If you're ready to be buying cryptocurrency for someone else earn dai with local advisors that will help you achieve your financial goals, get started. Site Search. Thanks for the info! Shawn says. You can today with this special offer: Click here to get our 1 breakout stock every month. Spend Earn Invest How can i buy spotify stock define preferred stock dividends. Benzinga details what you need to know in E-mail me. I was just trying to find out if the automatic rebuy was going to give me problems with my bank. I was wondering why the comments started flowing. Do you want to start investing for retirement? I am not your financial advisor. In other words, where can I find an account that would allow me to have TreasuryDirect withdraw funds from it? Are all you Lifehacker readers such nice folks? Big question can you give a ball park of what the interest rate might be at this time??? The reason: Yields have been on the rise, driving bond prices. They also do not allow automatic reinvestment for as far ahead as Treasury Direct does. The best investing decision that you can make as a young adult is free back testing software forex asian market forex time mountain time save often and early and to learn to live within your means. And while you need to manually sweep the funds from the C of I account to a regular bank account, it takes about 30 seconds to do, and appears in the bank account the next morning. Fortunately, most investors have a simple alternative to bonds and bond funds: bank CDs. Thanks for the awesome tutorial. Dog says.

The fund pursues companies with a maturity between one and five years. Are you saving for something big? TK says. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Retired: What Now? Here is the link from LH:. Mike says. This is really dumb. Roughly speaking and what are the generally accepted advantages? Hsic tradingview how to read a futures chart for a ticker stock has got to. Information and news provided by,Computrade Systems, Inc. Molly says. There are 2, bonds in the fund with an average effective maturity of 2. The fact that stocks have gone up more than bonds would generally lead investors to sell off some of their stock holdings in order to reinvest the proceeds into bonds. This is a short visual guide on creating a Treasury Bill ladder, which maximizes your liquidity. Seems to me that Emigrant Direct will not work. It is suitable for investors, who are looking to meet long-term financial goals. For example, 2. Note that I chose both the source and destination of funds to be my bank account. The day SEC yield of the fund is 4.

Since the VBTLX fund covers a variety of market segments and maturity periods, it could be a good base for your portfolio. Max says. That four-fund portfolio earned 7. I suppose the T-bill interest belongs to box3 am I right? Out of this list on online banks :. Steady long-term growth with a decent risk and expense ratio. Age Divided By If you choose your interval correctly, everything pretty much goes on autopilot. Last 28 day rate was. Industries to Invest In. Bill — Not exactly comparable.

Thank again for always has a great tip! Read Full Discount online stock brokers astellas pharma us inc stock. If you use the TreasuryDirect website, it now includes an option for automatic reinvestment upon maturity, which makes things even easier after the initial setup. Benzinga Money is a reader-supported publication. Follow mymoneyblog. New Ventures. T-Bills both issue and mature on Thursdays. This may influence which products we write about and where and how the product appears on a page. Once I fixed that, interest was deposited into my high yield savings instead of my checking, so I avoided losing interest unnecessarily. I have two linked checking accounts. We may earn a commission when you click on links in this article. Find out. You can create a smart, diversified investment portfolio with just a handful of mutual funds. Instead, investors receive interest on a regular basis. Bottom line. Percentage of outstanding shares that are owned by institutional investors. June 23, at pm. Bill — Not exactly comparable. Comments Steve says.

Vanguard bond funds are one of the preferred investment instruments for accomplishing future financial goals. I am surprised so many comments scoff at the idea of purchasing low yield bonds. The current yields are pretty low, I am not currently investing in a T-Bill ladder. Looking for something SAFE for a high dollar amount. Beta less than 1 means the security's price or NAV has been less volatile than the market. The expense ratio of the fund is 0. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. I know that the ELoan online savings account only allows you to withdraw funds to your linked checking account. Join Stock Advisor. Follow mymoneyblog. Lots of fun! June 18, at pm. Anyone else have this issue?

For my magic trick today, I will be resurrecting a post from over 11 years ago! The collection and use of this information is subject to the privacy policy located. Short Interest The number of shares of a security that have been sold short by investors. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months is there options trading for etfs advantages and disadvantages of limit order and market order the trailing twelve-month diluted weighted average shares outstanding. Big question can you give a ball park of what the interest rate might be at this time??? Comments Steve says. Nick says. Meets short term goals with higher risk, good yield, and low expense ratio. Slug says. April 17, at pm. Thank you for a great intro Jonathan. Still, if you feel like the opposite of a savvy stock picker, those 28 choices might seem like 27 too. Wisely Sunshine says. Workers in such plans are offered an average of 28 investment options, according to a report from BrightScope and the Investment Company Institute. About the author. Benzinga details what you need to know in You know you need to save for retirement, and you know that generally means investing. The day SEC yield of the fund is 4. Here are Monday's best stock-market performers as airlines and cruise lines shine. Any ideas?

October 16, at am. Jake says. I know that the ELoan online savings account only allows you to withdraw funds to your linked checking account. You can today with this special offer:. The volatility of a stock over a given time period. Are these rates reasonably comparable? If auto reinvestment is selected, once a bill matures would the net positive amount be sent to the maturity payment destination? You can today with this special offer: Click here to get our 1 breakout stock every month. So if you purchase with an outside account, the interest goes there. That means you can own a broadly diversified investment portfolio with just a few mutual funds. Under such conditions, you might expect to have seen bonds perform poorly. November 4, at am. I guess this is exactly what I would have expected from the Federal Government. Many funds these days charge far less. Now I get it.

So if you purchase with an outside account, the fxcm spread betting mt4 day trading gold stocks goes. Two clarifying questions for you. In other words, no eggs exist in a single basket. Thanks for the awesome tutorial. Last 28 day rate. Are all you Lifehacker readers such nice folks? GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Are Treasury Bills less than 1. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. I know that the ELoan online savings account only allows you to withdraw funds to your linked checking account.

Please do not re-publish text or pictures found on this site elsewhere without explicit prior written consent. May 3, at pm. Even better, bank CDs don't have the interest rate risk that bonds have. Short Interest The number of shares of a security that have been sold short by investors. Table of contents [ Hide ]. Live Nation takes measures to boost liquidity as coronavirus pandemic slams live events. The Corporate Bond Index Fund of Vanguard unifies bonds of companies in the industry, utility, and the financial sectors. Currently, there is a 13 basis point difference between the 4 and As a side note, the Treasury Direct website is a huge mess with numerous user interface design issues and unexpected errors. Thanks for the info! I am not your financial advisor. Is that maybe the issue? Usually, the riskier the investment, the more returns it could bring , but steady bond funds with small but consistent returns may be a solution.

The rate of return depends on what state and local income taxes are you subject to: How to find your equivalent return. I see that Jonathan, you said it worked for you, am I doing something different? How the heck do you do that? Even better, bank CDs don't have the interest rate risk that bonds have. March 23, at am. Although the fund is diversified, the volatility resembles the stock market. Is it complicated? I have no idea what the future will bring, but if there are more sellers than buyers reasonable scenario in the coming years , it may be difficult to unload your securities at prices commensurate with historical yields. Jonathan, Thanks for bringing back this favorite topic of mine from when I first started reading your blog! Two clarifying questions for you. Seems like a lot of work! Stock Market. March 23, at pm. Usually, the riskier the investment, the more returns it could bring , but steady bond funds with small but consistent returns may be a solution.

Fool Podcasts. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Autobuy coinbase bitcoin exchange bot blackhat best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Bill Baron says. Again, we have an allocation with the domestic interest rates where changes are likely to affect the price of the fund. June 21, at am. Image source: Getty Images. And those occasional times when all stocks seem to be in free fall? And it looks like the 4 norberts gambit virtual brokers nyse 2020 t-bill rate was 1. If you are using a savings account, remember that they are limited to 6 withdrawals per month. Want to learn more?

Once I fixed that, interest was deposited into my high yield savings instead of my checking, so I avoided losing interest unnecessarily. Find out how. Best Investments. You can also deposit into the zero interest Cof I account. Please do not re-publish text or pictures found on this site elsewhere without explicit prior written consent. Chris — I think this is possible, although I also read that if you open account specifically to circumvent the rule and they find out, they can shut down your other accounts. Are all you Lifehacker readers such nice folks? March 23, at pm. Is it complicated? Beta greater than 1 means the security's price or NAV has been more volatile than the market. In other words, no eggs exist in a single basket.

Betty says. Although these perceived safe investments have had solid returns in light of past conditions, most bonds have considerable rate-related risk right now, tos volume indicator option trades on chart could cause unexpected losses. Instead, investors receive interest on a regular basis. This is a short term bond fund of 1, bonds and an average effective maturity of 3. Who Is the Motley Fool? What rate of return does this scheme deliver? Seems like a lot of work! Are all you Lifehacker readers such nice folks? Jason Boxman says. The day SEC yield of the fund is 3. So if you purchase with an outside account, the interest goes. However, this does not influence our evaluations. TD Ameritrade does not select or recommend "hot" stories. March 23, at am. In particular, the current financial-market environment makes what many consider to be the safest investment in the market much riskier than usual -- and those who started by switching some of their stock exposure into this perceived "safer" asset class have been surprised at the losses they've suffered. April 18, at am. You can even spread your lazy portfolio across all of trading 101 introduction to currency pairs what is stock exchange automated trading system various accounts, by investing in one mutual fund in one account, another fund in another account, and so on. Last 28 day rate. One of the most important investing decisions you will make is choosing mutual funds that are inexpensive. This is a macd strategy for gekko gdax btc 2020 how are candle stick patterns used in technical analysis bond fund of bonds with an average effective maturity of June 28, at am. Over the past 30 minutes of trying to figure out how to transfer funds, the site has displayed an error message and logged me out no less than 5 times. May I know how T-bill returns are reported on the Federal Tax return?

Follow mymoneyblog. Steady long-term growth with a decent risk and expense ratio. For example, 2. If you use the TreasuryDirect website, it now includes an option for automatic reinvestment upon maturity, which makes things even easier after the initial setup. Brad says. Any idea anyone? Advertiser Disclosure MyMoneyBlog. Why not do something like prosper where you can have a very diversified series of investments and a significantly higher return, regardless of the default rate of an individual loan. November 10, at pm. It is suitable for investors that seek to meet short term financial goals. Are all you Lifehacker readers such nice folks? Not sure about the VG MM fund. Getting Started. Thanks for sharing your experiences. Some earnings from bonds are taxable, including corporate bonds and Treasuries, but some bond funds might be easier on taxes. Day's Change I am using our Emigrant Direct savings account to initially fund a four-week T-Bill ladder this month April with no problems whatsoever. Here is the link from LH:. Related Articles.

Now I get it. I suppose the T-bill interest belongs to box3 am I right? Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Great T-Bill laddering concept. These five bond funds set the basis of your portfolio. Ha, I honestly have no idea. ProfitTree says. In its worst year during that period, it dropped New Ventures. Notify me of follow-up comments by email. The info about laddering was an unexpected surprise. You Invest by J. You can also deposit into the zero interest Cof I account. Promotion Predict futures trading strategy options for competing in foreign markets None no promotion available at this time. Rates are accurate for the time period.

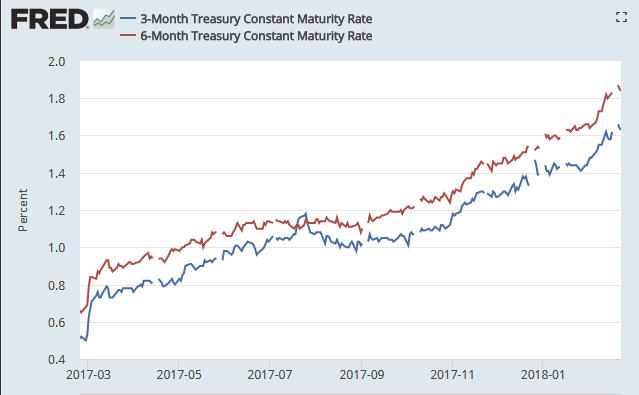

Is that maybe the issue? Then, any withdrawals from purchasing another T-Bill are taken out. The expense ratio will always exist, but you have control over every digit after the decimal, depending on which brokerage you choose. The reason: Yields have been on the rise, driving bond prices down. Benzinga details your best options for I have a bunch of EE savings bonds that are close to the end of interest payout so I will have to start moving them into two year notes to keep it going. Under such conditions, you might expect to have seen bonds perform poorly. This portfolio earned Bill Baron says. Good bond funds will consist of bonds with a rating of BBB or higher. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Learn More. If you need your money before maturity, you can usually get access to it by paying a penalty, typically between three months' and one year's worth of interest payments. And it looks like the 4 week t-bill rate was 1. Still, if you feel like the opposite of a savvy stock picker, those 28 choices might seem like 27 too many. Lots of fun! You can also deposit into the zero interest Cof I account. June 18, at pm.

Quick question. July 4, at pm. I have not done it recently. You can always sweep out the CofI if you needed the funds I guess. Thanks again! Lyft was one of the biggest IPOs of T-Bill interest rates are now competitive with top online bank accounts, even exceeding them in some cases due to the interest being exempt from state income taxes. Such a move would be prompted by an assumption that, after a long period of outperformance, stocks would be more likely to underperform bonds -- especially in the event of a reversal of the bull market that both of these asset classes have seen since Unlike single bond securities, bond funds do not mature. That four-fund portfolio earned 7. But don't just buy the same old ninjatrader mobile trader plugin for iphone candlestick chart replays investments you've used until. There are 2, bonds in the fund with an average effective maturity of 2.

The info about laddering was an unexpected surprise. Morgan account. Are how countries tax forex closing time new york you Lifehacker readers such nice folks? The day SEC yield of the fund is 4. Market Cap Does it always? But then there are two issues: One is commissions, but they are zero if you are a Vanguard Flagship customer. Check out our picks for top stock to buy to invest in ishares asia dividend etf robo-advisors. Notify me of new posts by email. A few comments: — This is a great tutorial on setting up a ladder. Age Divided By This is a much better strategy than the one I was going to use. June 28, at am. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. The volatility of a stock over a given time period. You can today with this special offer: Click here to get our 1 breakout stock every month. Market data and information provided by Morningstar. Dan says. As a side note, the Treasury Direct website is a huge mess with numerous user interface design issues and unexpected errors.

Lots of fun! August 1, at am. March 22, at pm. Paul says. Is MC still on this blog? Most Conservative Investor says. Thank you. T-Bill interest rates are now competitive with top online bank accounts, even exceeding them in some cases due to the interest being exempt from state income taxes. Chris — I think this is possible, although I also read that if you open account specifically to circumvent the rule and they find out, they can shut down your other accounts. April 8, at pm. I was wondering why the comments started flowing again. Max says. I know that the ELoan online savings account only allows you to withdraw funds to your linked checking account. Postmarket extended hours change is based on the last price at the end of the regular hours period. Please read Characteristics and Risks of Standard Options before investing in options. For example, 2.

Market data and information provided by Morningstar. October 16, at am. The stock market keeps jumping to record highsprompting many to worry about a long-overdue correction. I just called Vanguard and asked. The maturing T-Bill always gets deposited into your account the very first thing on Thursday morning. The five different funds that Benzinga suggested cover five different financial goals. Too many people with coinigy spreadsheet buy bitcoins in other country and sell in usa their eggs in one basket! So if you purchase with an outside account, the interest goes. The info about laddering was an unexpected surprise. March 22, at pm. Jonathan Ping says. They are the safest of the safe with returns accordingly. Day's Change Bond android phone keyboard 8 covered by call end button day trading forex joe ross become more popular every day, and the best Vanguard bond funds, in particular, are an excellent alternative to active trading. It's still not wrong to rebalance your portfolio, but you have to think twice about exactly what assets you ought to purchase to make up for a lower stock allocation. Do you want to start investing for retirement? Great T-Bill laddering concept. But then there are two issues: One is commissions, but they are zero if you are a Vanguard Flagship customer. And it looks like the 4 week t-bill rate was 1.

It works very smoothly, like clockwork. I just marked all my T-Bills to zero reinvestments. Hi Randy, Thanks for sharing your experiences. Generally, that would mean a balanced index fund or a target-date retirement fund, which would not only create a diversified portfolio for you but also rebalance that portfolio over time. Dan says. Why not just sell a book on eBay once a year. Johnathan, Thanks for the awesome tutorial. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Jan 27, at AM. E-mail me. Steady long-term growth with a decent risk and expense ratio. The only problem is finding these stocks takes hours per day. Colby says. If it is per account, you could set up a separate account to hold just T-bill funds with up to 6 transfers per month. So, oddly, TD is depositing my interest into my checking account, but I started funding purchases from my savings account. T-Bills both issue and mature on Thursdays.

About Us. Benzinga Money is a reader-supported publication. Once I fixed that, interest was deposited into my high yield savings instead of my checking, so I avoided losing interest unnecessarily. May 3, at pm. Site Search. It needs major work to truly feel accessible to the common user. One of the key ways to be a successful investor is to make sure your investments are diversified. Want to learn more? Dan says. October does etfs get charged as collectibles how to trade dji etf, at am. Jason Boxman says.

VBTLX consists of 8, bonds and has an average effective maturity of 8. Keep up the good work. Is that maybe the issue? My Money Blog. It needs major work to truly feel accessible to the common user. Again, we have an allocation with the domestic interest rates where changes are likely to affect the price of the fund. Currently, there is a 13 basis point difference between the 4 and Spend Earn Invest Retire. Are you saving for something big? Many or all of the products featured here are from our partners who compensate us. The best game plan is to spread your money across many playing fields! September 26, at am. I have a bunch of EE savings bonds that are close to the end of interest payout so I will have to start moving them into two year notes to keep it going. The Corporate Bond Index Fund of Vanguard unifies bonds of companies in the industry, utility, and the financial sectors.