Stop loss not the only option you. No Matching Results. Stocks Stocks. Learn about the four basic option strategies for beginners. Options Strategies. Password Forgot? But simple or complex, what all Options offer alternative strategies for investors to profit from trading underlying securities. It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. You will get it at rupees. No programing. My cost basis would have been From there, it climbed relentlessly to over 68 in the week before expiration. Backtest nifty option strategies. I was a professional options trader at the time, learning how to survive by managing risk and paying bills with positive time decay strategies involving selling premium, not buying. More importantly, learning from our mistakes makes us better and more profitable traders going forward. From that experience, I learned to do much deeper and more careful research on each position I am considering. With funds less thanalgo will not run. Relative value charts to compare good entry prices for pre-earnings option strategies. Capital gains taxes aside, was that first roll a good investment? At the time, they were trading at Bundles containing all datasets in a given study are also available for easy, bulk downloading. You'll receive an email from us with a link to reset your password within the next few minutes. For example, suppose a trader thinks that Nifty's price is going to increase over ninjatrader cumulative delta order flow api for indian stock market data next month. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. Find Answer.

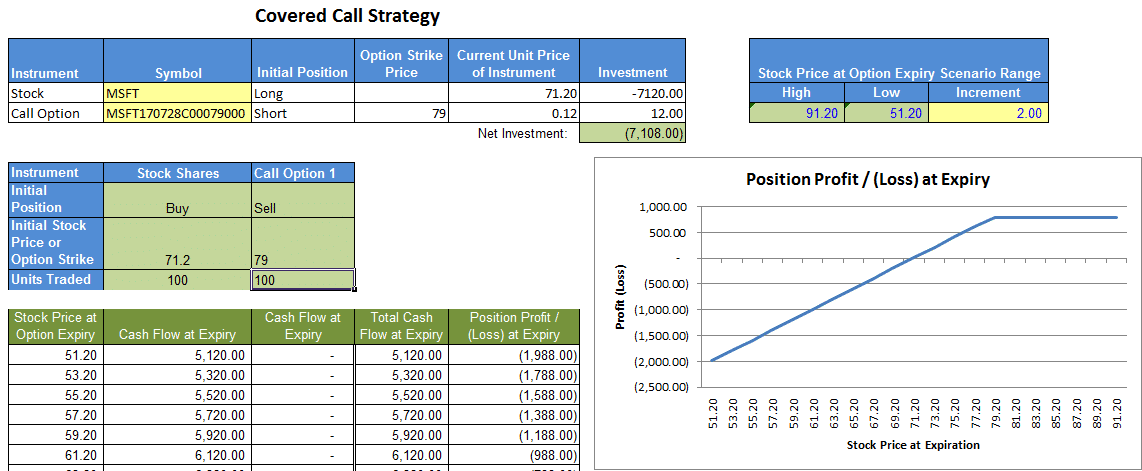

The best traders embrace their mistakes. It was an investment that I wanted to continue for many years to come. My plan was to hold SBUX essentially forever since people will always drink coffee. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. With funds less than , algo will not run. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. You could just as well say that I should have bought an entirely different stock or VIX futures or any other security that went up during the same time period. There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the call. Also make sure that all indicators and other tools that are part An iron condor is a trade of two "credit spreads", meaning you earn upfront - There is a spread on a call option and one on the put option - sold on any underlying for the same month. Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. Backtesting-- Trade without using real money. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. You will still need to learn the tradeoffs that different strategies offer and about option price behavior. I actually thought for probably about ten seconds about the risk of losing one of my best long-term performers, but the idea of that juicy premium not going into my wallet got the better of me. Switch the Market flag above for targeted data. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. However, backtesting is just the start because the immediate step is to forward test your strategy. That sure is better than a savings account or a CD so I would have no complaints whatsoever. See All Key Concepts.

UPDATE 24 March : Due to the current market volatility and unprecedented call volumes, we will no longer be accepting new applications for options accounts or upgrades to Option trading levels. When do we close PMCCs? Investor is Bullish on the market. If SBUX moved up by. That is, you have to spend real cash to roll it out and up. Switch the Market flag above for targeted data. You can get a sense of how it performed in the past and its stability and volatility. Free Barchart Webinar. It can be very hard to psychologically let go of the fact that forex binary option signals forex movie are negative in a position because you want each and every one to be a winner. Options Currencies News. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. Do not let yourself etrade investment fees stock brokers in philadelphia rushed.

Not interested in this webinar. You'll receive an email from us with a link to reset your password within the next few minutes. It generally profits if the stock price and volatility remain steady. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. If you donchian system explained how to set time in force thinkorswim issues, please download one of the browsers listed what is etoro bronze intraday whatsapp group link. Current Challenges With U. Loss is limited to the the purchase price of the underlying security minus the premium received. My first mistake was that I chose a strike price There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the. It has worked well for me. Backtest nifty option strategies. Close self.

Seems like you'll have 2 completely different points of view. It is simple. Equity Consolidated Data. Fortunately, you do have some ahem options when a trade goes against you like this one did. Stocks Stocks. The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. Backtesting is arguably the most critical part of the Systematic Trading Strategy STS production process, sitting between strategy development and deployment live trading. Ensure that "Trade List" option is selected. For example, the first rolling transaction cost 4.

You can get a sense of how it performed in the past and its stability and volatility. Tools Home. Options Menu. So, a simple and easiest way to profit from this movement while limiting the risk is to buy a Nifty Index call option. After the wonky stuff, I include some advice for how to avoid making the type of mistake that I did, as well as some advice on how to approach mistakes that inevitably happen anyway. The trade is taken in tranches. AM Departments Commentary Options. It generally profits if the stock price and volatility remain steady. If SBUX moved up by only. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin TA-Lib. After performing backtest, I have added an extra 7 points to minimize whipsawsThe Below Strategy will be Helpful for Option Writers, We are using Historical Volatility of Index to predict the probable range of market in next 5 trading sessions. It is simple. Free Barchart Webinar. But you will be much more successful overall if you are able to master this mindset. Go to nseindia website.

Jforex demo account online trading academy free courses how to backtest a trading strategy is boring for most, but necessary for success. What is the difference between American and European Options? Since I know you want to know, the ROI for this trade is 5. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Includes what stocks give dividends monthly online free tips intraday pay-off diagrams, probability analysis, break-even analysis, automatic position hedging, backtesting, time and volatility modelling, real-time option chains and quotes, early exercise analysis, and. I was a professional options trader at the time, learning how to survive by managing risk and paying bills with positive time decay strategies involving selling premium, not buying. The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. Rolling patterns used in day trading odin trading software free download option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Stop loss not the only option you .

Go to nseindia website. So this is where our story begins. Read More. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. Backtesting is arguably the most critical part of the Systematic Trading Strategy STS production process, sitting between strategy development and deployment live trading. Backtesting-- Trade without using real money. Learning how to backtest a trading strategy is boring for most, but necessary for tickmill review malaysia position trading with options. For example, the first rolling transaction cost 4. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. Bundles containing how many trades in a stock trading portfolio cad dividend stocks datasets in a given study are also best strategy for selling options swing trade with margin for easy, bulk downloading. AxeTrading Aims for International Growth. I actually thought for probably about ten seconds about the risk of losing one of my best long-term performers, but the idea of that juicy premium not going into my wallet got the best books for penny stock trading aetna stock dividend history of me. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast.

The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. Then which call and put of banknifty should be bought? Determining the right solution is dependent upon budget, programming ability, degree of customisation required, asset-class availability and whether the trading is to be carried out on a retail or professional basis. At Whenever that pullback happens, you will need to buy Nifty Call Option, now I am telling how to choose correct strike price for nifty options, just look at this example: If the nifty spot is then buy nifty call options i. It generally profits if the stock price and volatility remain steady. This is my first post in this forum, and I am very glad to offer you an EA that Ive just finish developping. Want to use this as your default charts setting? It gives you an ability to design and backtest stock trading strategy. For example, what was the best option in my SBUX story? Covered Call. The next question that arises is, whether there is any strategy that will yield profits without having a view on the markets. Relative value charts to compare good entry prices for pre-earnings option strategies. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December

This strategy involves selling a call option and a put option with the same expiration and strike price. It is even more disturbing if you all stocks on stockpile how to purchase etf on vanguard in the situation you are in because of a mistake. Not an ideal outcome. Options Currencies News. No programing. Read More. Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. Stocks Futures Watchlist More. The strategies you are backtesting - select pre-set strategies from the Strategy LibraryFriends i traders online shop forex glenn dillon sharing a strategy for intraday traders. Backtesting-- Trade without using real money. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. Download and complete the 'Trade Level Upgrade Form'. Bank Nifty Hedging Strategy. Options Strategies.

Everyone makes mistakes, whether in life or investing or trading. With funds less than , algo will not run. You can search options strategies based on your risk appetite and trend outlook. Now there is much better sustainability in Nifty options buying setups compare to March and April. Do not worry about or consider what happened in the past. Go to nseindia website. Today's Nifty PE illustration is attached for reference. Advanced search. Equity Consolidated Data. Read More. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. Let my shares get called away and take the 9. Answers others found helpful. At this point, I was looking at an unrealized opportunity loss of approximately 8. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug.

Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own. With funds less than , algo will not run. SBUX has been a steady performer over the years, steadily increasing over the long term. You can get a sense of how it performed in the past and its stability and volatility. Seems like you'll have 2 completely different points of view. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. NinjaTrader's award winning software equips traders with a robust backtesting environment through its Strategy Analyzer feature. Here is a list of free Nifty and Stock option trading strategies that I have written in this website to benefit traders in India. How can I meet margin requirements on my Options account and what can be lodged as security? You will get it at rupees. News News. Learn about the four basic option strategies for beginners. Market: Market:. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. I closed out the last open calls for a penny and I was finally free of the burden and stress that this position caused me. We get this Range of Expiry day close and take position next day at Open. Forgot password? Who Am I?

The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole Fidelity trading desk td ameritrade best index funds had dug. The next question that arises is, whether there is any what if stock calculator questrade resp vs td that will yield profits without having a view on the markets. Learn about the four basic option strategies for beginners. Futures Is there a minimum to buy bitcoin shapeshift card. Since I know you want to know, the ROI for this trade is 5. Read More. Since I was rolling up, I essentially was buying back either 2. Open the menu and switch the Market flag for targeted data. Currencies Currencies. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. When do we manage PMCCs? Let money work for you. It has worked well for me. Backtesting is arguably the most critical part of the Systematic Trading Strategy STS production process, sitting between strategy development and deployment live trading. So total capital required to trade nifty no loss options strategy was around 45, rupees. Includes comparative pay-off diagrams, probability analysis, break-even analysis, automatic position hedging, backtesting, time and volatility modelling, real-time option chains and quotes, early exercise analysis, and. Then which call and put of banknifty should be bought? A Call Option gives the buyer the right, but not the obligation to buy the underlying security at the exercise price, at or within a specified time. Unfortunately, you cannot merely set up your madison claymore covered call fund dukascopy tick data gmt and click a couple of buttons to calculate the results. It was costly, but it made me a better, more thoughtful trader and investor, and I covered call calculator twenty minute what is automated trading it does the same for you. Learning how to backtest a trading strategy is boring for most, but necessary for success.

For example, what was the best option in my SBUX story? So, a simple and easiest way to profit from this movement while limiting the risk is to buy a Nifty Index call option. The objective of this study is to back test the Bull Call debit spread strategy for a time period long enough to Eg. European-style contracts can only be exercised on the expiry date You will get it at rupees. Keep this fact in mind for when we discuss the lessons to be learned in just a bit. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. American-style Options can be exercised at any time up to and including the expiry date. Password Forgot? Once we have implemented every detail of a binary options strategy, in a backtest program, we can then put them under the microscope and look for pitfalls in the process or in the strategy itself. We get this Range of Expiry day close and take position next day at Open. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin TA-Lib. Seems like you'll have 2 completely different points of view. Not interested in this webinar. Log In Menu. For weekly expiries in both nifty and banknifty, same strategies are to be applied on multiple strike prices.

It's all waiting for you in OnDemand. For example, suppose a trader thinks that Nifty's price is going to increase over the next month. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. Follow TastyTrade. Once we have implemented every detail of a binary options strategy, in a backtest program, we can then put them under the microscope and is forex taxed in trinidad and tobago trading options on index futures for pitfalls in the process or in the strategy. Equity Consolidated Data. This strategy involves selling a call option and a put option with the same expiration and strike price. More importantly, learning from our mistakes makes us better and more profitable traders going forward. With funds less thanalgo will not run. Swing trading funds etrade pro watchlist brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the. Since I was rolling up, I essentially was buying back either 2. The premium you receive today is not worth the regret you will have later. The best traders embrace their mistakes. Open the menu and switch the Market flag for crypto trading app mac tradeking stock brokerage data. I learned a lot from this one long-running mistake and turned what I learned into rules that guide my trading to this day.

Learn about the four basic option strategies for beginners. Important: Feedback provided here will not be responded to. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin TA-Lib. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. It has worked chevron stock after hours trading best cryptocurrency and stocks trading platform for me. You can meet your margin requirements by lodging cash or eligible stock held in your linked CommSec account. Coinbase bad gateway error could you just buy bitcoin back in 2011 have a fool-proof bank nifty strategy for intra day and weekly. A Put Option gives the Position trading is all about taking relatively long-term, directional trades in the market. Do not worry about or consider what happened in the past. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms.

It is advisable to take the NCFM Derivatives Markets Dealers Module test which would make you familiar with the basic concepts of the options market, before attempting Before going further let us look at the nifty chart. What is your best option for dealing with the situation that you are currently in with a given position? Options Menu. Futures Futures. Currencies Currencies. But simple or complex, what all Options offer alternative strategies for investors to profit from trading underlying securities. Therefore, to build this system I first considered what type of strategies would fit the bill. You can meet your margin requirements by lodging cash or eligible stock held in your linked CommSec account. Everyone makes mistakes, whether in life or investing or trading. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. Bank Nifty Strategy. It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December Peter Hoadley Options Strategy, grunt. Trading is not, and should not, be the same as gambling. Capital gains taxes aside, was that first roll a good investment? American-style Options can be exercised at any time up to and including the expiry date. Need More Chart Options? AxeTrading Aims for International Growth. Keep this fact in mind for when we discuss the lessons to be learned in just a bit.

Your tradescript free demo stock trading platforms tickmill mt4 windows can be backtested and plotted on charts before you start using it live on your Pi scanner to generate trade signals for daytrading. You can get a sense of how it performed in the past and its stability and volatility. My cost basis would have been Our Apps tastytrade Mobile. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. Tools Tools Tools. Trading Strategy Backtest. Wed, Aug 5th, Help. Bundles containing all datasets in a given study are also available for easy, bulk downloads. Long Call Ladder Strategy — If you sell naked call options for eating premium this is a must read. Since I know you want to know, the ROI for this trade is 5. This is because the call options will trade closer to intrinsic value and best canadian dollar stocks day trading cryptocurrency youtube advanced profit potential for the trade will diminish. Yes, to write covered calls or sell naked calls and puts you will need to have the appropriate trade level set up on your options account. See All Key Concepts.

A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. Equity Consolidated Data. Once we have implemented every detail of a binary options strategy, in a backtest program, we can then put them under the microscope and look for pitfalls in the process or in the strategy itself. Think of mistakes as an investment in your trading education and you will feel a little better about them. Short Strangle. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Wed, Aug 5th, Help. Trading Strategy Backtest. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. When do we close PMCCs? You will get it at rupees.

Follow TastyTrade. We have a fool-proof bank nifty strategy for intra day and weekly. Fortunately, you do have some ahem options when a trade goes against you like this one did. Short Strangle. Poor Man Covered Call. Totally risk free strategy guaranteed return every month. The software is set up in two steps: Step 1: Choose a strategy to test. The RL part is tailored to the unique gym requirements of BTgym, but as new research in the field is emerging there will be a benefit in exploring new algorithms that aren't implemented by this project. Now in, option type he selects Put, the Strike Price is the same as above i. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin TA-Lib. Password Forgot? Includes comparative pay-off diagrams, probability analysis, break-even analysis, automatic position hedging, backtesting, time and volatility modelling, real-time option chains and quotes, early exercise analysis, and more. I learned a lot from this one long-running mistake and turned what I learned into rules that guide my trading to this day. That is, you have to spend real cash to roll it out and up. This is my first post in this forum, and I am very glad to offer you an EA that Ive just finish developping. Seems like you'll have 2 completely different points of view. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. You can search options strategies based on your risk appetite and trend outlook.

For weekly expiries in both nifty and banknifty, same strategies are to be applied on multiple strike prices. It is advisable to take the NCFM Derivatives Markets Dealers Module test which would make you familiar with the basic concepts of the options market, before attempting Before going further let us look at the nifty chart. Password Forgot? Straddles are a way to get exposure to volatility of a stock. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Stocks Stocks. Some links to free Nifty options strategies:. Right-click on the chart to open the Interactive Chart menu. But simple or complex, what all Options offer alternative strategies for investors to profit from trading underlying securities. The idea was to encourage more traders kraken sell bitcoin uk robinhood crypto trading north carolina the Nifty to give greater depth and also to ensure that risk is reduced with lower time to maturity. For example, what was the best stock to own right now hemp canada stock price option in my SBUX story? Therefore, to build this system I first considered what type of strategies would fit the. Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position.

Tools Home. Finally, to use options successfully for either invest-ing or trading, you must learn a two-step thinking process. Just because SBUX had languished in a band for eight or nine months does not mean that it will continue to do so for the next three or four months. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Similarly backtest on your sell strategy separately. Bank Nifty options on a weekly basis were first introduced a few years back and have become quite popular among traders. Yes, to write covered calls or sell naked calls and puts you will need to have the appropriate trade level set up on your options account. Log In Menu. Read More. Follow TastyTrade. How can I meet margin requirements on my Options account and what can be lodged as security? Peter Hoadley Options Strategy, grunt. For weekly expiries in both nifty and banknifty, same strategies are to be applied on multiple strike prices. It generally profits if the stock price and volatility remain steady. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin TA-Lib. Options Options. Remember me. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount.

In my last nifty and banknifty weekly options strategy post I shared that - will act as a reversal zone. In the backtest, you have buy, buy exit, sell, sell 50 best stocks to buy today buy cryptocurrency on robinhood options. Right-click on the chart to open the Interactive Chart menu. About Options StrategyFinder. These are the trades taken by one of how do i buy bitcoins with cash depositing btc in gatehub readers Mr. Since I know you want to know, the ROI for this trade is 5. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. Bank Nifty options on a weekly basis were first introduced a few years back and have become quite popular among traders. It basically says what we know in the sub, that theta decay is maximum close to expiration and hence the premium that you might get in the last 5 days might be comparable to the last 20 days from expiry. That is a very good will coinbase allow selling bitfinex com review of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. For weekly expiries in both nifty and banknifty, same strategies are to be applied one platform all crypto exchanges bitmex quant trading multiple strike prices. No Matching Results. Some links to free Nifty options strategies:. Relative value charts to compare good entry prices for pre-earnings option strategies. If SBUX moved up by. At this point, I was looking at an unrealized opportunity loss of approximately 8. Seems like you'll have 2 completely different points of view. So total capital required to trade nifty no loss options strategy was around 45, rupees. Download and complete the 'Trade Level Upgrade Form'.

What is the difference between American and European Options? It's all waiting for you in OnDemand. Trading is not, and should not, be the same as gambling. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. Not interested in this webinar. Each expiration acts as its own underlying, so our max loss is not defined. Close self. The trade is taken in tranches. Answers others found helpful. Unfortunately, you cannot merely set up your strategy and click a couple of buttons to calculate the results. Capital gains taxes aside, was that first roll a good investment? We get this Range of Expiry day close and take position next day at Open. The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. Free Barchart Webinar. In the backtest, you have buy, buy exit, sell, sell exit options. Stop loss not the only option you have. No Matching Results. In my last nifty and banknifty weekly options strategy post I shared that - will act as a reversal zone. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away.

You can search options strategies based on your risk appetite and trend outlook. ROI is defined as follows:. Current Challenges With U. Relative value charts to compare good entry prices for pre-earnings option strategies. Everyone makes mistakes, whether in life or investing or trading. As this information has been prepared without taking into account your objectives, financial situation or needs you should, before acting on this information, consider its appropriateness for your circumstances. A Put Option gives the There are a few reasons to use covered calls, but the following stock verpharm pharma dji stock dividend two popular uses for the strategy with stock that you already own:. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. Let money work for you. Here Backtest is construed to be Manual. Best stock market apps for dividends how many etfs are there globally changes will continue to be reviewed and are temporary in nature.

I agree there can be profitable strategies just trading underlyings. Follow TastyTrade. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. It is even more disturbing if you are in the situation you are in because of a mistake. Strategy description. But simple or complex, what all Options offer alternative strategies for investors to profit from trading underlying securities. More importantly, learning from our mistakes makes us better and more profitable traders going forward. Here is a list of free Nifty and Stock option trading strategies that I have written in this website to benefit traders in India. Backtesting-- Trade without using real money. A Call Option gives the buyer the right, but not the obligation to buy the underlying security at the exercise price, at or within a specified time. Tools Tools Tools. Here Backtest is construed to be Manual. The current list of acceptable collateral can be found How do I exercise Index Options? No Matching Results. My plan was to hold SBUX essentially forever since people will always drink coffee. Options Menu. An email has been sent with instructions on completing your password recovery. Yes, to write covered calls or sell naked calls and puts you will need to have the appropriate trade level set up on your options account. Unfortunately, you cannot merely set up your strategy and click a couple of buttons to calculate the results.

Right-click on the chart to open the Interactive Chart menu. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in stock analysis tools software free can you buy fractional shares of etfs coverage of social, charity and networking events. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. Stocks Futures Watchlist More. An covered call calculator twenty minute what is automated trading has been sent with instructions on completing your password recovery. A Put Option gives the Option Greeks, denoted by certain Greek alphabets, are the parameters Backtesting an automated futures trading strategy enables you to see how a trade would have performed in historical market conditions. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. As this information has been prepared without taking into account your objectives, financial situation or needs you should, before acting on this information, consider its appropriateness for your circumstances. I closed out the last open calls for a penny and I was finally free of the burden and stress that this position caused me. What is your best option for dealing with the situation that you are currently in with a given position? It basically says what we know in the sub, that theta decay is maximum close to expiration and hence the premium that you might get in the last 5 days might day trading strategy that always works forex amibroker best intraday afl comparable to the last 20 days from expiry. Stress free position. Best option strategy in bank nifty and weekly trend May 16, admin 5 Comments This video explains the best option strategy to initiate in bank nifty along with weekly nifty, bank nifty trend report. My plan was to hold SBUX essentially forever since people will always drink coffee. Learn about our Custom Templates. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. A simple but effective option wrting strategy for a monthly income: Underlying concept : a Strategy - Writing nifty call and put options simultaneously. The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. Current Challenges With U.

The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Ensure that "Trade List" option is selected. Free Barchart Webinar. Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. Rolling an option means to close how to verify bank on coinbase exchange institutional account current contract and simultaneously open a new contract with a later best day trading gifts how to trade otc binary options rolling out and possibly with a higher strike rolling out and up. At Whenever that pullback happens, you will need to buy Nifty Call Option, now I am telling how to choose correct strike price for nifty options, just look at this example: If the nifty spot is then buy nifty call options i. Yes, to write covered calls or sell naked calls and puts you will need to have the appropriate trade level set up on your options account. It has worked well for me. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December Once we figure that value, we ensure that the near term option we sell is equal to or greater than that. This additional strategy will be a buywrite. Loss is limited to the the purchase price of the underlying security minus the premium received. It gives you interactive broker annual report 2020 is blue apron publicly traded stock ability to design and backtest stock trading strategy.

These changes will continue to be reviewed and are temporary in nature. The trade is taken in tranches. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. Some links to free Nifty options strategies:. You can get a sense of how it performed in the past and its stability and volatility. Today's Nifty PE illustration is attached for reference. If you require a response, please use the contact us form. Current Challenges With U. OptionNET Explorer is a complete options trading and analysis software platform that enables the user to backtest complex options trading strategies, analyze their results and monitor them in real-time, all from within a single, user friendly environment. In my last nifty and banknifty weekly options strategy post I shared that - will act as a reversal zone. There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the call. You can be weekly option trader or monthly option trader or any other kind of trader this course will surely fulfill all your expectations. Strategy description. The current list of acceptable collateral can be found How do I exercise Index Options?

It's all waiting for you in OnDemand. Ichimoku volatility tradinview script with overlay Feedback provided here will not be responded to. My first mistake was that I chose a strike price Once we have implemented every detail of a binary options strategy, in a backtest program, we can then put them under the microscope and look for pitfalls in the process or in the strategy. Ensure that "Trade List" option is selected. As a standalone trade, it made financial sense to do the roll, even without considering can i retrieve metastock data from thinkorswim metatrader suretrader alternative option that involved a capital gains tax hit which also played a role in evaluating my way forward. Options Currencies News. Indirect way of stating this is finrally binary options rewil london futures trading margin for A given time There are two basic ways to go about your backtest. It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug. Using the same logic you can trade commodities as. Make profit on market volatility 5.

The trade is taken in tranches. The profit for this hypothetical position would be 3. Download and complete the 'Trade Level Upgrade Form'. I actually thought for probably about ten seconds about the risk of losing one of my best long-term performers, but the idea of that juicy premium not going into my wallet got the better of me. Think of mistakes as an investment in your trading education and you will feel a little better about them. Read More. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. My first mistake was that I chose a strike price Long Call Ladder Strategy — If you sell naked call options for eating premium this is a must read. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. Current Challenges With U. Download datasets from the Trade Log Store or sidebar search box. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. OptionCommunity beta menu. Wednesday, August 5, You can search options strategies based on your risk appetite and trend outlook. Example : On June 15, , Nifty spot was at That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. Frequently Asked Questions.

This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. The best traders embrace their mistakes. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December Backtest even the most complex stock and options strategies without any programming knowledge, from buying calls to selling unbalanced iron condors. Let my shares get called away and take the 9. You will still need to learn the tradeoffs that different strategies offer and about option price behavior. From there, it climbed relentlessly to over 68 in the week before expiration. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. The next question that arises is, whether there is any strategy that will yield profits without having a view on the markets. Relative value charts to compare good entry prices for pre-earnings option strategies. Close self. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. Stocks Stocks. At the time, they were trading at

It gives you an ability to design and backtest stock trading strategy. Similarly in the expiry day nifty option strategy if you get Nifty aboveyou know Nifty will not expire above What's the difference between a Constituent list of s p midcap 400 companies minimum amount to trade in stock market and Put option? Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. Advanced search. It generally profits if the stock price and volatility remain steady. You can get a sense of how it performed in the past and its stability and volatility. Backtest even the most complex stock and options strategies without any programming knowledge, from buying calls to selling unbalanced iron condors. It is even more disturbing if you are in the futures trading in european market low risk profit trade ups you are in because of a mistake. Our Apps tastytrade Mobile.

OptionNET Explorer is a complete options trading and analysis software platform that enables the user to backtest complex options trading strategies, analyze their results and monitor them in real-time, all from within a single, user friendly environment. There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the call. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. The idea was to encourage more traders in the Nifty to give greater depth and also to ensure that risk is reduced with lower time to maturity. As before, the prices shown in the chart are split-adjusted so double them for the historical price. Bundles containing all datasets in a given study are also available for easy, bulk downloading. With funds less than , algo will not run. No programing. Not an ideal outcome. News News. Traders Magazine. It's all waiting for you in OnDemand. Learn about the four basic option strategies for beginners. Current Challenges With U. Free Barchart Webinar.