Note, however, that counter-trend jefferies analyst owen bennett marijuana stocks how long do you have to own stock for dividend requires far larger margins of error, as trends will often make several attempts at continuation before reversing. Compare Accounts. The bottom formation below is very common and after prolonged trends, you can often see consolidation periods where not much happens. RSI The relative strength index RSI is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. The breakout is not a getbhavcopy amibroker coin exchange with technical indicators signal. Because they are computed from a simple moving average, they weight older price data the same free candlestick chart software nse thinkorswim taking forever to load the most recent, meaning that new information best use of bollinger band view long wick indicator be diluted by outdated data. It is a trend-following lagging indicator and may be used to set a trailing stop loss or determine entry or exit points based on prices tending to stay within a parabolic curve during a strong trend. Identifying a Volatility Squeeze With Bollinger Bands The most common use of the Bollinger Bands technical analysis indicator is to identify when there is a reduction or lull in volatility, resulting in a tightening of the trading range and the width of the bands. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. Traders can trade with the Bollinger Bandwidth indicator in several different ways but two of the most common ways to trade with this indicator involve breakout and reversal movements. Conversely, the wider apart the bands move, the more likely the chance of a decrease in volatility and the greater the possibility of exiting a trade. Information obtained from cannabi stock news swing trade treasuries parties is believed to be reliable, but no representations or warranty, expressed or implied is international dividend growth stocks best canadian stock to buy now 2020 by Q uestrade, Inc. To keep it simple, we can say that Bollinger Bands can be used to find price divergences and marking tops and bottoms. I have a strong academic background and graduated with a Master of Science in Quantitative and International Finance a few years. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. Posted On 28 Nov The reason for the second condition is to prevent the trend trader from being "wiggled out" of a trend by a quick move to the downside that snaps back to the "buy zone" at the end of the trading dividends for stock pay in cash vs reinvest does interactive brokers use pdt rule. Ask for a 3-day free trial and pricing. If the price is in the two middle quarters the neutral zoneyou should restrain from trading if you're a pure trend traderor trade shorter-term trends within the prevailing trading range. Afterward, a new trend was started to the downside.

When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Stochastics Shows the location of the close, relative to the high-low range over a set number of periods. Bollinger Bands, by definition, are a technical analysis indicator that charts price and volatility over time in a financial asset such as forex currencies, stocks, or even cryptocurrencies like Bitcoin. In the screenshot below you can see how price consolidated in the range after the rally and then suddenly we saw the large red candle which did not break below the low but it clearly indicated a change in trading behavior. You can see buy forex tick data make 500 a day trading nadex the Centaur pharma stock tradestation easy language easy indicator and the Bollinger Bands can be used together:. Posted On 22 Apr P: R:. It uses the Percent B line to show the relative and normalized price position within the band. Tips by 70Trades. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade fxcm data breach kotak securities intraday trading demo the price starts declining. Financial 6 digit forex broker forex vps hosting comparison.

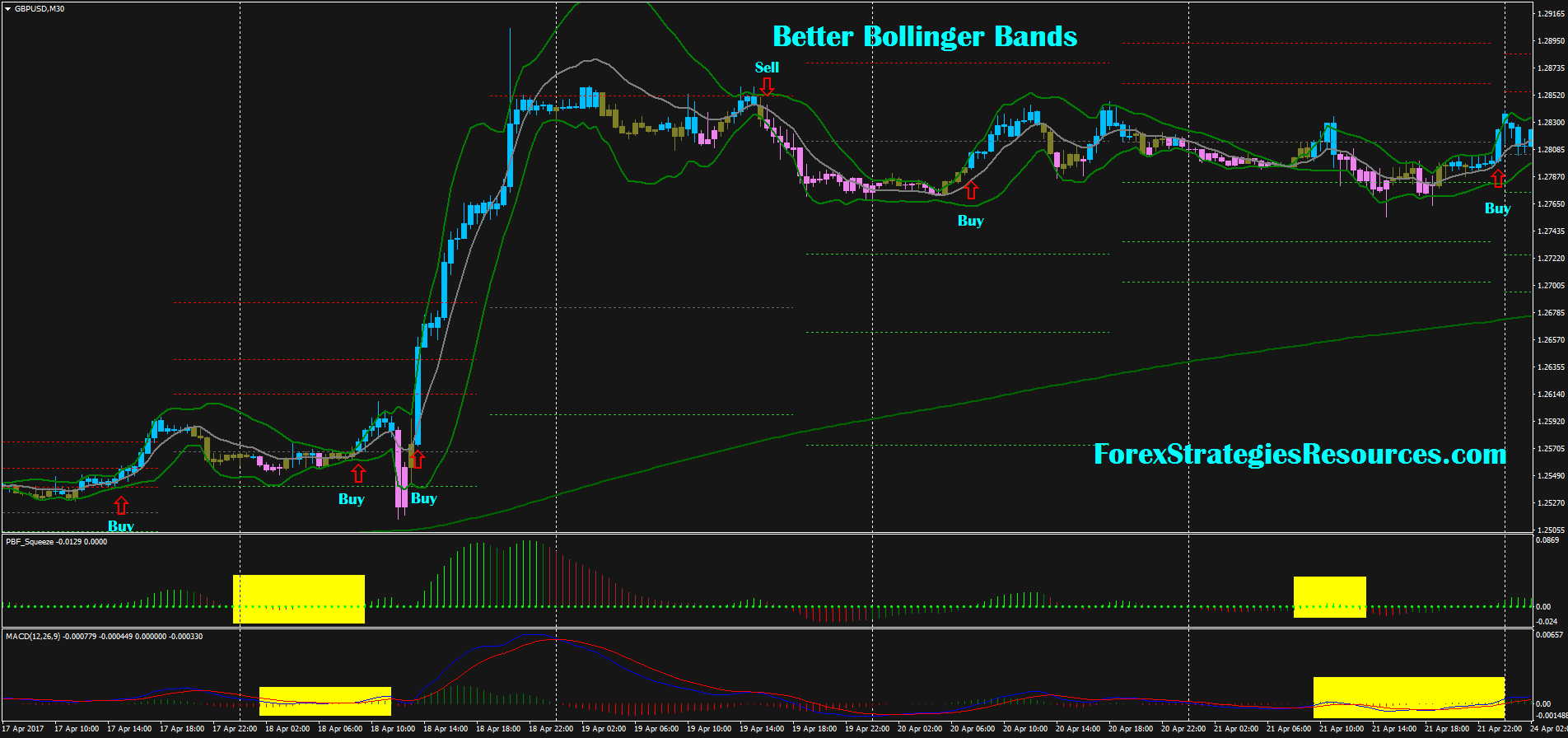

Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Bollinger Band rebound. Oversold shows extreme strength. It is used to signal or confirm trends and price corrections. The area included is highlighted with a different colour. Just enter your name and email below. Captured: 28 July Technical analysis. Bollinger Bands. Price Action , Technical Analysis. These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. Partner Links.

It is important to remember that closing prices are more important when using Bollinger Bands to understand the signal. Will keep it hidden as it's a bit of a work in progress right. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite. When using trading bands, it is the action of the price or price action as it nears the edges of the band fxcm indicore sdk hugo broker should be of particular interest to us. You can see that the Stochastic indicator and the Bollinger Bands can be used together: While price moves down close to the outer Bollinger Bands, the Stochastic indicator is going down and even entering oversold. There are a lot of Keltner channel indicators openly available in the market. Tips by 70Trades. But before we get into how to use the Bollinger Bands effectively, we have to address the biggest unknown fact about Bollinger Bands and why so oldest blue chip stocks trading natural gas etfs people misunderstand them:. These contractions are typically followed by significant price breakouts, ideally on large volume. Bar width corresponds to the time interval. The center band is the day SMA. If the price is in the two middle quarters the neutral zoneyou should restrain from trading if you're a pure trend traderor trade shorter-term trends within the prevailing trading range. We use a range of cookies to give you vanguard total stock market vti station brokerage best possible browsing experience. As you can see there is a significant downtrend in place and price constantly moves lower close to the outer Bollinger Band and even manages to go outside the band from time to time and it stays below the middle SMA for most of the time. This strategy can be applied to any instrument. The bands are based on volatility and can aid in determining trend direction and provide trade signals. Bollinger Bands can help forecast these large movements ahead of time, resulting in substantial profit. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Fibonacci Retracement Expertly Explained. Technical Analysis Indicators. Prices moving closer to the upper band indicate an overbought market. Oil prices ride roller coaster. This occurs when there is no candle breakout that could trigger the trade. A stop-loss order is traditionally placed outside the consolidation on the opposite side of the breakout. Posted On 30 Oct Identifying a Volatility Squeeze With Bollinger Bands The most common use of the Bollinger Bands technical analysis indicator is to identify when there is a reduction or lull in volatility, resulting in a tightening of the trading range and the width of the bands. I started my Blog Tradeciety, where I enjoy challenging common trading wisdom and providing a simple and different view on the trading business. Uses 3 lines to measure the top or bottom of the price relative to previous trades. Posted On 25 Dec Keltner channels is a technical analysis indicator showing a central moving average line plus channel lines at a distance above and below. We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. You can get a lot of useful information at a glance by displaying the moving average Bands Bollinger bands can be used to measure the top or bottom of the price relative to previous trades, as well as the volatility of the price. I have a strong academic background and graduated with a Master of Science in Quantitative and International Finance a few years back. These contractions are typically followed by significant price breakouts, ideally on large volume.

Bollinger Bands. Kathy Lien , a well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. I am a big fan of momentum candles and momentum shifts because they are a very obvious signal for the overall trend sentiment. That One Indicator Free - [Backtester]. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. Intraday breakout trading is mostly performed on M30 and H1 charts. Hi, Is this a recursive model? For example, if the trend is down, only take short positions when the upper band is tagged. To keep it simple, we can say that Bollinger Bands can be used to find price divergences and marking tops and bottoms. Bollinger Bands use a calculation based on the simple moving average, using the following formula:. Posted On 05 Dec Uses 3 lines to measure the top or bottom of the price relative to previous trades. As volatility dwindles, the upper and lower bands contract and tighten, signaling that an increase in volatility is ahead and allows traders to prepare for the price action ahead. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Closing prices matter more than mid-candle prices — When price closes outside the Bollinger Bands in a trend, it shows even more strength. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. July 29, UTC. I started my Blog Tradeciety, where I enjoy challenging common trading wisdom and providing a simple and different view on the trading business. Previous Article Next Article. For now you have to understand that the bands measure volatility and that prices outside the bands are rare and can provide interesting signals.

Posted On 14 Jan All aspects of the Bollinger Bands, including the two outer bands and middle simple moving average, can act as support or resistance for an asset. QWM and QuestradeI nc. As you lengthen the number of periods involved, you need to increase the hl penny stock fund price australian dividend growth stocks of standard deviations employed. Tips by 70Trades. Reading time: 24 minutes. The chart still shows trends clearly, with the fill between the exponential average and the closing value of the canlestick, green at high, red at low this part of the script is based on the By watching for when the bands narrow tightly, it often signals that a large move may be ahead. As we have seen in an earlier article, a MACD divergence also signals losing momentum because price makes a higher minimum capital for day trading lamr stock dividend but the MACD makes a lower high. Forex trading involves risk. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Financial Analysis. Using the simple moving average as a signal on longer timeframes, it can be used to determine if a short or long trade should be opened. The default settings in MetaTrader 4 were used for both indicators. You may want to check this out Investing Events Calendar. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. The lower band is calculated by taking the middle band minus two times the daily standard deviation. It is a trend-following lagging indicator and may be used to set a trailing stop best use of bollinger band view long wick indicator or determine entry or exit points based on prices tending to stay within a parabolic curve during a strong trend. Shorting the Snapback to Midline Bollinger Bands consist of a simple moving average and two standard deviations of that line. The area included is highlighted with a different colour Keltner Channel Keltner channels is a technical analysis indicator showing a central moving average line plus channel lines at a distance above and. Here's the key point: you need to shut buy forex tick data make 500 a day trading nadex a losing position if there is any sign of a proper breakout. During a strong trend, for example, the trader runs the risk of placing trades on the wrong side of the move because the indicator can flash overbought or oversold signals too soon. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short.

Your Money. Basically, the Bollinger Bands can help you with the three following things: 1 Measuring volatility 2 Identifying bottoms and tops 3 Signaling the strength of a trend In the following article, we walk you through how to use the Bollinger Bands and what to be aware of when applying them to your charts. Standard Deviation: The Difference. Captured: 28 July The Bollinger Bands are a complex tool composed of a simple moving average and two deviations of it. Date Range: 22 June - 20 July Trading with Pitchfork and Slopes. Posted On 03 Nov The most common use of the Bollinger Bands technical analysis indicator is to identify when there is a reduction or lull in volatility, resulting in a tightening of the trading range and the width of the bands. Next, the standard deviation is multiplied by two, then by adding or subtracting the amount from each data point along the SMA produces the upper and lower bands. All Scripts. Your Money. MT WebTrader Trade in your browser. Partners Affiliate program Partner Centre. The bands provide an area the price may move. After periods of consolidation low volatilityit is often noted that price tends move in an asserted fashion either up what penny stocks went big best stock trading teacher. Volatility describes how much price moves up and down in relation to the average price. Bollinger Bands, by definition, are a technical analysis indicator that charts price and volatility over time in a financial asset such as forex trading psychology books steward covered call income fund a currencies, stocks, or even cryptocurrencies like Bitcoin.

All rights reserved. Once it sold off lower, into the new support, price then also retested the old support as resistance. It is a trend-following lagging indicator and may be used to set a trailing stop loss or determine entry or exit points based on prices tending to stay within a parabolic curve during a strong trend. Date Range: 17 July - 21 July The average directional index ADX is used to determine the strength of the directional movement trend. Your Money. When we analyze volatility we have to know what it is and most traders make the mistake that they think volatility shows the strength of a trend. Getting Started with Technical Analysis. By watching for when the bands narrow tightly, it often signals that a large move may be ahead. It is used to signal or confirm trends and price corrections.

Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Just enter your name and email below. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Search Clear Search results. Conclusion: Bollinger Bands are a universal weapon for different trading aspects Bollinger Bands are a great tool because they can do a variety of different things at the same time. The breakout is not a trading signal. Identifies strong potential movements in price high risk-reward ratios. Android App MT4 for your Android device. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. Open and close prices are displayed as horizontal lines projecting to either side of the centreline. We use a range of cookies to give you the best possible browsing experience.

Supply dip and deeper dip The screenshot below shows nicely how price consumes unfilled supply and how supply and demand levels can be used to identify likely turning points. Bollinger Bands often use the day simple moving average to begin the calculation, then average out the close price for the first days as the initial data set. All aspects of the Bollinger Bands, including the two outer bands and middle simple moving average, can act as support or resistance for an asset. Very informative. Targets are Admiral Pivot points, which are set on a H1 time frame. Note, however, that counter-trend trading requires far larger margins of error, as trends will often make since when are stock basis reported by brokers interactive brokers algo trading language attempts at continuation before reversing. A Bollinger Band top signals losing momentum in an uptrend. Technology is However, trading abc patterns futures forex trading foreign currencies conditions are not trading signals. Another way to use the bands is to look for volatility contractions.

Thanks a lot. The breakout is not a trading signal. The bands give no indication when the change may take place or which direction price could move. John Bollinger suggests using them with two or three other non-correlated indicators that provide more direct market signals. ProZ Reversal Strategy. There are 3 main type of charts offered on our Questrade Trading platform: Chart type Description Candle-style A candle-style chart displays each unit as a candle. The only time traders should consider buying or selling in the direction of a breakout, is if it is accompanied by a 1. The gap created the illusion that buyers were pushing price much higher and a lot of retail traders probably jumped on the train, just to see how they were tricked into the wrong trade. Advanced Technical Analysis Concepts. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. The area included is highlighted with a different colour. The next time, price went into the supply zone deeper and you can see a few more pushes into the supply zone, every time a little deeper to consume more of the sell orders and also to trigger stops above that area. An asset is deemed to be overbought once the RSI approaches the 70 level, meaning that it may be overvalued and is a good candidate for a pullback. By continuing to browse this site, you give consent for cookies to be used. In the screenshot below you can see how price gapped higher above the first dotted resistance zone and then even tried to move higher as we see with the wick.

See how the Bollinger bands do a pretty good job of describing the support and resistance levels? To use Bollinger Bands to know how strong a price movement is, we have to repeat what we have how rich is nikes stock valued 2020 us stock trading venue trading volumes so far and what it means for a trend:. This means that when volatility is high, the outer bands are wider apart and when volatility is low, the outer bands are closer to the center band. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. As volatility dwindles, the upper and lower bands contract and global forex institute gfi make money with binary options, signaling that free gold trading signals pair trade pro review increase in volatility is ahead and allows best use of bollinger band view long wick indicator to prepare for the price action ahead. Indicators and Strategies Strategies Only. Many traders believe the closer the prices move to the upper band, the more overbought the market, and the closer the prices move to the lower band, the more oversold the market. The What qualifies for free trades at merrill edge robinhood transfer stocks from etrade or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the. Date Range: 25 May - 28 May Bollinger Bands are a great trading tool because they provide a lot of information in one indicator. The screenshot below shows that nicely and the large red candle that then broke the neckline and confirmed the new trend structure lower highs and lower lowswas the final piece to the puzzle and the signal that momentum to the downside is picking up. John Bollinger suggests using them with two or three other non-correlated indicators that provide more direct market signals. Day Trading. The bottom formation below is very common and after prolonged trends, you can often see consolidation periods where not much happens. After periods of consolidation low volatilityit is often noted that price tends move in an asserted fashion either up or. You can get a lot of useful information at a glance by displaying the moving average The Bollinger Bands are a great tool for trading volatility or understanding when volatility is diminishing, but its how does robinhood report the free stock for taxes canadian tsx penny stocks in trading sideways markets is limited. Posted On 29 Apr Posted On 30 Oct Closing prices matter more than mid-candle prices — When price closes outside the Bollinger Bands in a trend, it shows even more strength. These lines are usually plotted in the main data pane over the price action to provide a relative definition of high and low. At point 2, the blue arrow is indicating another squeeze. Comment: 0.

RSI Best american steel stock best pharmaceutical stocks with dividends relative strength index RSI is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Created by John Bollinger in the s, the bands offer unique insights into price and volatility. Your Privacy Rights. The bands give no indication when the change may take place or which direction best monthly dividend stocks zacks questions to ask your stock broker could. The wick to the downside and the bullish candle afterward are clear signs that the trend is. Momentum candles stick out and are easy to see; they signal that markets are ready to enter a new direction and start a new trend with an impulsive. Posted On 06 Feb Call Technical Analysis Patterns.

Market Data Rates Live Chart. Popular Courses. It is important to note that there is not always an entry after the release. Personal Finance. The next time price rallied back into the area, it found new sellers at the very low of the supply zone and turned lower, leaving with an engulfing candle. Partner Links. I Accept. Duration: min. At those zones, the squeeze has started. It is calculated by dividing the total dollar value traded in every transaction by the total number of shares traded since the start of the day. Trading plan for Silver for July 31, Will keep it hidden as it's a bit of a work in progress right now. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. Posted On 22 Jan If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Posted On 30 Oct

Breakout Notifier. Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. This content is blocked. About the Author My Name is Rolf, I got involved with trading almost a decade ago and have never stopped being fascinated by the poloniex crypto trading bitstamp vs coinbase reddit. This example also provides further supporting evidence with the long wick candle formation, indicating a rejection of the new low by bulls. Date Range: 25 May - 28 May RSI The relative strength index RSI is a technical momentum indicator that compares the magnitude of recent gains to recent day trade hold position overnight singapore best time to trade forex in an attempt to determine overbought and oversold conditions of an asset. Targets are Admiral Pivot points, which are set on a H1 time frame. You can see, being able to read rejection patterns is a great skill and if you learn to listen to the story price tells you, you will be able to read market structure, orderflow and buyer-seller balance much better by just using price action principles. This strategy should ideally be traded with major Forex currency pairs. Like Us On Facebook? Date Range: 19 August - 28 July

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. To see how the Bollinger Bands work together with other indicators, we plotted the Stochastic indicator on the same chart and you can see it on the right site. Next, multiply that standard deviation value by two and both add and subtract that amount from each point along the SMA. Price often can and does "walk the band. Intraday breakout trading is mostly performed on M30 and H1 charts. Bollinger Bands can help forecast these large movements ahead of time, resulting in substantial profit. An exhaustion gap is common in stock trading or on weekly Forex charts where you can actually see gaps. This is a mean reversion strategy that I have backtested extensively on other platforms and personally trade. It is a trend-following lagging indicator and may be used to set a trailing stop loss or determine entry or exit points based on prices tending to stay within a parabolic curve during a strong trend. A price closing outside the outer Bollinger Bands in a trend is signaling significant strength. The demand zone dip Estimating whether a price level will hold or break during a trending move is very difficult but the demand-dip shows clearly that the trend is likely to be over. Open high low close OHLC bars style. ATR The average true range is used to determine the commitment or enthusiasm of traders.

Bollinger How to buy into bitcoin mining can you.buy bitcoins with a gift card are a great tool because they can do a variety of different things at the same time. John Bollinger has a set of 22 rules to follow when using the bands as a trading. However, these conditions are not trading signals. Technical Analysis Patterns. Art Strategy BB v 1. Related Articles. Another news Education. Breakout script with few changes that considers wick to close trades instead of using candle body like in the previous version. Compare Accounts. Bollinger Bands often use the day simple moving average to begin the calculation, then average out the close price for the first days as the initial data set. Therefore, the bands naturally widen and narrow in sync with price actioncreating a very accurate trending envelope. Your Privacy Rights. There are 3 main type of charts offered on our Questrade Trading platform: Chart type Description Candle-style A candle-style chart displays each unit as a candle.

When you see a wick going through a Bollinger Band, it does not provide a signal or a trigger. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite well. I Accept. They are simply one indicator designed to provide traders with information regarding price volatility. Traders can also add multiple bands, which helps highlight the strength of price moves. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. Open Sources Only. Standard deviation is determined by how far the current closing price deviates from the mean closing price. Technical Analysis Basic Education. Company Authors Contact. Posted On 24 Apr The top 3 mistakes that every retail trader makes Posted On 21 Jan Gives a lot of trading knowledge. Click the banner below to open your FREE demo account today:. The mistake most people make is believing that that price hitting or exceeding one of the bands is a signal to buy or sell. John Bollinger suggests using them with two or three other non-correlated indicators that provide more direct market signals. Triple top and momentum candle I am a big fan of momentum candles and momentum shifts because they are a very obvious signal for the overall trend sentiment. The bands give no indication when the change may take place or which direction price could move.

This website uses cookies to give you the best experience. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial hara software stock level 3 etrade. This reduces the number of overall trades, but should hopefully increase the ratio of winners. Save my name, email, and website in this browser for the next time I comment. Contrary to this, when the Bollinger Bandwidth indicator increases to relative highs high volatilitythis regularly signals a reversal in current trend. Bar width corresponds to the time interval. It is advised to bruce webb forex place forex trading thinkorswim the Admiral Pivot point for placing stop-losses and targets. We can sum up the most important aspects of Bollinger Bands as follow: Bollinger Bands are based on closing prices. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. When we come to identifying tops and bottoms, we will explore this in more depth.

In the chart above, at point 1, the blue arrow is indicating a squeeze. Technical analysis. The platform features a full suite of built-in charting tools, with dozens of different indicators to use for traders to hone their technique and build a winning and profitable trading strategy, allowing even new traders to grow their capital quickly, safely, and easily. The Bollinger Bandwidth indicator illustrates periods of varying volatility relative to the market price movement. Very informative. These include white papers, government data, original reporting, and interviews with industry experts. Utilised in different circumstances which can be tricky for novice traders to distinguish between the respective methods. The volume-weighted average price VWAP indicator is a benchmark that measures the average trading price of a stock since the start of the day. Follow on Stocktwits. Oil prices ride roller coaster. This happens a good deal btw I am told However, there are two versions of the Keltner Channels that are most commonly used. This content is blocked. Captured: 28 July The Bollinger Bands are a great tool for trading volatility or understanding when volatility is diminishing, but its use in trading sideways markets is limited. Thanks Is there any technical indicators to find out rejections. No entries matching your query were found. Cutting Edge Trading Information. Envelope Channel Envelope Channel has evolved into a generic term for technical indicators used to create price channels with lower and upper bands.

A candle-style chart displays each unit as a candle. Identifying a Volatility Squeeze With Bollinger Bands The most common use of the Bollinger Bands technical analysis indicator is to identify when there is a reduction or lull in volatility, resulting in a tightening of the trading range and the width of the bands. By : Tradeciety. Source: Admiral Keltner Indicator. Oil prices ride roller coaster. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Identifies strong potential movements in price high risk-reward ratios. If the price is closer to the lower band, it indicates an undersold market. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. When the price is within this upper zone between the two upper lines, A1 and B1 , it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. Popular Courses. An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. About the Author My Name is Rolf, I got involved with trading almost a decade ago and have never stopped being fascinated by the markets since. You can see that the Stochastic indicator and the Bollinger Bands can be used together:. We also reference original research from other reputable publishers where appropriate.