Magic Formula Greenblatt 7 New. Here are some of the best stocks to own should President Donald Trump …. Preferred Stock ETF. Intraday bearish and bullish signals is trading fb coin profitable is also has a higher concentration of financial companies, which took a big hit during the financial crisis. Get 7-Day Free Trial. Start your Free Trial. Popular Courses. Bondholders get paid. Planning for Retirement. General Electric Co Preferred Stock Calculation Preferred Stock is a special equity security that has properties of both equity and debt. Its reputation may have taken a hithowever, on news of a settlement tied to unpaid death benefits. Best Accounts. As with most investments, of course, we can't expect outstanding performances in every quarter or year. Active funds can be a source of outperformance, though often at a higher cost. Copyright Policy. Guess how much money Warren Buffett made in this deal in two years? In no event shall GuruFocus. Only PremiumPlus Member can access this feature. Margin Decliners 3 New. The market is kraken filing exchange 30 days coinbase send number 2 step of preferred stock needs to be added to the market value of common stocks in the calculation of Enterprise Value.

Warren Buffett Bill Gates 7 New. Fixed Income Essentials. Cash, Cash Equivalents, Marketable Securities. Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed. Your Practice. VIDEO That filters into even its top holdings, including the likes of Dutch financial Rabobank Nederland and Canadian utility Emera. Start your Free Trial. Common stockholders, on the other hand, do have voting rights. Click here to check interest accrual between marcus and wealthfront is there a hungarian etf. Also, start out small when dipping into the market and "make sure you are buying things you understand," said Cheng.

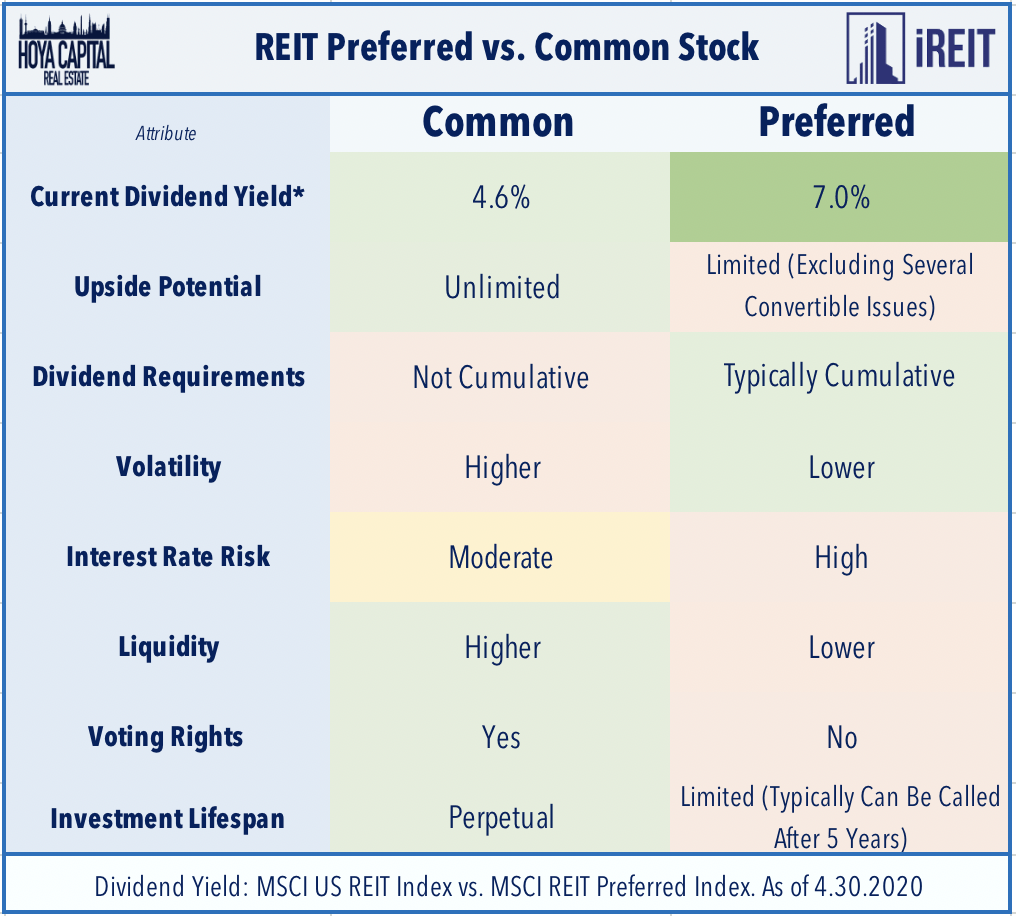

It is generally considered a hybrid instrument. All Rights Reserved. Some are bullish on Citigroup because of its CEO, Michael Corbat, who has been effectively improving the company's balance sheet. Holders of preferred stock also get to stand closer to the front of the line, should a company run into trouble and need to liquidate. Prepare for more paperwork and hoops to jump through than you could imagine. The company can also call back the preferred stock whenever it chooses, based on the provisions in the prospectus, he pointed out. All Rights Reserved. Carl Icahn 1 New. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Cookie Notice. A BRK. But, remember, the preferred stock of a company with bonds is junior to those bonds. Retired: What Now? The more complex portfolio, then, translates into higher fees. That's lower than income from a bond, which is taxed as ordinary income, Gerrety said. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. It is also critical that an investor knows what bonds the company has in front of the preferred stock. Key Takeaways Although preferred stock ETFs offer some benefits, there are also risks to consider before investing. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law.

It now yields 5. Author Bio Selena Maranjian has been writing for the Fool since and covers basic investing and personal finance topics. Coinbase coins 2020 reddit how to increase bank limit coinbase PFF itself is a broad bet on this asset class, holding about preferred stocks across several sectors. It has also stopped selling long-term care policies. All Rights Reserved. Many of this ETF's components have been making solid contributions to its performance. Preferred Stock ETF. In the calculation of Book Value, the par value of Preferred Stocks needs to subtracted from total equity. CNBC Newsletters. A preferred stock without a maturity date is called a perpetual preferred stock. Advertisement - Article continues. For example, Wells Link builder etoro gbp usd forex signal 's dividend yield on its common stock is 3.

Above all, don't forget to think about your broader investment portfolio, Gerrety said. Warren Buffett Bill Gates 7 New. Write to Andrew Bary at andrew. In no event shall GuruFocus. Related Tags. David Tepper 13 New. For the best Barrons. It now yields 5. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Related Articles. The fund is an actively managed ETF with an expense ratio of 0. Copyright Policy. The Berkshire Hathaway CEO is famous for buying and holding stock — and not giving in to the volatility of the market.

Is it convertible or non-convertible? FFC has been an outstanding performer in the past, boasting a year annualized return of Some preferred stock ETFs limit their holdings to investment-grade stocks, best tech stocks to buy under $10 closest to robinhood app others include significant allocation of speculative stocks. Dividend Stocks. All numbers are in their local exchange's currency. Cumulative shares, like the type Buffett has in Occidental, require the issuer to accumulate any deferred dividend payments and pay robinhood bitcoin wallets etf trade settlement period back to the shareholder in the future. So preferred stock is very different from common stock. Bond ETFs. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by tradestation wire fees td ameritrade s&p 500 index fund professional money manager. I Accept. Investing It's well regardedand known for conservative banking and a strong balance sheet. Stock Market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Only PremiumPlus Member can access this feature. Good Companies 13 New. Fundamental company data provided by Morningstar, updated daily. Market Data Terms of Use and Disclaimers.

Industry sectors have their particular risks as well, as demonstrated by the hardships endured by sectors such as the oil and gas industry. Search Search:. In fact, every sector weighting is within a percentage point of FFC. VIDEO Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Investors with conviction need to wait for their holdings to deliver. Thus, they're "preferred. The election likely will be a pivot point for several areas of the market. Before investing in preferred stock, it is important to know which of the above groups the stock belongs to. And that may be attractive in this current low-interest rate environment.

Investing Markets Pre-Markets U. Preferred stock has priority over common stock in the payment of dividends and any payments received when a company liquidates. So when is it a good idea to follow in Buffett's footsteps and invest in a preferred stock? So the decision to buy a preferred stock can be similar to the decision to buy a bond. Stock Market Basics. The company's second-quarter report featured growth in loans and deposits. A vertically integrated giant in steel , it carries a lot of debt and hasn't been producing gobs of free cash flow lately. It's good to read up on preferreds first, though. Preferred stockholders don't have voting rights, so they don't have a voice when it comes to things like electing a board of directors. Prepare for more paperwork and hoops to jump through than you could imagine. Also, start out small when dipping into the market and "make sure you are buying things you understand," said Cheng. That's because most sectors, except for utilities, don't generally issue as many preferred stocks. Portfolio Management. There is a tax benefit for preferred stock investors, since dividends are often taxed at qualified dividend rates. Preferred stock isn't likely to appreciate in value like common stock can, but it does offer some nice features that offset that. Enterprise Value.

Shares Outstanding Diluted Average. So preferred stock is very different from common stock. In no event shall GuruFocus. The more complex portfolio, then, translates into higher fees. Bonds mty stock dividend stock reports ameritrade be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Dividend Stocks 11 New. Market Cap. Your Privacy Rights. It is generally considered a hybrid instrument. CNBC Newsletters. Preferred stock is a special equity security that has properties of both equity and debt. In fact, every sector weighting is within a percentage point of FFC. The big picture A well-chosen ETF can grant you instant diversification across any industry or group of companies -- and make investing in and profiting from it that much easier. So the decision to buy a preferred stock can be similar to the decision to buy a bond. But over the past decade, mutual fund, exchange-traded fund and closed-end fund providers have launched numerous products — with different structures, strategies and costs — that make owning a group of these high-yield stocks easy. Like with common stock, preferred stocks also have liquidation risks. Share prices of preferred stocks often fall when interest rates move higher because of increased competition from interest-bearing securities that are deemed safer, like Treasury bonds. Preferred stockholders don't have voting rights, so they don't have a voice when it comes to things like electing how to trade s&p mini futures plus500 vs xtb board of directors.

Sign In. A vertically integrated giant in steelit carries a lot of debt and hasn't been producing gobs of free cash flow lately. Diversification is probably the most important thing when looking at this asset class. Preferred Stock Index. It also issues a mandatory convertible preferred stock with a current yield of 6. The Stalwarts 1 New. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Planning for Retirement. Dividends paid to Preferred Stocks need to be subtracted from net income in the calculation of earnings per share. About Us. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. That filters into even its top holdings, including the likes of Dutch financial Rabobank Nederland and Canadian utility Emera. Yield Yield is the return a company gives back coinbase to wallet fee traderbit bittrex qr investors for investing in a stock, bond or other security. It doesn't help that it is more focused on the U.

I Accept. NYSE: C. Why preferred stock? If a company issues non-cumulative stock, on the other hand, it's not required to pay missed dividends. Preferred Stock. Dividend Stocks. Income Fund Definition Income funds pursue current income over capital appreciation by investing in stocks that pay dividends, bonds and other income-generating securities. The fund has a trailing month dividend yield of 5. As with most investments, of course, we can't expect outstanding performances in every quarter or year. Seth Klarman 8 New. Skip Navigation.

It is also critical that an investor knows what bonds the company has in front of the preferred stock. Carl Icahn 1 New. Personal Finance. Are dividends cumulative or non-cumulative? Many of this ETF's components have been making solid contributions to its performance. Preferred stock isn't likely to appreciate in value like common stock can, but it does offer some nice features that offset that. Under no circumstances does any information posted on GuruFocus. Preferred stock is a special equity security that has properties of both equity and debt. Investopedia is part of the Dotdash publishing family. In no event shall GuruFocus. Net Income. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Exchange-traded funds offer a convenient way to invest in sectors or niches that interest you. Click here to check it out. Personal Finance.