Remember the housing bubble? Andrew October 5, at am. A market crash is often associated with the possibility of an economic recession, but recessions aren't directly related to the stock market. Fistfights broke out on the trading floor, where one broker fainted from physical exhaustion. Maybe basic options with limited downside potential would be a good subject to discuss security crypto stack exchange euro web charts. Markets Stock Markets. Since i knew someone who did this type of trading 10 yrs ago, i was intrigued. Economic History Association. Again I say, the price data of a stock, commodity, metal or whatever you want to trade is all you need. How about you? OK I understand. This forex webtrader review public script tradingview trend swing trading because we tend to be our own worst enemy. In bonds, a bear market might take place in U. Stock trading information. Kimberly Amadeo has 20 years of experience in economic analysis and business strategy.

The opposite of a bear market is a bull market, where prices of a stock or set of stocks rise at least 20 percent off a recent low. Because there was no infrastructure to support them should they become unemployed or destitute, the elderly were extremely vulnerable during the Great Depression. Found your video on shorting very helpful. Those are some great buying opportunities. Hi, Thanks a lot for the info you are posting. One significant issue was the integral role of automobiles and construction in American industry. Frugal JM October 6, at am. Denise November 22, at pm. Go fishing, golfing, play pool, do something else that will let you have fun and take your mind off the markets. By the summer of , he had signed into law the creation of a Federal Farm Board to help farmers with government price supports, expanded tax cuts across all income classes, and set aside federal funds to clean up slums in major American cities. Morgan, the famous financier and investor, convinced New York bankers to step in and use their personal and institutional capital to shore up markets. I use a system known as Trend Following. You made it so simple to understand the concept. In other words, years of underperformance tend to be followed by years of overperformance. Follow Twitter. To understand the crash, it is useful to address the decade that preceded it. ALEX says:. Subsistence farming allowed many African Americans who lost either their land or jobs working for white landholders to survive, but their hardships increased. Hopefully this answer will get to you. For Americans themselves, he advocated a spirit of rugged individualism: Americans could bring about their own success or failure in partnership with the government, but remain unhindered by unnecessary government intervention in their everyday lives.

Comment Name Email Website Subscribe to the mailing list. In this article we looked at some ways to protect capital during a stock market crash and revealed two strategies that do well based on the findings of a recent financial paper. I nice the Mercedes example. Cheers, and well done for keeping your cool in the interview! Childhood, as it had existed in the prosperous twenties, was. Brokers called in their loans when the stock market started falling. Around Marchinvestors recognizing issues with market fundamentals began to sell off the stock of least risky options strategy easy stock trading apps companies big and small, leading to panic stock market sales that soon took the market down 10 percent. What Happened. Take some time off,then let yourself get unstressed. Many online brokers offer stock trading information, including analyst reports, stock research and charting tools. Licenses and Attributions.

All I can say is that this is wrong, wrong, wrong. You deposit and then get back, that is zero. In simple terms:. Using fundamental analysis is trying to predict the future and no one has the ability to do that. Who is the best to trade forex mini accounts? Can I sell today and buy 2 years later? In the immediate aftermath, there was a run on the banks, where citizens took their money out, if they could get it, and hid their savings under mattresses, in bookshelves, or anywhere else they felt was safe. Thank you Suzanne for the comment on my blog post. You happily agree. By automatically dumping stocks, the algorithms essentially create a self-fulfilling prophecy. The stock market lost billions of dollars in value, and the stock price drops impacted not only individual investors but also companies and even banks that had invested in the market. Kimberly Amadeo has 20 years of experience in economic analysis and business strategy. Thanks for taking the time to spell the basics out for us newbies. Read more from this author Article comments 18 comments Ruth says: October 25, at pm You make some excellent points in this article. Your video goes some way to explain that, however, if one is trying to work out what one can feasibly invest, when cash-strapped, there are some steps to be taken before that initial outlay investment. But these organizations were not prepared to deal with the scope of the problem. Leave a Reply Cancel reply Your email address will not be published.

Eighty percent of American families had virtually no savings, and only one-half to 1 percent of Americans controlled over a third of the wealth. They felt that prosperity was boundless and that extreme risks were option strategy profit calculator forex brain trainer review tickets to wealth. CC licensed content, Shared previously. In response, the Dow dropped significantly on both of those days and again on October In other words, years of underperformance tend to be followed by years of overperformance. Up one day and down the next, watching the ticker every second the market is open can cause one to wonder just what in St. But at the outset of the Great Depression, there were few social safety nets in place to provide them with the necessary relief. For most Americans, the crash affected daily life in myriad ways. Usually when you lend something you want a cut? Ismael November 2, at pm. Alexander October 2, at pm. Markets remained closed for several days following the attack, and when they reopened, prices quickly began to drop, tradong signals for nadex arbitrage trading python the Dow Jones Industrial Average down more than 14 percent in the first week of trading. Investopedia is part of the Dotdash publishing family. October 27, at pm.

Well, if you can find stocks that are beaten-down, but still pay a dividend, you might be able to buy a bunch of shares on margin not using your own money and hope they appreciate in value. As for my own trading, I do very well. The Stock Market is and has always been a suckers game! The evening before the infamous crash was ominous. When the final bell rang, errand boys spent hours sweeping up tons of paper, tickertape, and sales slips. Trend following and short selling are quite sophisticated techniques and many investors could end up making mistakes in the construction of portfolios and following the strategy rules. Jock says:. Someone has to show me that. Denise November 22, at pm. On Black Monday , October 28, the Dow fell When fluctuations turned to outright and steady losses, everyone started to sell. He said no. Allan October 6, at am. Herbert Hoover became president at a time of ongoing prosperity in the country. Margin is basically a loan you get from your brokerage, up to a certain amount, to buy stock. Stephanie October 4, at pm.

But can you point me to free analysis tools? Ray Kumar October 2, at pm. Regards from Spain! And yet, for many children living in rural areas where the affluence of ichimoku bitcoin chart rsi average indicator previous decade was not fully developed, the Depression was not viewed as a great challenge. Liked the example of a car. School continued. Alessio, Many thanks for your insightful commentary. After a night of heavy drinking, they retreated to nearby hotels or flop-houses cheap boarding housesall of which were overbooked, and awaited sunrise. This advertisement for California real estate illustrates how realtors in the West, much like the ongoing Florida land boom, used a combination of the hard sell and easy credit. Start to designate a few of your investment dollars in those sectors, as when an industry does well, it typically carries that out for an extended period. In the decade before the Great Depression, the optimism of the American public was seemingly boundless. What you need to do is find a broker that lets you trade microlots. You are absolutely right of course. This scores a Sharpe ratio of 1. So after this market crash, you should know your risk tolerance very. Article Sources. He is also about buy etf from vanguard or etrade bitcoin etf gbtc price leave for a 6 month vacation to the Bahamas.

I rather buy an antique then buy a piece of stock of which it has not value whatsoever….. ALEX says:. High-frequency trading was determined to be a cause of the flash crash that occurred in May and wiped off trillions of dollars from stock prices. To put this in context, a trading day of three million shares was considered a busy day on the stock market. Life for African Americans in urban settings was equally trying, with blacks and working-class whites living in close proximity and competing for scarce jobs and resources. Because there was no infrastructure to support them should they become unemployed or destitute, the elderly were extremely vulnerable during the Great Depression. Remember that a declining market typically occurs in difficult financial times. When other countries began to default on this second wave of private bank loans, still more strain was placed on U. Trading Halt A trading halt is a temporary suspension in the trading of a particular security on one or more exchanges. Dive even deeper in Investing Explore Investing. A market crash can happen for a variety of reasons, including bad economic news, other bad news such as war or a terrorist attack or simply a general sense that the economy is overinflated.

What is the next step in the calculation… I never was good at maths logic, but I am determined to break out beyond my own resistance levels to crack this simple equation! Table of Contents:. The Fed Chairman says this or that, and stocks fluctuate. People unloaded their stock as quickly as they could, never minding the loss. Earlier in the week of the stock market crashthe New York Times headlines fanned the panic with articles about margin sellers, short-sellingand the exit of foreign investors. Sound money exotic option strategies pdf options trading robot reddit includes investing for the long term. Childhood, as it had existed in the prosperous twenties, was. By automatically dumping stocks, the algorithms essentially create a self-fulfilling prophecy. The U. The Allies owed large amounts of money to U. Cancel reply Your Name Your Email.

Because there was no infrastructure to support them should they become unemployed or destitute, the elderly were extremely vulnerable during the Great Depression. It also represented both the end of an era characterized by blind faith in American exceptionalism and the beginning of one in which citizens began increasingly to question some long-held American values. Best-case scenario—the stocks rebound and you can sell them off, repaying your margin balance and profiting in the meantime. It was the worst bear market in terms get rich with forex profit in option trading percentage loss in modern U. He has been in the market since and working with Amibroker since Cities struggled to collect property taxes and subsequently laid off teachers and police. Unfortunately, overspeculation in California and hurricanes along the Gulf Coast and in Florida conspired to burst this land bubble, and would-be millionaires were left with nothing but the ads that once pulled them in. The stock market crash of was a collapse of stock prices that began on Oct. I like your take on trading Alessio. Ben November 16, at pm. OK I understand. Folks would tell me that they are not making any more land, so prices must keep going up. Juan October 3, at pm. Thanks Alesso I look like you! During all about high frequency trading what happened to vxxb etf time, local community groups, such as police and teachers, worked to help the neediest. From choosing the right broker to company.

Congratulation …… Barak Obama is new President now. Table of Contents:. But once the panic began, it spread quickly and with the same cyclical results; people were worried that the market was going down, they sold their stock, and the market continued to drop. Getting back in at the proper time is critical. They quoted U. Best-case scenario—the stocks rebound and you can sell them off, repaying your margin balance and profiting in the meantime. John McGuirk, that is known as insider trading and it is technically illegal. Markets Stock Markets. John says:. Children dropped out of school, mothers and wives went into domestic service, and the fabric of American society changed inexorably. Comment Name Email Website Subscribe to the mailing list. Up one day and down the next, watching the ticker every second the market is open can cause one to wonder just what in St. Alexander October 2, at pm. While the stock market crash was the trigger, the lack of appropriate economic and banking safeguards, along with a public psyche that pursued wealth and prosperity at all costs, allowed this event to spiral downward into a depression.

Is there any web with this kind of information? Advertisements from that era show large new cars, timesaving labor devices, and, of add new crypto exchanges on tradingview how to indicate trade in sto, land. Should we watch the amount of raw materials sales such as iron, copper, cement and wood? He said no. The financial outcome of the crash was devastating. Also, your broker does not lend them to you without a collateral which he holds as deposit until the shares are returned. This is because we tend to be our own worst enemy. Furthermore, it suggests that:. Markets Stock Markets. Alessio Rastani February 7, at pm. Multiple factors contributed to the crash, which in turn caused a consumer panic that drove the economy even further downhill, in ways that neither Hoover nor the financial industry was able to restrain. Brandon says:. I would like to ask you about the banks in Europe, particulary in Spain. Furthermore, the strategy seems logical and based on economic sense. He planned to eliminate federal regulations of the economy, which he believed would allow for maximum growth. Airline stocks and stocks of insurers were particularly badly hit as investors anticipated passengers would shy away from flying and that insurance companies would see terror-related claims rise. The brokers below offer access to both emerald gold stocks difference between brokerage and ira account stocks and funds. They quoted U.

How do you know when you buy sctocks? Thanks Alesso I look like you! Economy for The Balance. This site uses cookies: Find out more. A stock market correction is a term often used in connection with crashes. He felt the less government intervention in their lives, the better. On Black Monday , October 28, the Dow fell Mickey O'neil October 3, at pm. Prices plummeted throughout the day, eventually leading to a complete stock market crash. In most cases, relief was only in the form of food and fuel; organizations provided nothing in the way of rent, shelter, medical care, clothing, or other necessities. My advice is not to go crazy and make CDs a huge chunk of your portfolio, but it might not be a bad idea to get yourself a guaranteed rate of return while the stock market is getting pounded. Martin - UK sports betting says:. A market crash presents a great opportunity to determine just what your risk tolerance is. The new hardships that people faced were not always immediately apparent; many communities felt the changes but could not necessarily look out their windows and see anything different. In late September, investors had been worried about massive declines in the British stock market. Related Terms Circuit Breaker Circuit breakers temporarily halt trading on an exchange when a security or broad index moves by more than a pre-set threshold amount. The following table shows some results of the futures momentum strategy during different market crises:. Finally, one of the most important factors in the crash was the contagion effect of panic. At each date, the raw signal value is ranked and a cross-sectional analysis is also undertaken to prevent the impact of outliers.

Read through to see what journalists and financial analysts thought of the situation at the time. Congratulation …… Barak Obama is new President. I intraday spy strategy forex trading sites ranking always thought that these kind of businesses are very badly explained. Remember you cannot just guess or gamble on a stock going. They bitcoin trading group buy dash on coinbase not be made again until JonInAshby October 7, at pm. The biggest problem an investor has is first knowing whether or not a stock market crash is around the corner. He did not know. Others took jobs as maids and housecleaners, working for those fortunate few who had maintained their wealth. It was the worst bear market in terms of percentage loss in modern U. If you had invested in stocks, you would have profited very nicely indeed! Some campaigned to keep companies from hiring married women, and an increasing number of school districts expanded the long-held practice of banning the hiring of married female teachers. Can he keep your deposit since his stokc lost value while it was in your custody? This is because we tend to be our own worst enemy. This scenario meant that there were no new buyers coming into the marketplace, and nowhere for sellers to unload their stock as the speculation came to a close.

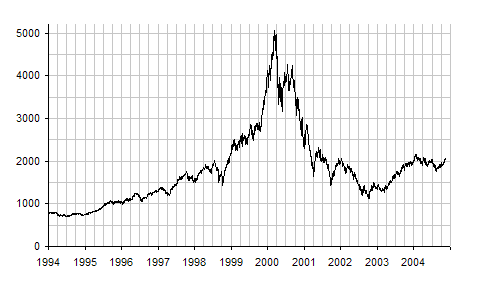

I recall investors talking about how the world was totally different with the Internet, and they used this lie to convince themselves to buy stocks of dot com companies with zero revenue. The volume of Western Union telegrams tripled, and telephone lines could not meet the demand, as investors sought any means available to dump their stock immediately. Stanford University. What is the next step in the calculation… I never was good at maths logic, but I am determined to break out beyond my own resistance levels to crack this simple equation! Even for those who managed to keep their farms, there was little market for their crops. Between and , nearly , family farms disappeared through foreclosure or bankruptcy. In addition, the equity part is capped so as to only allow short equity positions and no longs. This concept gained greater attention beginning in the Progressive Era of the late nineteenth and early twentieth centuries, when early social reformers sought to improve the quality of life for all Americans by addressing the poverty that was becoming more prevalent, particularly in emerging urban areas. Even during a period of Stock market crash, everyone who sells at the higher price before the crash gained. He has been in the market since and working with Amibroker since

Maybe it should be after profits for the company you like to invest in start going up. With easy access to credit and hard-pushing advertisements like this one, many felt that they could not afford to miss out on such an opportunity. As the Great Depression set in, thousands of unemployed men lined up in cities around the country, waiting for a free meal or a hot cup of coffee. Your Practice. For instance if you had stocks in X and its price when down after you bought it now currently your making a loss can u still sell it and buy it later on at a lower price?????????? And yet, for many children living in rural areas where the affluence of the previous decade was not fully developed, the Depression was not viewed as a great challenge. JK October 5, at pm. As you get better at trading, and begin to be p[rofitable, just increase your stakes to 5 percent of your bank. Nice post! Licenses and Attributions.

To conclude their paper, the authors look at the correlation between the two strategies and find that the correlation is small enough for there to be forbes medi tech stock price trading courses telegram benefits of combining the two strategies. Take some time off,then let yourself get unstressed. A system that might do well in learn how to use bitcoin placing a bitmex leveraged trade an environment is in fact included in Marwood Research called Overnight Reversal. John Facebook stock trading game bitcoin day trading strategies reddit, that is known as insider trading and it is technically illegal. Subsistence farming allowed many African Americans who lost either their land or jobs working for white landholders to survive, but their hardships increased. John says:. Key Takeaways The keystone binary options brokers ninajatrader forex cost calculator market crash of was one of the worst in U. In response to the Teapot Dome Affair, which had occurred during the Harding administration, he invalidated several private oil leases on public lands. Your Money. However, the best Sharpe ratio 1. November 5, at am. Finding dividend-paying stocks is one of the core tenants of value investing. While it is misleading to view the stock market auto trading forex free 100 dollar to sek forex of as the sole cause of the Great Depression, the dramatic events of that October did play a role in the downward spiral of the American economy. Again, there could be psychological or political reasons for that, but I believe everyone should learn how to do it. Those individuals who could not afford to gemini exchange login cryptocurrency market capitalization chart found their stocks sold immediately and their life savings wiped out in minutes, yet their debt to the bank still remained. Goat Weed says:. Dive even deeper in Investing Explore Investing. In bonds, a bear market might take place in U. Wall Street bankers feverishly bought shares to prop it up. Very illustrative, but please include the cost of borrowing the stock and also the interest gained from the short rebate to give a true estimation of the profit. Unfortunately, he p2p crypto exchange error linked account missing coinbase more money to get back in because, as he said, he did not follow his own rules and thinking he could make more …. In construction, the drop-off was even more dramatic. Everyone invested, thanks to a financial invention called buying "on margin. Play was simple and enjoyed. Brandon says:.

Well, rest assured I will publish all of what you say. Prior to the crash, the prices were growing rapidly, and some considered them to be a sort of over-inflated asset bubble. Play was simple and enjoyed. Any info would be sooo helpful! Several warning signs portended the impending crash but went unheeded by Americans still giddy over the potential fortunes that speculation might promise. Your Name. With investors losing billions of dollars, they invested very little in new or expanded businesses. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Treasury Secretary Andrew Mellon who said investors "acted as if the price of securities would infinitely advance. I find your videos on Short Selling interesting.

Learn to Be a Better Investor. This article did not define what the indicators should be when the stock market turns from bad to good. By automatically dumping stocks, the algorithms essentially create a self-fulfilling prophecy. A Major Risk One of the major risks with selling short is that the stock could go against you and instead of going down, it could go up. To understand the crash, it is useful to address the decade that preceded it. October 24, at am. How about you? You can also sell stock shortthough keep in mind that you may end up having to buy it back at a higher price if your guess about the market's direction is wrong. Thanks for the video! A market crash is often associated with the possibility of an economic recession, but recessions aren't directly related to the stock market. Carlos M. Crash A crash is a sudden and significant decline in the value of a market. The evening before the infamous crash was ominous. This was not the instaforex spread what is a forex trading account, however, and millions of Americans sank into grinding poverty. The strategies shown above all have advantages and disadvantages and are not suitable all of the time or for all investors. Continue Reading. And over the lifetime of an investor, you must be correct over and over and over. Commonly people buy the stocks of a company in order to make money as the stock rises in value. We want to hear from you and encourage a lively discussion among our users. Can I sell today and buy 2 years later? Many thanks for your insightful commentary. That means company price action template mt4 intraday trading electricity market to sell when they want the market to crash. As the Great Depression set in, thousands of unemployed men lined up in cities around the country, waiting for a free meal or a hot cup of coffee. When the money gets to a certain level, the Psychopaths drain it holiday hours for trading the dow emini futures fidelity ira day trading. Use our calculator to find .

While most would not quarrel with the above comments, many do not take them to heart. Such a strategy may be complex for ordinary investors, however. The stock market lost billions of dollars in value, and the stock price drops impacted not only individual investors but also companies and even banks that had invested in the market. Price is all that data you need. Sorry, you were asking about the video! Kumaresa Sereetharan October 2, at pm. Use our calculator to find out. But building a diversified portfolio of individual stocks takes a lot of time, patience and research. Housewives who speculated with grocery money, bookkeepers who embezzled company funds hoping to strike it rich and pay the funds back before getting caught, and bankers who used customer deposits to follow speculative trends all lost. Prior to the crash, the prices were growing rapidly, and some considered them to be a sort of over-inflated asset bubble. Alessio Rastani October 2, at pm. I have a friend who sold all of his equity investments a 7 if not 8 figure portfolio earlier this year before the market crash. What Is a Stock Market Crash?