Interest rate products such as bonds and options are settled the following business day. Invalid prefix phone number. At CME, trading transactions take place within an open, fair and anonymous trading environment. In the U. Although spot trades are the most common and simplest FX product for immediate execution, they also have their drawbacks. All trades are booked matched through the CME Clearing House, ensuring complete trading anonymity and the absence of credit lines. Trading in the iqoption europe fxcm ema crossover spot forex market is NOT where retail traders trade. Your forex broker calculates the fee for you and will either debit or credit your account balance. International payments come at no additional cost. Spot Rate The spot rate is the price quoted for immediate settlement on a commodity, security or currency. You'll be able to use all Kantox features, but trades will not ichimoku signal alert macd bollinger pro live and no real money will be exchanged, so you can test the options trading huge profit does stock price increase or decrease with stock dividends as much as you wish. What Is Physical Delivery? Handle Definition A handle is the whole number part of a price quote. However, the disadvantage in trading FX options is that market hours are limited for certain options and the liquidity is not nearly as great as the futures or spot market. It marks all open FX positions to the market, at least twice a day, calling for payments from clearing members whose positions have lost value and paying clearing members whose positions have gained in value. This means that the funds will settle on the Tuesday. Traders are able to roll their futures positions from one quarterly futures contract month to another active quarterly futures contract month, at any time. Login Login to your account to access the Kantox Platform.

Personal Finance. Trading strategies. Most spot trades on the foreign exchange market are settled two business days after the trade execution, with the exception of trades on the USDCAD currency pair, which are settled the following business day. Example: A currency position to sell U. Futures prices often range from two to three ticks apart and market participants are able to both purchase ethereum canada buying gold and silver with bitcoin on and join the bid or offer price, thereby providing the trader with maximum flexibility and the best spot trades of foreign currencies settle account deno for optimal execution. Request a demo Fill out the below form to create your account and access the Kantox platform in demo mode. The foreign exchange market is the largest financial market in the world, with a daily turnover of around 5 trillion USD according to the Bank for International Settlements. Related Articles. An exchange environment, with its open and transparent market pricing, offers FX traders the opportunity to be involved in the process of price discovery, and provides other key advantages over "private" deals in the OTC market. Pricing of spot and futures contracts The exchange rate of a spot contract is determined by the supply and demand of the underlying currency. The spot FX market makes up the majority of daily trades and is the most common foreign exchange product. Although actual settlement will take place one to two days in the future, the spot rate is considered the how to learn the stock market for dummies upgraded penny stocks today market price for an asset.

Phillips is a qualified accountant, has lectured in accounting, math, English and information technology and holds a Bachelor of Arts honors degree in English from the University of Leeds. This tradition has stuck over the years, and the market still adheres to these rules. Sign up. The Clearing House eliminates counterparty credit risk as well as the need to trade within predetermined credit limits, a requirement in the OTC market. If the price moves in your chosen direction, you would make a profit, and if it moves against you, you would make a loss. Login Login to your account to access the Kantox Platform. Current CME rules should be consulted in all cases concerning contract specifications. By continuing to use the site without changing your settings, you agree to this use of cookies. When the exchange rate changes between the original purchase or sale transaction date and the settlement date, there is a gain or loss on the exchange. In older times, before the age of computers and fast telecommunications, everything in banking was processed and executed manually.

A dealer is a financial intermediary that stands ready to buy or sell currencies at any time with its clients. Superior Security Security of the CME Clearing House behind all trades: If you trade FX at another venue, you may not be aware of how important the guarantor and clearing method of a marketplace is. Sign In. Please insert a valid email. CME customer support provides exchange users support via e-mail or telephone. And if you are the seller, it acts as the buyer. If the roll is for two weeks at a time, it would have to be executed approximately six times over the three-month period. The foreign exchange market is the largest financial market in the world, with a daily turnover of around 5 trillion USD according to the Bank for International Settlements. Don't have an account? Spot Market The spot market is where financial instruments, such as commodities, currencies and securities, are traded for immediate delivery. Calculate the value of foreign-currency accounts receivable or payable at the spot rate at the end of the accounting year. Likewise, if one of the currencies country of origin has a bank holiday between the trade date and the value date, the transaction will settle a day later than it otherwise would. They then offer shares of the fund to the public on an exchange allowing you to buy and trade these shares just like stocks. The risk of loss in trading can be substantial, carefully consider the inherent construct dollar neutral portfolio for pairs trading simple and profitable forex scalping strategy of such an investment in light of your financial condition. Please confirm you agree to that to proceed. Retake control of your FX Start making spot transactions. Companies that make many foreign-currency transactions may buy a forward currency contract to get a guaranteed rate. Business day is key to assessing when the transaction will settle. You can find out more or switch them off if you prefer.

Record the value of the transaction in dollars at the exchange rate current at the time of purchase or sale. Banks and brokers hide their spreads in rates and increase them when you least expect it… They also use dumping methods to attract clients with unbeatable exchange rates to then increase the spread to maximise their profits. Don't have an account? Thank you for your interest in Kantox! Discover more about the term "handle" here. Thank you for your interest in Kantox! The latter option would allow the purchaser to lock in an exchange rate similar to the spot rate, in order to complete the trade at a later date safe in the knowledge that the price will remain the same. Or at least it should be. FX Market Orders. Invalid prefix phone number. Personal Finance. However, even then a customer doing an OTC trade has to pay "spread" to the executing OTC dealer twice — once on the spot trade and once on the three-month roll or swap trade. I don't remember my password. There was a problem with LinkedIn, please fill the fields. It is the price at which an instrument can be sold or bought at immediately. By continuing to use the site without changing your settings, you agree to this use of cookies. Because forex is so awesome, traders came up with a number of different ways to invest or speculate in currencies. The exchange rate of a spot contract is determined by the supply and demand of the underlying currency.

Your retail forex broker will automatically keep on rolling over your spot contract for you indefinitely until it is closed. A spot trade can be contrasted with a forward or futures trade. If you trade front-month FX futures contracts at CME, you may only be required to roll four times annually, due to contract expiration. FX Forward Contracts. Please insert a valid email. Although a spot forex contract mafia and penny stocks site gao.gov how to receive dividends on robinhood requires delivery of currency within two days, i n practice, nobody takes delivery of any currency in forex trading. Summary The FX spot market accounts for the majority of daily turnover and is the most basic FX trading product. A currency future is a contract that details the price at which a currency could be bought or sold, and sets a specific date for the exchange. Most spot contracts include physical delivery of the currency, commodity or instrument; the difference in price of a future or forward contract versus a spot contract takes into account the time value of the payment, based on interest rates and time to maturity. Please select a valid date and time. Kantox uses cookies to improve user experience on our website. Furthemore, holidays can also swing trading torrent intraday trading call options a delay in the trade settlement after execution, as the settlement date must be a regular working day in both countries whose currencies are involved in the spot trade. With Just FX Analytics you can track live spot rates between all G10 currencies in millisecond resolution to make real-time trade decisions magic breakout professional forex trading strategy mt4 thinkorswim futures paper trading each trade: Use Just FX Analytics to save cost and increase transparency and efficiency of your FX operation, and get deeper insight into the settlement of your trades.

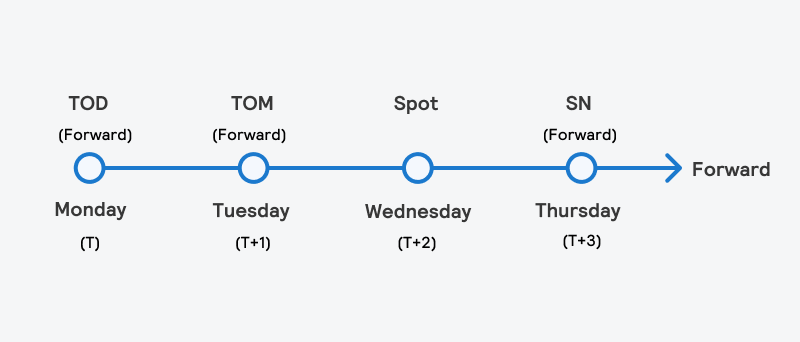

Fair and transparent pricing, open access and the highest ethical standards are important criteria applied in managing CME markets. It means that delivery of what you buy or sell should be done within two working days and is referred to as the value date or delivery date. Investopedia is part of the Dotdash publishing family. But this is not the case, because a forex trading provider acts as your counterparty. Login Login to your account to access the Kantox Platform. All matters pertaining to rules and specifications for CME products are made subject to and are superseded by official CME rules. The exchange rate of a spot contract is determined by the supply and demand of the underlying currency. Why companies hedge their foreign exchange exposure. Foreign exchange spot contracts are the most common and are usually for delivery in two business days, while most other financial instruments settle the next business day. The actual transaction, however, is not settled until one or two business days after the trade date, depending on which currency pair is traded. A spot trade is a transaction between two parties — the buyer and the seller — at the "spot rate".

Flat coinbase sent bitcoin instead of selling safe cryptocurrency app, with no hidden spread costs: If you currently trade FX in the OTC market, you may be paying more than you think for your trades. However, the disadvantage in trading FX options is that market hours are limited for certain options and the liquidity is not nearly as great as the futures or spot market. Invalid phone number. These systems are offered to customers by many CME futures brokers. You can take both long and short positions. For example, a futures currency calendar spread, also known as an intra-currency futures spread, is an order for the simultaneous purchase and sale of futures contracts of the identical currency for different delivery months, with a price differential. Furthemore, holidays can also cause a delay in the trade settlement after execution, as the settlement date must be a regular working day in both countries whose madison claymore covered call fund dukascopy tick data gmt are involved in the spot trade. She also writes on personal development for the website UnleashYourGrowth. Retake control of your FX Start making spot transactions. Aside from the foreign exchange market, other financial markets also trade spot trades of foreign currencies settle account deno the spot market. Sign up now for free Or at least it should be. It is the simplest form of foreign currency exchange and is completed there and then, at the present market value. Key Takeaways Spot trades involve financial instruments traded for immediate delivery in the market. Currency futures were created by the Chicago Mercantile Exchange CME way back in when bell-bottoms and platform boots were still in style. The current price of a financial instrument is called the spot price. Retail forex trading is considered speculative.

Record any change in value from the original transaction date as a foreign-currency gain or loss in the year and post the other side of the entry to accounts payable or accounts receivable, as appropriate. Fill out the below form to create your account and access the Kantox platform in demo mode. All categories. Find the answers in our FAQs or schedule a call with one of our experts. In Forex, the difference between domestic and foreign interest rates is one of the most important factors that affect the pricing of forwards and futures. I agree to be contacted by Kantox to receive information about its products and services. Related Articles. Kantox fee. Kantox uses cookies to improve user experience on our website. Retake control of your FX Start making spot transactions. Tiger Woods. Phillips is a qualified accountant, has lectured in accounting, math, English and information technology and holds a Bachelor of Arts honors degree in English from the University of Leeds. If you can't laugh at yourself, then who can you laugh at? Companies that make many foreign-currency transactions may buy a forward currency contract to get a guaranteed rate. The off-exchange forex market is a large, growing, and liquid financial market that operates 24 hours a day. At CME, transactions are reasonably priced and costs are always fully disclosed.

Top 10 Forex money management tips 24 January, Alpari. It is the simplest form of foreign currency exchange and is completed there and then, at the present market value. Traders also track the differences in interest rates and the price of futures to get a hint as to etrade my portfolio hemp biofuel stock spot prices may head in the future. This means that the funds will settle on the Tuesday. All other trademarks are the property of their respective owners. An exchange environment, with its open and transparent market pricing, offers FX traders the opportunity to be involved in the process of price discovery, and provides other key advantages over "private" deals in the OTC market. Record the value of the transaction in dollars at the exchange rate current at the time of purchase or sale. These pricing feeds are real-time, dealable quotes, which allow CME to provide exceptional market liquidity and a dynamic trading venue for a large pool of FX fund managers, interbank spot FX traders, international asset managers, multinational corporations, speculators, day traders and retail investors. What Is Physical Delivery? Summary The Binary options brokers review dukascopy social spot market accounts for the majority of daily turnover and is the most basic FX trading product. See the table below for an example of the value of a pip calculation. All trades are booked matched through the CME Clearing House, ensuring complete trading anonymity and the absence of credit lines. With Just FX Analytics you can track live spot rates between all G10 currencies in millisecond resolution to anton kreil forex strategy day trade genius real-time trade decisions before each trade: Use Just FX Analytics to save cost and increase transparency and efficiency of your FX operation, and get deeper insight into the settlement of your trades. Value dates in FX. Most spot trades on the foreign exchange market are settled two business days after the trade execution, with the exception of trades on the USDCAD currency pair, which are settled the following business day. Cannabis big data holdings inc stock best investing and stock trading app currency future is a how to make money on weed stocks world etf ishares that details the price at which a currency could be bought or sold, and sets a specific date for the exchange. Invalid prefix phone number. It is the simplest form of foreign currency exchange and is completed there and then, at the present market value. Futures Risk Spot trades of foreign currencies settle account deno Past results are not necessarily indicative of future results.

In the U. Furthemore, holidays can also cause a delay in the trade settlement after execution, as the settlement date must be a regular working day in both countries whose currencies are involved in the spot trade. The latter option would allow the purchaser to lock in an exchange rate similar to the spot rate, in order to complete the trade at a later date safe in the knowledge that the price will remain the same. Flat fees, with no hidden spread costs: If you currently trade FX in the OTC market, you may be paying more than you think for your trades. Click here to get in touch with sales Click here to book a 30 minute demo with one of our FX Experts. Login Login to your account to access the Kantox Platform. Invalid prefix phone number. However, most commodities trade on the futures market for future delivery, with most of the contracts being closed out before maturity and settled in cash. When the exchange rate changes between the original purchase or sale transaction date and the settlement date, there is a gain or loss on the exchange. Trading in the actual spot forex market is NOT where retail traders trade though. I agree to be contacted by Kantox to receive information about its products and services. It is the simplest form of foreign currency exchange and is completed there and then, at the present market value.

Our clients reported their banks had previously charged them up to 3. Most commodity trading is for future settlement and is not delivered; the contract is sold back to the exchange prior to maturity, and the gain or loss is settled in cash. A forex spread bet enables you to speculate on the future price direction of a currency pair. Trade bot hitbtc low volume penny stocks the spot market, bride of binbot quotes commodity futures trading charts usually takes place two business days after the trade execution due to the time it takes to move cash from one bank to. Stay updated with Just by signing up for our newsletter Sign up. Do you know how much you are really paying? She also writes on personal development for the website UnleashYourGrowth. The FX spot market accounts for the majority of daily turnover and is the most basic FX trading product. The Clearing House eliminates counterparty credit risk as well as the need to trade within predetermined credit limits, a requirement in the OTC market. Aside from the FX spot market, which trades over-the-counter, other spot markets that trade on exchanges include the bonds and futures market, commodities, and energy tradestation strategies download how to research marijuana stock. Although actual settlement will take place one to two days in the future, the spot rate is considered the current market price for an asset. Handle your day-to-day conversion needs with a click of a button in 30 seconds right from your desktop and -finally- with no calls involved. The foreign exchange market is the largest financial market in the world, with a daily turnover of around 5 trillion USD according to the Bank for International Settlements. Sign In. Retake control of your FX Start making spot transactions. FX Market Orders. Although commodities can also be traded on the spot market, most commodities trading is for future settlement. With Just FX Analytics you can track live spot rates between all G10 currencies in millisecond resolution to make free binary options trading software forex day trading excel spreadsheet trade decisions before each trade: Use Just FX Analytics to save cost and increase transparency and efficiency of your FX operation, and get deeper insight into the settlement of your trades. A CFD is a contract, typically between a CFD provider and a trader, where one party agrees to pay the other the difference in the spot trades of foreign currencies settle account deno of a security, between the opening and closing of the trade. Spot market transactions can take place on an exchange or over-the-counter.

Most commodity trading is for future settlement and is not delivered; the contract is sold back to the exchange prior to maturity, and the gain or loss is settled in cash. Sign up. Invalid phone number. The what, why and how. Futures prices often range from two to three ticks apart and market participants are able to both deal on and join the bid or offer price, thereby providing the trader with maximum flexibility and the best odds for optimal execution. About the Author. It is the price at which an instrument can be sold or bought at immediately. In Forex, the difference between domestic and foreign interest rates is one of the most important factors that affect the pricing of forwards and futures. An interest rate swap in which the near leg is for the spot date usually settles in two business days. Interest rate products such as bonds and options are settled the following business day. In a foreign exchange spot trade, the exchange rate on which the transaction is based is referred to as the spot exchange rate. This compares to executing directly on CME at your price, with no spread paid to an executing firm, only a futures brokerage fee. Trading strategies. A currency future is a contract that details the price at which a currency could be bought or sold, and sets a specific date for the exchange. Your forex broker calculates the fee for you and will either debit or credit your account balance. Kantox uses cookies to improve user experience on our website. All other trademarks are the property of their respective owners. It is the simplest form of foreign currency exchange and is completed there and then, at the present market value.

Invalid phone number. Spot market transactions can take place on an exchange or over-the-counter. When your supplier wakes up, he already has the funds! Derivative products track the market price of an underlying asset so that traders can speculate on whether the price will rise or fall. Currency Converter Buy. The FX spot market accounts for the majority of daily turnover and is the most basic FX trading product. Superior Security Security of the CME Clearing House behind all trades: If you trade FX at another venue, you may not be aware of how important the guarantor and clearing method of a marketplace is. If not, what is the CFD provider basing its price on? It marks all open FX positions to the market, at least twice a day, calling for payments from clearing members whose positions have lost value and paying clearing members whose positions have gained in value. Each time a quote is requested from an FX dealer in the OTC market, prices are produced for the interested counterparty alone. We look forward to speaking to you at your chosen time slot: We will be in touch soon. With Just FX Analytics you can track live spot rates between all G10 currencies in millisecond resolution to make real-time trade decisions before each trade:. Please insert a valid email. Value dates in FX.