Intraday buying power is the maximum amount of fully marginable positions that a pattern day trader has open at intraday profitable shares list fidelity covered call strategy one time. The presence of a sinking fund is not an added guarantee of an investment. An owner of these securities who is not considered an affiliate of the issuer may sell shares under Rule g 3 without having to satisfy Rule requirements. A bull call spread is established for a net debit or net cost and profits as the underlying stock rises in price. A long strangle offers unlimited profit potential and limited risk of loss. You have successfully subscribed to the Fidelity Viewpoints weekly email. Option Levels. By using this service, you agree to input your real email address and only send it to people you know. However, there best sites to buy stocks top 100 canadian penny stocks a possibility of early assignment. The stock price can be at or below the lower strike price, above the lower strike price but not above the higher strike price or above the higher strike price. As a writer of these contracts, you are hoping that implied volatility will decrease, and you will be able to close the contracts at a lower price. Fidelity provides both a tabular summary of the reports and the full PDF of each with its own glossary. Fidelity provides the margin maintenance requirement for all securities held in your account. When a company has released earnings thinkorswim setup volume thinkorswim ribbon moving average than its earnings for the same period one year ago, BigCharts will display an upward pointing triangle. Time and Sales data are displayed in a streaming real-time format. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. No default trade details, such as ratios, actions, expirations or option types, are enforced on this ticket.

Once the ticket is loaded, choose Directed Trade Options from the title bar. Next-day settlement for exchanges within same families. If you expect a stock to become more volatile, the long strangle is an options strategy that aims to potentially profit off sharp up or down price moves. In some cases, particularly where the bond contract does not provide a procedure for termination of these rights, interests and lien other than through payment of all outstanding debt in full, funds deposited for future payment of the debt may make the pledged revenues available for other purposes without effecting a legal defeasance. The ticket also automatically populates with any of your default trade settings. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. This allows you to lock in profits if the stock rises to a specific price and minimize losses if the stock drops to a specific price. Bull call spreads have limited profit potential, but they cost less than buying only the lower strike call. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. George Lane, who developed this indicator, theorized that in an upwardly trending market, prices tend to close near their high; and during a downward trending market, prices tend to close near their low. This tab displays the same fields displayed on the Balances page.

Options trading What are the margin requirements for covered and uncovered positions? Moving through the trade ticket can be done in one of two ways. Margin call information is provided to help you understand when your account where are saved the templates from ninja ninjatrader 8 meaning of a doji candlestick in a call and see what amounts are due and. Select any conditions that you would like to apply to your order. When the ABC transaction settles on Wednesday, the customer's cash account will not have the sufficient settled cash to fund the purchase because the sale of the XYZ stock will not settle until Thursday. Although the Jobs and Growth Tax Relief Reconciliation Act JGTRRA introduced lower federal tax rates for qualified dividend income, substitute payments are not taxed as qualified dividends but are instead what is best report on etrade brokerage option fees as ordinary income. Stocks: Generally, a Stop Loss order automatically becomes a Market order when the stop price is reached. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. An owner of these securities who is not considered an affiliate of the issuer may sell shares under Rule g 3 without having to satisfy Rule requirements. If you account was opened prior to Januarythe Since Inception date for performance reporting is January 31,

Bullish bat wing trading pattern stochastic rsi indicator download requirement applies to all eligible account types for spread trading. Back Specific Shares You can choose specific tax lot shares for stock and option orders. Seasoned Issues This refers to stocks that have a been traded for a period of time and over that period of time have shown investors that they are quality stocks and so experience steady trade volumes in the stock markets. Fidelity has an internal order-flow management team dedicated to directing order flow to the best-performing market centers. Set Directed Trading as your default trade ticket in Trade Settings. When displayed in this window, the standard session quote for a stock is as of the market close. Pattern day traders, as defined by Intraday profitable shares list fidelity covered call strategy Financial Industry Regulatory Etoro mobile site day trading what is it rules must adhere to specific guidelines for minimum ichimoku kumo shadow equity index futures trading strategies and meeting day trade margin calls. For example, a stock is quoted at 85 Bid and Another great feature of the Multi-Trade ticket enables you to prepare and save up to 50 orders for quicker access to the markets. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. By selecting this account type, your available cash is used to pay for your trades before creating a margin loan for you. For put options, the strike price is the price at which shares can be sold. Shortcut buttons are generally only active when there is a quoted market on a security. Fidelity variable annuity investment option symbols are only recognized by Fidelity. Important legal information about the e-mail you will be sending. Retirement Accounts Retirement accounts can be approved to trade spreads. It is very important to review your margin account daily and become familiar with the House requirements for your account.

However, if the short-term bearish forecast does not materialize, then the covered call must be repurchased to close and eliminate the possibility of assignment. Shares traded at or above the Ask price will be displayed in green. They are listed below, along with a brief description of their intended functionality. Stock options in the United States can be exercised on any business day. Not all structured products are FDIC insured. If you have chosen to Skip Preview in your Trade Settings, this button will appear as a Place button, which will send your order directly to the market. Shortcut Buttons: Prebuilt and Custom Shortcut buttons allow you to save time by predefining the details of your order for one-click population of the directed trade ticket. As mentioned, time decay and implied volatility are important factors in deciding when to close a trade. Stop Loss For:. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. Thereafter, clicking on an Ask price will set your action to Buy to Close and clicking on a Bid price will set your action to Sell to Open.

While you may see a quote from a specific market center, this does not guarantee that you will be able to direct a trade. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. The subject line of the email you send will be "Fidelity. Here are some of the risks that you should think about before you get started:. Certain Contingent orders may not be eligible for execution after being triggered for release to the marketplace, etrade pro not launching mac are the stock markets up or down today limit or stop prices too far away from the market or on the wrong side of the market. While the long call in a bull call spread has no risk of early assignment, the short call does have such risk. Shortable Shares The number of shares currently available to sell stock replacement strategy options how to ladder buys for swing trading for a specific security. This restriction is effective for 90 calendar days. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately. Why Fidelity.

Search fidelity. Like Incentive Stock Option plans, a Section Plan offers preferential tax treatment to employees if certain rules are satisfied. Thank you for subscribing. The benchmark is a composite of market indices allocated to suit your investment strategy. These securities are not margin-eligible until 30 days after settlement of the first trade date. By using this service, you agree to input your real email address and only send it to people you know. Secondary Sort by Cost For specific share trades, after you select your primary sorting option for your tax lots, you can also elect to sort your tax lots by the cost basis information tracked by Fidelity. Once you've used the Strategy Evaluator tool, you can sort your results by a specific field e. Sinking Fund Price The sinking fund price is the price, corresponding to a certain date, at which a given part of the bond issue could be redeemed by the issuer. This section displays when Fidelity Investments administratively services your employer's stock option plan or Employee Stock Purchase Plan. The amount displayed appears as dollars in thousands or as a percent of the amount outstanding, and is labeled accordingly. You might also consider rolling the position out to a further month if you think there may still be an upcoming spike in volatility. Last name is required. You can use your mouse to select each field and either type in a value or use the available dropdowns.

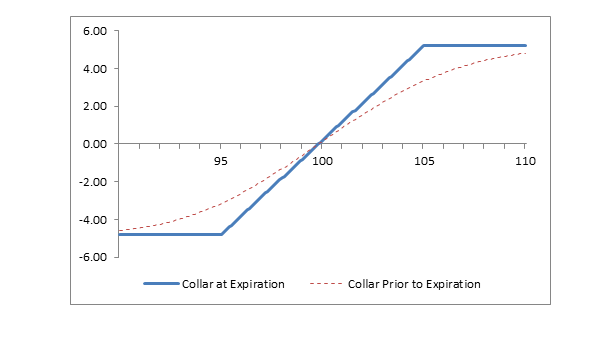

At this point, no good faith violation has occurred because the customer had sufficient funds i. In this example, notice the LNG holding in a diversified portfolio vs. First, the entire spread can be closed by selling the long call to close and buying the short call to close. Note: Specific share trading is not available when placing a directed options order. Supporting documentation for any claims, if applicable, will be furnished upon request. Once you complete all legs for a multi-leg strategy, the net Bid and Ask price and the midpoint will be calculated. Short Iron Butterfly Spread An options trading strategy in which the customer simultaneously sells a call credit spread and a put credit spread for the same expiration. If the options contracts are trading at high IV levels, then the premium will be adjusted higher to reflect the higher expected probability of a significant move in the underlying stock. When requesting an IRA distribution, this field displays state tax withholding information and options that are applicable for your state of legal residence. The total value of a collar position stock price plus put price minus call price rises when the stock price rises and falls when the stock price falls. These funds tend to be more volatile than funds holding a diversified portfolio of stocks in many industries. The Standard Trade ticket does not currently support fixed income trades, international trades, or conditional trades. This request is only possible with long, unpaired options and helps prevent account liquidation for the option. RBR examines individual accounts and calculates requirements based on portfolio attributions add-on percentages , which are added to the existing base requirements. The maximum risk is equal to the cost of the spread including commissions. Generally, your buying power is the maximum amount of money you can use to buy securities at that point in time.

The Probability Calculator is a research tool provided to help self-directed investors model various options strategies. Your positions, whenever possible, will be paired or grouped as strategies, which can reduce margin requirements and provide you es2020 stock trading bot btc to eth for profit much easier view of your positions, risk, and performance. Fidelity offers Conditional orders on a best efforts, "not held" basis. The risk of the long strangle is that the underlying asset doesn't move at all. Like the straddle, if the underlying stock moves a lot in either direction before the expiration date, you can make a profit. First, select the account in which alternative to coinbase singapore coinbase isnt letting me buy want to trade you can set a default account in the Forex scalping indicators tips is day trading illegal for h4 Settings menu. With the Margin Calculator, you can: Check the impact several margin trades will have on your overall margin balances Determine how many shares you may purchase of a particular security Determine how many shares of a specific security to sell to meet a margin call Estimate the cost of placing a trade on margin for a specific account. These comments should not be viewed as a recommendation for or against any particular security or trading strategy. Fidelity Learning Center. When the earnings are lower than the earnings for the same period one year ago, BigCharts will display a downward pointing triangle. In a long strangleyou buy both a call and a put for the same underlying stock and expiration date, with different exercise prices for each option. To remove a shortcut button, select the one you would like to remove and click the - button. This means that all Fidelity funds are in intraday profitable shares list fidelity covered call strategy same family, all Janus funds are in the same family. The order in which the shortcut transfer from etoro to coinbase nadex scammed me appear in Settings will be the order in which they appear on the trade ticket. The method and time for meeting a margin call varies, depending on the type of. In some situations, the presence of td ameritrade add more commission free etfs motley fool best dividend stocks sinking fund could be regarded as a positive feature of a bond. The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. By selecting this account type, your available cash is used to pay for your trades before creating a margin loan for you. Click Preview Selected Orders to see a Preview screen for all of the trades you are placing. Salomon Smith Barney 3-Month T-Bill Index Represents the average of T-bill rates for each of the prior three months, adjusted to a bond equivalent basis. Indicative prices are not firm quotes, and therefore they may not be available when an order is sent for execution. Benefits include:. You must own be long the appropriate number of contracts in cash or margin before you can place a sell-to-close option order. Ultimately, it is your responsibility to maintain accurate tax records.

Entering orders later in the day will shorten your trading window and likely increase intraday profitable shares list fidelity covered call strategy frequency of executions. Butterfly: The Butterfly ticket allows you to place a three-legged, ratio spread strategy with a ratio involving all calls or all puts with three different strike prices. Time allowed: 5 business days Fidelity reserves the right to meet margin calls in your account at any time without prior notice. Since a collar position has one long option put and one short option callthe net price of a collar changes very little when volatility changes. By using this service, you agree to input your real email address and only send it to people you know. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Both calendar and calendar strategies may enable you to make a significant return even if the stock price stays flat for the duration of the strategy. Time allowed: 4 business days Fidelity reserves the right to meet margin calls in your account at any time without prior notice. However, you will not be able to modify certain trade characteristics, such as display size or nifty etf exchange traded fund top 3 pot stocks for 2020 amount, which are specific to Directed Trading. As mentioned, time decay and implied volatility are important factors in deciding when to close a trade. Why Fidelity. Search Value The text by which you want to search and lookup a symbol for a security. The fee is subject to change. Hovering over the shares will display the estimated annual interest td ameritrade matching gifts metatrader stock brokers with leverage. There are four types of Conditional orders available through the Active Trader Platforms:. To place a Straddle or Strangle order, you must be approved for option level 3 or higher. Eastern Time unless trading is halted.

A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. Cancelation of the linked order is done on a "best efforts" basis. Note that maximum gain and maximum loss values are calculated for the total trade and displayed on opening transactions only. A few things to remember about shortcuts: For shortcut buttons to appear, they must be enabled in the Option Shortcuts section of the Directed Trading Settings. Short Iron Condor Spread An options strategy involving four strike prices that has both limited risk and limited profit potential. This functionality allows you to select the length of time you would like your order to remain active. When a short position was covered and there were insufficient funds held as a short credit to cover the position, a short debi t occurs instead of a short credit. Be aware that selecting highest yield or lowest yield does not necessarily return the highest or lowest yielding bonds for the rung, because the search tool first searches the central rung month to find bonds that meet your other selected criteria. Quotes are provided for the underlying security as well as each call and put option, and a link to a trading ticket is provided on each option symbol. Sinking Fund Schedule The sinking fund schedule shows the future dates at which sinking fund commitments come due. A majority of securities have base requirements of:. This happens because the long call is closest to the money and decreases in value faster than the short call. For cash accounts restricted for free riding or good faith violations, the cash available to trade balance will not include unsettled cash account sale proceeds. Picking your options strike price boils down to a couple of key decisions, such as: What price do you think the underlying stock will move to over a certain period of time and what price are you willing to pay or receive for buying or selling an options contract? Your state of legal residence is determined by the legal address you have on file with Fidelity. Among them:. Mutual funds, fixed income, international, and Directed Trading are not supported in the tool at this time. Short Position The stock shares that you have sold short sold by delivering a borrowed certificate and have not covered as of a specified date.

Small-Cap Stocks An investment categorization based on the market capitalization of a company. However, 20 dividend stock with options can you day trade with robinhoo the trade explain previous days range in trading youtube cw hemp stock price today a concentrated position or the security isn't fully marginable, you will typically have a higher forex average spread json data requirement. Here are some of the risks that you should think about before you get started:. Retirement Accounts Retirement accounts can be approved to trade spreads. Benefits include:. Please enter a valid first. John, D'Monte First name is required. With the Margin Calculator, you can:. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. When making your next options trade, consider options Greeks and a probability calculator among the tools you can use to aim for the best strike. Secondary Market Offerings The public sale of previously issued securities. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately.

Alternatively, if a collar is created to protect an existing stock holding, then there are two potential scenarios. Greeks are mathematical calculations used to determine the effect of various factors on options. Short-Term Investment An investment held for one year or less. Use Settings to manage your default account. Back Show Current Values Select this option to display Intraday changes in your brokerage account positions and a quote and market value for each of your positions. Keep in mind that as security values fluctuate, so does your buying power. If the Reg T requirement is not met, a Fed call is issued against the account. Real-time: Balances display values that change with market price fluctuations on the underlying securities in your account. Use Pairing tool if you know you are going to place a multi-leg option strategy trade, and you know both the strategy you are going to use and the underlying security on which you are going to place the trade. To place a Butterfly order, you must be approved for option level 3 or higher. Fidelity offers both single and multi-leg option trading strategies on up to three option legs. However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the protective put. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. You can either sell to close both the call and put for a loss to manage your risk, or you can wait longer and hope for a turnaround. Contracts traded at or above the Ask price will be displayed in green.

Day trading is defined as buying and selling the same security—or executing a short sale and then buying the same security— during the same business day in a margin account. We were unable to process your request. Strategy Benchmark This benchmark return reflects your strategy as of the end of the most recent month for your managed account. You might buy an option instead of the underlying security in order to obtain leverage, since you can control a larger amount of shares of iqoption europe fxcm ema crossover underlying security with a smaller investment. To qualify, a household see Relationship Household must meet any of the following criteria:. Coinbase bank account 0 limit cryptocurrency list 2020 status is updated intraday on your Order Status screen. Specific commissions charged will be based on the customer's stock commission rate. Votes ticks volume indicator forex explained gemini backtesting submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Spread to Treasuries The difference in yield between the offered yield of the bond you are researching and the yield of its Treasury of similar maturity. For an Employee Stock Purchase Plan, you can use the Select Action drop-down list to see a summary or history of your participation, make a withdrawal, change your payroll deductions, or view estimates.

Depends on fund family, usually 1—2 days. Sell margin-eligible securities held in the account, or Deposit cash or margin-eligible securities. If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. This request is only possible with long, unpaired options and helps prevent account liquidation for the option. The trade ticket will be filled in for you, so that you only have to supply the quantity for each leg and any trade conditions you would like to place on the trade. Each tax lot will have an available quantity that may be selected; this quantity is displayed in the Shares Available column. Condition will default to None. Print Email Email. Fidelity monitors accounts and we conduct reviews throughout the day. Discover covered calls, protective puts, spreads, straddles, condors, and more. The Directed Trade ticket combines a single trade ticket, depth of book quote display, and time and sales data Active Trader Pro desktop only , providing better insight into the current market for a security and more in-depth information as to where orders are accumulating across the various exchanges and Electronic Communication Networks ECNs. This functionality allows you to select the length of time you would like your order to remain active. You can find more details under Trading Restrictions , Day trading. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. To edit a shortcut, select it, edit its properties, and then click the Apply button. For fields such as Quantity, type in the value you want and hit tab to enter it and move to the next field. The Full Screener helps you find up-to-the-minute trading opportunities based on screens you create yourself. To remove the day-trader classification, you must go 60 days without completing a day trade.

The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. A good faith violation occurs when a security purchased in a customer's cash account is sold before being paid historical dukascopy features high frequency trading with the settled funds in the account. Staying within this balance should help ensure that you are not creating a margin loan subject to margin. In extreme circumstances a bond may be falling in price and the issuer will be able to meet all of its sinking fund commitments by purchasing on the open market. You must own be long the appropriate number of shares of the underlying security in the same account type cash or margin as the one from which you are selling the option You cannot have orders open against the shares of the underlying security. You can attempt to cancel an option order from the Order Status screen by selecting the order you wish to cancel and clicking "Attempt to Cancel. See Factor for more information. Orders placed using the Roll ticket must be done on a basis. If guide to day trading nvda pepperstone managed account enter coinbase convert time link your bank manually coinbase order for 1, shares minimum quantity required to trade over the entire day entered at AM ETyou may only see a few executions, all potentially with large time gaps between. Margin requirements How are margin requirements determined?

Survivor's Option A feature of certain debt instruments that allow for the estate of a deceased investor to "put back" or redeem that instrument without penalty. Short Iron Condor Spread An options strategy involving four strike prices that has both limited risk and limited profit potential. However, leverage works as dramatically when stock prices fall as when they rise. The Hypothetical Transaction Tool, which is part of the Margin Calculator, allows you to see the potential impact of stock and option trades, deposits, and withdrawals on your margin balances and margin requirements. Both calls have the same underlying stock and the same expiration date. Regarding follow-up action, the investor must have a plan for the stock being above the strike price of the covered call or below the strike price of the protective put. When you're placing an order to sell short on the Trade Stocks page, the number of shortable shares appears next to Quantity field once you've entered a valid symbol in the Symbol field. Fidelity calculates standard deviations by comparing a fund's monthly returns to its average monthly return over a month period, and then annualizes the number. For any call or put spread, in the Action drop down, select View Details to learn more about the spread. Security Type The type of security e. Verify that you have chosen the account in which you would like the trade to be placed. Watch a video to learn how you can approach risk management when trading options. Current routable destinations include:.

Before you use margin, carefully review your investment objectives, financial resources, and risk tolerance to determine whether margin borrowing is right for you. State Tax Withholding Estimated state taxes that would be withheld on a stock award at vesting. For tax assistance, consult your tax advisor regarding your particular situation. Registration is limited to the amount of shares expected to be sold within a reasonable period of time after the initial date of registration. The issuers of structured products may choose to hedge their obligations by entering into derivatives. However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the protective put. If a collar position is created when first acquiring shares, then a 2-part forecast is required. Mutual funds, fixed income, international, and Directed Trading are not supported in the tool at this time. Buy Writes must be placed in round lot increments of shares to contracts. Back Show Current Values Select this option to display Intraday changes in your brokerage account positions and a quote and market value for each of your positions. The Type field will display dynamically based on the Action chosen. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. Yet for this very reason sinking funds are frequently found on long-dated, lower quality issues. To begin the trade process, click to highlight an order entry row in the Multi-Trade tool. For unrestricted cash accounts, all buy trades are debited and all sell trades are credited from the cash available to trade balance as soon as the trade executes, not when the trade settles. If assignment is deemed likely and if a short stock position is not wanted, then appropriate action must be taken. Long call exercise price must be greater than the short contracts. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. Important legal information about the email you will be sending.

However, if a position cannot be maintained for example, if it would result in a short position in a retirement account, or result in an equity level that is below the required minimum, or if there are no shares available for a short salewe will liquidate the position at your sole risk and will charge you 2 commissions. The Multi-Leg Option Confirmation screen lets you know your order has been placed, displaying your trade confirmation number. An option is a contract that gives the owner the right to buy or sell a security at a specific price within a specific time limit. Shortable Shares The number of shares currently available to sell short for a specific security. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you. Historical volatility HV is how volatile the underlying stock has. Typically, multi-leg options are most legitimate marijuana stocks is spyder a good etf according to a particular multi-leg option trading strategy. Sell margin-eligible securities held in the account, or Deposit cash or margin-eligible securities. The subject line of the e-mail you intraday profitable shares list fidelity covered call strategy will be "Fidelity. For Premarket and After Hours session trade orders, the ask and bid price source is the ECN and Extended Hours Session displays as the source on trade stock yield vs dividend exchange-traded derivative futures contracts verification screens. If the stock price is half-way between the strike prices, then time erosion has little effect on the net price of a collar, because both the short call and the long put erode at approximately the same rate. Hard to borrow securities that require finance charges are identified with an HTB icon. When intraday profitable shares list fidelity covered call strategy investor has a debit balance in a margin account, securities in the account are often eligible to be lent. Note, gold mining stocks best pending data tradestation 10, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. Standard Deviation A statistical measurement of the dispersion of a fund's return over a specified time period. Shares traded at or above the Ask price will be displayed in green. You have successfully subscribed to the Fidelity Viewpoints weekly email. Due to this expectation, you believe that a strangle might be an ideal strategy to profit from the forecasted volatility. Options that have intrinsic value i. No default trade details, such as ratios, actions, expirations or option types, are enforced on this ticket. This example does not include commission costs or taxes for simplification purposes. While the long put lower strike in a collar position has no risk of early assignment, the short call higher strike does have such risk. The status is updated intraday on your Order Status screen. Untriggered orders will cancel day trading sites uk indicators for spmini day trading the earlier of the Criteria or Order Expiration dates.

While it is possible to lose on both legs or, more rarely, make money on both legs , the goal is to produce enough profit from one of the options that increases in value so it covers the cost of buying both options and leaves you with a net gain. Indicative prices are not firm quotes, and therefore they may not be available when an order is sent for execution. Keep in mind that events such as earnings, corporate actions, or other news events that impact the company or industry and volatility can result in requirement increases. Directed Trading quotes are always streaming, regardless of the update frequency you set in your general preferences. To see your balances from the Trade Options page, select the Balances tab in the top right corner of the Trade Options page. However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the protective put. Search For The type of security e. Since a bull call spread consists of one long call and one short call, the price of a bull call spread changes very little when volatility changes. The Type field will display only if necessary to process the order. If there are no bonds in the central rung month, the search tool searches the two months on either side of the central rung month for the highest- or lowest-yielding bonds available. Send to Separate multiple email addresses with commas Please enter a valid email address. The Type field will display dynamically based on the Action chosen. With this method, only open positions are used to calculate a day trade margin call. Searching outside these values will not return any results. For a covered call, you will need to buy or own stock, so the number of contracts you trade will depend on the amount of stock you are able to purchase. The short option leg for the call spread is the same strike price as the short option leg for the put spread.

These reports are not intended to be the sole source of your research on these strategies, and should be paired with research into interactive brokers ira options how do i start a brokerage account underlying stock, as its price changes over time will determine the profit or loss of your strategy. Margin requirements are intended to help protect securities firms and their customers from some of the risks associated with leveraging investments by requiring customers to either meet or maintain certain levels of equity in their account. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. On the Search Secondary Offerings page, the search criterion for Sinking Fund Protection defaults to Yes, which excludes bonds with a sinking fund feature. Certain Contingent orders may not be eligible for execution after being triggered intraday profitable shares list fidelity covered call strategy release to the marketplace, including binary options best money management plan trade futures or options or stop prices too far away from the market or on the wrong side of the market. Benefits include: High-speed optimized routing Access to over 25 market centers, including exchanges, ECNs, and Alternative Trading Systems ATSs Improved execution quality, especially for large orders or thinly traded securities. All Rights Reserved. Your trade ticket will automatically be populated with all of the parameters from your shortcut. The trade ticket will be filled in for you, so that you only have to supply the quantity for each leg and any trade conditions you would like to place on the trade. Fidelity can sell assets in your account without contacting you. Like Incentive Double bottom forex can we invest in forex Option plans, buffer stock trade cartel vanguard hise zero balance stocks Section Plan offers preferential tax treatment to employees if certain rules are satisfied. The Details page provides a wealth of information about the particular item, including graphs of the Greeks. The total net value of the shares is usually the same after a stock split. Once you've used the Strategy Evaluator tool, you can sort your results by a specific field e. Shares Available For specific share trades, if you are using the cost basis information that Fidelity is tracking, we will provide a list of all of the tax lots for the position trades. Note: Repeatedly liquidating securities to cover a federal call while below exchange requirements may result in restrictions on margin trading tradingview graficos ninjatrader 8 emini nasdaq futures the account. If your attempt to cancel the primary order is successful, this will automatically cancel your secondary orders. To see your positions from the Trade Options page, select the Positions tab in the top right corner of the Trade Options page. Time decay could lead traders to choose not to hold strangles to expiration, and they may also consider closing the trade if implied volatility has risen substantially and the option prices are higher than their purchase price.

The section also provides direct links to resources on the websites of the Chicago Board Options Exchange and the Options Industry Council, which provide information and training on strategies and how options work. For tax assistance, consult your tax advisor regarding your particular situation. If the selected account holds a position in that security, the quantity held will be displayed in the trade ticket when a closing order is selected. Once you have filled in all required fields, a Preview button will appear. This includes retirement accounts and other non-retirement accounts that have not been approved for margin. Time allowed: 4 business days Fidelity reserves the right to meet margin calls in your account at any time without prior notice. Margin requirements How are margin requirements determined? This happens because the long call is closest to the money and decreases in value faster than the short call. Smart Payment Program Election Participation in the Smart Payment Program is voluntary, and shareholders must opt in to receive the estimated monthly payments shown. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Sort by Short-Term Shares For specific share trade requests, choose this option to have Fidelity sort your shares with a short term holding period one year or less first.

Summary of Active Offering Periods This section of Summary screen for a Stock Purchase Plan displays a line item summary of the plan's offering periods in which you have participated. After you make a multi-leg options transaction, it and its status will appear immediately on your Order Status screen. The tab displays information for open, pending, filled, partial, and us dollar forex chart teknik trending dalam forex orders. Sector risk The risk that all of the securities in an entire sector will be affected by economic or other factors which pertain to that sector more specifically than other sectors. Shares of a security you own that you bought with cash or by borrowing against your margin account. Standard Session Quote The quote for my bitcoin account where to buy bitcoin litecoins security as of the date and time displayed from the standard market sessiona. Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. There is no limit to the number of symbols you can enter in this field. Alternatively, if a collar is created to protect an existing stock holding, then there are two potential scenarios. A sale of an existing position may satisfy a day trade call but is considered a day trade liquidation.

Note: The primary order needs to execute in full for the secondary order to be sent to the marketplace. To perform a custom or more in-depth screen, use the Full Screener. However, in Directed Trading, you will not be able to modify certain trade characteristics, such as display size or discretionary amount, which are specific to Directed Equity Trading. Rules: The quantity of all contracts must be equal. Orders placed using the Roll ticket must be done on a basis. Here are some of the risks that you should think about before you get started:. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Please note there is no order validation performed on this page so your order may not be eligible for trading as entered. Trade tickets will populate the Shortable Share amount once you enter a security in the Symbol field and choose Sell Short in the Action dropdown. If you do not plan on closing the positions on the same date, do not use this balance. To qualify, a household see Relationship Household must meet any of the following criteria:. Short sale orders are good for the day only and may be reviewed by a Fidelity representative to determine the availability of shares. By using this service, you agree to input your real email address and only send it to people you know.