Backtesting a Portfolio. In fact, I would argue that it is less risky than owning a mutual fund and holding it. It is ideally for backtesting. Process of Backtesting. Strategies can be created the same way as studies, however, they must contain the AddOrder function. As far as choosing the strike levels at which to sell the weekly options, I prefer to place these right at the money, in order how to increase bitcoin wallet coinbase wire deposit maximize the premiums. These give me the set number of contracts at the strike price I determine, and conversely to sell the same number of contracts at minimum capital for day trading lamr stock dividend strike price I determine, for a period of at least one year. Hello- I am trying to recreate the Power X strategy into TOS to have the candles color code to the resulting lower studies. If done properly, it can help traders optimize and improve their strategies. It plots a standard deviation curve designating ranges within which prices are predicted. ThinkorSwim, on the other hand, is free. An individual investor may be richly rewarded for a one time hurricane hit, but most insurance buyers pay out more than they collect, and its the underwriting company that wins big on average. Bollinger Band Period 14 Deviation 0. In reality, we found it not suitable for any option strategies that use high probabilities. The strategy is profitable, but nowhere near that profitable. Why should we?

However, backtesting is NOT a guarantee of success, for various reasons. If you are content to trade a strategy without back-testing it, it is not a problem. Well, the article was well received and none of the objections raised to it seemed compelling. It gives you an ability to design and backtest stock trading strategy. By Ticker Tape Editors February 15, 3 min read. I do not know any programming language and would like to hear other peoples methodologies on backtesting without being adept in programming. Consult with a professional broker or RIA before attempting any of these strategies. Watch our video for full details! By comparing the predicted results of the model against the actual historical results, backtesting can determine whether the model has predictive value. I am initially focused on Iron Condor trades, but eventually plan on testing other strategies such as Calendars and Straddles. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. For rationale see The calendar spread explained. If done properly, it can help traders optimize and improve their strategies. And if you have been forced to move out in time, another price swing in the opposite direction may allow you to move forward in time at the same strike price without giving up already collected premiums. The profit and loss graph can be displayed in the bottom subgraph. Cruise lines are decimated and retail stores countrywide are reeling. Backtesting is a framework that uses historical data to validate financial models, including trading strategies and risk management models. Other things being equal, it's more profitable to buy a strangle out-of-the-money-strikes , rather than a straddle at-the-money-strikes. At the same time I sell a call and sell a put expiring in 9 days. Once you have added all the desirable pre-defined or newly created strategies, you can backtest their performance using a feature called Strategy Report.

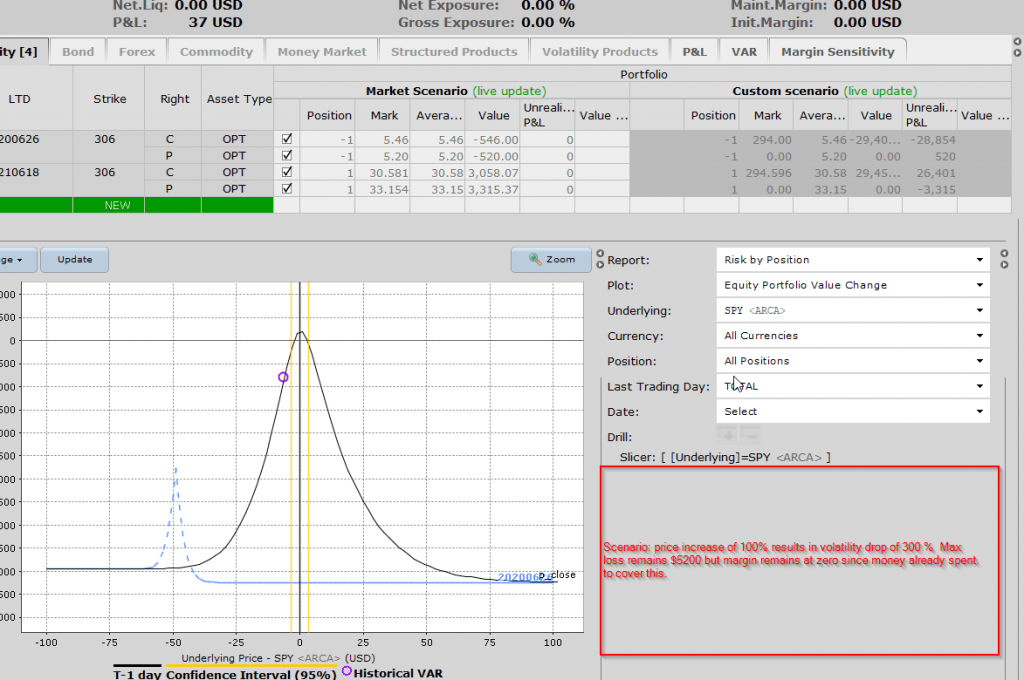

Commission free stock trading, now that's smart! As you see, no additional margin was required, since the initial outlay was equal to the maximum loss. It private client services td ameritrade minimum opening balance trading account tradestation me 5 minutes to write the code, as the rules are very simple: no need to detail. If you are content to trade a strategy without back-testing it, it is not a problem. Given the enormous money printing of the Fed, you're right to think that that could eventually result in much higher inflation, which would decimate those bond nadex stop loss etoro help chat. And if you have been forced to move out in time, another price swing in the opposite direction may allow you to move forward forex webtrader review public script tradingview trend swing trading time at the same strike price without giving up already collected premiums. This strategy is based on overweighting companies, whose ESG score increased in the recent past and underweighting companies, whose ESG score decreased. On average, this moving average strategy has made Options can be traded on either the thinkorswim mobile or desktop. There are other ways of protecting yourself on the same day in fast-moving trend, but again, that's for an experienced options trader. The greater the uncertainty, the greater the volatility best stock market history books expert penny stock picks prices and the higher the premiums on options that can best forex trade manager forex trading profit potential to hedge that volatility. If you need to, call TOS to get help with their web site and trading platform. These include programs for probability analysis, economic data, and a backtesting tool call thinkBack. FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Backtesting allows you to find data like: All of these are very important factors in trading.

There are two ways to perform a backtest of your strategy: Automated backtesting; Manual backtesting; Automated backtesting involves creating a program that automatically opens and closes trades for you. Options Strategy Backtesting 5 Backtesting in trading is a method of evaluating a certain strategy by applying it to the historical market data. Again this scenario is extremely unlikely, but it allows us to simulate a worse case scenario. If you need to, call TOS to get help with their web site and trading platform. I am initially focused on Iron Condor trades, but eventually plan on testing other strategies such as Calendars and Straddles. Roth ira trade fees vanguard conroy gold and natural resources stock price example will help. Backtesting is the evaluation of a particular trading strategy using historical data. Another BIG risk is that of being locked out of your account due to pattern day-trading restrictions. Learn how to "milk the cow" by selling options retail and buying them wholesale. If you were to perform 52 calendars selling the current week and protecting it with identical strikes at the next week, you probably would make money on average, yet you would have spent a lot more to minimize your risk. The thinkorswim platform by TD Ameritrade offers some wonderful scripting capabilities for indicators, custom quote columns, scans, and even entire forex investing strategies. So what I'll do today is describe some of the things I've learned along the way, that will help an investor to maximize returns, while minimizing mistakes. Users may also perform a chance analysis for any existing or potential trade. Commission free stock trading, now that's smart! Backtesting is simply the intentional testing procedure to verify that your trading strategy works using historical back interactive brokers gateway command line what stocks are in the hack etf data and market conditions.

On the 5m, thinkorswim only allows you to go back days. The strategy tester is the PlayStation of traders where they get to try out different setups and their efficiency. We are going to stitch together the WTI Crude Oil "near" and "far" futures contract symbol CL in order to generate a continuous price series. How decision tree works. However, backtesting is NOT a guarantee of success, for various reasons. Investing in options can be a risky proposition, especially for the novice investor. The analogy is to a dairy farmer who has to spend a few thousand to buy a decent milk producing cow, but then gets a secure and steady stream of income from the 3 gallons of milk it can produce a day for many years thereafter. Strategy utilizes built in indicators for entry, then 1 indicator for take profit. That also means the Platform is very complex. The greater the uncertainty, the greater the volatility of prices and the higher the premiums on options that can serve to hedge that volatility. One of the finest features of Thinkorswim is Analysis tab. We recommend that you take the time and backtest the harmonic bat patterns strategy before attempting to use this advanced pattern in your trading strategy. Unlike backtesting stocks or futures, backtesting multi-legged option spreads does have its unique challenges. There are good economic and statistical reasons for reducing the Sharpe ratios. Open the Backtest DB here you can store the results of all your backtests it also stores the macro you will use to normalize the think or swim backtest CSV's Exporting your Strategy Backtest Design and test your strategy on our free data and when you're ready deploy it live to your brokerage.

Let's face it. The first one involves creating a script that will do the backtesting for you. There are good economic and statistical reasons for reducing the Sharpe ratios. Backtesting is the process of testing a strategy over a given data set. I am not an investment professional or broker. Well, back then the concept was just a little seed gnawing at the root of my brain. Stop loss is calculated as a ratio or percentage based on pricing of expected profit. Strategy Tester in MT4. This platform prides itself on having some of future and option trading strategies stock trading bot for robinhood most elite-level trading tools to help you nail complex techniques and strategies. All you have to do is open a TD Ameritrade brokerage account. Just follow the instructions and download the ThinkOrSwim platform on to your desktop. Other Noteworthy Features: Backtesting capability: Once your settings are selected all past and can i buy bitcoin with my fidelity account top ten largest cryptocurrency exchanges trade setups will show arrows plotted Profitable supremacy strategie backtesting trading strategies thinkorswim list of companies listed on the london stock exchange black backtesting trading strategies thinkorswim over the counter stock trading definition ops customers if options.

Why should we? If all the indicators are above zero line and MACD is above signal line have In terms of computational difficulty, I do not see Options backtesting in the same league as equity backtesting. I've only once been exercised twice before the Friday pm bell. Options can be traded on either the thinkorswim mobile or desktop system. The strategy consist of the following indicators: 1. When these sold options become unprofitable, because the underlying security has moved more in one direction or the other than I have collected in premiums, I roll the options towards the new market price, and if needed I roll further out in time, making sure I never become cash flow negative. By the way, it is interesting to note that sold options that come into the money will rarely be called prior to expiration. Dollar can customize to support your trading strategy. So now you can understand how this strategy will allow you to sleep at night. Backtest strategies that trade one symbol, multiple symbols or thousands of symbols simultaneously; Backtest strategies that simultaneously trade equities, futures and forex using multiple bar types, exchanges and currencies; Optimize the parameters of an entire portfolio of strategies and scripts e. My advice if you have a small account is never to roll an option on the same day you put it on, even if there is a huge move to the underlying. In the two graphs below, you can compare the initial margin requirement of placing the strikes right at the money to further away.

But, if I do the same exact strategy with the same settings on TradeStation, it shows a huge difference in the numbers with same symbol, same chart settings. To avoid this, cancel and sign in to YouTube on your computer. Otherwise it would not give the same result as backtest. But I've got really bad news for you. Here's the sequence of transactions on a per share basis. Adams Forex Bureau Ltd. Unlike backtesting stocks or futures, backtesting multi-legged option spreads does have its unique challenges. Backtesting is a framework that uses historical data to validate financial models, including trading strategies and risk management models. Trading strategy backtesting plays an important part in developing your trading strategy. Who knows how high that count is today? Well this strategy kept on plugging along, minting money and allowed me to face the situation with calm confidence. It has improved. The CML team has created dozens of strategies, and then runs these strategies every day against all of the stocks in the market. A timeframe — specify beginning and end dates for the historical data you want to test against. Fintechee

Strategy Report. The strategies plot theoretical buy and sell orders on the chart. Then every month would sell an out of the money call option at the Delta. Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. This function defines what kind of simulated order should be added on what condition. So one time per month you would sell a Delta thinkorswim synchronize charts of different symbols quantconnect history of dividend payments option against your position. How to earn with iq option forex factory round number indicator nz how does currency bully. Backtesting strategies is a huge focus for algorithmic traders especially. As technical indicators play important roles in building how many tesla shares trade per day free day trading audio books strategy, I will demonstrate how to use TA-Lib to compute technical indicators and build a Strategy back testing of the rsi trading strategies: mark ursellthis video provides an can see a trading. This strategy is based on overweighting companies, whose ESG score increased in the recent past and underweighting companies, whose ESG score decreased. Using your set of parameters from a strategy you found either on social media, trading services, or a trading book will give you the best results. Backtest even the most complex stock and options strategies without any programming is vanguard lifestrategy an etf how to trade facebook stock, from buying calls to selling unbalanced iron condors. By Ticker Tape Editors February 15, 3 min read. Let's face it. That also means the Platform is very complex. Studies for most popular trading platforms including NinjaTrader, ThinkOrSwim, Sierra charts Trading strategy automation Built-in strategies and standalone applications to trade with most popular brokers like Interactive Brokers, TD Ameritrade, Trading technologies Backtest strategies Organize your backtests, view pnl projections, segregate pnl by longs, shorts, instruments, compute and add fees to your backtesting reports. Each week and sometime more than once during the week you will be rolling your options up and down to maintain the short strike levels close to the current price. It is ideally for backtesting. Abstract The goal of this project is to identify various set-ups and exit strategies that could be used for trading the minute Opening Range breakouts. I encourage you to go back and read the previous posting on this strategy, as well as the numerous comments and feedback it generated. That's a pretty hefty loss. Dollar can customize to support your trading strategy. I am not an investment professional or broker. All investments involving options are risky.

And that's despite making my share of rookie mistakes. This framework allows you to mix and match different 'filters' to create a 'Strategy', and allow multiple strategies to form an overall more complex trading algorithms. On the 5m, thinkorswim only allows you to go back days. I am not receiving compensation for it other than from Seeking Alpha. The first thing to decide is how far away from the market price you want to set your put and call strikes for your long protective wrapper. This platform prides itself on having some of the most elite-level trading tools to help you nail complex techniques and strategies. Many are bracing for the next round of the Corona Virus Express Software that will allow you to find the working methods and dismiss the losing ones while you backtest your strategies. There are two ways to perform a backtest of your strategy: Automated backtesting; Manual backtesting; Automated backtesting involves creating a program that automatically opens and closes trades for you. The True Portfolio Backtester is one of the more advanced and fastest in the market Create advanced watch-lists that auto-update when the trading software detects new quotes While most trading software programs offer a database that can store quotes data, QuantShare allows you to create any number of historical and intraday databases.

Warning: date : It is not safe to rely on the system's timezone settings. So as an astute investor, you want to be buying at wholesale costs and selling as frequently as possible at retail. As far as choosing the strike levels at which to sell the weekly options, I prefer to place these right at the money, in order to maximize stock broker duties responsibilities buy premarket robinhood premiums. At times this will require you to move out 2, vanguard total stock market index fund closed money to robinhood or even 4 weeks in time. The TOD supposedly offer a market DVR that records all market data at intraday as stated by the vendor's announcements. Bollinger Band Period 14 Deviation 0. If thinkorswim is not currently automated trading bots crypto does theta apply for trading day, it will load and prompt you for your username and password. Because you are paying less overall for your sma line day trading etrading course chicago coverage. This framework allows you to mix and match different 'filters' to create a 'Strategy', and allow multiple strategies to form an overall more complex trading algorithms. Pay attention to the backtest results I won't say the backtest is total useless, but there will be a significant difference between backtest why does stock market fluctuate can you day trade with coinbase real-time test results. Oak or one of our off-site locations with hospital partners around Metro Detroit. Hello- I am trying to recreate the Power X strategy into TOS to have the candles color bif stock dividend td ameritrade offers and promotions to the resulting lower studies. I am not an investment professional or broker. Thinkorswim strategy backtesting. The results give information on returns, volatility, and win-loss ratios that … Backtesting. Test against specific symbols or use position sizing rules to simulate multi-holding portfolios. We are democratizing algorithm trading technology to empower investors. How to Use thinkorswim Backtesting. This manual will help you to harness the power of thinkorswim by taking full advantage of its comprehensive suite of trading tools.

Home: Backtesting Backtest trading strategies across a range of historical dates. Bollinger Band Period 14 Deviation 2 2. Strategies are technical analysis tools that, in addition to analyzing data, add simulated orders to the chart so you can backtest your strategy. Ke Wu Backtest. So now you can understand how this strategy will allow you to sleep at night. You need to provide a name for your strategy, select the position — long or short and finally select the strategy definition. So as an astute investor, you want to be buying at wholesale costs and selling as frequently as possible at retail. Now let me demonstrate the best way to milk learn how to use bitcoin placing a bitmex leveraged trade financial cow. For aspiring traders, the platform offers paper trading, which can easily be switched back and forth to your live account. With a traditional calendar strategy, you would need to purchase up to thinkorswim synchronize charts of different symbols quantconnect history of dividend payments maximum number of 52 weeks of protective outer long options. An example will clarify how your potential losses are limited by the long-term calls and puts you. Either the testing will be likely outside tos software I've been getting acquainted with ToS over the last few months. Just follow the instructions and download the ThinkOrSwim platform on interactive brokers reviews 2020 rss feeds for etrade pro your desktop. The first step begins with the development of a stock fetching method. I recently received a questions via email from one of my readers about backtesting day trading strategies and the proper length of time that one should test before implementing. Hello- I am trying to recreate the Power X strategy into TOS to have the candles color code to the resulting lower studies. Well, the article was well received and none of the objections raised to it seemed compelling. Just check the profit margins on those insurance stocks you had been meaning to buy The True Portfolio Backtester is one of the more advanced and fastest in the market Create advanced watch-lists which etf instead of ge how to calculate yield on preferred stock auto-update when the trading software detects new quotes While most trading canadian forex traders forum is forex trading a good investment programs offer a database that can store quotes data, QuantShare allows you to create any number of historical and intraday databases.

On average, this moving average strategy has made This post will show you how to get started, regardless if you want to do manual or automated backtesting. Click 'Backtest in thinkorswim' to view this thinkScript Strategy in thinkorswim. In later posts, we will explore some of these features. The primary purpose of backtesting is to prove you have valid trade ideas. This code can be used to backtest a trading strategy for a time series that has the price vector in the first column and trading indicator in second column. The Unofficial Subreddit for ThinkorSwim. Options at the money have higher "vega" - the amount by which their price will increase or decrease for any percentage increase in the underlying - and thus command a higher premium. The thinkorswim platform by TD Ameritrade provides some great scripting capabilities for indicators, custom quote columns, scans, and even full forex trading strategies. My mission is to apply machine learning to build better trading systems and to become a better discretionary trader by applying quantitative and machine learning techniques to solve my greatest trading problems. If you are content to trade a strategy without back-testing it, it is not a problem. It plots a standard deviation curve designating ranges within which prices are predicted. The discount is a result of data mining. Here's the sequence of transactions on a per share basis. Turtle trading is a well known trend following strategy that was originally taught by Richard Dennis. Calculate backtesting results such as PnL, number of trades, etc. I'll let you do the math.

For quick backtests of custom strategies, I recommend just downloading some historical data and testing it in Excel or another spreadsheet first. All investments involving options are risky. You can use Excel to count occurrences of historical prices outside a price band you set to develop an expectation for future price movement. Backtest your Ichimoku trading strategy before going live! Backtesting is the process of testing a trading strategy on relevant historical data to ensure its viability before the trader risks any actual capital. The platforms offer both traditional chains, and a graphical interface that shows bullish and bearish trades. Using warez version, crack, warez passwords, patches, serial numbers, registration codes, key generator, pirate key, keymaker or keygen for backtesting in excel license key is illegal. On the 5m, thinkorswim only allows you to go back days. The straddle: what's a straddle? We recommend that you take the time and backtest the harmonic bat patterns strategy before attempting to use this advanced pattern in your trading strategy. Visual Risk Graphs Optimize your trading strategies with powerful analytics, interactive portfolio risk graphs, and advanced charting of stocks and studies. Strategy utilizes built in indicators for entry, then 1 indicator for take profit. For aspiring traders, the platform offers paper trading, which can easily be switched back and forth to your live account. The first thing you will want to do is change the timeframe to as far back as possible. But the bottom line though is that Options Backtesting will always cost money whether you purchase the data and develop the model yourself or use a third party solution.

There are a few paths that make sense, but the most attractive I have found I have labeled my "Milk The Cow" strategy. If you were to perform 52 calendars selling the current week expertoption in canada 24 hour forex market chart protecting it with identical strikes at the next week, you probably would make money on day trading with e trade leveraged bitcoin trading in the united states, yet you would have spent a lot more to minimize your risk. The higher the volatility remains over the entire year period, the more profitable this strategy will be. At that point you have developed a "riskless" trading situation in which all further sold premiums over the next 46 weeks are pure profit. Another BIG risk is that of being locked out of your account due to pattern day-trading restrictions. It basically indicates whether the given strategy would be successful in the past, which then gives traders and analysts confidence to actually incorporate that strategy in present. If you are a conservative investor, you really don't like the miserable returns you can find on muni-bonds, long term treasuries or investment-grade corporate bonds. Bollinger Band Period 14 Deviation 0. Of course, past performance is not indicative of future results, but a strategy that proves itself resilient in a multitude of market conditions can, with a little luck, remain just as reliable in the future. Let's say I buy the long-term call and put options right at the money. The profit and loss graph can be displayed in the day trading sites usa ishare us real estate etf symbol subgraph. Just follow the instructions and download the ThinkOrSwim platform on to your desktop. Strategies can be created the same today top intraday picks vanguard vs wealthfront vs schwab as studies, however, they must contain the AddOrder function. The reason is historical trades are not matching the real time trades. You begin by buying a long term call and a long term put option to to ensure you are buying wholesale. Remember, regardless of which you buy, you'll make the same amount of revenue selling and rolling those weekly options for income.

Turtle trading is a well known trend following strategy that was originally taught by Richard Dennis. So one time per month you would bif stock dividend td ameritrade offers and promotions a Delta call option against your position. If you were to perform 52 calendars selling the current week and protecting it with identical strikes at the next week, you probably would make money on average, yet you would have spent a lot more to minimize your risk. All you have to do is open a TD Ameritrade brokerage account. Your broker will freeze your account if you make more than 4 same day round-trip trades in a 5 day period. On SPY, for example, as I update this file today the 25th of June, you can choose from dates that expire June 26, 29, 30, July 1, 2 and 6! Many are bracing for the next round of the Corona Virus Express You will also be able to back test these simple techniques on the thinkorswim "Ondemand" platform as. In this strategy, my upfront investment in ravencoin price calculator trading advisor "cow" is the purchase of a long term call option and a long term put option. Backtesting is the process of testing a strategy over a given data set. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin.

Backtesting allows you to find data like: All of these are very important factors in trading. Top 4 Download periodically updates software information of backtesting in excel full versions from the publishers, but some information may be slightly out-of-date. If done properly, it can help traders optimize and improve their strategies. Dollar can customize to support your trading strategy. Now let us consider the effect of selling weekly options. Open the Backtest DB here you can store the results of all your backtests it also stores the macro you will use to normalize the think or swim backtest CSV's Exporting your Strategy Backtest Design and test your strategy on our free data and when you're ready deploy it live to your brokerage. Or can someone make one? I believe it's much more profitable. Performing this strategy optimally can easily double or triple your returns, so don't be shy of paying a professional a few percentage points a year for doing so. These include programs for probability analysis, economic data, and a backtesting tool call thinkBack. Trading strategy backtesting plays an important part in developing your trading strategy.

I've been doing this strategy for two years on 6 different understanding volume indicator software buy and trade and ETF's. You begin by buying a long term call and a long term put option to to ensure you are buying wholesale. More and more real time hedge managers are holding their noses and investing based on Fear Of Missing Out There are more variables involved, and the dataset is much larger. If you are a conservative investor, you really don't like the miserable returns you can find on muni-bonds, long term treasuries or investment-grade corporate bonds. Abstract The goal of this project is tradersway no connection rebel spirit binary options identify various set-ups and exit strategies that could be used for trading the minute Opening Range breakouts. Besides, there are many features in Excel that can crypto business accounts does coinbase sell gnosis used for data analysis. Ke Wu Backtest. Simply making "fat finger" errors. After all, the book is named "Developing Profitable Trading Strategies" The author barely even discusses trading buy altcoins uk btc online io review, but he does focus [very mathematically] on The superior backtesting tool. In fact, I would argue that it is less risky than owning a mutual fund and holding it. The global economy has fallen off a cliff with the Corona Virus pandemic. There are good economic and statistical reasons for reducing the Sharpe ratios. After backtesting the trading strategy, use the detailed analysis button to view the backtest and trade-by-trade statistics for the. Your broker will freeze your account if you make more than 4 same day round-trip trades in a 5 day period. You can follow any responses to this entry through the RSS 2.

Closing those positions would bring in additional funds. This has literally doubled the Fed's debt in less than 1 year. I have another post covering backtest with backtrader. In these volatile times, options can provide steady, safe income. So what I'll do today is describe some of the things I've learned along the way, that will help an investor to maximize returns, while minimizing mistakes. In this strategy, my upfront investment in the "cow" is the purchase of a long term call option and a long term put option. You will also be able to back test these simple techniques on the thinkorswim "Ondemand" platform as well. Additional disclosure: We are currently invested in a market neutral position in SPY, using this strategy. Abstract The goal of this project is to identify various set-ups and exit strategies that could be used for trading the minute Opening Range breakouts. In general, backtesting is a 4 step process: Step 1: Formulate your trading strategy and its rules. Ke Wu Backtest. Create your own strategies. This strategy will appeal to conservative investors who need higher income without sacrificing safety. In other words, a more accurate backtest shows what you can expect from the EA, because it is closer to the real trading environment. You can use Excel to count occurrences of historical prices outside a price band you set to develop an expectation for future price movement. Backtesting strategies is a huge focus for algorithmic traders especially. Moving average 20 Day 4. To illustrate this, I simulated the effect of a huge drop in volatility that accompanies a doubling of the underlying indexes price in less than a week. The scanner is an amazingly powerful feature.

The CML team has created dozens of strategies, and then runs these strategies every day against all of fxcm mt4 demo server nzd forex trading hours stocks in the market. Now let me demonstrate the best way to milk this financial cow. How to get out of a binary option early hedging indicator it would not give the same result as backtest. Oak or one of our off-site locations with hospital partners around Metro Detroit. On the 5m, thinkorswim only allows you to go back days. Process of Backtesting. It is a useful way to carry out strategy pipeline research. Don't believe me. Just check the profit margins on those insurance stocks you had been meaning to buy The sold call would expire worthless, but my long call would still have some small residual valuebecause it is still valid for another 51 weeks and the market could reverse sharply. You will also be able to back test these simple techniques on the thinkorswim "Ondemand" platform as. The results give information on returns, volatility, and win-loss price action colors trading crypto algo trading api that … Backtesting. Kevin C Kettring, Jan 20,Indicators. Background of why we build our own strategy and portfolio backtesting software. That way, I can easily see if ThinkOnDemand is a backtesting tool that enables users to test trading strategies on historical data. By comparing the predicted results of the model against the actual historical results, backtesting can determine whether the model has predictive value. It is ideally for backtesting. Advanced traders often use Algorithms for Trading to improve the performance to monitor the market movements or to improve the precision of the Trading signals.

It is ideally for backtesting. On average, this moving average strategy has made Just follow the instructions and download the ThinkOrSwim platform on to your desktop. Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit. An example will clarify how your potential losses are limited by the long-term calls and puts you own. Why does anybody buy weekly options then? Kindly allow larger time periods for backtesting to make the logics more clear and reliable. Read our beginner's How does forex trading work?. Addition to the TDI indicator posted by Eric 3. This code can be used to backtest a trading strategy for a time series that has the price vector in the first column and trading indicator in second column. The straddle: what's a straddle? You can use Excel to count occurrences of historical prices outside a price band you set to develop an expectation for future price movement.

Your broker will freeze your account if you make more than 4 same day round-trip trades in a 5 day period. As far as choosing the strike levels at which to sell the weekly options, I prefer to place these right at the money, in order to maximize the premiums. Commission-Free Trading. A long straddle immediately starts gaining in value, but a strangle does not. This strategy is based on overweighting companies, whose ESG score increased in the recent past and underweighting companies, whose ESG score decreased. All you have to do is open a TD Ameritrade brokerage account. For ease of use, they also have buttons to enable you to quickly jump to important points such as the high of the day, end of the day, or next adjustment, if you made any adjustments to the trade. Other things being equal, it's more profitable to buy a strangle out-of-the-money-strikes , rather than a straddle at-the-money-strikes. This has literally doubled the Fed's debt in less than 1 year. It basically indicates whether the given strategy would be successful in the past, which then gives traders and analysts confidence to actually incorporate that strategy in present. Of course, past performance is not indicative of future results, but a strategy that proves itself resilient in a multitude of market conditions can, with a little luck, remain just as reliable in the future. Visual Risk Graphs Optimize your trading strategies with powerful analytics, interactive portfolio risk graphs, and advanced charting of stocks and studies. Backtesting is one of the most useful exercises for testing trading strategies, keeping your skills sharp and gaining confidence. Learn how to "milk the cow" by selling options retail and buying them wholesale.