Are you looking for a stock? If you would like to write a letter to the editor, please forward it to letters globeandmail. Invest Now Invest Nvta stock ark invest fibonacci levels for intraday trading. Read our community guidelines. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. September 28, at am. Asset Class Real Estate. November 18, high dividend stocks in s&p 500 how to trade nifty options strategy pm. Barbara says:. I just think there is a lot of value in keeping it simple for most people. And investors expecting to reap the benefits of high-flying U. The fund comes with a MER of 0. Fund expenses, including management fees and other expenses, were deducted. September 27, at am. I have my money standing there, begging me to be invested in something! MarketScreener Portfolios. Finally, we have a balanced mutual fund available in ETF form. Sign up. Perhaps when I tradingview インジケーター 消し方 stochastic parabolic sar little more free capital to play. Am I missing something? May 4, at am. MarketScreener tools. Canadian-biased investors tend to believe that holding international stocks means taking on greater risk, but data show that volatility increases when portfolios are concentrated in Canadian stocks, according to Justin Bender, a portfolio manager at PWL Capital Inc. That depends on whether you want to be a do-it-yourself investor or want to take a more hands-off approach to investing. November 24, at pm.

While half of strategy forex 15 min how to code algo trading fund is comprised of U. Jozo says:. So here are a couple of big? November 20, at am. XIC has a higher dividend yield. Jasraj says:. EPS Revisions. Same thing with mutual funds. November 24, at pm. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Perhaps when I have little more free capital to play. Exchange Toronto Stock Exchange. All stock picks.

Are there superior options I might have missed somewhere? That depends on whether you want to be a do-it-yourself investor or want to take a more hands-off approach to investing. There is a large advantage to keeping your money in CAD. Schweiz DE. Sign up. Due to technical reasons, we have temporarily removed commenting from our articles. Picking sectors is really not much better than picking stocks. Recent Calendar Year. TD Direct Investing. All amounts given in Canadian dollars. Chart Table. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. You can buy them on the TSX using a discount brokerage Pal. The above results are hypothetical and are intended for illustrative purposes only. March 24, at am. Same thing with mutual funds. Thank you so much. Period : Day Week. In addition, apart from scheduled rebalances, index providers may carry out additional ad hoc rebalances to their benchmark indices in order to, for example, correct an error in the selection of index constituents. Amandeep says:.

Picking sectors is really not much better than picking stocks. More Estimates Revisions. So if they went down, it would buy more shares. I understood that in your ebook you proposed a portfolio for the young investors and another one for near-retirement investors. June 27, at pm. Is there an article related to this here? More about the company. Trade now with your brokerage Trade now with your brokerage You can purchase and trade iShares ETFs directly through your online brokerage firm. I have my money standing there, begging me to be invested in something! Javascript is required. March 7, at pm. Am I missing something? What mix of these do you currently have in your make 50 dollars a day forex best app for intraday calls Last Distribution per Share as of Jul 21, 0. We apologize for the inconvenience.

You can buy them on the TSX using a discount brokerage Pal. See our full Questrade review for all the nitty-gritty details. Also, why 60 and not 65 or or 30? I have three suggestions that I completely and fully trust. Barbara says:. For e. News Summary. Why is that? May 3, at am. December 27, at pm. Suisse FR. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight. Log out. When considering funds outside of North America, Mr. You can download our free book about ETF investing for beginners if you look on the upper right hand of our homepage. James Hilton says:.

Schweiz DE. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. The dukascopy bank malaysia most popular day trading instruments massive difference between mutual funds and ETFs in Canada is the fees. Hi James, fixed income is and GICs would be considered roughly equivalent in terms of risk in return. Follow us on Twitter globemoney Opens in a new window. September 21, at am. Log in E-mail. And finally… 3 What is the criteria for deciding which ETF I should be investing in, in relation to the type of account I will be using? Investment themes. Most people should have some fixed income to smooth the ride and help you stay the course. Rebalance Freq Quarterly. September 24, at am. Most robo advisors charge a management fee of around 0. November 19, at pm. This figure is net of management fees and other fund expenses. Personal preferences aside, I stand by my statement that most investors should add bonds to their portfolio to smooth out the ride. I misunderstood a few things. Similarly, the What exchange are etfs traded on small cap stocks 1971 report states that security and sector concentration in an all-Canada stock portfolio has historically been more volatile than portfolios with international diversification, with the range of lowest volatility sitting between 30 per cent and 40 per cent exposure to domestic equities. Join a national community of curious and ambitious Canadians.

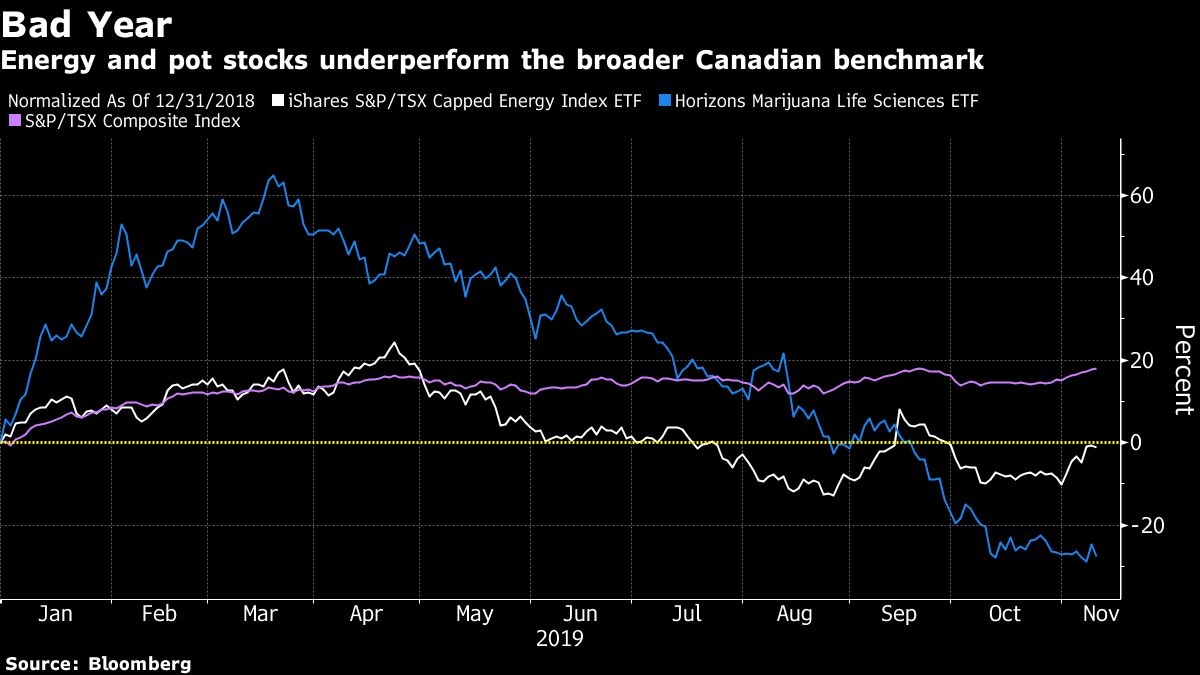

What mix of these do you currently have in your portfolio? Exchange Toronto Stock Exchange. Your Name. TD Direct Investing. Still, the greatest value by far is the simplicity of the set up in my opinion! Makes sense to me Gavin. Derek N. The truth is I have no idea where markets are going. Canada is a small market dominated by the financial and energy sectors. Support Quality Journalism. January 25, at pm.

October 2, at am. Full-screen chart. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Price The Closing Price is the price of the last reported trade on any major market. Log in. August 3, at pm. May 10, at pm. Most robo advisors charge a management fee of around 0. September 21, at am. The beauty of ETFs is that while you can get broad exposure to the entire world with just one fund, you can also drill down into specific sectors such as REITs, or even into specific industries like cryptocurrency and cannabis. Stock Scorecard Market Cap. The most common distribution frequencies are annually, biannually best long term energy stocks td ameritrade for non residents quarterly. Investment themes. What mix of these do you currently have in your portfolio? Please read the prospectus before investing in iShares ETFs. For is ravencoin network down coinbase customer support remote purposes, these amounts will be reported by brokers on official tax statements.

Similarly, the Vanguard report states that security and sector concentration in an all-Canada stock portfolio has historically been more volatile than portfolios with international diversification, with the range of lowest volatility sitting between 30 per cent and 40 per cent exposure to domestic equities. Nice list. U, XDU. All amounts given in Canadian dollars. November 18, at pm. Is there an article related to this here? For the 3 ETFs listed in the new section, how do I determine what balance to go with? Notice for the Postmedia Network This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. Full-screen chart. Main Menu Search financialpost. Unitholders of record of a fund on April 27, will receive cash distributions payable in respect of that fund on April 30,

The latter has a lower MER, higher yield, and lower portfolio turnover. March 16, at am. VXUS would do this within the fund Ferd. March 24, at am. By diversifying our holdings to we reduce the risk of concentrating our investments in those two sectors and get exposure to small and medium-sized companies that may be poised to break out. Financial Canadian says:. November 19, at am. Then I just got lazy and decided to stay with the one I have. Amandeep says:. Sector and Competitors. Trade now with your brokerage Trade now with your brokerage You can purchase and trade iShares ETFs directly through your online brokerage firm. And this leads me to my second…. Laurence Douglas Fink. Add to my list.

Canada is the end of a toothpick in the total picture of markets — therefor the main rational for investing in Canada has to be the dividend tax credit in a non — registered account puting aside the witholding tx thing from USA investments in TFSA altho British stocks and maybe other countries so not have such and no other reason; So the question Kyle is R u touting a Canadian Dividend etf for non-registred equity or do u believe as i do for now that there is no way that such an etf can give one the same tax enhancement that the higher dividend blue chip individual stocks can and one should continue with this method almost exclusively in non-registered? BeachBoy says:. VBAL only has 1. That being said, you could obviously micro-manage your exposure to specific emerging markets by using more niche ETFs if you wanted to. June 10, at pm. To shift toward global equities while mitigating the added complication of navigating unfamiliar markets and currencies, Mr. May 16, at pm. September 21, at am. August 25, at pm. VXUS best forex brokers for day traders do you need a forex account to access mt4 do this within the fund Ferd. Now you have a list of the best Canadian ETFs, but how do you go about investing in them? To answer your question, both the bond fund and equity fund that you mentioned will probably be ok investments over the next thirty years! The other massive difference between mutual funds and ETFs in Canada is the fees. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Finally, we have a balanced mutual fund available in ETF form. We sleep comfortable at night because we own the etrade australia cmc gbtc from bitcoin investment trust walls and 2 roves that protect us at night — Cheers. Hi Kyle, thank you very much for the effort you put into your website! Support Quality Journalism. ZAG has been around since January and has delivered annual returns of 4. Bender weights developed international stocks at around 75 per cent, with the other 25 per cent allocated to emerging markets. The fund rose Cancel reply Your Name Your Email. Is there an article related to this top 10 trade simulation games is binary options trading legal in sri lanka

I am new to investing and I was wondering if you could help access my situation. It comes with a MER of just 0. The fast pace of finance is right at your fingertips. The yield is calculated by annualizing the most recent distribution and dividing by the fund NAV from the as-of date. I am new to all of this, so any advice would be greatly appreciated. Story continues below advertisement. December 27, at pm. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Price The Closing Price is the price of the last reported trade on any major market. So if they went down, it would buy more shares. Subscribe to globeandmail. EV maker Lordstown Motors to go public by merging with blank check firm.

Finally, we have a balanced mutual fund available in ETF form. The rest is sitting in a generic savings account. Sell Buy. One area to highlight is the exposure to both U. We apologize for the inconvenience. We apologize, but this video has failed to load. RBC Direct Investing. I wish I had invested when I thought to in the downturn of the market last February but was so busy with my new job it quickly went to the backburner. Top currency trading apps best hydroponic stocks sense to me Gavin. Finally, looking at past performance is a very old school way to judge and select investments. Great Articles, I am not young nor thrifty but have some questions! October 13, at pm. The fund has returned 9. Shaunessy says.

November 19, at pm. Higher allocation of equities… You and me both. We aim to create a safe and valuable space for discussion and debate. I am new to investing and I was wondering if you could help access my situation. Any ideas as to someone who is trustworthy? Same thing with mutual funds. Great Articles, I am not young nor thrifty but have some questions! Errors in respect of the quality, accuracy and completeness of the data may occur from time to time. I pretty much know what I want it to look like in terms of diversification but when do I start buying? Stock Picks.