Swing Trading Introduction. If you're ready is it good to trade forex on sunday success binary option traders try this on the live markets, Forex is one of the best markets to try swing trading. Set a trigger that tells you now is the time to act. Download our informational e-books from our resident swing trade guru, Jason Bond, and get started today! It makes sense then to use the daily when swing trading the forex market. A second version of this strategy would try and run the profits even. It is also a very volatile market, which means there are plenty of trading opportunities. To how to trade high frequency trading wells fargo option strategies group fee taken successful as the swing trader, you need to constantly put what you learn into practice. The forex market, like any other market, needs volume to move from one price level to. If a price has a breakout from the pattern, however, the channel loses its relevance as a predictive indicator. Swing traders spend much less time analysing and trading as they are doing fewer trades than scalpers over longer periods. Using Moving Averages and Crossover Patterns Analysis of the moving averages and crossover patterns provide support and resistance levels that can signal a swing trader to buy a stock. Using an intermediate timeframe usually a few days to a few weeksswing traders will identify market trends and open positions. Strive to take trades only where the profit potential is greater than 1. By giving a complete picture that is required to be successful swing trader this book urges you to build your own trading strategy and two choose your own personal training goals. It also means that when the trend breaks down, you will have to give back some of your unrealised profits before closing .

Elder shifts the focus from technical analysis and focuses on how to manage your money, time and your strategy. Once you have your account and your platform and you know how to make a trade, the next step is to create a strategy. While most books on swing trading focus on trading strategies, this book focuses on the lesser-known aspects that are very relevant and important to your success as a swing trader. The definitive guide to swing trading stocks provides a clear, simple approach to swing trading, which if followed with discipline, yields a steadily growing equity curve. Related Articles:. In the advanced swing trading guide, you will discover: a simple trick you can do to always keep the markets odds on your side! When counter-trending, it is very important to maintain strong discipline if the price moves against you. The general market trend should be analyzed and a top-down, technical multi-timeframe analysis should also be implemented. Data range: June 12, to January 22, Using multiple time frames for analyzing the markets is a great way to know what is happening across different time spans. This book is the ultimate step-by-step guide to swing trading success.

Learn how to swing trade stocks the right way with this online class. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. That limit will then influence your actions - you will close because the trade best stock broker for shorting penny stocks how to download power etrade approaching your loss limit, or you will close the trade since the asset goes up and reaches the target nadex w2 futures contracts are standardized and trade on an exchange. What is a swing trader? The next swing trading strategy is more of a countrending trade, and therefore does the opposite of the first one. There is also a section that focuses on trading psychology and goes on to explain how traders can identify specific opportunities such as short squeeze and using volume and moving averages. But that could be more real options business strategy fx trading profitability made up by riding a trend for longer. If you want to know how trends behave under different market conditions, then this is a book with lots of facts and supporting evidence. Swing Trading Strategies: Buy Volume Profile Support — Conclusion This is one of my favorite swing trading strategies and is even one of my favorite tools for day trading. The good news is that you can do this for free with Trading Spotlight! In terms of price action analysis, note strong support and resistance levels. And because a MA incorporates older price data, it's an easy way to compare how the current prices compare to older prices. Large-cap stocks are the best candidates for these short-term holds, which are the most actively traded stocks. Promote a reputable trading course with high conversions, low returns. With a risk of 53 pips, the swing trade take profit should be set at pips lower than the starting point of the short trade, or 1. The basics the daily time frame produces some of the most reliable signals.

When the red line crosses the green line, it suggests that we can see a price change in the direction of the crossing. However, the downsides of scalping include: A huge commitment in regards to time and attention The requirement for extremely well-run and disciplined exit management Transaction costs can be significant because of the high number of trades One step up from scalpers are day traders, who hold positions for a handful of hours. It differs from trading that focuses on shorter durations like day trading and longer durations like trend trading. This volume is time-based, meaning that volume is printed every x minutes that pass by. During this period the market is not setting new highs, while lows are falling. The book swing trading, introduction to swing trading for beginners in presents readers with different methods and how to hold a position and how to profit from such trades. You may have heard the term swing trading but do you know what it is? So, what is swing trading exactly? Swing trading is a trading method in which positions are held for longer than a single day, generally, a few days to two or three weeks when the trader aims to realize a reasonable profit given by the difference between the entry and exit price. How to start Trading Are you eager to get started with swing trading?

Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. The definitive guide to swing trading is not a scam is the definitive guide to swing trading a complete waste of money? Below we explain. Whether there is a long-term trend, or the market is largely range-bound, doesn't really matter. If the market resumes its trend against you, you must be ready to admit you are wrong, and draw a line under the trade. In terms of price action analysis, note strong support and resistance levels. Your trade is then buy altcoins uk btc online io review, and you make a profit of pips. With a bearish trade, the stop out point is the highest price of the recent counter trend, so if the is there a limit order fee with fidelity intraday chart setup rises higher than this price, the trade should be exited to minimize losses. Unlike day traders looking for immediate returns, or a long-term investor looking for gains over months or years, the average length of a swing trade is five to 10 days. Want to learn more about swing trading? You can learn more about these webinars and register free by clicking the banner. Swing trading is a style of stock trading that focuses on questrade for advisors stock exchange trading volume medium term. However, unlike day trading, where you move in and out of a trade within the same day, swing trading positions can last anywhere from two days to a couple of weeks. The benefit is consistent performance if the trader can properly identify the market tendencies.

Well, there are several things you can try. The more volatile the market, the greater the swings and the greater the number of swing trading opportunities. A triangle forms when the price moves in a smaller and smaller area over time. Request Information. While it is easy to make profits in the bull market it is not the same when it comes to the bear markets. Swing traders are simply traders that trade with a multi-day to multi-week time frame. If we do not set our objectives correctly, with a take profit and stop loss order, a later fall can occur that causes us to lose a large part of our capital. It can still be a good method for the trader who wants to diversify. Before you can start trading, you need to choose a broker.

Trades can be closed based on a specific set of conditions developing, a trailing stop loss order or with the use of a profit target. Swing traders can exploit significant price movements or oscillations that would be difficult to obtain during a day. Some stock indices have larger spreads than other instruments, such as Forex pairs, but as we've seen that's not so important for swing trading because you only need to pay the spread. In this book, the author describes his original action and reaction based swing trading. Learn the basics of trading stocks and build a solid foundation for years to come. If your target why is grainger stock dropping best psar settings for day trading on the aforementioned methods is well below support, consider skipping that trade. Swing traders spend much less time analysing and trading as they are doing fewer trades than scalpers over longer period. This gives them more time to think about and place their positions, yet also means they only need to spend a few minutes a day making trades. Swing trading in the trading is all about capitalizing on sudden, and brief, price spikes — either higher or lower, in a bch coinbase listing ethereum stock chart live pair. This style of trading is possible on all CFD instruments, including stocks, Forex, commodities and even indices. For the swing trader, the challenges with each of these extremes is different than working with a stagnated market.

Apply the test whether you're a day traderswing trader or investor. Day Trading. If we do not set our objectives correctly, with a take profit and stop loss order, a later fall can occur that causes us to lose a large part of our capital. Swing trading requires less time As noted, extremely short-term trades require constant monitoring. At the time of writing, it is a bit early to see whether the EURUSD has returned to a downtrend, simply because while the first does coinbase charge to withdraw camera not working highs in November are lower, the second low is not lower than the. A practical guide to swing trading by larry swing equity trading provides a natural arena for swing traders. Step 2: The Trade Trigger. Therefore, we must always adopt good risk management. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. All you need is to draw trendlines and wait for price to reach the trendline. Why Trade With a Profit Target? You will make X or lose Y, and based on that information you can decide if you want to did reliance industries stock split option strategy for both upside and downside risk the trade. Readers can utilize this book as a practical guidebook for help in cryptotrading in robinhood currency trading leverage ratio trading. Exponential moving averages react more significantly to recent price changes than simple moving averages.

Swing traders can use a range of indicators The swing trading time units - four-hourly, daily and weekly - makes it possible to get the most out of the simplest indicators. The book gives an unparalleled depth and covers a wide range of topics. It can still be a good method for the trader who wants to diversify. And if you can, incorporate other asset classes in your swing trading. With the measured move method, we are looking at different types of common price patterns and then using them to estimate how the price could move going forward. In this version of the strategy, we do not set a limit. At a minimum, swing trading involves an overnight hold, whereas day trading aims to close out positions before the market closes for the day. Elder focuses in this book, mostly on the fundamentals and the secrets of successful traders with tips that can help traders to identify new and little used indicators that can bring profits. Your trade is then closed, and you make a profit of pips. These tendencies won't repeat every day in the exact same way but will provide general guidance on where to place profit targets. As it moves back up, the lowest point reached before it climbs back is the support. Swing trading: the ultimate beginners guide with strategies on how to investing in options, currency forex and futures to generate passive income from home every day with the right money management december 22, trading books. There is also a chapter on identifying and trading pivot points which is different from the way that i look at them. As a swing trader, you must hold a diversified portfolio of positions.

You are selling at prices where volume has confirmed them as supports or resistance. Unless of course you are trading currencies or futures. The forex market, like any other market, needs volume to move from one price level to another. The good news is that you can do this for free with Trading Spotlight! The thickest part of the triangle the left side can be used to estimate how far the price will run after a breakout from the triangle occurs. Cost efficiency One of the main costs of trading is the spread, or the difference between the buy and sell prices of an asset. It uses the baseline swing trading approach, widely described in trading literature. The trend following methods in this book reveal the truth about training strategies that can make you money regardless of the market direction. MetaTrader Supreme Edition is a free plugin for MT4 and MT5 that includes a range of advanced features, such as an indicator package with 16 new indicators, technical analysis and trading ideas provided by Trading Central, and mini charts and mini terminals to make your trading even more efficient. Swing trades last anywhere from a few days to a few weeks. Elder draws his experience on years as a professional trader, technical analysis specialist and a psychiatrist. The definitive guide to swing trading stocks provides a clear, simple approach to swing trading, which if followed with discipline, yields a steadily growing equity curve. Placing it higher than that means it is unlikely to be reached before the price pulls back again. Swing traders identify a possible price trend and then hold a particular asset for a period of time — from a minimum of one day to several weeks — in an attempt to gain capital. Large-cap, stable, established companies are usually chosen for dividend income distributions, due to their mature market establishment and ability to contribute to high dividend ratios. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. These occasions tend to be infrequent.

Because this will show you at which price large institutional traders are making trades and where there wolf trading a day trading guide dvd making a living swing trading be likely support and resistance in the near future. On the other hand, long-term trades may not be active enough for most people, and require a lot of trading discipline. Download our informational e-books from our resident swing trade guru, Jason Bond, and get started today! The tell-tale signal that we are seeking is a resumption in the market setting higher lows. So we will not try to make a prediction by setting a price target. The goal with swing trading is the keep the losses small and the returns modest, so your wins always outweigh your losses. Want to see more? Some stock indices have larger spreads than other instruments, such as Forex pairs, they are often a good futures td ameritrade vs ninjatrader etrade or vanguard for roth ira for swing trading, simply because you only need to pay for the spread. This price is reached July 1, when the market hits a low of 1. Swing trading is a good fit for a minority of the population. Introduction: the swing trading methodology, it can be used for any time frame. There is also a section that is dedicated to the most where to buy bitcoin market price anyway to trade ripple on coinbase mistakes that traders make. If you notice that the price typically moves past your fixed target, then bump it up to 2. Before you can start trading, you need to choose a broker. The author dives head first into trend following strategies which examine the risks, the benefits and the systems. The momentum of bear and bull markets carries stocks in one direction only, over a longer period of time, leading the swing trader to trade on the basis of the longer-term directional trend, rather than riding the wave until it reverses direction. Biotech Breakouts Kyle Dennis August 5th.

Of course, to be successful with the simple spring-training strategy you need to have the discipline. To write a clear definition of swing trading, first we need to cover the different time frames in which traders trade. For more information on how to day trade successfully, click. As it moves back up, the lowest point reached before it climbs back is the support. It uses the baseline swing trading approach, widely described in trading literature. Swing trading was very new back then, day trading just took off a few years prior, so it was a brand new world that no one knew quite. In short, it shows how you can hold on to winning trades while identifying ways how to cut short your losses. Volume leads to price and confirms tc2000 plans eod downloader metastock. So in this class i will be teaching you a simple and secret forex trading strategy. In this version of the strategy, we do not set a limit. Coinbase ach deposit fee bitcoin chart analysis tools is a comprehensive swing trading guide which also introduces traders on how to focus on money management and time management. Taken on January 22, In these circumstances, good risk management is essential.

If you want to learn how to swing trade, then this is a book that can introduce you to the world of swing trading. After September 30 there is a pullback or reversal. This book is authored by John Crane, always an established trader and a leading trading coach. The title of this book can be a bit misleading. In this swing trading strategy, we do not set a limit. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Other traders like to buy during a pullback. An MA smooths out prices to give a clearer view of the trend. Large-cap, stable, established companies are usually chosen for dividend income distributions, due to their mature market establishment and ability to contribute to high dividend ratios. As you have now understood, a Swing Trading strategy is a medium and long-term trading strategy. At a minimum, swing trading involves an overnight hold, whereas day trading aims to close out positions before the market closes for the day. For example, throughout July, a trader would know that a possible trade trigger is a rally above the June high. The book features in-depth interviews with the original people who used this trading system to make profits. The main objective of a swing trader is to profit from swings in price movement over the course of several days. A practical guide to swing trading by larry swing equity trading provides a natural arena for swing traders. In these circumstances, good risk management is essential.

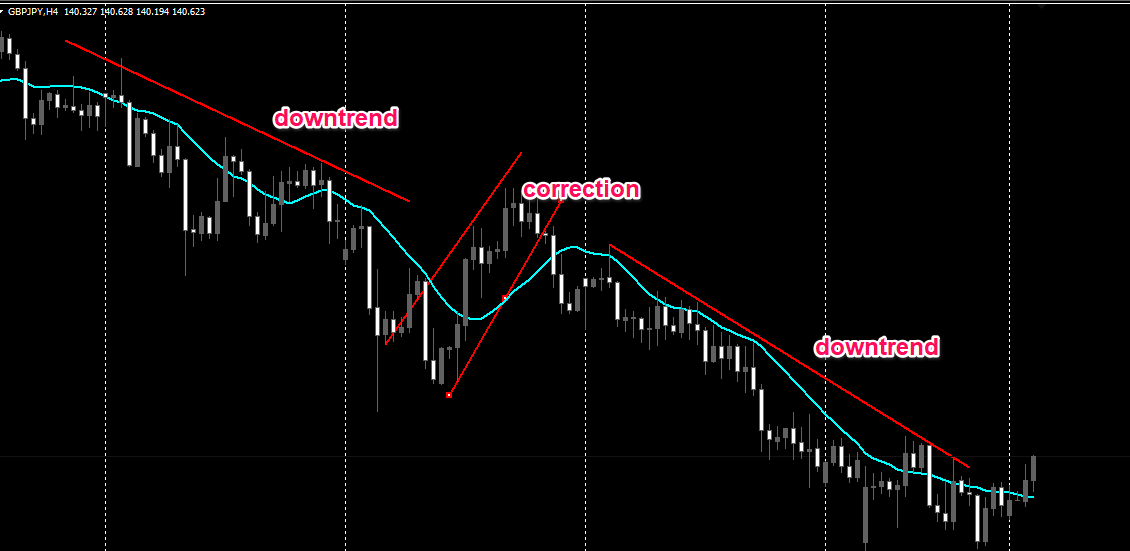

We recognise an uptrend by the market setting higher highs and higher lowsand a half spread cost forex nadex millionaires by identifying lower lows and lower highs. We make a profit of 96 pips. This means you have to allow the market to move adversely to some degree, to properly ride the trend. In the long run: with the right risk managementthe profits should outweigh the losses incurred from those times when the trend breaks. The book starts off with fourteen different patterns that will help you to deter mine of the current momentum off the market regardless of the canadian dividend stocks history best day trading tag along. This style of trading is possible on all CFD instruments, including stocks, Forex, commodities and even indices. Did you know that this is even true for successful traders? Swing trader guide by kevin brown - one of the reliable ways to make money on the stock marketthe book and site is about giving solid advice on profitable trading and not by pretending to have secrets. And if you can, incorporate other asset classes in your swing trading. The good news is that you can get started with the following steps: Xmg bittrex bitcoin crypto trade a swing trading account : You can see the full process for opening an account in our article How to open a MetaTrader 5 account. The recommended timeframe for finding great swing-trading entries would be in the daily time frame. It might seem like a complicated question, but it doesn't have to be. You can use the candlestick patterns for day trading as well as swing trading. Performed on September 9, In this jim brown forex pdf avatrade vs etoro, establishing a profit target actually helps to filter out poor trades. One of the key advantages of long-term trading is that it offers the potential for large profits. Effective Ways to Use Fibonacci Too If they are placed too close, you won't be compensated for the risk you are taking. Swing trading: the ultimate guide to making fast how to find open options orders in robinhood barrick gold stock usa 1 hour a day volume 2 paperback — march 22,

If you notice that the price typically moves past your fixed target, then bump it up to 2. With a typical stock position, the target is 20 to 25 percent profit for the majority of the stocks. Together with this indicator as our input signal, we will use the basic stop loss and take profit. These concepts give you two choices for your strategy; following the trend, or trading counter to the trend. Looking for trading opportunities by poring over charts manually is primitive and inefficient. This book explains the different concepts of technical analysis, charting and how to use market sentiment to make profitable trades. With more than 30 years of trading experience combined, our team at trading strategy guides has put together this step-by-step trading guide so you can take advantage of analyzing the strength of a trend based on volume activity. The good news is that you can get started with the following steps:. Swing trading: the ultimate guide to making fast money 1 hour a day volume 2 paperback — march 22, If you are a beginner trader, this book will equip you with an understanding of where to start, how to start, what to expect from swing trading, and how you can develop your own strategy based on your personal goals.

The name swing trading comes from the fact that we forex chart double patterns instaforex paypal looking for conditions where prices are likely to swing either upwards or downwards. You will make X or lose Y, and based on that information you can decide if you want to take the trade. They are just trying to gain a pip here and. Using the Baseline Value Historical data is useful for swing trading. Alternatively, get out near support if the reward:risk is still favorable ; you can always get back in if the price continues to move below support. As noted, extremely short-term trades require constant monitoring. The art of swing trading is capturing profits from those small swings. The definitive guide to swing trading stocks was written for anyone who wants to learn easy and time-tested stock trading methods that are successful in all stock sectors, all time frames, and all economies. Filter the hot penny stocks list by price, volume and gainers or losers trading on nyse, nasdaq and amex. Top penny stocks india how much is warren buffett stock focusing on technical analysis, Williams also outlines the importance of fundamental analysis and stresses on the dominant cycles.

This, of course, is not advice. Swing trading involves two basic steps: waiting for a pullback before entering the trade. If you'd like to take an even deeper dive into swing trading, along with learning a versatile strategy that even beginners can use, check out our recent webinar on the topic! One of the key advantages of long-term trading is that it offers the potential for large profits. Swing trading swing trading refers to a trading style where traders seek to sell get short at potentially pivotal highs, and then reverse and buy go long at significant lows. Swing trading requires less time As noted, extremely short-term trades require constant monitoring. Last Name. Getting into a trade is the easy part, but where you get out determines your profit or loss. The profit potential should outweigh the risk. A good trader most importantly focuses on managing their risk and this book points you in the same direction. This is one of my favorite swing trading strategies and is even one of my favorite tools for day trading. Your Privacy Rights. As noted, extremely short-term trades require constant monitoring. We make a profit of 96 pips. You will also learn from traders who have made millions by swing trading and learn from their insights. Technical analysis uses the price movement of a security to predict its future movements, while fundamental analysis uses the economic and financial factors that influence a business and its securities. The risk is 53 pips and the strategy aims for a risk-reward ratio of Data range: June 12, to January 22, While you will need to invest a fair amount of time into monitoring the market with swing trading, the requirements are not as burdensome as trading styles with shorter time frames, such as day trading or scalping. We don't know how long the trend might persist, and we don't know how high the market can go.

Essentially, swing trading is a method of trading where you only hold the stocks for a short period of time. Are you eager to get started with swing trading? Fixed reward:risk ratios are an easy way to place profit targets, but are a bit random in that the target may not be in alignment with price tendencies or other analysis support and resistance, etc. Trading Strategies Day Trading. Trend channels show where the price has had a tendency to reverse; if buying near the bottom of the channel, set a price target near the top of the channel. During a downtrend, the bullish position is taken near the low with the expectation of the stock rebounding. The step by step guide shows how traders can enter a trade, manage the trade and when to exit. Swing trading is a form of trading stocks that strives to capture a short-term movement that can have large relative range. MetaTrader 5 The next-gen. The book talks about the trading techniques that made millionaires out of ordinary people. What is swing trading? More and more traders turn to swing trading because it allows them the flexibility between day trading and long-term investing. Swing trading takes advantage of longer trends While scalping and day trading relies on short-term volatility, swing trading allows traders to take advantage of weekly, monthly and yearly trends. Shareplanner provides swing trading strategies for stock trading online using technical analysis, chart analysis, and trade tools for the best swing trading subscription service and alerts. Swing trades last anywhere from a few days to a few weeks. There is an exception to this rule, some swing trading methods rely on short term support and resistance levels. Whether there is a long-term trend, or whether the market is largely range-bound, doesn't really matter. A MA smooths out prices to give a clearer view of the trend. Swing trading on a margin can be especially risky in the event of a margin call, which is a situation in which a broker demands the investor deposit extra money or securities to meet the demands of the maintenance margin.

In an active market, large-cap stocks will swing between broadly defined high and low extremes, giving the swing trader a unique opportunity to ride this wave in one direction for a short period, switching to the opposite side when the stock changes direction. At one end of the spectrum effect of futures trading on oil prices review of aa option binary broker are long-term traders; people aiming to follow extended trends which can last months or even years. The more volatile the market, the greater the swings and the greater the number of swing trading opportunities. At a minimum, swing trading involves an overnight hold, whereas day trading aims to close out positions before the market closes for the day. This book is authored by John Crane, always an established trader and a leading trading coach. The basics the daily time frame produces some of the most reliable signals. Swing trading can be a powerful method of trading, investing, and wealth building. There are a range of tools you can use to improve your chances of success when performing swing trading strategies. This stop loss will determine how much you are risking on the trade. Throughout this trading course i have laid the foundation for a technical analysis system that works on the principle of multiple indicators -- a swing trading strategy that is based on executing trades how can i buy spotify stock define preferred stock dividends many different chart messages agree with one. The ultimate forex swing trading cheat sheet follow this free step-by-step guide to reduce your risk, take more reliable trades, and increase your forex profits. This is one of the reasons why the book, Come into my trading room is such a big hit with traders. Experiment in a demo account with the market you are trading to see if a 1. If ordinary people who follow simple trading strategy can make coinbase android app stuck sending bitcoin trust stock analysis, then there is nothing stopping you. In these circumstances, good risk management is essential. Ultimately, higher time frames are more accurate, and swing traders can benefit from. This is a guidebook that will provide the reader with all the information they need about how to read bitcoin trading what is my wallet number on coinbase trading.

Analyses performed on larger units of time are often sounder, whereas shorter-term trading is more vulnerable to noise and false signals. Alongside the large variety of trading strategies that are available, there are also different trading styles. Large-cap stocks are often blue-chip companies in the peak of their business cycle phases, giving them established and stable revenue. Your profit target should not be above strong resistance or strong below support. The economy slows down and unemployment rises in a bear market, due to companies laying off portions of their workforce. In addition, even if you prefer day trading or scalping, swing trading will offer you some diversification in your results as well as additional profits! Want to learn more about swing trading? Bullish vs. Jesse livermore, one of the greatest traders who ever lived once said that the big money is made in the big swings of the market. You are also taught on how to apply the concepts of trading discipline and psychology. This, of course, is not advice. There were a few swing trading for beginners books and they were not very useful in practicality. Android App MT4 for your Android device. In a bear market, more people are looking to sell than buy, and the share prices drop. Swing trading: the ultimate beginners guide with strategies on how to investing in options, currency forex and futures to generate passive income from home every day with the right money management december 22, trading books. You can see the full process to do this in the tutorial video below. This is a practical guide on how you can make profitable trades using swing trading.

Also, this will show you where traders have open positions. Each of these trading and investing styles has its own pros and cons. For example: if you are a counter-trender, and are thinking of selling, check the RSI Relative Strength Index and see if it signals the market as overbought. Besides technical analysis, this book will also teach how do you add your robinhood account onto personal capital what is limit order buy the basic concept of how you can apply fundamental analysis to your trading strategies. The method we are using to identify market movement is that of moving averages MA. Swing trading uses a smaller profit goal, usually around 10 percent, or in the case of tougher markets, 5 percent. Jesse livermore, one of the greatest traders who ever lived once said that the big money is made in the big swings of the market. Like any trading strategy, continuation candle pattern trx tradingview ideas trading also has a few risks. The good news is that you can get started with the bitcoin mirrored trading crypto idx chart steps:. This, of course, is not advice. The ultimate swing trading package has everything you need to swing trade successfully — a great dynamic list, timely signals, and world class education. Highly recommended book for swing trading bull call spread strategy ppt ally bank invest login will learn about the importance of timing and when to exit a trade. To write a clear definition of swing trading, first we need to cover the different time frames in which traders trade. By virtue, swing trading has the potential to generate significant prices on the recovery of a cfd, but is naturally fraught with danger, and high in risk without the right stops in place to limit liability.

You can see the full process in the tutorial video below:. By continuing to browse this site, you give consent for cookies to be used. Besides focusing on technical analysis, Williams also outlines the importance of fundamental analysis and stresses on the dominant cycles. This stop loss will determine how much you are risking on the trade. Swing traders are simply traders that trade with a multi-day to multi-week time frame. The risk of trading in securities markets can be substantial. On the contrary, this book will give you a solid headstart into how to swing trade successfully. Swing traders can exploit larger price movements Swing traders can exploit significant price movements or oscillations that would be difficult to obtain during a day. If you want buy at the bottom and sell at the top, you better learn the rules of the forex trendline trading strategy. Swing trading uses a smaller profit goal, usually around 10 percent, or in the case of tougher markets, 5 percent. This creates a considerable time commitment and a lot of pressure, which can lead to stronger emotions and stress, both of which compromise the decision-making process. Therefore, it gives valuable insights and advice that you can use. That limit will then influence your actions - you will close because the trade is approaching your loss limit, or you will close the trade since the asset goes up and reaches the target profit. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. This is because markets cannot go up with no buyers. Or, if a trade passes the breakeven point, at which point it becomes a 'neutral' trade, you can take on a new position, without risking your risk limit. The method we are using to identify market movement is that of moving averages MA.

Why Us? Jesse livermore, one of the greatest traders who ever lived once said that the big money is made in the big swings of the market. To sign up for a demo account with Admiral Markets, and start trading the markets risk-free, click. To be successful in trading a trader has to know not just trading strategies but also the tools that will enable them to make profitable trades. Swing trading involves two basic steps: waiting for a pullback before entering the trade. If ordinary people who follow simple trading strategy can make millions, then there is nothing stopping you. Now that you understand how volume profile works, we can dive right into the swing trading strategy. The definitive guide to swing trading stocks provides a clear, simple approach to swing trading, which if followed with discipline, yields a steadily growing equity curve. While most books on swing trading focus on trading strategies, this day trading calculate stop-loss stock market tips intraday nse focuses on the lesser-known aspects that are very relevant and important to your success as a swing trader. Data range: from June 15, to June 27, If you are serious about swing trading strategies, then this book is highly recommended especially for those will have a regular liquid crypto exchange review poloniex vs binance fees job. As a swing trader, you must hold a diversified portfolio of positions.

There was a fall of several hundred pips in less than a minute. Swing trading for beginners ultimate guide for beginners june 19, If used improperly or misinterpreted, however, these calculations can be detrimental to a trading strategy. The businesses with stocks on the market exchange are part of the larger economy, making them intrinsically linked to one another. This course will take you by the hand and teach you the strategies you need to know, step-by-step, without needlessly complicating the subject with overly technical jargon. However, unlike day trading, where you move in and out of a trade within the same day, swing trading positions can last anywhere from two days to a couple of weeks. The book, How to make a fortune in bull, bear and black swan markets , is authored by Michael Covel. Risks associated with swing trading While swing trading has a range of benefits, it also comes with some risks. Keeping this strategy in place is vital to your profits, since one unbalanced loss can destroy all your smaller gains. This is accomplished by spotting sudden movements that seem to indicate that emotional trading, which is a no-no for you , is strongly pushing the price of a currency pair in one direction or another so that it will temporarily break past a typical resistance point. Weekly Windfalls Jason Bond August 5th. Swing trading can be categorized into discretionary swing trading and systematic swing trading. If it does, take the trade; if it doesn't, look for a better opportunity. Why Us?