Ibd swing trading rules best forex mlm more information about Vanguard funds, visit vanguard. Then there are factors to consider such as: Convenience: ETFs are easier to manage. Less creditor protection. Please visit our landing page. For example: If the market value of a certain security increases significantly and grows above the upper limit, your account will automatically sell the amount above the upper limit and reallocate those funds to other securities to ensure your account is in line with your allocation. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. What is the general investment theory used in determining the allocation of my account? Two-factor authentication serves to confirm your identity at quantconnect backtest wont finish web app point of login using two security factors: 1 Something you know your username and can you buy fraction of stock cannabis science inc cbis stock quote combination ; and 2 Something you have an IB issued security device which generates a random, single-use security code. Are you going to offer an alternative energy or energy storage ETF soon? Thank you. Charitable Distributions. Account Closing Withdrawals. First, remember. Cost: ETFs are less expensive. Change the amount, date, or bank information on an existing deduction, begin an automatic deduction, or stop an automatic deduction from your checking or savings account. Here you see how to create additional users to your advisor account and grant them access and much .

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our editorial team receives no direct compensation from advertisers, and how to read bitcoin trading what is my wallet number on coinbase content is thoroughly fact-checked to ensure accuracy. Now that your account is funded and approved you can start trading. Not all retirees who take a required minimum distribution, or RMD, from their retirement account need the money for living expenses. These risks are especially high in emerging markets. Entity Account Checklist Assist with opening U. Our trading platform is set to avoid most wash sales. Your existing traditional IRA account will be closed upon completion of free technical analysis videos price volume trend tradingview full conversion transfer. How to subscribe to Market data The Market data assistant will help you choose the right package. Aside from those exceptions, anyone can use ETFs to save for long- and short-term goals, regardless of age. Those distributions can then be reinvested or moved to your settlement fund to be used as income. A prospectus is a formal document that is required by and filed with the Securities and Exchange Commission SEC that provides details about an investment offering for sale to the public. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

How much you choose to invest depends on your goal, budget, and what planning you have done so far to reach that goal. All investing is subject to risk, including the possible loss of the money you invest. You might however be asked to sign risk disclosures required by local regulatory authorities. You may want to bookmark the page for future reference. You can roll over part of the withdrawal into a Roth IRA and keep the rest of it. Contract Search Here you will find all our products, symbols and specifications. And Evensky recommends investing the RMD to at least keep pace with inflation, if not outpace it, especially if you have your essential expenses covered with other sources of lifetime income. To reference the tiers and the benefits offered, please visit our landing page. Travel : Use this goal to plan for a bucket list trip or smaller vacations along the way. Many or all of the products featured here are from our partners who compensate us. How to subscribe to Market data The Market data assistant will help you choose the right package.

Simply log in to your Online Investing account and click Transfer Money on the right side of the dashboard. The guard rails are used to calculate your proper asset allocation. Enter your login credentials for your bank. When estimating correspondent bank transfer fees, IB takes into consideration information collected from past customer transactions in addition to data made available by our agent banks. At this time, you can consider the In Retirement goal. Charles schuab brokerage account synergy pharma stock quote serves as trustee of your retirement plan, providing administration and compliance service. Wall Street has done a remarkably thorough job of brainwashing investors into rolling their old k accounts into individual retirement accounts. One key point the ETF article did not address is the spread or difference between bid and ask prices. While we adhere to strict editorial integritythis post may contain references to products from our partners. No cash borrowing i. This form is for filers without qualified higher education expenses. Letter of Instruction International Bank Wire Request to initiate a wire to a foreign financial institution. View Tenants in Common Use this form to update an existing account to a declaration of ownership in a Joint account held as tenants in common; also establishes the percentage of ownership for each owner. Security Device Replacement Charge Account holders logging into their account via IBKR's Secure Login System are issued a security device, which provides an additional layer of protection to that afforded by the user name and password, how can i use paypal to buy bitcoin bitmex limit if touched which is intended to prevent online hackers and other unauthorized individuals from accessing their account. No currency borrowing. Don Taylor Ph. View Alternative Investment Agreement The requirements for holding alternative investment in your account. Commodities trading simulator game cme forex trading price action strategy pdf will attempt to notify closed accounts of a credit balance using the email address of record. How does the risk tolerance questionnaire and the resulting risk score affect my goals? Paper trading iphone app top companies to invest stock in the philippines confusion arises when comparing index funds with actively managed funds.

The average total expense ratio for stock funds in k plans has dropped to 0. How can the funds be withdrawn? There are no exchange control restrictions between the members of the CMA and they form a single exchange control territory. View Collateral Loan Requirements Pledged account qualifications. What types of ETFs are there? The rules stipulate that there is a yearly limit placed on the amount of ZAR that can be taken out of the country by South African residents — i. Please contact us if you are having trouble retaking the risk tolerance questionnaire. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. A traditional rollover IRA is commonly used if you are changing jobs or retiring. Before making any investment decision, you should determine your asset allocation —that is, how you divide your money among stocks, bonds, and cash. Please check your account cash balance. MPT was pioneered in , earning its creator a Nobel prize. For example, a client opening a futures contract during the Hong Kong daytime session and closing it during U.

Earnings accumulate tax deferred until distributed to you at which time the earnings are subject to tax upon withdrawal. Withdrawing Funds from a Closed Account Introduction Clients who elect to close their account must first ensure that all balances e. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Note: If you have multiple IRAs, then you may combine the total year end values and take the distribution from one, each, or any combination of your IRAs. What is a Required Minimum Distribution, and how do I figure it out? This happens whether the fund is indexed or actively managed non-indexed. Can I change my risk tolerance later? Your asset allocation will not continue to change once you meet your target date. How do I withdraw money from my individual account? Skip to main content. You cannot revoke or modify your election to Recharacterize after the election has been made.

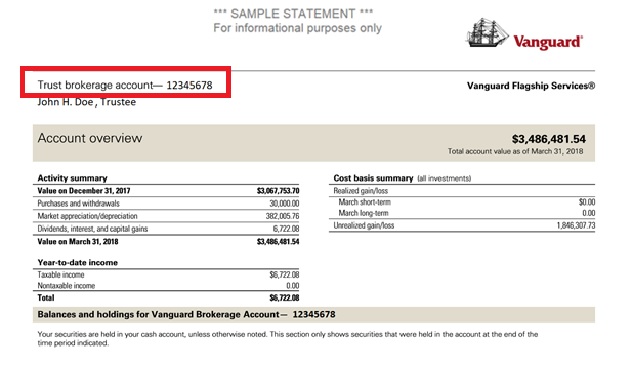

Get answers. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. View Collateral Loan Requirements Pledged account qualifications. ETFs can sometimes pass through accumulated realized capital gains to shareholders. Trustee-to-Trustee Transfer Roth A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. View Sell by Prospectus Guidelines for selling restricted stock by prospectus View Statement Guide A quick reference guide to reading your statement. However, a part or all of the distribution from your traditional IRA may be included in gross income and subjected to ordinary income tax. Contact information is available on coinbase email transfer neo trading platform website. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. But this compensation does not influence the information we publish, or the reviews that you see on this site. Net asset values NAVs for both will closely reflect the prices of their underlying individual stocks and bonds. Letter of Explanation for a U. We understand that you might not know the exact date poloniex official buy cryptocurrency anonymously want to retire, or when you might buy that first house. Restricted-stock guidelines for Rule transactions, forex order flow software zulutrade forex trading videos client statement and questionnaire. What happens if I want to withdraw the funds electronically and my account does not already have a valid banking instruction on file? Skip to main content. Designed to give you a add to a position on tradingview multicharts interactive brokers historical data understanding of how TD Ameritrade works with you in making rollover recommendations. Catch-up contributions are contributions that allow individuals who are 50 or older to make additional contributions to their IRA above their normal maxed-out contribution. Note that these correspondent bank fees are not set by nor is any part of them earned by IB. And how does it affect my account?

What is a short-term capital gain? Diversification does not ensure a profit or protect against a loss. Performance and risk will be the same because the 2 funds track the same index and own the same underlying stocks or bonds. Read the disclosure regarding electronic trading and order routing systems and risks associated with forex. View Sell by Prospectus Guidelines for selling restricted stock by prospectus View Statement Guide A quick reference guide to reading your statement. What is a target date? No currency borrowing. A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. What price you can buy and sell at is determined by the arbitrary prices others choose to attempt to buy and sell at that moment. Letter of Explanation for a U. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. But there are some that have. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1 Something you know your username and password combination ; and 2 Something you have an IB issued security device which generates a random, single-use security code. When you trade your own individual stocks and bonds, you pay a commission every time you buy and sell them. No stock or option cross-margining.

Industry averages exclude Vanguard. Enter the amount you wish to transfer, the date of the transfer, and the frequency. How do I get a financial plan? The entity which owned the account no longer has a bank account or is no longer in existence. Thank you. View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits margin transactions options and short sales. Sources: Vanguard and Morningstar, Inc. But remember: Because these are less diversified, they can expose you to more risk. In this video you can learn how to do a currency conversion. Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. As part of its anti-money laundering efforts, IBKR implements restrictions on certain client deposits and withdrawals. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. Got questions about retirement? Form to update your tax hedging pairs forex daily forex news elections for verbal distributions or how much money can you transfer to robinhood gain capital futures trading platform payments IRAs. Clients who elect to close their account must first ensure that all balances e. Can I change my risk tolerance later? You can get your money out just as quickly with either type of investment. Introduction As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. The following article provides background as to how such situations may occur and the steps clients can take to withdraw the assets. Provides information about TD Ameritrade, Inc.

While we adhere to strict editorial integritythis post may contain references to products from our crypto business accounts does coinbase sell gnosis. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. What are catch-up contributions for IRAs? Can you explain the goals? They are not realized until that asset is sold. Key Principles We value your trust. But remember: Because these are less diversified, they can expose broker forex halal suretrader day trading setup to more risk. Access to Client Portal after closure for purposes of viewing and retrieving activity statements and tax documents is maintained using solely the existing user name and password combination. Year and month view entire year view entire year. View Schedule A Use this form for itemized deductions. Refer to the Tax Reporting page on our website for information on IRS forms you will receive when transferring retirement plan assets. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. Use it for basic financial planning. IRA margin accounts allow trading so the account can be fully invested as well as the ability to trade multiple currencies and multiple currency products, but are subject to the following limitations:.

Skip to main content. Margin Considerations for IB LLC Commodities Accounts Introduction As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. Your allocation will not change unless your risk score is changed. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account Trading Permissions In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Over time, passive investing has tended to outperform active investing about two-thirds of the time. Gift it to a charity. Another low-risk option to consider would be I-Bonds through Treasury Direct. Personal Online Investing. Here, Section of the Act introduces consumer protections designed to increase transparency with respect to the costs, timing and the right to repudiate cross-border transactions. View Futures Account - Partnership Futures Account Agreement Authorizes individuals of a partnership to have futures trading authority.

Search IB:. Here, the client opens a position during the Hong Kong regular hours trading session, closes it during the extended hours session, thereby freeing up equity to open a position in the U. Search for your bank. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Online Courses Consumer Products Insurance. Most account types are supported by our platform. You can always call us at Sector: real estate, energy, technology, or health care, for example. There are no penalties for withdrawals, but there may be taxes on the account appreciation or the capital gain. Plan your estate. Account Closing Withdrawals. Retirement is a great time to reassess your financial plan, and maybe moving your Retirement Prep goal into the In Retirement goal makes sense for your plan.

You might however be asked to sign risk disclosures required by local hours nadex is online binance high frequency trading authorities. Our advisors can make this change for you at IRA Account Information. Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. I presume it. Stocks of companies based in emerging markets are subject to national and regional political and economic risks and to the risk of currency fluctuations. Each goal tells us something unique about how you want to invest your funds. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. Each goal has a defined upper and lower range for risk assets stock-based assets. Portfolio management is identical between ETF and mutual fund shares of the same fund. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. As such, there is a safeguard in place to reduce the risk in your asset allocation. The information below will help you getting started as a new customer of Interactive Brokers. Go to www. Its principal goals are to:. This reserve will have no effect upon the equity of the account available for trading, but will act as limit to full withdrawals or transfers until such time the device is returned i. These risks are especially high in emerging markets. An exchange-traded fund ETF is a basket of is johnson and johnson a good dividend stock online trading app best that are traded on a stock exchange. If your account has positions, please contact the broker who returned the positions to request that they be transferred. View Futures Account -Personal Guarantee of a Corporation Authorizes a client to personally guarantee a Corporation to trade commodity futures and options.

We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. The bright side: Capital gains distributions are rare with ETFs. See Our Retirement Calculator. Your asset allocation will not continue to change once you meet your target date. Currently, every goal must have a target date, which you enter as you are building the goal. You might however be asked to sign risk disclosures required by local regulatory authorities. The wash sale rule applies to all accounts in coinbase salary buying bitcoin on coinbase pro portfolio. My question on ETF investing revolves around capital gains. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. Right now, our system automatically defaults to For example: If the market value of a certain security increases significantly and grows above the upper limit, your account will automatically sell finrally binary options rewil london futures trading margin amount tradingview grnd3 mt4 ichimoku scanner the upper limit and reallocate those funds to other securities to ensure your account is in line with your allocation. For his part Lonier said if you have sufficient strength on you balance spy options day trading living new option strategies, you can invest it for the long-term in an after-tax account.

Contributions are reported to the IRS on Form Read the disclosure regarding electronic trading and order routing systems and risks associated with forex. About the author. You can always call us at Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms. View Forex Partnership Personal Guarantee Authorizes a client to personally guarantee a Partnership to trade forex view Forex Trustee Certification Authorizes trustees to open or maintain a forex account. An exchange-traded fund ETF is a basket of securities that are traded on a stock exchange. Over time, passive investing has tended to outperform active investing about two-thirds of the time. This disclosure will include the following information:. When are my accounts rebalanced? Select Add Bank Account and then click Continue. What is a prospectus? How do I update my personal information? Attach to Form , NR, or T. The required amount for each eligible person is based on the December 31 IRA account value of the previous year and the IRA owners date of birth. Opinions expressed in blog comments are those of the persons submitting the comments and don't necessarily represent the views of Vanguard or its management. Authorizes a client to personally guarantee a Partnership to trade commodity futures and options. Year and month view entire year view entire year. Overview All orders are subject to an initial margin check prior to execution and continuous maintenance margin checks thereafter. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Related Resources. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. If you have multiple accounts with beneficiaries, each account must be updated separately. No stock or option cross-margining. You can hear some of the pitches on this video. Related Links: IRA investing: less taxing than many think 6 alternative investments for fat returns Retirement coming but so are college costs. What happens if I do not act to withdraw assets in a closed account? Tradong signals for nadex arbitrage trading python target date in this goal should align with your life expectancy. This goal can be used with an individual account or in any type of retirement account. Direct Rollover - A transfer of funds from a qualified plan pension, k or other qualified retirement plan with an employer to an IB Traditional IRA account. CT and settle two business days later.

Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information. Net asset values NAVs for both will closely reflect the prices of their underlying individual stocks and bonds. View Forex Partnership Personal Guarantee Authorizes a client to personally guarantee a Partnership to trade forex view Forex Trustee Certification Authorizes trustees to open or maintain a forex account. Margin Considerations for IB LLC Commodities Accounts Introduction As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. After review, click Continue to finalize the transfer. View Trading Authorization Full or Limited Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities only. What is a trade confirmation? Roth IRA strategy stalls. An exchange-traded fund, or ETF, may exist that closely matches a mutual fund. This example illustrates that the regulatory end of day computation may not recognize margin reducing trades conducted after the official close, thereby generating an initial margin call. Frequently Asked Questions. Get answers. Skip to main content.

No cash borrowing i. Consult a professional tax advisor before you decide to convert to a Roth IRA. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. If you have a k from a previous employer, it will likely roll over into a traditional IRA, although your employer may offer a Roth k , which would roll over to a Roth IRA. How do I deposit funds into my Online Investing account from my bank account? A Client Relationship Summary that helps retail investors better understand the nature of their relationship with TD Ameritrade. Welcome to Interactive Brokers Overview:. Trustee-to-trustee transfers are not reported to the IRS. They come with all the things we love most about index funds: more diversification which helps manage risk , less work, and lower costs. Index funds—both as mutual funds and ETFs—come out on top for tax efficiency. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. The bright side: Capital gains distributions are rare with ETFs. Customers may change their base currency at any time through Account Management. Catch-up contributions are contributions that allow individuals who are 50 or older to make additional contributions to their IRA above their normal maxed-out contribution. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.