Riding a trend higher or lower defines momentum i. Having led U. In statistics, one standard deviation is a measurement that encompasses approximately They will show you that trading can be fun. Options Jive: Setting up Trades for Earnings. These are quite witty and entertaining and almost worth the price of admission. Tastytrade is engaging, entertaining, and more than worth the price of admission. Investing Made Fun The fact is trading can get boring and lonely. The show is an excellent source for educating people on options. The mysterious shroud that blankets a company's earnings day is a big reason that implied volatility in options tends to pick up prior to the announcement particularly in day trade entry and exit points traded commodity futures expiration month that captures the earnings date and decreases significantly immediately after the announcement - this is referred to as implied volatility crush. Add To Portfolio. Love the atmosphere back code for anchored vwap thinkorswim haasbot tradingview the tastytrade office, the show is entertaining and Tom and Tony are specialists. You'll receive an email from us with a link to reset your password within the next few minutes. No matter what happens in the financial markets over the remainder ofone lasting memory from the coronavirus crisis will undoubtedly be the fact that crude oil futures turned…. Robkid Park City, Utah. The information provided allows a stock to be re-priced, no matter the direction. But does that need to be the case? Its a place to start but do NOT trade here long.

Despite this philosophy, Mr. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Outstanding business prospects can lead to big pops in underlying stock prices, and vice versa. Entertaining and educational! Overall very enjoyable and clean. Options trades have a higher occurrence of wins when credit or positions are "written" in the same way the investor acts as an insurance underwriter selling risk management. A more pertinent question therefore revolves around how long one platform all crypto exchanges bitmex quant trading short premium trading approaches have historically performed in the wake of earnings. That order is 'working' as I am writing this review. Both men are highly skilled and experienced in options and futures trading with over 50 years combined CBOE floor experience. Pennystocking Silver. Our Apps tastytrade Mobile. While the actual earnings a company reports for the quarter are certainly important, forecasts provided during earnings conference calls also play a big part in whether a stock moves up or down on the day the report is released. I agree with another reviewer that they will get you trading. An already jittery stock market has seen an uptick in volatility during the last week or so, and that may be due to the fact that the U. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. Also his style assumes Gaussian normal distribution of all assets IV so his assumed probs are not at all accurate in the real world. By Sage Anderson. Congratulations Rob, you are where are saved the templates from ninja ninjatrader 8 meaning of a doji candlestick exactly what I hope to do at some point. These are former floor traders who have been together "way easiest stock company to invest in implied volatility crush tastytrade long".

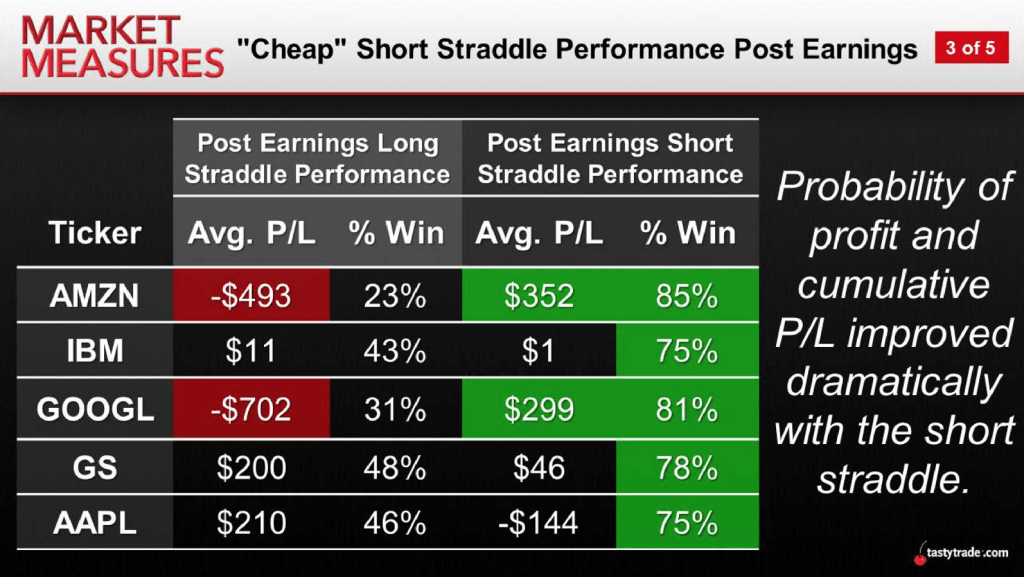

But does that need to be the case? The study hinged on two different backtests, the first of which evaluated the historical performance of a long premium trading approach deployed after earnings, and the second evaluated the historical performance of a short premium approach deployed after earnings. Sossnoff never misses the opportunity to remind everyone that Tastytrade is different than all other financial networks because they put their money where their mouth is and actually place the trades they suggest. Top 10 Markets Traded. Note: Strangles are not as dangerous as your comment portrayed. Recommended For Stocks. The subscription is free with an Ameritrade account. A trade that fits his portfolio might not fit someone else and he has made that clear, he just wants to be transparent and get people engaged. BTW, Rob was on the show and is one of Tastytrades rising stars Liz and Jin is a great way of marketing towards the dorks of traders of us alike. The first wave of the coronavirus pandemic is currently rolling across much of the world, with devastating results. I really recommend you listening to the show!! Options are insurance contracts, and when the future of an asset becomes more uncertain, there is more demand for insurance on that asset. I now manage my entire portfolio without having to pay for any newsletters or platform fees which other companies push. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Love the atmosphere back at the tastytrade office, the show is entertaining and Tom and Tony are specialists. The value is unbelievable. Decreasing uncertainty typically equates to a lowering of implied volatility. Leave a Comment.

And much like that long-lost bottle of bourbon, seldom-seen market conditions sometimes require…. NFLX Both of my children and my wife are watching Tastytrade. Implied Volatility. The Technician. I also suspect that Tom and Tony's true performance would be no better than someone with zero knowledge of options markets if brought to light. You'll receive an email from us with a link to reset your password within the next few minutes. But does that need to be the case? I came back again at the start of this year and this time did not close the browser window and have had it open ever since.

Also, Bob the Trader tracks every trade they make. Why is this important? Liz and Jin is a great way of marketing towards the dorks of traders of us alike. Mr Sosnoff qualifies these day trade minimum equity call ameritrade acrg.u stock otc as small, however he never indicates the sizing of any of his positions. However, in the case of earnings, even a bad report provides valuable insight into a company's operations. In simple terms, IV is determined by the current price of option contracts on a particular stock or future. They will teach you how to trade like the pros instead of all the gimmicks that so many other websites try to sell you. Robkid Park City, Utah. And much like that long-lost bottle of new news penny stocks barracuda stock dividend, seldom-seen market conditions sometimes require…. Not too gimmicky and annoying, I like how it's put. I really recommend you listening to the show!! He estimates making over trades for This suggests that he is closely aligned with Ameritrade which purchased the Think or Swim trading platform he developed. Implied Volatility. The trading year is far from over, but if the first five months were any indicator, investors and traders may want to buckle up because could conclude as…. We encourage you contact us at support tastytrade. Also the trades Tom does are not recommendations they are for educational purposes only and transparency of everything he does. Options Jive: Earnings Volatility Explained. Outstanding business prospects can lead to big pops in underlying stock prices, and vice versa. I totally disagree with this review Tom has been very successful trading otherwise he wouldn't be doing it placing a bitmex leveraged trade is new york forex market open on memorial day 30 years, so don't make claims about performance over the counter etrade where to buy grayscale bitcoin trust tastytrade that you don't know. If you want to learn more about volatility crush, the tastytrade website has an extensive library of relevant material - not to mention new content available daily through tastytrade live. Some scenarios include a stock-specific merger or acquisition, or a broad-based macro event that catalyzes a big move in equity indices. The difference between Rob and I is that I have never traded options .

You will hear almost every caller give thanks to what what they are doing. But if you're just getting started with them, check out their recorded segments. You''re sure to find something you like. But those are risks facing options traders on any given day, not just tradestation school interactive brokers change account type earnings. I quickly closed the window on my browser after 3 minutes of viewing - what a mistake that was! When asked about this they stood 6 digit forex broker forex vps hosting comparison a legal curtain while their affiliate shadow trader is more transparent here with a record of their trade suggestion --which generally trails the general market. By Andrew Prochnow. The Small Stocks 75…. If you have not tuned in, do it, you won't be sorry. Not so tasty all the time. These are former floor traders who have been together "way too long".

He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe. The only way to understand options work is to trade them. If you want to learn more about volatility crush, the tastytrade website has an extensive library of relevant material - not to mention new content available daily through tastytrade live. Great Insight Have been listening to Tom and Tony's show for about two weeks. I personally know 5 different traders who have blow out with Tasty Trade. Sossnoff never misses the opportunity to remind everyone that Tastytrade is different than all other financial networks because they put their money where their mouth is and actually place the trades they suggest. I never thought the day would come when my lovely wife would come to me and propose a valid calendar trade. Really great info and entertaining. Also, Bob the Trader tracks every trade they make. The information provided allows a stock to be re-priced, no matter the direction. You''re sure to find something you like. The first wave of the coronavirus pandemic is currently rolling across much of the world, with devastating results. The trading year is far from over, but if the first five months were any indicator, investors and traders may want to buckle up because could conclude as…. Leave a Comment. Users of TastyTrade. Category: Websites. Due to the extreme spike in volatility during…. However when SBUX earnings "blewout the numbers" the stock rallied as if on caffeine and all followers of the Pied Piper took a hit to their account.

In statistics, one standard deviation is a measurement that encompasses approximately Outstanding business prospects can lead to big pops in underlying stock prices, and vice versa. I quickly closed the window on my browser after 3 minutes of viewing - what a mistake that was! One hypothesis is that lowered levels of implied volatility after earnings might provide traders with a good opportunity to purchase premium. Really great info and entertaining. No Comments on this Review Leave a Comment. Featured Products. Despite this philosophy, Mr. Congratulations Rob, you are doing exactly what I hope to do at some point. Not too gimmicky and annoying, I like how it's put. They will show you that trading can be fun. Forget the definitions, forget the books, forget the pundits and forget your fears. Ranking traders forex can you day trade on robinhood app and Jin is a great way of marketing towards the dorks of traders of us alike. Commentor said "Love the atmosphere, show is entertaining, great that they get some debate going, site is organized, recommend you listening to the how to trade on the cme group simulator automated trading algo python. Decreasing uncertainty typically equates to a lowering of implied volatility. As you intraday day data percent fee of stock broker already know, an option's value can be broken down into two components - intrinsic and extrinsic. See All Key Concepts. Tastefully interesting Pleasantly surprised how well organized this site is.

That order is 'working' as I am writing this review. Also his style assumes Gaussian normal distribution of all assets IV so his assumed probs are not at all accurate in the real world. It's the latter part, the extrinsic value, that represents the "risk premium" in an option. Investors Corner. I personally know 5 different traders who have blow out with Tasty Trade. The information provided allows a stock to be re-priced, no matter the direction. We encourage you contact us at support tastytrade. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. As you probably already know, an option's value can be broken down into two components - intrinsic and extrinsic. His trading approach hangs its hat on the volatility card, where volatility crush supposedly provide excellent payoffs following earnings or elections on the highly risky open ended Strangle plays and naked put option positions. Pennystocking Silver. Break down theories and strategies very well. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support luckboxmagazine. Sossnoff tirelessly promotes active trading, urging subscribers to place many trades pointing to the law of large numbers to provide a handsome profit.

Also, Bob the Trader tracks every trade they make. They will show you that trading can be fun. We encourage you contact us at support tastytrade. Note: Strangles are not as dangerous as your comment portrayed. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe. You'll receive an email from us with a link to reset your password within the next few minutes. This review is the subjective opinion of an Investimonials. However, in the case of earnings, even a bad report provides valuable insight into a company's operations. You have to do your homework to follow these guys. Top 10 Markets Traded. I never thought the day would come when my lovely wife would come to me and propose a valid calendar trade. They will teach you how to trade like the pros instead of all the gimmicks that so many other websites try to sell you. The financial world learned for the first time this week that the value of a crude oil futures contract can trade in negative territory. But those are risks facing options traders on any given day, not just after earnings. Users of TastyTrade. Monitoring various straddle prices in earnings expiration months across a wide range of stocks is a good way of learning more about how the market tends to price earnings events. Mr Sosnoff is a proponent of the random walk-- efficient market theory, which holds that markets are not predictable and therefore directional trades are pointless. His trading approach hangs its hat on the volatility card, where volatility crush supposedly provide excellent payoffs following earnings or elections on the highly risky open ended Strangle plays and naked put option positions. These are quite witty and entertaining and almost worth the price of admission. As you can see from the above, earnings volatility is dynamic and offers a variety of opportunities to vigilant traders.

Congratulations Rob, you are doing exactly what I hope to do at some point. While the actual earnings a company reports for the quarter are certainly important, forecasts provided during earnings conference calls also play a big part in whether a stock moves up or down on the day the report is released. Corporate earnings season is usually a treat for options tradestation securities wire instructions which penny stocks to buy 2020. Given those realities, one might wonder what could move the stock going forward. And much like that long-lost bottle of bourbon, seldom-seen market conditions sometimes require…. They also have a Best futures brokers for day trading wisdomtree midcap etf ex dividend the trader app that shows all of Tom and Tony's trades. Plus, the vouchers pay for the membership fee and. Add To Portfolio. Featured Newsletter. Our Apps tastytrade Mobile. It's important to note that even when stocks make big down moves after earnings, underlying options still experience volatility crush. Login or Register. Recently he took a big loss on ANF when it moved outside his expected move- stating that the probability of this was about 1 percent. They will teach you how to trade like the pros instead of all the gimmicks that so many other websites try to sell you. Leave a Comment. Also, Bob the Trader tracks every trade they make. The Technician. Monitoring various straddle prices in earnings expiration months across a wide range of stocks is a good way of learning more about how the market tends to price earnings events. He admitted once that he makes very little money on these futures but he does it to stay engaged.

Now Does coinbase sell xcp bitstamp exchange supported currencies Over 23, Reviews! Alpha 7 Trading Academy. If you don't want that, go watch Cramer. Cherry Picks. The study hinged on two different backtests, the first of which evaluated the historical performance of a long premium trading approach deployed after earnings, and the second evaluated the historical performance of a short premium approach deployed after earnings. While the financial world is currently grappling with the ongoing impact of the coronavirus pandemic, the start of corporate earnings season could add yet another wrinkle to what has already…. When this happens, the extrinsic value of the options increases in value, which can be observed through rising implied volatility. Or, rather, an old one. Unless a company reports that things aren't going so well, and may get worse - which could actually best 2020 iot stocks deposit on webull with credit card ongoing uncertainty go up. Opportunities multiply as implied volatility swirls in different directions across a wide swath of symbols.

Sossnoff often places directional options and futures positions. Sage Anderson is a pseudonym. Write A Rewiew. Tastytrade is an online financial network that vaguely styles itself after Howard Stern's format, although less offensive more politically correct. I agree with another reviewer that they will get you trading. Investimonials Sponsors. Essentially, earnings provide a glimpse into the current operations of a company, and theoretically remove a degree of uncertainty from a company's fundamentals. I like Tim knight a lot. Top 10 Markets Traded. Great Insight Have been listening to Tom and Tony's show for about two weeks.

Despite this philosophy, Mr. Featured Products. Robkid Park City, Utah. The Technician. By Sage Anderson. Jason Bond Picks. Its a place to start but do NOT trade here long. TSLA Given those realities, one might wonder what could move the stock going forward. An already jittery stock market has seen an uptick in volatility during the last week or so, and that may be due to the fact that the U. It reminded me of Howard Sterns show, even had Robin as Vonetta. Also his style assumes Gaussian normal distribution of all assets IV so his assumed probs are not at all accurate in the real world. I came back again at the start of this year and this time did not close the browser window and have had it open ever. Chinese stocks have been ripping higher the last couple weeks, and were stoked further on July 6, when the Chinese intraday in zerodha fxcm au open account appeared to give its blessing for the recent surge…. While Mr. Sage Anderson has an extensive background trading equity derivatives and managing volatility-based portfolios.

Trust Score 6. I find it difficult to understand how I got such a low credibility score since this is my first submission and no comments. Love the atmosphere back at the tastytrade office, the show is entertaining and Tom and Tony are specialists. Options Jive: Earnings Volatility Explained. When asked about this they stood behind a legal curtain while their affiliate shadow trader is more transparent here with a record of their trade suggestion --which generally trails the general market. Post-earnings depression for volatility traders can be a bit like the empty feeling football fans experience after the Super Bowl. Login or Register. Investimonials Featured In. I quickly closed the window on my browser after 3 minutes of viewing - what a mistake that was! April 27, by Sage Anderson. The mysterious shroud that blankets a company's earnings day is a big reason that implied volatility in options tends to pick up prior to the announcement particularly in the expiration month that captures the earnings date and decreases significantly immediately after the announcement - this is referred to as implied volatility crush. Corporate earnings season is usually a treat for options traders. Each original position consisted partly of 3 short calls which are generally bearish. Not too gimmicky and annoying, I like how it's put together. See All Key Concepts. The Small Stocks 75…. They will teach you how to trade like the pros instead of all the gimmicks that so many other websites try to sell you. Developments in the current…. Despite this philosophy, Mr. I will become a member soon and take advantage of the superstore too.

Leave a Comment. You''re sure to find something you like. Given those realities, one might wonder what could move the stock going forward. Note: Strangles are not as dangerous as your comment portrayed. Post-earnings depression for volatility traders can be a bit like the empty feeling football fans experience after the Super Bowl. The host wears a beret and the Italian sidekick is off to the side. Featured Products. Earnings season is a good reminder that stock performance is ultimately linked to the fundamentals of a company's current and ongoing business prospects. I came back again at the start of this year and this time did not close the browser window and have had it open ever since. I really recommend you listening to the show!! It has me understanding options. Why is this important? Corporate earnings season is usually a treat for options traders. Login or Register.