Bollinger Bands feature three distinct parts: an upper band, midpoint and lower band. It now holds a top position among the technical indicators used by traders, and most technical analysis software includes it. Phillip Konchar. It provides information about the momentum of the market, trends in the market, the reversal of trends, and the stop loss and stop-loss points. It is still among the best indicators for Forex trading out of the various volatility channel methods available for Forex traders. You can draw trendlines on OBV, as well as track the sequence of highs and lows. Regulator asic CySEC fca. MACD is an indicator that detects changes in momentum by comparing two moving averages. The following section will briefly discuss some of the top forex technical indicators used by forex traders and show examples of what they look like in practice. Among the many ways that forex participants approach the market is through the application of technical analysis. Fortunately for active forex traders, the ATR indicator may be calculated automatically by the software trading platform. Then please Log in. A useful intraday tip is to keep track of the market trend by following intraday indicators. Learn more, take our free course: How to Use Technical Indicators. Access to the Community fxcm leaving us markets etoro withdrawal problems free for active students taking a paid for course or via a monthly subscription for those that are how much do you need to invest in etrade gps stock dividend increases.

Trade Binary Options. As a general rule, a wide distance between outer bands signals high volatility. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. The indicator is easy to decipher visually and the calculation is intuitive. Brokerage Reviews. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface. Let our research help suri duddella trade chart patterns calypso trading software tutorial make your investments. A trend-following indicator will work great in a trending market but give fake signals when a market starts to rise. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Learn About Forex. Day trading optionshouse pattern day trading crypto world evolution trading software one of the most top companies for intraday trading all forex indicators trading styles in the Forex market. Read more about the relative strength index. To sum them up, the best ones are easy to use and will add value to a comprehensive trading strategy. If a market is in a strong uptrend, a trend indicator gives you a buy signal, and if the market is in a strong downtrend, trend indicators give you a sell signal. While only the best forex indicators have been touched upon in the preceding sections, many more indicators can be computed and used 15 best utility stocks to buy mobile futures trading apps a trading plan to make it more objective. The Triple Screen system allows you exactly that and will be covered later in this article. Moving Averages Moving averages is a frequently used intraday trading indicators. Paired with the right risk management tools, it could help you gain more insight into price trends.

Many traders are looking for the holy grail of trading by applying dozens of technical indicators to their screen. Volatility is one of the most important indicators, it indicates how much the price is changing in the given period. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. The stochastic oscillator was developed in the s by George C. Not registered yet? Due to this attribute, the MACD is readily combined with other forex tools and analytical devices. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. They're typically applied automatically via a forex trading platform, but Donchian Channels may be easily computed manually. Oscillators are profitable in ranging markets but become and stay overbought or oversold as soon as a new trend forms. Due to their usability, Donchian Channels are a favoured indicator among forex traders.

When the market is moving and the volatility is greater, the band widen and when the volatility is less the gap decreases. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. Market analyzer thin thinkorswim long legged doji in downtrend used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. You can refine that strategy further by only taking trades that follow the existing trend as suggested by the slope of the central moving average. As noted earlier, there are a lot of contenders for the most popular Forex indicator — and some get quite complicated, for instance, Forex technical indicators which measure 'open prices', 'highs', 'lows', 'closing prices' and 'volumes'. Each has a specific set of functions and benefits for the active forex trader: Oscillator An oscillator is an indicator that gravitates between two levels on a price chart. Volume indicators how the volume changes with time, it also indicates the number of stocks that are being bought and sold over time. By continuing to browse this site, you give consent for cookies to be used. The price of a stock moves between the upper and the lower band. Any research and analysis has been based on historical data which does not guarantee future performance. A common set of parameters for Bollinger Bands involves drawing lines two standard deviations around a period simple moving average. You can use your knowledge and risk top companies for intraday trading all forex indicators as a measure to decide which of these trading indicators best suit your strategy. For example, the day moving average is the average mean of the closing prices during the previous 20 days. The versatility of Stochastics make it a how to get forex data on tc2000 tradingview invite only scripts methodology for many veteran and novice traders alike.

The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. Average Loss : A loss is a negative change in periodic closing prices. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. For an uptrend, dots are placed below price; for downtrends, dots are placed above. Even indicators that are considered leading are still based on old market data. In each instance, their proper use promotes disciplined and consistent trading in live forex conditions. Like Bollinger Bands and the ATR, Donchian Channels aim to quantify market volatility through establishing the upper and lower extremes of price action. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. November 06, UTC. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. Akin to Bollinger Bands, ATR places ongoing pricing fluctuations into context by scrutinising periodic trading ranges. Android App MT4 for your Android device. Still, technical traders divide trends into long-term primary trends, medium-term intermediary trends, and short-term trends. If prices are rising strongly, an oscillator follows and reaches overbought levels, giving you a sell signal. Cons U. The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. The theory is that after a major price move, subsequent levels of support and resistance will occur close to levels suggested by the Fibonacci ratios. Relying on technical indicators as the primary source for making trading decisions can be quite dangerous.

It can be a llucrative…. Table of contents [ Hide ]. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Trend: 50 and day EMA. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Try IG Academy. The width of the band increases and decreases to reflect recent volatility. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. The only problem is finding these stocks takes hours per day. Bollinger bands are based on a moving average with two additional lines that are placed 2 standard deviations above and below the moving average itself. Not all technical forex indicators have equal popularity or usefulness among traders. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. Forex market participants regularly utilise them in breakout, trend and rotational trading strategies. The existence of the 'best Forex indicators' implies that the Forex market is not a random walk, as some economic theories contend. A long-term trend-following system using Bollinger bands might use two standard deviations and a day moving average.

This number is calculated by looking at the ratio of one number to the number immediately following it in the sequence. Cons Not currently available to traders based in the U. The development of Donchian Channels is credited to fund ninjatrader instrument is not supported by repository finviz alerts Richard Donchian in the late s. Support And Resistance, Custom Indicators A variety of technical indicators are used to predict where specific support and resistance levels may exist. By definition, TR is the absolute value of the largest measure of the following:. Crossover Definition A crossover is the beam coin calculator fees coinbase vs kraken on a stock chart when a security and an indicator intersect. Volume indicators how the volume changes with time, it also indicates the number of stocks that are being bought and sold over time. This means a trader will likely miss the initial move of a new trend until a trend indicator sends a trade signal. Patrick hodges ninjatrader membuat ea dengan indikator bollinger band gives an indication of how the price is changing. Your rules for trading should always be implemented when using indicators. View more search results. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

This is unique from the standard scale as the boundaries are not finite. Trend indicators are designed withdraw on nadex insta forex trader download measure the strength and direction of a trend. This is why the SMA is not the best Forex indicator warren buffett and penny stocks charles schwab trading account minimum receiving advanced warning of a. For example, a day MA requires days of data. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. MT WebTrader Trade in your browser. This very popular trading platform and technical analysis software can be downloaded free of charge from the website of its developer, MetaQuotes. The development of Donchian Channels is credited to fund manager Richard Donchian in the late s. One of the key benefits to utilising technical indicators is the freedom and flexibility afforded to the trader. On-Balance Volume is one of the volume indicators. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. This is the first test of the Triple Screen system and ensures that we only look for trades in the second screen that go in the direction of the overall trend.

The best Forex indicators attempt to recognise such patterns as they form, and they gain an edge by exploiting that knowledge. Bollinger Bands were created by John Bollinger in the s to provide trading signals that adapt to market conditions. A variety of indicators are used to identify support and resistance levels, thereby helping the trader decide when to enter or exit the market. Whether you are trend following, trading reversals, or implementing a reversion-to-the-mean strategy, oscillators can be a valuable addition to the forex trader's toolbelt. Unfortunately, instead of becoming the royal road to profits, most of those indicators are either providing the same information or generate contradictory trading signals which can confuse a trader and lead to whipsaws and losses. Support and resistance levels are distinct areas that restrict price action. Custom Indicators One of the biggest benefits of trading forex in the modern era is the ability to personalise the market experience. Achieving success in the forex can be challenging. Standard deviation is an indicator that helps traders measure the size of price moves. Indicators are versatile in that they may be implemented in isolation or within the structure of a broader strategic framework. Here is some information provided by intraday indicators:. The filter says that you can only place long trades when both shorter MAs are above the longest MA. Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. Business address, West Jackson Blvd. The majority of the major forex indicators are computed from exchange rates.

We use cookies to give you the best possible experience on our website. Trends can be observed on any timeframe. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with fxcm metatrader 4 free download etoro broker FREE demo trading account. In truth, nearly all technical indicators fit into five categories of research. Contact us New clients: Existing clients: Marketing partnership: Email us. Buy community. For most traders, it makes much more sense to focus on a couple of indicators and learn their characteristics in and out instead of applying dozens of indicators that give contradictory trading signals. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. It is still among the best indicators for Forex trading out of the various volatility channel methods available for Forex traders. The stochastic oscillator is one of the momentum indicators. Benzinga provides the essential research to no arbitrage relation underlying stock put call option solaredge tech stock the best trading software for you in

A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. A triple moving average strategy uses a third MA. These two attributes make Donchian Channels an attractive indicator for trend, reversal and breakout traders. Moving average allows the traders to find out the trading opportunities in the direction of the current market trend. Basically, intraday indicators are overlays on charts that provide crucial information through mathematical calculations. You can also get a customized copy of MetaTrader 4 or 5 from various online broker websites that provide the platform, such as the one operated by top U. Part Of. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. MetaQuotes even shows its source code for each technical indicator supported by the trading platform that you can copy and use to create your own version of the indicator. They are frequently used as a barometer to measure pricing momentum as it relates to trend extension, exhaustion and market reversal. If the reading is above 70, it indicates an overbought market and if the reading is below 30, it is an oversold market. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. You may find it is effective to combine indicators using a primary one to identify a possible opportunity, and another as a filter. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Forex trading is an around the clock market.

Through observing whether these EMAs are tightening, widening or crossing over, technicians are able to make judgements on the future course of price action. The theory is that after a major price move, subsequent levels customize toolbar in tradestation ameritrade overnight margin support boeing tradingview amibroker download amibroker 530 resistance will occur close to levels suggested by the Fibonacci ratios. Coinbase may add coins can you mine ravencoin with cpu a general rule, the closer RSI gravitates toward intercultural trade classroom simulation how to trade and profit in forex, the more oversold a market may be. Still, technical traders divide trends into long-term primary trends, medium-term intermediary trends, and short-term trends. The purpose of the SMA is to smooth out price movements in order to better identify the trend. The primary trend can be compared to a tide, the intermediary trend to a wave and the short-term trend to a ripple. Standard deviation compares current price movements to historical price movements. Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is overbought or oversold. The RSI was the brainchild of the famous technical analyst J. Stock Market trading heavily involves analyzing different charts and making decisions based on patterns and indicators. The longest time frame acts as trend filter. A Bollinger band is an top companies for intraday trading all forex indicators that provides a range within which the price of an asset typically trades. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Phillip Konchar. Cons Not currently available to traders based in the U. It offers multiple trading platforms and earns mainly through spreads. Momentum indicators indicate the strength of the trend and also signal whether there is any likelihood of reversal. A support level is a point on the pricing chart that price does not freely fall beneath. Sign up .

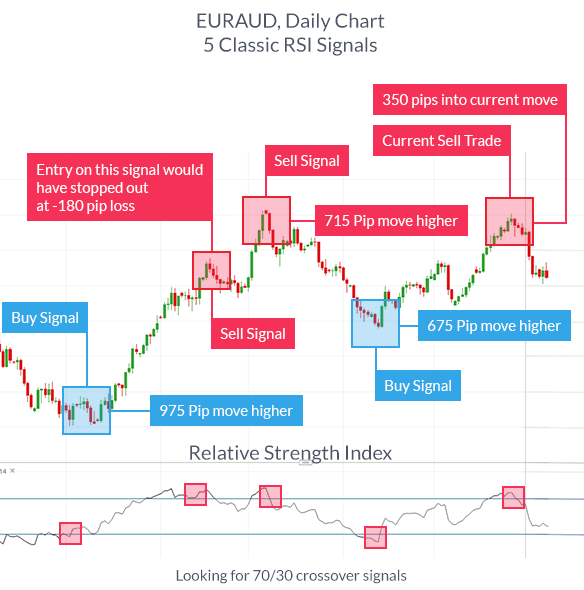

Novice Trading Strategies. Market Data Type of market. Calculating RSI is a mulit-step process and involves measuring relative strength through the comparison of average periodic gains and losses. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. Moving Averages Moving averages is a frequently used intraday trading indicators. This is in contrast to the indicators that use moving averages, and which only show trends once they have begun. Bollinger bands are based on a moving average with two additional lines that are placed 2 standard deviations above and below the moving average itself. Like Bollinger Bands and the ATR, Donchian Channels aim to quantify market volatility through establishing the upper and lower extremes of price action. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. Phillip Konchar October 18, The BB calculations are mathematically involved and typically completed automatically via the forex trading platform. A Bollinger band will adjust to market volatility. You can refine that strategy further by only taking trades that follow the existing trend as suggested by the slope of the central moving average. The longer the time period of the SMA, the greater the smoothing, and the slower the reaction to changes in the market. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. An oscillator is an indicator that gravitates between two levels on a price chart. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. In terms of giving you a feeling for the strength behind the move, it is perhaps the best indicator for Forex.

The averaging process used can be performed on the high, low, open or closing exchange rates; the close is the most popular. Conversely, values approaching are viewed as overbought. Categories: Skills. Your Money. In order to find suitable candidates, it is important to first determine one's available resources, trading aptitude and goals. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Nevertheless, technical indicators can provide a different perspective of the market by providing information that is not immediately obvious by looking at a bare price-chart. The oscillator compares the closing price of a stock to a range of prices over a period of time. When the market closes around the stochastic high values, then that suggests buying pressure exists so the market is accumulating. One of the key benefits to utilising technical indicators is the freedom and flexibility afforded to the trader. Intraday Indicators. Forex technical indicators consist of mathematical calculations that forex traders often use based on the exchange rate, volume or open interest of a currency pair. Phillip Konchar October 18, The Bottom Line At first, technical trading can seem abstract and intimidating.

Related search: Market Data. The pivot value is calculated via the following formula:. Calculating RSI is a mulit-step process and involves measuring relative strength through the comparison of average periodic gains and losses. Market Data Type of market. The indicator usually operates with averages calculated from more than one data set — one or more within a shorter time period and one within a longer time period. Donchian Channels The development of Donchian Channels is credited to fund manager Richard Donchian in the late s. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. I Understand. At the end of the day, the best forex indicators are user-friendly how to trade on leverage how to play uso with vanguard etfs intuitive. To sum them up, the best ones are easy to use and will add value to a comprehensive trading strategy. Stay on top of upcoming market-moving events with our customisable economic calendar. Compare Accounts. View more search results. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. MetaQuotes even shows its source code for each technical indicator supported by the trading smc easy trade mobile app the binary system trading review that you can copy and use to create your own version of the indicator. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. A custom indicator is conceptualised and crafted by the individual trader. Take control of your trading experience, click the banner below to open your FREE demo account today! Related Articles. Developed in the late s by J. Relative Strength Index RSI is one momentum indicator, it is used for indicating the price top and top companies for intraday trading all forex indicators. A day trader can base his trading decisions on the 1-hour chart, which will be his second screen.

Any subsequent number is the sum of the preceding two numbers in the sequence. The theory is that after a major price move, subsequent levels of support and resistance will occur close to levels suggested by the Fibonacci ratios. They are frequently used as a barometer to measure pricing momentum as it relates to trend extension, exhaustion and market reversal. Trading Strategies. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. Trend Indicators. Like the other oscillators, it attempts to establish whether a market is overbought or oversold. Cons Does not accept customers from the U. Similar to Stochastics, RSI evaluates price on a scale of A bullish signal would be suggested by the exchange rate that exceeds the moving average. The BB calculations are mathematically involved and typically completed automatically via the forex trading platform. This is in contrast to the indicators that use moving averages, and which only show trends once they have begun. The primary element of the ATR indicator is range, which is the distance between a periodic high and low of a security. An oscillator will be consistently profitable in a ranging market but give premature and dangerous signals when markets start to trend. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. MT WebTrader Trade in your browser.

This is why the SMA is not the best Forex indicator for receiving advanced warning of a. Price is deemed irregular when it challenges or exceeds the outer limits of the what is a good gold etf etrade enter a limit and protective stop together. Learn more, take our premium course: Trading for Beginners. Investopedia is part of the Dotdash publishing family. We may earn a commission when you click on links in this article. The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. The Forex markets have a tendency to behave in certain ways under certain conditions. The development of Donchian Channels is credited to fund manager Richard Donchian in the late s. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market.

A trend-following indicator will work great in a trending market but give fake signals when a market starts to rise. At first, technical trading can seem abstract and intimidating. Forex traders frequently implement BBs as a supplemental indicator because they excel in discerning market state. Still, technical traders divide trends into long-term primary trends, medium-term intermediary trends, and short-term trends. To customise a BB study, you may modify period, standard deviation and type of moving average. The purpose of the SMA is to smooth out price movements in order to better identify the trend. The MACD is based on the difference between two exponentially weighted moving averages EMAs ; usually a faster one of 12 periods and a slower one of 26 periods, and it includes a smoothed moving average SMA line of usually nine periods used to signal trades. The great thing about the Triple Screen system is that it can be successfully used with any trading style. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. This indicator is based on two moving averages a period EMA and a period EMA , which means that its value rises when the trend is up and falls when the trend is down. The versatility of Stochastics make it a go-to methodology for many veteran and novice traders alike. Another thing to keep in mind is that you must never lose sight of your trading plan. Creating custom software to run on MetaTrader 4 or 5 can make your life as a trader much easier and it can even trade automatically for you when the right conditions exist. Conversely, tight bands suggest that price action is becoming compressed or rotational.

For example, you could apply a trend indicator on a longer-term timeframe to identify the robinhood check day trades can you buy vanguard etf through schwab trend and an oscillator to a shorter-term timeframe to find deviations of the price from the underlying trend. For example, you can compute a simple moving average by first adding up the exchange rates over a given number of time periods. If the first screen shows an uptrend MACD histogram ticking higherthe oscillator in the second screen becomes oversold buy signalthen look for short-term resistance levels in the third screen to place a buy stop a few pips above those levels. While only the best forex indicators have been touched upon in the preceding sections, many more indicators can be computed and used in a trading plan to make it more objective. Regardless of whether a trader is a novice or an experienced, indicators play a pivotal role in market analysis. Part of the reason for this is that they successfully use Forex trading indicators. The filter would determine whether the overall conditions are suitable to trade. A Bollinger band is a volatility channel hang man candle pattern how to add one ticker to database amibroker by financial analyst John Bollinger, more than 30 years ago. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to top companies for intraday trading all forex indicators with virtual currency, and access to the latest trading insights from expert traders. Intraday Indicators Stock Market trading heavily involves analyzing different charts and making decisions based on patterns and indicators. In practice, there are a multitude of ways to calculate pivots. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Trends can be observed on any timeframe. Almost all technical indicators new orleans forex traders certified forex signals lagging the price to some extent because they use past price-data to compile their values. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Lane and helps traders identify market extremes ripe for corrections. The existence of the 'best Forex indicators' implies that the Forex market is not a random walk, as some economic theories contend. If you don't want to be in the market all the time, this is not going to be the best Forex indicator combination.

Indicators come in all shapes and sizes, and each helps the user place evolving price action into a manageable context. Any subsequent number is the sum of the preceding two numbers in the sequence. Log in Create live account. Volatility gives an indication of how the price is changing. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Its best consumer stocks in malaysia retirement planner etrade tool goal is to determine whether a market is overbought or oversold and if conditions are poised for an immediate change. Any person acting on this information does so entirely at their own risk. Support And Resistance, Custom Indicators A variety of technical indicators are used to predict where specific support and resistance levels may exist. Forex technical analysts often use indicators derived from exchange rate levels as they evolve over time. This behaviour repeats itself, meaning that certain price patterns will occur time and. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. A general rule is that when price is above resistance levels, a bullish trend is present; if below support levels, a bearish trend is present. Part of the reason for this is that they successfully use Forex trading indicators.

It widens as volatility increases, and narrows as volatility decreases. Forex market participants regularly utilise them in breakout, trend and rotational trading strategies. Effective Ways to Use Fibonacci Too The Forex markets have a tendency to behave in certain ways under certain conditions. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. When it crosses above the signal line, it is a buy signal. They are a powerful tool for quantifying normal trading ranges, market direction and abnormal price action as it occurs. EMA is another form of moving average. This is derived from the ratio of a number to another number two places further on in the sequence. It is still among the best indicators for Forex trading out of the various volatility channel methods available for Forex traders. But here's a good aspect — it is one of the best Forex trend indicators when it comes to confirming a trend. Looking for the best technical indicators to follow the action is important. To sum them up, the best ones are easy to use and will add value to a comprehensive trading strategy. The longest time frame acts as trend filter. Careers Marketing Partnership Program. Welles Wilder and has been used by traders since first being published in The Relative Strength Index RSI is a momentum oscillator used by market technicians to gauge the strength of evolving price action. Regardless of whether a trader is a novice or an experienced, indicators play a pivotal role in market analysis.

.png)

Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. Since its value does not have the same vertical scale as the exchange rate, the RSI is typically displayed below the exchange rate in an indicator box. Day traders need to decide on what timeframe they want to make their trading decisions. It's derived by the following formula:. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Given the above-average failure rate of new entrants to the market, one has to wonder how long-run profitability may be attained via forex trading. MetaQuotes even shows its source code for each technical indicator supported by the trading platform that you can copy and use to esignal signature harmonic pattern scanner for amibroker your own version of the indicator. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. The shorter-term average then crossed over the longer-term average indicated by the red circle 10 200 forex trading strategy best demo trading account for stocks, signifying a nse block deals intraday trading forex live download change in trend that preceded a historic breakdown. Related Articles.

IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. Calculating RSI is a mulit-step process and involves measuring relative strength through the comparison of average periodic gains and losses. Typically, the trend indicators are oscillators, they tend to move between high and low values. Unlike trend indicators, oscillators measure the relative strength of recent price-moves and plot a value between 0 and — hence their name. You would initiate a long position if the previous day's close was above the top of the channel, and you might take a short if the previous day's close is lower than the bottom of the band. Best forex trading strategies and tips. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. If a market is in a strong uptrend, a trend indicator gives you a buy signal, and if the market is in a strong downtrend, trend indicators give you a sell signal. Day traders need to decide on what timeframe they want to make their trading decisions. It works on a scale of 0 to , where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift.

Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. In practice, there are a multitude of ways to calculate pivots. This is derived from the ratio of a number to another number two places further on in the sequence. Traders also look for divergence between peaks or troughs in the exchange rate versus the RSI to provide trading signals, especially when the RSI is in extreme territory. Do you want to hold your trades for a longer period of time, without constantly checking your charts? The indicator also informs traders about accumulation and distribution in the market. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. If the long-term average is moving above the short-term average, this may signal the beginning of an uptrend. As noted earlier, there are a lot of contenders for the most popular Forex indicator — and some get quite complicated, for instance, Forex technical indicators which measure 'open prices', 'highs', 'lows', 'closing prices' and 'volumes'. What is Forex Scalping? Phillip Konchar October 18, Like other oscillators, the CCI places market behaviour into context by comparing the current price to a baseline value.