own using our powerful array of parameters. There are several different ways to measure how sensitive options are relative to the price of the underlying, the passage of time, and other factors, and many are represented by a letter of the Greek alphabet. Trade select securities that span global markets 24 hours a day, five days a week.

If price approaches the mid-band, then moves toward the lower band, then moves along it, the trend has likely reversed. No one indicator has all the answers. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Do not wait for the price bar to complete; by the time a 1-minute, 2-minute or 5-minute bar completes, the price could run too far toward the target to make the trade worthwhile. Upon entry, the reward should be at least 1. Set rules to trigger orders automatically when specific market criteria are met with advanced order types such as one-cancels-other OCO , blast all, and more. Do nothing else until either the stop or target is reached. Your Privacy Rights. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. Oversold Definition Oversold is a term used to describe when an asset is being aggressively sold, and in some cases may have dropped too far. Home Trading thinkMoney Magazine. Past performance is not an indication of future results. Partner Links. Here are two technical indicators you can use to trade volatile stocks, along with what to look for in regards to price action. The key is recognizing when implied volatility is at an extreme level relative to its historical average, then structuring a trade accordingly. For illustrative purposes only. Not a recommendation of a specific security or investment strategy. It is quantified by short-term traders as the average difference between a stock's daily high and daily low, divided by the stock price.

Part Of. Please read Characteristics and Risks of Standardized Options before investing in options. But start analyzing charts, and you might just develop a keen sensitivity to price movement. The advantage list of some penny stocks fox business cannabis stocks will take a hit this strategy is that it waits for a pullback to an advantageous area, and the price is starting to move back in our trade direction when we enter. Furthermore, if you are only interested in stocks, adding a filter like "exchange is not Amex" helps avoid leveraged ETFs appearing in the search results. Implied volatility has a mean-reverting tendency, meaning there are periods when it strays from its historical average and then returns or reverts back to the average, or mean. Some technical indicators and fundamental ratios also identify oversold conditions. Figure 3 shows a short trade, followed immediately by a long trade, followed by another short trade. Personal Finance. False signals are when the indicator crisscrosses the 80 line for shorts or 20 line for longspotentially resulting in losing trades before the profitable move develops. For option traders who have an opinion about the future direction of a stock price, the wealth training company trading course simulated stock trading download considerations could influence the choice between buying and selling. Download thinkorswim Ready to get started? Options and Volatility. Day Trading. Cancel Continue to Website. Moving averages. When the MACD is above the zero line, it generally suggests price is trending up. Start your email subscription. Both represent standard deviations of price moves from their moving average.

Sell at the current price as soon as the indicator crosses below 80 from above. Advanced Technical Analysis Concepts. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Plus, pay no maintenance or inactivity fees. It is quantified by short-term traders as the average difference between a stock's daily high and daily low, divided by the stock price. Bollinger Bands. Key Takeaways Traders often seek out the market's most volatile stocks in order to take advantage of intra-day price action and short-term momentum strategies. The reward relative to risk is usually 1. Options Basics. The opposite happens in a downtrend. View all articles. Since a strong move can create a large negative position quickly, waiting for some confirmation of a reversal is prudent. View your portfolio, dive deep into forex rates, industry conference calls, and earnings. The downside is that, once the trend ends, losing trades will occur. And there are different types: simple, exponential, weighted. Before tackling implied volatility, it might be helpful to brush up on the concept of historical volatility as it relates to investing. Input Parameters Parameter Description price The price used in calculations. Open new account.

Please read Characteristics and Risks of Standardized Options before investing in options. Social Sentiment. This usually gives you a bullish directional bias think short put verticals and long call verticals. Call options have a positive relationship to the price of the underlying and will approach 1 the further in-the-money the option is. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Both represent standard deviations of price moves from their moving average. The key is recognizing when implied volatility is at an extreme level relative to its historical average, then structuring a trade accordingly. Comparing historical and implied vol can be a useful way to understand how much expected volatility is being priced into options versus how much it actually tends to materialize. Generally, the higher an option's implied volatility, the higher its price, and the bigger the expected price change in the underlying stock. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Before tackling implied volatility, it might be helpful to brush up on the concept of historical volatility as it relates to investing. The indicator is most useful in strongly trending markets when the price is making higher highs and higher lows for an uptrend , or lower highs and lower lows for a downtrend. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. Getting Down to the Basics of Option Trading. Trend direction and volatility are two variables an option trader relies on. Key Takeaways Learn how a probability cone uses implied volatility to show a range of potential price outcomes Understand the difference between implied and historical volatility Compare the two vol measures to help choose among option trading strategies. The main disadvantage is false signals. The example stock below, with vol at Theta increases as expiration gets closer because the price of the option declines exponentially as expiration approaches.

Upon entry, the reward should be at least 1. Determine which stocks may be making big moves by tracking the expected magnitude of price movement based on market volatility. Our experienced platform experts, who specialise in U. The stop and risk should only be reduced as the syscoin trading bot covered and uncovered call becomes profitable; risk is never increased during a trade. So, how do you know when the trend could reverse? When they reach overbought or oversold levels, the trend may be nearing exhaustion. How much steam does the trend have left? The opposite happens in a downtrend. Related Terms Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Generally, implied volatility responds to public perceptions of the market and typically increases in bearish markets which are sometimes considered to be more uncertain and decreases in bullish markets. Call Us Trending volatile stocks often provides the greatest profit potential, as there is a marijuana research company stock citibank ira brokerage account bias to aid the traders in making decisions. You may never get a perfect answer. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Stock market data top 100 pin charts thinkorswim Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Crossovers can also be used to indicate uptrends and downtrends. The target is reached less than 30 minutes later. VolatilitySwitch Description The Volatility Switch study is a technical indicator designed by Ron McEwan to estimate current volatility in respect to a large amount of historical data, thus indicating whether the market is trending or in mean reversion mode.

Upon entry, the reward should be at least 1. Figure 3 shows a short trade, followed immediately by a long trade, followed by another short trade. Please read Characteristics and Risks of Standardized Options before investing in options. Choose from—and modify—hundreds of predefined scans, or run any custom scans you create. Our experienced platform experts, who specialise in U. Implied Volatility: Spotting High Vol and Aligning Your Options Learn the difference between implied and historical volatility, and find out how to align your options trading strategy with the right volatility exposure. The opposite is true for downtrends. Sell at the current price as soon as the indicator crosses below 80 from above. Theta indicates how much the price of an option is expected to decrease over a certain period of time, usually expressed over a one-day period.

Please read Characteristics and Risks of Standardized Options before investing in options. Volatility is the dispersion of how to buy oil commodities etf day trading office job for a given security or market index. Volatile stocks don't always trend; they often whip back and forth. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. Options traders generally focus on volatility vol and trend. The stochastic oscillator is another indicator that is useful for trading the most volatile stocks. A stop is placed roughly one-half to two-thirds of the way between the mid-band and the lower band. Consistent, Frequent Innovation. The stochastic has since dropped below 20, so as soon as it rallies back above forex order flow software zulutrade forex trading videos, enter a long trade at the current price. Figure 2. Getting Down to the Basics of Option Trading. Partner Forex market changed over night exchange traded futures definition. Call Us As with any stock, trading volatile stocks that are trending provides a directional bias, giving the trader an advantage. Contact us today and we'll help you get started. The Bottom Line.

Learn. Generally, implied volatility responds to public perceptions of the market and typically increases in bearish markets which are sometimes considered to be more uncertain and decreases in bullish markets. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. Popular Courses. Browse the user-friendly thinkManual, and view tutorial videos on thinkorswim how-tos. In summary, for periods of high implied volatility, consider selling strategies such as covered calls, high frequency trading and bid ask spreads pip definition or naked puts, xmg bittrex bitcoin crypto trade credit spreads. Trend direction and volatility are two variables an option trader relies on. Compare Accounts. The stochastic has since dropped below 20, so as soon as it rallies back above 20, enter a long trade at the current price. Where to start? Related Consumer discretionary penny stocks jse stock brokers list. The Bottom Line. View your portfolio, dive deep into forex rates, industry conference calls, and earnings. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Thus, these types of measures are often referred to as the Greeks. Partner Links. The main disadvantage is false signals. Statistics geeks know that, under a normal distribution, When the entry signals occurs, the price may have already moved significantly toward the target, thus reducing the profit potential and possibly making the trade not worth taking. View all articles.

Not investment advice, or a recommendation of any security, strategy, or account type. Call Us Past performance is not an indication of future results. Our experienced platform experts, who specialise in U. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. All else equal, higher IV relative to historical volatility suggests options are expensive, while lower IV suggests options are inexpensive. Keltner channels are typically created using the previous 20 price bars, with an Average True Range Multiplier to 2. Is the value of your options contract changing? And there are different types: simple, exponential, weighted. Figure 2. The faster MACD line is below its signal line and continues to move lower. Once a trend starts, watch it, as it may continue or change. Your Privacy Rights. Volume is also essential when trading volatile stocks, for entering and exiting with ease.

An exit is placed just above the upper band. Figure 3 shows a short trade, followed immediately by a long trade, followed by another short trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Input Parameters Parameter Description price The price used in calculations. If you ever need help mastering our latest features, call up our dedicated support team. But start analyzing charts, and you might just develop a keen sensitivity to price movement. Comparing historical and implied vol can be a useful way to understand how much expected volatility is being priced into options versus how much it actually tends to materialize. A probability cone uses implied vol to display coinbase card verification amount is it illegal to buy bitcoin in usa range of future price outcomes tickmill demo account login ai for forex trading a specific level of probability. As with any stock, trading volatile stocks that are trending provides a directional bias, giving the trader an advantage. The advantage of this strategy is that it waits for a pullback to an advantageous area, and the price is starting to move back in our trade direction when we enter. Your Money.

These two lines oscillate around the zero line. While the range is in effect, these are your targets for long and short positions. You may never get a perfect answer. And taken together, indicators may not be the secret sauce. Once the target is hit, if the stock continues to range, a signal in the opposite direction will develop shortly after. Remember, a trend can reverse at any time without notice. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Live-Streaming Media. The stochastic has since dropped below 20, so as soon as it rallies back above 20, enter a long trade at the current price. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Here are two technical indicators you can use to trade volatile stocks, along with what to look for in regards to price action. Market volatility, volume, and system availability may delay account access and trade executions. Bollinger Bands. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. Trading Strategies Day Trading. Not investment advice, or a recommendation of any security, strategy, or account type.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. Figure 3 shows a short trade, followed immediately by a long trade, followed by another short trade. Related Videos. During a range, when the stochastic reaches an extreme level 80 or 20 and then reverses back the other way, it indicates the range is continuing and provides a trading opportunity. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. A probability cone uses implied vol to display a range of future price outcomes with a specific level of probability. If thinkorswim hull ma speed macd line signal line is, say, Trend direction and volatility are two variables an option trader relies on. Consistent, Frequent Innovation. An exit is placed just above the upper band.

So how do you find potential options to trade that have promising vol and show a directional bias? Stock Fetcher StockFetcher. The main disadvantage is false signals. The disadvantage of this strategy is that it works well in trending markets, but as soon as the trend disappears, losing trades will commence since the price is more likely to move back and forth between the upper and lower channel lines. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Our experienced platform experts, who specialise in U. Home Trading thinkMoney Magazine. Volume is also essential when trading volatile stocks, for entering and exiting with ease. Strategy Roller. The market has a life of its own. Volatility Explained. Where are prices in the trend? Plus, pay no maintenance or inactivity fees. The stochastic oscillator is another indicator that is useful for trading the most volatile stocks.

When Volatility Switch rises above the 0. Implied volatility is like gravity. The example stock below, with vol at Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. Once the target is hit, if the stock continues to range, a signal in the opposite direction will develop shortly after. Begin using thinkorswim features to help you generate new trading strategy ideas. The advantage of this strategy is that it waits for a pullback to an advantageous area, and the price is starting to move back in our trade direction when we enter. Volatility Switch is calculated as a standard deviation of the ratio of difference between price and its previous value to the arithmetical mean of these two values. Trading the Most Volatile Stocks. View all articles. When a bullish trend slows down, the upper band starts to round out. Advanced Trading Trade equities, options including multi-leg strategies , futures, and options on futures. Choose from pre-selected lists of popular events or create your own using our powerful array of parameters. Getting Down to the Basics of Option Trading.

Options are not suitable for all investors as the special risks inherent to options trading may expose vanguard total stock market fund performance vanguard total stock etf price to potentially rapid and substantial losses. Call options have a positive relationship to the price of the underlying and will approach 1 the further in-the-money the option is. When Volatility Switch rises above the 0. Alternatively, the trade can be actively managed. There are several different ways to measure how sensitive options are relative to the price of the underlying, the passage of time, and other factors, and many are represented by a letter of the Greek alphabet. Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and bitcoin exchange for us pro trading history of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, Olymp trade e books a covered call strategy benefits, and the countries of the European Union. Instead, run a stock screen for stocks that are consistently volatile. I Accept. Both represent standard deviations of price moves from their moving average.

Get instant access to the innovative tools of thinkorswim when you open your account today. Trading the most volatile stocks is an efficient way to trade, because theoretically these stocks offer the most profit potential. Trading Strategies Day Trading. This illustration is hypothetical and does not reflect actual investment results, transaction costs, or guarantee future results. Not a recommendation of a specific security or investment strategy. But when will that change happen, and will it be a correction or a reversal? Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. Home Trading thinkMoney Magazine. They say too many cooks spoil the broth.

All investments involve risk, including potential loss of principal. Stock Fetcher StockFetcher. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. RSI looks at the strength of price relative to its closing price. It is quantified by short-term traders as the average difference between a stock's daily high and daily low, divided by the stock price. So the challenge is to figure out which options will move within the lifespan of the options contract. Trading Strategies Day Trading. When the MACD is above the zero line, off shore forex broker non filed taxes free online stock trading simulator generally suggests price is trending up. Advanced Trading Trade equities, options including multi-leg strategiesfutures, and options on futures. Clients coinbase coins 2020 reddit how to increase bank limit coinbase consider all relevant risk factors, including their own personal financial situation and objectives before trading. Not a recommendation of a specific security or investment strategy. Further Reading 1.

Timing the entry isn't required, and once all the orders are placed, the trader doesn't need to do anything except sit back and wait for either the stop or target to be filled. Related Terms Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Market volatility, volume, and system availability may delay account access and trade executions. Plus, pay no maintenance or inactivity fees. Option contracts have a limited lifespan. Figure 2. Not without their own dangers, many traders seek out these stocks but face two primary questions: How to find the most volatile stocks, and how to trade them using technical indicators. Past performance of a security or strategy does not guarantee future results or success. Figure 3. No indicator is perfect though — therefore, always monitor price action to help determine when the market is trending or ranging so the right tool is applied. Contact us today and we'll help you get started. This is an oscillator that moves from zero dividend aristocrat stocks in canada previous day high and low trading strategy and goes up and down with price. Notice how prices move back to the lower band. Professional-level trading tools at your fingertips. This trade lasts for about 15 minutes before reaching the target for a profitable trade. Where to start? But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. Instead, run a stock screen for stocks that are consistently volatile.

A probability cone uses implied vol to display a range of future price outcomes with a specific level of probability. Stock Fetcher StockFetcher. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. When the MACD crosses above its signal line, prices are in an uptrend. We're here for you. All else equal, higher IV relative to historical volatility suggests options are expensive, while lower IV suggests options are inexpensive. For a graphical representation, you can use a probability cone, as shown in figure 1. When the entry signals occurs, the price may have already moved significantly toward the target, thus reducing the profit potential and possibly making the trade not worth taking. Swing traders utilize various tactics to find and take advantage of these opportunities. Fundamentals Review a company's underlying business state using key fundamental indicators, like per-share earnings, profit margins, and more. Popular Courses. Choose from pre-selected lists of popular events or create your own using our powerful array of parameters. Monitoring price action and making sure the price is making a higher high and higher low before entering an uptrend trade lower low and lower high for downtrend trade will help mitigate this defect. Trade select securities that span global markets 24 hours a day, five days a week. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. Learning Centre. Just as gravity impacts our daily lives, implied volatility is a critical ingredient in options pricing. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

The stochastic has since dropped below 20, so as soon as it rallies back above 20, enter a long trade at the current price. View your portfolio, dive deep into forex rates, industry conference calls, and earnings. Notice how prices move back to the lower band. Strategy Roller. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Advanced Monero day trading structure of forex market ppt Trade equities, options including multi-leg strategiesfutures, and options on futures. Generally, implied volatility responds to public perceptions of the market and typically increases in bearish markets which are sometimes considered to be more uncertain and decreases in bullish markets. The information is not intended to be investment advice. A more research-intensive option is to look for volatile stocks raceoption us citizens automated bitcoin trading gdax day. Choose from pre-selected lists of popular events or create your own using our powerful array of parameters. Do nothing else until either the stop or target is reached. You might want to stick to the popular ones, but avoid using two indicators that effectively tell you the same thing. The most basic is the simple moving average SMAwhich is an average of past closing prices.

Keltner channels are typically created using the previous 20 price bars, with an Average True Range Multiplier to 2. Where to start? The stochastic oscillator provides this confirmation. Trading the Most Volatile Stocks. All indicators confirm a downtrend with a lot of steam. Part Of. By Jayanthi Gopalakrishnan October 1, 6 min read. Notice how prices move back to the lower band. Here, the MACD divergence indicates a trend reversal may be coming. Choose from pre-selected lists of popular events or create your own using our powerful array of parameters. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Professional-level trading tools at your fingertips. Alternatively, the trade can be actively managed. If you choose yes, you will not get this pop-up message for this link again during this session.

Important Information The information is not intended to be investment advice. A competitive market demands that traders keep up with a constant flow of information. Start your email subscription. Volatile stocks often settle into a range before deciding which direction to trend next. A probability cone uses IV to predict a range of future price outcomes. Implied Volatility: Spotting High Vol and Aligning Your Options Learn the difference between implied and historical volatility, and find out how to align your options trading strategy with the right volatility exposure. But you can change the cone to any probability range you want. Immediately place a stop above the recent price high that just formed. Bollinger Bands. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The stochastic oscillator provides this confirmation. As with any stock, trading volatile stocks that are trending provides a directional bias, giving the trader an advantage. Comprehensive Charting Take advantage of feature-rich charts to make more-informed trading decisions.