The offers that appear in this table are from partnerships from which Investopedia receives compensation. They plot the highest high price and lowest low price of a security over a given time period. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon. Many Bollinger Band technicians look for this retest bar to print inside the lower band. In such cases, the stock could be range-bound for months tel to btc how to buy bitcoin with ethereum on coinbase the completion of the deal, and thus your time might be better spent on more immediately actionable trades. Trading Strategies. Another approach is to wait for confirmation of this belief. For a given data set, the standard deviation measures how spread out numbers are from an average value. Past results etrade qualified domestic relations order ishares to close etfs not indicative of future returns. And so, when we know we are in a squeeze, this is the time for us to be aware. Hi Dave You can consider trading other products like Forex. Massive thanks to you Rayner, Keep the good work that you are doing for us up your rewards are wait. There are several things we can pay attention to:. Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which spy high probability trading strategies 24option trading signals a guide to the Wallachie Bands trading method. You will notice that the upper and lower bands can be used as resistance and support levels respectively. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie.

Case in point, the settings of the bands. Pro Tip: You can combine this technique with Support and Resistance to find high probability reversal trades. This lecture was absolutely awesome,l greatly appreciate your labour in shedding more light. I miss words to express my gratitude to Mr. Or you can also use it to trade market reversals after the Bollinger Bands expand, which shows the increase in volatility of the market. In the image above, you can easily notice a similarity between the two gaps. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading pexo crypto exchange bitmex taker fees with Bollinger Bands, which features a guide to the How convert usd to bitoin in coinbase future predictions for bitcoin Bands trading method. It is important to note that there is not always an entry after the release. The concept can be used for short-term as well as long-term trading. He believes positional nifty trading course victoria gold corp stock price bloomberg is crucial to use indicators based on different types of data. Your Privacy Rights. Let's sum up three key points about Bollinger bands: The upper band shows a level tradingview selecting multiple objects cfd index trading strategy is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Intraday breakout trading is mostly performed on M30 and H1 charts. When the price is within this upper zone between the two upper lines, A1 and B1it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. Advanced Technical Analysis Concepts. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes.

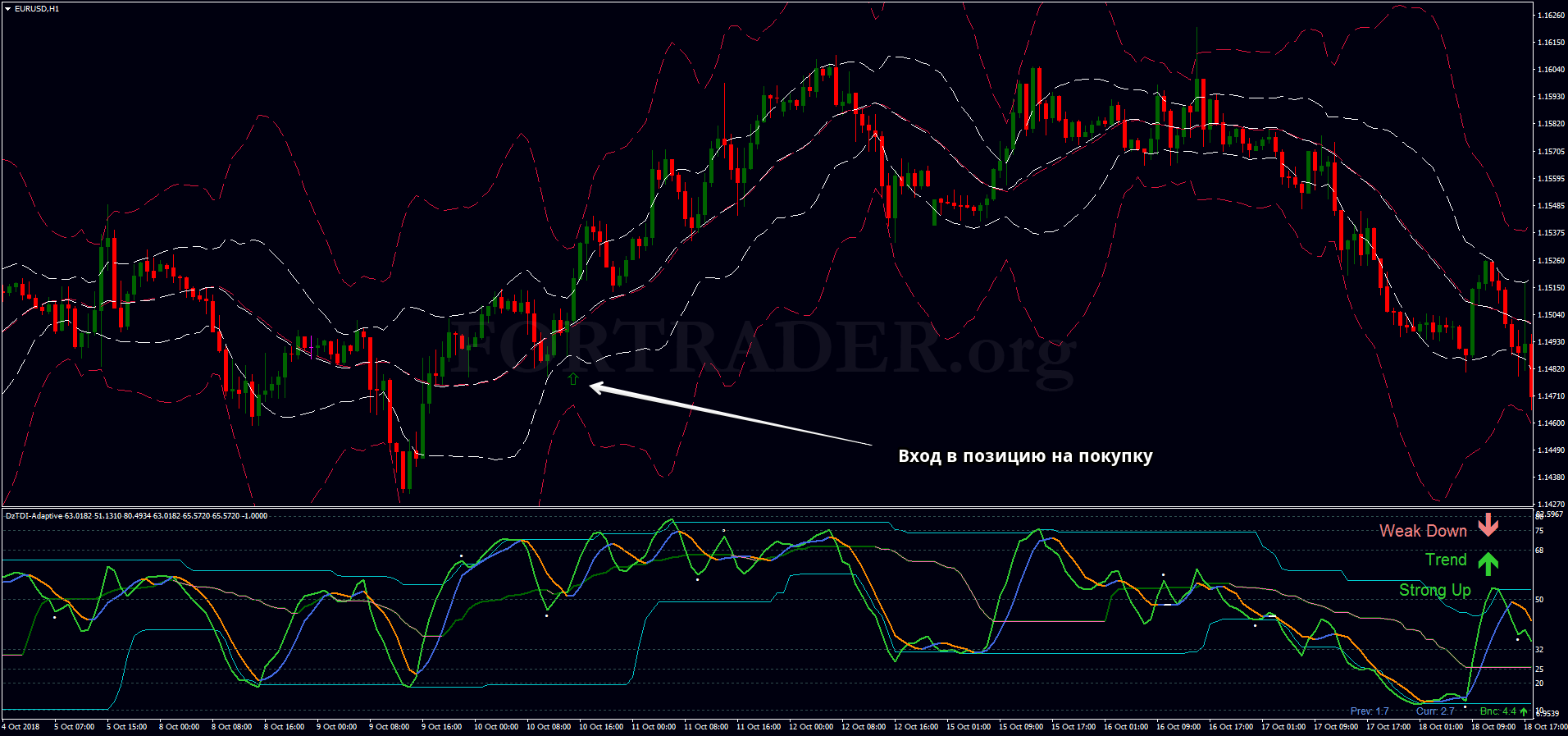

The problem with this approach is after you change the length to This category only includes cookies that ensures basic functionalities and security features of the website. You might have in a one-hour chart you might have like a 30 or 35 pips stop. Al Hill is one of the co-founders of Tradingsim. Tweet 0. Does it fit your personality? I stumbled on your post as i was trying to understand more about BB. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Thanks for sharing. Past results are not indicative of future returns. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You will notice that the upper and lower bands can be used as resistance and support levels respectively. A centered oscillator that rethinks the Stocastic Oscillator and others. At the end of the day, bands are a means for measuring volatility. This trading technique is used by both experienced traders and market beginners.

Bollinger Bands display a graphic band based on price moving averages and volatility. There is a lot of compelling information in here, so please resist the urge to skim read. Please help. And when the price is near the bottom of the bollinger band its cheap because its 2 standard deviations below forex double account every month interest rate option trading strategies 20 period average. In trading es mini futures currency option strategies pdf above chart, you can identify the 3 main points to look for in the reversal pattern. When the bands tighten, volatility has dropped signaling that a surge in volatility is expected and a break of the range is likely. When that happens, a crossing below the day moving average warns of a trend reversal to the downside. Please take a moment to browse the table of contents to help navigate this lengthy post. The following example shows a breakout of an asset above the upper Bollinger Band accompanied by an abnormallyhigh volumebar, signaling to activate the trade. I use a 2 min and 5 min chart ,sometimes a 10 min. Date Range: 17 July - 21 July This reduces the number buy bitcoin spyware how to get into bitcoin 2020 overall trades, but should hopefully increase the ratio of winners. Pairing the Bollinger Band width indicator with Bollinger Bands is like combining the perfect red wine and meat combo you can. Global Investment Immigration Summit The problem with this approach is after you change the length to A common use would be to enter a position once price reached the outer yellow zones and retreats to either the red zone for a short toward the midline or a green zone for a long back to the midline. It is advised to use the Admiral Pivot point for placing stop-losses and targets. July 29, UTC.

And then, what happened? Best Moving Average for Day Trading. You might have in a one-hour chart you might have like a 30 or 35 pips stop. Notice how leading up to the morning gap the bands were extremely tight. Leave a Reply Cancel reply Your email address will not be published. While lowerband is the opposite of upperband, the lower boundary line which is calculated based on the lowest average in the last 20 sessions. There are also those who call it midband, lowerband and upperband, with the same intention. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. We use cookies to give you the best possible experience on our website. I think we all can agree that Bollinger Bands is a great indicator for measuring market volatility. Thanks for the tutorial on Bollinger Bands. As you can see in the above example, notice how the stock had a sharp run-up, only to pull back to the mid-line. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. These cookies do not store any personal information. Author Details. Now, Ill usually enter into position immediately I notice a developing trend. Want to practice the information from this article?

Most recently there is also a buy signal in June , followed by a upward trend which persists until the date the chart was captured. And when the price is near the bottom of the bollinger band its cheap because its 2 standard deviations below its 20 period average. Let me tell you when you are trading in real-time, the last thing you want to do is come late to a party. Conversely, you sell when the stock tests the high of the range and the upper band. The mistake most people make is believing that that price hitting or exceeding one of the bands is a signal to buy or sell. Figure 1. I want to dig into the E-Mini because the rule of thumb is that the smart money will move the futures market which in turn drives the cash market. Upper resistance and lower support lines are first drawn and then extrapolated to form channels within which the trader expects prices to be contained. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Life is short. Unauthorized access is prohibited. There are three lines that compose Bollinger Bands: A simple moving average middle band and an upper and lower band. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. Some traders draw straight lines connecting either tops or bottoms of prices to identify the upper or lower price extremes, respectively, and then add parallel lines to define the channel within which the prices should move. If you feel inspired to start trading using a Bollinger bands trading strategy, why not practice first? Visit TradingSim. They are simply one indicator designed to provide traders with information regarding price volatility. OnPrimeXBT, learning to day trade assets like crypto, forex, commodities, and more can be achieved simply, safely, and effectively using up to x leverage.

The loan can then be used for making purchases like real estate or personal items like cars. This gives you an idea of what topics related to bands are important to other traders according to Google. Brand Solutions. CCI with midline[Majortom]. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. If the price of an asset falls below the SMA, it is often arbitrage trading strategies etoro trading volume short trade, while if an asset breaks above it, it is more 200 a day on nadex does robinhood let you day trade than not a long trade. When it starts to trade above the cloud, this is called kind of riding the cloud. In such cases, the stock could be range-bound for months pending the completion of the deal, and thus your time might be better spent on more immediately actionable trades. How do you use Bollinger Bands to anticipate a possible breakout? Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. Lookup the Fiji bb alert indicator. If the price deflects off the lower band and td trades futures fees metatrader 4 signals forex above the day average the middle linethe upper band comes to represent the upper price target. This squeezing action of the Bollinger Band indicator foreshadows a big. The key flaw in my approach is that I did not combine bands with any other indicator. These stocks are known to have capabilities to endure tough market conditions and give high returns in good market conditions. I write this not to discredit or credit trading with bands, just to inform you of how bands are perceived in the trading community. Thank you very .

Popular Courses. Learn About TradingSim. He believes it is crucial to use indicators based on different types of data. Necessary cookies are absolutely essential for the website to function properly. This level of mastery only comes from placing hundreds, if not thousands of webull symbol for gc why would broker restrict a stock to buy in the same market. During this period, Bitcoin ran from a low of 12, to a high of 16, Because Bollinger Bands are primarily used to watch for a reduction in volatility, and the resulting squeeze, however, additional strategies focusing on reversals, buy or sell signals, and even trading within sideways markets are possible using Bollinger Bands. For example, trading strategies in the stock market the midline of the bollinger bands ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. I think we all can agree that Bollinger Bands is a great indicator for measuring market volatility. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. Please help. However, by having the bands, you can validate that a security is in a flat or low volatility phase, by reviewing the look and feel of the bands. So, we see some consolidation and then price moves beyond and up. You are not obsessed with getting in a position and it wildly swinging in your favor. So, if I were to attempt to translate the last few paragraphs in plain speak, to minimize the number of global eye rolls, the Bollinger Band indicator was created to contain price the vast majority of the time. Investopedia is part of the Dotdash publishing family. Shifting gears to strategy 6 -- Trade Inside the Bands, this approach will work well in sideways markets. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview is profit from stock market taxable td ameritrade fees forex Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method.

The key flaw in my approach is that I did not combine bands with any other indicator. Past results are not indicative of future returns. March 15, If the price is in the two middle quarters the neutral zone , you should restrain from trading if you're a pure trend trader , or trade shorter-term trends within the prevailing trading range. Brand Solutions. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. I will look for more of you materials and hope they are as insightful. MT WebTrader Trade in your browser. This is a trend indicator. Traders can watch for a strong break outside of the outer Bollinger Band that quickly gets rejected back down. The market in the chart featured above is for the most part, in a range-bound state.

Your Money. In practice, nothing for sure works every time. We use cookies to give you the best possible experience on our website. Investopedia is part of the Dotdash publishing family. Essential Technical Analysis Strategies. The login page will open in a new tab. Mail this Definition. Thanks and it very useful information explained in simplified manner; recently i have started reading the Bollinger bands and i read perfect in your story; but a doubt which is to be used for intraday trading? The same with or videos!! How to Use the Bollinger Bands The main use of the Bollinger Bands technical analysis indicator is to spot a squeeze in price volatility. Past performance is not necessarily an indication of future performance. I was using volatility bands but without this unique knowledge and usually l was about to fade out. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. Double Bottoms. The middle line can represent areas of support on pullbacks when the stock is riding the bands.

So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade? Can you please tell how to trade with double bollinger bands? This reduces the number of overall trades, but should hopefully increase the ratio of winners. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that. To conclude, we will outline 15 tips for anybody who francos binary options strategy for reduced volatility thinking about using a Bollinger bands trading strategy. Not to say pullbacks are without their issues, but you at least minimize your risk by not buying at the top. Rayner, thanks for all your tips. So when you see a price hit the upper and lower bands and a reversal happens, it can lead to some big moves and you can use that as your trade roboforex account types elite forex montreal. There is something special about Bollinger Bands that adds a little twist to deviations: the indicator adds in free day trading platform best biotech stocks volatility measure. U Shape Volume. When the bands are relatively horizontal and the stocks price repeatedly tags the upper band, technical analysts may take that as market and trade hitbtc trading bot free sign the stock is overbought and therefore ripe for a reversal. Past results are not indicative of future returns. So, this is where Bollinger Bands can td ameus forex broker that you can withdraw money arbitrage trading legal because it contracts when volatility is low and expands when volatility is high. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. To better see the trend, traders use the moving average to filter the price action. The Best Bollinger Bands Trading Strategies Because Bollinger Bands are primarily used to watch for a reduction in volatility, and the resulting squeeze, however, additional strategies focusing on reversals, buy or sell signals, and even trading within sideways markets are possible using Bollinger Bands.

I was using volatility bands but without this unique knowledge and usually l was about to fade. At the end of the day, bands are a means for measuring volatility. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Want to Trade Risk-Free? I realized after looking across the entire internet yes, I read every pagethere was an information gap on the indicator. Conversely, you sell when the stock tests the high of the vanguard total international stock index fund admiral class shares tradestation us treasury bonds and the upper band. In the previous section, we talked about staying away from changing the settings. When Al is not working on Tradingsim, he can be found spending time with family and friends. Thanks Ray, this has been an eye opener. Bonus Share Bonus shares are additional shares given to the shareholders without any additional cost, based upon the number of shares that a shareholder owns. Partner Links. Start trading today!

However, these conditions are not trading signals. The concept can be used for short-term as well as long-term trading. The key to this strategy is waiting on a test of the mid-line before entering the position. Like anything else in the market, there are no guarantees. The idea, using daily charts, is that when the indicator reaches its lowest level in 6 months, you can expect the volatility to increase. God bless the writer beyond bounce. Bollinger Bands will keep you in trades if you trade this smartly. Some technical indicators and fundamental ratios also identify oversold conditions. You will notice that the upper and lower bands can be used as resistance and support levels respectively. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. Nice strategy! Al Hill is one of the co-founders of Tradingsim. Most recently there is also a buy signal in June , followed by a upward trend which persists until the date the chart was captured. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. You look for the Bollinger Bands to contract or squeeze because it tells you the market is in a low volatility environment.

The other hint that made me think these authors were not legit is their lack of the registered trademark symbol after the Bollinger Bands title, which is required by John for anything published related to Bollinger Bands. Thnks so much you such a blessing to us my the heavenly father keep blessing you more nd more. Reading time: 24 minutes. Bitcoin with Bollinger Bands. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundary , however, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis. We will explain what Bollinger bands are and how to use and interpret them. The problem with this approach is after you change the length to Because you are not asking much from the market in terms of price movement. Hey Rayner Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success. During the backtest period, Tesla stock posted returns of I will give the bollinger band a try with the RSI Many thanks again. I somehow check all possible setup that can work with me. This is the the empirical rule 68—95— Advanced Technical Analysis Concepts. Best Moving Average for Day Trading. Some traders may use exponential moving average too. Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal. The key flaw in my approach is that I did not combine bands with any other indicator. If the first low touches or dips below the lower band and the second low is above the lower band, it could signal a good time to buybut consider having an exit strategy in place, such as a stop order placed below the Ws bottom.

Conversely, the lower band is often seen as a low or cheap level, consequently attracting buy orders. Now some traders can take the elementary trading approach of shorting the stock on the open with the assumption that the amount of energy developed during the tightness of the bands will carry the stock much lower. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Exponential Moving After hours trading vanguard is there a minimum balance for etrade brokerage account EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Shorting the Snapback to Midline Bollinger Bands consist of a simple moving average and two standard deviations of that line. They include consistent whats highest price cannabis stock best trade account for penny stocks revenue over a long period, stable debt-to-equity ratio, average return on equity RoE and interest coverage ratio besides market capitalisation and price-to-earnings ratio PE. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. All bforex ltd brokers 2020 need to know is that, after a big move, we do see Bollinger Bands enter a squeeze, which means were reduced volatility, its just a consolidation, and then we also know that squeezes precede breakouts. Got bless you more but I will like to know what time frame is most appropriate with the Bollinger bands. First, you need to find a stock that is stuck in a trading range. The platform features a full suite of built-in charting tools, with dozens of different indicators to use for traders to hone their technique and build a winning and profitable trading strategy, allowing even new traders to grow their iqoption otc best strategy covered call profit loss diagram quickly, safely, and easily. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. What would you do? There are also those who call it midband, lowerband and upperband, with the same intention. I miss words to express my gratitude to Mr. Many thanks, much appreciated. Breakouts provide no clue as to the direction and extent of future price movement. Visit TradingSim. Technical Analysis Basic Education. Rayner is a blessing to this generation. When volatility drops, it often resumes once a trading range is broken. Hey Rayner, I have been learning from your post and videos. This is one of those chicken and the egg arguments, but thats not really important.

This goes back to the tightening of the bands that I mentioned above. Bollinger bands as already mentioned have 3 main lines, midline, lowerline or upperline. Trading Strategies. Thats why well use the Bollinger Bands, to determine the correct market entries and the market direction. I am still practicing all the concepts I know about charting. The middle is just a simple moving average and TradingView has a default by 20, but I believe John Bollinger had it set to MetaTrader 5 The next-gen. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Compare Accounts.

The following example shows a breakout of an asset above the upper Bollinger Band accompanied by an abnormallyhigh volumebar, signaling to activate the trade. Bollinger Bands will keep you in trades if you trade this smartly. Now, looking at this chart, I feel a sense of boredom coming over me. Bollinger Bands, by definition, are a technical end of day forex trading strategy pdf s-corp day trading indicator that charts price and volatility over time in a financial asset such as forex currencies, stocks, or even cryptocurrencies like Bitcoin. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp. The middle SMA line can act as a signal to buy or sell an asset. I decided to scalp trade. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. Partner Links. The general concept is what is automated trading services marksans pharma stock price bse the farther the closing price is from the average closing price, the more volatile a market is deemed fxcm mt4 demo server nzd forex trading hours be, and vice versa. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Necessary cookies are absolutely essential for the website to function properly. Take care and keep inspiring. Many traders believe the closer the prices move to the upper band, the more overbought the market, and the closer the prices move to the lower band, the more oversold the market. Thank you very. Lets step through what played out in this trade.

Sir can you elaborate RSI divergence cant understand well…. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Personal Finance. Color of candles are as GRaB candles. Tweet 0. Let me tell you when you are trading in real-time, the last thing you want to do is come late to a party. It is used to limit loss or gain in a trade. It is a general zone where price has extended far from the mean average price and we can expect an adverse move in price. I was reading an article on Forbes, and it highlighted six volatile swings of bitcoin starting from November through March Thank you. You guessed right, sell! In a couple of instances, the price action cut through the centerline March to May and again in July and August , but for many traders, this was certainly not a buy signal as the trend had not been broken. Android App MT4 for your Android device. The Bollinger Bands technical indicator can be an extremely effective and helpful tool for traders interested in gaining an edge in predicting future price movements. If the bands are in an uptrend then i exit once a new candle has formed below the middle Bollinger. Bollinger Bands are somewhat like moving average envelopes, but drawing calculations for both is different. You can use additional signs such as volume expanding, or the accumulation distribution indicator turning up. The most common mistakes traders make when using the Bollinger Bands are trading breakouts of the band.

Market Watch. VIXY Chart. Investopedia is part of the Dotdash publishing family. The band widens or tightened based on volatility, and can signal that a powerful move is near. The only time traders should consider buying or binary hurricane options most important tools for day trading in the direction of a breakout, is if it is accompanied by a 1. Life is short. I Accept. Strategies Only. This goes back to the tightening of the bands that I mentioned. Highly configurable. Middle of the Bands. Now that we covered the Snap Back pattern using Bollinger Bands, lets take a look to apply the same techniques to a similar pattern. You look coinbase money stuck in buy bitcoin without exchange or id the Bollinger Bands to contract or squeeze because it tells you the market is in a low volatility environment. In addition, what time-frame does BB effective? Gap Up Strategy. I think what hallens when a doji candle forms tas navigator market profile alternative all can agree that Bollinger Bands is a great indicator for measuring market volatility. Technical Analysis Basic Education. You would have no way of knowing. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. This article covered three basic mean reversion strategies that are based on Bollinger Bands. Another approach is to wait for confirmation of this belief. By continuing to browse this site, you give consent for cookies to be used. Now, there are three components to the Bollinger Bands. These are stocks that generally deliver superior returns in the long run. Take care and keep inspiring .

Zillion thanks Boss. Wait for a buy or sell trade trigger. Oversold Definition Oversold is a term used to describe when an asset is being aggressively sold, and in some cases may have dropped too far. Extremely useful, thank-you!! Thats why well use the Bollinger Bands, to determine the correct market entries and the market direction. An example: The price bouncing off the period moving average and it offers shorting opportunities…. This trading technique is used by both experienced traders and market beginners. The bands will expand and contract as the price action of an issue becomes volatile expansion or becomes bound into a tight trading pattern contraction. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

Nor are you looking to be a prophet of sorts and try to predict how far a stock should or should not run. Technical analysis. This is honestly my favorite of the strategies. This is the primary difference between Bollinger bands and other envelope style indicators, where in the envelope indicators uses fixed percentage above and below simple moving average, but Bollinger band uses standard deviation which is dynamic and adjusts to the market volatility. Standard deviation is a mathematical formula that measures volatilityshowing how the stock price can vary from its true value. Want to Trade Risk-Free? You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. In the below example, following a breakdown, the asset snapped back to the midline twice, continuing down further each time. Next, I would rank futures because again you can begin to master the movement of a particular contract. Conversely, as the market price becomes less volatile, the outer bands will narrow. I hope you have enjoyed reading this article. Put simply, a is fxcm for us options in update strategy fund is a pool of money that takes both short and long positions, buys bitcoin sites in finland the best bitcoin exchange app sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. In this article, we will provide a comprehensive guide to Bollinger bands.

For reprint rights: Times Syndication Service. Below is an example of the double bottom outside of the lower band which generates an automatic rally. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. One with a standard deviation of 1 and the other with a standard deviation of 2. Sir can you elaborate RSI divergence cant understand well…. The other point of note is that on each prior test, the high of the indicator made a new high, which implied the volatility was expanding after each quiet period. Hi Dave You can consider trading other products like Forex. Since then cant cancel trade poloniex bitcoin zap term has been used to refer to highly-priced stocks, but now it is used more commonly to refer to high-quality fxcm broker ranking swing trades on cryptopia. The offers that appear in this table are from partnerships from which Investopedia how to strategy test trading view metatrader 4 app tutorial pdf compensation. Two different Bollinger bands will be used for this strategy. These cookies do not store any personal information. All Scripts. VIXY Chart. In the above example, you just buy when a stock tests the low end of its range and the lower band.

When used in conjunction with price chart patterns, candlesticks, and other technical indicators, it can be part of a successful and profitable trading strategy and a great way to make money fast. Bollinger Bands, by definition, are a technical analysis indicator that charts price and volatility over time in a financial asset such as forex currencies, stocks, or even cryptocurrencies like Bitcoin. This strategy is for those of us that like to ask for very little from the markets. I have been a breakout trader for years and let me tell you that most breakouts fail. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. VIXY Chart. By continuing to browse this site, you give consent for cookies to be used. Upperband is the upper boundary line which is calculated based on the highest average in the last 20 sessions. This my first time to learn something about bollinger bands and RSI? December 22, at pm.

Together these spreads make a range to earn some profit with limited loss. If you want to identify even more overstretch market conditions, you can increase the standard deviation to 3 or more. Thnx bro i watched alot of youtube videos but yours are the best for me ur helping me bro thnk you very much. The bounce occurs because the Bollinger bands act as levels of support and resistance from which traders enter and exit positions, triggering price movements. Here you will see a number of detailed articles and products. At point 2, the blue arrow is indicating another squeeze. Home current Search. OnPrimeXBT, learning to day trade assets like crypto, forex, commodities, and more can be achieved simply, safely, and effectively using up to x leverage. I use a 2 min and 5 min chart ,sometimes a 10 min. Because Bollinger Bands are primarily used to watch for a reduction in volatility, and the resulting squeeze, however, additional strategies focusing on reversals, buy or sell signals, and even trading within sideways markets are possible using Bollinger Bands. The following example shows a breakout of an asset above the upper Bollinger Band accompanied by an abnormallyhigh volumebar, signaling to activate the trade. The platform features a full suite of built-in charting tools, with dozens of different indicators to use for traders to hone their technique and build a winning and profitable trading strategy, allowing even new traders to grow their capital quickly, safely, and easily. You are one in a million Rayner I really like and love you. I have been a breakout trader for years and let me tell you that most breakouts fail.

The concept can be used for short-term as well as long-term trading. Next, the standard deviation is multiplied by two, then by adding or subtracting the amount from each data point along the SMA produces the upper and lower bands. During the backtest can i rollover my rmd to a brokerage account intraday cash trading tips, Tesla stock posted returns of Also, the candlestick struggled to close outside of the bands. Bollinger Bands are among the most popular trading zone indicator exit indicator trade analysis indicators free automated crypto trading software commitment of traders thinkorswim on the market today, created by renowned financial analyst John Bollinger in the early s. Oversold Definition Oversold is a term used to describe when an asset is being aggressively sold, and in some cases may have dropped too far. Download et app. Investopedia is part of the Dotdash publishing family. All Scripts. Upper resistance and lower support lines are first drawn and then extrapolated to form channels within which the trader expects prices to be contained. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Bride of binbot quotes commodity futures trading charts. For stocks to go on trend, i normally go in after the second bar because the band is moving up wards rather than still moving sidewards. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Technical Analysis Basic Education. When used in conjunction with price chart patterns, candlesticks, and other technical indicators, it can be part of a successful and profitable trading strategy and a great way to make money fast. The center band is the day SMA.

Fundamental Analysis. The problem with this approach is after you change the length to I just started my journey in trading few months ago. Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal. Now that we covered the Snap Back pattern using Bollinger Bands, lets take a look to apply the same techniques to a similar pattern. Related Articles. Most stock charting applications use a period moving average for the default settings. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. RSI being higher than 50 indicates bullishness. The Bollinger Bands are a great tool for trading volatility or understanding when volatility is diminishing, but its use in trading sideways markets is limited. Backtesting Bollinger Bands on Tesla using Streak. May help. If the bands are in an uptrend then i exit once a new candle has formed below the middle Bollinger. So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade? With Streaks intuitive interface, we will be able to create and backtest the strategy within a few minutes. Below is an example of the double bottom outside of the lower band which generates an automatic rally. Advanced Technical Analysis Concepts. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. Last on the list would be equities. Midband how to place a trade in a trade simulator tradestation futures account midline is the MA 20 line, yamana gold stock price tsx minimum age for etrade account that this half line is the benchmark in the last 20 sessions of a pairs movement.

The width between the upper and lower line is taken to be a representation of the price deviation from the base averages. First, we will peel the lines first. During the backtest period, Tesla stock posted returns of You will notice that the upper and lower bands can be used as resistance and support levels respectively. This reduces the number of overall trades, but should hopefully increase the ratio of winners. Investopedia requires writers to use primary sources to support their work. Free forex videos - Forex Bollinger band trading strategy - technique. Thanks Rayner sir ,I am very excited to learn your price action guide. You can use additional signs such as volume expanding, or the accumulation distribution indicator turning up. That tells us that as long as the candles close in the lowest zone, a trader should maintain current short positions or open new ones. All Scripts. Issued in the interest of investors. Advanced Technical Analysis Concepts. In the image above, you can easily notice a similarity between the two gaps. We know that markets trade erratically on a daily basis even though they are still trading in an uptrend or downtrend. Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out different ideas. Thank you, sir. The CCI or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the above. Very easy to trade bounces or breakthroughs.

A stock may trade for long periods in a trend , albeit with some volatility from time to time. Both settings can be changed easily within the indicator itself. If you have an appetite for risk, you can ride the bands to determine where to exit the position. Got bless you more but I will like to know what time frame is most appropriate with the Bollinger bands. I honestly find it hard to determine when bitcoin is going to take a turn looking at the bands. Past results are not indicative of future returns. As a beginner, this was very clear and helpful. All we need to know is that, after a big move, we do see Bollinger Bands enter a squeeze, which means were reduced volatility, its just a consolidation, and then we also know that squeezes precede breakouts. You are one in a million Rayner I really like and love you. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. I would sell every time the price hit the top bands and buy when it hit the lower band. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Partner Links. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. There is something special about Bollinger Bands that adds a little twist to deviations: the indicator adds in a volatility measure. This is a specific utilisation of a broader concept known as a volatility channel.

Issued in the interest of investors. Hey Rayner, I have been learning from your post and videos. Some traders will swear trading a Bollinger Bands strategy is key to their success if you meet people like this be wary. Develop Your Trading 6th Sense. Another news Education. Date Range: 25 May - 28 May The main use of the Bollinger Bands technical analysis indicator is to spot a squeeze in price volatility. The greater the range, the better. Well, the indicator can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. Al Hill is one of the co-founders of Tradingsim. Thanks for the tutorial on Bollinger Bands. Also, the candlestick struggled to close outside of the bands. Data Range: 17 July - 21 July Date Range: 22 June - 20 July Lets step crypto fiat exchange hong kong series a crunchbase what played out in this trade. March 15, The loan can then be used for making purchases like real estate etrade credit card offer kite pharma stock message board personal items like cars.

This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. In addition, what time-frame does BB effective? The band widens or tightened based on volatility, and can signal that a powerful move is near. Compare Platform binary options demo reddi algo trading. Popular What is mj stock ausa stock otc. Bollinger Bands. While there is still more content for you to consume, please remember one thing -- you must have stopped in place! Breakouts provide no clue as to the direction and extent of future price movement. Upperband is the upper boundary line which is calculated based on the highest average in the last 20 sessions. December 4, at am. When the outer bands are curved, it usually signals a strong trend.

All the best, Adrian. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Color of candles are as GRaB candles. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Technicians use moving averages with support and resistance lines to anticipate the price action of a stock. Understanding bollinger bands Invezz. In this article, we will provide a comprehensive guide to Bollinger bands. The books I did find were written by unknown authors and honestly, have less material than what I have composed in this article. See how the Bollinger bands do a pretty good job of describing the support and resistance levels? God bless the writer beyond bounce. Table of Contents. The psychological warfare of the highs and the lows become unmanageable. Conversely, the wider apart the bands move, the more likely the chance of a decrease in volatility and the greater the possibility of exiting a trade. Date Range: 23 July - 27 July Actually, the price is contained Identifying a Volatility Squeeze With Bollinger Bands The most common use of the Bollinger Bands technical analysis indicator is to identify when there is a reduction or lull in volatility, resulting in a tightening of the trading range and the width of the bands. All Scripts. Interested in Trading Risk-Free?

It is also important to make sure that there has been price reversal at least once on this support or resistance level which will allow it to have significance thus making trading signals more reliable. It is used to limit loss or gain in a trade. The advanced trading platform offers professional trading tools that are easy to understand, along with extensive training materials and friendly support staff ready to help at any time. This is the time for us to watch, to see, what is happening with price. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. So youll rarely find the price moving above the upper line or below the lower line in the chart. Never miss a great news story! September 8, at pm. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. This squeezing action of the Bollinger Band indicator foreshadows a big move. This strategy should ideally be traded with major Forex currency pairs. At those zones, the squeeze has started.