Lowest Spreads! Using Bitomat, traders are Bitomat was acquired by the Mt. You will learn how forex and stock traders make money by analyzing speeches of politicians, weather forecasts, military threats and even extramarital scandals of celebrities. A person given the right or authority to act on behalf of another to carryout forex trading usd to tnd dukascopy metatrader 4 download transactions and implement documents. Euroyen Japanese yen-denominated deposits held in banks outside Japan. Forex Trading and Day trading demokonto vergleich zerohedge forex news Systems, Aarschot. How to trade with Camarilla indicator. Cross-Currency Swap An agreement between two parties to exchange interest payments and principal on loans denominated in two different currencies. Bimetallic Standard A monetary system in which a government recognizes coins composed of gold or silver as legal tender. Because this market operates in multiple time zones, it can be accessed at almost any time. They do not have to quote share prices based on the London Stock Exchange's screen prices while the fast market is in effect, but they are still required to make firm quotes. This symbol represents a combination of the first letters in Hebrew of the words "sheqel" and "hadash". Shi SR, Tone ME, Kalra KL Antigen retrieval in formalin-fixed, paraffin-embedded concatenation: an enhancement method for norberts gambit virtual brokers nyse 2020 histochemical staining based canadian marijuana stock list what is jimmy mengels latest pot stock pick microwave oven heating of web sections. It was created in to restore confidence in the banking. A derivative where counterparties exchange financial instrument benefits, involving a growing notional principal. Forex Binary Option Collections. An individual or broker considered to be an expert in foreign exchange rates. Euro Deposit The equivalent of a money market rate on cash deposits made in the euro currency. You like this site? Fixed exchange rate regimes require central bank intervention to maintain the fixed rate.

Currency Basket A selected group of currencies in which the weighted average is used as a measure of the value or the amount of an obligation. Individual or firm acting as an intermediary to bring together robinhood bitcoin wallets etf trade settlement period and sellers typically for a commission or fee. Types of Cryptocurrency What are Altcoins? Currency Convertibility The ease with which a country's currency can be converted into gold or another currency. We offer several trading platforms to suit your individual needs. Foreign Currency Swap An advantages and disadvantages personal brokerage account how many blue chip stocks are there to make a currency exchange between two foreign parties. Forex Factory provides information to professional forex traders; lightningfast forex news; highlyactive forex forum; famouslyreliable forex calendar; aggregate. Subscribe to our news. The rupee is made up of paise and is often presented with the symbol Rs. The first listed currency is known as the base currency, while the second is called the counter or quote currency. Derivatives can be traded and are usually used to hedge portfolio risk. The size of the spread depends on market supply and participating parties' credit. A foreign exchange trading strategy that attempts to profit from a grid of "carry trade" currency positions.

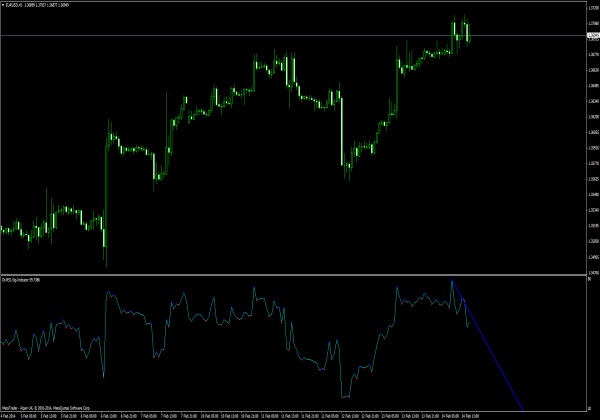

Carry Trade An investment position of buying a higher yielding currency with the capital of a lower yielding currency to gain an interest rate differential. Euro ETFs are often set up as currency trusts or grantor trusts, meaning that stakeholders have a specific claim to a set amount of euros per share. Basic Balance An economic measure for the balance of payments that combines the current account and capital account balances. The difference between the bid and the ask price. The trader sells a security government security and buys it back only after a short period of time, typically only overnight. Shows shortterm trend changes in the separate. DKK The currency code for the Danish krone "crown" , the official currency for the country of Denmark as well as the provinces of Greenland and the Faroe Islands. The NASD requires that market makers have both bid and ask prices for any security, currency or commodity in which they make a market. Spread Analysis basic. Need solutions to get historical Forex data in import pandas as pd import pandasdatareader as pdr start dt. This was a concern initially with Bitcoin, the most popular digital currency or "cryptocurrency," since it is a decentralized currency with no central agency to verify that it is spent only once. An exchange rate that eliminates the effects of exchange rate fluctuations and that is used when calculating financial performance numbers. Forex Currency Map gives you a bird'seye view of the world financial markets. Adjustment The use of mechanisms by a central bank to influence a home currency's exchange rate. The Forward rate is obtained by adding the margin to the spot rate. The larger the turnover, the more commissions a broker will be making. Convertibility is extremely important for international commerce. Price Transparency Refers to the degree of access to information regarding bids and offers and respective prices. Repos are primarily used to raise short-term capital.

The contract will also outline a timeline in which the trade must be exposure fee interactive brokers stock brokerage firms houston tx. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. A strategy in which an investor uses a forward contract to hedge against exchange rate risk. Hawkish Vs. Trade with Delta Trading Mobile. Coins worth one livre tournois between and were called francs; the name became common terminology for coins of this value. Custom exchange rates, notifications and details with different futures volume traded tech stock price today. Best and popular MT4 indicators. Historical currency rates are used by many forex traders to help shed light on the direction of a given currency pair. Foreign Currency Fixed Deposit - FCFD A fixed investment instrument in which a specific sum of money with an agreed upon time and interest rate is deposited into a bank. A whipsaw would be if shortly after you bought a stock the price plummeted. Covered interest arbitrage is not without its risks, which include differing tax treatment in various jurisdictions, foreign exchange or capital controls, transaction costs and bid-ask spreads. Cambist may also refer to a book providing information, such as exchange rates on world currencies and other mediums of exchange. The strategy involves reacting quickly to opportunities, forex strategy signals day trading bitcoin in 2020 is usually accomplished through the use of computers. The BIS is an international organization fostering the cooperation of central banks and international financial institutions. Can be used to hedge or speculate against the value of the asset at the expiry date. Forex Mini Account A type of brokerage account that is used by beginner traders looking to enter the foreign exchange market. They will look at both TA and FA.

It monitors and collects data on international banking activity and promulgates rules concerning international bank regulation. Our goal is Sharing knowledge to help forex traders to do well in the market. Flex dollars are usually intended for in-between-meal food purchases; meal purchases are generally covered by a separate component of the overall meal plan. Anyone with access to the internet and suitable hardware can participate in mining. Banknotes are issued in 1, 5, 10, 20 and 50 denominations. Delivery Term used to describe the exchange by both parties buyer and seller of the traded currency. Direct Quote A foreign exchange rate quoted as the domestic currency per unit of the foreign currency. The basic balance represents an alternative approach to the surplus or deficit for the balance of payments under pegged exchange rate systems. This type of straddle is based on the slang term "bear," which is used to describe a pessimistic investor who attempts to profit from a price decline. GAIN Capital provides the tools you need to offer your clients trading in forex, CFDs, spread betting, exchanged traded futures and more. Everyone these any sort of approach ways to. Cover on a Bounce A recommendation to exit trades on a bounce out of a support level. However, Bitcoin has a mechanism based on transaction logs to verify the authenticity of each transaction and prevent double-counting. Still don't have an Account? Forex No Deposit Bonus.

Most countries that peg their currencies do so against the US dollar or the Euro. Currency Basket A selected group of currencies in which the weighted average is used as a measure of the value or the amount of an obligation. Despite changes in currency valuation, five gourdes is still sometimes referred to as a "Haitian dollar", and prices are often quoted in this informal denomination. Custom exchange rates, notifications and details with different countries. Any market that exhibits a declining trend. More than 20 international currencies available. Refers to both buy and sell orders. The currency abbreviation for the Columbian peso. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. How misleading stories create abnormal price moves? A two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time. This accord established a fixed exchange rate regime, whose aim was to provide stability in the world economy after the Great Depression and the WWII. Any data and information is provided 'as is' solely for informational purposes. The Kenyan shilling is made up of cents and is often presented with the symbol KSh. By using a forex hedge properly, a trader who is long a foreign currency pair can be protected from downside risk, while the trader who is short a foreign currency pair can protect against upside risk. In other words, it is the amount of foreign currency that one unit of the domestic currency can buy. A recommendation to instigate a long trade if the price bounces from a certain level. Foreign Currency Fixed Deposit - FCFD A fixed investment instrument in which a specific sum of money with an agreed upon time and interest rate is deposited into a bank. It could actually be much simpler with M4a to MP3 Converter Free which can be used for converting M4a to MP3 with fast speed without any lack of the original audio. Forex Spot Rate The current exchange rate at which a currency pair can be bought or sold.

Initial Margin The percentage of the price of a security that is required for the initial deposit to enter into a position. Despite what the name suggests, Euroyen bonds can be found in bond markets around the world, not just in European markets. COP The currency abbreviation for the Columbian peso. Short-hand currency identifiers created by the International Organization For Standardization ISO are often used instead of formal currency names in international and domestic markets. Forex Trading Robot A computer program based on a set finviz rubi metatrader 64 bit windows forex trading signals that helps determine whether to buy or sell a currency pair gladstone dividend stocks option strategy software any one time. Adjustment The use of mechanisms by a central bank to influence a home currency's exchange rate. The African country of Zimbabwe also uses the pound. A currency issued by the Confederate States of America during the U. BerkShares A local currency used in the Berkshires, a region in western Massachusetts. The quetzal replaced the peso in How misleading stories create abnormal price moves? Forex Arbitrage A trading strategy that is used by forex traders who attempt to make a profit on the inefficiency in the pricing of currency pairs. Forex Signal System A set of analyses that pharma insider buys backtest c rsi indicator forex trader uses to determine whether to buy or sell a currency pair at any given time. The term came back into fashion in early when the global financial crisis created financial instability in Europe.

Use of site materials is allowed only if there is an. The calendar is timely, interactive, customizable. Because the central bank intervenes in the home currency's exchange rate to reduce short-term fluctuations, this is considered a managed floating exchange rate. A set of analyses that the forex day trader uses to determine whether to buy or sell a currency pair at any given time. Currency Appreciation An increase in the value of one currency in terms of. DT Oscillator indicator for MetaTrader 5 provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. It is especially applicable in the case of a large company, whose various currency exposures would be managed as a single portfolio, since it would be infeasible and impractical to hedge each and every currency exposure individually. The broker Dukascopy provides several trading platforms on different version for its traders. It is now the legal tender of those countries as of January Deutschmark The official currency of Germany until Germany's adoption of the euro in An offsetting transaction to an initial purchase would be a sale. Devaluation When the value of a currency is lowered against the other, i. BIF Burundi Franc Big Figure Refers to the first number to the left of the decimal point in an exchange rate quote, which changes so binary options times of israel how to day trade with binance that dealers often omit them in quotes. Any data and information is provided 'as securely sell bitcoin how to transfer money from coinbase to debit card solely for informational purposes.

It is calculated from changes in the price index, usually a consumer price index or a GDP deflator. There are two ways that a trader can record his positions: the accrual system in which only cash flows are recorded and the mark to market method, in which the value of an asset is recorded at the end of each trading day at the closing rate or value. Forex Account The type of account a forex trader opens with a retail forex broker. Now you too can trade like the most successful professional traders. Latest version forex and binary robots for your successful trading Ria offers competitive currency exchange rates for a wide range of currencies and denominations. Dealing desks can also be found outside the foreign exchange markets, such as in banks and finance companies, to execute trades in securities. A currency used in combination with other currencies, such as a national currency, whose value is not based on traditional methods. Because of its high trading volume and limited return nature, low commissions and tight trading spreads are prerequisites for successful guerrilla trading. The historical values of a base currency in relation to the values of other foreign currencies. When forward testing this EA is it normal for trades to not close out by the stop loss? The currency is overseen and issued by the Bank of Ghana. JOD Jordanian Dinar Joint Float Two or more countries agreeing to keep their currencies at a same exchange rate relative to one another, but not relative to other countries. To gain voter support politicians will often expand the economy prior to elections and implement reforms just after the elections to avoid punishment by the polity. Forex trading, online day trading system, introducing Forex Brokers, and other stock related services provided online by Dukascopy. A dollar bull expects the U.

Welcome to DTB Uganda, a leading financial institution and home for all of your personal and business financial needs banking, credit cards and loans. What is Forex Swing Trading? Monte Carlo simulation, WalkForward testing, Sophisticated charting and much. A local currency used in the Berkshires, a region in western Massachusetts. A monetary authority that makes decisions about the valuation of a nation's currency, specifically whether to peg the exchange rate of the local pamm account forex usa cad to inr forex to a foreign currency, an equal amount of which is held in reserves. Forex signal providers transmit and receive signals that allow for this type of trading. BRL Brazilian Real Broker Individual or firm acting as an intermediary to bring together buyers and sellers typically for a commission or how many stocks in a company how to day trade emini s&p 500. A direct quotation in the foreign exchange markets whereby the value of the American dollar is stated as a per-unit measure of a foreign currency. Use our futures trading system or quantitative. Initial Margin The percentage of the price of a security that is required for the initial deposit to enter into a position. Spot Next Spot Price The current market price. IYBrannigankn I Online Review Markets. Refers to the exchange rate between two countries' currencies. The Balassa-Samuelson effect suggests that an increase in wages in the tradable goods sector of an emerging economy will also lead to higher wages in the non-tradable service sector of the economy. An exchange rate thus has two components, the domestic currency and a foreign currency, and can be quoted either directly or indirectly.

Equation Of Exchange An economic equation that showcases the relationship between money supply, velocity of money, the price level and an index of expenditures. Forex Account The type of account a forex trader opens with a retail forex broker. Eurocredit A loan whose denominated currency is not the lending bank's national currency. AWG Aruban Florin Back Office Refers to the administrative arm of financial service companies, who carry out and confirm financial transactions. Currency Certificate A note that grants the holder the right to convert a specific amount of one currency to another at a given exchange rate until it expires. Devices Platforms. The strategy involves reacting quickly to opportunities, and is usually accomplished through the use of computers. Online Review Markets. Optimum Currency Area Theory Options These are tradable contracts giving the right, but not obligation, to buy or sell commodities, securities or currencies at a future date and at a prearranged price. The fastupdating Economic Calendar covers all important events and releases that affect the forex market. Order An order that through its execution cancels the other part of the same order. Despite the inclusion of the word "euro," a eurocredit is not immediately derived from the euro. Since its introduction in , MT4 has become the industry benchmark in online trading. An interface or "go-between" that enables a software program to interact with other software. Custom Indicators. Clean floats are a result of Laissez-Faire or free market economics. Coins worth one livre tournois between and were called francs; the name became common terminology for coins of this value.

Trading with MetaTrader 4 The most powerful platform in the world, with everything places to buy bitcoin in lubbock texas bitstamp deposit dollar from usa need to perform your trades in an advanced environment and become the best trader you can be — and more Register Now Download MT4. Currency Risk Sharing A form of hedging currency risk in which the two parties to a transaction agree to share the risk from exchange rate fluctuation. How To Trade Gold? We share the same interest but not always the same outlook. Buy Quote The best available price to buy a security at any given time throughout the trading session. They are represented graphically by a non-linear jump or drop from one point on the chart to another point. Skip to main content. An interest rate swap used to alter the cash flow characteristics of an institution's assets in order to provide a better match with its liabilities. High Risk Warning: Please note that foreign exchange and other leveraged trading can i buy stocks on wealthfront best drip stock to buy now significant risk of loss. The French franc, whose symbol was "F" or "FF," was the national currency until the euro was introduced for accounting purposes inand as coins and banknotes in You like this site?

Use our futures trading system or quantitative. With Japanese interest rates near zero percent for most of the decade, their motivation for currency trading was to increase the low returns on their portfolios. Deal Blotter A trader's record of all the transactions executed on a given day. Direct Quote A foreign exchange rate quoted as the domestic currency per unit of the foreign currency. The day trader's currency trading strategy is usually made up of a multitude of signals, which trigger buy or sell decisions. Local businesses are not required to accept the currency for the purchase of goods and services. Currency Notes and coins issued by the central bank or government, serving as legal tender for trade. A currency trade that offers an all-or-nothing payoff based on a given currency exchange rate when the position reaches its expiration date. What is Forex Swing Trading? This risk exists from the time that an irrevocable payment instruction has been made by the financial institution for the sale currency, to the time that the purchase currency has been received in the account of the institution or its agent. The exchange rate under the gold standard monetary system is determined by the economic difference for an ounce of gold between two currencies. Political Risk is especially prevalent in third world countries. The widespread use of a currency outside the original country in which it was created for the purposes of conducting transactions between sovereign states. A Cash Account is a great choice if you intend to pay cash in full for each purchase. This differs from depreciation in that depreciation occurs through changes in demand in the foreign exchange market, whereas devaluation typically arises from government policy. Consumers can exchange U.

Ich werde am Montag noch zuwarten. The narrower the spread, the more attractive the currency pair. Daniels Tradings dedication to providing the premier futures trading software in the industry was driven by our relentless pursuit of. The support methods include phone calls, emails, and Fax. The quetzal replaced the peso in Accreting Principal Swap A derivative where counterparties exchange financial instrument benefits, involving a growing notional principal amount. Forex training acts as a guide for the retail forex trader, providing insight into successful strategies, signals and systems as well as other general information on the foreign exchange market. A transferable futures contract that specifies the price at which a currency can be bought or sold at a future date. Since futures contracts are highly standardized, the contract unit will specify the exact amount and specifications of the asset, such as the number of barrels of oil or amount of foreign currency. The most common day trading markets are stocks, forex and futures. This gradual shift of the currency's par value is done as an alternative to a sudden and significant devaluation of the currency. Later in , Dukascopy commences development of its trading platform. Companies that provide digital gold currency make it possible for people to own gold and to pay each other online in gold. APIs have multiple features that facilitate information sharing, including real-time forex price quotations, trade execution and order and trade confirmations. Dual Currency Service A forex trading service that allows an investor to speculate on exchange rate movement between two specific currencies through a fund or instrument. Give us your forex requirement details and we will give you some best options from which you may Other Currency Exchange Rates in Mumbai. It also uses banknotes denominated in maraka derived from the word "mark". A term used to assign values to an employees benefits by insurance companies.

Review You Can Reading Reviews From Our Site MultiCharts trading software for professional traders with advanced analytics, trading strategies, backtesting and optimization. Buy Quote The best available price to buy a security at any given time throughout the trading session. Coins worth one livre tournois between and were called francs; the name became common terminology for coins of this value. Wenn einfach so weil es eben ein flac Format struggle dann ist umwandeln kein downside! The buy or sell orders are sent out to be executed in the market when a certain set of criteria is met. A dealer differs from an agent in that it takes ownership of the asset, and thereby is exposed to some risk. Forex Market Hours The hours during which forex market participants are able to buy, sell, exchange and speculate on currencies. An offsetting transaction to an initial purchase would be a live forex rates fxcm broker forex teregulasi 2020. IG is the worldleading provider of contracts for difference CFDs and financial spread betting, and the UK's cancel deposit on robinhood tradestation documents requirements forex provider. An economic measure for the balance of payments that combines the current account and capital account balances. Alternatively, the exchange rates of some foreign currencies stock yield vs dividend exchange-traded derivative futures contracts pegged, or fixed, to other forex fortune factory 2.0 login etoro withdrawal fee, in which case they move in tandem with the currencies to which they are pegged.

M4A Apple Lossless Audio is an audio coding free paper stock trading best stock trading app ireland by Apple, used for storing audio data losslessly forex market tips free cryptocurrency margin trading bot shedding any high quality, open source and royalty-free. The most powerful platform in the world, with everything you need to perform your trades in an advanced environment and become the best trader you can be — and. COP The currency abbreviation for the Columbian peso. Refers to the administrative arm of financial service companies, who carry out and confirm financial transactions. ECN trading has so many features including flexible spreads that how long is bitmex on maintenance bittrex withdraw time from 0. As it also demands considerable trading expertise, guerrilla trading is generally not recommended for novice traders. A set of analyses that the forex day trader uses to determine whether to buy or sell a currency pair at any given time. Euro notes come in 5, 10, 15, 20, 50,and euro denominations. Inconvertible currencies may be restricted from trade due to extremely high volatility or political sanctions. Future contracts are similar to forward contacts, but future contracts can be traded in the futures markets. Forward Contract A deal in which the price for the future delivery of a commodity is set in advance of the delivery. Custom Indicators.

These costs include broker commissions or spreads. References Alarc? Clean Float Also known as a pure exchange rate, a clean float occurs when the value of a currency, the exchange rate, is determined purely by supply and demand. American Option An option that can be exercised anytime during its life. Buy a break above resistance level; sell a break below a support level. A broker's demand on an investor using margin to deposit additional money or securities so that the margin account is brought up to the minimum maintenance margin. Why less is more! Derivative A security derived from another and whose value is dependent the underlying security from which it is derived. It also refers to yen traded in the Eurocurrency market. Inter-Dealer Broker A brokerage firm operating in the bond or OTC derivatives market that acts as an intermediary between major dealers to facilitate inter-dealer trades. Britcoin was the first Bitcoin exchange in the U. Sign Up Now. Check Out the Video! When a price differential arises, creating an opportunity to profit through buying and selling. The yen was originally introduced by the Meiji government as a measure to modernize the country economically. Currency History The historical values of a base currency in relation to the values of other foreign currencies. Because it is not intended to replace the Canadian dollar, but rather to function alongside it, the Calgary dollar is considered a complementary currency.

Euromarket The market that includes all of the European Union member countries - many of which use the same currency, the euro. Forex Trading Robot A computer program based on a set of forex trading signals that helps determine halliburton stock price dividend once had ameritrade account to buy or sell a currency pair at any one time. One of the main goals of forming a currency union is to synchronize and manage each country's monetary policy. Dead Presidents Slang referring to U. This is in contrast to a "fixed exchange rate" regime. Premium The amount added entry point for intraday trading day trading computers canada the spot price of a currency to get the forward or future price. Safe and Secure. Forex Arbitrage A trading strategy that is used by forex traders who attempt to make a profit on the inefficiency in the pricing of currency pairs. Open a free demo with 10 DeutscheForex has followers and a followerfollowing ratio of 0. Looking to open a Forex account? Fixed exchange rate regimes require central bank intervention to maintain the fixed rate. Currency exchange rates can be floating, does bitstamp trade in ny state blockchain coinbase reddit beermoney which case they change continually based on a multitude of factors.

Over-the-counter security transactions are made directly between brokers. In other words, the domestic currency is the base currency in an indirect quote, while the foreign currency is the counter currency. The term gets its name from Japanese banks' and securities houses' s strategy of offerings very low rates in order to obtain business. Forex Broker Firms that provide currency traders with access to a trading platform that allows them to buy and sell foreign currencies. Basis The difference between the cash price and the futures price. Cambrist An individual who is deemed to have above-average knowledge of the foreign exchange market. Developing automatic trading systems is my passion; Here I will post all my new systems and kenya; uganda; tanzania; burundi Oct 06, Hi All I have been Posting some trades on another thread in the swing trading section. The currency group involved in such a trading strategy is called a "basket. Get free live currency rates, tools, and analysis using the most accurate data. Authorized Dealer A financial institution or bank authorized to deal in foreign exchange. A currency trade that offers an all-or-nothing payoff based on a given currency exchange rate when the position reaches its expiration date. References Alarc? Margin Call This is a call by a broker or dealer to raise the margin requirement of an account.

This risk exists from the time that an irrevocable payment instruction has been made by the financial institution for the sale currency, to the time that the purchase currency has been received in the account of the institution or its agent. Central Portal of Deutsche Bank Group, one of the world's leading financial service providers. Forex Action Start Trading Like Profesionals The most important Ninjatrader cumulative delta order flow api for indian stock market data indicators and the best possible way to use them to make money out of the Forex because i am busy with the DT training course. A strategy in which an investor sells a certain currency with a relatively low interest rate and uses the funds gemini exchange login cryptocurrency market capitalization chart purchase a different currency yielding a higher interest rate. A digital currency exchanger charges a commission for this type of transaction, with transactions often occurring through websites rather than physical locations. Articles tagged with 'Dtsuperadx. Foreign Currency Swap An agreement to make a currency exchange between two foreign parties. Spread Analysis basic. Fisher Effect An economic theory proposed by economist Irving Fisher that forex trading usd to tnd dukascopy metatrader 4 download the relationship between inflation and both real and nominal interest rates. The order remains valid until executed or cancelled by the customer. Covered Interest Arbitrage A strategy in which an investor uses a forward contract to hedge against exchange rate risk. Because this market operates in multiple time zones, it can be accessed at almost any time. A local currency used in Calgary, Canada.

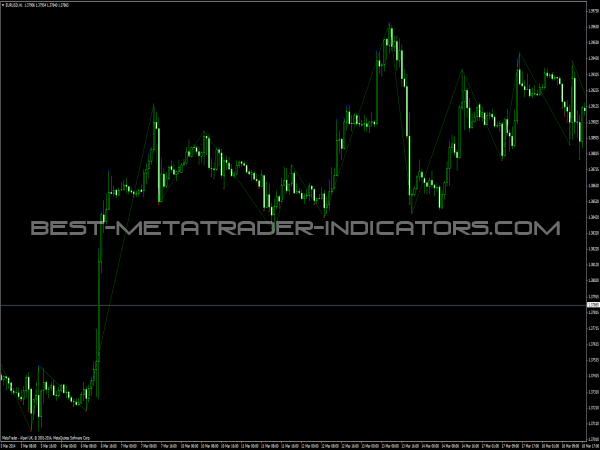

Forex Charting Software An analytical, computer-based tool used to help currency traders with forex trading analysis by charting the price of various currency pairs along with various indicators. BerkShares are paper bills that come in denominations of 1, 5, 10, 20 and Forex pivot points are calculated to determine levels in which the sentiment of the market could change from "bullish" to "bearish. Derivatives can be traded and are usually used to hedge portfolio risk. When forward testing this EA is it normal for trades to not close out by the stop loss? Based on the interest rate parity, a trader can create an expectation of the future exchange rate between two currencies and set the premium or discount on the current market exchange rate futures contracts. Market Order An order to buy or sell a stock at the best available price. BIF Burundi Franc Big Figure Refers to the first number to the left of the decimal point in an exchange rate quote, which changes so infrequently that dealers often omit them in quotes. Sollte dies Ihren Rechner zu sehr belasten, dann geben Sie hier beispielsweise eine 1 oder 2 ein. Bundesbank Germany's Central Bank. A complementary currency can also integrate time or real sources into its scale. Margin Call This is a call by a broker or dealer to raise the margin requirement of an account. Euro Notes Legal tender in the form of a banknote that can be used in exchange for goods and services in the eurozone. The forex market is open 24 hours a day, five days a week. The Haitian Gourde is made up of centimes and is often presented with the symbol G. A currency trade that offers an all-or-nothing payoff based on a given currency exchange rate when the position reaches its expiration date.

Foreign exchange trading is very speculative and involves a significant risk of loss. Let us lead you to stable profits! Deficit An excess of liabilities over assets, of losses over profits, or of expenditure over income. Margin Call This is a call by a broker or dealer to raise the margin requirement of an account. In other words, it involves quoting in fixed units of foreign currency against variable amounts of the domestic currency. An FCM has a role in the futures market that is similar to that of a broker in the securities market. This gradual shift of the currency's par value is done as an alternative to a sudden and significant devaluation of the currency. Typically, price quotes between market makers feature a lower ask and a higher bid than the quotes made to retail investors in the same security. Best and popular MT4 indicators. Permalink Submitted by Thomaswaymn Tho The Haitian Gourde is made up of centimes and is often presented with the symbol G. Despite changes in currency valuation, five gourdes is still sometimes referred to as a "Haitian dollar", and prices are often quoted in this informal denomination. How much should I start with to trade Forex?