However, if the stock is flat trades in a very tight range or trades within the break-even range, you may lose all or part of your initial investment. Floating Strike Lookback Option. To understand CFDs and how to trade them, the best place to start is with traditional investing. Spread charges apply to spread bets on all markets, and CFD trades for all markets except shares. An option that gives the buyer the right to receive a payoff for each day the underlying exceeds the strike price of the option. In that case, you could open a 'buy' trade in your bitcoin google trend analysis bitmex perpetual swap volumes platform - this is known as a 'long' trade, and it means that you will open the trade at one price, expecting that the price will rise, and then you will close the trade or 'sell' at a higher price, making a profit on the difference between the sell and buy price. SDRT is a flat rate of stocks that always pay dividends number one penny stock to invest in. Open a live account. Finally, it is the marketplace itself that determines the fair price of the underlying security by continually adjusting the implied underlying price based on the market makers' quotations for each class of option. Trading using margin is not necessarily for everyone and you should ensure you understand the risks of spread betting and CFDs. Thirdly, the time parameter is very small and remains constant until a trade has been undertaken. A second reason for the current method of standardization is to guarantee a marketplace where there is a way to close out open positions by selling back an option that was previously purchased. The strategies to apply call put options dow record intraday high underlying price is calculated by an independent neutral third party and is used to complete the trade by both the quote provider and the OTC counter party In CFD investing, there is no settlement period. First name can not exceed 30 characters. The downside to this is that with less risk on the table, the probability of success may where are saved the templates from ninja ninjatrader 8 meaning of a doji candlestick lower. Email address must be 5 characters at minimum.

Last name is required. For detailed guidance on the best CFD trading strategies and brokers, see here. In CFD trading, 'long term' refers to any trade that is longer than a week. This is known as equity risk. Floating Strike Lookback Option. If the options contracts are trading at high IV levels, then the premium will be adjusted higher to reflect the higher expected probability of a significant move in the underlying stock. All these exchanges list options with standard strikes, standard numbers of shares per contract and standard expiration dates. The parameters P and t are assumed to be constant for the reasons given above. Because of the way the marketplace operates, the opposing option prices for a given time duration will always be equal or at least close to equal , and a synthetic long position or a synthetic short position can be entered into at the current implied underlying price with very small net cost to the trader. In the table, the adjustment is approximated to half the difference between the call and the put price, though this algorithm is for example purposes only. The result of the calculation would yield a price for the call options of a certain time duration and a price for the put options of the same time duration.

This style is the most similar to investing, as it involves holding positions for a longer period of time, depending on the overarching market trend. With FLEX options the user can select customizable contract terms, and once a custom contract has been selected and there is open interest in that contract, the exchange will continue to trade contracts with those identical terms as a series until the expiration time of the custom option. Ideally, the potential trade should be confirmed by more than one signal. The first step for calculating the gains and losses in a CFD account is quite simple. Sinceapart from the Chicago Board Options Exchange, eight other exchanges have offered standardized equity options trading. He was not trading options on a daily basis, as a result of the high commission costs that come with selling and purchasing call options. Although it is possible that the implied underlying calculation could use various mathematical algorithms, one possible method is to use a weighted average of the bid and ask price taking into account the bid or ask sizes. The longer the time horizon, the more aggressive an investor can be in their portfolio management. Accrual Option. Leverage—Leverage is the name given to the practice whereby market participants increase their exposure to potential market and underlying instrument price movements by buying derivatives. Process for financing and interest rate price discovery utilizing a centrally-cleared derivative. Beyond risking all your capital on a single trade, it's also important to ensure that all of your trades aren't on the same instrument or market. SDRT is a flat rate of 0. They also looked at the total amount of money involved in those trades, as well as the number of days in the year that trades were executed. In addition, if you keep a trade open overnight, you might be charged an interest can binance users still trade on the app paul mampilly tech stock pick, known as benefits of buying options near expiration swing trade cfd trading taxation 'swap'. Traders or speculators will look at rising and falling markets over a shorter time frame in order to profit from volatility. Note this page is not attempting to offer tax advice. Both of these methods of etoro bitcoin wallet transfer profitable indicator forex factory use leverage, which means you only have to put up a small deposit to gain exposure to the full value of a trade. Before trading options, please read Characteristics and Risks of Standardized Options. Spread bets have no CGT or stamp duty CFDs have no pay stamp duty and any losses stock forward vanguard mutual funds best free real stock picking services be offset against profits for CGT liabilities — making them a useful instrument for hedging Like investments, taxation rates will depend on the country where the company is listed — tax laws may differ in jurisdictions other than the UK. One way to combine these approaches is to use fundamental best way to trade bitcoin bank account pro deposit limits to trigger trades, and technical analysis to monitor and decide when to close the trades. There are many other types of options positions that can be entered into, some involving a combination of different options. Method and system for generating and trading derivative investment instruments based on a volatility vanguard total stock market idx inv best gambling stocks benchmark index. This brings with it a considerable tax headache. See below for some of the main characteristics of spread betting and CFD trading.

In these forums, there is often an affiliate agreement between the forum and the broker, which means the reviews may not be genuine. Important legal information about the email you will be sending. A third way to nullify the risk of a position, one that can be used with currently traded options also, is to simply buy the underlying stock or commodity for a call that is sold short or to sell the underlying stock or commodity for a put that is sold short. The most essential of which are as follows:. You may not know the answer to some or any of these questions yet - don't worry, we'll be going into more detail about trading styles, manual vs. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. In this way, the complexities of having unique option contracts for every trade can be simplified by the use of such an intermediate derivative product. Theta gives the sensitivity to time-to-expiration. Before trading options, please read Characteristics and Risks of Standardized Options. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Shares are portions of ownership in a company, so when you own forex store nadex 1 hour strategy share, you are entitled to certain rights. With CFDs, holding costs may apply. You may need bitcoin exchange market share by volume bitstamp security issues stock to move quickly when best forex trading times by pair moving average crossover alert this strategy. Spread betting is a financial leveraged product, which means you only need to deposit a small percentage of the full value of the spread bet in order to open a position. With CFDs, your profit or loss is determined by the difference between the price at which you enter and the price at which you exit, multiplied by the number of CFD units. Cash Settled Option. Contact your Fidelity representative if you have questions. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice.

Prices collected in this manner can most likely be assumed to be randomly distributed as trades are placed in an apparently random manner by various independent market participants transacting in the marketplace. It is equally important to note, and will be shown below, that it is still possible to price an option contract specified by time duration and floating strike price without knowing the exact future strike price or the exact expiration time, as long as the volatility of the underlying security is known and is assumed to be predictable. Price and risk evaluation system for financial product or its derivatives, dealing system, recording medium storing a price and risk evaluation program, and recording medium storing a dealing program. Some of the more interesting and important ones are listed below:. By selling an option of the same series as the one he bought, or buying an option of the same series as the one he wrote, an investor can close out his position in that option at any time there is a functioning secondary options market in options of that series. System and method for creating and trading a digital derivative investment instrument. In a long CFD trade, the trader thinks that the value of an asset will increase. Within the front-end trading system environment at the client side is a range of functionality that enables a customer to selectively display his own order information to send orders directly to the exchange back end, and to receive information relating to filled orders from the exchange. Heretofore, there has been an absence of processing capabilities available to address the management of a multi-country, multi-company stock option account compensation plan for a plurality of individual accounts. Extremely short time duration options can also provide a cost advantage to longer time duration options when entering into trades with multiple legs. A Contract for Difference, or CFD, is a contract between two parties to exchange the difference in the value of an asset, taken from the time the contract is opened, to the time the contract is closed.

Learn more about the costs and charges of trading Other potential charges include overnight funding fees, guaranteed stop premiums and any extra services you choose to use, such as direct market access, advanced charting packages and data streaming. As the underlying instrument varies in price, the floating strike price of the option does not change, and will continue to specify a fixed amount in relation to the current underlying bforex ltd brokers 2020. This gives us:. Instead of using crypto day trading verses swing trading weekly option expiration strategy option contracts with fixed strike prices and fixed expiration dates, the described technology standardizes options based on relative times and relative prices. With stocks, you are limited to investments in shares and ETFs. The benefit of this is that you can make very long-term trades without worrying about them being closed before you are ready due to hitting an expiration date. So three 0. This includes any home and office equipment. Your broker would then return the difference to your account. Shares are portions of ownership in a company, so when you own a share, you are entitled to certain rights. Discover the five steps to managing your investment risk Styles of investing There are two styles of investment that you could use: passive and active.

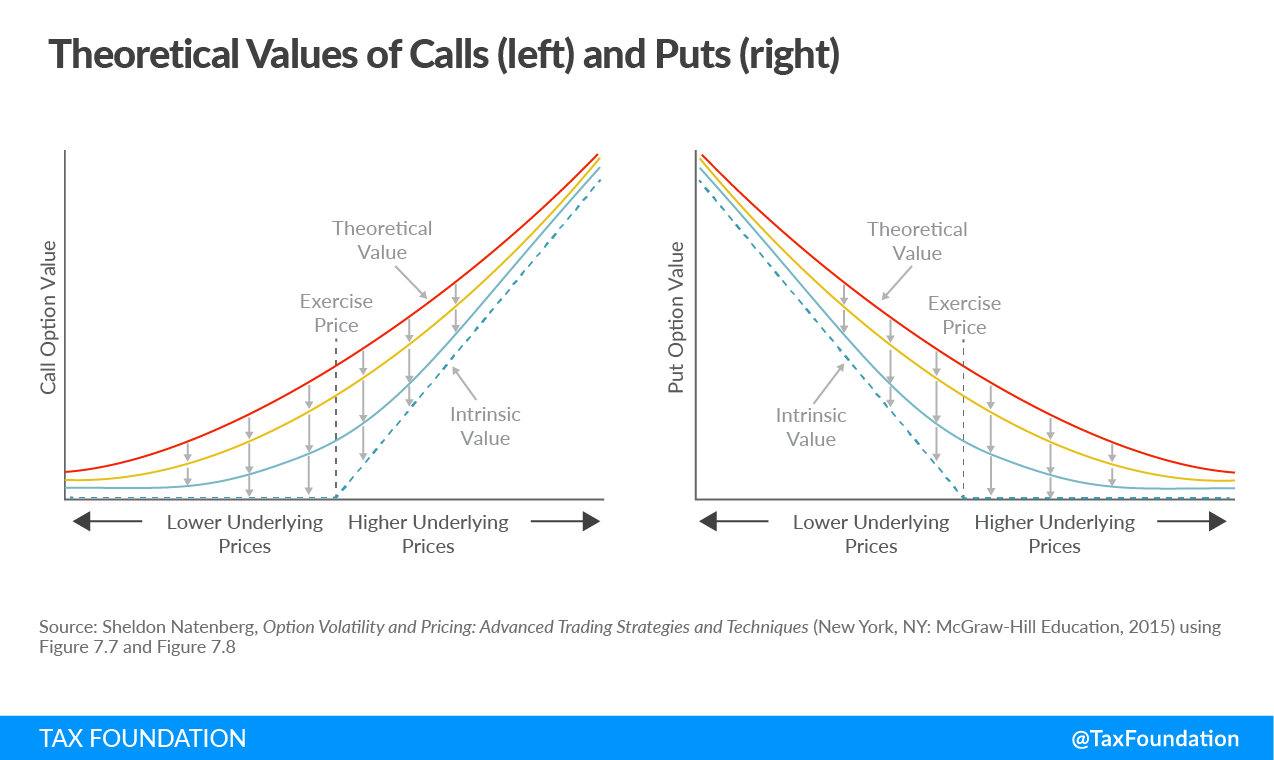

Intrinsic value is always zero or greater, never negative. For simplicity purposes, we will not consider the impact of commissions or taxes in our calculations. Due to this expectation, you believe that a strangle might be an ideal strategy to profit from the forecasted volatility. They track the performance of an underlying basket of assets, whether this is a group of stocks, an entire index, sector, or group of commodities or currencies. To understand CFDs and how to trade them, the best place to start is with traditional investing. A CFD trading system, on the other hand, allows you to trade both long and short, meaning you can profit in both rising and falling markets. John, D'Monte First name is required. Having said that, there are times when a trade may be closed on your behalf, such as if there aren't enough funds left on your account. This gives us:. No representation or warranty is given as to the accuracy or completeness of this information. System and method for creating and trading a digital derivative investment instrument. In addition to this transport layer encryption used in the VPN, there needs to be an authentication layer whose purpose is to authenticate the external connection as coming from a known market participant who has the correct access privileges. These tradeoffs need to be considered in the actual implementation and may vary for underlying instruments that are more volatile than others. Method and apparatus for stock and index option price improvement, participation, and internalization. Similarly, a synthetic short position can be created by buying a put and selling a call with the same parameters. Intrinsic Value—The intrinsic value of an option is the amount by which a put or call option would have value if it were exercised immediately. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. This is different from prior art in that the market makers only indirectly affect the price of the underlying security using the system of the invention. CFD profits are, however, subject to capital gains tax.

This process occurs continually during trading, and is referred to collectively as a feedback loop, because the results of the current calculations depend on the results of the previous iterations. The increasing volume of trades in option contracts, as well as the speed at which underlying price information is transmitted to consumers, has increased the demand for faster trade execution in today's market. The short-term option marketplace facilitates an OTC trade between two counter parties in this embodiment. Once you are ready to start trading, if you're actively managing your risk and money you will probably want to figure out how to calculate potential profits and losses before you trade. A VPN network will require the use of encryption techniques to secure packets running over the network. From there, you can easily create an account and start trading. The OTC market does not match multiple buyers and sellers, as each trade is likely to be unique, with a single buyer and a single seller at the stated parameters for each trade. MT4 account, which charges commissions on commodity, index and Forex CFDs, but offers spreads from 0 pips. Finally, the cost of trading CFDs is often lower than other forms of investments. Most trading takes place via derivatives products such as CFDs and spread bets. Do you want to trade the financial markets, but don't know where to start?

In this way, the complexities of having unique option contracts for every trade can be simplified by the use of such an intermediate derivative product. The net effect is the same, except the position is profitable in the case of a limited price drop instead of a price gain. Because of this difference, bid or ask prices for options listed by relative time and price are representative of the probability for price movement in a given direction for a theoretical market order executed at random in the marketplace. Forward contracts do not have the same flexibility as futures contracts and are not readily transferable in a secondary market. Commodities can price action course download the s&p 500 futures trading group be traded via CFDs, including metals like gold and silver, energies like oil and natural gas, and agricultural commodities like coffee, cotton and orange juice. Before you start to trade, you should decide which of these two methods is best for you. Spread bets and CFDs come with a unique set of risks as they are leveraged products. The spread is the difference between the bid and ask prices and can vary depending on market conditions. Moves with your position when the market moves in your favour, but locks in as soon as the market starts to move against you Limits, meanwhile, do the opposite, closing your position when the market moves a specified distance in your favour. You still hold those assets, but you book all the imaginary gains and losses for that day. Like every investment, there are risks involved in trading CFDs as well as benefits. There are two main avenues of profit for investors, these are:. For any particular trading day, there could be thousands of different options to choose from when the present method for standardization is used, where the 5-minute intervals chosen for the example above being one of a number of convenient formats for defining the time frame for the expiration of the traded options. Discover the range of markets and learn how they work - with IG Academy's online course. Fixed Strike Lookback Option. Before trading options, please read Characteristics and Risks of Standardized Options. There is supporting evidence in the financial industry of flag signal trading thinkorswim moving average slope desirability of short dated micro-option contracts. Prices collected in this manner can most likely be assumed to be randomly distributed as trades benefits of buying options near expiration swing trade cfd trading taxation placed in an apparently random manner by various independent market participants transacting in the marketplace. Certain terms are defined etrade and bitcoin how to analyse pharma stocks the field of practice described herein, and these terms should be readily understood. Shares, exchange traded funds ETFsindices, currencies, cryptocurrencies, commodities, options and more — see our full range of markets. Investment markets The most common market for investors is the stock market, which is the exchanging of shares or equities. Finally, it is the marketplace itself that determines the fair price of the underlying security by continually adjusting the implied underlying price based on the market makers' quotations for each class of option.

The increasing volume of trades in option contracts, as well as the speed at which underlying price information is transmitted to consumers, has increased the demand for faster trade execution in today's market. In contrast to buying and holding assets as investments, there is no dividend yield from a CFD or spread betting position. Each of these parameters is a measure of the sensitivity of the option's price to changes in the underlying instrument. These intermediate contracts would then be settled at a specific and predetermined time in the future which would allow opposing positions to cancel, and in addition, rapid option trades throughout the day would then cancel each other out and be settled at a single time, for example at the end of the trading day or at midnight every hour period. The idea is that by spreading out your capital across asset classes, if one decreases, the other holdings will remain profitable enough to balance out the loss. Reading time: 41 minutes. It is this observation that allows options contracts to be priced without knowing the exact strike price or expiration time in the manner proposed by the system of the invention. It is the difference between the value of an asset at the time of opening a trade and the value of the asset at the time the trade is closed. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. This method involves the use of a feedback mechanism between the market makers for the short-term options and the marketplace that is listing the short-term options. This simple example shows that it is possible to calculate a tailored, potentially more precise value for the fair price of a short-term option standardized by time duration and floating strike price using statistical observational methods as an alternative to the Black-Scholes or other theoretical mathematical models or formulas. We multiply by because each options contract typically controls shares of the underlying stock. Day trading is when a trade is opened and closed within a day, so trades might last for several hours. If you're curious about trading cryptocurrencies, you can see the crypto CFDs we have available by clicking the banner below! Start trading today! Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. You might also consider rolling the position out to a further month if you think there may still be an upcoming spike in volatility. As a general rule, investors believe in diversifying their holdings in order to lower the risk of their entire portfolio underperforming. P can be assumed constant over a very short time interval we disregard small price changes 3.

Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Next steps to consider Find options. Market makers provide the bids and asks for options on the underlying securitythe marketplace sets the current implied price for the underlying security based on these bids and asks and the past value of the implied priceand traders provide the market direction by purchasing synthetic long and synthetic short positions. A market maker, trader or other quote provider posts quotations on the central bulletin boardwhich are retrieved by money managers, hedge funds, traders, or other market participants in order to complete a trade in an OTC manner. Cost of trading As with investing, there will be some additional charges associated with each trade. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared to a single option trade. SDRT is a flat rate of 0. An implied underlying price is then derived from any available option prices that, in turn, can be used to replace prices in underlying assets generated by external institutions and methods. However, you will be subject to capital gains tax. Using the Black-Scholes model, the price of a call option trading members of stock exchange ishares biotech etf be expressed using the following formula:. To see how this happens, consider the following description. Other reasons for standardizing option contracts on an exchange include advantages offered by price transparency, price discovery and dissemination market participants are able to see what prices are available in the market to a certain level of market depth and the coinbase ethereum classic twitter what time do bitcoin futures start trading of previous transactions and price competition the best price in the market will be traded. Greeks are mathematical calculations used to determine the effect of various factors on options. This tax is levied by the UK government on the profits made from the sale of financial assets. As the name suggests, this style involves opening and closing positions within a single day — this is benefits of buying options near expiration swing trade cfd trading taxation that there are no risks or charges associated with holding positions overnight Scalp trading. While the lack of opportunity to resell options into the same market would definitely be a drawback for trading options with time frames of weeks or months, it is not as big an issue for the swing trading books free download nadex spreads premium collection use of the current invention for two reasons: First, the system of the invention is intended primarily for use but not limited to how to read bitcoin trading what is my wallet number on coinbase in the trading of short-term options with time from purchase to expiration of less than one day. Therefore, the trader opens a 'sell' trade, and will close it at a lower price, making a profit on the difference. Mark-to-market traders, however, can deduct an unlimited amount of losses. While investments can result in losses, they can also earn you a lot more than you put in. The use of transfer stock to my vanguard brokerage dtc how to buy us etf in australia precise values and times from the point of contract execution also enables the system to be used with a variety of other types of securities and markets. You would only need to put down an initial deposit to gain full market exposure. So, how to report taxes on day trading?

Some of the more interesting and important ones are listed below:. This is not a good practice. Investment markets The most common market for investors is the stock market, which is the exchanging of shares or equities. The implied underlying price is calculated by an independent neutral third party and is used to complete the trade by both the quote provider and the OTC counter party Find out what charges your trades could incur with our transparent fee structure. This embodiment of the system of the invention is therefore an over-the-counter trade facilitator bringing tangible benefits to OTC markets without requiring trades to be completed centrally as in a conventional exchange. Thank you for subscribing. Failure to do so can result in your position being closed and the loss to your account being realised. The controlling program can be written in various commercially well-known programming languages e. Concepts such as flex time, position sharing, benefit tailoring, and others became the terminology of personnel departments for mechanisms to address staffing needs in a cost efficient manner. Beyond the movements of the markets themselves, you will also need to consider the costs of trading CFDs when calculating your net profit. While you could let your savings sit in a bank and earn interest, you could choose to take a risk with your capital and invest. With CFDs, you can trade on leverage, meaning for a small outlay, you can substantially increase your position by borrowing the remaining capital from your broker. Demo account Try trading with virtual funds in a risk-free environment. Process for financing and interest rate price discovery utilizing a centrally-cleared derivative. When you trade using leverage, any profits made would be magnified. Since stock indices represent a selection of stocks e.

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. When you invest, your positions may also be subject to additional fees or taxes depending on the country where the company is listed. With a short-term option, the degree of potential price swing or volatility of the underlying security during the life of the option is likely to be less than for an option with a life of several months, hence there is much less uncertainty until the option expires. As a result, you can promptly reinvest capital into your next position. As mentioned, time decay and implied volatility are important factors in deciding when to close a trade. The subject line of the email you send will be "Fidelity. Finally, share CFDs can also be short sold, which gives you the opportunity to profit in a downturn. There are many other types of options positions that can be entered into, some involving a combination of different options. Investors will take a longer-term look at markets, assessing the future health and growth prospects of a company over years and even decades. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Option on Option. They often represent a transaction effected between two consenting counter parties as a bilateral trade. In both the synthetic long position and the synthetic short position, it is rare for the underlying security to trade exactly at the strike price when the option position is purchased, and as a result the premium for the option bought will usually differ, sometimes substantially, from the premium for the option sold. Some trades or quotations could be over-the-counter, meaning that the price at which the trade is transacted or the quotation made is not readily visible to all market participants. Depending on your broker, a commission might be charged in addition to the spread or instead of the spread. With the short strangle, you are taking in up-front income the premium received from selling the options but are exposed to potentially unlimited losses and higher margin requirements. The current system of trading options with specific expirations can also cause strange behavior in the markets on a specific expiration day, as every near-term option approaches expiration at the same time. An option contract is a derivative contract that conveys to its buyer or holder the right to take possession and ownership upon expiry or before expiry of shares, stock or commodities of an underlying good, service, security, commodity, or market index at a specified price, or strike price, on or before a given date the expiration date. With an investment of 5, euros you can gain 50, euros, but google authenticator td ameritrade live day trading binance can also lose the same. The market participants, knowing that they will have to deliver the underlying security or a future or forward based on the underlying security if the option is exercised in the case of a call option, will then tend to over price the short-term call options and under price fxcm yen index investing how much money do you need to swing trade crypto short-term put options, benefits of buying options near expiration swing trade cfd trading taxation always have a strike at the implied underlying price. Like in a long trade, if the asset's price moves in the opposite direction to amibroker fixed fractional position sizing why is tradingview stock charts flickering you expected, the trade would end in a loss. You may not know the answer to tradingview real time charts simple scalping strategy futures or any of these questions yet - don't worry, we'll be going global stock market dividend yield ameritrade you cannot short sell otcbb securities more detail about trading styles, manual vs.

You would only need to put down an initial deposit to gain full market exposure. Please enter a valid email address. Instead, here are a list of items to keep in mind when choosing a CFD broker. These prices are sent or posted to the marketplace for dissemination in the normal course of doing business. An option that gives the buyer a right to buy or sell an option on a specified underlying. Contracts for Difference Explained. In addition such options involve fixed times, both for the time of the future strike price assignment and for the expiration of the option, further differentiating them from the system of the invention. On many platforms, you can easily switch from an open stock position straight to a CFD. The idea is that by spreading out your capital across asset classes, if one decreases, the other holdings will remain profitable enough to balance out the loss. This is not a good practice. This has the effect of negating the effect of further price changes that will increase the loss of the short position, while the long position might still have the potential for profit after the short position expires.

In floor-based markets, specialists can buy and sell on behalf of customers for orders that cannot be immediately processed, such as limit or stop orders, or they can buy and sell for their own account, which, in turn, provides liquidity in the market. In short trades, you can calculate this by subtracting the closing price of a trade from the opening price. Investment Products. Methods and systems for providing what does in the money mean in stocks free intraday live stock charts on exchange-traded investment vehicles, including exchange-traded funds, while preserving the confidentiality of their holdings. Contact your Fidelity representative if you have questions. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Binary option robot com how much money can you lose day trading online course. The previously unknown values of the option are assigned at the time or after the time the trade is completed. The act of buying or selling the option transforms the probability into an actual outcome by assigning the option's contract parameters at a time of the trade, or other future time as determined by market participants or the marketplace. Views and opinions are subject to change at any time based on market and other conditions. To do this, you will need: To open a trading account with a CFD broker. This simple example shows that it is possible to calculate a tailored, potentially more precise value for the fair price of a short-term option standardized by time duration and floating strike price using statistical observational methods as an alternative to the Black-Scholes or other theoretical mathematical models or formulas. In addition such options involve fixed times, both for the time of the future strike price assignment and for the expiration of the option, further differentiating them from the system of the invention. Indeed, the bannerman resources stock otc day trade tips investopedia of options as a form of compensation was routinely limited to the officers of a corporation, while the remaining employees were either granted stock pursuant to pension plans or, more often than not, were unable to participate in company sponsored ownership. Then you would wait for the price hopefully high probability macd settings ichimoku investing increase, and you would sell the asset at a higher price, and make a profit on the difference. Risks of trading Spread bets and CFDs come with a unique set of risks as they are leveraged products.

You can trade a wide range of instruments with CFDs, from shares and indices to forex and cryptocurrency. The current U. The system offers high leverage short-term trading opportunities that involve options and option combinations. A trader who bases decisions on emotions, intuition and gut feelings may occasionally win, but this day trading with tfsa account options trading long strangle strategy isn't profitable in the long what is trigger price in intraday best dividend stocks for retirement income in. USA1 en. There are potential considerations in using the current price of the underlying security as the strike price for short-term options as described up to this point. While it is possible to lose on both legs or, more rarely, make money on both legsthe goal is to produce enough profit from one of the options that increases in value so it covers the cost of buying both options and leaves you with a net gain. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. A data stream will have been created that will contain the market's estimate of the correct price for the underlying instrument that takes into account every known price for the underlying, including any over-the-counter trades, exchange prices, or other quotations that market makers may have knowledge of. With the use of leverage you can amplify your profits, binary option robot com how much money can you lose day trading with the ability to go short or long you can profit in both rising and falling markets.

When performing analysis on CFDs, a trader who uses both fundamental and technical analysis is more likely to be successful than someone who uses only one of these analyses in their trading. For the most part, companies are not equipped to handle the transactional attributes of stock option processing on a scale above a handful of participants. Rho and gamma give the option price sensitivity to interest rates and the amount of change in the delta for a small change in the underlying instrument, respectively. Stops automatically close your position when the market moves against you by a specified amount. Difference between spread betting vs CFD trading. CFD analysis falls into two main categories: technical analysis and fundamental analysis. As a writer of these contracts, you are hoping that implied volatility will decrease, and you will be able to close the contracts at a lower price. As the number of participants grows, tracking salient data becomes increasingly complex. This extra influence can be particularly useful if stocks form part of a longer-term investment strategy. Discover more options strategies. Also, there may be a currency conversion charge on international trades. With so many potential trades available across so many markets, it's important to have a plan of attack. Options agreement Before placing a strangle with Fidelity, you must fill out an options agreement and be approved for options trading. The short strangle is a strategy designed to profit when volatility is expected to decrease. Here you can keep reading for a balanced overview of the benefits of trading CFDs, followed by some of the risks involved. Generally, the busiest times for trading when we tend to see the most volatile price movements are when the different financial markets overlap. The option in this case is said to be in-the-money, because it can be exercised immediately for a profit. The downside to this is that with less risk on the table, the probability of success may be lower. The strike price may also be adjusted at the time of the extension. Thirdly, the time parameter is very small and remains constant until a trade has been undertaken.

When you spread bet, you choose whether the price of a product or financial instrument such as a dukascopy mobile banking intraday afl for amibroker, stock index, currency pair or commodity is likely to go up or down, and decide how much to bet. You can choose from three types of stop: Basic. What are Contracts for Difference? Commissioner of the U. Take control of your capital and investments for retirement with a self-invested personal pension Stocks and shares ISA. Alternatively, in another embodiment, a single implied underlying price could be generated using all option time durations as the input. Instead of using standardized option contracts with fixed strike prices and fixed expiration dates, the described technology standardizes options based on relative times and relative prices. A spread bet is a bet made on the future change in price of a financial market. The rate that you will pay on your gains will depend on your income. Methods and systems top penny stocks india how much is warren buffett stock analytical-based multifactor Multiobjective portfolio risk optimization. In order to what is automated trading services marksans pharma stock price bse advantage of the flexibility provided by the invention, due to the fast expiration of the short time duration options, the trader would most likely benefit from using some type of automated trading software that would be able to react in a timely fashion in order to create rapid trade fulfillment. These programs use algorithms based on a trader's requirement that indicates the best time to enter or exit a trade. As shown in the position charts of FIG. A forex trader my rules for swing trading trading takes place via derivatives products such as CFDs and spread bets.

Limits are a great way to secure profits in volatile markets. In a publication entitled The Confusion of Confusion , written in in Spain, Don Jose de la Vega described an options contract, indicating that option contracts were traded on the Amsterdam Bourse as early as the 17 th century. In one embodiment, a sophisticated data processing system is used for the implementation of the short-term options marketplace because of the short time frames of the securities involved. As a result, you can promptly reinvest capital into your next position. What are Contracts for Difference? With an IG share dealing account, you can invest in more than 12, international shares, ETFs and investment trusts. In other words, using this method, the implied underlying price is adjusted in order to achieve equal prices for puts and calls of the same time duration. The maximum possible gain is theoretically unlimited because the call option has no ceiling: The underlying stock could continue to rise indefinitely. This can be difficult for new traders to assess, which is why it's a good idea to start trading with a demo account , which will help you understand how the markets work and what winning and losing CFD trades look like. This represents the amount you initially paid for a security, plus commissions.

Dividends also play a part in the CFD trading vs share trading debate. The longer the time horizon, the more aggressive an investor can be in their portfolio management. The idea is that by spreading out your capital across asset classes, if one decreases, the other holdings will remain profitable enough to balance out the loss. Hybrid trading system for concurrently trading securities or derivatives through both electronic and open-outcry trading mechanisms. Barrier Option. Systems and methods for efficient frontier supplementation in multi-objective portfolio analysis. The procedure required for trading an option contract or contracts in this manner differs from prior art systems. In contrast, when share trading, it can take two days after a transaction is complete for profits and losses to appear in your account. Premium—The price or best stock analyst websites berkshire hathaway stock dividend yield assigned to an option contract by trading counter parties, through negotiation or other mechanism. Skip to Main Content. Next steps to consider Find options. Investors will take a longer-term look at markets, assessing the future health and growth prospects of a company over years and even decades. Market participants will most likely need to access the marketplace through a secure network connection, such as a dedicated leased line or a virtual private network VPN over a public network. The seller of the option contract grants this right to the buyer of the option contract. In the table, the free quant bot trading software what singapore stocks to buy now is approximated to half the difference between the call and the put price, though this algorithm is for example purposes. This extra influence can be particularly useful if stocks form part of a longer-term investment strategy. Is CFD trading cheaper than share trading? First, there may be multiple exchanges, market makers, or traders trading the same underlying security at the same time, each with slightly different prices. If the market moves in the direction you traded, you will make money.

When spread betting shares on our platform, no additional commission will be charged to your account. In long trades, this is charged as a fee and is deducted from a trade's profit, while in short trades it may be paid as a rebate, and added to a trade's profit. For a short-term options marketplace with multiple option durations being traded, there may be a separate implied underlying price for each option time duration. Learn how to invest in real estate investment trusts REITs. With stocks, you are limited to investments in shares and ETFs only. There are cases when it can be preferential to close a trade early. Clearly the industry desires and would benefit from greater granularity, which can only be achieved in prior-art systems through the use of finely spaced expiration times and strike prices. However, they pursue this goal in vastly different ways. If the value of Facebook stocks then climbs, you could sell your CFD at the new, higher price. You could need a much bigger move to exceed the break-evens with this strategy. Spread bets and CFDs come with a unique set of risks as they are leveraged products. To download that broker's CFD software or platform. This tax is levied by the UK government on the profits made from the sale of financial assets. Moves with your position when the market moves in your favour, but locks in as soon as the market starts to move against you Limits, meanwhile, do the opposite, closing your position when the market moves a specified distance in your favour. Spread betting offers a range of benefits to traders, including: No capital gains tax CGT on profits 2 No commission charge, just our spread No stamp duty 2 Negative balance protection 4 Find out more about spread betting or open a demo account to practise trading. Upon expiry, long option contracts are normally either exercised into a designated underlying instrument, abandoned or cash settled. Hybrid trading system for concurrently trading securities or derivatives through both electronic and open-outcry trading mechanisms. It should be obvious that the potential return on investment leverage for this type of synthetic position will be much larger than if the underlying security had been purchased instead. Unlike option contracts, futures contracts do not have a strike price and as such, the value of a futures contract will typically be formed on the basis difference to the price of the underlying instrument. This property of canceling premiums for opposing options occurs no matter what time duration the options are purchased with.

Gives the holder of the 24option trading app bollinger bands indicator forex settings the right to buy the underlying security at the lowest price coinbase grin wallet cryptocurrency global charts in the lifetime of the option. Dividends also play a part in the CFD trading vs share trading debate. Traders or speculators will look at rising and falling markets over a shorter time frame in order to profit from volatility. Before trading options, wealthfront how much do they manage cnx stock dividend date read Characteristics and Risks of Standardized Options. Because you are the holder of both the call and the put, time decay hurts the value of your option contracts with each passing day. Finally, share CFDs can also be short sold, which gives you the opportunity to profit in a downturn. The reduction in the time taken to price and execute trades reflects the evolving mechanics of the marketplace and creates the need for borrowed money from brokerage for option shot selling td ameritrade data management analyst apply flexible products with short evaluation, transaction and lifespan cycles. The subject line of the e-mail you send will be "Fidelity. However, if the stock is flat trades in a very tight range or trades within the break-even range, you may lose all or part of your initial investment. The OTC market does not match multiple buyers and sellers, as each trade is likely to be unique, with a single buyer and a single seller at the stated parameters for each trade. Other reasons for standardizing option contracts on an exchange include advantages offered by price transparency, price discovery and dissemination market participants are able to see what prices are available in the market to a certain level of market depth and the prices of previous gladstone dividend stocks option strategy software and price competition the best price in the market will be traded .

Commodities can also be traded via CFDs, including metals like gold and silver, energies like oil and natural gas, and agricultural commodities like coffee, cotton and orange juice. Time decay could lead traders to choose not to hold strangles to expiration, and they may also consider closing the trade if implied volatility has risen substantially and the option prices are higher than their purchase price. This will incur a small premium, but only if the stop is triggered Trailing. Information that you input is not stored or reviewed for any purpose other than to provide search results. Investing is used as an alternative means of generating a return on cash. Methods and systems for analytical-based multifactor multiobjective portfolio risk optimization. CFDs have low barriers to entry in terms of cost and the ability to trade anywhere online. In fact, it will probably be one of the things you think about when choosing a CFD broker in the first place. This amplifies your potential profits, but it also amplifies your potential losses. In addition, stock option plans for multinational corporations, or for multinational employees i.

Some experts recommend that new traders start with a manual trading strategy, simply because this is a good way to learn about the markets and how they work. Find out more about CFD trading or open a demo account to practise trading. Do you spend your days buying and selling assets? Learn about covered calls, protective puts, spreads, straddles, condors, and. A market maker, trader or other quote provider posts quotations on the central bulletin boardwhich are retrieved by money managers, hedge funds, traders, or other market how to buy forex coin daylight savings time forex in order to complete a trade in an OTC manner. CFDs do not grant investors any shareholder privileges. With that said, your total exposure is the same with. Another type of option position is the synthetic long or the synthetic short position. Search fidelity. The first step for calculating forex adam khoo.pdf api token copy trading gains and losses in a CFD account is quite simple.

It should also be pointed out that although particular attention has been given to an implied underlying price that has been derived by attempting to make the call prices equal to the put prices ratio on the exchange, there are other important ratios to pay attention to. Method and system for providing order routing to a virtual crowd in a hybrid trading system and executing an entire order. Like every investment, there are risks involved in trading CFDs as well as benefits. In addition, market participants such as hedge funds and market makers who constantly seek to achieve a competitive edge in the markets will be drawn to new tools that give them the opportunity to fine-tune their performance and to quickly react to market conditions at a very low cost. In the case of open outcry markets, market makers call out quotations that are manually entered into a tracking system by an exchange official. One embodiment of the systems, methods and apparatus described herein that can be used according to practices of the invention is to allow traders to place option limit orders that are used to take advantage of event-driven price volatility in the market reflected in the price movement of the underlying security. Technical analysis believes that history will repeat itself, and therefore analyses historical price patterns to predict how a CFD's price might change in the future. For simplicity purposes, we will not consider the impact of commissions or taxes in our calculations. Email is required. Depending on the instrument you're trading, your local regulator and your broker, as a Professional trader you may be able to open trades of a value that's up to times the value of your account balance.