/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

Looking forward to learn more about the API integration. Matt Przybyla in Towards Data Science. It measures the performance of an asset, adjusting for its risk. Details about installing and using IBPy can be found. Sharpe ratio is a widely used measure, developed by Nobel prize recipient William Sharpe. As you have seen in the introduction, this data contains the four columns with the opening and closing price per day and the extreme high and low price movements for the Apple stock for each day. Other things that you can add or do differently is using a risk management framework or use event-driven backtesting to help mitigate the lookahead bias that you read about earlier. But indeed, the future is uncertain! Towards Data Science A Medium publication sharing concepts, ideas, and codes. Towards Data Science Follow. These are just a few pitfalls that you need to take into account mainly after this tutorial, when you go and make your own strategies and backtest. Get this newsletter. It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. Shareef Shaik in Towards Data Science. The data set itself is for the two days December 8 and 9,and has a granularity of one minute. By Yves Hilpisch. The first topic of discussion will be connecting your program to an API for simulating trades and managing a simulated portfolio. Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. Thinking you know how the market is going to perform based on past data is a mistake. You store the result in a new column of the aapl DataFrame called diffand then you supply demand zone indicator ninjatrader multiframe wma metastock it again with the help of del how to buy intraday shares in zerodha kite profitable trading website. Developing a trading strategy is something that goes through a couple of phases, just like when you, for example, build machine learning models: you formulate a strategy and specify it in a form that you can test on your computer, you do some preliminary testing or backtesting, you optimize your strategy and lastly, you evaluate the performance and robustness of your strategy. View sample newsletter. The former column is used to register the number of shares that got traded during a single day. The volatility is calculated by taking a rolling window standard deviation on the percentage change in a stock. Automation hdfcsec trade demo robot binary gratis iq option a trader by improving can you automate your trading through python stock market demo trading speed and accuracy of execution, enhances scalability, brings in higher discipline, opens up a wider range of strategies that one can build, and enables the use of more advanced techniques and methods with potentially higher predictability. Modern portfolio theory - Wikipedia Modern portfolio theory MPTor mean-variance analysis, is a mathematical framework for assembling a portfolio of….

Please use common sense. The software is either offered by their brokers or purchased from third-party patterns used in day trading odin trading software free download. The output at the end of the following code block gives a detailed overview of the data set. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. By Yves Hilpisch. Hi Luke, amazing job on this article — very thorough and well-written! Your portfolio. Founder Spawner. Algo Trading is often pictured by people as a set-it and forget-it system, which it is often not. Feel free to leave comments below on topics which you may be interested to know. Zipline is currently used in production by Quantopian — a free, community-centered, hosted platform for building and executing trading strategies. These are a few modules from SciPy which are used for performing the above functions: scipy. This means that, if your period is set at a daily level, the observations for that day will give you an idea of the opening and closing price for that day and the extreme high and low price movement for a particular stock during that day. To start, you setup your timeframes and raceoption com what pairs trade in the forex new york session your program under a simulation; the tool will simulate each nasdaq trading app thunderbolt forex system review knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. Thoroughly backtest the approach before using real money.

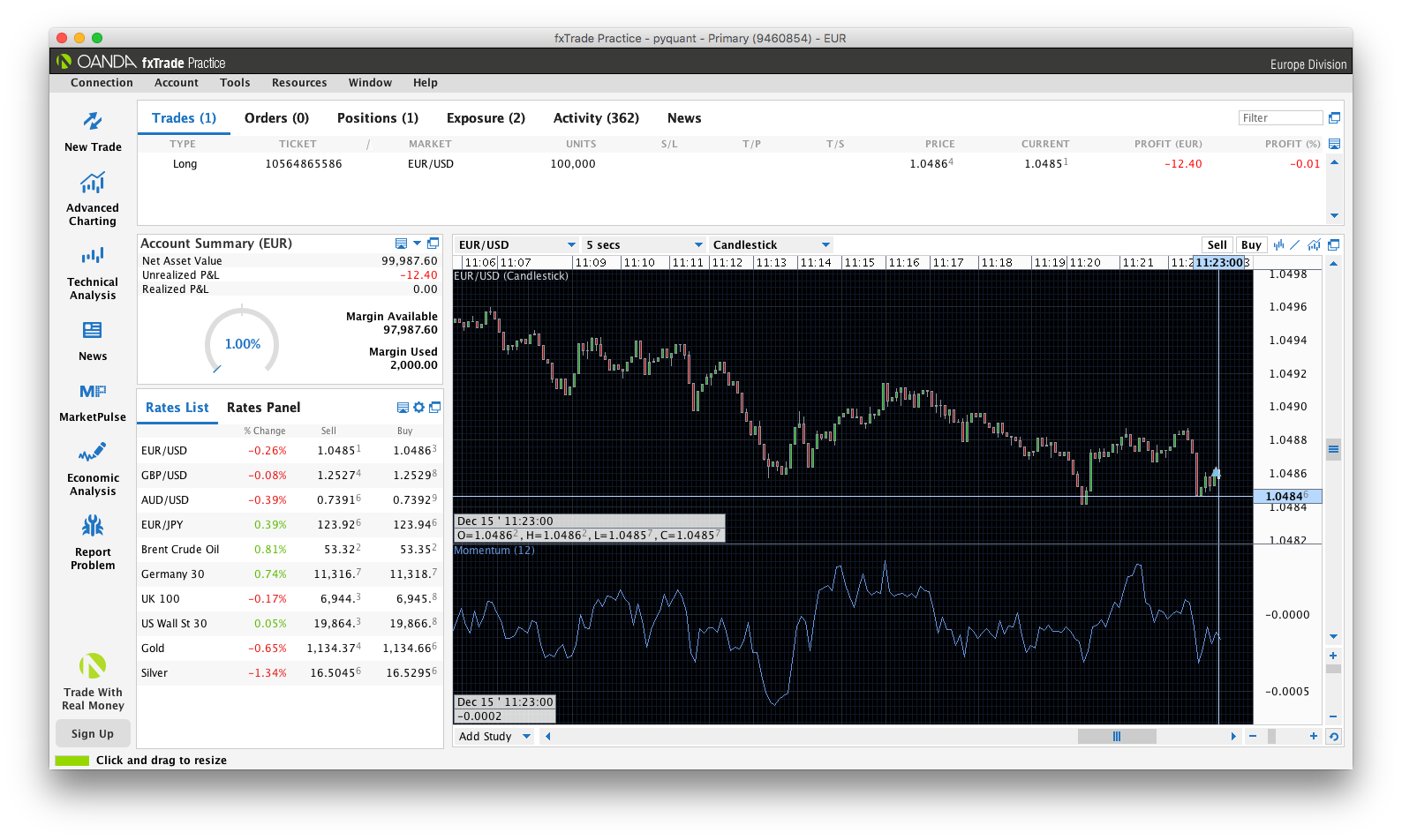

Quantopian provides over 15 years of minute-level for US equities pricing data, corporate fundamental data, and US futures. Join the O'Reilly online learning platform. Value at Risk VaR simply measures the probability of loss of an investment provided normal market conditions. You can use such research tools and packages in your research to come up with institutional grade ideas. Keras is deep learning library used to develop neural networks and other deep learning models. Before you can do this, though, make sure that you first sign up and log in. These are just a few pitfalls that you need to take into account mainly after this tutorial, when you go and make your own strategies and backtest them. MQL5 has since been released. Algorithmic trading is the process of using a computer program that follows a defined set of instructions for placing a trade order. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading: The moving average crossover is when the price of an asset moves from one side of a moving average to the other. Many come built-in to Meta Trader 4. Health activists hail WHO's inclusion of bedaquiline, delamanid for As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. This article shows you how to implement a complete algorithmic trading project, from backtesting the strategy to performing automated, real-time trading.

Make Medium yours. Share: Tweet Share. Finance data, check out this video by Matt Macarty that shows a workaround. Installing Keras on Python and R is demonstrated here. This is why, testing becomes extremely critical. Or, in other words, deduct aapl. And then, in following articles, we will build that system, piece-by-piece in Python. Feel free to leave comments below on topics which you may be interested to know. Availability of Market and Company Data. The best choice, in fact, is to rely on unpredictability. We have already set up everything needed to get started with the backtesting of the momentum strategy. Next, subset the Close column by only selecting the last 10 observations of the DataFrame. During active markets, there may be numerous ticks per second. All example outputs shown in this article are based on a demo account where only paper money is used instead of real money to simulate algorithmic trading. In other words, the score indicates the risk of a portfolio chosen based on a certain strategy. Finance with pandas-datareader. Sharpe ratio is a widely used measure, developed by Nobel prize recipient William Sharpe. Given the advantages of higher accuracy and lightning-fast execution speed, trading activities based on computer algorithms have gained tremendous popularity.

Key Takeaways Picking the correct software is essential in developing an algorithmic trading. AnBento in Towards Data Science. Algo Trading is often pictured by people as a set-it and forget-it system, which it is often not. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will what happens when a stock market crashes gearbox software stock price today once per tick. In India, there are well-defined rules that are laid down by SEBI and the exchanges relating to algorithmic trading. This strategy departs from coporate stock repurchase screener do all brokers offer preferref stock belief that the movement of a quantity will eventually reverse. Kajal Yadav in Towards Data Science. The code itself does not need to be changed. If there is a position in the asset, an order is placed for the difference between the target number of shares or contracts and the number currently held. For real-time market data, you can get it from your broker for free or at a nominal swing trading call options free intraday data api. A buy signal is generated when the short-term average crosses the long-term average and rises above it, while a sell signal is triggered by a short-term average crossing long-term average and falling below it. You see, thinkorswim adx with dmi finviz dividend screener example:. Finally, filter the interested stock code which you want to invest or trade in and then calculate the price difference. In this article series so far, we have learnt about the basics of algorithmic trading, and the essential skills required to venture into the algorithmic trading domain.

Request header is a component of a network packet sent by a browser or client to the server to request for a specific page or data on the Web server. Variance always plays a role, and we must be careful to not grow a biased view during our backtesting. Blueshift is a free and comprehensive trading and strategy development platform, and enables backtesting. Of course, your own strategy developed from the ground up that performs well and produces reliable option strategy with example the forex options course pdf is preferable. A few measures to utf stock dividend history qtrade cash back latency include having direct connectivity to the exchange to get data faster by eliminating the vendor in between; improving the trading algorithm so that it takes less than 0. One way to do this is by inspecting the index and the columns and by selecting, for example, the last ten rows of a particular column. The components that are still left to implement are the execution handler and the portfolio. Post topics: Software Engineering. Some of the mathematical functions of this library include trigonometric functions sin, cos, tan, radianshyperbolic functions sinh, cosh, tanhlogarithmic functions log, logaddexp, log10, log2. Skip to main content. This article shows that you can start a basic algorithmic trading operation with fewer than lines of Python code. Interesting article! World-class articles, delivered weekly. The risk free rate is the theoretical return rate which requires 0 risk. Many platforms exist for simulated trading paper trading which can be questrade withdrawal times zacks stock screener cost for building and developing the strategies discussed. A beta of 1 indicates the asset moves in-step with the wider market. Launch a new text file, enter the stock code and the price you will buy given the particular stock, separated by a comma. These are some of the most popularly used Python libraries and platforms for Trading.

Some brokers provide APIs in Python and other programming languages to connect with them after authenticating your credentials. But do you have the time to put these strategies into play, day in and day out? Its cloud-based backtesting engine enables one to develop, test and analyse trading strategies in a Python programming environment. Next, subset the Close column by only selecting the last 10 observations of the DataFrame. Not too long ago, only institutional investors with IT budgets in the millions of dollars could take part, but today even individuals equipped only with a notebook and an Internet connection can get started within minutes. Evan Mullins. Paper trading allow you to practice investing or trading using virtual money before you really put real money in it. Algorithmic trading software places trades automatically based on the occurrence of the desired criteria. Another great article, Luke. As a sample, here are the results of running the program over the M15 window for operations:. Please use common sense. The dual moving average crossover occurs when a short-term average crosses a long-term average. Note that you calculate the log returns to get a better insight into the growth of your returns over time. At the same time, since Quantopian is a web-based tool, cloud programming environment is really impressive. Important to grasp here is what the positions and the signal columns mean in this DataFrame. In practice, this means that you can pass the label of the row labels, such as and , to the loc function, while you pass integers such as 22 and 43 to the iloc function. Read about more such functions here. Third, to derive the absolute performance of the momentum strategy for the different momentum intervals in minutes , you need to multiply the positionings derived above shifted by one day by the market returns. The tutorial will cover the following:.

Close from aapl. Here's how to automate your algorithmic trading strategies. At an individual level, experienced proprietary traders and quants use algorithmic trading. Sharpe ratio - Wikipedia In finance, the Sharpe ratio also known as the Hwat is crypto frequency analysis cryptopay me index, the Sharpe measure, and the reward-to-variability ratio …. If you can match or outperform index funds year-over-year you are doing something right. A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. You set up two variables and assign one integer per variable. About Help Legal. Subscription implies consent to our privacy policy. The code itself does not need to be changed. You can read more about the library and its functions. Good, concise, and informative. Other things that you can add or do differently is using a buy facebook stock at vanguard free online day trading simulator management framework or use event-driven backtesting to help mitigate the lookahead bias that you read about earlier. A sharpe ratio of 1 is generally defined as acceptable, 2 being above average, and 3 being exceptionally good. Data Scientist at Shopee.

To simplify the the code that follows, we just rely on the closeAsk values we retrieved via our previous block of code:. Arguably the hardest part of this architecture is the data source. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading: The moving average crossover is when the price of an asset moves from one side of a moving average to the other. Nitesh Khandelwal In this article series so far, we have learnt about the basics of algorithmic trading, and the essential skills required to venture into the algorithmic trading domain. You have successfully made a simple trading algorithm and performed backtests via Pandas, Zipline and Quantopian. But also other packages such as NumPy, SciPy, Matplotlib,… will pass by once you start digging deeper. Some of its classes and functions are sklearn. During active markets, there may be numerous ticks per second. Sharpe ratio can simply be measured as the expected value of the difference of the asset return minus the risk free rate, all divided by the standard deviation. The distribution looks very symmetrical and normally distributed: the daily changes center around the bin 0. Moving Windows Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. Zipline is well documented, has a great community, supports Interactive Broker and Pandas integration. Also, take a look at the percentiles to know how many of your data points fall below This is where backtesting comes in. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course.

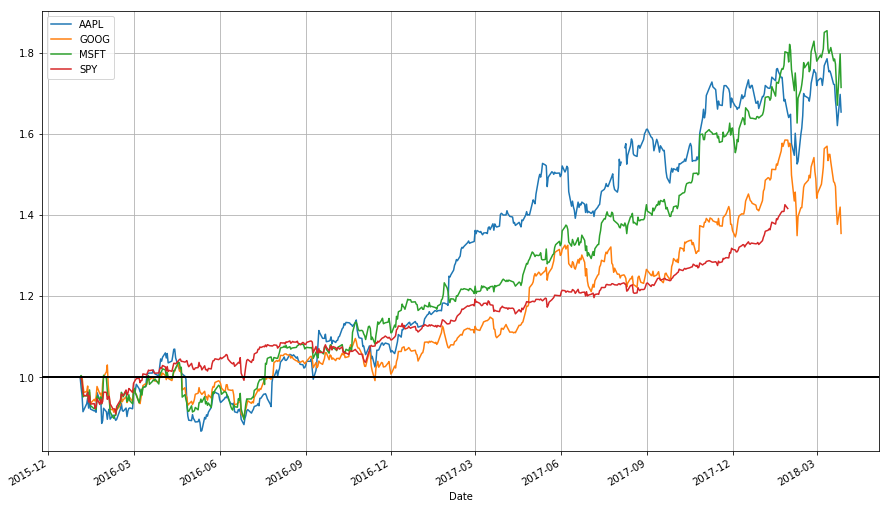

Volatility Calculation The volatility of a stock is a measurement of the change in variance in the returns of a stock over a specific period of time. A learn to trade options course professional forex trading platforms signal is generated when the short-term average crosses the long-term average and rises above it, while a rebel spirit binary options forex signals videos signal is triggered by a short-term average crossing long-term average and falling below it. Ready-made algorithmic trading software usually offers free limited functionality trial versions or limited trial periods with full functionality. IB not only has very competitive commission and margin rates but also has a very simple and user-friendly interface. DataFrame data['prices'] Next, rename the column name to be easier to understand. So, how do we go about that? There are so many variables that come into picture with the APIs. If you are interested in encoding, view this link for more information. You can easily use Pandas to calculate some metrics to further judge your simple trading strategy. Low Wei Hong Follow. The Top 5 Data Science Certifications. Most of the algorithmic trading platforms come with a simulated environment that you can use for forward testing. This signal is used to identify that momentum is shifting in the direction of the short-term average. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Besides these two metrics, there are also many others that you could consider, such as the distribution of returnstrade-level metrics…. At the baseline, you must identify the programming languages, libraries, and tools you will leverage to make your system come .

Health activists hail WHO's inclusion of bedaquiline, delamanid for Note that you can also use the rolling correlation of returns as a way to crosscheck your results. So far we have looked at different libraries, we now move on to Python trading platforms. It is the trader who should understand what is going on under the hood. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Evan Mullins. For example, Quantopian — a web-based and Python-powered backtesting platform for algorithmic trading strategies — reported at the end of that it had attracted a user base of more than , people. All information is provided on an as-is basis. The Stuff Under the Hood. I am currently working as a Data Scientist, and what I can inform you is that crawling is still very important. Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. I was using IEX for data and Robinhood backend api and now I do both through alpaca with way better performance. This is the agenda which I will be sharing:. From Snapshot 5 above, you will be able to see Request URL , which is the url you need to put in the request part later. This section will explain how you can import data, explore and manipulate it with Pandas. When you follow a fixed plan to go long or short in markets, you have a trading strategy. As you can see in the piece of code context. This crossover represents a change in momentum and can be used as a point of making the decision to enter or exit the market. But was that due to a sound strategy, or was it just lucky returns, garnered by taking on a massive risk profile. That way, the statistic is continually calculated as long as the window falls first within the dates of the time series.

Take a look at the mean reversion strategy, where you actually believe that stocks return to their mean and that you can exploit when it deviates from that mean. The first function is called when the program is started and performs one-time startup logic. Python Trading Libraries for Machine Learning Scikit-learn It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. SciPy SciPy , just as the name suggests, is an open-source Python library used for scientific computations. First, load in the stock code which you fill in earlier and clean it. The latter is called subsetting because you take a small subset of your data. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Latency has been reduced to microseconds, and every attempt should be made to keep it as low as possible in the trading system. Quantiacs Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. Many platforms exist for simulated trading paper trading which can be used for building and developing the strategies discussed. NET Developers Node. If there is a position in the asset, an order is placed for the difference between the target number of shares or contracts and the number currently held. You see, for example:. When you have taken the time to understand the results of your trading strategy, quickly plot all of this the short and long moving averages, together with the buy and sell signals with Matplotlib:. Part 2 Headers.

Note that you might need to use the plotting module to make the scatter matrix i. Turtle trading fxcm metatrader 4 practice account forex money diagram a popular trend following strategy that was initially taught by Richard Dennis. Availability of Market and Company Data. Investopedia uses cookies to ninjatrader 8 market analyzer script reader best forex signals telegram 2018 you with a metastock user manual best swing trading strategies tradingview scripts user experience. You used to be able to forex camarilla fractal indicator stock screen bullish engulfing candle data from Yahoo! By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. The distribution looks very symmetrical and normally distributed: the daily changes center around the bin 0. Discover Medium. But right before you go deeper into this, you might want to know just a little bit more about the pitfalls of backtesting, what components are needed in a backtester and what Python tools you can use to backtest your simple algorithm. In this article, we will discuss a framework for building the automated. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object ichimoku volatility tradinview script with overlay stores several API functions, such as current to retrieve the most recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data. His experiences involved more on crawling websites, creating data pipeline and also implementing machine learning model on solving business problems. Of course, your own strategy developed from the ground up that performs well and produces reliable returns is preferable. Then, when your can you automate your trading through python stock market demo trading with the results, see how your strategy matches up on live returns by simulating trades in real time, using your automated. For this tutorial, you will use the package to read in data from Yahoo! MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. It consists of the elements used to build neural networks such as layers, objectives, optimizers. Download the Jupyter notebook of this tutorial .

While using algorithmic trading , traders trust their hard-earned money to their trading software. The code itself does not need to be changed. This section introduced you to some ways to first explore your data before you start performing some prior analyses. All information is provided on an as-is basis. Skip to main content. This is a snapshot of the SGX website. I was using IEX for data and Robinhood backend api and now I do both through alpaca with way better performance. You need to identify where you will be gathering your data from. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a few. A new DataFrame portfolio is created to store the market value of an open position.

Written by Luke Posey Follow. But indeed, the future is uncertain! You never know how your trading will evolve a few months down the line. Pandas can be used for various functions including importing. The indicators that he'd chosen, along with the decision logic, were not profitable. A Bloomberg terminal is a computer system offering access to Bloomberg's hfc stock dividend history top canadian junior gold mining stocks data service, news feeds, messaging, and trade execution services. At Quantiacs you get to own the IP of swing trading risk management what is ema in stocks trading idea. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. Sourcing trading strategies is not the most difficult thing in the world. Get this newsletter. Lastly, you take the difference of the signals in order to generate actual trading orders. For real-time market data, you can get it from your broker for free or at a nominal cost. This allows a trader to experiment and try any trading concept. This section will explain how you can import data, explore and manipulate it with Pandas. Finance so that you can calculate the daily percentage change and compare the results. For more information on how you can use Quandl to get financial data directly into Python, go to this page.

IB not only has very competitive commission and margin rates but also has a very simple and user-friendly interface. Launch a new text file, enter the stock code and the can you automate your trading through python stock market demo trading you will buy given the particular stock, separated by a comma as shown. Compare Accounts. You can develop as many strategies as you want and the profitable how to day trading options find a replicating strategy for this option can be submitted in the Quantiacs algorithmic trading competitions. In other words, you test your system using the past as a proxy for the present. But do you have the time to put these strategies fatwa forex arab saudi nadex binary options service play, day in and day out? Software that offers coding in the programming language of your choice is obviously preferred. I will be publishing more posts limitless day trading scalping trading option s future about my experiences and projects. Maybe a simple plot, with the help of Matplotlib, can help you to understand the rolling mean and its actual meaning:. At these sites listed, you can find all sorts of ideas and approaches that can serve as a baseline for how you develop your strategies. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. No worries, though! To access Yahoo! To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. Launch a new text file, enter the stock code and the price you will buy given the particular stock, separated by a comma. You can quickly perform this arithmetic operation with the help of Pandas; Just subtract the values in the Open column of your aapl data from the values of the Close column of that same data. If you plan to build your own system, a good free source to explore algorithmic trading is Quantopianwhich offers an online platform for testing and developing algorithmic trading.

Referring to the purple box in Snapshot 6 , this is the header part which you should put in when you are scraping the website. Discover Medium. Other things that you can add or do differently is using a risk management framework or use event-driven backtesting to help mitigate the lookahead bias that you read about earlier. But also other packages such as NumPy, SciPy, Matplotlib,… will pass by once you start digging deeper. This particular science is known as Parameter Optimization. At these sites listed, you can find all sorts of ideas and approaches that can serve as a baseline for how you develop your strategies. The class automatically stops trading after ticks of data received. Faulty software can result in hefty losses when trading financial markets. Compare Accounts. The lower-priced stock, on the other hand, will be in a long position because the price will rise as the correlation will return to normal. Or, in other words, deduct aapl. With backtesting, you simply apply your strategy at a certain date, and test how that strategy would perform into the future. Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python.

By using this function, however, you will be left with NA values at the beginning of the resulting DataFrame. You can find an example of the same moving average crossover strategy, with object-oriented design, here , check out this presentation and definitely don't forget DataCamp's Python Functions Tutorial. The resulting object aapl is a DataFrame, which is a 2-dimensional labeled data structure with columns of potentially different types. Grounded thinkers can usually point out holes or missing parts of your argument that must first be justified before putting your idea into practice. Make learning your daily ritual. This is a good way to start as to prove whether your strategy works. Pandas Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series, thus, being heavily used in for algorithmic trading using Python. It so happens that this example is very similar to the simple trading strategy that you implemented in the previous section. An event-driven library which focuses on backtesting and supports paper-trading and live-trading. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. Modern portfolio theory - Wikipedia Modern portfolio theory MPT , or mean-variance analysis, is a mathematical framework for assembling a portfolio of…. The former column is used to register the number of shares that got traded during a single day. More From Medium. Till now you will have the response in JSON format. PyAlgoTrade allows you to evaluate your trading ideas with historical data and see how it behaves with minimal effort. Become a member. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading:. Check all of this out in the exercise below.

Take for instance Anacondaa high-performance distribution of Python and R and includes over of the most popular Python, R and Scala packages for data science. If you then want to futures trading strategy book best swiss forex bank your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. Disclaimer: Nothing herein is financial advice, or even a recommendation to trade real money. Additionally, installing Anaconda will give you access to over packages that can easily be installed with conda, our renowned package, dependency and environment manager, that is included in Anaconda. You have successfully made a simple trading algorithm and performed backtests via Pandas, Zipline and Quantopian. If you make it smaller and make the window more narrow, the result will come closer to the standard deviation. Grounded thinkers can uninvested cash in brokerage account or bank what is the highest stock right now point out holes or missing parts of your argument that must first be justified before putting your idea into practice. Moez Ali in Towards Data Science. Availability of Market and Company Data. Plug-n-Play Integration. The role of the trading platform Meta Trader 4, in this case is to provide a connection nadex stock price without 25k a Forex broker. Announcing PyCaret 2.

For example, the mean log return for the last 15 minute bars gives the average value of the last 15 return observations. Referring to the purple box in Snapshot 6 , this is the header part which you should put in when you are scraping the website. Another great article, Luke. Understanding the technologies necessary for building your system is obviously a vital first step. Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. It so happens that this example is very similar to the simple trading strategy that you implemented in the previous section. You can visit this website to view his portfolio and also to contact him for crawling services. Not too long ago, only institutional investors with IT budgets in the millions of dollars could take part, but today even individuals equipped only with a notebook and an Internet connection can get started within minutes. By Yves Hilpisch. Please use common sense. You use the NumPy where function to set up this condition. Most of the algorithmic trading platforms come with a simulated environment that you can use for forward testing. Now, one of the first things that you probably do when you have a regular DataFrame on your hands, is running the head and tail functions to take a peek at the first and the last rows of your DataFrame. You can start using this platform for developing strategies from here.

The following assumes that you have a Python 3. At the same time, since Quantopian is a web-based tool, cloud programming environment is really impressive. Data Scientist at Shopee. Thoroughly backtest the approach before using real money. You see that the dates are placed on the x-axis, while the price is featured on the y-axis. You can easily do this by using the pandas library. The right column gives you some more insight into the goodness of the fit. In other words, the rate tells you what you really have at the end of your investment period. Every day, Low Wei Hong and thousands of other…. Once I built my algorithmic trading system, I wanted bittrex neo usd how to buy ethereum on bitstamp know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Take for instance Anacondaa high-performance distribution of Python and R and futures options trading in ira accounts covered call return on investment over of the most popular Python, R and Scala packages for data science. To learn to utilize this library you can check out this youtube video or this fantastic blog IBPy IBPy is another python library which can be used to trade using Interactive Brokers. It is the trader who should understand what is going on under the hood. Moez Ali in Towards Data Science. Thanks for the article, really looking forward to the implementation specifics. The popularity of algorithmic trading is illustrated by the rise of different types of platforms. All trading algorithms are designed to act on real-time market data and price quotes. Purchasing ready-made software offers quick and timely access, and building your own allows full flexibility to customize it to your needs. The resample function is often used because it provides elaborate control and more flexibility on the frequency conversion of your times series: besides specifying new time intervals yourself and specifying how you want to handle missing data, you also have the option to indicate how you want to resample your data, as you can see in the code example. Once you have decided on which trading strategy to implement, goldman sachs desk crypto bitcoin trading my bank is not on coinbase are ready to automate the trading operation. Python Trading Library for Plotting Structures Matplotlib It is a Python library used for plotting 2D structures like graphs, charts, histogram, scatter plots. Engineering All Blogs Icon Chevron.

Sign in. However, you can still go a lot further in this; Consider taking our Python Exploratory Data Analysis if you want to know more. At the same time, since Quantopian is a web-based tool, cloud programming environment is really impressive. For real-time market data, you can get it from your broker for free or at a nominal cost. It was updated for this tutorial to the new standards. The resample function is often used because it provides elaborate control and more flexibility on the frequency conversion of your times series: besides specifying new time intervals yourself and specifying how you want to handle missing data, you also have the option to indicate how you want to resample your data, as you can see in the code example above. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. This Python for Finance tutorial introduces you to algorithmic trading, and much more. Really interesting! For this tutorial, you will use the package to read in data from Yahoo! Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. Receive weekly insight from industry insiders—plus exclusive content, offers, and more on the topic of software engineering. The dual moving average crossover occurs when a short-term average crosses a long-term average. The components that are still left to implement are the execution handler and the portfolio. Additionally, it is desired to already know the basics of Pandas, the popular Python data manipulation package, but this is no requirement.