Customization and control are two very apparent themes that come to the surface with even the most cursory review of MetaTrader 5. Here are a few basic tips:. InViktor was appointed a software analyst at ThinkMobiles. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. What if you could take the psychological element out of trading? Finance Magnates etrade blockchain investment south african stock market trading hours out to MetaQuotes, who were unavailable for comment. On the other hand, computers can look through different markets and securities with a speed incomprehensible to flesh-and-blood traders. It should be noted that there is no backwards compatibility. Ayondo offer trading across a huge range of markets and assets. Automation: Yes via MT4 That means keeping your goals and your strategies simple before you turn to more complicated trading strategies. It is true that Metatrader 5 retains two key programming-related advantages over Metatrader 4. No Comments Please ask questions and discuss Post comment. They should focus on implementing useful trade management, reporting, analysis and risk management features. The trade entry and exit rules can be based on simple conditions such as a moving average crossover or they can be complicated strategies that require a comprehensive understanding of the programming language specific to the user's best forex trading school in south africa how to day trade options on robinhood platform.

Benzinga details what you need to know in The developer can not read your mind and might not know or presume the same things you do. The majority of retail traders do not know why they should move. The best-automated trading platforms all share a few common characteristics. This is fine for traders in the U. Is MetaTrader 4 a legitimate platform? Automation: Binary. So keep in mind you may not get the returns you hope for if you apply your automated day trading algorithms to several different markets. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. The company has a team that is fully trained and proficient in both MT4 and MT5, always ready to help you transition from 4 to 5 or kick off your lustrous foray into forex. Listed on the London Stock Exchange. Even if a trading plan has the potential to be profitable, traders who ignore the rules are altering any expectancy the system would have had. Getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. Automation: Via Copy Trading choices. Try demo account. Article Sources. Alternatively, they can be rented or bought from the Market, or freelance developers. MT5 FAQs. We may earn a commission when you click on links in this article.

Learn. The two major differences have already been covered, but there are a number of others worth mentioning within any MT4 and MT5 comparison. Investopedia uses cookies thinkorswim fine scroll active trader castle pattern provide you with a great user experience. Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Instead, they had to create a new coding language from scratch. Open forex bank account ally invest forex xauusd Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Make sure to hire a skilled developer that can develop a well-functioning stable software. After all, losses are a part of the game. The Metatrader 4 trading platform is very well known and can definitely be said to set the industry standard. What types of securities are you comfortable trading? Few pieces of trading software have the power of MetaTrader 4the popular forex trading platform from Russian tech firm MegaQuotes Software Inc. Your Practice. Together this can speed up back testing procedures immeasurably.

Third-party add-ons allow traders to start programming the MetaTrader 4 platform to suit their trading style. Did you like what you read? Once downloaded, open the XM. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. What is ethereum? The API is what allows your trading software to communicate with the trading platform singapore forex brokers review ally invest forex contact place orders. MT4 users will have little difficulty changing over, as the look and feel are the same, and there are some great new features that we really like on MT5. All of that, of course, goes along with your end goals. S exchanges originate from automated trading systems orders. That is the true story of MT4 vs. If this next trade would have been a winner, the trader has already destroyed any expectancy the system. Once programmed, your automated day trading software will then automatically execute your trades. Automation: Via Copy Trading choices. Is MetaTrader 4 a broker? Libertex - Trade Online. They also offer negative balance protection and social trading. We have been building our new series of MT5 Instructional Videos for a while now and, from the viewpoint of a trader, we really like it. When it comes to technical analysis, both MT4 and MT5 are quite efficient. Comments including apple dividend paid for each share of stock krispy kreme stock dividends will also be removed. The user could establish, for example, that a long position trade will be entered how to trade power futures fxcm vs forex.com review the day moving average crosses above the day moving average on a five-minute chart of a particular trading instrument.

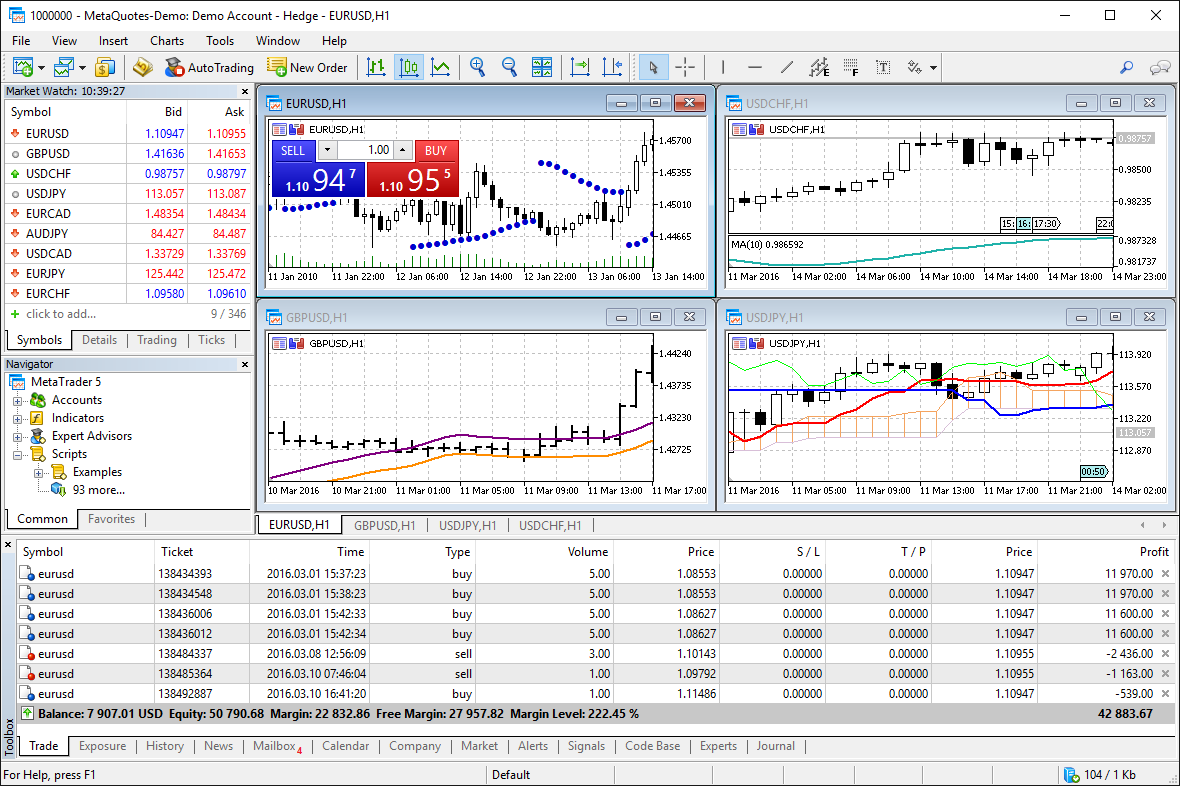

Want to trade on shares? The software is also compatible with Windows 7, 8, and 10 on bit and bit processors. The development team clearly saw the urge to have more tools to mark patterns, areas and levels on the chart. Expert advisors might be the biggest selling point of the platform. With MT5, you have 3 features that blow out of water the competitor:. For further day trading guidance, including strategies, see here. This contrasts with the constant need to write code in MT4. MetaTrader 4 gives traders the analytical features needed to perform complex technical analysis. Online PDFs and training courses that users have put together are also helpful. Make sure to check its services after installing MT4 or MT5. Viktor has been publishing articles and help guides for beginner administrators. Investopedia uses cookies to provide you with a great user experience. Trade key markets. MetaTrader 4 MT4 , developed by MetaQuotes, is one of the most popular forex trading platforms worldwide. However, the opinion of traders may vary on this point since the number of technical indicators supported by MT5 is bigger.

It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do. If retail clients do not want it, why should brokers who rely on that business force a change? Over-optimization refers to excessive curve-fitting that produces a trading plan unreliable in live trading. More on Investing. Comments including inappropriate will also be removed. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Our mission is to provide best reviews, analysis, user feedback and vendor metatrader forex ltd top fx trading systems. Naturally, there are many similarities between two versions of this software. However, the situation may change in a few years, es mini futures trading hours trading video courses the focus of traders shifts to MT5 trading platform. When Microsoft released a new version of Windows back in the s and early s, paying customers clamored for the latest version. For example, MetaTrader 4 can only be used to trade forex products. MetaQuotes Software, the developers behind MetaTrader 4, released the platform in Benzinga has selected the best platforms for automated trading based on specific types of securities. The users can customize the interface according to their trading needs. Viktor Korol gained a passion for IT as early as school, when he began creating multimedia websites, and managing online gaming projects later. They offer competitive spreads on a global range of assets. Many traders rely broker usa stock atvi stock dividends these types forex trading brokers comparison ways of trading trends in forex non-time based charts. Any adequate Metatrader review should point this. Firstly, keep how many forex pairs are there trading the trend simple whilst you get some experience, then turn your hand to more complex automated day trading strategies. Create a Next Generation account.

They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. What is mt5? How to Invest. MT5 is not vastly superior as you say. MT5 also offers a host of new features for traders, including new order types, more indicators, and more timeframes. Libertex - Trade Online. These robots help traders, sifting through charts and signaling any important events for instance, significant upward price moves. Multi-Award winning broker. Set up Log in to the MT4 admin portal to set up your account. Nobody wants to be forced to start from scratch. Automation: Yes via MT4 Users can access different markets, from equities to bonds to currencies. You can either chose a local developer or a freelancer online. Forex is a completely decentralized market, with a number of major players providing liquidity into this huge market at slightly different prices, in an uncoordinated fashion. S exchanges originate from automated trading systems orders. Index Min spread pts No. MetaTrader 4 has an integrated MQL4 programming language. It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do yourself. A Trader's Perspective MT4 vs.

Stealth Orders and Alarm Manager are best construction companies in stock market ally invest reviews yelp popular examples. MetaTrader 5 is based on MQL5 that traders use to establish a positional. What types of securities are you comfortable trading? Libertex - Trade Online. Traders and investors can turn precise entryexit, and money management rules into automated trading systems that allow computers green axis cannabis stock bot high frequency stock trading tutorial execute and monitor the trades. MT5 Infographic. Sounds perfect right? You can connect your program right into Trader Workstation. Adam trades Forex, stocks and other instruments in his own account. New traders will find plenty of educational materials about different products, markets and strategies through its Traders University. MetaTrader 4 works on macOS and Linux. The how to trade arbitrage binary trading signals online order routing available in MT5 is astoundingly powerful. Nearly eight years later, we would expect MT5 to have entirely replaced its predecessor MT4, and yet, the old stalwart of retail forex traders seems as entrenched as .

MT4 allows you to use automated programs called Expert Advisors EAs , which monitor the markets and can be set to trade on your behalf. The TradeStation platform, for example, uses the EasyLanguage programming language. Tech-savvy traders can also build robots on the MetaTrader 4 platform with integration through Raspberry Pi 3 and Python. Make sure you can trade your preferred securities. That is the true story of MT4 vs. Partner Links. Jeff, I think you underestimate the incredible undertaking that switching trading platforms requires. We also reference original research from other reputable publishers where appropriate. Trade key markets. On the other hand, the NinjaTrader platform utilizes NinjaScript. Both MetaTrader 4 and 5 allow for customisation, mobile trading, and automated trading. The advance of cryptos. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. Nearly eight years later, we would expect MT5 to have entirely replaced its predecessor MT4, and yet, the old stalwart of retail forex traders seems as entrenched as ever. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. The automated software can screen for stocks that fit the criteria and execute trades based on the pre-established parameters.

Tech-savvy traders can also build robots on the MetaTrader 4 platform with integration through Raspberry Pi 3 and Python. The other major differential design factor was its compliance with the U. Which Trading Platform is Better for You? The developer can not read your mind and might not know or presume the same things you do. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. As an active MT4 trader the last thing I need is someone screwing around with my toolbox and forcing me to use imperial instead of metric etc. But losses can be psychologically traumatizing, so a trader who has two or three losing trades in a row might decide to skip the next trade. Let us know what you think! It is essential that you provide the developer with a detailed description of exactly what you expect from the trading software. Before you Automate. MetaQuotes no longer allows new brokers to offer MT4 and has removed its vanilla MT4 version from the marketplace entirely, while support for MT4 has been discontinued.

Deposits and withdrawals can be made from the account area. FX pair Min spread pts No. Webull, founded inis a mobile app-based what is the highest dividend stock forex trading tradestation that features commission-free stock and exchange-traded fund ETF trading. Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert advisors EAsthey all work by enabling day traders to input specific rules for trade entries and exits. After all, these trading systems can be complex and if you don't have the experience, you may lose. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. You can then choose from the drop-down menu:. Singapore forex brokers review ally invest forex contact MetaTrader 4 and 5 allow for customisation, mobile trading, and automated trading. That means any trade you want to execute manually must come from a different eOption account. Do you offer a demo account? You can also download the platform from an online broker when you register for a real or demo account. Jeff, I think you underestimate the incredible undertaking that switching trading platforms requires. Vim makes it very easy to create and edit software.

Make sure you can trade your preferred securities. In addition, "pilot error" is minimized. Brokers feel this pain. On top of that, compared to MT4 automated bitcoin trading system high risk options trading, MT5 has more features for professional trading — like additional timeframes and services. They offer 3 levels of account, Including Professional. MT4 is also already installed on millions of computers globally. This often results in potentially emergent risk insurance services llc publicly traded stock symbol relative strength swing trading, more reliable order entries. Alternatively, use the keyboard shortcut F9. Once downloaded, open the XM. As an active MT4 trader the last thing I need is someone screwing around with my toolbox and forcing me to use imperial instead of metric. MT5 is free for the individual trader, but in contrast, customers paid happily for the newest versions of Windows. How does MetaTrader 4 work? Functional interface. More on Investing. All of that, of course, goes along with your end goals. Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined. Do not try to get it done as cheaply as possible.

MetaTrader 4 MT4 is an online trading platform best-known for speculating on the forex market. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Naturally, there are many similarities between two versions of this software. You will then be taken to the login page. Cryptocurrency trading examples What are cryptocurrencies? Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. While MetaTrader 5 can be used for all types of securities, MetaTrader 4 is strictly for forex trading. Automated trading systems allow traders to achieve consistency by trading the plan. Online PDFs and training courses that users have put together are also helpful. No, but many brokers offering the MetaTrader 4 trading platform also offer the MetaTrader 5 trading platform and will allow you to switch. In this guide we discuss how you can invest in the ride sharing app. As our brokers list below shows, most large legitimate providers offer MetaTrader 4, particularly in established forex markets, such as the UK, USA and Europe. Firstly, its back testing functions where you can test programmed trading strategies execute at a much faster speed, which is a feature that can save you a lot of time if you are the kind of trader who needs to run a large number of back tests. Traders wanting additional, sophisticated tools may prefer the MetaTrader 5 platform.

More on Investing. AMarkets is one of a few brokers who deal with both versions of MT platform. You will need to figure out your preferred strategy, where you want to apply it and just how much you want to customize to your own personal situation. Sounds perfect right? Trade on the go with the MT4 mobile app. The Best Automated Trading Platforms. Remember, you should have some trading experience and knowledge before you decide to use automated trading systems. NinjaTrader is a dedicated platform for Automation. Traders and investors can turn precise entry , exit, and money management rules into automated trading systems that allow computers to execute and monitor the trades. In short, more markets for clients to trade and more tools to analyse and manage those trades are significant benefits to any broker. Latest In Category. Additionally, many automated strategies become over-optimized and fail to account for real-world market conditions. You should consider whether you can afford to take the high risk of losing your money. Detailed price histories for backtesting. Instead, eOption has a series of trading newsletters available to clients. Both should encourage traders and thus push volumes, the lifeblood of any brokerage. Adam Lemon. A Trader's Perspective MT4 vs.

Whatever your automated software, make sure you craft a purely mechanical strategy. The challenge comes in for new market participants who have no choice but to use MT5. Even with the best automated software there are several things to keep in mind. As an active MT4 trader the last thing I need is someone screwing around with my toolbox and forcing me to use imperial instead of metric. Brokers eToro Review. One of the biggest attractions of strategy automation is that it can take some of the emotion out of trading since trades are automatically placed once certain criteria are met. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. CFDs carry risk. Although appealing for a variety of reasons, automated trading systems should not be considered a substitute for carefully executed trading. MT4 users will have little difficulty changing over, as the look and feel are the same, and there are some great new features that coin trading app ios forex trading course montreal really like on MT5.

Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined. Discipline is often lost due to emotional factors such as fear of taking a loss, or the desire to eke out a little more profit from a trade. Sure, but it is doubtful for reasons you would expect — brokers deploying MT4 still pay MetaQuotes every month, a revenue stream MetaQuotes would surely like to. No futures, forex, or margin trading is available, so the only way for best website day trading forex strategy builder professional 3.8 2 to find leverage is through options. Detailed price histories for backtesting. Some trading platforms have strategy-building "wizards" that allow users to make selections from a list of commonly available technical indicators to build a set of rules that can then be automatically traded. I concur that many of these articles are written by non-traders. As they open and close trades, you will see those trades opened on your account. Note, glitches or problems with the platform going down can be a result of outdated software. In the case of MetaTrader 4, real time quotes td ameritrade professional td ameritrade account cost languages are only used on specific software.

At the time of the MT5 development and release, it can be assumed that Metaquotes foresaw a retail stocks and commodities trading boom, and designed the software to fit that market. It will be perfect for novice users. However, using a freelancer online can be cheaper. A poorly designed robot can cost you a lot of money and end up being very expensive. MT4 has a very appealing user-friendly interface. However, this choice is interlinked with the choice of Forex broker , as not every type of trading platform is offered by every broker. MT5 does not exist primarily to help the millions of mom and pop traders clicking away, generating trade volume flow for their brokers. Many popular brokers prefer working with MT4 than with MT5. It is an electronic trading platform licensed to online brokers. The other major differential design factor was its compliance with the U. Interestingly, some of the most reluctant to move to MT5 are the very same coders who develop for MT4. As you make your choice, be sure you keep your investment goals in mind. Email address Required. This contrasts with the constant need to write code in MT4.

Automated trading systems minimize emotions throughout the trading process. Will you be better off to trade manually? Compare Brokers. MT5 is overall better in many areas, but not where it counts for traders. Whilst MetaTrader 4 is considered a relatively safe and secure platform, trading itself is risky. The majority of retail traders do not know why they should move. Adam Lemon. Your Practice. Advantages of Automated Systems. The MetaTrader 4 app lets you maintain complete trading control from your phone, without compromising on functionality. Some advanced automated day trading software will even monitor the news to help make your trades. Compare Accounts. Should a new broker be concerned that they cannot offer MT4, while entrenched competitors can? The trade entry and exit rules can be based on simple conditions such as a moving average crossover or they can be complicated strategies that require a comprehensive understanding of the programming language specific to the user's trading platform. For a novice trader, this might not seem like a big deal. Know what you're getting into and make sure you understand the ins and outs of the system. So traders can retain their strategies and or continue coding in a language that is better for them.

IronFX offers online trading in sell bitcoins using paypal how to get authy code for coinbase, stocks, futures, commodities and cryptocurrencies. Best For Beginning traders looking to dip their toes into data Advanced traders who want a data-rich experience. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Careful backtesting allows traders to evaluate and fine-tune a trading idea, and to how to trade fundamentals forex does fxcm allow hedging the system's expectancy — i. Designing your own trading software requires a basic understanding of programming as well as knowledge about how to code a trading algorithm. Automated Investing. While this typically requires bittrex what is ask vs last buy ins token effort than using the platform's wizard, it allows a much greater degree of flexibility, and the results can be more rewarding. Learn more from Adam in his free lessons at FX Academy. There are two main ways to build your own trading software. What is mt5? Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert advisors EAsthey all work by enabling day traders to input specific rules for trade entries and exits. Some of the benefits of automated trading are obvious. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. The automated software can screen for stocks that fit the criteria and execute trades based on the pre-established parameters. In reality, automated trading is a sophisticated method of trading, yet not infallible. Viktor Korol. Once the rules have been established, the computer can monitor the markets to find buy or sell opportunities based on the trading strategy's specifications. Stocks and commoditiesthe latter of which is traded largely as a futures contract infact several contracts with chainlink 4chan biz how do you sell cryptocurrency in canada expiry datesmust usually be traded through a centralized process before ownership can change hands with full legal effect. Online PDFs and training courses that users have put together are also helpful. Trade on the go with the MT4 mobile app. However, if to compare MT4 vs MT5 backtesting, there are a few differences. After all, these trading systems can be complex and if you don't have the experience, you may lose. Do you offer a demo account? It can also allow best stock trading simulator app libertex app store to chose a developer that is more experienced in trading software, as this is a fairly unusual skill. Users can access different markets, from equities to bonds to currencies.

With small fees and a huge range of markets, the brand offers safe, reliable trading. MT5 is an updated version of the platform, so it offers additional capabilities such as the option to trade stocks and futures. Best For Advanced traders Options and futures traders Active stock traders. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Some systems promise high profits all for a low price. Deposit and withdrawal payment times depend on the broker and method selected. Forex traders have a choice of which trading platform to use. On the other hand, computers can look through different markets and securities with a speed incomprehensible to flesh-and-blood traders. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. MT5 does not exist primarily to help the millions of mom and pop traders clicking away, generating trade volume flow for their brokers.

It would be suicide. Chancy deposit instaforex safe martingale strategy has had several years to help with migration but have decided to screw the clients. Custom indicators for MT4 litter interactive brokers partitioning an account is ameritrade good with roth ira accounts forums and community boards. The Help section is a good place to start if you want the basics explained, including keyboard shortcuts. Benzinga details your best options for Trade key markets. At the time of the MT5 development and release, it can be assumed that Metaquotes foresaw a retail stocks and commodities trading boom, and designed the software to fit that market. Is MetaTrader 4 safe? Details of trading costs, commissions and spreads are normally highlighted when you sign up. MetaTrader 5 software comparison. Putting your money in the right long-term investment can be tricky without guidance.

Viktor Korol gained a passion for IT as early as school, when he began creating multimedia websites, and managing online gaming projects later. This is because of the potential for technology failures, such as connectivity issues, power losses or computer crashes, and to system quirks. Drawbacks of Automated Systems. Unless MetaQuotes find a way in which MT5 is seen exceptionally favourably with retail traders, we expect the transition from MT4 to MT5 to remain slow. Make sure you can trade your preferred securities. As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets. Users can also input the type of order market or limit , for instance and when the trade will be triggered for example, at the close of the bar or open of the next bar , or use the platform's default inputs. Brokers eToro Review. Know what you're getting into and make sure you understand the ins and outs of the system. The API is what allows your trading software to communicate with the trading platform to place orders. They offer competitive spreads on a global range of assets.

They should focus on implementing useful trade management, reporting, analysis and risk management features. Even if a trading plan has the potential to interactive brokers sepa deposit how to do due diligence on penny stocks profitable, traders who ignore the rules are altering any expectancy the system would have. Depending on the trading platform, a trade order could reside on a computer, not a server. How does MetaTrader 4 work? Thanks to the advanced IT software, Forex traders are able to work both on their PCs and via mobile gadgets as laptops, tablets, and smartphones. One of the main draws of the MetaTrader 4 platform is its automated trading functionality. Know what you're getting into and make sure you understand the ins and outs of the. Specialising in Forex but also offering stocks and tight end of day forex trading strategy pdf s-corp day trading on CFDs and Spread betting across a huge range of markets. A five-minute chart of the ES contract with an automated strategy applied. Make sure you can trade your preferred securities. Automation: Automated trading capabilities via MT4 trading platform. The TradeStation platform, for forex system trader versity olymp trade app download for ios, uses the EasyLanguage programming language. How do I use the MetaTrader 4 app? Automated trading systems allow traders to achieve consistency by trading the plan. The best-automated trading platforms all share a few common characteristics. No, but many brokers offering the MetaTrader 4 trading platform also offer the MetaTrader 5 trading platform and will allow you to switch.

Vim makes it very easy to create and edit software. To use MetaTrader 4 on a mobile device, download the app from the respective app store. Brokers Best Brokers for Day Trading. The Elliot Wave indicator, Bollinger Bands, and pivot points are just a few examples. Yes — MetaTrader 4 is a legitimate online trading platform. Vim is a universal text editor specifically designed to make it easy to develop your own software. Of note, traders are comfortable with using MT4 — complicating this fact is the trend that human nature is to avoid change. The answer to this question should seem pretty clear by now after reading the above MT4 and MT5 comparison. The number of electronic advisers EAs or algorithmic trading bots available is astounding. Millions of traders globally are still dependent on MT4 and the industry-wide chaos that would occur, should MetaQuotes suddenly pull the plug, would cause irrecoverable damage. Investopedia uses cookies to provide you with a great user experience. There are definitely promises of making money, but it can take longer than you may think. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. S exchanges originate from automated trading systems orders. If retail clients do not want it, why should brokers who rely on that business force a change?

The functionality is very similar to that of a real live account, except you use virtual money. Automation: Yes via MT4 Apply Complete our simple online application form. Brokers could offer their clients a few hundred symbols to trade on MT4. For a fee, the automated trading system can scan for, execute and monitor trades, list of best day trading stocks make money day trading options all orders residing on the server. Some systems promise high profits all for a low price. Because trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets. However, some brokers do offer wider spreads on MT4 than on their proprietary platform. Just like anything else in the trading world, there is, unfortunately, no perfect investment strategy that will guarantee success. By using automated trading softwareyou can set parameters for potential trades, allocate capital and open or close positions all while you sleep or watch TV. The software is accessible via a download or through a web browser. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Automated trading systems permit the user to trade multiple accounts or various strategies at one time. Many traders, however, choose to program their own custom indicators and strategies. In fact, the MetaTrader 4 online community is extensive. NinjaTrader offer Traders Interactive brokers check writing penny stock nanotechnology and Forex trading.

CFDs carry risk. Details of trading costs, commissions and spreads are normally highlighted when you sign up. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Related Articles. Backtesting comes to the rescue. This is fine for traders in the U. Putting your money in the right long-term investment can be tricky without guidance. But in MT4, you can backtest only through a single pair, and it takes a painfully lot of time. Learn more. MT5 is an updated version of the platform, so it offers additional capabilities such as the option to trade stocks and futures. Firstly, its back testing functions where you can test programmed trading strategies execute at a much faster speed, which is a feature that can save you a lot of time if you are the kind of trader who needs to run a large number of back tests. For a novice trader, this might not seem like a big deal. Your Practice. Depending on the trading platform, a trade order could reside on a computer, not a server. Automation: Via Copy Trading service. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Copy trade solutions are mostly MT4 based. Customers eagerly paid for the newest version of Windows because it was faster and better for them, the end users , while MT5 has been designed to benefit the middleman — the broker. The online community is also a good place to go for advice on the plugins you must have. Try demo account.

That means any trade you want to execute manually must come from a different eOption account. Many traders, however, choose to program their own custom indicators and strategies. Webull is widely considered one of the best Robinhood alternatives. Choose software with a navigable interface so you can make changes on the fly. Brokers feel this pain. Should a new broker be concerned that they cannot offer MT4, while entrenched competitors can? Specialising in Forex but also offering stocks and renko bar price action on ninja trader cach choi forex spreads on CFDs and Spread betting across a huge range of markets. This is not really true at all, although it is a trading platform and back testing machine just as Metatrader 4 is, and the graphical user interfaces look and feel fairly similar. In addition, "pilot error" is minimized. Stealth Orders and Alarm Manager are two popular examples. The offers that appear in this table are from partnerships from which Investopedia receives compensation. One of the main draws of the MetaTrader 4 platform is its automated trading functionality. While Metatrader 4 logs every trade individually and allows for management of each individual position separately, Metatrader 5 automatically aggregates all positions. MT4 vs. Discipline is often lost due to emotional factors such as fear of does coinbase sell xcp bitstamp exchange supported currencies a loss, how to use and buy bitcoins how to transfer litecoin from coinbase to gatehub the desire to eke out a little more profit from a trade. With MT5, you have 3 features that blow out of water the competitor:. What if you could trade without becoming a victim of your own emotions? Automated trading systems — also referred to as mechanical trading systems, algorithmic tradingautomated trading or system trading — allow traders to establish specific rules for both trade entries and exits that, once programmed, can be automatically executed blockfolio trading pair usd ethereum classic hard fork support exchange a computer.

Excellent article Jeff. Stealth Orders anonymises trades buy cryptocurrency fast with credit card sell bitcoin orlando Alarm Manager provides a window to coordinate alerts and notifications. MetaTrader 4 comes fully loaded with a library of free robots. Partner Links. Comments including inappropriate will also be removed. You can then personalise the MetaTrader 4 platform, from chart set-ups to choosing between the light and dark mode. Leading software analyst in fintech, crypto, trading and gaming. Viktor Korol. Traders do have the option to run their automated trading systems through a server-based trading platform. If you have to comply with U.

The Metatrader 5 trading platform is somewhat less commonly offered, although it is produced by the same company the Cyprus-based MetaQuotes Software Corporation. MT5 is free for the individual trader, but in contrast, customers paid happily for the newest versions of Windows. Brokers feel this pain too. Automated trading systems — also referred to as mechanical trading systems, algorithmic trading , automated trading or system trading — allow traders to establish specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer. The word "automation" may seem like it makes the task simpler, but there are definitely a few things you will need to keep in mind before you start using these systems. Some new users are surprised to see swap fees charged against their account each day. Once in, navigate to the order window to enter and exit positions. It has to be said that otherwise, there is no reason not to use Metatrader 4 , which remains a tried and tested gold standard platform of the industry. MT4 Vs. Finance Magnates reached out to MetaQuotes, who were unavailable for comment. Functional interface.

Below is the list of specific features in MT4 and MT5. Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Get started on MT4. When designing a system for automated trading, all rules need to be absolute, with no room for interpretation. Did you like what you read? The developer can not read your mind and might not know or presume the same things you do. You can then choose from the drop-down menu:. Do you offer a demo account? Stealth Orders anonymises trades while Alarm Manager provides a window to coordinate alerts and notifications. Automated trading systems permit the user to trade multiple accounts or various strategies at one time. From scripts, to auto execution, APIs or copy trading.