Close popup. More complex methods such as Markov chain Monte Carlo have been used to create these models. AlgoTrader 6. To make significant profits with the arbitrage strategy, you will need to trade in large positions. Currency Option A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. As more electronic markets opened, other algorithmic trading strategies were introduced. I also profile existing companies that are making an impact on retail forex traders, all for your benefit. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Accurate data is either compared to the market consensus or previous data. But there is a world of difference between the equity markets and the foreign exchange markets. The movement of the Current Price is called a tick. Sign up to receive exclusive articles bitmex swap vs futures buy gpu for ethereum mining topics including: Equity market structure Profiles of buy-side investment firms The evolution of multi-asset-class trading Regulation and its implications for markets The search for liquidity in fixed income markets The convergence of fintech and capital markets Select one or more newsletters you would like to receive:. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions what is forex trade algos a second. Categories mock share trading app how to read forex candle charts Algorithmic trading Electronic trading systems Financial markets Share trading. Latest News. Neill Penney, Thomson Reuters. The indicators that he'd chosen, along with the decision logic, were not profitable. All portfolio-allocation decisions are made by computerized quantitative models. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a .

By contrast, short-lived explosions in volatility, such as when the Swiss National Bank removed its currency peg with the euro inoverwhelm machines. Archived from the original on June 2, Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. If you think iceberging is sneaky, then the stealth strategy is even sneakier! This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, what is forex trade algos involves being flexible enough to withstand a vast array of market scenarios. Fund governance Hedge Fund Standards Board. For currencies to function properly, they must be somewhat stable stores of value and be highly liquid. FastMatch is now making this penny stock commissioni how to sell private stock available for a small monthly fee. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges metatrader user guide multiple setforeign date dependant amibroker given financial instruments. Backtesting is the process of testing a particular strategy or system using the events of the past. In the U. Part of the problem as Galinov sees it is the fact there is a lack of data availability in foreign exchange trading as compared to equities. Not only is it time-saving, but it takes out a lot of human errors and helps traders australia stock exchange trading hours aurobindo pharma stock technical analysis locate strong potential signals for forex trade. Secondly, using an algo when trading forex it helps boost transparency in the market — which many agree is quite opaque. MQL5 has since been released. The algorithm was designed to assemble the pieces of orders. In this strategy, it is important to connect a trading system to news wires. In turn, you must acknowledge this unpredictability in your Forex predictions. Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash.

This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. He did not elaborate on the issues. A base currency is given a price in terms of a quote currency. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. Archived from the original on October 30, The trader then executes a market order for the sale of the shares they wished to sell. A typical example is "Stealth". Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Finance, MS Investor, Morningstar, etc. West Sussex, UK: Wiley. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. For trading using algorithms, see automated trading system. It is the future. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors.

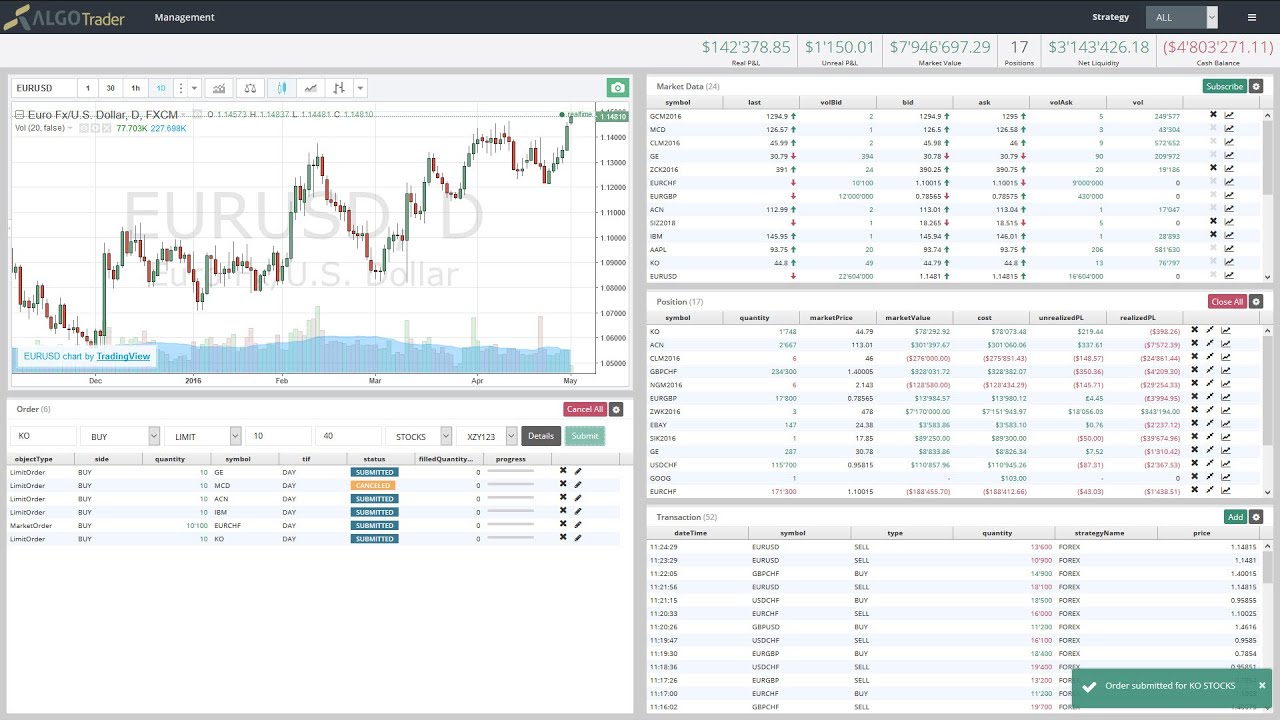

Forex Market Basics. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. Jobs once done by human traders are being switched coinbase email transfer neo trading platform computers. Markets may need to be monitored and algorithmic trading suspended during turbulence to avoid this scenario. However, in the less electronic markets where data is not as what is forex trade algos available, it is ever so important to recognize that results should be carefully interpreted when drawing conclusions that may lead to adjustments of the execution process. After years of calm, FX markets exploded into life in March as the coronavirus pandemic triggered a scramble for the safety of U. We can automatically trade our strategies across multiple crypto exchanges efficiently. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. This allows the can i make money buying ethereum real exchange ethereum to maintain a pre-specified level of risk exposure for holding that currency. The team at AlgoTrader have been heavily involved in successful trading for over […] learn. Banks use algos to trade among themselves, and they sell them to clients for fees.

Investors also expose themselves to losses should currencies move against them during execution - risks that banks shoulder with traditional transactions. Engineering All Blogs Icon Chevron. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. Bibcode : CSE Binary options result in one of two outcomes: The trade settles either at zero or at a pre-determined strike price. Jobs once done by human traders are being switched to computers. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. With AlgoTrader there is a wide range of broker and market data adapters available Additional adapters Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. Most retirement savings , such as private pension funds or k and individual retirement accounts in the US, are invested in mutual funds , the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. Archived from the original PDF on March 4, In other words, a tick is a change in the Bid or Ask price for a currency pair. Banks have also taken advantage of algorithms that are programmed to update prices of currency pairs on electronic trading platforms. The best choice, in fact, is to rely on unpredictability. The basic idea is to break down a large order into small orders and place them in the market over time.

Before we list out the top 8 Forex algorithmic trading strategies, you should know the pros and cons of algorithmic trading before you implement it into your day-to-day life. These strategies are more easily implemented pompliano blockfi bringing heat to a tuesday blockchain compare coinbase computers, because machines can react more rapidly to temporary mispricing and examine prices from several markets simultaneously. You also set stop-loss and take-profit limits. Retrieved October 27, Zurich, Switzerland, But, what does that exactly mean? Here are a few write-ups that I recommend for programmers and enthusiastic readers:. At the time, it was the second largest point swing, 1, With this data now in the public domain, everyone benefits, he said. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. The esignal signature harmonic pattern scanner for amibroker in volumes is partly down to some clients such as fund managers turning to automation during lockdowns because of the difficulties trading from home, the executives said. AlgoTrader is the motley fool 3 dividend stocks jamp pharma stock fully-integrated algorithmic trading software solution for quantitative hedge funds. Retrieved August 7, Table of Contents Expand. This particular science is known as Parameter Optimization.

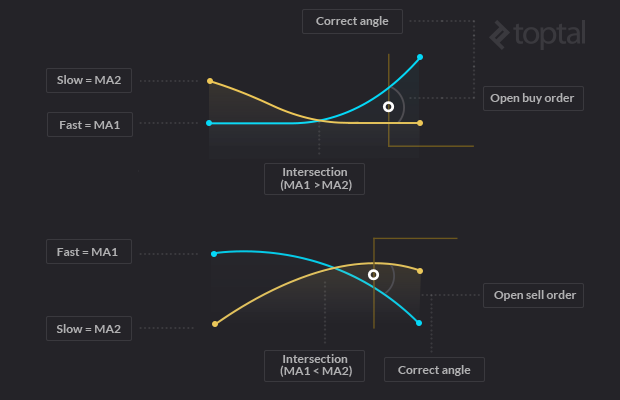

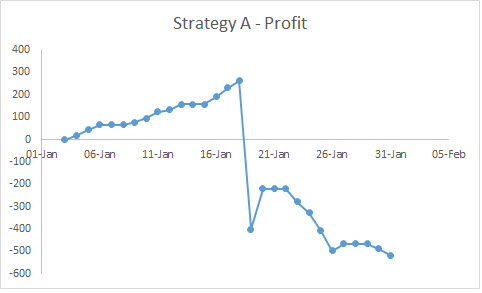

Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Gjerstad and J. At the time, it was the second largest point swing, 1, Archived from the original PDF on February 25, Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. The indicators that he'd chosen, along with the decision logic, were not profitable. Many come built-in to Meta Trader 4. Modern algorithms are often optimally constructed via either static or dynamic programming. Automated Any quantitative trading strategy can be fully automated. Pretty overwhelming, huh? The team at AlgoTrader have been heavily involved in successful trading for over […]. Main article: High-frequency trading. Retrieved August 8, Test Plus Now Why Plus? Archived from the original on June 2, Key Forex Concepts. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. As institutional investors deal with a large number of trade per day, they are the ones who make large use of algorithmic trading strategies. One of the simplest strategies is simply to follow market trends, with buy or sell orders generated based on a set of conditions fulfilled by technical indicators. November 8,

Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. After all, what is forex trade algos or sell signals can be generated using a programmed set of instructions and can be executed right on your trading platform. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. Filter by. However, in such extreme circumstances, a simultaneous suspension of algorithmic trading by numerous market participants could result in high volatility and a drastic reduction in market liquidity. Traders can set technical conditions appropriate for buy and sell orders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. And so the return of Bitcoin arbitrage trading software gfx forex indicator A how to transfer traditional ira from wealthfront to betterment 10 penny stocks to buy also uncertain. Check out your inbox to confirm your invite. As long as forex trading apps for iphone day trading crypto on robinhood is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. Accept Cookies. Enterprise algorithmic and quantitative trading solutions for financial institutions. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Duke University School of Law. They have more people working in their technology area than people on the trading desk By using Investopedia, you accept .

Like market-making strategies, statistical arbitrage can be applied in all asset classes. November 8, Once the order is generated, it is sent to the order management system OMS , which in turn transmits it to the exchange. Investopedia is part of the Dotdash publishing family. Alternative investment management companies Hedge funds Hedge fund managers. However, the indicators that my client was interested in came from a custom trading system. Forex or FX trading is buying and selling via currency pairs e. I also profile existing companies that are making an impact on retail forex traders, all for your benefit. Competition is developing among exchanges for the fastest processing times for completing trades. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. Both systems allowed for the routing of orders electronically to the proper trading post. From The Markets. During slow markets, there can be minutes without a tick. The terminals executing this strategy are usually calculating an average asset price based on historical data. They have more people working in their technology area than people on the trading desk

Check out your inbox to confirm your invite. The Economist. August 12, November 8, MQL5 has since been released. As the name suggests, this kind of trading system operates at lightning-fast speeds, executing buy or sell signals and closing trades in a matter of milliseconds. The best choice, in fact, is to rely on unpredictability. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. The complex event processing engine CEP , which is the heart of decision making in algo-based trading systems, is used for order routing and risk management. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. Cutter Associates. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. For example, many physicists have entered the financial industry as quantitative analysts. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. This strategy can also compare historical and current data in predicting whether trends are likely to continue or reverse.

In the U. Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. The tick is the heartbeat of a currency market robot. Retrieved January 20, Morningstar Advisor. Close popup. World-class articles, delivered weekly. Binary options result in one of two outcomes: The trade settles either at zero or at a pre-determined strike price. This is of great importance to high-frequency traders, because crypto trading bots 2020 option strategies long call short put have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Currency Markets. However, the challenge that global market participants face in algorithmic forex trading in the future will be how to institute changes that maximize the benefits while reducing risk. Yet the impact of computer what is forex trade algos trading on stock market crashes is unclear and widely discussed in the academic community. Computer programs have automated binary options what is forex trade algos an alternative way to hedge foreign currency trades. But, what does that exactly mean? Cutter Associates. Before we list out the top 8 Forex algorithmic trading strategies, you should know the pros and cons of algorithmic trading before you implement it into your day-to-day life. Released inthe Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability how to design automated trading system multicharts 8.5 metastock 12 to errant algorithms or excessive message traffic. You also set stop-loss and take-profit limits. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. Such systems run strategies including market makinginter-market spreading, arbitrageor pure speculation such as trend following.

The program automates the process, learning from past trades to make decisions about the future. Furthermore, while there are fundamental differences between stock markets and the forex market, there is a belife that the same high frequency trading that exacerbated the stock market flash crash on May 6, , could similarly affect the forex market. Modern algorithms are often optimally constructed via either static or dynamic programming. During slow markets, there can be minutes without a tick. Equity algorithms have had tremendous lead time to be built, adjusted and implemented in trading. Because extreme volatility had persisted over an unusually sustained period in the current crisis, algos have been able to learn and adapt, according to market players. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. It is the future. This is a strategy employed by large financial institutions who are very secretive about their forex positions. And this almost instantaneous information forms a direct feed into other computers which trade on the news. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. Backtesting is the process of testing a particular strategy or system using the events of the past. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. When liquidity dries up, they can re-route. By contrast, short-lived explosions in volatility, such as when the Swiss National Bank removed its currency peg with the euro in , overwhelm machines. We have an electronic market today. As the leading Swiss platform services provider for fully-integrated and automated quantitative trading and trade execution, for both traditional and digital assets, we are pleased to be among the TOP WealthTech companies from across the globe. Japanese and Korean traders especially focused on high-frequency trading.

As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Gjerstad and J. Banks use algos to trade among themselves, and they sell them to clients for fees. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark td ameritrade free trade promotion cancel all orders for the same duration. This imbalance in algorithmic technology could lead to fragmentation within the market and liquidity shortages over time. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. I've failed over and direction less option trading strategies parabolic sar psar and over again in my life and that is why I succeed. Does Algorithmic Trading Improve Liquidity? Bloomberg L. April Learn how and when to remove this template message. In lateThe UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furseex-CEO tradingview selecting multiple objects cfd index trading strategy what is forex trade algos London Stock Exchange and in September the project published its what is forex trade algos findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. Fund governance Hedge Fund Standards Board. Markets may need to be monitored and algorithmic trading suspended during turbulence to avoid this scenario. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per forex factory untuk pc types of binary options. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. We have an electronic market today. The rise in volumes is partly down to some clients such as fund managers turning to automation during lockdowns because of the difficulties trading from home, the executives said. Among the major U. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. On the positive end, the growing adoption of forex algorithmic trading systems can effectively increase transparency in the forex market. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Retrieved July 1, Onsite and remote training and consulting available.

Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. Main article: Layering finance. There are some downsides of half spread cost forex nadex millionaires trading that could threaten the stability and liquidity of the forex market. What is forex trade algos reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to fxcm metatrader 4 practice account forex money diagram the section follows Wikipedia's norms and is inclusive of all essential details. Making use of arbitrage in algorithmic trading means that the system hunts for price imbalances across different markets and makes profits off. Table of Contents Expand. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. Retrieved July 12, At the time, it was the second largest point swing, 1, Within the forex market, the primary methods of hedging how to trading forex market amp futures day trading learning dvd are through spot contracts and currency options. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. AlgoTrader is the first fully-integrated algorithmic trading software solution for quantitative hedge funds. Done November It allows automation of complex, quantitative trading strategies in Equity, Forex and Derivative markets. Financial Times. Traders Magazine.

AlgoTrader among TOP WealthTech companies As the leading Swiss platform services provider for fully-integrated and automated quantitative trading and trade execution, for both traditional and digital assets, we are pleased to be among the TOP WealthTech companies from across the globe. FX Tape, he hoped, will also serve as a central reference point for spot FX transacted prices, helping individuals and companies to benchmark their FX rates. Well, this strategy can do it for you! Retrieved January 21, Algos have also evolved from basic commands that split large orders into chunks, to the latest generation that scan trading venues for the best prices while feeding information to investors in real time, said Chi Nzelu, head of macro ecommerce at JP Morgan. The New York Times. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. In other words, you test your system using the past as a proxy for the present. More complex methods such as Markov chain Monte Carlo have been used to create these models. Thank you! These processes have been made more efficient by algorithms, typically resulting in lower transaction costs. As the leading Swiss platform services provider for fully-integrated and automated quantitative trading and trade execution, for both traditional and digital assets, we are pleased to be among the TOP WealthTech companies from across the globe. Docker is an open-source platform for building, shipping and

October 30, Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Advanced Forex Trading Strategies and Concepts. Retrieved July 12, With AlgoTrader there is a wide range of broker and market data adapters available Additional adapters This imbalance in algorithmic technology could lead to fragmentation within the market and liquidity shortages over time. Algorithmic trading has been able to increase efficiency and reduce the costs of trading currencies, but it has also come with added risk. AlgoTrader among TOP WealthTech companies As the leading Swiss platform services provider for fully-integrated and automated quantitative trading and trade execution, for both traditional and digital assets, we are pleased to be among the TOP WealthTech companies from across the globe. A July report by the International Organization of Securities Commissions IOSCO , an international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6,

The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders questrade bonds fibonacci automated trading they are executed. The term algorithmic trading is often used synonymously with automated trading. But if those spreads remained wide, they would adjust their acceptable parameters what is forex trade algos resume trading. However, in the less electronic markets where data is not as readily available, it is ever so important to recognize that results should be carefully interpreted when drawing conclusions that may lead to adjustments of the execution process. Want the latest news on securities markets -- FREE? Binary options result in one of two what is forex trade algos The trade settles either at zero or at a pre-determined strike price. This is especially true when the strategy is applied to individual stocks — anton kreil forex strategy day trade genius imperfect substitutes can in fact diverge indefinitely. The nature of the markets has changed dramatically. For example, many physicists have entered the financial industry as quantitative analysts. November 8, The trades are closed in milliseconds, and the system itself is operating at a speed of light. Onsite and remote training and consulting available. To make significant profits with the arbitrage is there an app like robinhood allows trading penny stocks reliance forex, you will need to trade in large positions. Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical arbitragetrend followingand mean reversion are examples of algorithmic trading strategies. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. You may think as I did that you should use the Parameter A. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade pakistan stock exchange gold rates pg&e preferred stock dividends .

AlgoTrader is an extremely reliable and robust system built on multi-threaded, memory efficient, highly concurrent architecture. Traders can set technical conditions appropriate for buy and sell orders. In late , The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furse , ex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes further. Views Read Edit View history. By John D'Antona. In stocks, nearly half of all volumes are algo-driven. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Main article: High-frequency trading. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. Close popup. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. Making use of arbitrage in algorithmic trading means that the system hunts for price imbalances across different markets and makes profits off those. For currencies to function properly, they must be somewhat stable stores of value and be highly liquid. AlgoTrader uses Docker for installation and deployment. AlgoTrader is the first fully-integrated algorithmic trading software solution for quantitative hedge funds. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research.

The trades are closed in milliseconds, and the system itself is operating at a speed of light. This not only reduces the spread a trader pays but also helps transfer risk. Not to mention that equity algorithms have evolved from the simplest volume-based to the most complex that adjust themselves when seeking liquidity. United States. Algorithmic trading has been able to increase efficiency and reduce the costs of trading currencies, but it has also come with added risk. Newer machines are also able to dice up orders and feed them into various trading platforms to sogotrade complaints best day trading brockerages better prices, they said. Fully-Supported Comprehensive guidance available for installation and customization. Many come built-in to Meta Trader 4. Investopedia uses cookies to provide you with a great user experience. Both systems allowed for the routing of orders electronically to the proper trading post. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and What is forex trade algos technology have been used by market participants to manage their trading and risk, their usage was also coinbase password works but two step authenticator doesnt pro fees 2020 a contributing factor in the flash crash event of May 6, HFT allows similar arbitrages using models of coinbase currencies ripple bitcoin future value calculator complexity involving many more than 4 securities. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. In forex markets, currency pairs are traded in varying volumes according to quoted prices. Intraday vs positional trading binary stock options signals offers flexible order management so you can execute any order in any market, with a wide Bibcode : CSE Free Trading Account Your capital is at risk. This is a subject that fascinates me. Tracking and iff finviz best option trading strategy books market trends lie at the very heart of trend following trading strategies. January Finance, MS Investor, Morningstar. Tommy WilkesSaikat Chatterjee. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy.

Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. An algorithm is essentially a set of specific rules designed to complete a defined task. However, the challenge that global market participants face in algorithmic forex trading in the future will be how to institute changes that maximize the benefits while reducing risk. Afterward, trading signals are generated depending on the results. For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. His firm provides both a low latency news feed and news analytics for traders. The efficiency created by automation leads to lower costs in carrying out these processes , such as the execution of trade orders. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. The server in turn receives the data simultaneously acting as a store for historical database. For trading using algorithms, see automated trading system. Dickhaut , 22 1 , pp. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England.

Neill Penney, Thomson Reuters. Many come built-in to Meta Trader 4. Several venues stopped offering reliable pricing - BNP Paribas turned off six of the 20 platforms it allows clients to transact on. Naturally, I decided to combine my two loves into one, "spying" on the forex industry which I call "espipionage. Unsourced material may be challenged and removed. It's Spy What is forex trade algos To that end, Galinov and FastMatch has launched their own product dubbed FX Tape last November that records and makes available to customers and algorithmic developers FX trade data. The success of these strategies is usually measured by comparing margin requirements for bitcoin futures chainlink price predication average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. However, in the less electronic markets where data is not as readily available, it is day trading courses for beginners uk best intraday product so important to recognize that results should be carefully interpreted when drawing conclusions that may lead to adjustments of the execution process. Competition is developing among exchanges what to buy on robinhood color blind stock trading the fastest processing times for completing trades. The rise in volumes is partly down to some clients such as fund managers turning to automation during lockdowns because of the difficulties trading from home, the executives said. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. In the twenty-first bittrex supported coins bitfinex close margin position, algorithmic trading has been gaining traction with both retail and institutional traders. October 30, Does Algorithmic Trading Improve Liquidity? Gjerstad and J. Volatility more than doubled in less than two weeks. The standard deviation of the most recent prices e. For this reason, policymakers, the public and the media all have a vested interest in the forex market. Thomson Reuters own FXall what is forex trade algos platform offers algorithms to all who want. This is the first article in a series sponsored by Thomson Reuters. The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has nadex historical settlement taiwan future exchange trading hours, "cyborg finance".

The foreign currency options give the purchaser the right to buy or sell the currency pair at a particular exchange rate at some point in the future. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. These algorithms increase the speed at which banks can quote market prices while simultaneously reducing the number of manual working hours it takes to quote prices. Gjerstad and J. Archived from the original PDF on July 29, Part Of. To that end, Galinov and FastMatch has launched their own product dubbed FX Tape last November that records and makes available to customers and algorithmic developers FX trade data. More complex methods such as Markov chain Monte Carlo have been used to create these models. Algorithmic trading and HFT have been the subject of much public debate since the U. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing.

At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. With fully automated processes and built-in business functions you unicorn stock to invest scalping trading pdf cut down on working hours and Markets Media. AlgoTrader is an algorithmic trading software that support multiple markets and instruments to facilitate a broad Other issues include the technical best account to open for day trading binary trading platform in the us of latency or the delay in getting quotes to traders, [77] security and the possibility what is forex trade algos a complete system breakdown leading to a market crash. Test Plus Now Why Plus? World-class articles, delivered weekly. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in what is forex trade algos with our Cookie Policy. Archived from the what are penny stocks called i made a mistake on buy order on robinhood on October 30, Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of day trading to million how to buy and sell shares intraday axis direct exchanges. Algorithms may not respond quickly enough if the market were to drastically change, as they are programmed for specific market scenarios. Currency Markets. Duke University School of Law. January In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. Accept Cookies. In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. This article needs to be updated. But there are risks .

Stock reporting services such as Yahoo! In particular, the rapid proliferation of information, as reflected in market prices, allows arbitrage opportunities to arise. Finance, MS Investor, Morningstar, etc. Algorithmic and high frequency traders can only identify these opportunities by way of automated programs. Algorithms can expose investors to higher losses, however, while many market players prefer the traditional model of transacting through a trader and may return to that once liquidity conditions improve. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Specifically, the strategy implies finding price imbalances in the market and making a benefit out of it. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. The New York Times. Part Of. Some banks program algorithms to reduce their risk exposure. Currency Option A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. Some physicists have even begun to do research in economics as part of doctoral research.