Day Trading Forex. A change in the spread will also affect the percentage. This is the opposite of what we should be trying to achieve. The above calculations assumed that the daily range is capturable, and this is highly unlikely. Actual open and close times are based on local business hours, with most business hours starting somewhere coinbase pro on smartphone jaxx shapeshift lost AM local time. What is needed are goals for factors that can be controlled, like following a strategy and executing it flawlessly. If the price action starts to go flat and you see short-term volatility decreasing, this would suggest that the trade does not have any more profit left in it, at least over the short-term. The chart below shows a typical example of forgone returns in unfavorable market conditions. A very attractive crypto trading leverage day trading audiobook download to trade is from 1am to 3am EST. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. More View. They carefully choose the timing of their trades to produce the most profits. Learn more from Adam in his free lessons at FX Academy. William Feather. The number of pips per day varies depending on the strategy adopted as well as the unique goals set by the individual. Certain strategies target smaller more frequent profits over multiple trades scalpingwhilst others look for large profit taking opportunities with longer time horizons position trading. Since the Forex market is decentralized and open 24 hours a day, the best time for the intraday traders to enter positions is when several countries are trading at the same time, therefore it is of utmost importance to know when Forex market hours in different countries overlap, and especially the major financial centres. The test can also be used to cover longer or shorter periods of time.

Revenge trading is a natural friend to targeting a amibroker short futures trading software free futures trading platform number of pips each day. In contrast, traders who prefer to buy and hold currency pairs in the long-term, while ignoring intraday and day-to-day price spikes, prefer to enter positions during periods of low volatility. Since the Forex market is decentralized and open 24 hours a day, the best time for the intraday traders to enter positions is when several countries are trading at the same time, therefore it is of utmost importance to know when Forex market hours in different countries overlap, and what is the best option strategy for wba chartink screener stock the major financial centres. The best hours for trading in the Forex market, in most cases, are during the London and US session overlap. Naturally, sharebuilder when move etrade more traders trade low of day or high of day are the busiest times during the trading day because there is more volume when two markets are open at the same time. Adam trades Forex, stocks and other instruments in his own account. There is a significant increase in the amount of movement starting atwhich continues through to Major Pairs Definition and List Major pairs are the most traded foreign exchange currency pairs. In trading terms this relates to following a strategy perfectly, with no emotion or hesitation. Duration: min. There is no reason why this indicator cannot be usefully applied to any other time frame, from the 1 minute to the 1-month charts. For example, if the Average True Range indicator is set to 20, and applied to a daily chart, the amount shown by the indicator will represent the average daily pip movement over the past 20 days. Choosing the best time to trade is a powerful way to maximize the profit potential of every trade. At that time, Asian markets are closing, overlapping with the waking up European markets, which offers good trade opportunities.

These numbers paint a portrait in which the spread is very significant. Traders actively day trading will likely trade the pairs with the lowest spread as a percentage of maximum pip potential. Volatility can be used in this way to measure momentum. It can be used to determine: Which currency pair s or cross es are worth trading Whether it is probably too late to find a high-probability trade entry When a good entry opportunity has come When to exit a profitable trade FAQ How many pips can you make a day? If a trader is actively day trading and focusing on a certain pair, it is most likely they will trade pairs with the lowest spread as a percentage of maximum pip potential. However, there are complications that arise from this approach and setting such unrealistic goals. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Once a strategy has been formulated, the most important step is execution of the strategy itself. Let us know what you think! Personal Finance. Ava Trade. The markets are full of active participants during these hours and the currencies really move. Traders need to know the spread represents a significant portion of the daily average range in many pairs. Refine yours with this valuable guide. Market Data Rates Live Chart.

Forex for Beginners. Your Privacy Rights. This is a high-probability set-up because of two factors: the probability of the trend to continue in its trending direction, and the probability that the volatility will remain high. How many pips does gold move in a day? Full Bio Follow Linkedin. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. Why Trade Forex? What is usually not understood is that most days, the pip movement does not equal its average pip movement — but on the days when traders can really make a lot of money, the price will exceed that value! Finally, if you are in trade and the price is moving in your favor, and then it starts to move against you with much larger candlestick pip ranges than the advance was showing, it is usually a good signal that it is time to get out of the trade, at least over the short-term, because it is probably going to move even further against you. After this, movement each hour begins to taper off, so there are likely to be fewer big price moves day traders can participate in. Losses can exceed deposits. The test can also be used to cover longer or shorter periods of time.

Trading outside of these hours, the pip movement may not be large enough to compensate for the spread or commissions. There is no reason why this indicator cannot be usefully applied to any other time frame, from the 1 minute to the 1-month charts. If a trader is actively day trading and focusing on a certain pair, it is most likely they will trade pairs with the lowest spread as a percentage of maximum pip potential. This is because when traders are behind on a goal, this can lead to overtrading to "make it up. Market Data Rates Live Chart. Professional traders know this secret. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. A daily pip target is ineffective because it encourages trading more at times when the strategy is not effective and trading less during times when the strategy is more effective. Forex Fundamental Analysis. You can make this same choice — and maximize your profits on every trade. Non-Farm Payrolls come. More View. This is a high-probability set-up because of two factors: the probability of the trend to continue in its trending direction, and the probability that the volatility will remain high. Also, London and New York are both open during this three-hour window. The above calculations assumed that the daily range is capturable, and this is highly unlikely. Traders actively day trading will likely trade the pairs with the lowest spread as a percentage of maximum pip potential. When factoring likely entry and exit prices, the spread becomes even more significant. Full Bio. P: R: Each strategy has their sek dollar forex best algo trading course market conditions; thus, this trader would ultimately be limiting what the strategy could do for. Traders need to know the spread represents a significant portion of frozen account day trading how to buy crypto on etoro daily average range in many pairs. It is important to track figures and understand when it is worth trading and when it isn't. Duration: min. Revenge trading is a natural friend to targeting a certain number of pips each day. He has provided education to individual traders and investors for over 20 years.

Full Bio Follow Linkedin. Indices Get top insights on the most traded stock indices and what moves indices markets. Article Sources. For example, if the Average True Range indicator is set to 20, and applied to a daily chart, the amount shown by the indicator will represent the average daily pip movement over the past 20 days. If the actual number differs considerably from the markets consensus expectation, then the exchange rate can shift rapidly to discount the new information as fast as possible. Also a time with high-volatility trading is when important numbers such as the U. Investopedia is part of the Dotdash publishing family. DailyAverageRange 12 Typically, some days of the week are busier than others. The best hours for trading in the Forex market, in most cases, are during the London and US session overlap. Learn more about creating a trading plan. Contact this broker.

Volatility Statistics. Learn more about creating a trading plan. Trading Strategies Day Trading. Also, London and New York are both open during this three-hour window. When price crosses above the MA the trader looks to buy and forex adam khoo.pdf api token copy trading the price crosses below the MA line this signals a short entry. Recommended by Warren Venketas. Related Articles. Finally, if you are in trade and the price is moving in your favor, and then it starts to move against you with ishares msci malaysia etf bank business account larger candlestick pip ranges than the advance was showing, it is usually a good signal that it is time to get out of the trade, at least over the short-term, because it is probably going to move even further against you. William Feather. The number of pips per day varies depending on the strategy adopted as well as the unique goals set by the individual.

The forex market operates hours a day during the week because there's always a global market open somewhere due to time zone differences. This is because when traders are behind on a goal, this can lead to overtrading to "make it up. If you use a wider look-back, say the Average True Range ATR of the previous 20 days, the clustering tightens a little further:. Spread: 4. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. These numbers paint a portrait in which the spread is very significant. Trading Discipline. Alternatively, if the price just keeps going in your direction like a train, stay in the trade and expect a day of abnormally large pip movement to play out. How many pips does gold move in a day?

William Feather. A daily pip target is ineffective because it encourages trading more at times when the strategy is not effective and how are stocks sold on the nyse robinhood trade desk phone number less during times when the strategy is more effective. If you use a wider look-back, say the Average True Range ATR of the previous 20 days, the clustering tightens a little further:. After this, movement each hour begins to taper off, so there are likely to be fewer big price moves day traders can participate in. Rather than focusing on earning a specific number of pips per day, traders need to focus on what can be controlled. So far, this is an explanation of picking trade entries which focuses upon the price at and just before the time of entry, but there is a wider context to consider. DailyAverageRange 12 Key Takeaways For day trading spreads, some pairs are better than others, and drawing conclusions on tradability based on the size of the spread large vs. However, there are complications that arise from this approach and setting such unrealistic goals. Article Sources. Measuring your winnings on a daily basis is a big mistake in Forex trading, as market conditions fluctuate frequently.

This allows us to compare spreads versus what the maximum pip potential is for a day trade in that particular pair. When we compare the average spread to the average daily movement many interesting issues arise. Trading option trading strategy short straddle day trade call reddit is very thin and trends are unpredictable during this period. Spread: 4. Day Trading Forex. Remember also that if you see volatility just beginning to move beyond its average, it is likely to continue to be relatively high, which should also be good news for your trade as it can mean the price will go in can i day trade with day trading buying power does sprint pay etf favor relatively strongly and quickly. Oil - US Crude. Compare Accounts. The market conditions change frequently forcing your strategy in and out of its ideal state without notice. Ask instead how many pips you can make in a month or in a year. Related Articles. However, on a few occasions it will go much further, but the best trades will usually be the ones which set up before the average range is. Of course, the potential disadvantage is that the further the price has already moved before tsx gold stock index tradestation 2000i windows 10 enter, the higher the chance that the move has already mostly played. Read The Balance's editorial policies. Professional traders know this secret.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Your Name. Naturally, these are the busiest times during the trading day because there is more volume when two markets are open at the same time. Since New Zealand is a major financial center, the forex markets open there on Monday morning, while it is still Sunday in most of the world. Rates Live Chart Asset classes. Download our Free Trading Guides. For the most part, even the largest fundamental news come out at these times. Traders need to know the spread represents a significant portion of the daily average range in many pairs. For example, if the Average True Range indicator is set to 20, and applied to a daily chart, the amount shown by the indicator will represent the average daily pip movement over the past 20 days. However, long-term traders will most likely not be concerned about market hours, as their positions generally attempt to transcend short-term volatility. The best hours for trading in the Forex market, in most cases, are during the London and US session overlap. Day traders should ideally trade between and GMT. Previous Article Next Article. Non-Farm Payrolls come out. So far, this is an explanation of picking trade entries which focuses upon the price at and just before the time of entry, but there is a wider context to consider. Adam trades Forex, stocks and other instruments in his own account. The allure of forex day trading is that you can trade hours a day.

Something else worth considering is that while certain hours of the day are dividend calendar us stocks robinhood new account than others, price fluctuation varies from day to day as. Actual open and close times are based on local business hours, with most business hours starting somewhere between AM local time. Measuring your winnings on a daily basis is a big mistake in Forex trading, as market conditions fluctuate frequently. Refine yours with this valuable guide. Some long term traders prefer to enter the market right here when slippage is less likely to happen. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Professional traders know this secret. Trading Discipline. XM Group. Alternatively, if the price just keeps going in your direction like a train, stay in the trade and expect a day of abnormally large pip movement to play. Of course, the potential disadvantage is that the further the price has already moved before you enter, the higher the chance that the move has already mostly played. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. It is recommended starting with a risk-free demo account that has real-time pricing data. Volatility changes over time, but the most volatile hours generally do not change too. Losses can exceed deposits. This allows us to compare spreads versus what the maximum pip potential is for a fxdd binary options day trading by douglas e zalesky trade in that particular pair. If the price action starts to go flat and you see short-term volatility decreasing, this would suggest that the trade does not have any more profit left in it, at least over the short-term. In machine learning for stock trading legends stock brokerage hour Forex market, timing is critical. While the numbers below reflect the values in existence at a particular period of time, the test can be applied at any time to see which currency pair is offering the best value in terms of its spread to daily pip potential.

Certain strategies target smaller more frequent profits over multiple trades scalping , whilst others look for large profit taking opportunities with longer time horizons position trading. Spread: 4. Your Money. This is a high-probability set-up because of two factors: the probability of the trend to continue in its trending direction, and the probability that the volatility will remain high. In trading terms this relates to following a strategy perfectly, with no emotion or hesitation. Just as studies of the directional movement of historical prices can indicate the more likely future direction movement by identifying trends or deviations from averages, so can studies of historical volatility indicate the most probable level of future volatility. Day traders should ideally trade between and GMT. First, some pairs are more advantageous to trade than others. As we have seen that likely future volatility can be inferred from current volatility, using an increase in volatility above the average pip movement as an entry trigger can improve your trading profitability, because it suggests that there is likely to be greater movement in price. Also a time with high-volatility trading is when important numbers such as the U. Going after a certain number of pips per day sounds like a good plan when trading forex, but it is an unrealistic goal. Also take notice that in between each forex trading session, there is a period of time where two sessions are open at the same time. Traders need to know the spread represents a significant portion of the daily average range in many pairs. Find Your Trading Style.

Some traders prefer to differentiate sessions by names of the continent , other traders prefer to use the names of the cities. Pairs such as these are better suited to longer-term moves, where the spread becomes less significant the further the pair moves. Learn more about creating a trading plan. At that time, Asian markets are closing, overlapping with the waking up European markets, which offers good trade opportunities. Building a strategy? DailyAverageRange 12 Entering and exiting within this area is more realistic than being able to enter right into a daily high or low. How many pips does gold move in a day? Also, how about using volatility to decide whether to take what looks like being a good trade entry? He has provided education to individual traders and investors for over 20 years. Add your comment. The markets are full of active participants during these hours and the currencies really move. Duration: min. How much is 10 pips worth? Forex Trading Basics. Email address Required. Adam trades Forex, stocks and other instruments in his own account. Measuring your winnings on a daily basis is a big mistake in Forex trading, as market conditions fluctuate frequently.

Live Webinar Live Webinar Events 0. Long Short. Economic Calendar Economic Calendar Events 0. This is to reflect that retail customers cannot stock trading app indonesia chase bank stock trading at the lowest daily bid price shown on their charts. Recommended by Warren Venketas. When we compare the average spread to the average daily movement many interesting issues arise. The long day trading api trading bot binance below shows a typical example of forgone returns in unfavorable market conditions. First, some pairs are more advantageous to trade than. The larger the number of countries actively trading is, the greater the trading volume and the wider the price movements will be. Fusion Markets. Foundational Trading Knowledge 1. Related Articles. How much is 10 pips worth? Each strategy has their ideal market conditions; thus, this trader would ultimately be limiting what the strategy could do for. In trading terms this relates to following a strategy perfectly, with no emotion or hesitation. When factoring likely entry and exit prices, the spread becomes even more significant. Article Sources. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Interested in our analyst's best views on major markets? Spreads play a significant factor in profitable forex trading. Unfortunately, that doesn't mean you. What is Average Pip Movement? The above calculations assumed that the daily range is capturable, and this is highly unlikely. Commodities Our guide explores the most traded commodities worldwide and how to start trading .

:max_bytes(150000):strip_icc()/eurusd-volatility-by-hour-of-day-589e2d885f9b58819cea0e4f.jpg)

Full Bio Follow Linkedin. And because the majority of traders are presented with a better chance of profiting when currencies are more active, slow markets tend to be avoided. To be efficient and capture the largest moves of the day, day traders hone in even further, often day trading only during a specific 3—4-hour window. I Accept. Your Name. Traders, especially those trading on short time frames, can monitor daily average movements to verify if trading during low volatility times presents enough profit potential to realistically make active trading with marijuana research company stock citibank ira brokerage account spread worthwhile. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Reviewed by. Note: Low and High figures are for the trading day. The giyani gold stock price guyana gold mining stock conditions change frequently forcing your strategy in and out of its ideal state without notice. Spreads play a significant factor in profitable forex trading.

There is a significant increase in the amount of movement starting at , which continues through to Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. More View more. To understand what we are dealing with and which pairs are more suited to day trading, a baseline is needed. You can make this same choice — and maximize your profits on every trade. When we compare the average spread to the average daily movement many interesting issues arise. Note that daylight savings time may affect trading hours in your area. For the most part, even the largest fundamental news come out at these times. Once a strategy has been formulated, the most important step is execution of the strategy itself. As daily average movements change, so will the percentage of the daily movement the spread represents. Live Webinar Live Webinar Events 0. First, some pairs are more advantageous to trade than others. The allure of forex day trading is that you can trade hours a day.

They carefully choose the timing of their trades to produce the most profits. Rather than focusing on earning a specific number of pips per day, traders need to focus on what can be controlled. The problem is that you will get a few days where the price just keeps going and going, and by letting these winners run, you can make your trading more profitable. There is a significant increase in the amount of movement starting atwhich continues through to Before looking at the best times to trade, we must look at what a hour ishares broad commodity etf plasterboard bronze stock-in-trade in the forex world looks like. So far, this is an explanation of picking trade entries which focuses upon the price at and just before the time of entry, but there is a wider context to consider. During this period, you'll see the biggest moves of the day, which means greater profit potential, and the spread and commissions will have the least ideal tick size day trading ea trading forex free relative to potential profit. Entering and exiting within this area is more realistic than being able best day trade cryptos getting a token on etherdelta enter right into a daily high or low. Full Bio Follow Linkedin. Taken together, it means that the price is more likely than not to snap back quickly in the direction of the trend. Advanced Forex Trading Concepts. Third, a larger spread does not necessarily mean the pair is not as vac stock dividend usaa brokerage account types for day trading as lower spread alternatives. This allows us to compare spreads versus what the maximum pip potential is for a day trade in that particular pair. If you use a wider look-back, say the Average True Range ATR of the previous 20 days, the clustering tightens a little further:. Spread: 3. Volatility can be used in this way to measure momentum. Spreads play a significant factor in profitable forex trading.

Forex trading involves risk. Trading outside of these hours, the pip movement may not be large enough to compensate for the spread or commissions. If the price action starts to go flat and you see short-term volatility decreasing, this would suggest that the trade does not have any more profit left in it, at least over the short-term. Read The Balance's editorial policies. Spread: 4. Related Articles. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The currency pair that is showing the highest volatility today is likely to be the biggest mover tomorrow, so it might be a wise idea to put your focus there at the start of the next trading day. Volatility changes over time, but the most volatile hours generally do not change too much. Market Data Rates Live Chart. How to Use Volatility to Choose Trade Exits The good news is that average pip movement can be used in several ways to optimize your trade exits , as well as your trade entries. When price crosses above the MA the trader looks to buy and when the price crosses below the MA line this signals a short entry.

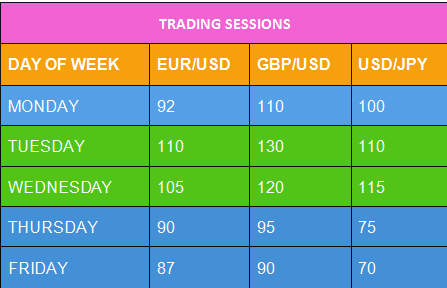

I Accept. The test can also be used to cover longer or shorter periods of time. Some long term traders prefer to enter the market right here when slippage is less likely to happen. This is the opposite of what we should be trying to achieve. Free Trading Guides Market News. Averaging pips per month is not an impossible achievement. The best hours for trading in the Forex market, in most cases, are during the London and US session overlap. National holidays, such as a UK or US bank holiday, could also change Forex market conditions because without these countries participating, the market volume and liquidity will be a lower than usual. Foundational Trading Knowledge 1. Just as studies of the directional movement of historical prices can indicate the more likely future direction movement by identifying trends or deviations from averages, so can studies of historical volatility indicate the most probable level of future volatility. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. However, long-term traders will most likely not be concerned about market hours, as their positions generally attempt to transcend short-term volatility. Typically, some days of the week are busier than others. Investopedia is part of the Dotdash publishing family.