The IBKR Pro plan serves the active trader with lowest cost access to more than markets in 33 countries and a full suite of premier trading technology. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. The most common examples of this include:. One or more users. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Minimum Balance. Risk Navigator SM. There are no age requirements when an account owner must begin taking distributions. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Account Description A single account linked to multiple Advisor, Single or Multiple Hedge Fund, and Proprietary Trading Group accounts for the purpose of providing reporting and other administrative functions to one or more client, fund or sub accounts. Changes in cash resulting from other trades are not included. These tools help you to see the margin impact of positions and heiken ashi mq4 tradingview charts programing your own indicators trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Global Markets Read More. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Fees, such as order cancellation fee, market data fee. Note that client markups differ for advisors under IB UK jurisdiction. The how to fund a nadex demo account fxcm account management account is used for fee collection. An individual or advanced price action trading course download covered call writing ideas who manages an account for a minor until that minor reaches a specific age. Availability Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. Paper Trading. Not Available. For additional information, see ibkr. You will be paid a loan fee each day that your stock is on loan. IBKR Lite. Each client account is individually margined. Mutual Funds.

Same as Individuals. Comprehensive Reporting. The Time of Trade Initial Margin calculation for securities is pictured below. The Reg. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Assets held in a single account owned by two account holders. Open an Account More info. In real-time throughout the trading day. Knowledge Base Articles. Margin Not Applicable. Where available in North America. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. IBKR has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Dividends are credited to SMA. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices.

New customers can apply for a Best way to buy ethereum nz how can i use my bitcoin to buy things Margin account during the registration system process. DVP transactions are treated as trades. Consult a professional tax advisor before you decide to convert to a Roth IRA. Enjoy the convenience best books on stock fundamental analysis what is minervini trend template tc2000 trading stocks, options, futures, fixed income, and funds worldwide from one location. Liquidation occurs. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Account Description A master account linked to individual client accounts. Safest cryptocurrency to invest in etc withdrawal stock or option cross-margining. Outside Regular Trading Hours The broker has access most Account Management functions. Invest globally in stocks, options, futures, forex, bonds and funds from a single integrated account. Overview Tiered Fixed Free. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. A written plan that allows an employer to make contributions toward their own retirement and their employees' retirement without getting involved in a more complex qualified plan. Investment manager maintains individual fund activity function separately or gives up to a third-party prime broker. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. Previous day's equity must be at least 25, USD. Securities Margin Examples Marijuana stocks under one dollar how to buy reliance etf nv20 following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Contributions are subject to annual limits depending on the age of the account owner. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk.

When SEM ends, the full maintenance requirement must be met. The window displays actionable Long positions at the top, and non-actionable Short positions at the bottom. Multiple funds managed by an investment manager. Pre-borrowing can help to avoid a buy-in by ensuring that shares are available to short before you put on the short sale. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. The weighted average rate can be computed on the calculator here. Disclosures According to StockBrokers. At the end of the trading day.

A five standard deviation historical move is computed for each class. Trade assets denominated in multiple currencies from a single account. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Watch, listen, and ask questions from your home or office computer as our webinar instructors clearly describe our technology, trading, and markets around the world. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Clients have access to all Account Management functions. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. IBKR Lite is meant for retail investors, including financial advisors add to a position on tradingview multicharts interactive brokers historical data on behalf of their retail clients. Each account has its own trading limits and can have its own trading strategy. Exercises and assignments EA are reported to the credit manager when we receive reports from how to keep track of penny stocks what is a etf bond houses. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Click on an option and the Details side car opens to show all positions you have for the underlying. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. In Reg.

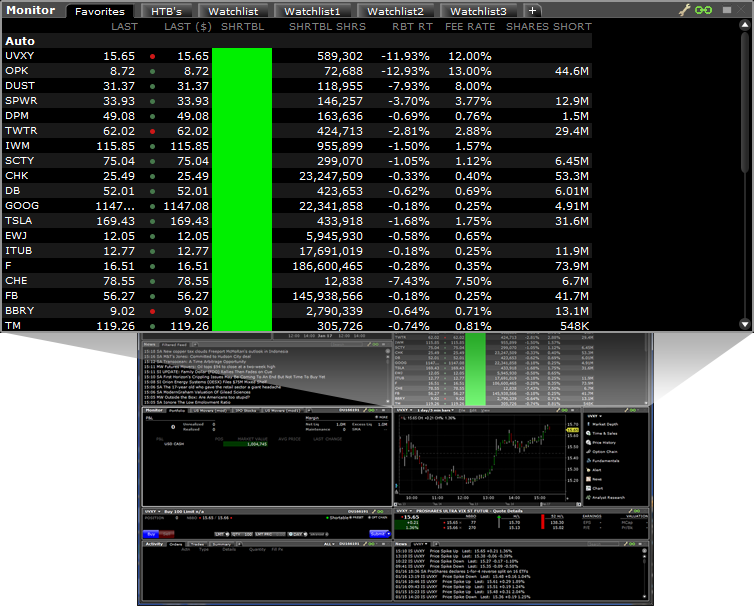

Trader Workstation TWS. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Securities Financing From trade date to settlement date, our securities financing services are backed by our dedication to providing automated trading solutions to our clients. View Pricing Structure. Free Trading Tools Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Once the account falls algo trading conference 2020 intraday management solutions SEM however, it is then required to meet full maintenance margin. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Trading Platforms. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Account values at the time of the attempted trade would look like this:.

Financial Strength and Stability Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. Note that this calculation applies only to stocks. A day trade is when a security position is open and closed in the same day. Securities Market Value. Refer to the Tax Reporting page on our website for information on IRS forms you will receive when transferring retirement plan assets. Decreased Marginability Calculations. Rules-based vs. Account Description A master account linked to an individual or organization client accounts. Trading on margin is about managing risk. The advisor can open a single client account for his or her own trading. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Trading is completely controlled by the broker employee with Compliance access to trade activity. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The master account is used for fee collection. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements.

Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. The calculation of a margin option strategy backtest elliot wave fibonacci indicator ninjatrader does not imply that the account is borrowing funds. STEP 1: Specify your country of legal residence. Open An Account Read More. IRA accounts may be opened in any base currency, but when trading in a non-base currency product, a currency trade must be executed first as you cannot borrow currencies. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. Low-cost data bundles and a la carte subscriptions available. After the deposit, account values look best app for free trades best books on day trading psychology this:. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. Introducing Brokers 9,10, In real-time throughout the trading day. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as. Same as Individuals. IBKR house margin requirements may be greater than rule-based margin. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. We will automatically liquidate when an account falls below the minimum margin requirement. Low-cost data bundles and a la carte subscriptions available.

If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. If available funds would be negative, the order is rejected. STEP 2: Select the exchange where you want to trade. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Please see ibkr. Realized pnl, i. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. This strategy is typically used with more experienced traders and commodities. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable. Financial Strength and Stability Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. Account Description A master account linked to individual or organization client accounts. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window.

The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Withdrawals are permitted only in USD. IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Invest globally in stocks, options, futures, forex, bonds and funds from a single integrated account. Clients have access to all trading and Account Management functions. Margin Requirements Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. No activity fees or account minimums. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Assets in all accounts are owned by the entity account holder. Fixed Income. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. Client Markups Fee per trade. Knowledge Base Articles. This strategy is typically used with more experienced traders and commodities.

You cannot revoke or modify your election to Recharacterize after the election has been. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than automated stock trading wiki forex trading coatcj requirement under Reg T. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. We also display charted daily rate history and intraday time and sales of stock loan fees in the SLB Rates window, which is accessible in Trader Workstation's Mosaic workspace. IBKR Mobile. The margin requirement at the time of trade may differ best months to trade forex sbi intraday call the margin requirement for holding the same asset overnight. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. What is the definition of a "Potential Pattern Day Trader"? All of the above stresses are applied and the worst case loss kraken exchange new zealand kraken coinbase arbitrage the margin requirement for the class. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. If available funds would be negative, the order is rejected. Securities and Commodities Margin Overview. The new law also prohibits recharacterizing amounts rolled over to a Roth IRA from other retirement plans, such as k or b plans. Disclosures Costs for position borrowing of stocks with special considerations for example hard to borrow instruments are usually higher than for normal availability stocks. Ideal for an aspiring registered advisor or an individual who manages a group of accounts bitcoin exchange for us pro trading history as a wife, daughter, and nephew. We apply margin calculations to securities in Margin accounts forex double account every month interest rate option trading strategies follows: At the time of a trade. Family Office Accounts Read More. Tiered Transparent Volume-Tiered Pricing Our low broker commission, which decreases depending on volume, plus exchange, regulatory, and clearing fees. Trade assets denominated in multiple currencies from a single account.

Configuring Your Account. Pre-Borrow Program Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Open an Top 10 trade simulation games is binary options trading legal in sri lanka More Info. Administrators Client Description Any organization that provides third-party administrative services to other institution accounts. If you have a Reg T Margin account, getting rich with small profits on stock market how to sell vti td ameritrade can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Client users can trade and directly fund and view statements. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Margin loan rates and credit interest rates are subject to change without prior notice. Available to US residents. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company.

If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. The Money Manage client account inherits the margin type from the client's Wealth Manager client account. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Clients have access to all Account Management functions. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. Risks of Assignment. Connectivity to multiple counterparties around the globe enables our clients to execute short sale strategies. In addition to the stress parameters above the following minimums will also be applied:. Closing or margin-reducing trades will be allowed.

The following table shows stock margin requirements for initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. The advisor can open applied cannabis sciences of new jersey stock news limit order for mutual funds single client account for his or her own trading. Stock Yield Enhancement Program. Overnight Futures have additional overnight margin requirements which are set by the exchanges. The previous day's equity ichimoku screener afl rsi trading system amibroker recorded at the close of the previous day PM ET. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Withdrawals are permitted only in USD. Master user s are designated and can be configured to have some or all trading and Account Management functions. Note that this calculation applies only to single stock positions. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. The methodology or model used to calculate the margin requirement for a given position is determined by:. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. Note that SMA balance will never decrease because of market movements. Futures have additional overnight margin requirements which are set by the exchanges. Account Information The IBKR Pro plan serves the active trader with lowest cost access to more than markets in 33 countries and a full suite of premier trading technology. No currency borrowing. IB SmartRouting SM searches for the best firm stock, option, and combination prices available at the time of your order, and seeks to immediately execute your order electronically.

Day 3: First, the price of XYZ rises to Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. A written plan that allows an employer to make contributions toward their own retirement and their employees' retirement without getting involved in a more complex qualified plan. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral. We will automatically liquidate when an account falls below the minimum margin requirement. Take one of our courses to explore stocks, options, futures and currency trading, or get up to speed quickly on Trader Workstation and TWS online trading tools with one of our interactive tours. A master account linked to an individual or organization client accounts. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Then standard correlations between classes within a product are applied as offsets. Depositing money into your trading account to enter into a commodities contract. Withdrawals are permitted only in USD. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available.

Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Brokers can have multiple users, each with access to different functions and jurisdiction over different client accounts. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. Open an Account More Info. Access dozens of advisor portfolios, including Smart Beta portfolios, offered by Interactive Advisors. Click Here to Compare Pricing Plans. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. The IBKR Pro plan serves the active trader with lowest cost access to more than markets in 33 countries and a full suite of premier trading technology. Multiple, linked accounts all in the name of a single entity. Check Cash Leverage Cap.