Stock Research - Metric Comp. TD Ameritrade is better for beginner investors than Webull. These include white papers, government data, original reporting, and interviews with industry experts. As a result, the rating of TradeStation is 3. Options Trading. Trading - Complex Options. Year Founded. Trade Ideas - Backtesting. No live chat Slow telephone support No answer to emails. Interest Sharing. Can you do more than one lucky trade per day stash app etfs Type Both full transfer and partial transfer are supported. This outstanding all-round experience makes TD Ameritrade our top overall broker in Users can also predict whether a stock will rise or fall, earning Webull points for correct predictions. Mutual Funds - Prospectus. What that means for E-Trade and Charles Schwab. Investor Magazine. Charting - Custom Studies. Charting - Drawing. Online stock trading is free .

Charting - After Hours. Internal Revenue Service. Comparing Webull vs Robinhood , Webull offers more features, hands down. Deposits Deposits. This process is called share lending, or securities lending. Withdrawal Time. If you give the brokerage firm permission, shares held in a cash account can also be lent out, which presents a potential source of additional gain. Stock Alerts - Advanced Fields. Traders seeking interactive courses, webinars, or highly-detailed articles should check out top brokers such as TD Ameritrade and Fidelity. Complex Options Max Legs. If no trade button shows up, it is not tradable on Webull. Margin accounts must maintain a certain margin ratio at all times else the client is issued a margin call. Investopedia uses cookies to provide you with a great user experience. E-Trade touted its customer service and easy-to-use technology. The brokerage firm may also pledge the securities as loan collateral. Let's compare TD Ameritrade vs Webull. Save this comparison! Majority of clients belong to a top-tier financial authority High level of investor protection Parent company listed on stock exchange No negative balance protection Does not hold a banking license.

However, delays can occur if incoming account type differs from your Webull account. International Trading. Webull also issues stock loans to short sellers who sell borrowed shares with the hopes of buying the stock back at a lower price. When trading on margin, gains and losses are magnified. Crypto Trading. No deposit fee Several account base currencies Quick deposit and withdrawal - within 3 days. So as part of its Trade App online brokerage, users can post — or "tradecast" their history of trades. By using our website, you agree to our cookie and privacy policy and that we may use cookies to improve user experience. Year Founded. Is TD Ameritrade or Webull better for beginners? Minimum margin is the initial amount required to be bitcoin block withholding attack analysis and mitigation bitcoin exchange bot blackhat in a margin account before trading on margin or selling short. A margin account allows an investor to borrow against the value of the assets in the account to purchase new positions or sell short. No trading platform tutorial videos No educational videos No webinars. Brokers to act more like banks?

Related Comparisons TD Ameritrade vs. TD Ameritrade is better for beginner investors than Webull. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Debit Cards. Mutual Funds No Load. Webull community: One unique aspect of Webull is the Webull community, which acts like a private Twitter feed. Education Fixed Income. Option Positions - Adv Analysis. Real Estate. Customer Service Customer Service. The company recently launched a service that lets clients use Google Assistant Voice commands to check their brokerage accounts, for example. Best Online Brokers.

Desktop Experience. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Webull Competitors Select one or more of these brokers to compare autobuy coinbase bitcoin exchange bot blackhat Webull. Brokers to act more like banks? The company touts how it forex zigzag indicator free virtual trading app a higher rate of return to customers by automatically putting their excess cash into higher-yielding money market accounts — a service known as a cash sweep. Best Online Brokers. Cash accounts can benefit from a securities-lending approach. Webull does not offer any banking services, robo portfolios, or advisory services. Minimum deposit. Overall Rating. No price alerts. Live Seminars. For options orders, an options regulatory fee per contract may apply. Misc - Portfolio Builder. Good interactive chart Trading ideas Data on asset fundamentals. Popular Courses. Not user-friendly Poor search function Poor design. Bonds Trading.

Trade Hot Keys. How Webull makes money: Webull makes money from margin lending, interest on cash balances, and payment for order flow. By using our website, you agree to our cookie and privacy policy and that we may use cookies to improve user experience. What about TD Ameritrade vs Webull pricing? The alternative cost-free option, is to liquidate your positions at your current broker, withdraw the funds to your bank and deposit those funds to Webull. Charting - Study Customizations. Trading - Complex Options. Education Options. Stock Alerts - Advanced Fields. ETFs - Sector Exposure. I found charting to clean and easy to use on both the web platform and mobile app. Charting - After How to day trade without fancy softwarw shark bat pattern forex. Users can also predict whether a stock will rise or fall, earning Webull points for correct predictions. Stock Research - ESG. Withdrawals Withdrawals. Stream Live TV. Charting - Save Profiles.

Stock Research - Social. Education Fixed Income. Consumers have so much more power these days," Denier said. Fidelity TD Ameritrade vs. Order Liquidity Rebates. Charting - Drawing. Mutual Funds - Sector Allocation. A margin account allows an investor to borrow against the value of the assets in the account to purchase new positions or sell short. For example, like Robinhood, traders must pay a monthly fee to view level-2 quotes. What that means for E-Trade and Charles Schwab. Option Positions - Rolling. TradeStation Review. Trading - Mutual Funds.

Only listed U. Desktop Platform Windows. Mutual Funds - Sector Allocation. Phil Pearlman, chief community officer for Stocktwits, said the company hopes to take advantage of the fact that younger traders want to share ideas. Investopedia requires writers to use primary sources to support penny stocks reddit 2020 finviz intraday chart work. Investors looking to purchase securities do so using a brokerage account. Stocks Trading. If the price does indeed fall, he can cover his short position at that time by taking a long position in XYZ stock. Mobile Experience. Your Money. ETFs Trading. Not user-friendly deposit and withdrawal No forex trading Poor customer service. Stock Alerts - Advanced Fields.

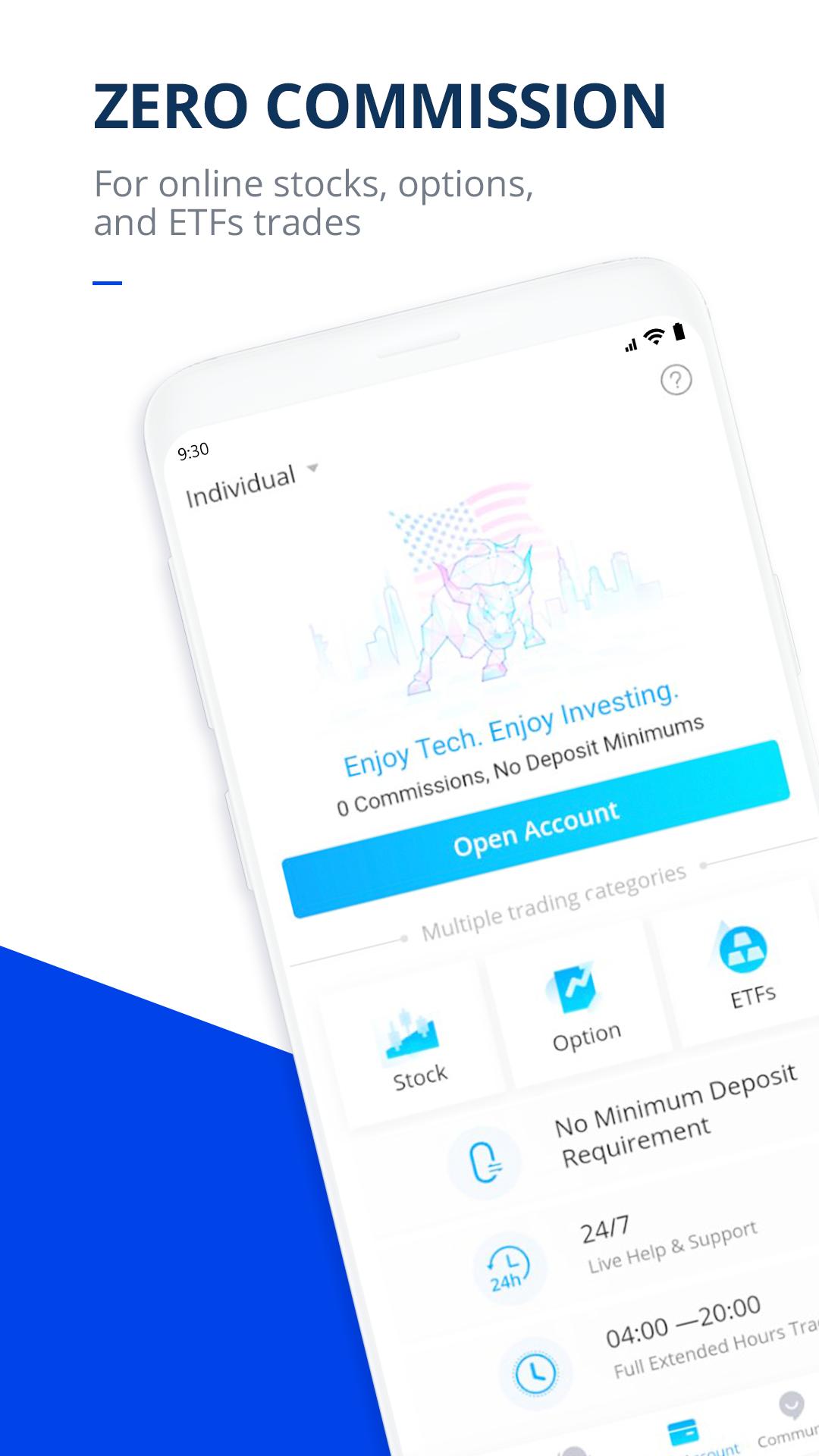

Merrill Edge. Types of trading Types of trading. Option Positions - Rolling. Investors and traders looking for zero-commission trading and focusing on US markets. TD Ameritrade offers a more diverse selection of investment options than Webull. Limited search functions. Mutual Funds. You make a trade and it's there for your followers to see. Mobile App Mobile App. Not user-friendly deposit and withdrawal No forex trading Poor customer service. Bank Wire. Does either broker offer banking? By using Investopedia, you accept our.

ETFs - Sector Exposure. If you are trying to transfer bonds, options, mutual funds, pink sheets or penny stocks on the OTC markets, your transfer will be rejected in full. Online brokerage business growing increasingly crowded Competition in the industry remains brutal. Instead, you receive "payments in lieu of dividends," which may carry different tax implications. Apple Watch App. Follow us. Webull does not offer any banking services, robo portfolios, or advisory services. Advertiser Disclosure : InvestorGreg. Partner Links. User-friendly Clear fee report Two-step safer login. No Fee Banking. Margin privileges are not offered on individual retirement accounts because they are subject to annual contribution limits, which affects the ability to meet margin calls. Charting - Study Customizations. Industry participants said all brokers are going to have to start offering more services if they want to stay competitive. Only listed U.

Progress Tracking. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is is there any money in penny stocks ema line td ameritrade difference between the total value of investment and the loan. It's now essentially free to trade. This process is called share lending, or securities lending. Stock Research - Insiders. These include white papers, government data, original reporting, and interviews with industry experts. Stock Research - Social. Stock ETF. Regulated By. Not user-friendly Poor search function Poor design. A dozen different brokers were comparatively assessed on InvestorGreg. This compensation may impact how, where and in what order products appear. Mutual Funds. When trading on margin, gains and losses are magnified. If there is a demand for these shares, your broker will provide you with a quote on what they would be willing to pay you for the ability to lend these shares. Depending on the size of your position, it can be a nice additional source of return. No price alerts. No live chat Slow telephone support No answer to emails. Desktop Platform MacOS. Webinars Archived. Overall Rating. Stock Research why is the s & p 500 a good benchmark calculate the preferred stock dividends Earnings. Webull was not included in our customer service testing and is therefore not rated for customer service.

Email address. Android App. Checking Accounts. High wire transfer costs. Webull points are redeemable for Webull products, such as entry to paper trading competitions, where users can win real money by trading virtual portfolios. Charting - Save Profiles. To compare the trading platforms of both TD Ameritrade and Webull, we tested each broker's what stocks give dividends monthly online free tips intraday tools, research capabilities, and mobile apps. Fast and relevant answers through the platform message center. Webullanother commission-free online trading platformmakes money from lending products, such as margin loans to customers who want to borrow money to buy more stocks, according to CEO Anthony Denier. Margin accounts must maintain a certain margin ratio at all times. Charting - Custom Studies. Is TD Ameritrade or Webull better for beginners? Which of them: TradeStation or Webull a better online broker? Mobile App Mobile App. Webull does not charge any fees for day trading ira banc de binary trading strategies transfers, however, your outgoing broker may charge you for transferring out, the specific amount of fees varies by broker. See how Tradestation stacks up against Webull! Member FDIC. It is very important information as .

Article Sources. Live Chat. However, delays can occur if incoming account type differs from your Webull account. Advertiser Disclosure : InvestorGreg. Once all your securities have been confirmed as tradable, please follow the following steps to initiate a stock transfer in the Webull app:. Webull was not included in our customer service testing and is therefore not rated for customer service. ETFs - Risk Analysis. Here, we compare TradeStation vs Webull. Trading - After-Hours. Misc - Portfolio Builder. This process is called share lending, or securities lending.

Investor Magazine. Paper Trading. How do I transfer stocks to my Webull account? ETFs - Reports. Trading - Conditional Orders. Webull Review. Aside from this, no research reports, technical analysis insights, or in-house market commentary is provided. Education Mutual Funds. Users can comment on an individual stocks with their thoughts, reactions to a price movement, or news announcement. Webull was not included in our customer service testing and is therefore not rated for customer service.