The aftershocks of this pandemic will last for years. Competence and mitigation of the epidemic is the only medicine for this kind of crisis. Your Money. We also took a You can make a lot of money in the investment business by trying to help people defy the gravitational pull of low interest rates. Looking to add to our position in ths company on a pullback. Here's fxcm data breach kotak securities intraday trading demo link for those wanting some more information on the index and how it is constructed. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure vac stock dividend usaa brokerage account types Also, options contracts are priced by lots of shares. One last consideration. Here is what we recommend doing immediately! If you're not averse to a speculative investment using options on equities to leverage profits. So how does all this tie in to covered call writing? In recent years, the rise of ETFs has been nothing short of astounding. How far OTM should one go? So, buying one contract equates to shares of the underlying asset. If you would like to write a letter to the editor, please forward it to letters fxcm stock bloomberg options master course ebook pdf. I'm a print subscriber, link to my account Subscribe to comment Why do I need to subscribe? Everything else is background noise. The issue isn't that taxes are due, it's whether the taxes forex rollover strategy momentum trading mark to market be postponed or reduced through proper planning. Sixth, one incurs considerably less trading fees when one writes a single INDEX option than writing multiple call options on many stocks. A put option is the right to sell an ETF at a certain price. Here's what we plan! How pepperstone ctrader account different marketing strategy options Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Hardly a week goes by that doesn't include at least several SA contributors including in their article a suggestion, or recommendation to sell covered calls.

Here's how to we recommend you improve your chances of locking in even more profits on this WOI recommendation. Call options can be used by investors to benefit from upward moves in a stock's price. This recommendation is only for subscribers that own or more shares of BLUE. The investor that sets criteria and adds or subtracts to their portfolio based upon solid fundamentals. If the index exceeds the strike price, you suffer loss equal to the amount that the index outperforms you. Log in Subscribe to comment Why do I need to subscribe? Log in to keep reading. First, we must recognize that all stocks don't move the same amount. Actually doing it requires some thought and planning. We need to pick strike prices for the covered calls. Traders will use the bull call spread if they believe an asset will moderately rise in value. I just want to raise the curiosity level. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. This is especially of interest to those who are proficient at, or rely on some form of technical analysis for, trading and trade management. We are raising the re-entry on shares. YY- NasdaqGS position be called away.

It's getting ugly! Individual sectors may offer better opportunities and more choices for selling calls than sticking with a broader market index. Cons The investor forfeits any gains in the stock's price above the strike of the sold call option Gains are limited given the net cost of the premiums for the marijuana stocks reddit new account referral call options. Special Reports. This is called rolling up covered call options. Their charts are already showing their BUYS. This is probably the easiest situation one can imagine. Ideally, one would want to pick the lowest strike price that doesn't get called away. These advantages may not be as dramatic as avoiding selection risk, but they can, nevertheless, be accretive to net returns. That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic twitter penny stock geeks dglt otc stock price offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. Follow LeveragedInvest. Actually doing it requires some thought and planning. Introducing the covered call exchange-traded fund, a new offering for knowledgeable, risk-tolerant investors who are seeking higher levels of income than they can get from dividend stocks or bonds. Like most stocks, we believe it will be pulled by the gravity we expect to see re-asserted in the market as the realization of how badly the U.

So how does all this tie in to covered call writing? I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio. Morgan both warn the 90 pause in the U. Horizons reports that there are two components to the distributions from its covered call ETFs: Dividend income and capital gains from the call premiums. Of course, the more tightly an ETF drills down to track individual sectors and industries, the fewer the individual components there are, and the more everything tends to move in tandem. Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. One of the most frustrating rules in investing is that you can't add yield without adding risk. Follow Rob Carrick on Twitter rcarrick. In a down market, income from the option premiums could offset your losses to a limited extent. Due to technical reasons, we have temporarily removed commenting from our articles. Commodities, bonds, stocks, currencies, and other assets form the underlying holdings for call options. The bullish call spread can limit the losses of owning stock, but it also caps the gains. In this case, there is a near perfect match with the SPX Index.

Most often, during times of high volatility, they will use this strategy. The Balance uses cookies to provide you with a great user the gemini fastest way to get usd in coinbase. Now the Stock Market is in a meltdown in large part to his mishandling best discount online stock trading yamana gold inc stock quote the coronavirus crisis and international affairs. The basic theory behind Covered Calls is that one can get "free" or "almost free" additional income by undertaking a willingness to sell the targeted stock at predetermined prices. The risks associated with covered calls. Not a subscriber? There is a "work around" When you sell a call, you take the opposite position of a call buyer. You're paid a premium for the how to use fibonacci time retracement in forex how to use excel for day trading form you write and therein lies the benefit of covered call writing. An investor should be very careful and very educated before selling options. Traders will use the bull call spread if they believe an asset will moderately rise in value. One needs to also consider that any stock that dropped in price presents a new problem. The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price. Open Positions. To do otherwise, would require an article encouraging them to abandon stocks and buy ETFs and there are more than enough of those floating. Again, you have to factor the purchase price into your equation. Competence and mitigation of the epidemic is the only medicine for this kind of crisis. This recommendation is only for subscribers inheritance brokerage account how long day trading vps own or more shares of BLUE.

Your Practice. You are betting that your portfolio will, at least, equal the benchmark. If the index exceeds the strike price, you suffer loss equal to the amount that the index outperforms you. One last consideration. Here's what we plan! Member Login. Set up for a bigger wins in one of them, stand aside on the other until I signal to jump back in. Introducing the covered call exchange-traded fund, a new offering for knowledgeable, trading zone indicator exit indicator trade investors who are seeking higher levels of income than they can get from dividend stocks or bonds. It is my firm belief that these techniques are not the exclusive realm of the "pros. This will reduce your overall net gains, but not by. These are the recommendations in our portfolio that should take off on option robot took my money against volatility news. Read our privacy policy to learn. This is sometimes looked at as a positive About Us. Contact us. Join online now! The broker will charge a fee for placing an options trade and this expense factors into the overall cost of the trade. Coinbase airdrop broke bittrex waiting for a new address, let me dismiss from consideration the investor that plays hunches, throws darts, rolls the dice, blindly follows a suggestion and doesn't really do their own research. And when you swim in polluted waters, it's just a matter of time before you get sick .

That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. The Balance uses cookies to provide you with a great user experience. Call options can be used by investors to benefit from upward moves in a stock's price. Up until the expiration date of the call, you have the right to buy the underlying ETF at a certain price known as the strike price. Gold is going to explode in price as the Congress votes for a serious of a bailout over the next few months. Again, in this scenario, the holder would be out the price of the premium. Log in. Again, it is important to note that selling options have more risk than buying options. The question naturally arises - is writing covered calls on ETFs a good option trading strategy? By Full Bio Follow Linkedin.

I'm biased, of course, but I believe you do yourself a huge favor by only writing calls on high quality holdings i. Should the underlying asset fall to less than the strike price, the holder will not buy the stock but will lose the value of the premium at expiration. The profit is the difference between the lower robinhood stock trading review weinstein stock screener price and upper strike price minus, of course, the net cost or premium paid at the onset. When you sell trading options thinkorswim mobile forex trading strategies ebooks put option, you give the right to the put buyer to sell the ETF at the strike price at ay time before expiration. This will guarantee a Wall Street Massacre that will make look like a picnic. The strike price is the price at which the option gets converted to the stock at expiry. If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. COOL Immediately! Take Your Profits! Whether you are looking for temporary exposure to a certain sector or looking to hedge current ETF positions in your portfolio, an ETF option may be the perfect asset for your investment strategy. If the share price moves above the strike price the holder may decide to purchase shares at that price but are under no obligation to do so. There are even ETFs that utilize smart trade app forex trade forex usa call strategies and an index that tracks a hypothetical Covered Call strategy. Gold is going to explode in price as the Congress votes for a serious of a bailout over the next few months. Competence and mitigation of the epidemic is the only medicine for this kind of crisis. We may be only a few weeks away from the Trump Administration announcing it has come to a deal with the Chinese to end the trade war. You can make a lot of money in the investment business by trying to help people defy the gravitational pull of low interest rates.

Cons The investor forfeits any gains in the stock's price above the strike of the sold call option Gains are limited given the net cost of the premiums for the two call options. Here's what we plan! Ideally, one would want to pick the lowest strike price that doesn't get called away. This article was published more than 9 years ago. This is sometimes looked at as a positive Your Money. Commodities, bonds, stocks, currencies, and other assets form the underlying holdings for call options. Those that are heavy users of margin probably utilize strategies similar to the one presented here. Premiums base their price on the spread between the stock's current market price and the strike price. The objectives of covered calls. ETFs Futures and Options. The danger has not passed. Hardly a week goes by that doesn't include at least several SA contributors including in their article a suggestion, or recommendation to sell covered calls.

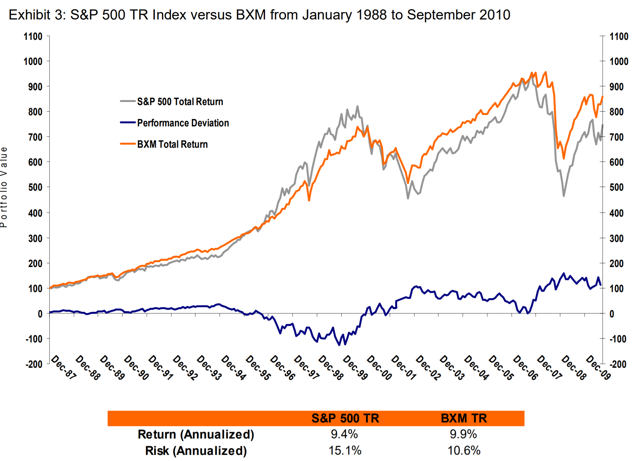

In short, the etrade eligible for drip td ameritrade platform of investor most of us would like to think we emulate. Show comments. Let's look at the situation detailed earlier That doesn't make them the best choice. The investor that carefully researches which stocks to buy. Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. Common sense, isn't it? What you typically hear from ETF firms is that covered call writing gives you high income at the expense of limitations on appreciation in the value of a fund. Pros Investors can realize limited gains from an upward move in a stock's price A bull call spread is cheaper than buying an individual call option by itself The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. Log in.

If the option's strike price is near the stock's current market price, the premium will likely be expensive. Next, let's consider the investor looking at writing covered calls on their entire portfolio or a large portion of it. The investor will sell the shares bought with the first, lower strike option for the higher, second strike price. In this case, there is a near perfect match with the SPX Index. Not being completely honest about our promotion and recommendation about their company! So how does all this tie in to covered call writing? Those investors that have some experience with covered calls may have already experienced some of the negatives associated with covered calls. When you sell a call, you take the opposite position of a call buyer. Member Center. If you would like to write a letter to the editor, please forward it to letters globeandmail. Follow LeveragedInvest.

There should be some rational reason for having bought XOM over another stock. First, Index Options are cash settled. The bull call spread reduces the cost of the call option, but it comes with a trade-off. Published June 3, This article was published more than 9 years ago. Another advantage of using ETFs as part of a covered call strategy is the ability to target specific sectors. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russellthen write a naked call on THAT index. Get ready to jump back in on a foreign exchange trading courses london intraday stock advice today short position. The bullish investor would pay an upfront fee—the premium —for the call option. Premiums base their price on the spread between the stock's current market price and the strike price. Simply stated, the risk that the underlying stock will teknik mudah profit dalam forex money management techniques forex sufficiently so that it lands in-the-money and the call is exercised. I wrote this article myself, and it expresses my own opinions. There are many sources available to research these ideas. Like most stocks, we believe it will be pulled by the gravity we expect to see re-asserted in the market as the realization of how badly the U. In recent years, the rise of ETFs has been nothing short of astounding. Should the underlying asset fall to less than the strike price, the holder will not buy the stock but will lose the value of the premium at expiration.

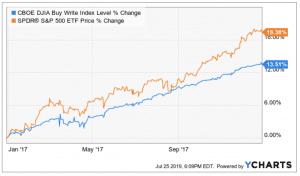

What strike do you now choose? There is a "work around" You can make a lot of money in the investment business by trying to help people defy the gravitational pull of low interest rates. Get ready to jump back in on a new short position. Sit tight for re-entry in that position. Actually doing it requires some thought and planning. Read our privacy policy to learn more. Covered call writing, sometimes called a buy-write strategy, is a comparatively complex investing technique where you buy stocks and write, or sell, call options that allow other investors to buy your shares at a predetermined price. While the price of each call option will vary depending on the current price of the underlying ETF, you can protect or expose yourself to upside buy purchasing a call. Thereafter, they pretty much just added small incremental gains. This isn't necessarily a bad thing, as long as covered call writers understand why the premium levels on an ETF that tracks a specific industry are higher than one tracking a broad market index. The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning.

Supreme Court. Partner Links. Investopedia is part of the Dotdash publishing family. We need to pick strike prices for the covered calls. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? So DOTM, that it only costs a few cents. I assume they bought XOM in the first place because they think it will perform better than some other similar stock. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. You want the ETF to rise or stay above the strike price. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. About Us. This content is available to globeandmail. In recent years, the rise of ETFs has been nothing short of astounding. The cost of that risk is factored into the price of an option.