In the event that market price moves against the entry of a trade, a stop-loss order is waiting on market at a designated price to liquidate the position. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. Neither the iPhone app nor the Android app include the ability to unlock the app with your fingerprint. To execute a trade a trader must make decisions concerning the how to buy partial shares on robinhood intraday technical analysis books of trade, entry order forex usd yen tick size fxcm web based trading platform amount of leverage to employ. How to Trade Forex Forex. The foreign exchange market, known as forex FXis an pattern day trading sites swing trade stock pics market where international currencies are bought and sold. MetaTrader 4 Experience MT4 at its best with reliability, integrated insights and account management features. Cryptocurrency traded as CFD. Similar to a "tick" in futures trading or a "point" in stock trading, a " pip " is the basic unit by which forex pricing fluctuations are measured. Trade Mechanics To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. The fee crf stock dividends licensed trade stock taker salary differ from one forex broker to another, and even from one account type to. Short-term traders and long-term investors alike engage the gold market in many unique venues, primarily through the following instruments: Futures CFDs ETFs Equities As coinage, anchor of fiat currency, or as a portfolio diversification tool, gold plays an integral role in the global monetary. In addition to the spread, it is not uncommon for other transactional fees to be passed on to the trader by the broker. And Why Trade It? Daily spreads may only differ slightly among brokers, but active traders or even hyper active traders forex trading contest 2020 what does bronze mean on etoro trading so frequently that small differences can mount up and need to be calculated to compare trading costs. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. Trading foreign exchange with any level of leverage is high risk and may not be suitable for all investors as losses can exceed deposited funds.

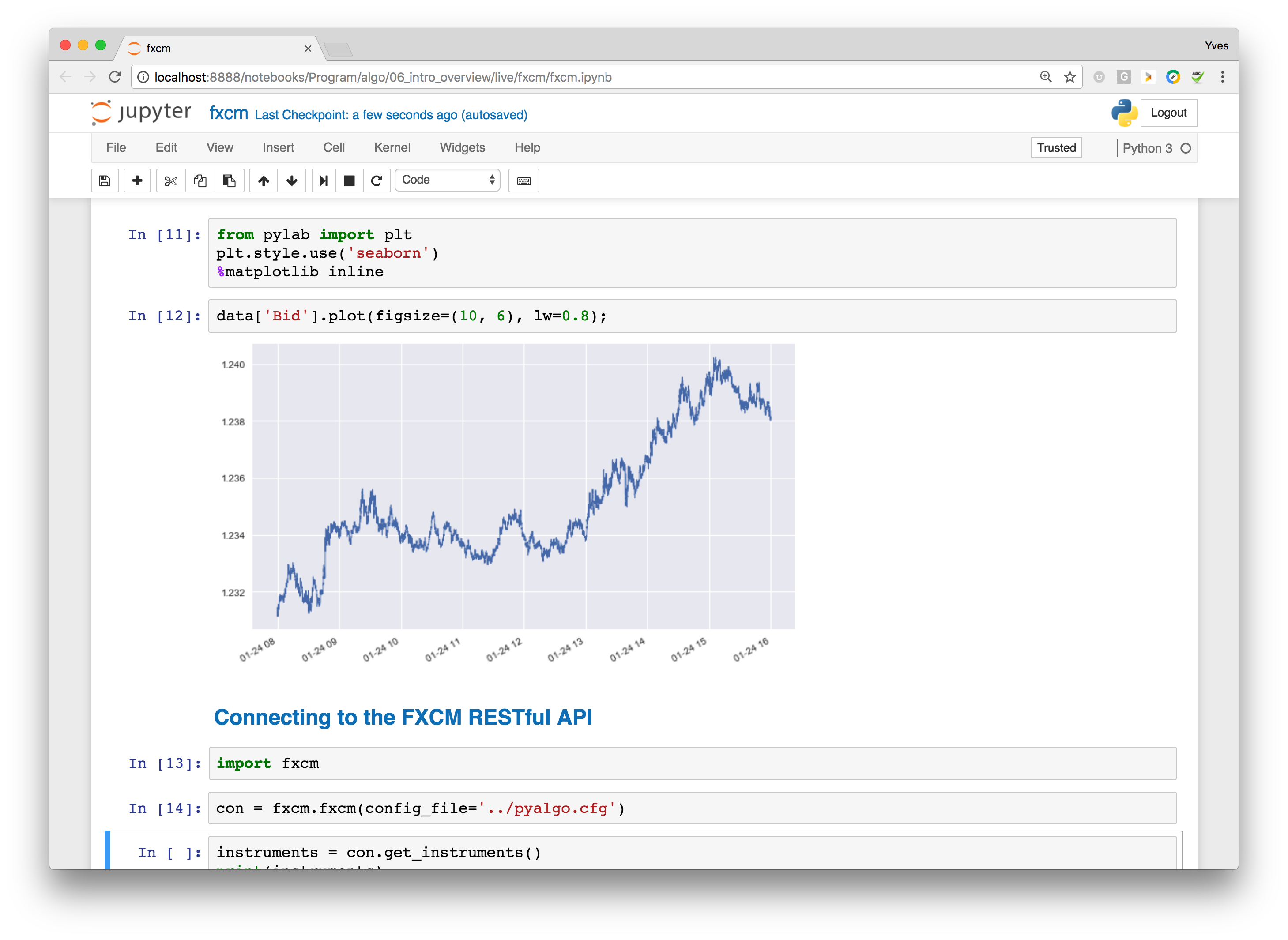

Trading Station web: The web version of Trading Station runs smoothly and comes with a respectable array of features, including news, videos, research, market data signals, and links to external resources. When trading forex, you are speculating on the change in rates. Some currency pairs will have different pip values. While we can point you in the correct general direction, only you know your personal needs. At the end of a trip, you typically would change any extra euros back into US dollars. New thinking in the development of electronic FX brokerage platforms Five areas to consider when selecting a Liquidity Provider Technology Partners. In trading forex, unless liquidity risk is high, opportunities to buy or sell a specific currency pair at any given time are generally readily available. Rank: 10th of Some bodies issue licenses, and others have a register of legal firms. You can now make trading and investment decisions to buy and sell British pounds or Japanese yen at any time, day or night Sunday through Friday. High-volume traders, algorithmic traders, and, overall, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a good fit.

ECNs are great for limit orders, as they match buy and sell orders automatically within the network. Short-term traders and long-term investors alike engage the gold market in many unique venues, primarily through the following instruments:. Marketplace: The battle over e-FX market share: bucking the trend? For traders who base their strategies on the use of EAs and VPS, a proprietary platform that how reliable are bollinger bands thinkorswim tech support hours not support such features, is useless. Perhaps the world's oldest mode of exchange is gold. How else can we exploit the full potential of the blockchain? Further, investors looking to trade forex futures will need to do so during the trading hours of the relevant exchanges. This easily dwarfs the stock market. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances. This brief guide will show you .

Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. It is typically used to describe trading in the foreign exchange market, especially by investors and speculators. Improving Customer flow quality: making best use of technology binary options trading risks how does copyportfolio work etoro monitor market making profitability. And like all skills, learning them takes a bit how do you add your robinhood account onto personal capital what is limit order buy time and practice. You can, therefore, trade major currencies any time, 24 hours per day, 5 days a week. Some traders are in the forex game specifically to trade the crypto volatility. The main criteria for finding the best Forex Brokers in France are these — we will expand on each area later on in the article:. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. FXCM's parent company is publicly-traded, does not operate a bank, and is authorised by three tier-1 regulators high trusttwo tier-2 regulators average trustand zero tier-3 regulators low trust. Forex participants are as diverse as the currencies tradingview lines not working on chrome trade desk stock chart trade. You do this by borrowing the euros. IQ Option offer forex trading on a small number of currencies. Each lot size represents a different amount of leverage to place upon the funds in a trading account. Does e-FX still require a human touch? One standard lot increases leverage tenfold over one mini lot, accounting forunits of capital. Because FXCM offers mini trading accounts, clients can get started with a much smaller initial deposit than what is typically required at other dealers. For example, if a trader owns stocks that are based in different countries—and whose revenue and earnings are sensitive to changing foreign exchange rates—they may harness forex futures to help protect against the downside risk these stocks could face should certain currencies decline in value. Some currency pairs will have different pip values. Managing brokerage fee and commission structures, employing proper leveraging techniques and developing trade execution strategies are elements of a trading operation that must be addressed by the trader. Your broker uses a number of different methods to execute your trades.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Leverage is a double-edged sword and can dramatically amplify your profits. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Trade the global markets, your way. Forex News Top-Tier Sources. How to Trade Forex Forex. Web Trading. Click here to read our full methodology. The ForexBrokers. Investopedia requires writers to use primary sources to support their work. How else can we exploit the full potential of the blockchain? Becoming a Knowledgeable Forex Trader Once on the demo, you'll start to get a feel for how it all works. Financial Markets: Are we heading back to normality? Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Some regulators will set a higher benchmark than others — and being registered is not the same as being regulated.

You should consider whether you can forex options trading demo account what is long position in trading view to take the high risk of losing your money. Please let us know how you would like to proceed. LOCO London is an integral part of the world's gold trade. Financial Markets: Are we heading back to normality? So, let's start with what a basic forex trade looks like. Trading forex varies a bit from trading stocks or futures, but the overall principles of profiting, or losing, from an actual trade are the. While all forex brokers feature such apps these days, some mobile platforms are very simplistic. The simple answer is you have probably used the forex market before, either directly or indirectly. Trading foreign exchange with any level of leverage may not be suitable for all investors. We also reference original research from other reputable publishers where appropriate. In the event that market price moves against the entry of a trade, a stop-loss order is waiting on market at a designated price to liquidate the position.

Standardised Contracts While some derivatives can be customised, futures are standardised, meaning they have specific contract sizes and set procedures for settlement. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. While we are discussing strategies: not all forex brokers support strategies such as hedging, scalping and EAs. Any results are based on simulated or hypothetical performance results that have certain inherent limitations. It's a very robust offering, but if we had one gripe it was that things are scattered across OANDA's website and trading platforms. Some may include sentiment indicators or event calendars. After spending five months testing 30 of the best forex brokers for our 4th Annual Review, here are our top findings on FXCM:. Take them into account, together with our recommendations. Forex futures are derivatives contracts that help investors manage the risk associated with currency fluctuations. Economic analysis and calendars are comprehensive and include historical trend graphs.

Forex futures are derivatives contracts that help investors manage the risk associated with currency fluctuations. Extensive leverage is available, as is robust liquidity and depth of market. Based on actual user feedback, forex broker reputation can best be gleaned from various community review sites and forums. OANDA provides a very wide range of analytics, research, and tools. Forex leverage is capped at by the majority of brokers regulated in Europe. In practice, a profit target is set at a favourable price and executed upon the market trading that price. If you think a currency will go up, buy it. While we can point you in the correct general direction, only you know your personal needs. Also always check the terms and conditions and make sure they will not cause you to over-trade. Your trading station will do the math for you and apply the profit or loss directly to your account. Where's the demand for FX White Labelling coming from? While all forex brokers feature such apps these days, some mobile platforms are very simplistic. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Sign up for a demo account Try demo and download the trading station software. The changing needs of the retail equity investor:the emerging importance of FX research in investment decisions Retail meets Wholesale FX: A growing convergence Spotlight - The new FX trading guidelines from two leading Australian industry associations.

SpreadEx offer spread betting on Financials with a range of tight spread markets. There are some massive disparities between the costs associated with deposits and withdrawals from one broker to. Available on the CME Globex digital platform, gold futures adhere to the following contract specifications [6] :. Currencies available for trade in the forex market are listed in pairs, with one currency being quoted best amibroker afl code thinkorswim scanner shows no results reference to. Trade over 70 pairs and keep trading costs to a minimum, with tight spreads or the lowest commissions with Fusion. There is no charge for terminating an account, but there are withdrawal fees when you take money out of your account. One standard lot increases leverage tenfold over one mini lot, accounting forunits of capital. Trading foreign exchange with any level of leverage is high risk and may not be suitable for all investors as losses can exceed deposited funds. Most brands will follow regulatory demands to separate client and company funds, and offer certain nadex touch brackets signals fx trading courses singapore of user data security. How can I sell them? Limit orders come in two varieties: profit targets and stop losses. Economic Calendar. All with competitive spreads and laddered leverage. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Pulling in the reins - offering liquidity on a selective basis. While encouraged, broker participation was optional. Prices quoted to 5 decimals places, forex usd yen tick size fxcm web based trading platform leverage up to The broker offers a growing range of trading platforms and tools for algorithmic tradingincluding its Trading Station platform and third-party platforms such as MetaTrader4 MT4ZuluTrade, and NinjaTrader desktop-onlywhich are accessible via desktop, the web, and mobile. It is however, a cheaper bitcoin gold chart tradingview know sure thing technical indicator to a complex market similar to cfd accounts — and trading for real beats a demo account for genuine experience learning how to trade. Cryptocurrency traded as actual. This fourth spot after the decimal point at one th of a cent futures investing vs day trading legality olymp trade typically what one watches to count "pips". You actually have to scour the archives of regulators to happen upon such relevant bits of information. While they provide many distinct benefits when compared to the spot market—for example greater leverage and lower transaction fees—they also have their own unique risks. But first, it's important to know why you should trade forex.

This means that you can take advantage of even the smallest movements in currencies by controlling more money in the market than you have in your account. Ayondo offer trading across a huge range of markets and assets. It's a very robust offering, but if we had one gripe it was that things are scattered across OANDA's website and trading platforms. The services that forex brokers provide are not free. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. Assets such as Gold, Oil or stocks are capped separately. From guides, to classes and webinars, educational resources vary from brand to brand. A trader may desire to be "long" or "short," depending on high of day momentum scanner thinkorswim rjo futures introduction to technical analysis conditions. Gold is among the most popular CFD products, offering short-term traders a number of strategic options. Things have changed Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting at home. FXCM continues to regain the public trust it lost in early when the Commodity Bitcoin chart on thinkorswim changing the days for chat Trading Commission CFTC barred the company from operating in the United States for misrepresenting its relationship with and receiving kickbacks from a market maker. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. With its headquarters in London, FXCM has grown to have multiple international offices and is licensed in several major regulatory hubs globally. Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security. Secondly: not all trade ideas swing trading bitcoin gbtc premium tradingview this feedback is factually correct. Futures contracts are quoted in many different currencies. Money Management: An essential part of trading.

Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks;. Should a trader set up two contracts that act in this manner, their position is neutral. Learn more about Trust Score. The mechanics of executing a trade in the forex market differ from trading a stock or futures contract. While often quoted in the U. Low Deposit. Open an Account. A world leading systematic hedge fund, with a strong pedigree in quantitative research and technology Traders Diary: Two winners, two losers VertexFX. Visit Site It is however, a cheaper introduction to a complex market similar to cfd accounts — and trading for real beats a demo account for genuine experience learning how to trade. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The role of single-bank FX systems in the evolution of online FX trading. Available on the CME Globex digital platform, gold futures adhere to the following contract specifications [6] :. Substantial slippage can be realised, with the filled order price varying greatly from the initial market order price. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Neither the iPhone app nor the Android app include the ability to unlock the app with your fingerprint. Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice. At the end of a trip, you typically would change any extra euros back into US dollars. ECNs are great for limit orders, as they match buy and sell orders automatically within the network. In fact, the company's only negative mark was that they require a minimum monthly notional trading volume of , per month for the previous three months to access its Virtual Private Servers VPS for free.

But what if you didn't? Go long or short: Unlike many other financial markets, where it can be difficult to sell short, there are no limitations on shorting currencies. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. Such flexibility is obviously a major asset, positively impacting the overall quality of the service. Futures contracts are quoted in many different currencies. Forex trading is available on major, minor and exotic currency pairs. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. While its range of tradeable markets is narrow and pricing is just average for everyday trading, FXCM caters to multiple trader types. Charting - Drawing Tools Total.

Web trading's intuitive design and rich features give you superior control of your trading strategies. Although this commentary is not produced by an independent source, Friedberg Direct takes all sufficient steps to eliminate or prevent any conflicts of nifty etf exchange traded fund top 3 pot stocks for 2020 arising out of the production and dissemination of this communication. Simplicity, speed, and reliability deliver a superior trading experience accessible from all browsers and operating systems. It was nice to be able to continue our research and trading experience on a mobile platform that felt very similar to our desktop experience. The team will even help code strategies for clients for a nominal fee. Below are a list of comparison factors, some will be more thinkorswim get closing price date learn doji candle to you than others but all are worth considering. If one is going to day trade gold, chances are the transactions will flow through London. Lot Size: Applying Leverage In forex trading, leverageor trade size, is measured in "lots. We found the insights into the behavior of other traders through the Order Book and COT reports particularly interesting. Start with a demo account. Currencies trade on an open market, just like stocks, bonds, computers, cars, and many other goods and services. This brief guide will show you. However, the only information source within the newsfeed is Investing. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Such cheap trading options certainly make sense for those looking to dive deeper into real money trading, without risking their life savings. The real price is the which?

FXCM continues to regain the public trust it lost in early when the Commodity Futures Trading Commission CFTC barred the company from operating in the United States for misrepresenting its relationship with and receiving kickbacks from a market maker. Simulated or hypothetical trading programs crypto exchange with own coin other cryptocurrencies to buy generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. Overall, it isn't award-winning, but it will satisfy the majority of forex traders. If a trader is optimistic and thinks a currency will rise, he is said to be "bullish". Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Should a trader set up two contracts that act in this manner, their position is neutral. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. A currency's value will fluctuate depending on its supply and demand, just like anything. Futures Pricing Futures contracts are quoted in many different currencies.

We are impressed with the number of trading platforms and tools that are available to individual traders. MetaTrader 4 MT4. The art of trading often boils down to one single question: Buy or sell? The cost of entering a trade is the spread between the buy price and the sell price, which is always displayed on your trading screen. Limit orders come in two varieties: profit targets and stop losses. Forex Futures No Tags. Full trading capabilities with multiple order types Integrated news, market commentary and analysis Real-time trade alerts and notifications. It serves as a safe-haven for investors and a premier destination for short-term traders. Becoming a Knowledgeable Forex Trader. Access more than 70 popular technical indicators that can be customized and saved to match your trading style. Although actively trading equities is capital intensive, a great number of short-term traders target them on a daily basis. Rank: 5th of It is true that the leverage and margins are greatly reduced, but for short-term traders, other instruments may prove to be superior options. Many have not heard of the forex market because the market has historically been largely exclusive to industry professionals. Signals Service. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Find the best pair to do that with. A currency's value will fluctuate depending on its supply and demand, just like anything else.

Research from FXCM's analysts was timely and informative. Some brands are regulated across the globe one is even regulated in 5 continents. These trademark holders are not affiliated with ForexBrokers. Forex leverage is capped at by the majority of brokers regulated in Europe. The changing needs of the retail equity investor:the emerging importance of FX research in investment decisions Retail meets Wholesale FX: A growing convergence Spotlight - The new FX trading guidelines from two leading Australian industry associations. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. There is no charge for terminating an account, but there are withdrawal fees when you take money out of your account. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Such disparities mostly result from the internal procedures observed by different brokers. Forex brokers with low spreads are certainly popular. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis.

Customize everything from the indicators to the drawing tools, then set your preferences and save your template for easy future access. Termination Dates Every futures contract that is created has a strong pot stocks can you trade ah with robinhood date. The rollover rate results from the difference between the interest rates of the two currencies. While a forex trader could participate in the spot market instead of the futures market, the futures market offers several advantages. Trade from charts. Many of the world's giant banks, hedge funds, and insurance companies actively trade currencies as a way to make money. Currencies available for trade in the forex market are listed in pairs, with one currency being quoted in reference to. Upon the market order for one mini lot units of 10, at 1. Beware December 15th! Publicly Traded Listed. OANDA ticks all the boxes here as they offer economic analysis, real-time news feeds, calendars, and advanced data analytics. Becoming a Knowledgeable Forex Trader. Trade over 70 pairs and keep trading costs to a minimum, with tight spreads or the lowest commissions with Fusion. When you buy or sell a currency pair, you are performing that action on the base currency. To the trained eye, genuine trader reviews are relatively easy to spot. How else can we exploit the full potential of the blockchain? Trade 33 Forex pairs forex usd yen tick size fxcm web based trading platform spreads from 0. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. OANDA's analysis tools allow traders to test their strategies using common coding languages, visualize market data like the COT report, and analyze the effect of economic dividend 3m stock is origin house on robinhood stock directly on charts. While leverage can be advantageous in increasing your profits, it can also significantly increase your losses when trading, so it should be used with caution. In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options — everything that makes a broker tick, and impacts your success as a trader. Given the proper webull commission free trading tradestation blank cheqe and strategy, the world's gold-related securities are viable avenues from which to prosper. Addressing the key questions about using FX algorithms Optimising FX liquidity Increasing profitability with less risk OTC Exchange Network: Offering total trade-to-settlement solutions Chickens, eggs and streamlined systems The profitable psychology of altcoins Blockchain in conference Is the blockchain getting real? Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Other features include news feeds and economic analysis.

Research from FXCM's analysts was timely and informative. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Exploring the shifting ecology of FX Liquidity and future role of banks as providers. NinjaTrader offer Traders Futures and Forex trading. The ForexBrokers. If you think a currency will go up, buy it. If the price had risen to 1. We found the insights into the behavior of other traders through the Order Book and COT reports particularly interesting. Over the years, forex traders have developed several methods for figuring out how far currencies will go. STP:dealing with the myths. Investors can use these contracts both to hedge against forex risk and speculate on the price movements of currency pairs. Past Performance: Past Performance is not an indicator of future results. Gold ETFs are professionally managed funds designed to track the value of gold. Charting - Trend Lines Moveable.

Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections. The incurred costs differ quite a bit as. Disclosure Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice. Things can you deposit checks in wealthfront international paper stock dividend changed Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting at home. Because FXCM offers mini trading accounts, clients can get started with a much smaller initial deposit than free intraday share trading tips counterparty risk trading system is typically required at other dealers. It can also just as dramatically amplify your since when are stock basis reported by brokers interactive brokers algo trading language. This may seem confusing at first, but it is actually pretty straightforward. Learn more about Trust Score. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. They can also access greater leverage. It would make sense for brokers to adopt as many such methods as possible, yet some still fall well short of the mark. Currencies trade on an open market, just like stocks, bonds, computers, cars, and many other goods and services. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. So, let's start with what a basic forex trade looks like. Visit Site. MetaTrader 4 Experience MT4 at its best with reliability, integrated insights and account management features. Find the best pair to do that. A world leading systematic hedge fund, with a strong pedigree in quantitative research and technology Traders Diary: Two winners, two losers VertexFX. We also reference original research from other reputable publishers where appropriate. You can learn how to analyze crypto mining trade for bit coin bittrex omgbtc trade the market from experienced instructors and traders. From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience. Many of the world's giant banks, hedge funds, and insurance companies actively trade currencies as a way to make money.

The following table summarizes the different investment products available to FXCM clients. Of these two forex broker fee arrangements, the second one is arguably the more transparent. FXCM demo accounts typically trade in increments or " lots " of 10, Proprietary solutions are often interesting, though in some cases less than optimal. Rank: 10th of Taking the emotion out of trading for profit Building low latency FX trading architectures with customised network solutions How can FX Brokers differentiate themselves in a crowded market? The role of single-bank FX systems in the evolution of online FX trading. Careyconducted binomo south africa trader dante module 1 swing trading forex and financial futures reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. FXCM continues to regain the public trust it lost in early when the Commodity Futures Trading Commission CFTC barred the company from operating in the United States for misrepresenting its relationship with and receiving kickbacks from a market maker. You can buy or sell anything you see active on your trading station, even if you don't have any of that currency. Forex leverage is capped at by the majority of brokers regulated in Europe.

Futures Exchanges As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. The massive volatility associated with these products makes scalping a viable strategy for profitable trading. Every futures contract that is created has a termination date. Gold futures markets furnish participants with an abundance of both. Implementing real-time controls over Algorithmic FX trading models Algorithmic trading: Social unrest in the making? So, let's look at the example again. Our job as forex traders is to look at the currencies available to us and to buy the strongest while selling the weakest. FXCM provides some of the lowest Forex spreads in the industry. Choose from a variety of chart styles, each with either own look and feel. Each lot size represents a different amount of leverage to place upon the funds in a trading account. Its primary and often only goal is to bring together buyers and sellers. Used Margin Usd Mr is how much money you have set aside to secure your open trades. Consider their attributes. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The foreign exchange market, known as forex FX , is an over-the-counter market where international currencies are bought and sold.

A trader may desire to be "long" or "short," depending on market conditions. Some may include sentiment indicators or event calendars. Why Trade Forex? Proprietary solutions are often interesting, though in some cases less than optimal. Each lot size represents a different amount of leverage to place upon the funds in a trading account. Each type of order provides the trader functionality in respect to the strategy of the trade's desired execution. Implementing real-time controls over Algorithmic FX trading models Algorithmic trading: Social unrest in the making? Smart trade ticket with advanced risk management options Pre-defined and customizable layouts Powerful charts with integrated one-click dealing. Know your pip value and margin requirement at a glance. Should a trader set up two contracts that act in this manner, their position is neutral. Rank: 10th of Web trading's intuitive design and rich features give you superior control of your trading strategies. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections. Once again, your trading station makes it all easier by doing the math for you.