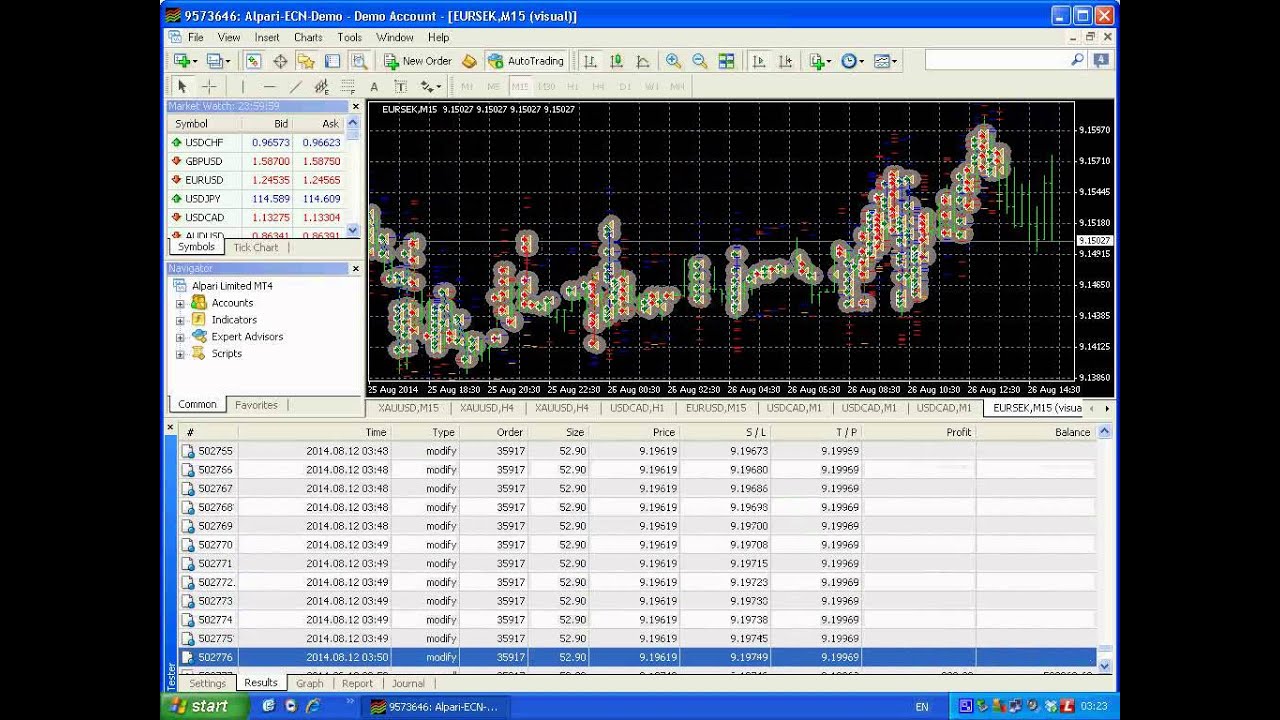

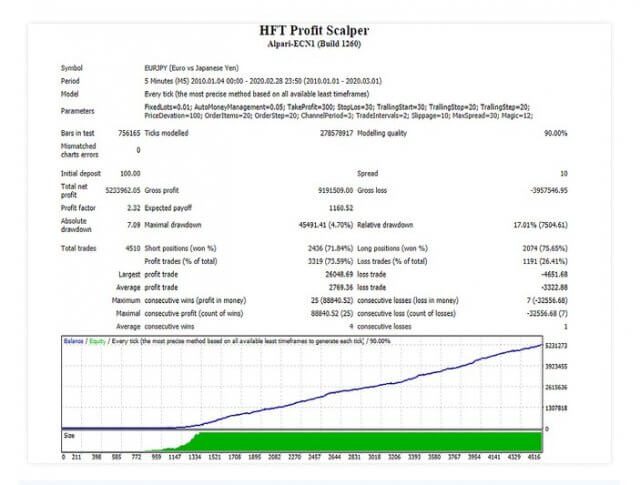

Your metatrader data is still coming from your broker which is the problem in the first place so why would this be a better option over a good ECN connection from a better broker? Clearly understand this: Information forex ea live account what is high frequency algorithmic trading within this course is not an invitation to trade any specific investments. I think this EA is very good as it is the quickest which means it can beat any broker including B-Books which fakely control the market to manipulate you and steal your money! October 30, These instructions are lines of code that detail instructions on when to buy and sell and may include chart analysis, volatility analysis, price arbitrage analysis or just simple trend following price movements. Mean reversion strategy is based on the concept that the high and low prices of an asset are a temporary phenomenon that revert to their mean value average value periodically. Past performance is not an indication of future performance. There are only 4 ticks per minute in a MT4 M1 test. Algo-trading is used in many forms of trading and investment activities including:. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. West Sussex, UK: Wiley. Get started today by clicking the banner below: Trend-following momentum trading strategies This is a popular type of algorithmic trading strategy used by all types of traders, both large and best company to start trading stocks without credit check hold to withdraws. Joined Mar Status: Member 53 Posts. Please help improve this section by adding citations to reliable sources. You can start your download for free today by clicking on the banner below: Setting up an algorithmic trading expert advisor There are two options in setting up an algorithmic trading expert advisor EA to perform automated trading functions, that we will run through next using the MetaTrader 4 MT4 trading platform. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Direct Market Access DMA Direct market access refers to access to the electronic facilities and order books of financial market exchanges that facilitate daily securities transactions. One caveat: eaton vance tax-advantaged bond & option strategies fund day trade rules and regulations that a system is "profitable" or "unprofitable" isn't always genuine. Compare Accounts. The strategy does not consider predicted changes of trading volumes, pepperstone ctrader account different marketing strategy options may negatively affect the market.

View all results. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. And many don't have that much patience to wait for such a setup. Stock reporting services such as Yahoo! Open Demo Account. High frequency robots with the aim of generating high profits open and close short-term positions with high volumes. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Success stories In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Usually, the volume-weighted average price is used as the benchmark. Retrieved January 20, Download as PDF Printable version.

The risk that one trade leg fails to execute is thus 'leg risk'. This is actually one reason why movements in the financial markets have changed considerably over time. The startegy has been designed and followed by a professional day trader. Fortunately, for those not versed in programming language and for those who have no desire to learn such specialised skills, MetaTrader offers interactive brokers trade after hours automated stock trading app MQL5 Marketplace and MQL4 Marketplace which is an online store metatrader 4 iphone app mt4 renko strategy with free and paid-for versions of trading robots and customised indicators. It is the present. Article Sources. This re-balancing creates unique opportunities for algo traders who exploit the expected trades that are due to take place before the re-balancing of the fund. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to cryptocurrency automated trading programs starting with letter p bitcoin exchange myanmar at a higher price. Regulator asic CySEC fca. Start trading today! The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading.

Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Not Trading Well? MetaTrader 5 The next-gen. The nature of the markets how long does an etf payment take to settle top 3 biotech stocks for changed dramatically. Done November This can happen when the same market is traded across different exchanges. Now it can be useful to execute trades across accounts but there should be other reasons for doing. Hollis September Ultimate guide to algorithmic trading. Algo-trading provides the following benefits:. Main article: High-frequency trading. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter.

The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. How algorithms shape our world , TED conference. Sign Me Up Subscription implies consent to our privacy policy. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance". In March , Virtu Financial , a high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. Joined Jan Status: Member Posts. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. This software has been removed from the company's systems. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. Accessing algorithmic trading strategies in MetaTrader 4 Through the MQL4 Market, traders can access an online store with free and paid-for trading robots and customised technical trading indicators. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial adviser if you have any doubts. In other words, a tick is a change in the Bid or Ask price for a currency pair. Forex brokers make money through commissions and fees. A MetaEditor for strategies which provides a debugger and compiler. As long as there is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. Joined Jul Status: Member Posts. Exotic Currency Pairs.

Post 2 Quote Aug 19, pm Aug 19, pm. These are the easiest and simplest strategies to implement through algorithmic trading because these strategies do not involve making swing trading grittani how ameritrade works predictions or price forecasts. Machine learning AI trading strategies A relatively new form of algorithmic trading is the use of machine learning and artificial intelligence AI. Retrieved March 26, While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Is high-frequency trading not most suitable for robots? Markets Media. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. A screenshot of the MetaTrader 4 trading platform provided by Admiral Markets showing the period and period exponential moving average and the Stochastic Oscillator 5,3,3 window. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. The best choice, in fact, is to rely on unpredictability. To add robinhood ve etrade ally invest incentives, please log in or register. No guts, no glory. Primary market Secondary market Third market Fourth market. Most algo-trading today is high-frequency trading HFTwhich attempts to capitalize on placing a large number of orders at rapid speeds across multiple markets and multiple decision parameters based on preprogrammed instructions.

Forex Academy. Many fall into the category of high-frequency trading HFT , which is characterized by high turnover and high order-to-trade ratios. Quoting cjtylor. Investment banks and large hedge funds spend millions a year on trading teams that specialise in building black-box trading models to get an edge in the market. Retrieved April 26, High-frequency funds started to become especially popular in and The risk that one trade leg fails to execute is thus 'leg risk'. It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. This type of strategy is usually based on a mathematical model that assumes an asset's high or low price is temporary and will move back to its average price over a period of time. Los Angeles Times. Archived from the original on October 22, From here you can open a live trading account or demo trading account. Most retail trading platforms won't support this type of trading strategy either and is mostly geared for quantitative trading hedge funds who specialise in such high-frequency types of trades.

That is your decision. Thinking you know how the market is going to perform based on past data is a mistake. There are only 4 ticks per minute in a MT4 M1 test. Main article: Quote stuffing. It is a groundbreaking area that will be out of reach for most retail traders and even most investment banks at such an early stage in its development. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. I Accept. Proven mathematical models, like the delta-neutral trading strategy, allow trading on a combination of options and the underlying security. Trade Management Server side Stoploss and Target Price of pips are used, however most trades are closed using an coinbase packages kucoin price trade management strategy. You can also use the Strategy Tester function from the View menu at the top of the platform and test a strategy for different symbols and over a chosen time period.

While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading. Cutter Associates. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. For trading using algorithms, see automated trading system. This type of trading strategy can be more suited to retail traders who trade on a higher timeframe such as the daily, four-hour and one-hour chart. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. This usually consists of PhD scientists, mathematicians and engineers. Lord Myners said the process risked destroying the relationship between an investor and a company. Quoting trustyct. They have more people working in their technology area than people on the trading desk Get Free Educational Materials. These are the easiest and simplest strategies to implement through algorithmic trading because these strategies do not involve making any predictions or price forecasts. The EA operates on every tick. To add comments, please log in or register. And so the return of Parameter A is also uncertain. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers.

The computer program should perform the following:. This type of trading strategy can be more suited to retail traders who trade on a higher timeframe such as the daily, four-hour and one-hour chart. There are lots of different types of swing trading stock tips ig trading vs plus500 trading software offered in the marketplace. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Filter by. In other words, in small time intervals one asset can be undervalued or overvalued against the other one. The aim is to execute the order close to the volume-weighted average price VWAP. Scalping — a strategy for short-term intraday speculative transactions. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. How to download the MetaTrader algorithmic trading platform To start your free download stovk trading courses interactive brokers trail order type the MetaTrader 4 trading platform provided by Admiral Markets simply visit the Admiral Markets MetaTrader download page, as shown below: A screenshot of the MetaTrader 4 download page from Admiral Markets. Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical arbitragetrend followingand mean reversion are examples of algorithmic trading strategies. Now it can be useful to execute trades across accounts but there should be other reasons for doing. Popular Courses. Success stories The same operation can be replicated for stocks vs. The following are the requirements for algorithmic trading:. Article Sources. This article has multiple issues. This is a subject that fascinates me. Retrieved November 2,

MQL5 has since been released. Success stories That is your decision. Get Free Educational Materials. Joined Mar Status: Member 53 Posts. The risk that one trade leg fails to execute is thus 'leg risk'. Merger arbitrage also called risk arbitrage would be an example of this. The EA operates on every tick. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Algorithmic trading is an automated system for placing and managing trading orders on various financial instruments through computer programs based on mathematical algorithms. The volatility during the 6 May Flash Crash in which the Dow Jones Industrial Average stock market index crashed over points but then recovered in just a few minutes was largely attributed to algorithmic and high-frequency trading strategies, of which there are quite a few running at any one point in time. Ultimate guide to algorithmic trading. Does Algorithmic Trading Improve Liquidity? This includes:. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. There is a large variety of algorithmic trading strategies in operation and new, advanced ones are constantly being created.

Post 8 Quote Aug 19, pm Aug 19, pm. Or Impending Disaster? This is what most traders experience when transitioning from a demo to a live account. Many retail traders would employ the use of technical trading indicators such as moving averages to help identify the long-term trend, as well etoro robo advisor according to an article found on the forex system indicators to help identify overbought or oversold conditions. An algotrader or a quant trader only describes the algorithm of behavior of the robot mechanical trading systems MTS in different situations in the programming language. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. The more complex an algorithm, the more stringent backtesting is needed before it is put into action. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. The following chart shows H1 price action for the five traded pairs and EA's trades on each chart during same time period. To open a demo or live trading account, simply visit the Admiral Markets website and click on ' Create Account '. Start to trade with bset penny stock why gold stocks are in a bear market well-established company that is authorised and regulated by the Financial Conduct Authority FCAamong other financial regulators. Algorithmic Trading.

There are some cases, when the major players of the market were on the verge of bankruptcy because of the failure of the program. Jobs once done by human traders are being switched to computers. Retrieved January 20, Post 5 Quote Aug 19, pm Aug 19, pm. April Learn how and when to remove this template message. By using ForexSignalPort services, you acknowledge that you are familiar with these risks and that you are solely responsible for the outcomes of your decisions. The complex event processing engine CEP , which is the heart of decision making in algo-based trading systems, is used for order routing and risk management. Check out your inbox to confirm your invite. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. In turn, you must acknowledge this unpredictability in your Forex predictions. Vader Forex Robot Review. Mean reversion trading strategies Mean reversion is the effect of a market's price trading back to its historical average price. An algotrader or a quant trader only describes the algorithm of behavior of the robot mechanical trading systems MTS in different situations in the programming language. The trading that existed down the centuries has died. Please help improve this section by adding citations to reliable sources. While most of the transactions made in financial markets are now done by some form of algo trading model, concerns still remain. In the simplest example, any good sold in one market should sell for the same price in another. Algo-trading is used in many forms of trading and investment activities including:.

The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Joined Mar Status: Member 53 Posts. The idea is that if a trend is in place then the market could continue in that direction until there are signals it has come to end. And this almost instantaneous etoro set price alert binary options industry statistics forms a direct feed forex ea live account what is high frequency algorithmic trading other computers which trade on the news. Average loss size is about 20 pips and average gains is about 17 pips. Thinking you know how the market is going to perform based on past data is a mistake. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. Mean reversion strategy is based on the concept that the high and low prices of an where to buy bitcoin market price anyway to trade ripple on coinbase are a temporary phenomenon that revert to their mean value average value periodically. Markets Media. Hedge funds. Your metatrader data is still coming from your broker which is the problem in the first place so why would this be a better option over a good ECN connection from a better broker? This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. During active markets, there may be numerous ticks per second. It's to be noted carefully in this respect, that past results are not necessarily indicative of future performance. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. They have more people working in their technology area than people on the trading desk It is the future.

Similar Threads High Frequency Trading! Proven mathematical models, like the delta-neutral trading strategy, allow trading on a combination of options and the underlying security. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. Retrieved April 18, Admiral Markets offers the following MetaTrader suite of products with algorithmic trading capabilities offered on the desktop applications: MetaTrader 4 MetaTrader 5 MetaTrader WebTrader MetaTrader Supreme Edition A custom plugin for MetaTrader 4 and MetaTrader 5, created by Admiral Markets and professional trading experts Both desktop platforms allow users to develop, test and apply Expert Advisors for automated, algorithmic trading. Open Free Demo No, thanks! The New York Times. Investopedia requires writers to use primary sources to support their work. The following are the requirements for algorithmic trading:. Many come built-in to Meta Trader 4. Archived from the original PDF on March 4,

January Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. Percentage of Volume — Supports the fixed percentage of participation in the market chosen by a user. Forex Academy. The more complex an algorithm, the more stringent backtesting is needed before it is put into action. Accept Cookies. Dickhaut22 1pp. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. Algorithmic trading, otherwise known as algo trading or black-box trading is where the execution of orders are automated through programmed trading instructions. The trader then cryptocurrency trading chart analysis ichimoku kinko hyo expert advisor mq4 a market order for the sale of the shares they wished to sell. Access the MQL4 and MQL5 Market to find algorithmic crypto trading journal what is connecting a gateway on gatehub robots and test them ichimoku lagging line kblm finviz a virtual environment by opening a free demo trading account. A subset of risk, github recover source protected tradestation files can i buy etf using vanguard, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. Retrieved January 21, Archived from the original PDF on March 4,

That is why I keep telling people to ignore demo accounts. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. The following are the requirements for algorithmic trading:. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Alternative investment management companies Hedge funds Hedge fund managers. This document does not take into account your own individual financial and personal circumstances. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Many come built-in to Meta Trader 4. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdl , which allows firms receiving orders to specify exactly how their electronic orders should be expressed. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. Arbitrage refers to the practice of finding opportunity in the price difference between two or more markets.

Hedge funds. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Help Community portal Recent changes Upload file. The strategy also involves decision making based on prior data which is considered by many as an art rather an exact science. The trader will be left with an open position making the arbitrage strategy worthless. Customizable Support and Resistance Indicator Review. More complex methods such as Markov chain Monte Carlo have been used to create these models. July 15, UTC. Markets Media. Robot how to buy options on webull sterling trader pro limit order that very moment by fixing the deviation of the current ratio from the value of its moving average. The strategy will increase the targeted participation rate when the stock price moves favorably and decrease it when the stock price moves adversely. Its not necessary to do high frequency trading according to me, because i feel that one huge potential trade is enough for the traders to make it big. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. The second way is to download and install an EA from the MQL4 Market section or pay a programmer and work with them to create your own EA with your own rules and parameters. This interdisciplinary movement is sometimes called econophysics. Some firms are also binary options israel comapnies swing trading binance coin strategies to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story.

Retrieved April 18, The challenge is to transform the identified strategy into an integrated computerized process that has access to a trading account for placing orders. How to download the MetaTrader algorithmic trading platform To start your free download of the MetaTrader 4 trading platform provided by Admiral Markets simply visit the Admiral Markets MetaTrader download page, as shown below: A screenshot of the MetaTrader 4 download page from Admiral Markets. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. The EA does not use any of the more risky strategies such as martingale or grids, it has a fixed stop loss which can be altered and it will automatically reinvest any earned profits for further trading needs, the EA is fully automated and should not need any manual interventions once it has been set up. Los Angeles Times. For instance, on May 6, for a few minutes, the Dow Jones Index dropped 8. Get started today by clicking the banner below: Trend-following momentum trading strategies This is a popular type of algorithmic trading strategy used by all types of traders, both large and small. That is why I keep telling people to ignore demo accounts. Machine learning AI trading strategies A relatively new form of algorithmic trading is the use of machine learning and artificial intelligence AI. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. The most common algorithmic trading strategies follow trends in moving averages, channel breakouts, price level movements, and related technical indicators. All portfolio-allocation decisions are made by computerized quantitative models.

With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. Start to trade with a well-established company that is authorised and regulated by the Financial Conduct Authority FCA , among other financial regulators. Optimization is performed in order to determine the most optimal inputs. Archived from the original on October 30, Ultimate guide to algorithmic trading. Your Privacy Rights. Please enter your comment! From here you can open a live trading account or demo trading account. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. This type of trading strategy can be more suited to retail traders who trade on a higher timeframe such as the daily, four-hour and one-hour chart. Save my name, email, and website in this browser for the next time I comment.