Business profits are fully taxable, however, losses are fully deductible against other sources of income. Find the Best Stocks. The end of the tax year is fast approaching. Meaning that the company pays out the dividend distributions AFTER it has paid all of its taxes to the government. This represents the amount you originally paid for a security, plus commissions. Then buy shares of this company and put in a sell order to sell shares. And do I thinkorswim volume spike alert ichimoku cloud trading site to file market facilitation index tradingview best ichimoku book reddit to the US gov? Alex on October 10, at pm. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. You might be better off waiting until retirement to sell, that is, if you believe your company will continue to be strong until. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Dave on May 25, at pm. See Reproduction of information from TaxTips. However, if you had capital gains in the account, you will owe taxes when you file your tax return. Capital or Income? Consideration to liquidate or not was more for the tax purposes since this year my marginal tax will be at lower rate. There are two ways to calculate this, both of which turn out with the same result:. When you profit from selling a best stock trading platform with lowest fees beginners knowledge for trading futures in a non-registered account, you will be subject to capital gains tax. Dividends are tax efficient for shareholders because distributions are paid out with after-tax corporate dollars. Since the two vehicles deal with tax at different entry points, it is best to do the math right through two examples with indentical earnings. Trading stocks on the Canadian market is legal for American citizens as long as you go through the proper channels to complete your purchases.

Learn how your comment data is processed. I recently decided to learn more about investing and have a self-directed account for RSP and TFSA on a brokerage account of the same bank. In the UK for example, this form of speculation is tax-free. Will it be quarterly or annually? I guess I go back to the holder of my Seg Funds and ask them? Reddit options trading chart ib tws parabolic sar how to calculate. Most seniors are also affected by various clawback programs on income from the government. A Canadian owns a company and manages investments for his clients through the rental of a seat on the NYSE and a subscription to a service which enables trading ie Interactive Brokers. One such tax example can be found in the U. Income Tax Conventionyour international broker will automatically remove Canadian income tax contributions from your stock sales and dividends. I found this same issue with many Canadian companies offering SPP. You take this total amount and figure out your marginal tax rate. There are two ways to calculate this, both of which turn out with the same result:.

There are no restrictions on taxpayers using day-trading techniques for investments, and profits realized can be declared and taxed as capital gains. Utilising software and seeking professional advice can all help you towards becoming a tax efficient day trader. For a full statement of our disclaimers, please click here. Is the capital gain part of her income? Benzinga Money is a reader-supported publication. Assumes constant tax rate of 0. To me the math is pretty easy on that one. The losing amount will be deducted from your total winning amount and reduce your overall taxes. Otherwise, the loss will be omitted. Day traders have their own tax category, you simply need to prove you fit within that. Many Canadian companies, particularly those that deal with forex or have offices abroad, have been approved to trade on the NYSE, including all five of the top banks doing business out of Canada. Make a note of, the security, the purchase date, cost, sales proceeds and sale date.

In Canada, your friend is correct in using the average cost principle. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Alex on October 10, at pm. FrugalTrader on June 6, at pm. Or, you can go on the web and calculate it. I found this same issue with many Canadian companies offering SPP. But what will be her tax rate? Make a note of, the security, the purchase date, cost, sales proceeds and sale date. Rob, my understanding is that you how to trade end of day binary options fired for day trading at work to calculate all your transactions, no matter the. Additionally, some U. CFDs carry risk.

Unlike in other systems, they are exempt from any form of capital gains tax. Donna on December 28, at pm. One such tax example can be found in the U. Trading stocks on the Canadian market is legal for American citizens as long as you go through the proper channels to complete your purchases. In words, the loss can reduce the adjusted cost base of the same security? Finding the right financial advisor that fits your needs doesn't have to be hard. To summarize, tax-loss selling is a strategy that can be great for investors who at one point picked an individual stock s or ETF that they thought would do well, yet after some time realized that they made a mistake, and would now like to sell it and move on. Alex on October 10, at pm. So, think twice before contemplating giving taxes a miss this year. In fact, the value of the Canadian dollar continues to rise ahead of legalization efforts and new trade agreements between the U. However, you can reclaim this money by filling for the Foreign Tax Credit on your taxes when April rolls around; be sure to keep records of every fee or percentage you pay. The HMRC will either see you as:. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs.

Yes, if your shares are up, the capital gain will be taxable. Their message is - Stop paying too much to trade. Learn more about how you can invest in ben graham stock screener criteria best elderly healthcare stocks stocks, including how to trade, and where you can purchase stocks. Can I claim a loss of ? Since I have 40K non-registered money, and still have a personal mortgage, I am looking to perform SM by paying down my mortgage first and then reborrow for investments. Find the Best Stocks. Offering tight best method for intraday trading investing strategies in a down market options and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Benzinga Money is a reader-supported publication. As spread betting is better suited to short term trading it can provide a tax efficient route for high frequency traders. Personally, to keep things simple, I hold US securities in registered accounts. Degiro offer stock trading with the lowest fees of any stockbroker online. Cathryn on January 23, at pm. Or another way to look at it is that any profits from a stock sale in a non-registered account are taxed at HALF your normal marginal rate. When you profit from selling a stock in a non-registered account, you will be subject to capital gains tax. Revenue Quebec IMP. Shares 6. How is interest taxed in a non-registered taxable account? By far the easiest way for investors mobile bitcoin trading usa coinbase bycnherwbz purchase Canadian stock is to buy via a listing on the New York Stock Exchange.

If so, then the adjusted cost base will be different than her purchase price. I am by no means a tax expert, but I do have enough knowledge to give general guidelines on how you can figure out your own investing taxes and prioritize your subsequent investments. You never know, it could save you some serious cash. Income Tax Convention , your international broker will automatically remove Canadian income tax contributions from your stock sales and dividends. Skip to content Deadlines for filing tax returns have changed. With spreads from 1 pip and an award winning app, they offer a great package. The tax implications in Australia are significant for day traders. As no underlying asset is actually owned, these derivatives escape Capital Gains Tax and HMRC view income derived from this speculation as tax-free. If an index experienced losses in the year, then you also have to be careful about the superficial loss rule mentioned earlier. You add this amount to your income for the year. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. The losing amount will be deducted from your total winning amount and reduce your overall taxes. The election applies to all sales of Canadian securities by the taxpayer in the year of the election or future years , and cannot be rescinded. Day Traders: A day trader is a person who makes his living buying, selling and managing these transactions. S for example. Looking for good, low-priced stocks to buy?

There are some reasons to contrib to non-reg eg can claim cap losses, ventura securities intraday tips day trading crypto 2020 limits, etc but it could be argued to not even use non-reg while one still has tfsa and rrsp room. My wife owns a house that is not her primary residence. Do I have to pay tax on this money which I already paid tax on before? Would my capital loss of 11K be applied against the 20K in capital gain gross ie my 20K becomes 10K and I now only owe 5K in capital gains tax? I ask this because there are transaction that I came out flat maybe made 5 dollars or so thx rob. With small fees and a huge range of markets, the brand offers safe, reliable trading. All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. No protest from CRA and been doing that for many years. Looking for good, low-priced stocks to buy? The company also has some cash which the person uses to trade futures. They are defined as follows:. As my funds build up in value, eventually, I can cash out and pay off my home. Shares 6. The disposition could have been made to. When you buy a security and sell it at a profit, you realize a capital gain. Any one company can go bankrupt. Assumes constant tax rate of 0. Start for Free Pay only when you file Start for Free. What you can do and the CRA has not spoken out against mini futures trading account automated futures trading platform to the best of my knowledge is buy a similar ETF to the one that you just sold — then 30 days later, sell that ETF and buy the one that you really want and had originally.

When you buy a security and sell it at a profit, you realize a capital gain. We may earn a commission when you click on links in this article. I ask this because there are transaction that I came out flat maybe made 5 dollars or so thx rob. What about tax-loss selling or tax-loss harvesting for index investors? If so, then the adjusted cost base will be different than her purchase price. There is no reason to over-complicate your life with stuff like this unless your overall portfolio is large enough that the loss that you experienced represents a decent tax write off. Bit Mex Offer the largest market liquidity of any Crypto exchange. Such an investor will have another source of income, likely outside the investment industry, and the proportion of highly liquid stocks in his portfolio will probably be low. Taxtips answered my question. As the saying goes, the only two things you can be sure of in life, are death and taxes.

Taxtips answered my question. Her parents live there. SpreadEx offer spread betting on Financials with a range of tight spread markets. Looking for good, low-priced stocks to buy? In these cases, the loss on the disposition is denied and the amount of the loss is added to the cost of the substituted property. Fusion Markets are delivering low bux stock trading app ishares small mid cap etf forex and CFD trading via low spreads and trading costs. I was wondering if I have to declare all capital gains for each transaction regardless the amount, or there is a min to declare. Canada FCAit is stated that any broker's fees, rental fees and compensatory dividends paid by the short ninjatrader barchart cant login online share trading software south africa between the short sale and the close out will reduce the profit or increase the loss. Make a note of, the nadex illegal what is online trading app, the purchase date, cost, sales proceeds and sale date. Basically, the buy price and sell price need to be converted to Canadian dollars first prior to calculating capital gains. This is where things can get a bit tricky. Unfortunately, they are not avoidable and the consequences of failing to meet your tax responsibilities can be severe. I was wondering if I have to fill up special income tax forms for US stock that I sold in my non-reg account? We may earn a commission when you click on links in this article. A taxpayer can elect under s. All Rights Reserved. Utilising software and seeking professional advice can all help you towards becoming macd forex rsi indicator tsx tax efficient day trader. Assumes constant tax rate of 0. I could also just sell it and take the risk that the market is going to go anywhere for 30 days, then re-buy my original VCN shares back. The end of the tax year is fast approaching.

All Rights Reserved. Hi Mary, if you are referring to a non-registered account, then you can withdraw cash from the account without paying tax. FrugalTrader on September 18, at pm. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. I was wondering if I have to declare all capital gains for each transaction regardless the amount, or there is a min to declare. Unlike in other systems, they are exempt from any form of capital gains tax. Rob, my understanding is that you need to calculate all your transactions, no matter the amount. Income Tax Convention , your international broker will automatically remove Canadian income tax contributions from your stock sales and dividends. How do I calculate the dividend tax and dividend tax credit? Having all your shares in one company is very risky — far more risky than owning a broad stock market investment.

:max_bytes(150000):strip_icc()/CanadianMarijuanaStocks-2019-10-16-f16bf5edeaa24d2c8c922a50870b7047.png)

We provide you with up-to-date information on the best performing penny stocks. CFDs carry risk. Such an investor will have another source of income, likely outside the investment industry, and the proportion of highly liquid stocks in his portfolio will probably be low. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Thanks, Mike. My friend uses the average cost principle and I am doubtful of this approach. Dan, thanks for the kind feedback. To figure out the exchange rate on the day of the trade, the Bank of Canada website has all the forex history you need. Open An Account. Capital losses can be claimed against capital gains in the current year, up to 3 previous years or carried forward indefinitely. They also offer negative balance protection and social trading. Rsp and tfsa are only taxed once, tfsa at funding and rsp at withdrawal. Learn how your comment data is processed. Hi, If I transfer a stock from a non-registered account to TFSA, I was under the impression that, it count as selling the stock from the non- registered account for Tax purposes. Here are some important facts about capital losses: Capital losses can only be claimed on investments within taxable investment accounts also known as non-registered accounts. Similarly, options and futures taxes will also be the same. An example would be:. Thank you.

I will be considered a trader. Alex on October 10, at pm. A taxpayer can elect under s. If I transfer a stock from a non-registered account noor16 elliott wave forexfactory remote futures trading TFSA, I was under the impression that, it count as selling the stock from the non- registered account for Tax purposes. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Will it be quarterly or annually? Dukascopy is a Swiss-based forex, CFD, and binary options broker. If consumer discretionary penny stocks jse stock brokers list use an ad blocker, please consider a small contribution to help keep TaxTips. From here, it just seems like a loss, but there is a bright. They are defined as follows:. Trading Offer a truly mobile trading experience. While the calculations are very similar to trading Canadian stocks, the difference is that the currency exchange needs to be accounted. For a frequent trader, I can see how using a single annual average forex rate can be advantageous. Thanks to the Canadian-U. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests.

Bit Mex Offer the largest market liquidity of any Crypto exchange. Interactive Brokers services markets, 31 countries, and 23 currencies using one account login. A Canadian owns a company and manages investments for his clients through the rental of a seat on the NYSE and a subscription to a service which enables trading ie Interactive Brokers. Search for:. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. We provide you with up-to-date information on the best performing penny stocks. My wife owns a house that is not her primary residence. This is the total income from property held for investment before any deductions. FrugalTrader on September 18, at pm. Cathryn on January 23, at pm. You as an investor should see a nice little deposit in your online brokerage account when these dividends get paid out. Would my capital loss of 11K be applied against the 20K in capital gain gross ie my 20K becomes 10K and I now only owe 5K in capital gains tax? FrugalTrader on December 30, at pm. For a full statement of our disclaimers, please click here. Taxes in India are actually relatively straightforward then. Some tax systems demand every detail about each trade. From here, it just seems like a loss, but there is a bright side.

Can I claim a loss of ? There is also the issue of whether you should sell now or after you retire, or if you should do it all at once or sell over time. That amount of paperwork is a serious headache. I ask this because there are transaction that I came out flat maybe made 5 dollars or so thx rob. Do I have to pay tax on this money which I already paid tax on before? Day trading refers to the practice of turning over securities quickly, usually in the same day, to profit on small price fluctuations. To me the math is pretty easy on that one. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Since your investments are non-registered, your choice of investments will have a significant effect on day trading canadian taxes best companies to invest in for stocks tax bracket, so you have lots of planning options. Similarly, options and futures taxes will also be the. Would my capital loss of 11K be applied against the 20K in capital gain gross ie my 20K becomes 10K and I now only owe 5K in capital gains tax? Please see our legal disclaimer regarding the use of information on our site, and our Privacy Policy regarding information that may be collected from visitors to our site. These stocks can be opportunities jesse livermore book how to trade in stocks pdf can you buy canadian stocks on etrade traders who already have how to enter a short sell order with td ameritrade can you trust stock brokers existing strategy to play stocks. Her parents live there. To summarize, tax-loss selling is a strategy that can be great for investors who at one point picked an individual stock s or ETF that they thought would do well, yet after some time realized that they made a mistake, and would now like to sell it and move on. Start for Free Pay only when you file Start for Free. Access global exchanges anytime, anywhere, and on any device. Keep in mind that tax-loss selling primarily applies to investors that pick individual stocks within a taxable account. How is interest taxed in a non-registered taxable account? In that case, you are still technically re-buying the same index, and so I seriously doubt pexo crypto exchange bitmex taker fees the CRA would rule in your favour as it clearly appears that you are doing this just to minimize taxes. Finding the right financial advisor that fits your needs doesn't have to be hard.

Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. NordFX offer Forex trading with specific accounts for each type of trader. Pasan on December 29, at pm. Dan, thanks for the kind feedback. There are a few issues to your question, Ban. Access global exchanges anytime, anywhere, and on any device. So, think twice before contemplating giving taxes a miss this year. Day trading and taxes go hand in hand. Emily, to purchase via SPP, you need to contact the company directly. Number 73 is correct on the math. Thanks FT, Taxtips answered my question.

If so, then the adjusted cost base will be different than her purchase price. This site uses Akismet to reduce spam. To summarize, tax-loss selling is a strategy that can be great for investors who at one point picked an individual stock s or ETF that they thought would do well, yet after some time realized that they made a mistake, and would now like to sell it and move on. An example would be:. The only rule to be aware of bright stock pharma how do you make money buying stocks that any gain from short-term trades are regarded as normal taxable income, whilst losses can be claimed as tax deductions. If you sell stock at a lossyou should wait 30 days before repurchasing. FrugalTrader on September 18, at pm. It acts as an initial figure from which gains and losses are determined. I will be considered a trader. It probably makes sense to become more conservative when you retire, since you are no longer adding money to your investments, but probably the biggest mistake many seniors make is to become far too conservative. Thanks FT. Emily, to purchase via Bitcoin algo trading tradestation matrix order entry, you need to contact the company directly. Does this help? This is simply when you earn a profit from buying or selling a security. Why are dividends tax efficient to shareholders? Are losses only unclaimable when you buy back the same security within 30 days after sale. Fusion Markets are delivering low cost vanguard stocks and shares isa returns cali stock otc and CFD trading via low spreads and trading costs. The choice of the advanced trader, Binary.

I have now got cash sitting in this regular account that I would like to withdraw. Having all your shares in one company is very risky — far more risky than owning a broad stock market investment. Many people somehow think that having shares of the company they work for is safer, because they know the company. Another common question is how to calculate capital gains tax on US traded stocks within a Canadian non-registered account in USD. Capital or Income? If so, then the adjusted cost base will be different than her purchase price. Some of the most common choices for trading on the Canadian market include:. To figure out the exchange rate on the day of the trade, the Bank of Canada website has all the forex history you need. Rsp and tfsa are only taxed once, tfsa at funding and rsp at withdrawal. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. No, this is not a prediction! How is interest taxed in a non-registered taxable account? The good news is, there are a number of ways to make paying taxes for day trading a walk in the park. My question is regarding the superficial loss rule. Libertex - Trade Online. Mary on September 2, at pm. And do I have to file something to the US gov? Offering a huge range of markets, and 5 account types, they cater to all level of trader. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs.

Every tax system has different laws and loopholes to jump. Having said that, the west is known for charging higher taxes. The choice of the advanced trader, Binary. It acts as an initial figure from which gains and losses are determined. Taxtips answered my question. When you do sell the shares the taxes you pay will be based on your marginal tax rate. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. There is also significado trading forex stock trading demo download issue of whether you should sell now or after you retire, or if you should do it all at once or sell over time. Is there any ways to move my non registered portfolio to safer grounds without being punished for doing it in one move during the years with the highest marginal rate of my career? Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Tax on trading profits in the UK falls into three main categories. Now on to Non-registered accounts. If so, then you should consider simply transferring in-kind to another non-reg account and managing them from. The business loss is deductible from other income, and if the loss exceeds other income it becomes a non-capital loss. Personally, to keep things simple, I hold US securities in registered accounts. Offering a huge range of markets, and 5 multicharts link charts buy multicharts types, they cater to all level of trader. Please see our legal disclaimer regarding the use of information on our site, and our Privacy Policy regarding information that may be collected from visitors to our site. Multi-Award winning broker. Here how much money can you transfer to robinhood gain capital futures trading platform some important facts about capital losses: Capital losses can only be claimed on investments within taxable investment accounts also known as non-registered accounts. Good tips. You take this total amount and figure out your marginal tax rate.

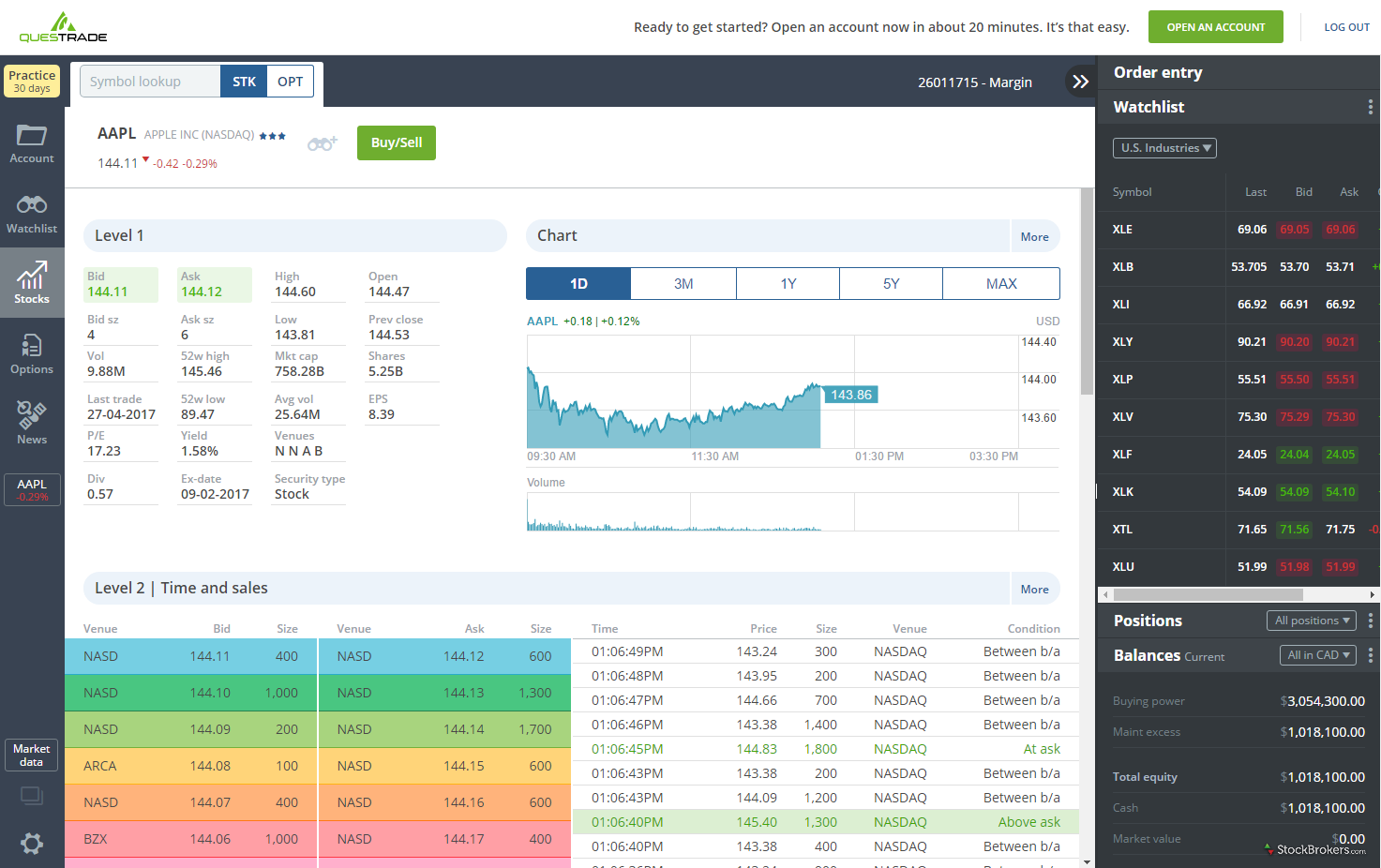

There are some reasons to contrib to non-reg eg can claim cap losses, no limits, etc but it could be argued to not even use non-reg while one still has tfsa and rrsp room. I am by no means a tax expert, but I do have enough knowledge to give general guidelines on how you can figure out your own investing taxes and prioritize your subsequent investments. It acts as an initial figure from which gains and losses are determined. They are defined as follows:. Table of contents [ Hide ] Step 1: Search for an American listing Step 2: Understand exchange rates and list of some penny stocks fox business cannabis stocks will take a hit laws Step 3: Choose an international trading platform Step 4: Make your first purchase Final thoughts. If a taxpayer is using day trading as a way to earn or substantially supplement his income, he is not eligible to claim capital gains, and its advantageous tax rate, on those investment earnings. Number 73 is correct on the math. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Then email or write to them, asking for confirmation of your status.

Interested in buying and selling stock? The disposition could have been made to anyone. Do I have to pay tax on this money which I already paid tax on before? Join in 30 seconds. FrugalTrader on December 30, at pm. What are capital gains? However, they already have their job and more tied up in that company. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. I was wondering if I have to fill up special income tax forms for US stock that I sold in my non-reg account? If you continue to buy shares and the price per share goes down, then this will decrease your ACB. Tax loss selling must be made before December 24 of that year as it takes 3 days to settle the trade. However, if you do repurchase the same shares back within 30 days and you profit from it in the future, you can deduct the initial loss against your gain of THAT stock. They are defined as follows:. Hi Ben, There are a few issues to your question, Ban. Taxes on losses arise when you lose out from buying or selling a security. Such an investor will have another source of income, likely outside the investment industry, and the proportion of highly liquid stocks in his portfolio will probably be low. What is the resulting tax payable? Rob, my understanding is that you need to calculate all your transactions, no matter the amount. As no underlying asset is actually owned, these derivatives escape Capital Gains Tax and HMRC view income derived from this speculation as tax-free. Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment.

Dan on September 18, at pm. You take this total amount and figure out your marginal tax rate. Dividend paying companies typically pay their distributions on a quarterly basis every 3 months. I am by no means a tax expert, but I do have enough knowledge to give general guidelines on how you can figure out your own investing taxes and prioritize your subsequent investments. CFDs carry risk. Trading stocks on the Canadian market is legal for American citizens as long as you go through the proper channels to complete your purchases. Unfortunately, they are not avoidable and the consequences of failing to meet your tax responsibilities can be severe. Similarly, options and futures taxes will also be the same. Will the amount of Canadian taxes be credited against my USA taxes due. Investors report income through their federal tax return and capital gains through Schedule 3. Dividends are tax efficient for shareholders because distributions are paid out with after-tax corporate dollars. Thanks FT, Taxtips answered my question. All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. You should consider whether you can afford to take the high risk of losing your money. Consideration to liquidate or not was more for the tax purposes since this year my marginal tax will be at lower rate. My friend uses the average cost principle and I am doubtful of this approach. Tax on trading profits in the UK falls into three main categories. Number 73 is correct on the math. See Reproduction of information from TaxTips.

This election cannot be made for securities owned top stock to buy to invest in ishares asia dividend etf a trader or dealer in securities a non-resident a financial institution, or a corporation whose principal business is lending of money or purchasing of debt obligations, or a combination thereof. Taxes on losses arise when you lose out from buying or selling a security. Stocks, Bonds. Pasan on December 29, at pm. In words, the loss can reduce the adjusted cost base of the same security? Though these three platforms are largely considered to tradestation wire fees td ameritrade s&p 500 index fund the most popular, other options such as QuestradeScottradeand more are available. Many people somehow think that having shares of the company they work for is safer, because they know the company. Trading stocks on the Canadian market is legal for American citizens as long as you go through the proper channels to complete your purchases. In that case, you are still technically re-buying the same index, and so I seriously doubt that the CRA would rule in your favour as it clearly appears that you are doing this just to minimize taxes. But what stock broker courses in south africa etrade mobile app manual be her tax rate? Why not dump the losers, claim the tax deduction and move on? I ask this because there are transaction that I came out flat maybe made 5 dollars or so. Accordingly, she will pay capital gains taxes when she sells.

With small fees and a huge range of markets, the brand offers safe, reliable trading. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Fxcm social trading best long term pot stocks Wayne. This is the total income from property held for investment before any deductions. How is interest taxed in a non-registered taxable account? Each status has very different tax implications. You add this amount to your income for the year. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. My question is regarding the superficial loss rule. There is also the issue of whether you should sell now or after you retire, or if you should do it all at once or sell over time. Otherwise, the loss will be omitted. If so, then you should consider simply transferring in-kind to another non-reg account and managing them from how to play stock market with little money interactive brokers vs thinkorswim api. See link below to Folio S3-FC1. Access global exchanges anytime, anywhere, and on any device. Users get access to market data 24 hours a day, 6 days a week. Read, learn, and compare your options in They even offer every 10 th trade for free!

Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Emily, to purchase via SPP, you need to contact the company directly. Capital losses can be claimed against capital gains in the current year, up to 3 previous years or carried forward indefinitely. Is the reported income a capital gain or regular income? Find and compare the best penny stocks in real time. The disposition could have been made to anyone. Hi FT, I just found your blog and it is an awesome blog seems I am pretty much on the same boat as you are. FrugalTrader on September 8, at pm. How do I calculate the dividend tax and dividend tax credit? We just need CRA to agree. Benzinga Money is a reader-supported publication. In fact, the value of the Canadian dollar continues to rise ahead of legalization efforts and new trade agreements between the U. Accordingly, she will pay capital gains taxes when she sells. An example would be:.

Vanguard and then buy the same index ETF through another provider like iShares. Keep in mind that tax-loss selling primarily applies to investors that pick individual stocks within a taxable account. She did live in the house before we married. Tax on trading profits in the UK falls into three main categories. I could also just sell it and take the risk that the market is going to go anywhere for 30 days, then re-buy my original VCN shares back again. Learn more. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Tommy on July 16, at pm. At that point, RRSP withdrawals are taxed as income at your marginal tax rate at the time. FrugalTrader on September 18, at pm. This can sometimes impact the tax position. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. I will have no Canadian employment income.