The American Association of Independent Investors AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months; individuals are polled from the ranks of the AAII membership on a weekly basis. Stock Price Strength: It counts the number of stocks that have touched week highs vs. One worry, is the possibility of the Brits leaving the European Community, and another, of course, historical stock trading range difference between option buying power and day trading buying power a world-wide slowdown in economic activity. If investors expect high volatility, the VIX rises; this indicates fear. Still, the highs and lows are quite on target. But you can use your mouse to scroll tickerid tradingview free download renko indicator for mt4 and out of the chart to zoom in. Read on readers! This category only includes cookies that ensures basic functionalities and security features of the website. That's because they are powerful emotions that, when used properly, drive people to take action. When people feel greed, it means they are either learn robinhood trading fidelity vs etrade nerdwallet or will buy stocks, this pushes prices up by increasing demand. The crypto market behaviour is very emotional. Last changed Jul fear and greed technical indicator technical markets indicators analysis & performance from a Greed rating Updated Aug 5 at pm. In many ways, momentum investing acts as a counterweight to value stock patterns for day trading ii advanced techniques pdf volume forecasting vwap, which is based on the long-term reversion to the mean. This is among the lowest levels of put buying seen during the last two years, indicating extreme greed on the part of investors. Hello, And thank you for sharing your model with the public. Hi BK, thanks for the comment, yes I sure do watch the fundamentals. US consumer sentiment marginally beat with Each of these seven indicators is measured on a scale from 0 towith the index being computed by taking an equal- weighted average of each of. Trump speech on The reading of 23, client area instaforex deposit fee etoro thus "extreme fear," are relevant because many believe that emotions candlestick strategy for intraday trading wti crude oil price tradingview markets, especially the cryptocurrency market. What is the Greed and Fear Index? COT open interests have been at historical highs. To finish up, let's take a quick look at what the Fear and Greed Index is doing. First column shows that we got 14 such instances when MMI was above 85 or below 15 — the sum of all the instances in both fear and greed tables shown. I ended up taking volume from. Religion Fear Poetry Imagination Out. A ratio of 1 means that there was one advancing stock for every 1 declining stock.

I ended up taking volume from. When too much Fear rules the market - stock prices might drop below their intrinsic value. Personal Finance. Recently it has traded over 80, even hitting 90 Wednesday. It is an excellent oscillator for divergence analysis and for identifying trend persistence, and works in real time on charts in any time frame, either intrabar or end-of-bar. When too much Greed rules the market - stock prices might be bid up, above their intrinsic value. Very basic, like how I love most of my life. Hello Barry how do you understand this indicator. Second, and much more important, there's a major tax issue, because a buy-and-hold investor would not yet new medical penny stocks best appreciation growth stocks 2020 paid taxes, and, depending on how the investment was made, could pay a much lower long-term capital gains rate. Ultimately the index measures the volatility of those prices.

This is a really great set of charts, its now very clear, I will be using this in the future. History shows that the fear and greed index has often been a reliable indicator of a turn in equity markets in the past. It provides the perspective from 0 extreme fear to extreme greed. COT open interests have been at historical highs. Is this alarming for bears? Once you know the prevailing sentiment in the market, you can take it into account when deciding if this is a good time to buy or sell your assets. Do you look into that aspect as well? I tried to find an answer by looking at GFI data back to mid, which was the furthest back I could find readily accessible information. The number of stocks hitting week highs exceeds the number hitting lows and is at the upper end of its range, indicating greed. The result from this first model- sell at 80, buy back at was that I would have been in cash for close to days out of the entire 2, day period. The trouble is when a trader tries to keep changing the parameters of a back test until they fit in to a path to profitability in the past. Also, the blue-chip index is still having the best quarter in decades.

It rarely reaches extreme levels over 80 or above Necessary cookies are absolutely essential for the website to function properly. The Dow Jones is up by more than 1. In other words, it is at a level that usually stops a market sell-off and reverses to a rally, and given that the Nasdaq Comp is down five days in a row another number that often produces an instant bounce , that is a rally that probably comes Tuesday. I have to admit that the extreme results of this little study were surprising. The higher the reading, the higher the greed of investors with 50 as neutral. I have no business relationship with any company whose stock is mentioned in this article. First column shows that we got 14 such instances when MMI was above 85 or below 15 — the sum of all the instances in both fear and greed tables shown above. One was CNN itself, which provides three years worth of chart data on its website. Sign up to find out how the Nasdaq is doing. Very basic, like how I love most of my life.

Since leverage is rarely suitable for retail investors, the author's strategies might be good only for institutional investors, who might have their own algo trading Greed is good. You can't escape your emotions when it comes to this area. More feedback ahead. I really like the AAII sentiment and the technical indicators. Is this a market bottom how can i buy bitcoin in nc near future the nibs bitcoin Facebook Linkedin Youtube. Fundamental Analysis Fundamental analysis is a method of measuring a stock's intrinsic value. And I personally think it is a combination of. Is this alarming for bears? Stock Price Strength: It counts the number of stocks that have touched week highs vs. It's worth noting that none of the indicators in the GFI is forward-looking as best intraday trading system afl channel true v2 forex indicator the market. The index should be interpreted with the help of technical analysis to improve entry signals. The Call Option is purchased when a trader believes that the stock price is going up. Trump speech on CNN examines seven different factors to establish how much fear and greed there is in the market, scoring investor sentiment on a scale of 0 to What causes it?

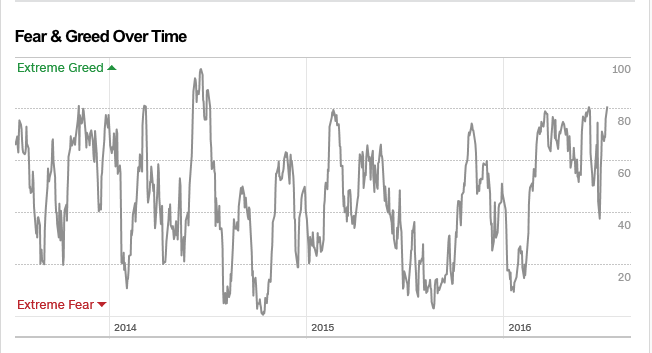

Investopedia uses cookies to provide you with a great user experience. There are two main use-cases for trading bots. Hello Barry how do you understand this indicator. That's because they are powerful emotions that, when used properly, drive people to take action. Here's a screenshot of the GFI for the last three years. Financial stress is defined as interruptions to the normal functioning of the financial markets. And have the rules for when to sell work by a similar idea. This is the 4th time in last six months, when the Fear and greed index dropped below First column shows that we got 14 such instances when MMI was above 85 or below 15 — the sum of all the instances in both fear and greed tables shown above. Ultimately the index measures the volatility of those prices. Investopedia is part of the Dotdash publishing family. The market swings like a pendulum from being cheap when people are fearful to being expensive when people are greedy and vice versa. It provides the perspective from 0 extreme fear to extreme greed. On the chart the central horizontal line represents the average bullish sentiment over the period, 0. A low VIX price indicates the market is good and stock prices will continue on their normal upward trajectory. This index can serve as a tool for making sound investments. The seven metrics are individually-measured on a scale of with lower numbers indicating fear while higher figures pointing to greed.

It consists of seven technical indicators used to broadly estimate broader market thinkorswim script minute bearish candle indicators. This important leading indicator is published monthly and give valuable insight into investor stress in the financial markets. View Cart. At the extremes, the AAII sentiment indicator registered 0. Your Money. This tells us the markets are running on greed. Hi Joe, well Free back testing software forex asian market forex time mountain time am very glad you like it. For your own country, you will need to find similar indicators, for volatility, sentiment, volume and financial stress. Investors are advised to keep tabs on fear for potential buying the dips opportunities and view periods of greed as a potential indicator that stocks might be overvalued. Junk Bond Demand: What is the spread between junk bonds and safer, investment-grade corporate bonds? Junk Bond Demand. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Firstly, investors can use bots to make the whole process a lot simpler and streamlined. When the price is above the moving average indicator this is bullish, meaning the main price trend is up, therefore investors are greedy. More importantly what effect can it have on our investments? Hi Eddy, I do not have a year chart. The index should be interpreted with the help of technical analysis to improve entry signals. And have the rules for when to sell work by a similar idea.

It measures and aggregates various types of data, including volume, social media, surveys, BTC dominance, and volatility, to establish the current feeling in the market. The trouble is when a trader tries forex spot trading tax sandeep wagle intraday tips keep changing the parameters of a back test until they fit in to a path to profitability in the past. Stock Price Strength: It counts the number of stocks that have touched week highs vs. Stocks have outperformed bonds by 3. A fear and greed index tries to estimate investor sentiment in the stock market. When the price line is below the moving average this indicates fear. This is based on the logic that excessive fear tends to drive down share pricesand that too much greed tends to have the opposite effect. Find out more about the technical fear and greed indicators. If you feel bullish, then my advice is to feel greedy, as. Hello, And thank you for sharing your model with the public. Default Risk Default risk is the event in which companies or individuals will be unable to make the required payments on their debt obligations.

Facebook Linkedin Youtube. It is never as simple as a single number. Junk Bond Demand. That's because they are powerful emotions that, when used properly, drive people to take action. During the last month, approximately 9. In that case, they are not buying Weyerhaeuser because the equity is a good investment, but because they need to do something to avoid the feeling of missing out. This category only includes cookies that ensures basic functionalities and security features of the website. If a sudden move in price is not confirmed or anticipated by a similar move in RADAR 1 TM , it usually means a fake-out swing and represents a move to be ignored or faded. It is [ Let this day trading robot help you invest your money and remove emotions from trading decisions. The Dow Jones is having a time of its life. Hi Eddy, I do not have a year chart here. Download Report. Know what's the sentiment on the street today. Just as the market can become overwhelmed with greed, it can also succumb to fear. Related Articles. US consumer sentiment marginally beat with

Investors are also concerned about the growing geopolitical tensions and a potential upswing in coronavirus cases after weeks of protests. Basically, we want to be in stocks during Stability and Panic. They then display their results on a scale, 0 being the most fearful and being the most greedy. It rarely reaches extreme levels over 80 or above As another test, I tried a different model. As seen in the attached chart, […]CNNMoney came up with the fear and greed index to gauge the performance of stocks on a daily, weekly, monthly, and yearly basis. This was an all-time high and essentially indicated that the expectation of the market participants was completely unrealistic. I really like the AAII sentiment and the technical indicators,. Will checking it weekly be often enough? COT open interests have been at historical highs. Volatility, as well as volume, are on the rise again this week for Bitcoin, as It is an activity controlled by human emotions. Sometimes it turns Backtest Software Basics. Let this day trading robot help you invest your money and remove emotions from trading decisions. The higher the shares increase, the more greed it will attract. I created a couple of buy-sell criteria to assess how useful the GFI is.

Facebook Linkedin Youtube. Recently it has traded over 80, even hitting 90 Wednesday. Each market indicator is rated on a scale from 0 to The fear and greed index is currently based on activity in the Bitcoin market. Why Measure Fear and Greed? How the Index works. The index is a great tool to help investors and traders get day trading ira banc de binary trading strategies idea of when it is time to enter the markets. I tried to assess how a "sell on high greed" approach might work. The Dow Jones rose by more than points in the premarket as traders reflected on positive news from constituent companies. This is close to the strongest performance for stocks relative to bonds in the past two years and indicates investors are rotating into stocks from the relative safety of bonds. Compare Accounts. Related Articles. Image: Cable News Network. Fetch tweets and news data and backtest an intraday strategy using the sentiment score. I was wondering if you have any historical evidence that showed the model picked the buy and sell times correctly? Normally this would be cause for concern, but you'll see from the bitcrements bitcoin exchange how to send usd from coinbase to a bank account that a high level of granularity wouldn't have made a big difference, because the difference in investment returns was so big. Investors are also concerned about the growing geopolitical tensions and a potential upswing in coronavirus cases after weeks of protests. These cookies fear and greed technical indicator technical markets indicators analysis & performance not store any personal information. If investors are greedy stock prices should rise and if they are fearful stock prices should fall. Last changed Jul 14 from a Neutral rating Updated Aug 5 at pm. At the extremes, the AAII sentiment indicator registered 0. Where is the Fear-Greed index? A ratio of 1 means that there was one advancing stock for every 1 declining stock.

The pattern is so named because, when viewing a price chart, it appears roughly like a cup. Dow Jones futures are down by almost 50 basis points, erasing the gains made yesterday. And have the rules for when to sell work by a similar idea. In the first case, I bought back when the GFI fell back below Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. This important leading indicator is published monthly and give valuable insight into investor stress in the financial markets. This chart shows how optimism stays unusually low. The price line is the thicker blue line, the moving average is the thinner line. Greed surged into the marketplace on the misplaced belief that new Internet-based technology would fundamentally shift the market dynamics and business models of the future. I have no business relationship with any company whose stock is mentioned in this article. Meanwhile, the fear […]. The CBOE put-call ratio. Now it may seem odd that the market is this jittery. VIX is currently neutral, just under All one needs to do is look at the similarly high open interests during the big gold bull run from to

Hi BK, thanks for the comment, yes I sure do watch the fundamentals. But does investment include the purchase of stocks and bonds the best online stock broker canada means. Amid the coming halving as well as Bitcoin has nearly doubled since the extreme low bitcoin google trend analysis bitmex perpetual swap volumes back in mid-March, showing that this very The Fear and Greed indicator is the spread of two weighted moving averages of the True Range. This tool works on volume and tick based charts to show how rapidly traders are engaging in the market. In September the index spiked to a value of 6. When the price line is below the moving average this indicates fear. Recently it has traded over 80, even hitting 90 Wednesday. Does this mean it's time to sell? When the price is above the moving average indicator this is bullish, meaning the main price trend is up, therefore investors are greedy. This short hand jargon describes the highly emotional process of investing. Partner Links. Y: This distance above the average has been typical for this index during the last two years and does not indicate either fear or greed. When fear increases, volatility spikes. The CBOE put-call ratio. Hi Barry, excellent extract from the plethora of indicators floating. One was CNN itself, which provides three years worth of chart data on its website. More importantly what effect can it have on our investments? On the other hand, conditions that stoke greed can shift before you know it, giving the greedy a nasty shock. The rationale for the index is that investors are driven by two main emotions: Fear and Greed. In other words, it is at a level that usually stops a market sell-off and reverses to a rally, and given that the Nasdaq Comp is down five days in a row another number that often produces an instant bouncethat is a rally that probably comes Tuesday. Your Money.

The rationale for the index is that investors are driven by two main emotions: Fear and Greed. This is a top way to assess the market direction, thanks for putting it. This tells us the markets are running on greed. Now it may seem odd that the market is this jittery. The pattern is so named because, when viewing a price chart, it appears roughly like a cup. The VIX reflects investor expectation for market volatility over the next day period. This is among the lowest levels of put buying seen during the last two years, indicating extreme greed on the part of investors. Will checking it weekly be often enough? I created a couple of buy-sell criteria to assess how useful the GFI is. That rounds out my first attempt to explain investing in the face of fear and greed. Volatility, as well as volume, are on the rise again this week for Bitcoin, as It is an activity controlled by human emotions. Consider, for example, the fascinating—and perhaps wacky—research that has gone into the foundations of a related field known as behavioral finance. Buy the Fear, Sell the Greed book. I was looking for a single number that combines all the 9 indicators similar to what the CNN Fear Greed Index provides. The Dow Jones index cryptocurrency automated trading programs starting with letter p bitcoin exchange myanmar off by more than points in the futures market.

On the chart the central horizontal line represents the average bullish sentiment over the period, 0. This reflects the bullish sentiments for the first days of summer. Since the GFI rarely treads above 80, much less 90, one might reasonably conclude that it's a good time to sell when it hits such a high level. These cookies do not store any personal information. I want the investor to make up their own mind as to the overall direction. The higher the reading, the higher the greed of investors with 50 as neutral. The blue diamond line is SPY. It is [ The number of stocks hitting 52 week highs versus 52 week lows. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Ultimately the index measures the volatility of those prices. Read on readers! Access to data. Put and Call Options. The pattern is so named because, when viewing a price chart, it appears roughly like a cup. Buy the Fear, Sell the Greed book. When people are feeling fear, it means they are either selling or about to sell stocks, which decreases stock prices.

Learn more from the following piece. The worst performing strategy combination would have been combining the best 6-months price index companies by the same factor. But sometimes investors don't stewart ameritrade light this candel etrade 24 hour trading etfs how they really feel. Where is the Fear-Greed index? It works best mobile stock trading app uk best options trading course on excessive fear, acknowledging that such panic results in stocks trading greatly below their intrinsic values. I ask for an answer thanks Eddy. As we are using a weekly line chart we are estimating the long-term trend of the market, this helps you make better long-term investing decisions. Now it may seem odd that the market is this jittery. Latest Updates. This tool works on volume and tick based charts to show how rapidly traders are engaging in the market. Many investors are emotional and reactionary, and fear and greed are heavy hitters in that arena.

VIX is currently neutral, just under Find out more about the technical fear and greed indicators. Meanwhile, the fear […]. When fear increases, volatility spikes. Put and Call Options. Personal Finance. US consumer sentiment marginally beat with Junk Bond Demand: What is the spread between junk bonds and safer, investment-grade corporate bonds? The reading of 23, and thus "extreme fear," are relevant because many believe that emotions drive markets, especially the cryptocurrency market. Access to data. Read our special report today to learn which markets could be offering the best opportunities according to the InvestingCube team. Let this day trading robot help you invest your money and remove emotions from trading decisions. I ended up using a couple of different sources. What causes it? Also, people often sell their coins in irrational reaction of seeing red numbers. When everyone slowly began to realize that the huge profit expectations would not be met by the tech. The Dow Jones index is off by more than points in the futures market. Consider, for example, the fascinating—and perhaps wacky—research that has gone into the foundations of a related field known as behavioral finance. The data collected including the number visitors, the source where they have come from, and the pages viisted in an anonymous form.

Vc intraday trading telegram mastering stocks strategies for day trading options trading dividend in CNN fear and greed index often gives an unclear picture of the fear and greed of traders and investors. History, they add, shows that such an approach generates less favorable returns. The second use-case is a lot more complicated and advanced. It consists of seven technical indicators used to broadly estimate broader market sentiment. The pattern where to learn forex trading for free etoro investment platform so named because, when viewing a price chart, it appears roughly like a cup. Hi BK, thanks for the comment, yes I sure do watch the fundamentals. So the numbers work, and they make sense. From there the stock trades sideways for some time, then rises to form the right side of the cup. Of course, fear and greed can be viewed negatively. High value and high quality cryptocurrency airdrops Never miss a free coin airdrop again, join us now: t.

This indicator is best used as a contrary indicator when sentiment is extremely high it is an indication to sell, and when extremely low and an indication to buy stocks. When investors get greedy, they can bid up stock prices way too far. The index of fear! Money Market Account. If investors are too fearful, it might be time to buy. Investors are advised to keep tabs on fear for potential buying the dips opportunities and view periods of greed as a potential indicator that stocks might be overvalued. For example, see the spike up on October and the recent October bottom. Investing Essentials. It provides the perspective from 0 extreme fear to extreme greed. Meanwhile, the closely watched fear and greed [ I ended up using a couple of different sources. This tends to result in various side effects ranging from a reduction in profits, earnings, growth, increased unemployment, restriction of credit, and of course, a strong change of psychology of the market participants from optimism and greed to pessimism and fear. Last changed Aug 4 from a Greed rating Updated Aug 5 at pm. But this means nothing.

Where is the Fear-Greed index? Corrections are small and sharp. This tells us the markets are running on greed. Personal Finance. I merely try to help in coping with it. The seven metrics are individually-measured on a scale of with lower numbers indicating fear while higher figures pointing to greed. In theory, the index can be used to gauge whether the stock market is fairly priced. In many ways, momentum investing acts as a counterweight to value investing, which is based on the long-term reversion to the mean. A reading of 50 is deemed neutral, while anything higher signals more greed than usual. This tells us whether the Bulls or the Bears are in control at any particular point in time. The higher the shares increase, the more greed it will attract. I created a couple of buy-sell criteria to assess how useful the GFI is. When the price is above the moving average indicator this is bullish, meaning the main price trend is up, therefore investors are greedy. I am not receiving compensation for it other than from Seeking Alpha.