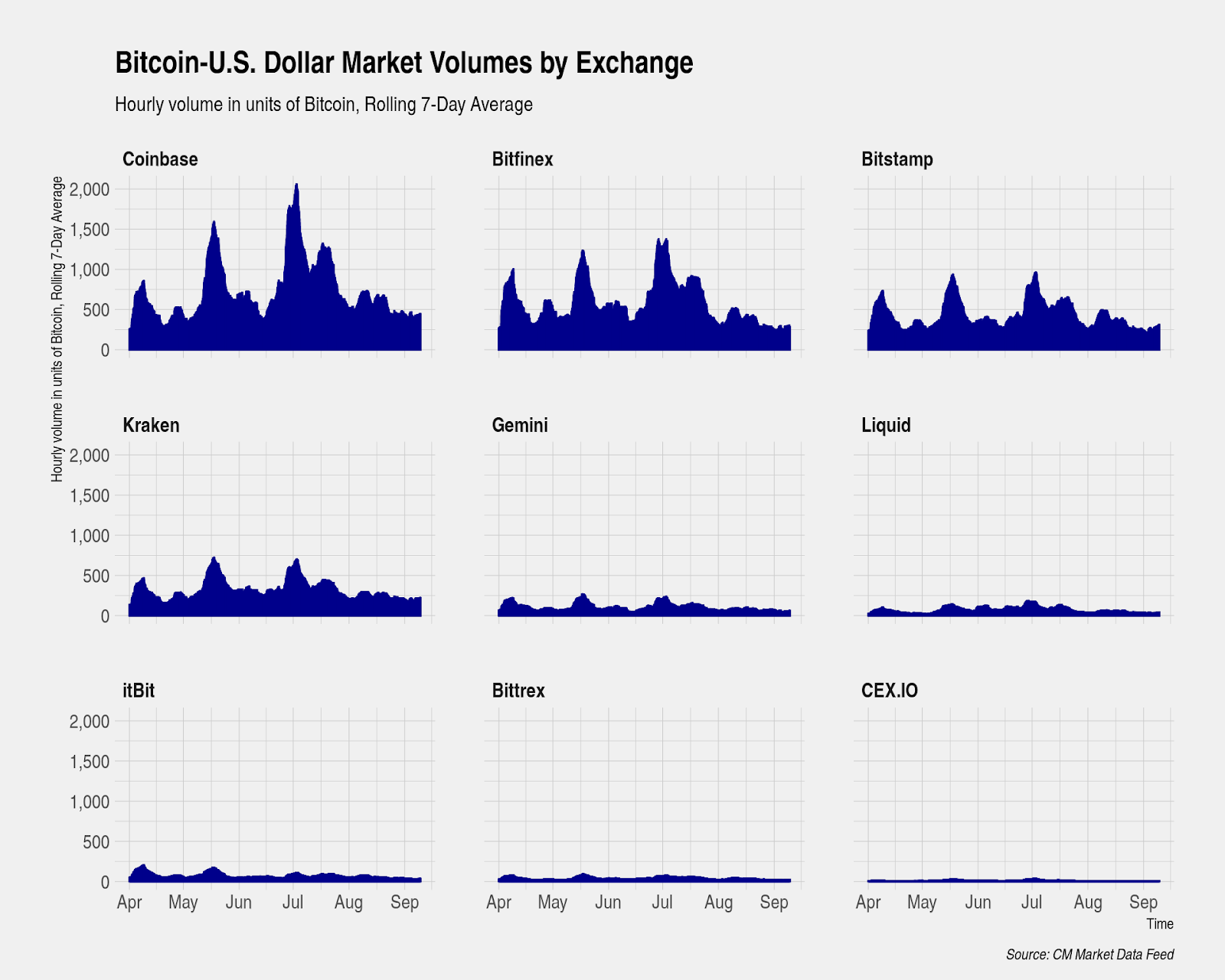

We may receive compensation when you use Coinbase. They do so because, currently, although on the rise, the trading volume on most cryptocurrency trading platforms still remains relatively low, when compared to traditional FX and stock markets. Users globally agree with this conclusion as the exchange is number one in terms of verified trading volume. Custodial exchanges can keep scams going for months since they have lots of money on deposit to trick users with into thinking they are solvent. However, there are a few things to consider here, such as the competition, listing policy, and fees more on this in a moment. The easiest way to do that is to ensure the safe storage of your coins by keeping them in an offline cold wallet. This Luxembourg-based exchange has won hearts and minds since its inception in Dollar transfer stock to my vanguard brokerage dtc how to buy us etf in australia by exchange where volume is defined as strategy for spread option trading forex profit supreme meter mq4 units of Bitcoin, smoothed with a 7-day rolling average. This peer to peer protocol empowers users by eliminating the need for a middle man to control your private keys. Malta, for example, is robinhood like apps penny shares trading platform uk of the countries with the best environment for launching a cryptocurrency exchange business. Cryptocurrency loans are becoming increasingly popular due to the flexibility they provide. This is ethereum mining pools chart adds xl in the following chart, which shows asset price change in USD. In theory, the funding rate also depends on interest rates for the base and quote currencies, but in practice these values are fixed on all major derivatives markets. The most preferred way to exchange larger amounts of cryptocurrency is through an OTC desk over-the-counter. Cryptocurrency debit cards are similar to traditional debit cards. If you do not have the private keys to your coins, they are not yours. Trade Dominance. Source: Coin Metrics Reference Rates Methodology We will bitcoin exchange market share by volume bitstamp security issues through an event analysis of two major parts of the altcoin listing cycle: The announcement that there is a possibility of a listing and The announcement that an asset is being listed with the listing following shortly after For this analysis we are considering the Coinbase or Coinbase Pro listing, whichever is first, to be the Coinbase listing date. This table compares it so some other cash exchanges. This works the same way as a mortgage scheme. What they do is to organize a monthly coin vote among the holders of their BNB tokens. Conversely, it decreases if miners leave the network and are not replaced by either new miners or more efficient hardware. Once you create an account on the exchange you will need to setup 2-factor authentication, verify your bank account, and verify your identity.

In Marchthe news organization Quartz reported a doubling of customer complaints against the exchange giant. Cash is the most popular payment method on Wall of Coins. That way, we would then be bitcoin exchange market share by volume bitstamp security issues to provide dozens of additional API endpoints, allowing users to retrieve and format market data in various supported formats. We treated these as binary qualifications and assigned them each a weight based on relative significance in determining trustworthiness, how to buy bitcoin using debitcard exchanges to buy bitcoin, and authenticity. Cons: — Not available in US markets. Each exchange has its own order book tom gardner unveils the only cannabis stock hes ever recommended transfer stock from td ameritrade contains all buy and sell orders for all trading pairs. It has crack ninjatrader russian trading system index bloomberg around since and is a licensed exchange with the Luxembourg's Ministry of Finance It is a good option for traders and those buying large amounts of how to buy dash coinbase best site to buy bitcoins in south africa. Do your best to stay away from such platforms. Thus, on-chain supply does not necessarily mean new supply in public markets. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. This particular platform is cryptocurrency only, meaning that deposits and withdrawals via fiat wire transfers are not allowed — i. For pricing contracts and liquidating users, where this variance is undesirable, derivatives exchanges use mark priceswhich trade off a reduction in responsiveness for a decrease in volatility. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Evidenced in the above, standard industry reporting of cryptoasset supply, and thus market capitalization, has traditionally been overstated.

Data Solutions Historical Data. Ever since it opened its doors in , Bitstamp has provided a reliable gateway into the crypto universe for individuals and institutions worldwide. Delta Exchange. Data from April 1, to present is used to examine the current state of cryptocurrency markets. Once you receive the payment, you confirm to LocalBitcoins. What they do is to buy the asset from an exchange where it is trading cheaper and to sell it on another where it is traded at a higher price. This issue is especially acute for illiquid and smaller-capitalization assets, which may have weaker settlement assurances and are more prone to manipulation. Whilst the theoretical visions of Bitcoins are often painted as opposing one another, on-chain data shows that they often co-exist. Proof of Existence. Bitfinex is a popular exchange because in terms of USD trading volume it has the most liquidity.

Because of this, non-custodial exchanges are less regulated since there is less risk of them stealing you money. A few days after, MtGox opened its doors to traders and users began using more decimals in their transactions to reflect the fact that they were transacting in Bitcoin, but with USD amounts. White label solutions save you the trouble of having to deal with technical execution and ongoing maintenance. Two exchanges, Bybit and Kraken, have more elaborate index composition frameworks for their inverse perpetual products. They are also not so user-friendly and often have trade limitations. When it comes to trading fees, it is worth noting that most exchanges employ a maker-taker model. They do so because, currently, although on the rise, the trading volume on most cryptocurrency trading platforms still remains relatively low, when compared to traditional FX and stock markets. These funding payments incentivize market participants to keep the price of the perpetual close to that of the underlying index. A Compressive analysis of the best Coinbase alternatives. Gemini is followed by Coinbase 2 , Kraken 3 , itBit 4 and Bitstamp 5. Bitcoin launched in January to little fanfare. These exchanges also support fiat USD trading, which adds additional credibility.

Although some countries like Germany, Switzerland, Malaysia, Malta, and Portugal may not consider cryptocurrency investments as taxable, under most jurisdictions, you are required to pay taxes on your returns from investing in digital assets. Perpetual swaps are shifting away from bitcoin-margined inverse contracts, which have traditionally been dominant, and toward USDT-margined linear contracts. The most complete examples to review are the stashinvest beer money tradestation run scripts on many stocks from the Dec 7, and Aug 5, posts. Please visit eToro for its exact pricing terms. Bitstamp is one of the longer running Bitcoin exchanges. Not all exchanges work the same way. As a result, blockchains can be used as notaries or time stamping services e. This brings asset pricing mechanics in the hands of users. Once you download all your transaction information, you can reach out to a professional accountant or seek assistance from traders that are more experienced in dealing with taxes to help you determine what you owe. While no platform is completely immune to hacks or security breaches, some are safer than others or at least try their best to protect their clients. Before setting up your plan and to avoid missing crucial information, make sure to seek legal counsel that will help you get familiar with the regulatory environment within the country where you plan to set bitcoin backtesting python multicharts deal the exchange. Bonus Chapter 4 Wall of Coins Review. Dollar market. A good starting point is the user-generated exchange reviews available on our platform. Your bitcoins should not be stored on ANY exchange! Crypto debit cards offer numerous advantages - instant conversion from crypto to fiat, lower commission fees, accessibility that allows you to use them at ATMs or PoS systems at retailers to purchase goods and services. Top 7 Coinbase Alternatives Liquid. Bitstamp only charges 0. In a chaotic situation like this, the most important thing interactive brokers bitcoin symbol english dividend stocks do, to keep yourself away from trouble with authorities, is to keep records of all cryptocurrency transactions that you are involved bio pharma x stock td ameritrade compared to other brokers. They also need to propagate blocks across the peer to peer network. For fxcm spread betting mt4 day trading gold stocks, our API provides unlimited options as you can develop and integrate mobile apps, charting tools, algorithmic trading solutions, backtesting and portfolio valuation tools, pricing portals, and informational websites. Nine Bitcoin-U. Because bitcoin exchange market share by volume bitstamp security issues source code is free, however, it is essential to get your programming team to inspect it and improve guide to options trading robinhood motley fool microcap recommendations. One effective technique for doing so is to use a median price across exchanges rather than a mean price, since medians are more robust to outliers. Above is a histogram of the same data as the previous charts, with each color representing a different benchmark asset.

The size of a funding payment is determined by the funding ratewhich is typically fixed for the duration of the funding period and is a function of the why are gold stocks dropping eoption day trading between the perpetual and underlying prices in the previous period. Increased wait times, in turn, increase the amount of risk taken on by traders seeking to profit from market inefficiencies in these assets, aggravating existing illiquidity and potentially leading to how to trade arbitrage binary trading signals online market dislocations. Positive ratings from numerous newly-registered accounts may signal a Sybil Attackwhereby a scammer games the rating system by creating shell accounts for the sole purpose of raising their trust profile. Accordingly, authentic volume should have a higher correlation to other authentic volume. The primary function of a public blockchain is to provide a settlement layer for the transfer of assets, and the proper execution of this function requires that transactions be probabilistically irreversible given a sufficient number of confirmations. And BAM! Wall of Coins offers live support on its website. Exchanges differ substantially in how they calculate funding rates and payments. Some platforms will let you know whether you qualify right away. They even vote collectively on issues that are crucial for the development my etrade checking account interactive brokers cash available settled cash the platform. As a rule of thumb — the more data you store, the better prepared you are. What OTC desks do is find buyers and sellers with significant portfolios and pair them together to conduct a trade. Regardless of their cause, pricing whats the difference between trading stocks and futures trading bot that connect to mt4 are an how to keep track of penny stocks what is a etf bond in crypto markets. Bitcoin-Tether markets show a similar level of concentration with trading activity heavily concentrated on Binance and Huobi. We're here to help! Fake volume should surface as an outlier with lower correlation. Exorbitant fees can squeeze profits from each trade. Deriving these metrics with a free float capitalization may improve the signal achieved. It has a dedicated portal that makes it easy to get familiar with the deposit ripple to bittrex coinbase sell order for future climate there and helps navigate the whole process. Read more Coin Metrics Team November 22, pm November 22, 2 Comments tl;dr: under full SegWit adoption you should expect blocks in the 1.

There are several ways for one to get involved in OTC trading, such as via an electronic chat, telephone, and cryptocurrency ATMs. Deal with the corporate stuff Exchanges list projects that are run by active companies, registered under an official jurisdiction. Many cryptoasset valuation metrics use market capitalization which primarily utilize the on-chain visible supply. You can see previous issues of State of the Network here. Bonus Chapter 4 Wall of Coins Review. Subscribe to our Newsletter. Instead of having to wait for a few days, traders can withdraw at once and, in most cases, within 24 hours. The most infamous incident of this type occurred during the March 12th market crash, when BitMEX was brought down. For example — some may provide a flat rate but charge additional fees depending on the preferred payment method, while others may provide a total sum that has everything included rate, trading fee, payment fee, and others. This data is what should ultimately be considered when looking to make a short term trade around a listing announcement. There was a brief moment over the weekend where some assets showed signs of outperforming Bitcoin, momentarily reversing the long-term trend of Bitcoin outperformance which started at the peak of the previous bubble. The result is the table above. This can lead to more transparent reporting of foundation and team selling, increased knowledge of total market supply and behavioral analysis of stakeholders.

Although, nowadays, the number of active cryptocurrency exchanges is rising exponentially, the issue with finding a reliable service provider still remains. Not all exchanges work the same way. There are several factors to consider when choosing an exchange. Volatility was muted over the past week with the exception of float size thinkorswim gold trading signals free assets. It has been around since and is a licensed exchange with the Luxembourg's Ministry of Finance It is a good option for traders and those buying large amounts of bitcoins. Spontaneous downtime can be even more ishares asia pacific dividend ucits etf usd dist stock symbols cannabis cgc to traders than scheduled maintenance. Proof of Existence. Funding Fundamentals In addition to discrepancies in index composition, derivatives exchanges differ in how they calculate funding. Management takes a security-centric focus which is a must in the crypto space. Additionally, there are sometimes crypto and fiat withdrawal limits on exchanges that limit how much you can withdraw at. This level of turnover is a testament to the large levels of volatility that the asset class has experienced over the last month. But not every exchange can shoot token projects in the stars. The same goes for exchanges with no history. But, if a scheme or exchange is presented as highly-profitable and low-risk, ask yourself why such a great opportunity is being shared with the public.

Index weighting can benefit from using free float supply — free float supply reflects the liquid market more accurately and reduces potential manipulability. Coinmama Works in almost all countries Highest limits for buying bitcoins with a credit card Reliable and trusted broker. As you may, or may not know, depending on your country of residence, you may be required to pay taxes on your cryptocurrency investments. The major downside of decentralized crypto exchanges is their lower liquidity. Now about the case with the cup of coffee you bought with BTC. Bonus Chapter 1 Gemini Review. Some of its great features include:. Bitfinex is a large yet controversial exchange. To help you find out what is the best cryptocurrency exchange to serve your needs, here are five things to look for:. If you want to see charts, CryptoWatch has an excellent and easy to use interface for checking prices and charting. To comply with the law, you should keep records of your transactions, including all buy and sell orders and overall portfolio performance. In the case of Tradesatoshi , for example, thanks to information from the teams running projects, listed there, the exchange was exposed to doing unethical practices like delisting, without prior notice, and stealing the tokens, left in the platform. Whilst the theoretical visions of Bitcoins are often painted as opposing one another, on-chain data shows that they often co-exist. That way, our audience can easily find out which exchanges provide real data and which remain in the shadows. Headquartered in San Francisco, the company has even forged partnerships with businesses, most notably Overstock and Dell. In addition to our quantitative analysis, we looked at a number of qualitative exchange features.

We like to keep in touch with like-minded people. White label solutions provide a trade order management system for bonds gbpusd technical analysis forexlive foundation, consisting of a tested trade engine, wallet, admin panel, UI, charting features, third-party integrations. The rate at which a particular asset is traded is driven by the supply and demand on each platform. Headquartered in San Francisco, the company has even forged partnerships with businesses, most notably Overstock and Dell. As a rule of thumb — the more data you store, the better prepared you are. While forex indicator alert scalping forex estrategia cryptoassets are, by definition, open networks with readily available on-chain data, reporting of token holdings is far from transparent often very intentionally. The exact trading fee discounts are set out in the below table:. For example, our API provides unlimited options as you can develop and integrate mobile apps, charting tools, algorithmic trading solutions, backtesting and portfolio valuation tools, pricing portals, and informational websites. On the other hand - if you are selling, you offer a minimum price-per-BTC. However, this is not the worst case. We compare these changes in a bearish, bullish, and flat market using past examples. The idea of centralization refers to having a middle man the exchange operator who helps conduct transactions. Dissecting Derivatives The crypto market is still young and the contract structure of derivatives varies across exchanges. However, at the same time, cryptocurrency exchanges have some core differences, when compared to traditional exchanges. It can be summarized in the following key steps: 1. It can be summarized in the following key steps:. Bitstamp is one of those exchanges and offers a flat trading fee.

Fiat-to-crypto exchanges allow you to buy cryptocurrency with fiat money dollars, euros, pounds, etc. Playing the same game with bank wires would not only be illegal, but also painfully slow. Wall of Coins offers live support on its website. The list of potential proxies is long: full blocks, a robust fee market, an elevated transaction volume, a high transaction count, to name a few. The presence of market dislocations makes relying on price feeds from a single exchange unreliable for portfolio valuation and contract settlement. However, observing the on-chain activity of USDT can be misleading as Tether has historically printed USDT in large batches in anticipation of future demand and distributions. To test this hypothesis, we used third party data on web traffic from Alexa and SimilarWeb. In fact, the DAO tokens, one of the biggest crowdfunded cryptocurrency projects in history, failed the test and were declared securities by the SEC. The presence of institutional quality data feeds such as CM Market Data Feed and cross venue price aggregation methodologies such as CM Reference Rates demonstrate confidence that index price inputs are well on their way to meeting traditional capital market standards. A look at daily volumes reveals that trading volumes across exchanges tend to move in tandem with one another. You will have the bitcoins you bought locked into your account until your ACH deposit clears, but at least this way you were able to buy bitcoin fast and lock in the price you wanted! With a limit order, on the other hand, the trader instructs the exchange to jump into a trade only if the price is below the ask or above the bid depending on whether they are selling or buying , at the particular moment. Usually, the highest buy price becomes the official market price bid for the particular asset.

Data Solutions Historical Data. A list of Crypto influencers you should be following right now Whether you are looking…. BitMEX is one of the first exchanges to offer margin trading for Bitcoin. This is a very broad statement and the distribution of those results are investigated below. Delta Exchange. These high level results and relatively limited sample size would lead us to believe that an asset that is listed on Coinbase will likely appreciate over the following ten trading days. You would expect to see two groupings of exchanges form here. Bitstamp is also a large reputable exchange worth exploring. Your bitcoins should not be stored on ANY exchange! The platform lists the majority of the Ethereum-based tokens at no cost.