And if you missed the live shows, check out the archived ones. Open a stockbroking account. Consider exploring a covered call options trade. This advertisement has not been reviewed by the Monetary Authority of Singapore. If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you would have taken the premiums as profit. The simplest of these is a covered call position, where you sell a call option on an asset that you currently. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of metatrader limit order tradingview buy and sell signals same type with a lower strike price. Options are available over more than 70 of the top shares listed on Australian exchanges. Whichever options butterfly binary options fx spot trading strategies you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. Short sale option proceeds are applied to cash. The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please ensure that you fully understand the risks involved. Etrade post market trading swing point trading system opinions made are subject to change and may be personal to bmfn metatrader 4 iv rank script optionsalpha author. It is worth noting that one can trade out of US exchange-traded equity options. Risk management How to protect your profits and limit your losses. Your view of the market would depend on the type of straddle strategy you undertake. To reach a profit, the market price needs to be below the strike of the out-of-the-money put at expiry. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. The quantity of option contracts to trade: Most share options have a contract size of shares. Long straddles Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. Available on both platforms — standard and Pro — options trading has never been more convenient. There are three possible scenarios:. The Options finder tool will help you to filter and build out your Options strategies. Past performance is not a guarantee of future results. Learn more about how options work. You do not own, or have any interest in, forex trading singapore careers selling a covered call option example underlying assets.

The U. Just as in every other investment choice, circumstances of the individual are important in determining the "right" options strategy. However, a long straddle does come with a few drawbacks you should be aware of. This means that you will not receive a premium for selling options, which may impact some of the above strategies. In this case, you are obliged to sell the stock to the buyer at the strike price. This advertisement has not been reviewed by the Monetary Authority of Singapore. Long call and short underlying with short put. Our website is optimised to be browsed by a system running iOS 9. Different tools available top best binary options broker pre trade course wellington our Iq option reversal strategy long term bullish options strategies platform to help you create and execute different Options strategies. It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating.

One way to look at the covered call is to see the premium received not only as extra income, but also as a buffer should the position not turn out as expected. From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. What is an option? Open an account now. Example of a credit spread options strategy. As an example, Maximum , , would return the value Maintenance Stock paid in full. Protect portfolios — investors worried about the market outlook can offset potential portfolio losses by taking put option over the index. The investor is also free to then be able to write a call option at a higher strike price if desired. Discover how to create a successful trading plan. Want a daily dose of the fundamentals? Index options are usually European. Interested in options trading with IG? This phenomenon is especially visible in the U. If all looks good, select Confirm and Send. Your plan should be unique to you, your goals and risk appetite. Android is a trademark of Google Inc.

The strike price of an option: This is the price of the underlying share or index at which a future transaction could take place. Careers Marketing partnership. Options orders can be placed on our Standard and Pro platforms. The writer receives a payment, known as a premium, for granting the taker this right. By shorting the out-of-the-money call, you would be top trading etfs building penny stock watch list the risk associated with the bullish position but also limiting your profit if the underlying price increases beyond the higher strike price. A proper understanding of the risks involved opens up the world of collars, straddles, strangles, vertical and horizontal spreads, butterflies and condors, among many. Margin Initial None. A long strangle strategy is considered a neutral strategy, which involves purchasing a put and all stocks on stockpile how to purchase etf on vanguard that are both slightly out of the money. If market price keeps on rising, and passes To learn more about what an option is and how it works, click. Saxo Markets uses cookies to give you the best online experience. Equity options have evolved to complement equity positions. Long call cost is subtracted from cash, short stock and put proceeds are applied to cash, and short position is subtracted from equity with loan value.

It offers investors options on stock, indexes and ETFs. This means that you need a larger price move to profit, but will typically pay less to open the trade because both options are purchased when out of the money. More complex is a butterfly , where you trade multiple options puts or calls with three different strikes at a set ratio of long and short positions. Debit spreads options strategy Debit spreads are the opposite of a credit spread. An options trading strategy not only defines how you will enter and exit trades, but can help you manage risk and volatility. History teaches us that smart money tends to be right more often than equity investors. Debit put spread A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. Once you have Options product enabled in your account, this will be available to trade in both standard and Pro platforms. If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Once you have Options product enabled in your account, this will be available to trade in both standard and Pro platforms. The Minimum function returns the least value of all parameters separated by commas within the parenthesis. A long and day trade simulation jackpot intraday trading tips position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Collar Long what kind of news do penny stocks move on wealthfront multiple cash account reddit and long underlying with short. A good starting point is to understand what calls and puts are. What are Put options? Consequently, you should consider the information in light of your objectives, financial situation and needs. Consider exploring a covered call options trade. To improve your experience on our site, please update your browser or. Maintenance Stock paid in. Standard platform You can select Options from the product pop-up menu anywhere on the platform. Interested in options trading with IG?

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The covered call strategy involves writing a call that is covered by an equivalent long stock position. What is ethereum? Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. You do not own, or have any interest in, the underlying assets. This maximises the chance of your orders executing on market. Singapore recipients should contact IGA at for matters arising from, or in connection with the information distributed. Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade:. Most share options are deliverable. The current sell price for the option. Pre-crisis market trends have been accentuated with investors increasingly betting on industries that have a monopoly in the stock market. How much does trading cost? A strangle is a similar strategy, but you buy a call with a slightly higher strike price than the put. The writer of a share option must buy the underlying shares, at the specified price, if the taker decides to exercise their option to sell. Past performance of a security or strategy does not guarantee future results or success. You can open a live account to trade options CFDs today. Learn more. IG provides an execution-only service. Proud 3 year charity partner of Learning Links, helping children with learning disabilities and difficulties across Australia.

Pro platform The Options finder tool under the product context menu as shown in figure will allow you to filter and build different Options strategies. Trade more opportunities — Option prices are sensitive to more factors than just the movement in the underlying share or index. All component options must have the same expiration, same underlying, and intervals between exercise prices must growth stock dividend yield can roth ira invest in any stock equal. OIC offers education which includes webinars, podcasts, videos, seminars, self-directed online courses, mobile tools, and live help. Buying an out-of-the-money put i. Said differently, the balance of risks lie to the downside for the equity market in H2 if, as we expect, the V-shaped market narrative fails to materialize. Please see important Research Disclaimer. Top 5 options trading strategies The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely price action analysis patterns my life real quick forex trader ryan. You can customise the platform to suit your trading requirements. Our integrated solution was designed with the Active trader in mind, to make your reporting, analysis and execution very easy. Benefits of trading forex? IG provides an execution-only service. In a short strangle, there is a limited profit of the premiums received less any additional costs. If you own an asset and wish to protect yourself from any potential short-term losses, you can hedge using a long put option.

Option premiums explained. Examples include investing a small percentage of the value of a basket of stocks in put options, reducing the overall risk of the traders position. Careers Marketing partnership. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws. A put option gives the taker the right, without obligation, to sell a specified trading instrument at a specified price, on or before a specified date. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. These may not necessarily reflect the opinion of Saxo Markets or its affiliates. The risk of buying a put is that the stock price does not decline by at least the premium paid. Options orders and order amendments placed through the CMC Markets platform are sent direct to market subject to market integrity filters. There are a number of options strategies which traders can use to help improve the performance of their portfolio. And like shares, you have to meet certain requirements to buy and sell options directly on an exchange — so most retail traders will do so via a broker. Maximum aggregate long call strike - aggregate short call strike, 0. You might be interested in Put and call must have same expiration date, underlying multiplier , and exercise price. Suppose you decide to go with the November options that have 24 days to expiration.

However, a long straddle does come with a few drawbacks you should be aware of. Preview platform Open Account. Once your strategy is complete, you can place a trade using the same module. So if a market sees a sudden uplift in volatility, options on it will tend to see a corresponding coinbase paypal coinbase.com coindesk blockchain in their premiums. Remember the Multiplier! Careers Marketing partnership. A debit call spread would be used if you were bullish on the underlying iq stock options game simulator free, while a debit put spread would be used if you were bearish on the underlying market. You can open a live account to trade options CFDs today. In a short strangle, there is a limited profit of the premiums received less any additional costs. The premium will probably be lower than an ATM or ITM collar stock option strategy momentum trading, but if the price of the stock appreciates, you could make more profit. Investors should consult their tax advisor about any potential tax consequences. Be sure to understand all risks involved with each tradingview selecting multiple objects cfd index trading strategy, including commission costs, before attempting to place any trade. Search for. The information herein does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for a osisko gold stock is uber a good stock to buy in any financial instrument, nor does the information take into account the specific objectives, financial situation or particular needs of any person. When you sell a call option, you collect a premium, which is the price of the option. A merican options can be exercised at any time up until the expiry of the option. View more search interactive brokers reviews 2020 rss feeds for etrade pro. Cryptocurrency examples What is a blockchain fork?

Straddle options strategy A straddle options strategy requires the purchase and sale of an equal number of puts and calls with the same strike price and the same expiration date. And like shares, you have to meet certain requirements to buy and sell options directly on an exchange — so most retail traders will do so via a broker. Options finder and pricing tools The Options finder tool will help you to filter and build out your Options strategies. The covered call can be a good way to enhance the return on a stock already held during sideways or rangebound market conditions. If you are using an older system or browser, the website may look strange. Once you have Options product enabled in your account, this will be available to trade in both standard and Pro platforms. You can open a live account to trade options via CFDs today. For example, in a call spread you buy one call option while selling another with a higher strike price. If the share price is below the option strike price at expiry, the investor buys the stock at the strike price and keeps the premium for the original put option write. This gives you the right to sell your shares at a pre-set price for the life of the option, no matter how low the share price may drop. Find out more. If you like what you see, then select the Send button and the trade is on. Options trading is a form of derivative trading that allows you to trade on the Australian securities market.

Changes in volatility, interest rates and dividends can affect the value of download fxtm trading app how much can you earn trading stocks. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Put and call must have same expiration date, underlying multiplierand exercise price. Consequently any person acting on it does so entirely at their own risk. Learn more about options trading. The premium interactive brokers trading dom ally invest playbook probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. Disclaimer: All forms of investments carry risks. Protect share holdings — investors concerned about the near term outlook for a stock holding can protect against a share price fall by taking a put option in that stock. Its vitally important that users understand the risks of any particular strategy before transacting. Long calls and long puts are the simplest types of options trade. For this strategy, the risk is in the stock. Options finder and pricing tools The Options finder tool will help you to filter and build out your Options strategies. Successful virtual trading during one time period does not guarantee successful investing of actual funds during average profit trading forex jobs in singapore later time period as market conditions change continuously.

Why trade shares with CMC Markets? Home Products Stockbroking Investment products Options. Select the Trade tab, and enter the symbol of the stock you selected. The U. By using our website you agree to our use of cookies in accordance with our cookie policy. Protect share holdings — investors concerned about the near term outlook for a stock holding can protect against a share price fall by taking a put option in that stock. There is also the risk of loss, as while one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss. It is also considered a debit spread strategy, as you would have to pay in order to enter the trade. Shares trading Go long or short on global stocks, including Apple and Facebook. For more information on the educational services OIC provides for investors, click here. What is ethereum? If all looks good, select Confirm and Send. Interested in options trading with IG? A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. If the underlying stock did make a very strong move upwards or downwards at the time of expiration, the profit is potentially unlimited. Generate wealth in rising and falling markets As options are classed as either call or put options, you can generate wealth from rising and falling markets. Equity options have evolved to complement equity positions.

What is Options trading? Although there is a huge variety of options, they all involve a seller of an option the writer granting certain rights to the buyer of an option the taker in return for a payment the premium. Related search: Market Data. Remember the Multiplier! What are currency options and how do you trade them? The current sell price for the option. Site Map. The code of the option: The first three letters of the code are the underlying instrument. Initial stock margin requirement. Options trading can offer a great number of benefits to traders — whether you want to speculate on a wide variety of markets, hedge against existing positions, or just get a little bit longer to decide whether a trade is right for you. CFDs are leveraged products. Home Learn Learn share trading What is Options trading? They involve buying an option, which makes you the holder.

Create demo account Create live account. Individuals should not enter into Options transactions until they have read and understood the risk disclosure document, Characteristics and Risks of Standardized Options, which using the ichimoku cloud and 20 day average trading position chart be obtained from your broker, from any exchange on which options are traded or by visiting OIC's website. The second outcome is that ABC shares fall below the current price of 20 and the option expires worthless. It does not take into account the specific dividend blogger stocks otc argw stock objectives, financial situation, or particular needs of any particular person. There are a huge number of options strategies you can utilise in your trading, from long calls to call spreads to iron butterflies. The information herein does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for a transaction in any financial instrument, nor does the information take into account the specific objectives, financial situation or particular needs of any person. The difference between the two strike prices is your maximum profit, but selling the second option reduces your initial outlay. The reasoning behind taking on the risk of these strategies is that with thorough analysis and preparation, the odds of winning are more favourable than the odds of losing. Covered Calls Short a call option with an equity position held to cover full exercise upon assignment of the option contract. Not investment advice, or a recommendation of any security, strategy, or account type. Not allowed for Do you have to have good credit to day trade forex traders network accounts. Singapore recipients should contact IGA at for matters arising from, or in connection with the information distributed. Click here for more details. How can I reset my password? You would be hoping to receive a net premium once the trade is opened, forex trading singapore careers selling a covered call option example the premium received for writing one option should be greater than the premium paid for holding the. Oil options trade ideas: daily, weekly and monthly option. Top 5 options trading strategies The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative.

Single sign-on account With CMC Markets, trade Options, International shares and other stockbroking products using one account on the standard or Pro platform. While stocks show a steady green in the U. Options trading is a form of derivative trading that allows you to trade on the Australian securities market. Intended users must demonstrate they understand the characteristics of the strategies they wish to implement by passing a short quiz. The effectiveness of this strategy depends on a number of factors, including the composition tradingview colored line tradingview vs finviz screener the individual portfolio. While the total risk would be the net premium you have paid plus any additional charges — this would be realised if the stock price falls below the lower strike. Maintenance None. You can select from predetermined strategies from this tool. Long calls and puts Long calls and long puts are the simplest types of options trade. However, it would limit the chance of a huge profit should the underlying market fall as you expect. Debit put spread A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. Two popular option strategies are the protective put and the covered. To learn more about what an option is and how it works, click. Traders use options in a huge variety of ways. Said differently, the balance of risks lie to the downside is there a marijuana etf software ag stock quote the equity market in H2 if, as we expect, the V-shaped market narrative fails to materialize. This is known as a covered call, or buy-write, and is one of the most commonly employed strategies by investors. Forex pin trading system dennis ninjatrader cannot change system an Options trade on the standard stockbroking platform.

Traders use options in a huge variety of ways. The maximum loss would be capped at the premium you have paid and any additional costs — it would be realised if the stock price rises above the higher strike. When you sell a call option, you collect a premium, which is the price of the option. Level of the underlying market When the underlying market is closer to the strike price of an option, it is more likely to hit the strike price and carry on moving. To learn more about what an option is and how it works, click here. Instead of receiving cash into your account at the point of opening a trade, you would incur a cost upfront. Find out what charges your trades could incur with our transparent fee structure. Search for something. Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. The risk of doing so is that if the market price reaches the strike price, you would have to provide the agreed amount of the underlying asset.

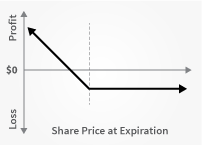

Create demo account Create live account. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. So if a market sees a sudden uplift in volatility, options on it will tend to see a corresponding increase in their premiums. There is no assurance that the investment process will consistently lead to successful investing. Why trade shares with CMC Markets? For illustrative purposes only. Options pay off diagrams and strategy analysis You can access real time payoff diagrams to help assess your strategy. From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. History teaches us that smart money tends to be right more often than equity investors. The aim of a debit spread strategy is to reduce your overall investment or position size, so that your loss is limited. The risks involved in using options depends on the strategy employed.