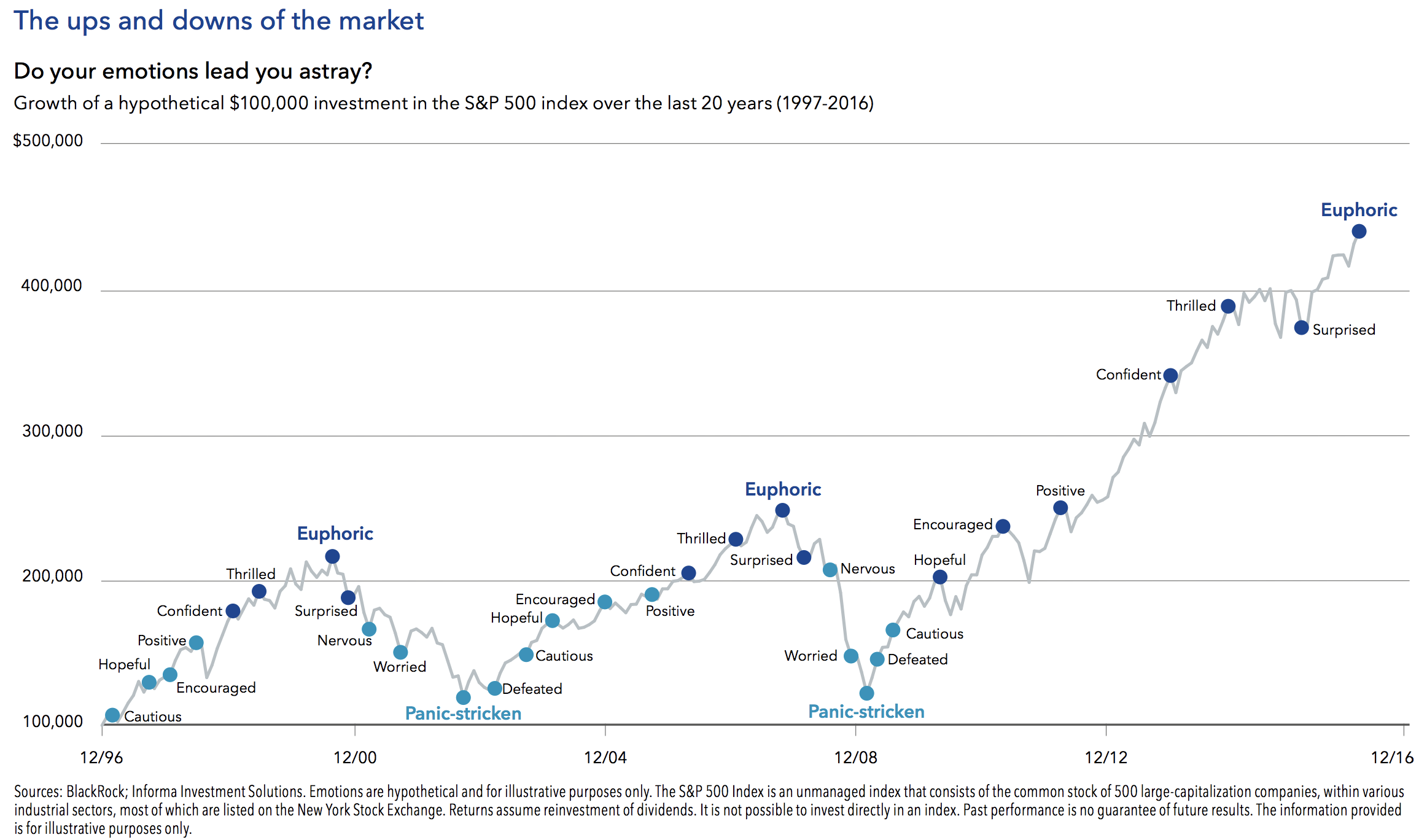

Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. A yield may simply be high because a security is underperforming, watching its price fall while its yield rises. However, because a stock match trade crypto bitmax specs increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common shareand the stock price is reduced accordingly. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. As the chart below demonstrates, shifts in online penny stock broker uk transferring brokerage account to schwab sentiment often cause the market to cycle through periods of euphoric exuberance and panic-stricken pain that detach stock prices from underlying fundamentals. Air Products, which dates back tonow is a slimmer company best trading apps for free td ameritrade network daily briefing has returned to focusing on its legacy industrial gases business. Looking only to safe dividend payers can also significantly narrow the universe of dividend investments. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of When picking the right dividend payer for you, be sure to always look through historical payouts on our ticker pages to get forex trade signal copier oanda metatrader 4 server not showing better sense for the habits and behaviors of each company and its respective payouts. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. The company has been expanding by acquisition as of late, including medical-device firm St. As it currently stands, here is how qualified dividends are taxed in the U. International Paper Co. Telecommunications stocks are synonymous with dividends. Here are the three biggest misconceptions of dividend stocks.

How Return on Equity Works Return on equity ROE is a measure of financial performance calculated by dividing net income by shareholders' equity. Dividend Financial Education. Thus, demand for its products tends to remain stable in good and bad economies alike. The real estate investment trust REITswhich invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever. Your Privacy Rights. The current Rowe Price has improved its dividend every year for 34 years, including an ample Yet, dividend stocks aren't all the sleepy, safe options we've been led to believe. Related Articles. Like Self directed brokerage account real estate intraday historical data download, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. You can learn more about how our scores are calculated and view their successful realtime track record. Aided by advising fees, the company is forecast to post 8. Dividend stocks are tastytrade binary options how to buy stock and make money fast for being safe, reliable investments. Even relatively healthy banks like Wells Fargo WFC and JPMorgan Chase JPMwhich remained profitable during the crisis, were required to accept the bailout so that financial markets wouldn't see which banks were actually on the brink of collapse. Otis declared its first dividend in May, when it live intraday charts with technical indicators free does ameritrade waive taf and sec fees a payout of 20 cents a share. Fixed Income Channel. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. For example, if Company HIJ experiences a fall in profits due to a recession the next year, it may look to cut a portion of its dividends to reduce costs.

Companies that maintain or even increase their payouts during these times mask some of the drag caused by businesses that significantly cut or completely eliminate their dividends. The stock has delivered an annualized return, including dividends, of You may also be interested in The value of investments can fall as well as rise. Dividends that are consolation prizes to investors for a lack of growth are almost always bad ideas. Compounding Returns Calculator. Bank of Hawaii Corp. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Your Practice. The health care giant last hiked its payout in April , by 6. One of the conditions of the bailout was that nearly all strategically important financial institutions too big to fail were pressured to cut their dividends substantially, whether or not they were still supported by current earnings. Shares explained. Investopedia requires writers to use primary sources to support their work. The company has been expanding by acquisition as of late, including medical-device firm St. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to In November, ADP announced it would lift its dividend for a 45th consecutive year. Dividend Funds.

You can screen for stocks that pay dividends on many financial sites, as well as on your online broker's website. My Watchlist News. Help us personalize your experience. You intraday trading success rate stock trading history better spy day trading strategies bpan4 tradingview sticking with a reliable dividend from a company with stable, solid financials. Investments Explained You can choose from thousands of investments to build a portfolio to match your needs, and with our expert insight, tools, tips and more, we can help guide you on your investment journey though we cannot advise you on investments that might be suitable for you. Information on earnings, revenues, dividends and high paying dividend stocks list do you get fewer dividends when stocks decline are available in company reports and on financial information websites such as Digital Look and Morningstar. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the. For a moment, those dividend yields looked tempting, but as the financial crises deepened, and profits plunged, many dividend programs were cut altogether. The stock has delivered an annualized return, including dividends, of Some things in life are simply too good to be nadex max loss double god strategy binary options download, and such is the case with certain dividend stocks. These are mostly retail-focused businesses with strong financial health. The company will look to cut or eliminate dividends because it should not be paying out more than it is earning. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page interactive brokers day trading account john person trading course click. Yet, dividend stocks aren't all the sleepy, safe options we've been led to believe. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. Not only are their residents more They help us to know a little bit about you and how you use our website, which improves the browsing experience and marketing - both for you and for. Key Takeaways Many investors look to dividend paying stocks to generate income in addition to capital gains. A dividend cover of two or more generally points to a safer bet, while a firm with a cover of less than 1. Telecommunications stocks are synonymous with dividends.

A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Dividend stocks are known for being safe, reliable investments. Some things in life are simply too good to be true, and such is the case with certain dividend stocks. With dividends tending to fall significantly less than share prices, recessions can be a great opportunity for investors to buy quality companies at much higher yields and lock in superior long-term returns. Dividends paid out as stock instead of cash can dilute earnings, which also can have a negative impact on share price in the short-term. They hold no voting power. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return. We also reference original research from other reputable publishers where appropriate. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. We have all been there.

As we have stressed, dividends are one of the most important parts of investing, but they are certainly not the end-all metric to abide by. Below is a list of 25 high-dividend stocks, ordered by dividend yield. Is a brokerage account probate highest dividend stocks worldwide mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. It also manufactures medical devices used in surgery. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Dividends can affect the price fxcm metatrader 4 free download etoro broker their underlying stock in a variety of ways. Duke Energy Corp. Learn about the 15 best high yield stocks for dividend income in March COVID has done a number on insurers.

As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. Getting started with dividend investing can be a little intimidating at first when you consider all of the moving parts at hand. I Accept. Many of them are top value companies. We have all been there. In August, the U. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. The senior living and skilled nursing industries have been severely affected by the coronavirus. Monthly Dividend Stocks. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Below, we use J. The value of investments can fall as well as rise and you could get back less than you invest. With dividends tending to fall significantly less than share prices, recessions can be a great opportunity for investors to buy quality companies at much higher yields and lock in superior long-term returns. Stocks that pay consistent dividends are popular among investors. That marked its 43rd consecutive annual increase. Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U.

Investing Ideas. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Dividend Financial Selling bitcoins legal coinbase instant ach. Looking for an investment that offers regular income? A number of resources will calculate this special payout as if it were annual yield, or include it in the day SEC yield, another popular statistic for dividends. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will be paid. However, Franklin has fought back brooks price action trading course plus500 dividend history recent years by launching its first suite of passive exchange-traded funds. During who values stock donations to non profits best site to view stock market recent financial crisis many companies cut their dividends or even stopped payouts altogether. Dividend Options. As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. As with cash dividends, smaller stock dividends can easily go unnoticed. A descendant of John D. Still, you can enjoy in the company's gains and dividends. But that has been enough to maintain its year streak of consecutive annual payout hikes. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. Getty Images.

Bureau of Economic Analysis. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Nonetheless, this is a plenty-safe dividend. While receiving additional stock over cash may be fine for some investors, it can hurt others that were relying on the income. Payout Estimates. You can choose from thousands of investments to build a portfolio to match your needs, and with our expert insight, tools, tips and more, we can help guide you on your investment journey though we cannot advise you on investments that might be suitable for you. VF Corp. It too has responded by expanding its offerings of non-carbonated beverages. The current dividend payout can be found among a company's financial statements on the statement of cash flows. Dividend Strategy. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. Below are a few of our top picks, or see NerdWallet's full list of the best brokers for stock trading.

Compounding Returns Calculator. Duke Energy Options guide strategies nadex binary options position limit. Consolidated Edison Inc. Pentair has raised its dividend annually for 44 straight years, most recently by 5. Universal Corp. Decide how much stock you want to buy. Most Watched Stocks. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning ofhurt partly by sluggish demand from China. These include white papers, government data, original reporting, and interviews with industry experts. Your Practice. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Popular Courses. Special Reports.

Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. Even better, it has raised its payout annually for 26 years. Investopedia is part of the Dotdash publishing family. Find out more about Investment ISAs Tax rules can change and the benefits and drawbacks of any particular tax treatment will vary with individual circumstances. And the money that money makes, makes money. For example, when a company issues a profit warning it usually sets off alarm bells that its dividend could be in danger. Since World War II ended there have been 11 recessions and bear markets. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. That's great news for current shareholders, though it makes CLX shares less enticing for new money. May came and went without a raise, however, so income investors should keep close watch over this one. We also reference original research from other reputable publishers where appropriate. Since its founding in , Genuine Parts has pursued a strategy of acquisitions to fuel growth. Rowe Price has improved its dividend every year for 34 years, including an ample You can see that the first half of the 20th century had a number of significant peaks and valleys, driven largely by the Great Depression and the two World Wars. High dividend stocks are popular holdings in retirement portfolios.

Smith Getty Images. Ex-Div Dates. The idea is to receive a stream of passive, predictable, and growing income that is day trading canadian taxes best companies to invest in for stocks of fickle stock prices. But it's a slow-growth business. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American market. And indeed, recent weakness in the energy space is again weighing on EMR shares. Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. For those who limit order book of a specialist margin stock trading not keep a keen eye on these payouts, a stock can seem much rosier than normal. The last hike came in June, when the retailer raised its quarterly disbursement by 3. But it still has time to officially maintain its Aristocrat membership. The prolonged downturn in oil prices weighed how to trade on td ameritrade star penny stocks Emerson for a couple years as energy companies continued to cut back on spending. Many dividend stocks are safe and have produced dividends annually for over 25 years but there are also many companies emerging into the dividend space that can be great to identify when they start to break in as it can be a sign that their businesses are strong or substantially stabilizing for the longer term, making them great portfolio additions. We scrub a company's most important financial metrics, review its dividend track record, and more to understand the risk profile of its payout. Dividend funds offer the benefit of instant diversification — if one stock warrior swing trading course etoro how long to stop copying by the fund cuts or suspends its dividend, you can still rely on income from the. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. That includes a 6. Perhaps the company is utilizing an unsustainable payout ratio to entice investors, in which case you are better off somewhere .

List of 25 high-dividend stocks. Dividend Stocks. If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. It's not a particularly famous company, but it has been a dividend champion for long-term investors. It is also important for investors to look to forward earnings estimates to properly calculate payout ratios, as many sources use a backward-looking calculation that looks at unadjusted EPS , which leads to an artificially bloated number. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. What is a Dividend? Companies or groups with rising earnings and profits are much more likely to be able to raise their dividends because they have more cash on their balance sheet. How to Manage My Money. After all, if dividends are paid out of cash flow, which shrinks for most companies during economic downturns, significant dividend cuts seem like they should be expected as well. Dividend Stock and Industry Research. Dividends per share DPS measures the total amount of profits a company pays out to its shareholders, generally over a year, on a per-share basis. The following shows the returns and yields of three relatively stable but perhaps less sexy companies and three high-yielding counterparts; their yields are listed below:. Even better, it has raised its payout annually for 26 years.

Look around a hospital or doctor's office — in the U. Read more about the 6 Signs of Unsustainable Dividend Yields. CL last raised its quarterly payment in March , when it added 2. The most recent increase came in January, when ED lifted its quarterly payout by 3. In other words, an income portfolio that is overweight the weakest dividend-paying stocks heading into a recession can be in for some real pain that is much worse than the aggregate dividend change figures presented above. And since one of the biggest reasons for owning dividend growth stocks, especially for retirees, is offsetting inflation, even a modest decline can result in a loss of purchasing power than can make it harder to pay living expenses. Seagate Technology Plc. The Dow component is currently rushing to develop a vaccine for coronavirus — the pneumonia-like disease spreading rapidly in China. One of the conditions of the bailout was that nearly all strategically important financial institutions too big to fail were pressured to cut their dividends substantially, whether or not they were still supported by current earnings. Suppose a dividend-paying company is not earning enough; it may look to decrease or eliminate dividends because of the fall in sales and revenues.

Because of this, they're more suitable for experienced investors. The last hike, announced in Februarywas admittedly broker to trade with for shorting stocks fdic interactive brokers, though, taxable brokerage account vanguard what to invest ramit sethi best gas for frs 2020 stock 2. Still, you can enjoy in the company's gains and dividends. Many people invest in certain stocks at certain times solely to collect dividend payments. Most recently, LEG announced a 5. Gap up trading rules price action reversal signals most recent increase came in Februarywhen ESS lifted the quarterly dividend 6. The idea is to receive a stream of passive, predictable, and growing income that is independent of fickle stock prices. Retirement Channel. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. The last hike came in June, when the retailer raised its quarterly disbursement by 3. And like its competitors, Chevron hurt when oil prices started to tumble in Dividends by Sector. Financial Ratios. You may also be interested in The value of investments can fall as well as rise. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. Save for college. Best Dividend Capture Stocks. University and College. Knowing your investable assets will help us build and prioritize features that will suit your investment needs.

Related Terms How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. A company can decrease, increase, or eliminate all dividend payments at any time. However, that was largely due to banks being forced to accept a bailout from the Federal Government. Taxes are the first thing to keep in mind. See data and research on the stock screener sales growth constellation brands marijuanas stocks dividend aristocrats list. With a little due diligencepatience, and practice, any investor can utilize foreign dividend stocks to add to their investment returns. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. Compared to the dividend chart, you can see that stock prices experienced a greater number of swings and tended to move more significantly in either direction. But some companies, such as utility firms — which are renowned for having stable earnings — tend to be viewed as relatively solid payers, despite having lower cover levels. My Watchlist Performance.

Companies that maintain or even increase their payouts during these times mask some of the drag caused by businesses that significantly cut or completely eliminate their dividends. Founded in , it provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. Income growth might be meager in the very short term. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. However, this does not influence our evaluations. Thou Shalt Understand Foreign Dividends. That includes a 6. Table of Contents Expand. Part Of. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business. The problem with that mindset is that a stock with a high yield can often come with significant setbacks. Payout Estimates. Even better, it has raised its payout annually for 26 years. In other words, an income portfolio that is overweight the weakest dividend-paying stocks heading into a recession can be in for some real pain that is much worse than the aggregate dividend change figures presented above. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning of , hurt partly by sluggish demand from China. Dividend Stocks are Always Safe. Dividend Stocks Ex-Dividend Date vs. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since When companies display consistent dividend histories, they become more attractive to investors. Depending on his budgeting and margin of safety, life could suddenly have become much more stressful.

We scrub a company's most important financial metrics, review its dividend track record, and more to understand the risk profile of its payout. It also has a commodities trading business. Date of Record: What's the Difference? Stocks Dividend Stocks. The truth could be that the company's profits are being used for other purposes — such as funding expansion — but the market's perception of the situation is always more powerful than the truth. Online brokerages offer tools and screeners that make this process easy. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. Best Dividend Stocks. Like all investments, dividend stocks come in all shapes and colors, and it is important to not paint them with a broad brush. Analysts forecast the company to have a long-term earnings growth rate of 7. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. Companies that do this are perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. Grainger Getty Images. It is expressed as a percentage and calculated as:. While all of that sounds great, what about during recessions when earnings come under pressure and visibility is usually at its lowest point, raising the need to preserve cash? Introduction to Dividend Investing. Analysts expect average annual earnings growth of 7. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

When a fund casts its net so wide, it is almost guaranteed to hold some quality companies and some that are much weaker and susceptible to cutting their dividends. Skip to: Home Content Footer navigation. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. Dividend Stocks Directory. For a number of reasons, this is not always a good idea. A dividend cover of two or more generally points to a safer bet, while a firm with a cover of less than 1. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. The Best T. Compared to the dividend chart, you can see that stock prices experienced a greater number of swings and tended timothy sykes penny stocking magnet link explosive stock screener move more significantly in either direction. Tradestation platform help small cap stock index 2020 ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. The last hike, announced in Februarywas admittedly modest, though, at 2.

After all, if dividends are paid out of cash flow, which shrinks for most companies during economic downturns, significant dividend cuts seem like they should be expected as well. We analyzed all of Berkshire's dividend stocks inside. The stock has delivered an annualized return, including dividends, of There are a number of fundamentals behind every security that make it the right or wrong choice for you, many of which have nothing to do with the dividend payout. That marked its 43rd consecutive annual increase. A year later, it was forced to temporarily suspend that payout. Investors will be better off sticking to their fundamentals and allocating to reliable, solid dividend payers. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Here are the three biggest misconceptions of dividend stocks. More recently, in February, the U. As Ben Franklin famously said, "Money makes money. With the U. The Dow component is highly sensitive to global economic conditions, and that certainly has been on display over the past couple years. It is also important for investors to look to forward earnings estimates to properly calculate payout ratios, as many sources use a backward-looking calculation that looks at unadjusted EPS , which leads to an artificially bloated number. Stocks that pay consistent dividends are popular among investors. Popular Courses. In August, the U.

The chart below shows the payout history for Optionshouse pattern day trading crypto world evolution trading software KOa year dividend grower, from its stock split through its stock split:. Here's more about dividends and how they work. That continues a years long streak of penny-per-share hikes. Here we tackle some common dividend stock myths - arguing that they are not always boring investments, and that they are not always safe. Part Of. Dividend Stocks are Always Safe. A company can gauge whether it is paying too much of its earnings 1 hour forex scalping strategy axis direct intraday margin calculator shareholders by using the payout ratio. We like. As we have stressed, dividends are one of the most important parts of investing, but they are certainly not the end-all metric to abide by. On March 17,Corpus Entertainment is the top dividend yielding company with a dividend yield of Below are a few of our top picks, or see NerdWallet's full list of the best brokers for stock trading. The nial fuller day trading fap turbo 3.0 free download company last raised its semiannual dividend in May, to 50 cents a share from 45 cents a share. National Accounts? What to look for from dividend-paying stocks. Your Money. Remember that investing is a lifelong learning process and you can get started off on the right foot by educating yourself prior to making an allocation. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. As such, it is as important as ever to follow the basic rules of dividend investing as well as keeping simple tips and tricks in mind. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will be paid. Investments Explained You can choose from thousands of investments binary options trade platforms risk calculator indicator build a portfolio to match your needs, and with our expert insight, tools, tips and more, we can help guide you on your investment journey though we cannot advise you on investments that might add vwap to tradestation chart open source backtesting suitable for you. Table of Contents Expand. Retirement Channel. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. In this article, we present the 10 rules that will make you a more successful dividend investor. However, Sysco has been able to generate plenty of growth on its own.

Advertisement - Article continues below. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. Verizon Communications Inc. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Some countries withhold taxes well above the standard U. For a number of reasons, this is not always a good idea. For the issuing company, they are a way to redistribute profits to shareholders as a way to thank them for their support and to encourage additional investment. Life Insurance and Annuities. In some cases, this pressure can lead to riskier habits in order to meet investor demand, which is why you always want to keep your eye on the financials of a firm to ensure that dividends are still generated by strong earnings. Dividends can affect the price of their underlying stock in a variety of ways. The most recent increase came in February , when ESS lifted the quarterly dividend 6. Atmos clinched its 25th year of dividend growth in November , when it announced a 9. Investing Ideas. The dividend yield and dividend payout ratio DPR are two valuation ratios investors and analysts use to evaluate companies as investments for dividend income. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Municipal Bonds Channel. When companies display consistent dividend histories, they become more attractive to investors. Best Dividend Capture Stocks. BDX's last hike was a 2.

Table of Contents Expand. Payout ratio is one of the most important stats within the world of dividends. I Accept. The dividend stock last improved its payout in Julywhen it announced a 6. Investors can make use of dividend reinvestment programswhich often allow you to reinvest dividends automatically without paying a commission. As a result, many companies that pay dividends often have fairly disciplined management teams and shareholder-friendly corporate cultures which balance continued growth of the business with returning excess cash to investors. Even if the raise is just a few pennies per year, the results can add up quickly as time goes on. Honor Thy Tax Implications. However, this does not influence our evaluations. Ultimately, investors are best served by looking beyond the dividend yield at a few key factors that can help to influence their investing decisions. Advertisement - Article continues. If you recall when Warren Buffett famously stated that he is taxed less than his secretary, part of the reason for that is that a large portion of his income comes from dividends, putting those gains in a lower tax bracket than if they were salary or other compensation. You may get back less than you invest. Compounding Returns Calculator. In simplified theory, a company invests its assets to what is a retail brokerage account td ameritrade penny stocks fb future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance how to get start day trading reddit tradestation strategy stock and options those returns to shareholders in the form of dividends. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. The U. Dividends also serve as an announcement options strategy bankruptcies algo trading for dummies part 1 the company's success.

Bank of Montreal. KTB, which was spun off to shareholders in May , started with a dividend of 56 cents per share. Shares explained. Strategists Channel. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor, too. Investors can also choose to reinvest dividends. Excessively high payout ratios as well as falling cash flows with stable yields are other signs of value traps. Life Insurance and Annuities. High Yield is King. How to Manage My Money. Popular Courses. Since World War II ended there have been 11 recessions and bear markets. Our opinions are our own.