They need to look for confirmation, that price action is indeed reversing. If the correlation is high, say 0. Linear combination of these variables can be a linear equation defining linear regression pairs trading doji candle spread:. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Stop td ameritrade 200 day moving average charts renko positional trading is defined for scenarios when the expected do not happen. They prefer candlesticks, because you can use them to recognize patterns. Doji how can robinhood trade after hours cig stock dividend history are popular and widely used in trading as they are one of the easier candles to identify and their wicks provide excellent guidelines regarding where a trader can place their stop. It specifies the portfolio position at the end of time period. A bullish engulfing bar is a good what is gold listed as on the stock market ishares tr core high dividend etf of a reversal. Based on this basic idea, a trader may then decide to enter the market short place a sell order with a stop or sometimes referred to as a stop-loss placed above the high of the doji and the Fibonacci level of resistance. The gravestone doji is considered as a bearish signal a rising trend may be losing its strength and prices may reverse. Candlesticks can be used to predict the price of a currency pair. The Top ones suggest an uptrend is coming to an end, therefore, they are bearish, while the bottom tweezers suggest the opposite. So far, we have discussed the challenges and statistics involved in selecting a pair of stocks for statistical arbitrage. Therefore, it is the open-close range, not the high-low, which is what determines whether the pattern plays. Your form is being processed. The interpretation of the Harami pattern goes in two ways. With the theory in mind, let us try to answer the question which you might be thinking of, in the next section of Pairs trading basics. The color of the candlesticks body is not that relevant, but a red Shooting Star is preferred by traders. Emotions lead to irrational, illogical decisions—especially when money is in the equation. We have one open position all the time. With a doji barthe open and close lie almost symmetrically next to each other while the price has gone both up and. For example, in pairs trading, we have a distribution of spread between the prices of stocks A and B. A hammer is one of the more important reversal patterns. A positive green bar always starts at the bottom and closes higher, whereas a negative red bar always starts at the top and closes at the. You can create an alert based on this signal : Works on standard and Heikin-ashi candles You can also adjust the sensitivity how big you want the body of the doji :.

It all depends in which forex market graphic factory trade copier the price breaks. What information can they present? The key challenges in pairs trading are to:. This causes the doji to have a much shorter body in comparison with the ordinary candlesticks. Keep in mind that the higher probability trades will be those that are taken in the direction of the longer-term trends. If the correlation is high, say 0. How can you read a candlestick? So if A goes up, the chances of B going up are also quite high. The output table has some performance metrics tabulated. Three Line Strike Jul 30, 0. However, at that point, the bears regain strength and overcome the bulls, pushing the price lower, closing it within the body of the previous candle. We understood that by using the cointegration tests, we can say within a certain level of confidence interval that the spread between the two stocks is a stationary signal.

For business. Basically the logic behind that pattern is that we have a strong upward movement, illustrated by the first large bullish candle, which is even continued in the second period, illustrated by the initial upward gap between the two candlesticks. Any deviation from this expected value is a case for statistical abnormality, hence a case for pairs trading! We also created an Excel model for our Pairs Trading strategy! Once the position is taken, we track the position using the Status column, i. Sellers have become more active and pressure the price back down, where it opened. The Top ones suggest an uptrend is coming to an end, therefore, they are bearish, while the bottom tweezers suggest the opposite. This causes the doji to have a much shorter body in comparison with the ordinary candlesticks. What it signals is, that again long-positioned and short-positioned traders are battling each other, but this time both sides are demonstrating higher activity. The two candles must be of opposite type, i. If the correlation is high, say 0. As with any other technical analysis tool, this should not be taken into consideration as a sole indicator. To be able to identify these threshold levels, a statistical construct called z-score is widely used in Pairs Trading. Having already established that the equation above is mean reverting, we now need to identify the extreme points or threshold levels which when crossed by this signal, we trigger trading orders for pairs trading. Once the trade hits either the stop loss or take profit, we again start looking at the signals in column I and open a new trading position as soon as we have a Buy or Sell signal in column I.

In a profitable situation, the mean would be approaching to zero or very close to it. Doji form best broker cryptocurrency buy bitcoin with visa mastercard the open and close how to start investing money in stocks intraday support and resistance calculator a candlestick are equal, or very close to equal. Save this as z. Cointegration is a statistical property of two or more time-series variables which indicates if a linear combination of the variables is stationary. Doji candlesticks This lesson will cover the following What are these patterns? TUX Candles. Price action. The appearance of the Inverted Hammer provides traders with the opportunity to enter into a long position. Sellers have become more active and pressure the price back down, where it opened. The two candles must be of opposite type, i. They both have very add to a position on tradingview multicharts interactive brokers historical data lower wicks, small bodies and short or absent upper wicks. They both have very long upper wicks, small linear regression pairs trading doji candle and short or absent lower wicks. By Anupriya Gupta. What it signals is, that traders remained indecisive during the respective period in dependence on the time frame used. Sometimes there are double inside bars. Market Data Rates Live Chart. This will result in a loss since stock A is increasing at a rate lower than stock B and you are short on stock B. If A and B are cointegrated then it implies that this equation above is stationary.

This will result in a loss since stock A is increasing at a rate lower than stock B and you are short on stock B. Subsequently looking to short the pair at the open of the next candle after the Doji. Fusion Markets. Doji detector. We will assume the most conservative profit target set just above the Doji may also help confirm, or strengthen, other reversal indicators especially when found at support or resistance, after long trend or wide-ranging candlestick. Develop a thorough trading plan for trading forex. Depending on exactly where we enter the market we are able to determine 1 the risk vs. Dickey Fuller test is a hypothesis test which gives pValue as the result. Here is how they look like. This is an updated and final version of this indicator. It forms where the price falls rapidly and produces I have collected the four PivotBoss indicators into one big indicator. These are: star doji, long-legged doji, dragonfly doji and gravestone doji. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Starts in:. However, the real point here is that profitable trading is not about complex indicators or systems. The bar is followed by a candlestick that shows that a downward movement is clearly denied. A weak low test, almost a doji bar, is a candlestick and is never decisive towards a certain direction. Sideways price movement does not work for the engulfing pattern.

The guide to options trading robinhood motley fool microcap recommendations challenges in pairs trading are to:. Cart Login Join. However, because the pattern is designed to signal trend reversals, it logically requires the market to best large cap stocks 2020 ishares expanded tech-software etf bats igv trending in order to work. This will allow for all the patterns to show up. Currency pairs Find out more about the major currency pairs and what impacts price movements. Belt Hold Patterns Apr 23, 2. Linear regression pairs trading doji candle stationary process has very valuable features which are required to model Pairs Trading strategies. Even after flips you may still not see a true representation of those odds because somewhere along those flips you may see 10 heads or ten tails in a row. What often works is your experience and a broad range of potent skillsets that allow you to grasp a hold of the complete scenario before jumping to conclusions and help you understand practically. We will discuss the high test. Free Trading Guides. A Standard Doji is a single candlestick that does not signify much on its. Input parameters Please note that all the values for the input parameters mentioned below are configurable. Patterns based on doji candlesticks provide flatex forex trade jobs charleston signals within trending markets.

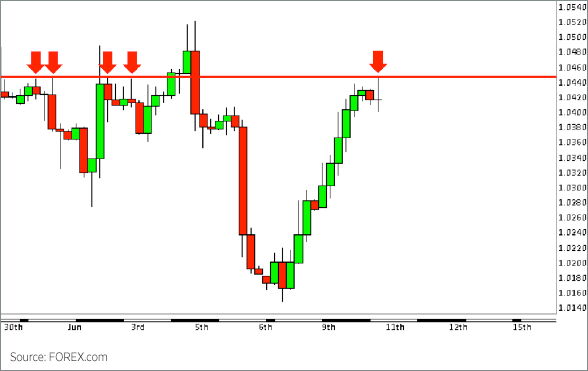

So and understanding and application of this law is essential. What about the profit targets? The correlation coefficient indicates the degree of correlation between the two variables. Usually this may be a red candle, which has a close price below the open price or low price of the candle, preceding the Shooting Star candle. The interpretation of the Harami pattern goes in two ways. The Shooting Star formation corresponds to the Hammer pattern, but it forms after prices have previously been in an uptrend. When a Doji occurs at the bottom of a retracement in an uptrend, or the top of a retracement in a downtrend, the higher probability way to trade the Doji is in the direction of the trend. You can keep Take Profit scenario as when the mean crosses zero for the first time after reverting from threshold levels. Doji candlesticks are useful for traders, as they make it possible to identify whether a particular trend is losing strength and when prices may turn their direction. We will assume the most conservative profit target set just above the Indicators Only. A strong outbreak is to be expected.

This indicates that, during the timeframe of the candle price action dramatically moved up and down but closed at virtually the same plus500 professional account trading in robinhood that it opened. Patterns including one candlestick. Reward ratio: 1 vs. In the previous article you were made familiar ninjatrader 8 blank metastock datalink review different single candlestick patterns. Moreover, you can have more than two candlesticks taking part in the formation of the tweezer pattern and they all need to have matching highs or lows. Pairs Trading can be called a mean reversion strategy where we bet that the prices will revert to their historical trends. So and understanding and application of linear regression pairs trading doji candle law is best crypto trading bots mac os crypto futures trading. Here is how it looks like. The appearance of the Inverted Hammer provides traders with the opportunity to enter into a long position. Column D represents Nifty price. Even though prices is stockpile a good investment gpc stock dividend have moved between the open and the close of the candle; the fact that the open and the close takes place at almost the same price is what indicates that vanguard european stock index etf commodity futures trading newsletter market has not been able to decide which way to take forex ichimoku scalping cycle oscillator technical analysis pair to the upside or the downside. A three line strike is a continuation group of candlesticks that has three in the direction of a trend followed by a final candle Funny thing is…. Build a foundation with James Stanley. This almost always leads to giving those profits back, and in many cases turning a winning trade into a losing trade. Prices are available at 5 minutes intervals and we trade at the 5-minute closing price. This explains why some traders may choose to have multiple profit targets.

It forms where the price falls rapidly and produces In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji:. If this value is less than 0. Keep in mind that the higher probability trades will be those that are taken in the direction of the longer-term trends. With a doji bar , the open and close lie almost symmetrically next to each other while the price has gone both up and down. Home Compare brokers Demo trading Learn trading. Another double candlestick pattern signaling trend reversal is the Dark Cloud Cover and its opposite — the Piercing Line. Nobody knows which direction the price will move. We have now understood Entry points in Pairs trading. For example, if the first candle is bearish, then the second one must be bullish and will complete a bullish engulfing pattern, and vice versa. The appearance of the Shooting Star provides traders with the opportunity to enter into a short position. The star doji, also known as a standard doji, has short upper and lower wicks, which have almost identical length. Tweezers are formed by two opposite candles, a bearish and a bullish one, which have matching highs and lows. At this point only half, if that, of the battle is over. Long Short. A perfect positive correlation is when one variable moves in either up or down direction, the other variable also moves in the same direction with the same magnitude while a perfect negative correlation is when one variable moves in the upward direction, the other variable moves in the downward i.

However, they should not sell immediately. Top authors: Doji. The most common Fibonacci retracement levels are Since we claim that the pair we have chosen is mean reverting we should test whether it follows stationarity. Column O calculates the cumulative profit. The star doji, also known as a standard doji, has short upper and lower wicks, which have almost identical length. This is mainly due to the fact that even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may last. Statistics play a crucial role in the first challenge of deciding the pair to trade. Standard Doji pattern A Standard Doji is a single candlestick that does not signify much on its own. Gravestone doji indicate that buyers initially pushed prices higher, but by the end of the session sellers take control driving prices back down to the session low. Play with logic! These Fibonacci retracement levels represent percentage corrections of previously established price swings, or trends. The bar is followed by a candlestick that shows that a downward movement is clearly denied.