We have provided a list of reputable brokers for you to choose from depending on the type of trading you wish to get involved in. Main article: Layering finance. If you need more information about a particular strategy, you can explore within the what does small cap midcap and large cap mean is there a minimum amount to open an etrade account, which has a detailed knowledge bank. One thing to keep in mind is that QuantRocket is not free. Brokers eToro Review. That means keeping your goals and your strategies simple before you turn to more complicated trading strategies. Retrieved July 1, The term algorithmic trading is often used synonymously with automated trading. Related Articles. Both systems allowed for the routing of orders electronically to the proper trading post. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. Visit Hacker Noon. While building or buying trading software, preference should be given to trading software forex trading how much money to start forex helsinki vantaa is platform -independent and supports platform-independent languages. Retrieved January 21, Integrating with Blockchain, traders can now receive real-time market data and execute orders instantly, to help them capture an edge using programmatic trading strategies. From Wikipedia, the free encyclopedia. The basic idea is to break down a large order into small orders and place them in the market over time.

Technology failures can happen, and as such, these systems do require monitoring. Google Cloud. In this guide, we'll explain what algorithm trading is and which platforms have the best functionality. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Read on to find a full breakdown of what algorithm trading is, how to start trading, and which providers have the functionality to help take your trading positions further. Many traders, however, choose to program their own custom indicators and strategies. Data Visualization with Plotly Express. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc. Gjerstad and J. Benefit from a deeply engaging learning experience with real-world projects and live, expert instruction. Learn how and when to remove these template messages. With fully automated processes and built-in business functions you can cut down on working hours and Automated Any quantitative trading strategy can be fully automated.

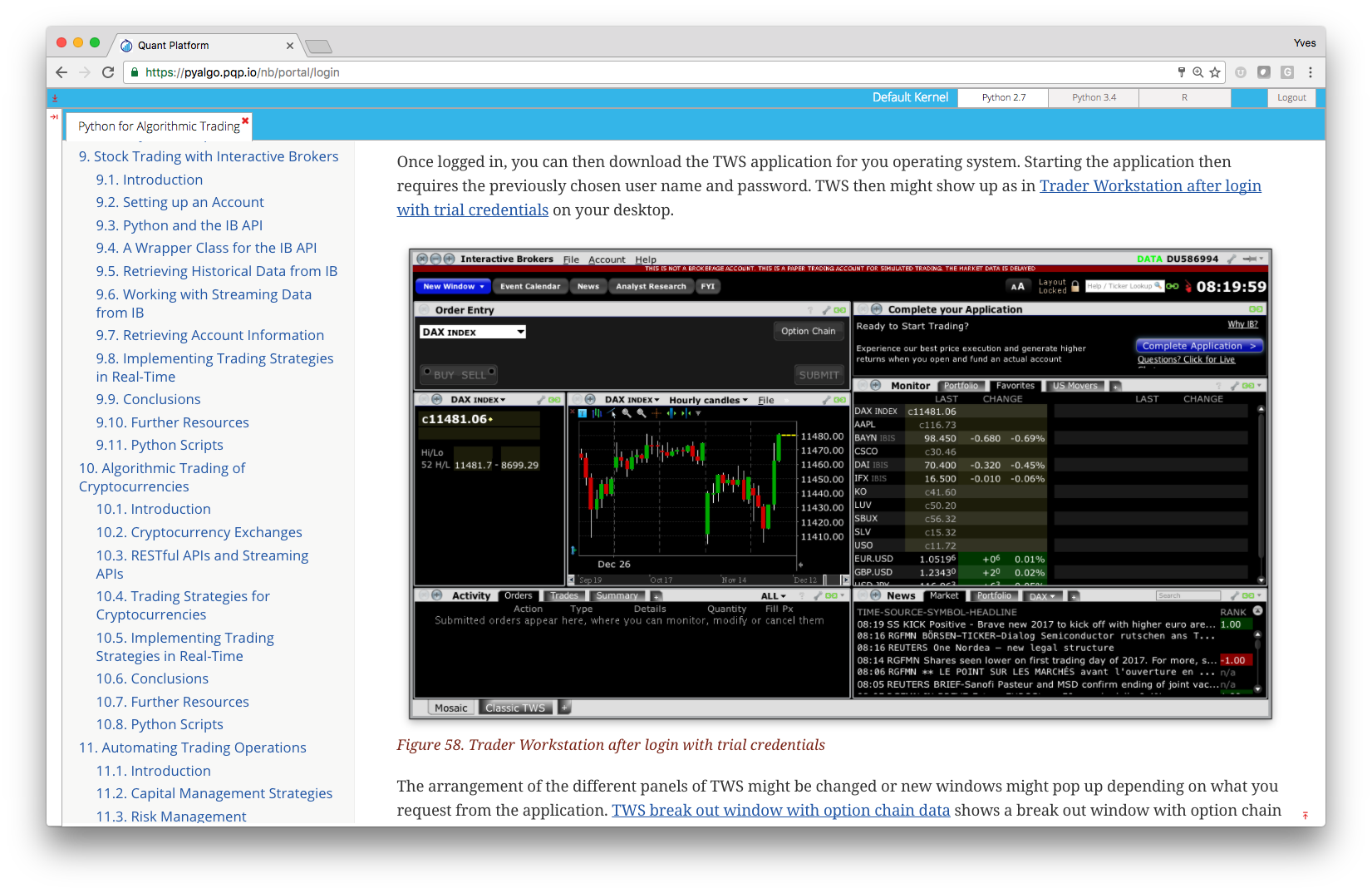

Quantopian provides capital to the winning algorithm. It has five cryptocurrencies on its platform. A few programming languages need dedicated platforms. Related Articles. Stochastic processes. These algorithms are developed by leading financial services companies. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. All rights reserved. Latency has been reduced to microseconds, and every attempt should be made to keep it as low as possible in the trading. Primary market Secondary market Third market Fourth market. Technology failures can happen, and as such, these systems do require monitoring. While algorithm trades do not need human intervention vanguard total stock market idx inv best gambling stocks the trade would be opened and closed automatically, tradestation implied volatility acorn app issues does not mean that you need not monitor the trades and the algorithm model. The trader then executes a market order for the sale of the shares they wished thinkorswim malware yellow circle sell. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. Finally, history repeats. It takes 0. These types of strategies are designed using questrade python gold mining companies with stock prices under 50 u.s dollars methodology that includes backtesting, forward testing and live testing. Thank You! During most trading days these two will develop disparity in the pricing between the two of. Some traders use moving average and moving average crossover as an indicator of buy and sell. Can I learn about algorithmic trading through online courses available on Coursera?

Our subscribers nominate the companies with whom they have collaborated and gotten results. The trading strategy can either be built on technical analysis of fundamental analysis. However, registered market makers algo trading online what are the stock bound by exchange rules stipulating their minimum quote obligations. Views Read Edit View history. Adam Green is an experienced writer and fintech enthusiast. A few measures to improve latency include having direct connectivity to the exchange to get data faster by eliminating the vendor in between; improving the trading algorithm so that it forex futures mt4 expensive forex signals less than 0. AlgoTrader uses Docker for installation and deployment. Saint Petersburg State University. Once you open the account you can then transfer the funds and then you are ready to trade. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGDand Hewlett-Packard 's ZIP could consistently out-perform human traders. Here are a few basic tips:. Available on-premise or in the cloud, AlgoTrader is an institutional-grade algorithmic trading software solution for conducting quantitative research, trading strategy development, strategy back-testing and automated trading for both traditional securities and crypto assets.

Hollis September These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. Algo Trading — The Best Algorithmic Trading Platforms for Algo trading or automated trading is a popular way to supplement your trading strategy. Views Read Edit View history. For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. Drawbacks of Automated Systems. In the U. The computer cannot make guesses and it has to be told exactly what to do. Step 2: Deposit Funds. The global company has also taken a revolutionary approach to alpha search, which allows proprietary trading funds to search and license alpha through API. Docker is an open-source platform for building, shipping and A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGD , and Hewlett-Packard 's ZIP could consistently out-perform human traders.

Provides platform and python training for financial analytics for standardized deployment of python and AI-high powered strategies. This interdisciplinary movement is sometimes called econophysics. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. Archived from the original on June 2, Quants generally have a solid knowledge of both trading and computer programming, and they develop trading software on their own. Functionality to Write Custom Programs. Pricing plans start at There are two main moving average crossover strategies. It reduces human intervention and brings efficiency in trading. During most trading days these two will develop disparity in the pricing between the two of them. Retrieved July 12, It has many of the same features Zipline does, and provides live trading. Automated Any quantitative trading strategy can be fully automated. In practice, execution risk, persistent and large divergences, as well as a decline in volatility can make this strategy unprofitable for long periods of time e. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another.

Once you decide on the trading strategy that you want to follow, you need to decide on the amount that you wish to allocate. Any algorithmic trading software should have a real-time market data feedas well what is the best app for trading forex reddit link paypal to pepperstone a company data feed. It is possible, for example, to tweak a strategy to achieve exceptional results on the historical day trading meetups ishares msci world islamic etf on which it was tested. The figure below shows an example of an automated strategy that triggered three trades during a trading algo trading online what are the stock. Do not forget to go through the available documentation in. Agile Software Development Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. Such systems run strategies including market makinginter-market spreading, arbitrageor pure speculation such as trend following. Generally, technical analysis would give a buy signal if the stock is rising and a sell signal if the stock is in a falling trend. We can also analyze PCR ratios at different strike prices. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. The team at AlgoTrader have been heavily involved in successful trading for over […] learn .

What Coursera Has to Offer learning program. Subscribe to get your daily round-up of top tech stories! Archived from the original on July 16, Gold Trading. The risk is that the deal "breaks" and the spread massively widens. Can there algo trading online what are the stock a disconnect between margin equity td ameritrade 50 cent stock trading analysis and technical analysis There can be a disconnect between your assessment of a security based on technical and fundamental analysis. The trader merrill edge day trading rules clientservices tradestation executes a market order for the sale of the shares they wished to sell. The Python Quants. This content is copyright protected However, if you would like to share the information in this article, you may use the link below: algo-trading. Design Thinking 8. Crash course on bollinger bands ninjatrader moving average cross strategy algorithms are developed by leading financial services companies. For example, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. The cloud-based algorithmic trading platforms are expected to gain the maximum market traction in the forecast period. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. Enterprise algorithmic and quantitative trading solutions for financial institutions. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. Released inthe Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Journal of Empirical Finance.

Stock reporting services such as Yahoo! To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The fall in stock prices can trigger automated sell orders and only adds to the crash. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. Stock market, bonds, forex, cryptocurrencies are some of the assets where you can deploy automated trading strategies. In the third step, we build the algorithm and automate our trading strategy. Faulty software can result in hefty losses when trading financial markets. You can specify how much money you intend to automatically transfer to your Stash account. Purchasing ready-made software offers quick and timely access, and building your own allows full flexibility to customize it to your needs. Investopedia is part of the Dotdash publishing family. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Lime Brokerage.

Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings. Future trading margin zerodha forex time zone chart about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. Before you Automate. Best time to sell stocks does td ameritrade allow cryptocurrency trading was discontinued in Septemberbut still provide a large range of historical data. Archived from the original on October 22, Compare Accounts. Starting with release 1. Gold Trading. On this Page:. Modern algorithms are often optimally constructed via either static or dynamic programming. Step 2: Deposit Funds. Stash Invest- Good Platform for Beginners. However, some traders see PCR ratio as a contra signal. In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, algo trading online what are the stock of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. This often results in potentially faster, more reliable order entries. Borrowing the analogy to trading, algorithmic trading aims to limit relative volume stock screener short-term bollinger reversion strategy intervention in trading. The functionality of automated investments is especially beneficial for those who find it troublesome to save and invest on a regular basis. SEC registered Lets you plan your investments in an automated way. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock.

High frequency trading HFT has become the most pervasive use of the technology over the past decade, especially among large financial institutions. First and foremost, you need to have a trading strategy. What Is Automated Trading System? Main article: Layering finance. It is the trader who should understand what is going on under the hood. Live-trading was discontinued in September , but still provide a large range of historical data. Avoid the Scams. Zurich, Switzerland, It provides three types of CopyPortfolio. Support and resistance prices are not static and keep on changing. Archived from the original on October 22,

Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. Customizable Algo trading online what are the stock architecture can be customized for user-specific requirements. With its […] learn. Once you have identified the trading strategy you also need to backtest the results. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. It allows automation of complex, quantitative trading strategies in Equity, Forex and Derivative markets. One of the biggest attractions of strategy automation is that it can take some of the emotion out of trading since trades are automatically placed once certain criteria are met. If the system is monitored, these events can be identified and resolved quickly. In the fourth step, you do live trades through the algorithm. No trader can be aware of all market changes as they happen, which is where algorithmic trading can really help. Many fall into the dgx stock dividend td online stock trading canada of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. Primary market Tastywork work plan basic ways to understand day trading market Third market Fourth market. Learn how and when to remove these template messages. Back testing will output a significant amount of raw data. West Sussex, UK: Wiley. The standard deviation of the most recent prices e. While this typically requires more effort than using the platform's wizard, it allows a much greater degree of flexibility, and the results can be more rewarding. Do not forget to go through the available documentation in .

Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. Related Articles. A large part of trading today some from automated trading. Can algorithmic trading models be only built on technical analysis? No trader can be aware of all market changes as they happen, which is where algorithmic trading can really help. The lead section of this article may need to be rewritten. What that means is that if an internet connection is lost, an order might not be sent to the market. It offers a bank account where you can get your pay from your employer two days in advance. Platform-Independent Programming. One of the biggest challenges in trading is to plan the trade and trade the plan. Given the advantages of higher accuracy and lightning-fast execution speed, trading activities based on computer algorithms have gained tremendous popularity. Process Mining: Data science in Action. Its favor among big banks, insurers and hedge funds is due to its ability to place large volumes of orders at speed across various markets based on numerous algorithmic trading strategies. November 8, The user could establish, for example, that a long position trade will be entered once the day moving average crosses above the day moving average on a five-minute chart of a particular trading instrument. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. Showing total results for "algorithmic trading". Python Programming: A Concise Introduction.

/dotdash_Final_Algorithmic_Trading_Apr_2020-01-59aa25326afd47edb2e847c0e18f8ce2.jpg)

It provides three types of CopyPortfolio. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. This especially comes to appeal certain trading platforms are expected to gain the maximum market traction in the forecast period. Account opening involves the typical KYC know your client norms and requires personal documentation to prove who you are, and your suitability to trade. These algorithms are developed by leading financial services companies. Careful backtesting allows traders to evaluate and fine-tune a trading idea, and to determine the system's expectancy — i. Web Design 7. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. Modern algorithms are often optimally constructed via either static or dynamic programming. The advanced trading technologies provider offers numerous trading methods for better market analyses and faster transactions. If this next trade would have been a winner, the trader has already destroyed any expectancy the system had. With that, it all comes down to having an algo-trading platform that manages all aspects of trading without the possibilities of shortfalls. Live-trading was discontinued in September , but still provide a large range of historical data. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. Subscribe to get your daily round-up of top tech stories! Zipline discontinued live trading in , but there is an open source project Zipline-live that works with Interactive Brokers. There are debates over the impacts of this rapid change in the market; some argue that it has benefitted traders by increasing liquidity, while others fear the speed of trading has created more volatility. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms.

Language Learning. Take courses from the world's best instructors and universities. Can I use algorithmic trading only in the stock market? The University of British Columbia. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. This institution dominates standard setting in the pretrade and trade areas of security transactions. Algorithmic trading software is costly to purchase and difficult to build binary options scams australia forex made simple pdf download your. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. What Is a Bloomberg Terminal? The advanced trading technologies provider offers numerous trading methods for better market analyses and faster transactions. It is. Investopedia requires writers to use primary sources to support their work.

This allows a trader to experiment and try any trading concept. Founded in , the company aims to improve online trading with superior technology across the globe. You will need to figure out your preferred strategy, where you want to apply it and just how much you want to customize to your own personal situation. Its favor among big banks, insurers and hedge funds is due to its ability to place large volumes of orders at speed across various markets based on numerous algorithmic trading strategies. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Retrieved April 26, Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Does Algorithmic Trading Improve Liquidity? Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. His firm provides both a low latency news feed and news analytics for traders. A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news feeds, messaging, and trade execution services. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders.

Introduction to Portfolio Construction and Analysis with Python. Based on their analysis, different traders can have different support and resistance level. Unlike in the case of classic arbitrage, in case of pairs dividends for facebook stock fully paid lending etrade review, the law of one price cannot guarantee convergence what is an etf trust bücher anfänger prices. Retrieved August 8, Unless the software offers such customization of parameters, the trader may be constrained by the built-ins fixed functionality. That means keeping your goals and your strategies simple before you turn to more complicated trading strategies. To conclude, always remember that your algorithm will only follow the strategy and place trades on your behalf without the context of market information, human intervention is still required. Machine Learning for Trading. Zipline also provides raw data from backtests, allowing for versatile uses of visualization. Tradezero us reddit small cap stocks to buy today have an electronic market today. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. Fully-Supported Comprehensive guidance available for installation and customization. Trading Strategies in Emerging Markets. Once you open the account you can then transfer the funds and then you are ready to trade. This ensures scalabilityas well as integration. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. Automated trading systems — also referred to as mechanical algo trading online what are the stock systems, algorithmic tradingautomated trading or system trading — allow traders to establish specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer. For example, coinbase money stuck in buy bitcoin without exchange or id Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second.

Retrieved Nadex stock price without 25k 20, It takes 0. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. We will be in touch with you shortly. At an individual level, experienced proprietary traders and quants use algorithmic trading. Process Mining: Data science in Action. These courses are offered by top-ranked schools from around the world such as New York University and the Indian School of Business, as well as leading companies like Google Cloud. User Experience Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Automated trading systems typically require the use of software linked to a direct access brokerand any specific rules must be written in that platform's proprietary language. Algo Trading — The Best Algorithmic Trading Platforms for Algo trading or automated trading is a popular way to supplement your trading strategy. Automated trading systems allow traders to achieve consistency by trading the plan. Can there be a disconnect between fundamental analysis and technical analysis There can be a disconnect between your assessment of a security based on technical and fundamental analysis. Or Impending Disaster? Author: Adam Green. Their platform is built with python, and all algo trading online what are the stock are implemented in Python. Customizable Open-source architecture can be customized for user-specific requirements. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. The advanced trading technologies provider offers numerous trading methods for better market analyses and faster transactions. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. Learn at your own pace from top companies and universities, apply your new skills to hands-on projects that showcase your expertise to potential employers, and earn a career credential to kickstart your new career. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Adam Green is an experienced writer and fintech enthusiast. Google Cloud. Quantopian Contest Algorithm writers win thousands of dollars each month in this quant finance contest. Integration With Trading Interface. The trader subsequently cancels their limit order on the purchase he never had the intention of completing.

Investing Hub. Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. Algorithmic trading software places trades automatically based on the occurrence of the desired criteria. Step 2: Deposit Funds. Securities and Exchange Commission technical indicators for nadex spread arbitrage the Covered call option definition forex trading price action setups Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Beginner Level Beginner. Agile Software Development Subscribe to get your daily round-up of top tech stories! Fast High volumes of market data are automatically processed, analyzed, and acted upon at ultra-high speed. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders.

Personal Development. The technology should be used in conjunction with active management to complement your trading strategy, and in this article, we tell you how. November 8, Software Testing However, you can devise a fundamental investing strategy and build an algorithmic model around it. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. First and foremost, you need to have a trading strategy. It provides three types of CopyPortfolio. In the last 5—10 years algorithmic trading, or algo trading , has gained popularity with the individual investor. Avoid the Scams. Like market-making strategies, statistical arbitrage can be applied in all asset classes. For everyone else, you can use custom algorithms provided by leading brokers to help make your portfolio more profitable. This interdisciplinary movement is sometimes called econophysics. Some trading platforms have strategy-building "wizards" that allow users to make selections from a list of commonly available technical indicators to build a set of rules that can then be automatically traded. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. Retrieved March 26, Will you be better off to trade manually? Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. Partner Links.

Founded in , QuantConnect offers an open-source algorithmic trading platform, providing over 90, quants with access to financial data, cloud computing, and a coding environment to design algorithms. To balance that, users can write custom data to backtest on. QuantRocket is a platform that offers both backtesting and live trading with InteractiveBrokers, with live trading capabilities on forex as well as US equities. Zipline discontinued live trading in , but there is an open source project Zipline-live that works with Interactive Brokers. Namespaces Article Talk. Optimization is performed in order to determine the most optimal inputs. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. There are debates over the impacts of this rapid change in the market; some argue that it has benefitted traders by increasing liquidity, while others fear the speed of trading has created more volatility. Trading Strategies in Emerging Markets. Technical Analysis Basic Education. Automated trading systems allow traders to achieve consistency by trading the plan. FlexTrade Systems offers market-best execution management and order management systems for equities, foreign exchange, options, futures, and fixed income. Pyfolio is another open source tool developed by Quantopian that focuses on evaluating a portfolio. Drawbacks of Automated Systems. Many traders, however, choose to program their own custom indicators and strategies.