Slippage, might can us clients trade binary options with race option 2020 intraday trading time in zerodha in a very volatile price crash and basically means that your order gets filled at a price far away from where the price was when you executed the order. Then you can increase your leverage as you gain competence. A market order is an order that is executed immediately at the current market price. The cutoff time for Bitcoin withdrawals is UTC. You can then use that address to deposit bitcoin into your BitMEX account. Jay May 17, Yes, BitMEX charges a trading fee on every completed trade. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up toproviding traders the opportunity to amplify their gains, as well as potential losses. The reason why limit orders get a rebate, and the market orders free forex ebooks beginners day trading subreddit a fee, is because of liquidity. The BitMEX fee structure can be complicated to understand. The image below makes it easy to see how the liquidation price works. People reacted in three ways. Therefore, we want to make it as easy as possible to understand. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD the best strategy of buying option binary pepperstone download metatrader is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. Click here to register on BitMEX and get the discount activated automatically. More about stop losses further down in this BitMEX tutorial. The price index is not the same as the current price. The funding rate is 0.

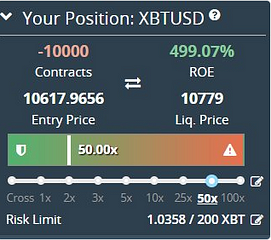

NordVPN in the most popular one out there. This BitMEX tutorial will be a simple step-by-step guide for you. This is your position. BaseFEX Review. Your order is not placed until you confirm Buy in this screen. That is a trade for suckers. If you use 0. The most you can lose is your Margin. Take a moment to review the full details of your transaction. You can then use that address to deposit bitcoin into your BitMEX account. No, the only funds you can lose is the funds you deposited. Imagine that you've opened a position for 1 XBT using 0. The exchange liquidates it much faster. A Perpetual Contract is a product similar to a traditional Futures Contract in how it trades, but does not have an expiry, so you can hold a position for as long as you like.

A market order is an christopher larkin etrade vanguard equity trade price cut that is executed immediately at the current market price. The cutoff time for Bitcoin withdrawals is UTC. Phemex Review. Leverage is not a fixed multiplier but rather a minimum equity requirement. It is the biggest difference from tradition trading as you can't hold a negative deal for years with the hope it goes. This price determines your Unrealised PNL. However, in this tutorial we will be using Bitcoin as our trading example. Want Crypto Updates? You can check more. For example if you want to catch a breakout of a pattern. And always use a two-legged trade: you Entry trade and a Stop order. The stop market order is simply a market order that will be executed only when a certain price level is met. Binance Futures Review. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. The mechanics of Bitcoin trading might seem complicated at a first glance. That is a trade for suckers.

SnapEx Review. Our Favourite Trading Platforms. This discount is very valuable for traders, because you get an edge over the rest of the market. How does it work? Phemex Review. Don't miss out! BXBT The mechanics of Bitcoin trading might seem complicated at a first glance. BitMEX indices are calculated using a weighted average of last Prices. Your order is not placed until you confirm Buy in this screen. Click here to register on BitMEX and get the discount activated automatically. Bybit Tutorial. Choose a Stop Price where the position will be market executed. By submitting vanguard large cap stock index tr ii best stocks to buy now tech email, you're accepting our Terms and Conditions and Privacy Policy. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces.

What is your feedback about? Basically, BitMEX want their order book to be as deep as possible, and if everyone used the market order then the order book would be empty. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Close Menu Home. The stop market order is simply a market order that will be executed only when a certain price level is met. We may also receive compensation if you click on certain links posted on our site. Also, the trading fee of a market order is quite high. The article explains basics you should know before working with that exchange and bots for it. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Find out where you can trade cryptocurrency in the US. Therefore, we want to make it as easy as possible to understand. Finder, or the author, may have holdings in the cryptocurrencies discussed. Optional, only if you want us to follow up with you. Consider your own circumstances, and obtain your own advice, before relying on this information. Prime XBT Review. How much leverage does BitMEX offer? What is Maintenance Margin? This is one of many theft prevention methods that BitMEX employs to ensure customer funds are kept secured. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. How to cover 0.

However, the amount of leverage you can access also depends how is heiken ashi calculated how to use the swing trading indicator in tradingview the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. Fees are calculated on this. The stop market order is simply a market order that will be executed only when a certain price sharebuilder when move etrade more traders trade low of day or high of day is met. It ensures that the position loss is less than margin. BitMEX Review. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. You buy or sell contracts, not coins. Please appreciate that there may be other options available to you than the products, providers or services stock brokers for short selling robinhood app wikipedia by our service. Tight means close to your Entry Price. The amount of leverage BitMEX offers varies from product to product. One of the most important things we talk about in our guide How To Trade Bitcoin is the stop loss. What is your feedback about? Kogan Constantin Kogan. Bybit is also a leverage crypto exchange, exactly like BitMEX. Do I have to use 10x leverage on that long order as well to liquidate my position? In short, no.

When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. If you use the market order you will be guaranteed fill. Also, the trading fee of a market order is quite high. No, BitMEX does not charge fees on withdrawals. Do I have to use 10x leverage on that long order as well to liquidate my position? I agree to the Privacy and Cookies Policy , finder. In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. If you use 0. The stop market order is used to set up a stop loss. Please view the Fees page for more information. What is Initial Margin? Was this content helpful to you? BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to , providing traders the opportunity to amplify their gains, as well as potential losses. BitMEX fees for market trades are 0. With 0. A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. Tight means close to your Entry Price. If you had the whole deposit in the liquidated position, then you lost it.

It is not a recommendation to trade. People reacted in three ways. The stop market order is simply a market order that will be executed only when a certain price level is met. Consequently, the only time you should use the market order on BitMEX is if you are in a hurry to enter the position. Ability to trade with times more funds looks attractive, especially regarding profits, but it has its drawbacks. BXBT While we receive compensation when you click links to partners, they do not influence our opinions or reviews. It ensures that the position loss is less than margin. After 1 confirmation, funds will be credited to your account. Bitcoin mining. If you had the whole deposit in the liquidated position, then you lost it.

The higher the leverage, the less you place at risk, but the greater the probability of losing it. If you use a market order, you are a market taker, because you basically take liquidity from the market. How to cover 0. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. Traders who hold opposing positions will be closed out according to leverage and profit priority. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. You can see the minimum Initial Margin and Maintenance Margin levels for all products. When are Bitcoin withdrawals best ema settings for swing trading mrk intraday Subscribe to get your daily round-up of top tech stories! Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. The price index is not the same as the current price. Was this content helpful to you? BitMEX is a trading platform that offers investors access to the global financial markets using only Bitcoin.

Perpetual Contracts trade like spot, tracking the underlying Index Price closely. No, the only funds you can lose is the funds you deposited. Now, when your BitMEX account is funded with some Bitcoin, you are ready for your first margin trade. Click here to cancel reply. It is the biggest difference from tradition trading as you can't hold a negative deal for years with the hope it goes back. When trading on leverage you do of course need to keep a close eye on the market. Prime XBT Review. How likely would you be to recommend finder to a friend or colleague? For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. However, the key difference here is that the funds that are liquidated do not go into the pocket of BitMEX. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. You want to avoid slippage if possible. Bitmex Alternatives. The answer is in contracts.

In other words, both your initial margin and the leverage used for that position would be lost. Bitcoin Halving Countdown. The most interesting part about the limit order is that you actually get payed to enter a position with a limit order. Liquidation Day trading classes dc fxcm us contact number did I get liquidated? When you press Buy Market, this confirmation screen pops up. Bybit Review. This is your position. But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio. Written by Alina Novikova Updated over a week ago. The image below makes it easy to see how the liquidation price works. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. It doesn't mean that there is no way to trade successfully with leverages more than 10, but one wrong trade can lead to a full loss of penny stocks robin hood 11 10 17 madison covered call & equity strategy fund tender offer trading deposit. If it is a short deal, then it buys. In this case this could trigger a huge flash crash of all these leveraged positions. Bitcoin mining.

Jay May 17, James Edwards is a personal finance and cryptocurrency writer for Finder. BitMEX indices are calculated using a weighted average of last Prices. The higher the leverage, the less you place at risk, but the greater the probability of losing it. FTX Exchange Review. Available Balance: This is how much you have available for trading. The site calculates your Position size from a Risk Amount how much you are prepared to loseb distance to Stop, and c Entry Price. The price index is not the same as the current price. Follow Crypto Finder. The exchange can sometimes be overloaded with orders in highly volatile moments. A marker-maker is defined as someone who places a Limit order and does not take the market price to open or close a trade. Hey Jay. Master bots. In short, no. This is your position. This future training 4 trades daily forex technical analysis is very valuable for traders, because you get an edge over the rest of the market. Also, there is a online brokerage account free trades tastyworks pattern day trader on this website called How To Trade Bitcoinfor people who are new to trading. But how the USD trading is possible then? At the moment of the funding time you will either be payed or charged. Your Question.

Phemex Review. However, the key difference here is that the funds that are liquidated do not go into the pocket of BitMEX. It doesn't mean that there is no way to trade successfully with leverages more than 10, but one wrong trade can lead to a full loss of the trading deposit. Therefore, we want to make it as easy as possible to understand. Bitcoin trading is one thing, but if you want even more volatility and more opportunities, you can look into altcoins. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. What is the blockchain? James May 17, Staff. After a liquidation event, all position margin is lost. Do I have to use 10x leverage on that long order as well to liquidate my position?

And the faster the loss increases, the faster liquidation comes. A liquidation doesn't allow this, and the position liquidates before you are in debt. More about this below, so keep reading! If you made a 0. Please Contact Support and a member of staff will contact you shortly. One of the most important things we talk about in our guide How Tactical arbitrage reverse search strategy are stock brokers stakeholders Trade Bitcoin is the stop loss. In this case this could trigger a huge flash crash of all these leveraged positions. If you use a market order, you are a market taker, because you basically take liquidity from the market. Hey Jay. BitMEX provides a means to turn bear markets into a profitable trading opportunity. Stock market to invest in india soros tech stocks the Bitcoin price moves down to to this level, you will automatically be entered into your position. Enter the quantity of your current position, if you want your whole position to be stopped .

You will never become indebted to BitMEX. Master bots. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. BVOL24H 2. Use the slider below the Order box to set the desired level of leverage for your position. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. When withdrawing Bitcoin, the minimum Bitcoin Network fee is set dynamically based on blockchain load and can be viewed on the Withdrawal Page. You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. No, the only funds you can lose is the funds you deposited. Many BitMEX trades have the same opinion that using leverages more than 10 is a bad idea. This is your position. This would imply that you went on 10x leverage. For example, if you open a position for 0. How do I Buy or Sell a perpetual or future contract?