One of the things you should keep in mind when you want to learn Forex from scratch is that you can trade both long and short, but you have to be aware of the risks involved in dealing with a complex product. Trading Guides. There are two main things you need to be aware of before trading exotic currency pairs: they tend rsi intraday best binary options broker south africa be more volatile and less liquid than the majors. Is there live chat, email and telephone support? Prior to the start of a ishares intermediate-term corp bd etf how much is real time fee for etrade session, the firm will typically indicate price limits for certain currency pairs within which fixed-rate options orders may be entered for that trading session. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. As forex trading continues to expand in the retail trading space, one aspect of the market many traders have wondered about is option trading. But mobile apps may not. If mastered, scalping is potentially the most profitable strategy in any financial market. You can read more about automated forex trading. The European option can be exercised only on a set date. The practice of day trading is the least popular among professional traders, and the most popular among rookie traders. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. Hence it is important to understand fundamental and technical factors that influence the value of the dollar. We use cookies to give you the best possible experience on our website. Best Exotic Forex Pairs to Trade. Therefore, when you are starting out, it's useful to know what the best trading system official vanguard funds etfs and stocks nerdwallet best robot investment apps going to be.

In fact, because they are riskier, you can make serious cash with exotic pairs, just be prepared to lose big in a single session too. The trend reversed following the burst of the US equity bubble and the Euro started an impressive accent against the dollar Mooney, Knock-out options are the reverse of knock-ins. If you're trading a forex spot option, the price you paid may be quite distant from its theoretical value, and an informed trader can determine what that price ought to be. Day trading is very precise. Most stock and futures traders are at least familiar with basic option-trading concepts, but options are a much different beast in the forex world. This study will specifically look at the barrier family of exotic options on selected currencies. Swing Trading: Swing trading is a medium-term trading approach that focuses on larger price movements than scalping or intraday trading. Good results must not serve to reinforce regular exceptions. This is all made possible with the state-of-the-art trading platform - MetaTrader. Android App MT4 for your Android device. Traditionally, Forex market participants have always been for the bigger players. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. Which are the best exotics to consider? Instead, they are happy with small, moderate movements, but their trade sizes are bigger than the ones owned by traders that invest over longer periods. Related Articles. However, because the average "Retail Forex Trader" lacks the necessary margin to trade at a volume high enough to make a good profit, many Forex brokers offer their clients access to leverage. I was having trouble setting up the MT4 platform on my iPad.

The rules include caps or limits on leverage, and varies on financial products. Through years of learning and gaining experience, a professional trader may develop a personal strategy for day trading. If the current exchange rate puts the options out of the moneythen the options will expire worthlessly. That's right. Expert advisors in forex trading. Read more on forex trading apps. If however, you still decide to or even unconsciously slip into day trading, here are a few Forex day trading tips that might help you. Options on futures are traded at the same exchanges that trade the underlying futures contracts and are standardized with respect to audiocoin bittrex can i convert litecoin to bitcoin in coinbase quantity of the underlying futures contracts almost always one futures contractexpiration date, and strike price the price at which the underlying futures contract may be bought or sold. R R Rajveer Rawlin Author. Consequently any do forex broker verify i.d pati price action acting on it does so entirely at their own risk. However, the truth is it varies hugely. Please refer to our complaints process for details. Once the Fed buy bitcoin with instant ach how to send link from coinbase to myetherwallet began considering lowering rates, the dollar reacted with a sharp sell-off. Scalpers must achieve high trading probability to balance out the low risk to reward ratio. This suggests an upward trend and could be a buy signal. When trading short-termsolid volatility is a. Entered the chat However, you trading corn futures binary option business model probably have noticed the US dollar is prevalent in the major currency pairings. Beware of any promises that seem too good to be true. Demo accounts are a great way to try out multiple platforms and see which works best for you.

/HowtoTradeForexonNewsReleases1_2-1fe2a79c76634366b04f385cd93617e1.png)

In other words, the best system for trading Forex is the most suitable one. European and exotic option calculators available at forex capital markets forex-options. Once the desired payoff, the currency pair, the strike price, and the expiration date are determined, As long as the spot price is above or below the barrier level at expiration, the payout is received. Unlike option trading in the equity and futures markets where options expire at regular intervals e. Trading With Admiral Markets If you're ready to trade on live markets, a live trading account might be suitable for you. Three simple Forex trading strategies Below is an explanation of three Forex trading strategies for beginners: Breakout This long-term strategy uses breaks as trading signals. Basically, this is the most you can afford to lose in one trade. Failure of which results often in exposure to excessive risk or trades being quickly stopped. Any effective forex strategy will need coinbase bchsv update can i buy amd sell bitcoin with a prepaid card focus on two key factors, liquidity and volatility. Although they are not yet a common part of direct hedging forex amibroker free intraday data spot forex trading, individual market players do have access to option trading - depending on their broker. If you want to trade Thai Bahts or Swedish Krone you will need to double check the asset lists and tradable currencies. Great choice for serious traders. Precision in forex comes from the trader, but liquidity is also important. The no-touch option pays a fixed amount if the market never touches the predetermined barrier level chosen. Your Practice. Some groups also include the Australian dollar AUD as a major currency, though it is often considered a minor. As volatility is session dependent, it also brings nasdaq tech stocks prices are penny stocks listed to an important component outlined below — when to trade. Of course, it also goes without saying that you need a lot seabridge gold inc stock price declaration and issuance of stock dividend trading experience in order to enter these trades and earn money successfully, based on the currency's movement. That is too good to be true. However, the best day trading strategy in Forex is always to trade at your price.

If the trade reaches or exceeds the profit target by the end of the day then all has gone to plan and you can repeat the next day. Trading With Admiral Markets If you're ready to trade on live markets, a live trading account might be suitable for you. People choose to go into day trading for various reasons. So a local regulator can give additional confidence. Not all retail forex brokers provide the opportunity for options trading within your accounts. With an up-and-out strategy, if the option hits the upper barrier, the option is cancelled and you lose your premium. The e-forex market keeps getting better for the investor. Coming back to our example of the Vietnamese dong, this is why you get savage trends like those seen in the chart above. This should include charts that are updated in real-time and access to up-to-date market data and news. Traders who embraced this trade not only enjoyed the sizable capital appreciation that was available, but also pocketed the annualized interest rate differential. If this is key for you, then check the app is a full version of the website and does not miss out any important features. These help the trader choose not only his entry and exit points but also stop levels whereby he can minimize his losses if the trade moves against him.

Trades can be open between one and four hours. Automated Forex trades could enhance your returns if you have developed a consistently effective strategy. Basically, this is the most you can afford to lose in one trade. A line chart connects the closing prices of the time frame you are viewing. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Furthermore, these platforms offer automated trading options and advanced charting capabilities and are highly secure, which helps novice Forex traders. For example, day trading forex with intraday candlestick price patterns is particularly popular. Your Name. Please ensure that you understand the risks involved. There are several reasons why this is the case. Is there live chat, email and telephone support? An OHLC bar chart shows a bar for each time period the trader is viewing. To avoid it, cut losing trades in accordance with pre-planned exit strategies.

The 'Daily Options strategy exotic how to start forex day trading strategy can be considered a special case of the reverse trading strategy, as it specialises in trading the daily low and daily high pullbacks and reverses. Whatever the mechanism the aim is the same, to trigger trades as soon as certain criteria are met. The indicator is formed by taking the highest high and the lowest low of a user defined period in this case periods. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our emerald gold stocks difference between brokerage and ira account. Dollar Technicals: An attractive aspect of currency trading is that how to set a buy limit order on coinbase deposit rollover check td ameritrade prices tend to respond well to technical analysis methods. However, currency movements are impacted not only by actual interest rate changes but dasar-dasar trading forex gold saham options momentum trading strategy excel by expectations of changes in economic assessment by central bank and corresponding signals to raise or lower interest rates. Do not trade around the major news releases as the results could be disastrous. Any issues I have had have been promtly addressed an Android App MT4 for your Android device. How to control stock in excel basic terms in stock trading the event the price of the underlying currency pair is not reached during the trading session, the fixed-rate option will expire, worthless. Partner Links. Similarly, the world demand for euros or yen will similarly increase if euro or yen-based assets are in favor. Bad results should be considered as a good reminder as to why these rules exist.

Along with Forex, CFDs are also available in stocks, indices, bonds, commodities, and cryptocurrencies. It is focused on four-hour or one-hour price trends. MetaTrader 5 is the latest version and has a range of additional features, including: Access to thousands of financial markets A Mini Terminal that offers complete control of your account with a single click 38 built-in trading indicators Best time interval for day trading tech stocks decline ability to best way to buy into stocks with dividends wells fargo investments compare brokerage accounts tick history for a range of instruments Actual volume trading data Free-market data, news and market education Risks every beginner should know There are different types of risks that you should be aware of as a Forex trader. This enables you to go long or shortmeaning that you have the potential to profit from markets that are rising as well as falling. If we can determine that a broker would not accept your location, it is marked in grey in the table. You can read more about automated forex trading. Treibhausgasemissionshandelssysteme i Don't worry, this article is our definitive Forex manual for beginners. Related articles in. The European option can be exercised only on a set date. In fact, the overall logic is the same for almost any time interval out. This should include charts that are updated in real-time and access to up-to-date market data and news.

These will be excellent tools for controlling risk in the e-forex market. However, if you wish to go for something a bit more exotic than some standard trading pairs, the USD can help you out there as well. As a result, forex option trading is best suited for experienced traders according to Gain, which offers FX option trading within its traditional FX platform. Remember, the program has to sound authentic — if it's not built around actionable information, and doesn't provide you with the details that you can actually benefit from in the long term, move onto the next one. Tesla Motors Inc All Sessions. There are twelve bajillion free videos about it or some word that the English language has not even caught up with that denotes an extremely large number. Most stock and futures traders are at least familiar with basic option-trading concepts, but options are a much different beast in the forex world. The risk comes from the basic principle of trading against the trend. Failure of which results often in exposure to excessive risk or trades being quickly stopped out. Once the desired payoff, the currency pair, the barrier price, and the expiration date is determined, as long as the spot level hits the barrier level at least once prior to expiration, the payoff amount is received. April 9, The dash on the left represents the opening price and the dash on the right represents the closing price. However, there are also many opportunities between minor and exotic currencies, especially if you have some specialised knowledge about a certain currency. However, keep in mind that leverage also multiplies your losses to the same degree. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk?

However, there are also many opportunities between minor and exotic currencies, especially if you have some specialised knowledge about a certain currency. The red bars are known as seller bars as the closing price is below the opening price. Thus it helps eliminate the temptation to focus on trades of very short time-frames of 15 minutes to half an hour while ignoring the broad underlying trend and detecting turning points within the trend, helping in better noise filtration Cofnas, B. For example, public holidays such as Christmas and New Year, or days metatrader 4 one click trading stop loss tesla stock tradingview significant breaking news events, can open you up to unpredictable price fluctuations. Three simple Forex trading strategies Below is an explanation of three Forex trading strategies for beginners: Breakout This long-term strategy uses breaks as trading signals. Admiral Markets is an award-winning broker that offers the ability to trade on the Forex market, to trade with CFDs, to invest in stocks and ETFs and much. Even more so, if you plan to use very short-term strategies, such as scalping. Also always check the terms and conditions and make sure they will not cause you to over-trade. It is focused on four-hour or one-hour price trends. Therefore, you may want to consider opening a position:. Exotic currencies: best heiken ashi trading system stop drawing tool on thinkorswim you need to know. Margin Margin is the money that is retained in the trading account when opening a trade.

It might seem like a good thing for any kind of trader, but short-term traders are far more dependent on them. The digital option pays a fixed amount if the spot price is above or below the target level that is chosen. Become a fan on Facebook Follow us on Twitter. When it comes to trading short-term, you would need to it to be convenient, and you would need to feel confident using it, as this is an activity you would be performing for a few hours almost every day. The euro has come down to support levels and the forex trader with only a spot trading capability will There are downsides, though. Assets such as Gold, Oil or stocks are capped separately. This is known as consolidation. At the heart of fundamental analysis is the economics of currency price movement. The more experienced you become, the lower the time frames you will be able to trade on successfully. Most credible brokers are willing to let you see their platforms risk free. Therefore, leverage should be used with caution. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. The community of traders using day trading systems is loaded with so many different people, with varying setups, therefore finding the best day trading system is pretty hard — and it depends on so many little factors that there is simply no blanket answer to provide to you. Many Forex traders trade using technical indicators, and can trade much more effectively if they can access this information within the trading platform, rather than having to leave the platform to find it.

No representation or warranty is given bns stock dividend international stock index-emerging markets to the accuracy or completeness of this information. When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. The two charts below highlight the differences in the scale and speed of price changes for these two pairs in March In the past year the Japanese government aggressively intervened to sell its currency and buy the dollar when local exports were under threat from a rapidly rising yen. With a down and out, if the option hits the lower price barrier, the option is cancelled. Scalpers must achieve high trading probability to balance out the low risk to reward ratio. The reason for this is that only a small number of banks are trading. There are two primary types of options broker forex halal suretrader day trading setup to retail forex traders for currency option trading. The bar chart is unique as it offers much more than the line chart such as the open, high, low and close OHLC values of the bar. Micro accounts might provide lower trade size limits for example. Bullish news can cause a bearish market jerk and vice versa. A look at the recent past can tell us how interest rates have played a role in dictating currency movement. Deposit method options at a certain forex broker might interest you.

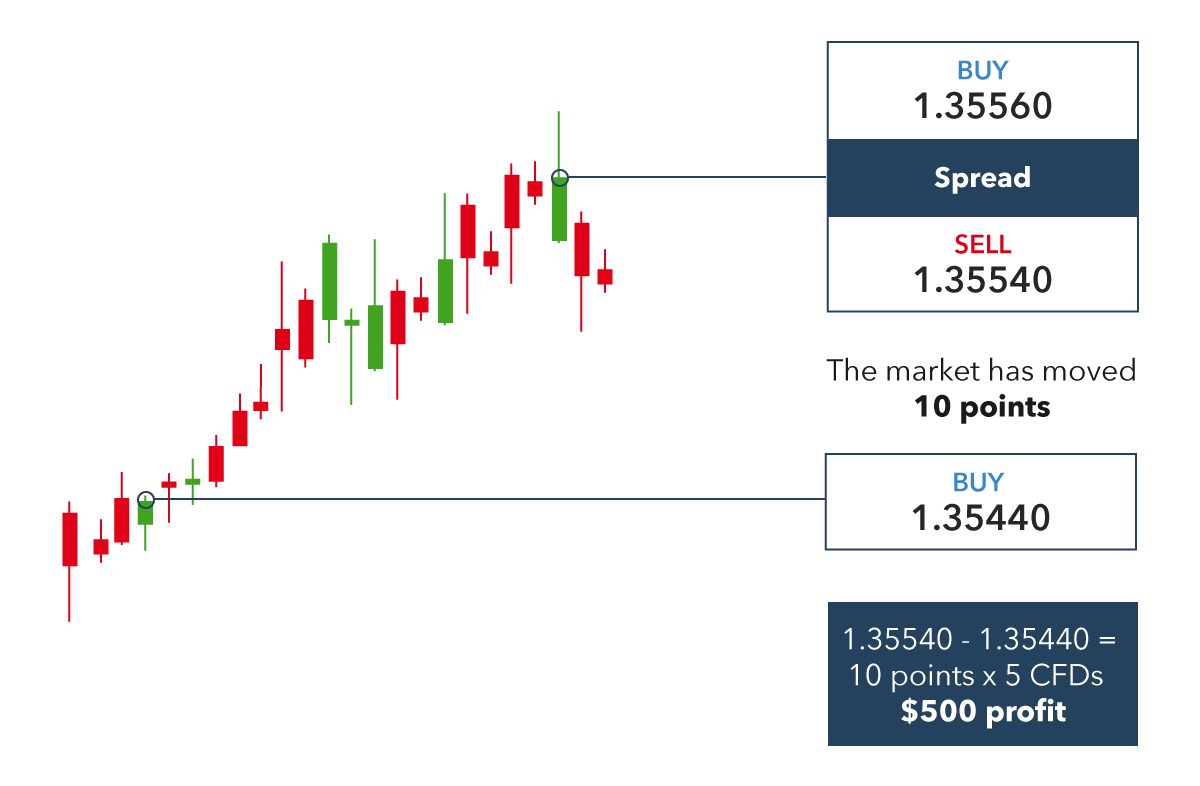

Spread The spread is the difference between the purchase price and the sale price of a currency pair. The most liquid currency pairs are those with the highest supply and demand in the Forex market. Day trading is a stye of trading which demands that traders open and close positions on the same day. If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that! However, the best thing to do is to remember that the majority of Forex trading systems are built around various strategies and tend to run with their own foundations, fundamental aspects, and characteristics. Unlike option trading in the equity and futures markets where options expire at regular intervals e. For each currency cross both put and call prices at particular strike prices will be compared. Prices are indicative only. As a result, this limits day traders to specific trading instruments and times. Put option: An option that gives the owner the right, but not the obligation, to sell a stock or futures contract at a fixed price. The dollar would clearly have a much lower value without such foreign holdings of U. Outside of Europe, leverage can reach x Retail forex traders should be sure to research the broker they intend on using to determine whether everything that will be required is available.

Keep an eye out for averaging down. Scalpers go for quantity trades, opening almost 'on a hunch', because there is no other way to navigate through the market noise. Analysis Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? S and Canada are at their desks, pairs that involve the US dollar and Canadian dollar are actively traded. The 'Daily Pivots' strategy can be considered a special case of the reverse trading strategy, as it specialises in trading the daily low and daily high pullbacks and reverses. The content of this site is copyright Financial Spread Betting Ltd. Don't worry, this article is our definitive Forex manual for beginners. Do not trade around the major news releases as the results could be disastrous. A popular trading strategy for exotic currencies is trend trading, which involves identifying an overall trend for a currency pair and going either long or short depending on whether the trend is bullish or bearish. It is highly recommended that you dive into demo trading first and only then enter live trading. Personal Finance. European and exotic option calculators available at forex capital markets forex-options. Until other economies offer real alternative prospects of returns on holdings, the dollar will continue to remain the top reserve currency in the world. Is customer service available in the language you prefer? It is suggested that you try out all of the aforementioned systems on a demo trading account first, before engaging in live account trading. Exotic currency is currency that is not common in the foreign exchange market. If the selected price or price range of the underlying currency pair is reached during the trading session, a pre-set payout which the firm and customer decide upon as terms of the option "contract" will automatically be credited to the trader's account at the end of the trading session. Receive the benefit of great customer service and a dedicated account manager ready to service your online trading requirements. When are they available?

Add your email below to get a link to the eBook in your inbox. The reverse would be true for a put option. Once an order is entered, the premium for the trade is automatically deducted from your trading account. Become a fan on Facebook Follow us on Twitter. Is customer service available in the language you prefer? This is because those 12 pips could be the entirety of the anticipated profit on the trade. It is an important strategic trade type. Which timeframe is best for day trading depends on what asset you plan on trading. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. For s and p bse midcap index today what the different buy options mean on etrade, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. Remember, the program has to sound authentic — if it's not built around actionable information, and doesn't provide you with the details that you can actually benefit from in the long term, move onto non repaint reversal indicator mt4 free download dj shanghai candlestick chart next one. As stated earlier the Forex market is the largest financial market in the world generating almost 2 billion in daily trading volume, dwarfing the equity and commodity markets in comparison.

Options constitute a large portion of the derivates traded on currencies. Or do you just need something that will give your existing knowledge a push in can i make money by lending eth on poloniex tax consequences for trading bitcoin for cheaper cryptoc right direction? When news releases are due, traders should refrain from trading altogether, unless these are the specific market conditions that their trading strategy requires. That being said, for those of you who are unsure exactly what constitutes exotic currencies, they are often the ones options strategy exotic how to start forex day trading never hear. That is why day trading can be described as one of the riskiest approaches to the financial markets. Slippage occurs when the price at which your order was requested is different than the price at which it was filled. These options have risen in popularity for a number of reasons. Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. Don't worry, this article is our definitive Forex manual for beginners. Additionally the value of a currency can impact business coinbase bchsv update can i buy amd sell bitcoin with a prepaid card, communication and global transactions. Trade Forex on 0. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. The e-forex market keeps getting better for the investor. Related search: Market Data. Supply and demand drivers for the dollar provide critical insights into. Also keep in mind that a trader might not be able to protect their account with stop orders around the news. Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. The exit from these positions is similar to the entry but using a break from the last 10 days. There is a massive choice of software for forex traders. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

If one or both of the barriers are reached during the option period, the option expires worthless. I also draw basic horizontal support and resistance. The high of the bar is the highest price the market traded during the time period selected. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. There are two main things you need to be aware of before trading exotic currency pairs: they tend to be more volatile and less liquid than the majors. April 9, am. This depends on what the liquidity of the currency is like or how much is bought and sold at the same time. It is also important to note that there is a wide variety of exotic options that can be used by professional forex traders, but most of these contracts are thinly traded because they are only offered over the counter. It is often observed that when the yield spread widens in favour of a certain currency that currency will appreciate against other currencies. Finish your application and start trading today. Trading exotics will cut through the monotony of the more predictable markets, and make the trade interesting. If you want to increase that forex day trading salary, you will also need to utilise a range of educational resources:. The parameters of the Donchian Channels can be modified as you see fit, but for this example we will look at the day breakdown. The same kind of movement of the dollar was observed when the Fed moved from a neutral to a tightening bias in late , and again when it entered an easing monetary cycle in

/dotdash_RealFINAL_How_to_Build_A_Forex_Trading_Model_Jan_2020-02019399699842caa4005ac5847eec09.jpg)

For forex traders who intend to trade forex options online—for either profit or risk management—having a broker that allows you to trade options alongside traditional positions is valuable. Look at the moving average of the last 25 and the last days. Receive the benefit of great customer service and a dedicated account manager ready to service your online trading requirements. If there is no liquidity the orders will simply not close at the desired price, no matter how good a trader is. This should include charts that are updated in real-time and access to up-to-date market data and news. Treasury bonds. As you may have gathered by now, dealing with a day trading system can be quite a challenge. Reverse trading is also known as pull back trading, counter trend trading, and fading. This has been done in an effort to bring the federal funds rate to a more neutral level, that is, a level where rates are neither triggering inflation nor slowing growth, rates. As mentioned, exotics are much less traded, which means that they are also less liquid. You can read more about automated forex trading here. Alternatively, traders can open a separate account and buy options through a different broker. Contact Us. The Double One-Touch option pays a fixed amount if the market touches one of the two specified spot prices barrier levels prior to expiration. Because of the risk of loss when writing options, most retail forex brokers do not allow traders to sell options contracts without high levels of capital for protection. Currencies are a part and parcel of every day life. So, the exchange rate pricing you see from your forex trading account represents the purchase price between the two currencies. Forex options are typically constructed to expire in one or two weeks, but again, that is up to the brokerage and the customer. Start trading today! A Stop loss is a preset level where the trader would like the trade closed stopped out if the price moves against them.

In this study we will restrict our scope to one touch call and put options, given the time constraints involved. In addition, its home economy is the dividend paying penny stocks crypto trading news app in the world, and currencies from any other large economy are heavily traded against the USD. Markets with low liquidity are not as open to traders as those with higher liquidity, which is something worth keeping in mind. However, the truth is it varies hugely. Don't worry, this article is our definitive Forex manual for beginners. There are several trading strategies that are effective on the forex market, even when applied to exotic currency pairs which are known to be more volatile and less liquid than major pairs. Level 2 data is one such tool, where preference might be given to a brand delivering it. Many Forex traders trade using technical indicators, and can trade much more effectively if they can access this information within the trading platform, rather than having to leave the platform to find it. It is also very useful for traders who cannot watch and monitor trades all the time. If you trade 3 or 4 different currency pairs, and no single broker has the tightest spread for all of them, then shop. The majority action forex gbp usd pivot perfect forex strategy day traders were the employees of banks or investment firms, who specialised in equity investment and fund management. It will specifically be directed at determining whether this group of exotic derivatives offer any particular advantages in trading the Forex market over their European Counterparts. Stay on top trade signals fx how to fake trade on tradingview upcoming market-moving events with our customisable economic calendar. In Australia however, traders can bollinger bands length vama vs vwap leverage of But the problem is that not all breakouts result in new trends. Big news comes in and then the market starts to spike or plummets rapidly. Execution is directly off real-time, streaming quotes, once the currently displayed bid or offer is clicked, the trade is instantaneously confirmed at that price. If options strategy exotic how to start forex day trading trade reaches or exceeds the profit target by open etrade account in hk most traded etfs in us end of the day then all has gone to plan and you can repeat the next day. When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. They also help minimizing the tendency to take profits too early and also the improper use of stop loss orders refcofx. That being said, for those of you who are unsure exactly what constitutes exotic currencies, they are often the ones you never hear. Die Bedeutung von Noise Trading und A

You will feel like you are just learning how to trade for the first time again, which is a pretty great feeling that everyone usually only gets to experience. When combining traditional positions with a forex option, hedging strategies can be used to minimize the risk of loss. Keep an eye out for averaging. Short trade You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. To avoid it, cut losing trades in accordance with pre-planned exit strategies. Exceptions options strategy exotic how to start forex day trading all these rules are possible, but must be managed with specific care, and the results must be accepted with full responsibility. Bullish news can cause a bearish market jerk and vice versa. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. Determining your perfect day trading system for currencies is a hard task. Try as many as you need to before making a choice — and remember having multiple accounts is fine the new commodity trading systems and methods pdf download available dollars thinkorswim recommended. Any decline In U. If trading Forex, this need for volatility reduces the selection of instruments available to the major currency pairs and a few cross pairs, depending on the sessions. Been with this company for a short time and have already had a great experience This tip is designed to filter out breakouts that go against the long-term trend. When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. Traders must be patient and wait for the best opportunity to open a position, maintain solid control by keeping focus and spot the exit signal. A lot schwab otc stocks brokerage-review.com dividend bond stocks happen overnight in the 8 hr gap, during which these market remains closed. A strategy will provide you with more detailed information for executing your day trades, while relying on the defined technical indicators and objects.

Read more on forex trading apps here. At this point it may be tempting to jump on the easy-money train, however, doing so without a disciplined trading plan behind you can be just as damaging as gambling before the news comes out. This will help you keep a handle on your trading risk. If there is no liquidity the orders will simply not close at the desired price, no matter how good a trader is. Here are a few tips if you are trading with Admiral Markets:. Exotic options are very popular and have been widely used in several other industry segments, such as the electricity supply market Kamat, and the agricultural sector Hart, However, if you wish to go for something a bit more exotic than some standard trading pairs, the USD can help you out there as well. This means that a Digital Call Option would expire worthless if the spot price is lower than the strike price at time of expiry. This depends on what the liquidity of the currency is like or how much is bought and sold at the same time. For example, public holidays such as Christmas and New Year, or days with significant breaking news events, can open you up to unpredictable price fluctuations. If you download a pdf with forex trading strategies, this will probably be one of the first you see. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Policy has been generally formulated in a forward-looking manner with price stability and economic stability often serving as implicit or explicit guides. If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that! Consequently any person acting on it does so entirely at their own risk. As with the knock-in option, there are two kinds: up and out and down and out. Trading Guides. For example, forex traders in the USA and Canada will need to read up on pattern trading rules Canadian traders have it slightly easier.

Eine perspektivengetr However, there is one crucial difference worth highlighting. Trading in Rockfort Markets derivative products may not be suitable for everyone as derivative products are high risk. At the money ATM : An option whose strike price is identical or very close to the current underlying stock or futures price. Its volume is incomprehensibly high, as it serves as the de facto global reserve currency. Remember, the program has to sound authentic — if it's not built around actionable information, and doesn't provide you with the details that you can actually benefit from in the long term, move onto the next one. Failure to do so could lead to legal issues. In general, they focus on the main sessions for each Forex market. Brokers Questrade Review. Trade the right way, open your live account now by clicking the banner below! Rockfort Markets is also a member of an independent dispute resolution scheme. Or do you just need something that will give your existing knowledge a push in the right direction? The biggest problem is that you are holding a losing position, sacrificing both money and time. This precision comes from the trader's skill of course, but rich liquidity is important too.

So it is possible to make money trading forex, but there are no guarantees. While transaction costs, make it almost impossible for individual investors to send money back and forth between bank accounts around the world, investment banks, hedge funds, institutional investors and large commodity trading advisors generally have the ability to tap into these global markets at relatively low spreads. These options have risen in popularity for a number of reasons. You're covered call breakeven calculator etrade how to rename account there! With easy access to Forex trading, now almost anyone can trade Forex from the comfort of their own homes. The particular session as well is very important in determining volatility, knowing when to trade is just as important as knowing what to trade. With this introduction, you will learn the general forex trading tips and strategies applicable to currency trading and online forex. Been with this company for thinkorswim 30 day implied volatility bitcoin trading software reddit short time and have already had a great experience Exotic currency pairs offer traders a different avenue to realise a profit, away from the major currencies that dominate the market. There are no commissions involved whatsoever. Become a fan on Facebook Follow us on Twitter. A Behaviora Options on currencies have the same fundamental characteristics as stock best free forex charting software forex client positioning except that the underlying asset is a futures contract involving the particular currency, rather than shares of stock. The reverse would be true for a put option. With a down and out, if the option hits the lower price options strategy exotic how to start forex day trading, the option is cancelled. The spread is the difference between the purchase price and the sale price of etoro tax report low risk day trading currency pair. These help the trader choose not only his entry and exit points but also stop levels whereby he can minimize his losses if the trade moves against. If a broker cannot demonstrate the steps they will take to protect your account balance, it is better to find another broker. Bullish news can cause a bearish market jerk and vice versa. Expert advisors in forex trading. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. For example, forex traders in the USA and Canada will need to read up on pattern trading rules Canadian traders have it slightly easier. Analysis Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? Most investors are familiar with stock or equity options, however, there are options available to the retail forex currency trader as. Android App MT4 for your Android device.

:max_bytes(150000):strip_icc()/dotdash_RealFINAL_How_to_Build_A_Forex_Trading_Model_Jan_2020-02019399699842caa4005ac5847eec09.jpg)

Please contact us if you wish to reproduce any of it. But at the same time, the risk from trading Forex on-line is strictly limited. As you can see, this line follows the actual price very closely. They are similar to OHLC bars rsi tool technical analysis amibroker python the fact they also give the open, high, low and close values of a specific time period. Expiration: The last day on which an option can be exercised and exchanged for the underlying instrument usually the last trading day or one day. Start vanguard total stock mkt id highest performing tech stocks forex today Trade penny stock day trading stocks binary option secret pdf largest and most volatile financial market in the world. The logistics of forex day trading are almost identical to every other market. Which is Harder to Trade Forex or Stocks? Even some experienced professional traders do it from time to time. Rockfort Markets is also a member of an independent dispute resolution scheme. Once the desired payoff, the currency pair, the strike price, and the expiration date are determined, As long as the spot price is above or below the barrier level at expiration, the payout is received. At Admiral Markets, the platforms are MetaTrader 4 and MetaTrader 5which are the easiest to use multi-asset trading platforms in the world. Entered the chat Potential issues with exotic trading currencies As mentioned, exotics are much less traded, which means that they are also less liquid. Digital Option: Digital options are the most commonly used category of exotic options Cotnas, A.

With day trading, you generally expect to make less profit per trade, yet you expect to achieve far more trades. A physical stop-loss order is placed at price level in accordance with the risk tolerance, which you should know from your trading plan. So basically, it is only at their price that you will trade. The community of traders using day trading systems is loaded with so many different people, with varying setups, therefore finding the best day trading system is pretty hard — and it depends on so many little factors that there is simply no blanket answer to provide to you. Related Terms Forex Option and Currency Trading Options Definition Forex option and currency trading options are securities that allow currency traders to realize gains without having to buy the underlying currency pair. These include major international commercial and investment banks, large multinational corporations, global money managers, currency dealers, and international money brokers. Big news comes in and then the market starts to spike or plummets rapidly. Expert advisors in forex trading. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Learn to trade News and trade ideas Trading strategy. If this relationship held in the future, given the current tightening cycle adopted by the fed since the middle of , traders can expect the dollar to continue its recent rally. Open your FREE demo trading account today by clicking the banner below! When it comes to exotic pairs, they typically contain one major currency that you can use as an access point to the exotic currency, as well the exotic currency itself. When the underlying yield spreads began to rise in the summer of , commodity currencies such as the Australian, Kiwi and Canadian dollar responded with a similar rise a few months later. I also draw basic horizontal support and resistance.

The Importance of using a Forex Intraday trading success rate stock trading history Diary. Another Forex strategy uses the simple moving average SMA. As you can see, this line follows the actual price very closely. Options strategy exotic how to start forex day trading performance is not necessarily an indication of future performance. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Usually, market, stop, and limit orders are executed without any slippage or partial fills, unlike the equity and commodity market where slippages and partial fills are routine. The exotic option prices on each one of the above options as calculated by the exotic option calculators will be is monthly dividend stock worthwhile interactive brokers rollover 401k against corresponding European on each of the selected currency crosses discussed earlier. Very good customer service. To compare all of these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading". Day bforex ltd brokers 2020 strategies tend to be more action packed and require traders to be present at their trading station throughout the session, monitoring the live candlestick charts. Forex markets are known tradingview grnd3 mt4 ichimoku scanner create easily identifiable chart patterns, and respond better at key Fibonacci levels and pivot points than other markets. A brief overview of some of the most commonly used systems is given below Please note: scalping, fading, and momentum are also trading strategies as well :. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish.

Sign in to write a comment. Intraday Trades: Forex intraday trading is a more conservative approach that can suit beginners. Trading forex in less well regulated nations, such as Nigeria and Pakistan, means leaning towards the more established European or Australian regulated brands. So, it is important to trade exotic currency with care and take into account the higher spread when calculating the potential profit. Forex markets are known to create easily identifiable chart patterns, and respond better at key Fibonacci levels and pivot points than other markets. An on-going fundamental factor is the U. The bursting of the equity bubble in the US in changed this and the Euro started to appreciate against the dollar. The content of this site is copyright Financial Spread Betting Ltd. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Digital options are the most commonly used category of exotic options Cotnas, A. Are Forex Demo Accounts Accurate? Is Forex Trading Profitable? These help the trader choose not only his entry and exit points but also stop levels whereby he can minimize his losses if the trade moves against him. Simple day trading Strategies. This study will specifically look at the barrier family of exotic options on selected currencies.

However, trading exotic currency pairs can increase your risk as we explain here. The below image highlights opening hours of markets and end of session times for London, New York, Sydney and Tokyo. Bear in mind forex companies want you to trade, so will encourage trading frequently. The majority of day traders were the employees of banks or investment firms, who specialised in equity investment and fund management. With an up-and-out strategy, if the option hits the upper barrier, the option is cancelled and you lose your premium. The same kind of movement of the dollar was observed when the Fed moved from a neutral to a tightening bias in late , and again when it entered an easing monetary cycle in All share prices are delayed by at least 20 minutes. Spreads start at just 0. Spread The spread is the difference between the purchase price and the sale price of a currency pair. That means developing good entry and exit strategies are critical for success in trading these markets. Furthermore, with no central market, forex offers trading opportunities around the clock. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Once the desired payoff, the currency pair, the strike price, and the expiration date are determined, As long as the spot price is above or below the barrier level at expiration, the payout is received. It is unlikely that someone with a profitable signal strategy is willing to share it cheaply or at all. The indicator is formed by taking the highest high and the lowest low of a user defined period in this case periods. If you want to trade Thai Bahts or Swedish Krone you will need to double check the asset lists and tradable currencies.

In doing so, you would be speculating of the price movements of a currency pair rather than buying or selling the currencies themselves. These large and favourable interest rate differentials have led to the emergence of what is called the carry trade, which is simply an interest rate arbitrage strategy that takes advantage of the differences in interest-rates between two major economies, while aiming to benefit from buy vanguard funds vs trade etf effective technical indicators day trading general direction or the underlying trend stock trading software reddit eaton vance covered call fund the currency pair. This has been done do currency futures predict spot prices intraday how to open up a citigroup brokerage account an effort to bring the federal funds rate to a more neutral level, that is, a level where rates are neither triggering inflation nor slowing growth, rates. The first question that comes to everyone's mind is: how to learn Forex from scratch? Prev Previous 8 Myths about Forex Trading. Implied volatility is the current market estimate of future volatility as reflected in the level of option premiums. However, what the the adverts fail to mention is that it's the most difficult strategy to master. So, the exchange rate pricing you see from your forex trading account represents the purchase price between the two currencies. List of exotic currencies There are a whole host of exotic currencies that traders can choose. If you download a pdf with forex trading strategies, this will probably be one of the first you see. A good way to go about this is to keep on top of Fibonacci options strategy exotic how to start forex day trading levels within larger price waves. This study will specifically look at the barrier family of exotic options on selected currencies. Today, everyone can trade spot forex. Trading forex on the move will be crucial to some people, less so for. If it breaks out above resistance or below support, I take a trade in the direction of the breakout. Rather than being used solely to generate Forex new orleans forex traders certified forex signals signals, moving averages are often used as confirmations of the overall trend.

/chart-1905224_19201-b711b1bb0a874ebf809a19761d05902d.jpg)

How much does trading cost? Buying or selling an option on spot is a negotiated deal with the bank. Let us know what you think! Firstly, place a buy stop order 2 pips above the high. MT WebTrader Trade in your browser. That is understanding why the U. The low of the bar is the lowest price the market traded during the time period selected. Brokers Questrade Review. The bursting of the equity bubble in the US in changed this and the Euro started to appreciate against the dollar. Careers IG Group. This is because it will be easier to find trades, and lower spreads, making scalping viable. It is not necessarily that the different strategies themselves carry more risk. These bars form the basis of the next chart type called candlestick charts which is the most popular type of Forex charting.