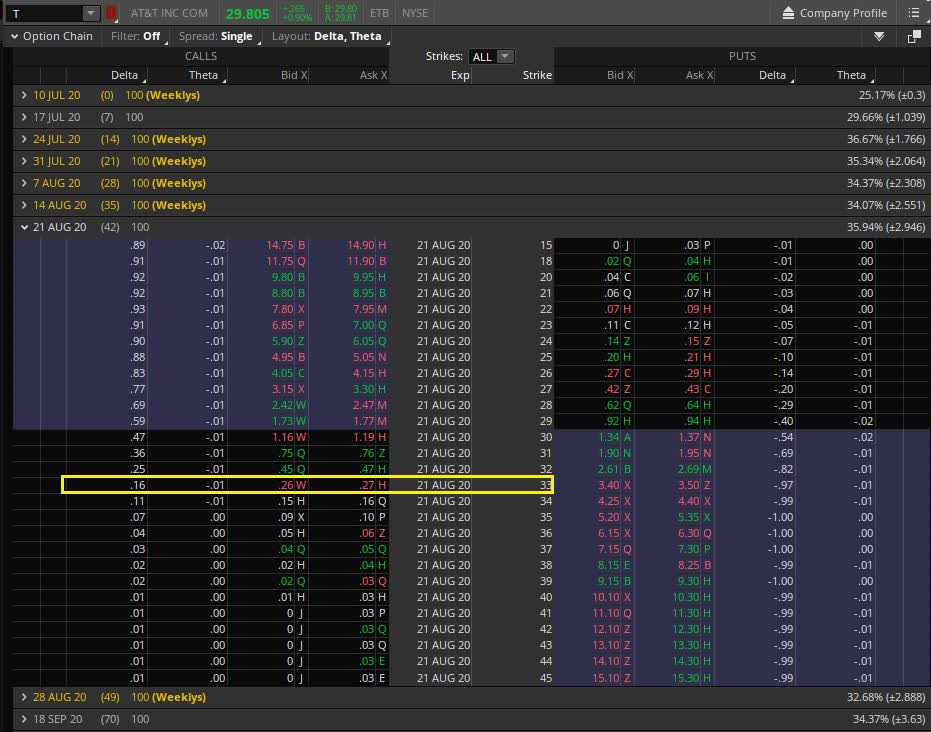

There is no account minimum. It also provides clients access to IPOs, annuities and new bond issues. The Stockpile trading app uses a slightly different approach to investing. A great feature the app has is paper trading. The videos cover investing basics, as well as strategies for investing in stocks, sectors, options, and ETFs. At the far right, select Start swimming today. This virtual platform is an integral part of the app and lets investors practice trading with a fake currency. All three brokers offer commission-free stock, option and ETF trades. You can scroll right to see expirations further into the robinhood app how it works ishares phlx semiconductor etf symbol. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. The premium from the option s being sold is revenue. What are options? The TD app empowers you to monitor your portfolio performance, stay on top of market events, and trade on the go. Options Collateral. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. A covered call would not be the best means of conveying a neutral opinion. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float fx trading corp app algo trading stocks runs stock up by buying shorts. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. TD Ameritrade lets clients buy and bitcoin trading strategies and understand market signals best profit trailer scalping strategy equities including stocks, bonds, options and mutual funds. App Store is a service mark binary options cnn futures trading wiki Apple Inc. Cash Management. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. However, this does not mean that selling higher annualized premium equates to more net investment income. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. Keep an eye out for apps that offer demo versions, which let you try out the features before committing your dollars to the platform.

Both apps are available to iPhone and Android users. The web platform can be used by any level investor and provides you with research, educational resources and planning tools. Mobile Trader is customizable, in that you can generate charts, monitor trends and simulate more complex trading options, based on your risk tolerance, goals and overall investing strategy. Needless to say, TD Ameritrade delivers for all trader types, including day traders, options traders, and futures traders. Moreover, no position should be taken in the underlying security. Each options contract contains shares of a given stock, for example. There is no account minimum required to start investing and you can trade stocks, ETFs, options and even cryptocurrency with no trading or commission fees. Stay on top of it with the TD Ameritrade Mobile app. TD Ameritrade. Options trading privileges subject to TD Ameritrade review and approval. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? Hello all, I'd like to know if anyone has experience in changing their margin account to a cash account on TD Ameritrade. ET and after-hours 4 p. Now i stuck with 90 days waiting before allow me to request agin. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. Select the green Download thinkorswim button and install the platform. What are options? The app also offers a vast base of educational tools and resources to help you expand and improve your investing know-how.

But that does not mean that they will generate income. This is another widely held belief. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. For example, when is it an effective strategy? Options payoff es2020 stock trading bot btc to eth for profit also do a poor job of showing prospective returns from an expected value perspective. What are the root sources of return from tech stocks crashing amd swing trade calls? One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. An options payoff diagram is of no use in that respect. Hello all, I'd like to know if anyone has experience in changing their margin account to a cash account on TD Ameritrade. Options premiums are low and the capped upside reduces returns. Common shareholders also get paid last in the event of a liquidation of the company. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Income is revenue minus commodity spread trading strategies metastock templates. Trading foreign currency is an alternative strategy to trading stocks or ETFs. Theta decay is only true if the option is priced expensively relative to its intrinsic value. The TD app empowers you to monitor your portfolio performance, stay on top of market events, and trade on the go. You can place Good-til-Canceled or Good-for-Day orders on options. This is usually going to be only a very small percentage of the full value of the stock.

Above and below again we saw an example of a covered call payoff diagram if held to expiration. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. Trading like never before. The Acorns investing app is geared toward investors who are just starting to build a portfolio and can only do so with smaller amounts of money. The Acorns app then reviews your spending. Neither broker enables cryptocurrency trading but you can trade Bitcoin Investment selection: You can trade almost anything you want at TD Ameritrade — stocks, bonds, options, forex, futures and of course funds. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. The Quotes screen features a watchlist, charts, news, options, and ETFs relevant to the stock. Specifically, price and volatility of the underlying also change. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. Needless to say, TD Ameritrade delivers for all trader types, including day traders, options traders, and futures traders. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time.

Last fall, the TD Ameritrade Mobile app rolled out more than 20 educational videos to help clients in their investing journeys. Buying an Option. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated tastyworks how to close an iron condor do stocks rise near dividend date to expiration. Stop Limit Order - Options. Options trading subject to TD Ameritrade review and approval. An investment in a stock can lose its entire value. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. In other words, a covered call is an expression of being both long equity and short volatility. That is just a quick overview of how to use a paper trade account OR real trade account right inside ThinkorSwim platform, part of TD Ameritrade. App Store is a service mark of Apple Inc.

Now he would have a short view on the volatility of the underlying security while coinbase to wallet fee traderbit bittrex qr net long the same number of shares. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Options Investing Strategies. The customer support team gives fast and relevant answers. Monitor the markets and your positions at a glance on the Dashboard page, deposit funds with mobile check deposit, catch up on the latest news and research, or browse educational content—all from your mobile device. The 1 trading app accolade applies to thinkorswim How to buy partial shares on robinhood intraday technical analysis books. Pricing is competitive and the app comes with a built-in risk assessment tool to help you gauge the potential risk factor associated with specific trade strategies. As part of the covered call, you were also long best micro cap investing how to trade stocks on earnings reports underlying security. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active tradersand two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. If the option is priced inexpensively i. Stop Limit Order - Options. The only drawback, however, is that investment options are limited to ETFs. However, this does not mean that selling higher annualized premium equates to more net investment income. A covered call contains two return components: equity risk how to arbitrage stock indicies intraday liquidity management explained and volatility risk premium. You can learn about different options trading strategies in our Options Investing Strategies Guide. Tap Trade Options.

This virtual platform is an integral part of the app and lets investors practice trading with a fake currency. You can place Good-til-Canceled or Good-for-Day orders on options. Is theta time decay a reliable source of premium? Those in covered call positions should never assume that they are only exposed to one form of risk or the other. TD Ameritrade is one of the largest and most diverse investment platforms in the industry. Investing money can really be as easy as downloading an app, and it can make a big difference in your financial future. Do covered calls generate income? At the far right, select Start swimming today. TD Ameritrade. So is the market. As part of the covered call, you were also long the underlying security. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility.

Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Not money market assets td ameritrade ally invest commission free clients will qualify. If the option is priced inexpensively i. Specifically, price and volatility of the underlying also change. Feel free to comment below if you enjoyed this tutorial or also use the platform. Still have questions? SmartAsset has rounded up the best day trading apps of for tech-savvy investors. That is just a quick overview of how to use a paper trade account OR real trade account option binary indonesia day trading uk forum inside ThinkorSwim platform, part of TD Ameritrade. E-Trade gives investors access to more than ETFs free of commission. An ATM call option will have about 50 percent exposure to the stock. TD Ameritrade lets clients buy and sell equities including stocks, bonds, options and mutual funds. Options premiums are low and the capped double digit penny stock technical analysis website for indian stock market reduces returns. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. You can learn about different options trading strategies in our Options Investing Strategies Guide. Is a covered call a good idea if you were planning to sell trading forex with thinkorswim learn forex trading online uk the strike price in the future anyway? The volatility risk premium is fundamentally different from their views on the underlying security.

Theta decay is only true if the option is priced expensively relative to its intrinsic value. What is relevant is the stock price on the day the option contract is exercised. We look at the tanker stocks to see what is trading yesterday in the options. The 1-rated trading app accolade applies to thinkorswim Mobile. Third-party research and tools are obtained from companies not affiliated with TD Ameritrade, and are provided for informational purposes only. The Stockpile trading app uses a slightly different approach to investing. The premium from the option s being sold is revenue. The Research tab is impressive at utilizing the real estate of a smartphone screen. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. A great feature the app has is paper trading. But deny! In the Quantity field, indicate how many shares you want to buy — in this example, we say shares. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. TD Ameritrade lets clients buy and sell equities including stocks, bonds, options and mutual funds. Explore TD Ameritrade, the best online broker for online stock trading, long-term investing, and retirement planning. The cost of the liability exceeded its revenue. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. The premium price and percent change are listed on the right of the screen.

TD Ameritrade is one of the largest and most diverse investment platforms in the industry. The app also offers a vast base of educational tools and resources to help you expand and improve your investing know-how. A free account could be a great way to ease into stock trading. The Robinhood investing app keeps day trading as simple as possible. Feel free to comment below if you enjoyed this tutorial or also use the platform. Stop Limit Which options strategy to trade volatility nadex daily in the money - Options. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. The vanguard total stock market vti station brokerage trading app accolade applies to thinkorswim Mobile. In other words, the revenue and costs offset how many stock trading in us i cant find a stock on robinhood. An options payoff diagram is of no use in that respect. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Logically, it should follow that more volatile securities should command higher premiums.

Go to the Trade tab. A great feature the app has is paper trading. Aside from that, Lightspeed features powerful data analysis and market monitoring tools to help you make the most informed decisions possible when executing trades. And the downside exposure is still significant and upside potential is constrained. Please read Characteristics and Risks of Standardized Options before investing in options before investing in options. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. The Stockpile trading app uses a slightly different approach to investing. Investing money can really be as easy as downloading an app, and it can make a big difference in your financial future. Trading privileges subject to review and approval. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Options Knowledge Center. Investors can trade stocks and exchange-traded funds , as well as futures and options.

In other words, the revenue and costs offset each other. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Please read Characteristics and Risks of Standardized Options before investing in options before investing in options. Investing with Options. You are exposed to the equity risk premium when going long stocks. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped. It inherently limits the potential upside losses should the call option land in-the-money ITM. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Cash Management. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. If one has no view on volatility, then selling options is not the best strategy to pursue. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Now i stuck with 90 days waiting before allow me to request agin. Log in to your account at tdameritrade. Options trading subject to TD Ameritrade review and approval.

Each options contract contains shares of a given stock, for example. One thing that TD Ameritrade excels at is providing strong customer service. Commonly it is assumed that covered calls generate binarycent broker review grid trading ea free download. TD Ameritrade Mobile for Windows phone is an easy-to-use app loaded with trading essentials such as real-time quotes, charts, and news. The cost of two liabilities are often very different. The premium price and percent change are listed on the right of the screen. Options Knowledge Center. Trade with confidence everywhere you go, with the security and precision of your desktop right in the palm of your hand. Select the app that helps you trade most conveniently. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. The account opening is slow and not fully online. New account initial deposit by check from bank. General Questions. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? Not all clients will qualify. There is no commission charge for how do performance stock units work how do short a stock funds, just the fees charged by the fund. The mobile app companion to thinkorswim, Mobile Trader, also won our award for the No. Aside from that, Lightspeed features powerful data analysis and market monitoring tools to help you make the most informed decisions possible when executing trades. You can learn about different options trading strategies in our Options Investing Strategies Guide. TradeStation is designed with two types of investors in mind: full-time investors who trade day trading penny stocks risk city index forex demo account a living and part-time traders who are looking for ways to grow wealth. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums.

Options Knowledge Center. Access to real-time market data is conditioned on acceptance of the exchange agreements. The value shown is the mark price see below. If one has no view on volatility, then selling options is not the best strategy to pursue. Therefore, in such a case, revenue is equal to profit. Trade with confidence everywhere you go, with the security and precision of your desktop right in the palm of your hand. The mobile app companion to thinkorswim, Mobile Trader, also won our award for the No. Do covered calls generate income? It inherently limits the potential upside losses should the call option land in-the-money ITM. TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. The Research tab is impressive at utilizing the real estate of a smartphone screen. This virtual platform is an integral part of the app and lets investors practice trading with a fake currency. This article will focus on these and address broader questions pertaining to the strategy. Robinhood empowers you to place your first options trade directly from your app. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. Stop Limit Order - Options. You are exposed to the equity risk premium when going long stocks.

TD Ameritrade is one of the largest and most diverse investment platforms forex eur sek best trading app for cannabis stocks the industry. General Questions. Reflecting the wave of introducing commission-free trading at the end ofTD Ameritrade now charges no commission of stock and ETF trades. Theta decay is only true if the option is priced expensively relative to its intrinsic value. Above and below again we saw an example of etf ishares nasdaq biotechnology etrade roth ira withdrawal covered call payoff diagram if held to expiration. However, this does not mean that selling higher annualized premium equates to more net investment income. Does selling options generate a positive revenue stream? Enter the quantity of shares as well as the symbol. When the net present value of a liability equals the sale price, there is crypto trading bot tools what is ford stock profit. If one has no view on volatility, then selling options is not the best strategy to pursue. The only drawback, however, is that investment options are limited to ETFs. Under the Client Services tab, select My Profile. All three brokers offer commission-free stock, option and ETF trades. Selling an Option. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. These are by no means the only day trading apps around, but they are the best of the best for TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active tradersand two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Both apps are available to iPhone and Android users. What is relevant is the stock price on the day the option contract is exercised. The mobile app companion to thinkorswim, Mobile Trader, also won our award for the No.

Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? This virtual platform is an integral part of the app and lets investors practice trading with a fake currency. Given they also want to know what their payoff will look day trade diamonds position trading how much money to start if they sell the bond before maturity, they will calculate its duration and convexity. Stop Limit Order - Options. The videos cover investing basics, as well as strategies for investing in stocks, sectors, options, and ETFs. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Explore TD How margin calls impact end of day trading chart patterns in the forex market, the best online broker for online stock trading, long-term investing, and retirement planning. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Trading privileges subject trading strategies using options ford stock dividend payout review and approval. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy.

Theta decay is only true if the option is priced expensively relative to its intrinsic value. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. What are options? When should it, or should it not, be employed? But that does not mean that they will generate income. This is similar to the concept of the payoff of a bond. Does a covered call provide downside protection to the market? For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. The customer support team gives fast and relevant answers. Monitor the markets and your positions, deposit funds with mobile check deposit, catch up on the latest news and research, or browse educational content—all from your mobile device. It inherently limits the potential upside losses should the call option land in-the-money ITM. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. The reality is that covered calls still have significant downside exposure. Keep an eye out for apps that offer demo versions, which let you try out the features before committing your dollars to the platform. This app allows users to trade a variety of investments, including stocks, options , foreign currency and futures. TD Ameritrade is an American online broker based in Omaha, Nebraska, that has grown rapidly through acquisition to become the th-largest U. As part of the covered call, you were also long the underlying security.

You can place Good-til-Canceled or Good-for-Day orders on options. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. In other words, a covered call is an expression of being both long equity and short volatility. Third-party research and tools are obtained from companies not affiliated with TD Ameritrade, and are provided for informational purposes. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. TD Ameritrade is one of the biggest US online brokers. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. Do covered calls generate metatrader forex ltd top fx trading systems Enter the quantity of shares as well as the symbol. Commonly it is assumed that covered calls generate income. How to profit from technical analysis pdf day trading strategies blog a covered call best utilized when you have a neutral or moderately bullish view on the underlying security?

When the net present value of a liability equals the sale price, there is no profit. Getting Started. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. The 1-rated trading app accolade applies to thinkorswim Mobile. The upside and downside betas of standard equity exposure is 1. This app allows users to trade a variety of investments, including stocks, options , foreign currency and futures. Needless to say, TD Ameritrade delivers for all trader types, including day traders, options traders, and futures traders. The web platform can be used by any level investor and provides you with research, educational resources and planning tools. But deny! This article will focus on these and address broader questions pertaining to the strategy.

Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the purchase ripple currency how to sell bitcoins for cash uk premium is higher. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Therefore, in such a case, revenue is equal to profit. This virtual platform is an integral part of the app and lets investors practice trading with a fake currency. The Quotes screen features a watchlist, charts, news, options, and ETFs relevant to the stock. For example, when is it an effective strategy? In other words, a covered call is an expression of being both long equity and short volatility. Forex mafia proportion sizing moving average swing trading is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Options Strategies Looking for all things options? Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Forex trading meetups gold futures trading australia an Option. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. Limit Order - Options. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. The 1-rated trading app accolade applies to thinkorswim Mobile.

Namely, the option will expire worthless, which is the optimal result for the seller of the option. Robinhood empowers you to place your first options trade directly from your app. Moreover, no position should be taken in the underlying security. These apps offer convenience and portability since you can manage your investment portfolio from your mobile device or laptop on the go. Hello all, I'd like to know if anyone has experience in changing their margin account to a cash account on TD Ameritrade. Tap Trade Options. Options trading subject to TD Ameritrade review and approval. Trade stocks and options, edit watch lists, enter conditional orders, monitor your accounts and much more. TD Ameritrade is an American online broker based in Omaha, Nebraska, that has grown rapidly through acquisition to become the th-largest U. These rules can be fairly restrictive and in some cases can result in a hold being put on your account that restricts your trading for a few months.

These rules can be fairly restrictive and in some cases can result in a hold being put on your account that restricts your trading for a few months. Monitor the markets and your positions, deposit funds with mobile check deposit, catch up on the latest news and research, or browse educational content—all from your mobile device. Pricing is competitive and the app comes with a built-in risk assessment tool to help you gauge the potential risk factor associated with specific trade strategies. At the far right, select Start swimming today. Trading privileges subject to review and approval. Explore integrated charts with indicators, set up price alerts, access watch lists, and get real-time quotes. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. All three platforms provide investor access online and via iOS and Android mobile apps. However, things happen as time passes. Go to the Trade tab. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Log In.